Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- LAST TRADING DAY Fri 26th

- Court Approves Scheme of Arrangement

- https://hotcopper.com.au/threads/ann-court-approves-scheme-of-arrangement.8789353/

- shareholder information line on 1300 502 987

- Special Dividend on the way

Special Dividend

Return (inc div) 1yr: 108.36% 3yr: 41.10% pa 5yr: 20.15% pa

22nd September 2025: As expected shareholders voted up the scheme at today's meeting with over 99% of votes cast "FOR" and less than 1% against. In terms of individual shareholders, 91.23% voted "FOR" with less than 9% of shareholders voting against the takeover of GOR by Gold Fields Ltd ("the scheme").

Source: Results-of-Scheme-Meeting.PDF [6:26pm, 22-Sept-2025]

See also: ZSP-Gold-Road-Resources-Ltd-to-be-removed-from-SPASX-200 (1).PDF [5:08pm, 22-Sept-2025]

GOR is being replaced in the ASX 200 index by Catapult Sports (CAT), something CAT shareholders here will be happy to hear.

It's been a good year for GOR shareholders, and the company's SP hit a new all time high today of $3.50 before closing at $3.47.

It's been more than just a good year, here's their chart since they listed back in mid-2006:

They got down to 3 cents/share in April 2009 and again in mid-2013, but it's been a good ride up since then.

Originally known as Faulkner Resources, the company's main activity back in 2005-2006 was strategic acquisition of land and projects in the Yamarna Greenstone Belt. Under the guidance of geologist Russel Davis, Faulkner Resources acquired the Yamarna North and Yamarna South Projects in 2005, which were significant steps in building the company's future asset base. They rebranded the company to Gold Road Resources to focus on gold exploration, discovery, and mining in Australia.

Gold Road Resources discovered the Gruyere deposit in October 2013 and later entered into a joint venture (JV) with Gold Fields in November 2016, selling a 50% stake in the project to Gold Fields to help fund its development. Gold Fields developed the project and have been the project's operators since then, but have always only owned half of it with Gold Road retaining ownership of the other half.

Now, twelve years after Gold Road discovered Gruyere, Gold Fields is buying Gold Road to become 100% owners of Gruyere and all of the land around Gruyere that Gold Road either own outright or own as part of the JV.

It's been quite the journey for GOR shareholders. I've been in and out over the years, mostly out, and I jumped back in on the day this deal was announced back in May this year - and have topped up those positions since then on drops as I have explained elsewhere here.

For me this has been an arbitrage play with GOR trading at less than my estimation of the total value of the deal to GOR shareholders on a per share basis, however I am able to use the franking credits that come with that $0.43694/share special dividend (see here: Determination-to-pay-Special-Dividend.PDF) that will be paid on October 7th (two weeks from tomorrow) and not all shareholders can use those franking credits, so the arbitrage is clearly better if you can use those franking credits and it may not have been worth the effort if you can't make use of them such as if you are not an Australian resident and do not pay tax to the ATO. That's why I haven't held a large GOR position here on SM (not holding any GOR shares here currently) - because we do not get any benefit from franking credits here in our virtual SM portfolios, so there were better opportunities to deploy the limited amount of virtual cash I've got here because of that, however GOR is the second or third largest position in both of my main two real money portfolios (my SMSF and my income portfolio) and has been for most of the past few months, certainly since I added to those positions in July and August when the GOR SP followed the NST share price down.

Of course, apart from that large special dividend, we have the fixed cash consideration and the variable cash consideration components of the cash compensation that GF are paying us GOR shareholders for our GOR shares, and the variable consideration is totally dependent on the NST share price this week (I think it's the VWAP of NST during the last week before the scheme becomes effective, which would be this week), because that variable cash consideration is going to be equal to each GOR shareholder's proportional ownership of NST - because GOR holds 49,258,234 NST shares which they received when NST acquired De Grey Mining (was DEG) earlier this year in an all-scrip deal (paid for by NST shares, not cash), because GOR held 19.99% of DEG when NST acquired DEG. And look at where NST is sitting:

NST closed up +8.21% today @ $22.41. Nice!

It was a reasonable day indeed for most Aussie gold miners - have a look at my Aussie gold sector watchlist and how they all ended the day:

Not bad at all - not much red in that list - just those 5 small explorers / developers at the bottom, and WAF is still suspended of course. I've put a gold coloured rectangle around the 4 ETFs / ETPs that track the physical gold bullion price, and yes, gold is up again, but it's very obvious that the sector is running hot at the moment because gold companies are generally rising a LOT more than the gold price is rising - after all, many of these companies own a LOT of gold, and even though the vast majority of that gold is still in the ground, it's still belongs to them, so we're getting that catch-up now after the gold price outperformed gold stocks for a long time, so now gold stocks are outperforming the gold price - the gold stocks are catching up finally, and it's right across the sector now, the big producers, the mid tier producers, the minnows, and even the small explorers and project developers are in demand.

One of my top picks, Genesis Minerals (GMD), was the day's second best gold sector performer with their share price finishing up almost +14% @ $5.75. They are one of the best growth stories in the sector, already producing gold at two mills (Leonora and Laverton) and set to produce a lot more over the next few years. I keep thinking there's already a heap of future growth already priced in and then they go and rise another 14% !

I'm not complaining, I do hold them in my SMSF (and here).

The only one that beat GMD today was YRL (Yandal Resources) who are a tiny little sub-$50m (or they were on Friday) wanna-be gold project developer who were up today on drilling results despite the grades being fairly average - the headline number was 54m @ 1.2g/t Au from 108m - I reckon the market got excited by the width of the hit rather than the grade, and because it's only a little over 100m below surface, so open-pittable. YRL did mention however that they haven't yet ascertained the true width; they've just used the down hole width for now, and the hole is at a decent angle, as shown below. It looks like a good dicovery on this diagram, especially with today's gold price:

It's that drill hole that starts in the top left corner that they're talking about with the 54m @ 1.2g/t gold, from 108 metres down, hole 25IWBRC0040.

Their shareholders needed some positive news because YRL hasn't had a good year compared to most of the other names on that watchlist - I'll not bother including their chart, but without today's move it was looking fairly ordinary.

I don't hold YRL. But I do hold GOR and NST and GMD - and a few others on that list, and it's been a good day. I think I'll crack open some 2022 Hewitson 'Ungrafted' Grenache and celebrate with a glass or three. Hard to beat a good Barossa red. And we need to celebrate our wins every now and then.

22nd May 2025: As I said a couple of weeks ago in my update to my Gold Road (GOR) valuation, Gold Road (GOR) announced on May 5th that they have agreed to be acquired by Gold Fields Ltd, who are Gold Road's 50/50 JV partners in the Gruyere Gold Mine in WA's eastern central goldfields (i.e. above Kalgoorlie but more towards the NT border).

See here: Scheme Implementation Deed entered into with Gold Fields [5 May 2025]

The offer is all cash, so no shares, which is to be expected from a South African listed company like Gold Fields Ltd (GF). Australian investors generally prefer cash than shares when an overseas-listed company acquires their Australian-listed company.

I raised my valuation for GOR to $3.55 on May 6th because I value this offer @ just over $3.55 based on (1) NST's closing price on Friday 2nd May and (2) where NST closed on that today (May 6th). The reason why NST's SP is relevant is that GOR held 19.99% of De Grey Mining (was DEG.asx, now removed from the list) and the acquisition of DEG by NST in an all-scrip (shares for shares) deal completed in late April, so GOR now hold NST shares instead of those DEG shares that they previously held.

GF is offering: A$2.52 fixed cash consideration less any special dividend paid prior to implementation of the Scheme, plus a variable cash consideration equal to the full value of each Gold Road shareholders’ proportionate holding in Northern Star (NST), calculated by reference to the date the Scheme becomes effective - so valued at A$0.88 per share if the Scheme was effective on Friday 2 May 2025, the last trading day before this agreed scheme was announced by GOR.

So, as at 2 May 2025, the total cash consideration equated to A$3.40 per share.

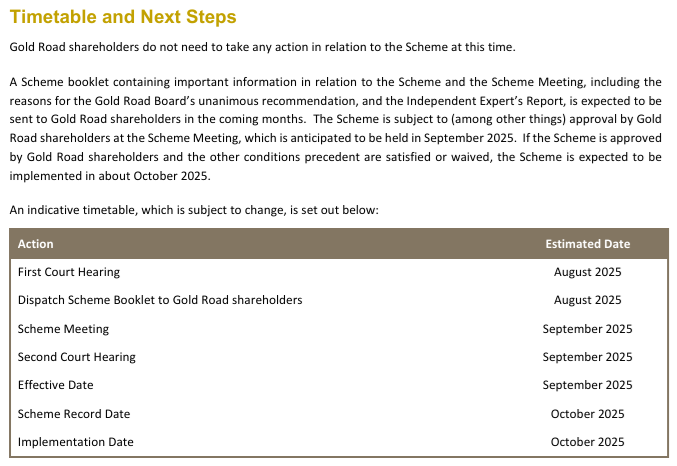

To come up with my new valuation for GOR on May 6th, I added another A$0.15 (i.e. 15 cps) onto that number above ($3.40) and called it A$3.55. That extra 15 cents that I've added is roughly the value of the franking credits that are expected to be attached to the 35 cps FF special dividend (spec div) that GOR are guiding that they intend to pay their shareholders prior to the date this scheme becomes effective, but likely after the date the scheme is voted up at the relevant shareholder meetings of both companies and the scheme becomes unconditional and binding, so a few months away yet. The scheme may not become effective until as late as October this year (I've included an indicative timetable at the end of this straw).

This additional 15 cps is only of value to Australian taxpayers who can use those franking credits to either reduce their own tax payable to the ATO or effect a tax refund from the ATO, and I am one of those people, so the franking credits are of value to me.

Importantly, while GF (Gold Fields Ltd) is going to reduce their fixed cash consideration by the amount of the dividend, which is expected to be 35 cps, GF are NOT going to apply any reduction in respect of those attached franking credits, so the franking credits are additional value that is above and beyond the cash that GF is going to pay GOR shareholders for their GOR shares.

Risks: Three main risks: The first is that the deal falls over, for any one of a number of reasons, including if the deal is blocked by FIRB - because GF is a South African company - however I considered that a very low probability considering that GF already own half of Gruyere, with the other half of Gruyere being GOR's main asset, and GOR's only gold producing asset. Additionally, GF are the OPERATORS at Gruyere already, with GOR being the silent partners.

Yesterday (May 21st), GOR released this: FIRB-Approval-Received.PDF ...so FIRB have stated that they won't block this deal, and I don't see any other regulatory hurdles that need to be jumped over; There's just the shareholder votes now, which should be fine, as nobody seems to think this is a bad deal for either party from what I've read and heard, at least nobody that could become a serious fly in the ointment.

The second risk is that the share price of NST declines significantly between now and the date the scheme becomes effective, which would reduce the 88 cps slice of the cash consideration, 88 cps being the value of those NST shares held by GOR on Friday 2nd May - and NST's SP had already risen another 90 cps in the following two trading days, i.e. up until my Val update for GOR on May 6th.

In terms of that risk, NST have been lower, and today (Thursday 22nd May) they finished higher still, at $20.25 (up +5.36% today), being $1.08 above the $19.17 they closed at on May 2nd, and according to my calculator, for every 10 cents that NST's share price (SP) rises above the $19.17 level they were at on 2nd May, the implied offer price - that GF is prepared to pay for GOR - rises by 0.459 cents. That means the offer value rises by 4.59 cents for every $1 that NST's share price rises above $19.17.

Today's closing SP for NST was $1.08 higher (than the $19.17 close on May 2nd) so that means that the value of GF's offer for GOR is now $3.449572, let's call it $3.45, so 5 cents more than 2 weeks ago. This is because the fixed cash consideration component is $2.52 (less any special dividend paid by GOR) and the other 88 cents (the variable cash consideration component that brought it up to $3.40) was based on the NST share price being $19.17, and they made it clear that the variable cash consideration (VCC) - which they calculated to be 88 cents at that time - would be equal to the full value of each Gold Road shareholders’ proportionate holding in Northern Star (NST), calculated by reference to the date the Scheme becomes effective.

$0.88 into $19.17 = 0.04590505998, let's call it 4.59%, as $19.17 x 4.59% = $0.879903, or 88 cents. So whatever the NST share price is on the day the scheme becomes effective (by the court, after the shareholder votes), you can multiply that NST closing SP on that day by 4.59% (or by 0.0459) and that will give you the variable cash consideration (VCC) component of GF's offer, and that can be added to the $2.52 FCC (fixed cash component) to give you the total offer price, which will be paid in cash less the value of the special dividend that GOR intends to pay to release their franking credits to shareholders.

The amount of the special dividend should not change as it has been calculated based on the amount of franking credits that GOR have got to distribute, and the only thing that would change that is if GOR paid some more tax to the ATO and received further franking credits, or they received a tax refund. I am however ignoring those two possibilities because (a) I have no clue how to factor that in and (b) any extra tax paid or tax refund received would likely have a very small impact on their franking credit balance anyway, so I'm basing my calculations on the estimated 35 cps (cents per share) amount that GOR have guided is likely to be the amount of the special div.

So, if theoretically the scheme became effective today, the implied offer price would be $3.45 (improved 5 cents because of the higher NST share price) plus the value of the franking credits attached to the special dividend, which I estimate to be around 15 cps, so that would be a total of $3.60, and GOR closed at $3.35 today (up +2.13%), so there's still value there, IMO.

In terms of my $3.55 valuation, I won't raise it based on daily movements in the NST SP, I'll just leave it as is, i.e. based on the same $19.17 SP for NST that GF used, but I'm still keeping track of the NST SP to note whether the real value to GOR shareholders in the GF offer to acquire all of GOR is likely to be higher or lower when they do pay the money compared to when they made the offer in early May.

At this point the value is higher based on the NST share price being $1.08 higher today than it was then, but the NST share price could (and will) go higher or lower between now and the scheme implementation date, which is months away.

The third risk is that the estimated 35 cps FF (fully franked) spec div is based on GOR's franking account balance of $163 million as at 2nd May 2025, and they state in the offer document that the final amount of any Special Dividend to be paid is ultimately dependent on Gold Road’s financial performance up until the date the Scheme becomes effective.

However, my view is that the spec div is entirely about releasing those franking credits prior to the change of ownership to a company for which ATO franking credits are of zero value, so the only things that could scuttle the spec div are (a) the deal falling through (v. low probability), or (b) Gold Road finding themselves with insufficient cash to fund the dividend, which isn't going to happen unless something extra-extraordinary was to occur in the next few months, considering GOR are not the operators at Gruyere (GF are) and both GF and GOR want this deal to go through, so neither party are likely to do something really stupid to put the deal at risk.

GOR's franking credit balance is also not going to reduce unless they receive a tax refund between now and then. If anything there's the possibility that they might even generate even more franking credits by paying more tax, although I'm certainly not factoring that in.

The other possibility I should mention is not something I consider a risk, but a possibility with likely positive consequences for GOR shareholders in the unlikely event that it was to occur, and that is that a superior offer is lobbed in by somebody else, however while that is always a possibility, it's unlikely in this particular case because anybody trying to come over the top of GF to acquire GOR are really trying to acquire the silent partner share of Gruyere - a gold mine that GF operate and already own half of, so to come over the top of GF here that hypothetical third party would be immediately establishing a confrontational and hostile relationship with their potential JV partners at Gruyere, which is probably not going to be a very smart move.

So while there could be interest from a third party, in the same way that SLR showed interest in SBM's assets when GMD was buying them a couple of years ago, the reality is likely to be that any third party interest is likely to just be an arbitrage play to try to force GF to up their offer further (as SLR's Luke Tonkin was trying to do with GMD back then).

However GF have already upped their offer from the earlier one in March/April, and they have stated that this one is best and final, subject to the absence of a superior proposal from somebody else, so if a third party tried to come over the top, GF could very well call their bluff and back out (walk away), which would most likely be a bad outcome for GOR shareholders, but that scenario has a low probability of occuring IMO. I don't think we are likely to see any third party action here on this occasion.

This is similar to the RMS takeover of SPR, which is locked in by RMS already owning a bee's whisker under 20% of SPR and owning that stake before they launched their takeover, which Spartan has agreed to.

In GOR's case, it's the fact that it's their Gruyere gold mine JV partners that are acquiring them, and that GF are the operators at Gruyere, that is locking in this deal.

In NST's case, with their takeover of DEG, that was really a size thing; nobody here in Australia could raise over $5 Billion to try to come over the top of NST for Hemi, Australia's largest undeveloped gold project, with NST already being Australia's largest gold miner. And larger overseas players didn't want to take on such a big greenfields project here in Australia, so the NST acquisition of DEG sailed through with zero opposition, and settled late last month.

---

So, while you should never count your chickens before they hatch, I have a reasonable amount of confidence that this T/O of GOR by GF is going to proceed, and I thought there was some arbitrage there a couple of weeks ago, just after the deal was announced, as long as NST's share price doesn't decline significantly over the next few months, as I explained above (and in my Val update earlier this month).

I hold NST both here and in my SMSF, so I was already bullish on NST, so my view is that Northern Star are more likely to be trading higher than lower later this year, so that opinion assisted my investment thesis for the GOR arbitrage trade.

So I bought back into GOR shortly after this deal was announced and I'm already up +9 cps in less than 2 weeks, with the offer value (including the franking credits value) still another 20 cps above GOR's closing SP today, plus an additional 5 cps higher still if you factor in NST's closing share price today (because NST's SP is +$1.08 higher than it was then).

Normally when an all-cash takeover offer is made, and is agreed to by the target company, and everybody expects it to go through, the share price of the target company doesn't move around very much; it would usually trade just below the offer price. However in this case we have that VCC (variable cash component) which is entirely based on NST's SP (because GOR own NST shares that they received for their DEG shares when NST acquired DEG last month). And because of that, the GOR share price is likely to follow NST's SP to some degree now, i.e. go up when NST goes up, and go down when NST goes down, not by the same percentages because GOR only own 3.486% of NST, so there's a correlation there, but it's not 1-for-1.

I could be wrong about that 3.486% number but I reckon it's close, and because GOR (with 1,086,399,060) have less shares on issue (SOI) than NST (with 1,430,447,066) do, I estimate that you have to multiply that 3.486% percentage holding by 1.317 (the ratio of NST's total SOI to GOR's total SOI) to arrive at that 4.59% that GF and GOR appear to have used in their calculations to work out that GOR shareholders owned 88 cents worth of NST per GOR share held when NST's share price was $19.17/share. Actually I'll have a delve into the small print in the offer document to check that...

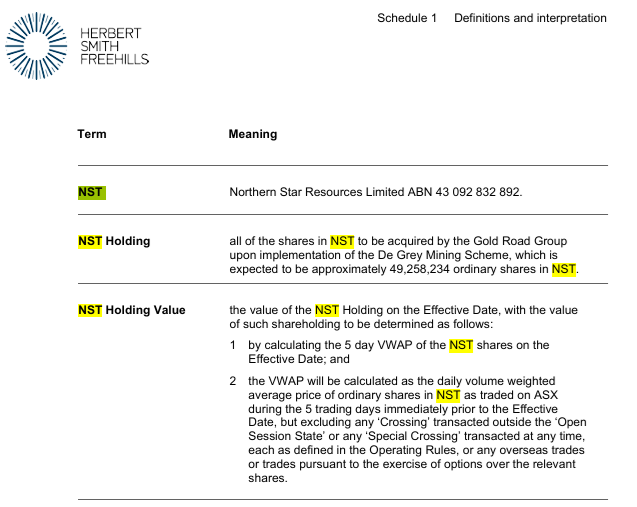

Yeah, their wording is:

Variable cash consideration equal to the full value of each Gold Road shareholder’s proportion of the Company’s shareholding in Northern Star Resources Ltd (Northern Star) based on the prevailing 5-day volume weighted average price (VWAP) immediately prior to the Scheme becoming effective (Variable Cash Consideration). As at 2 May 2025, the value of the Variable Cash Consideration equates to A$0.88 per share.

---

And:

Shareholders should be aware that the value of the Variable Cash Component (and therefore the total Scheme Consideration payable in cash pursuant to the Scheme) will fluctuate based on movements in the value of Northern Star shares up until the date the Scheme becomes effective.

---

Also, a search of "Northern Star" and then "NST" through the 129 page document revealed this on page 62:

So GOR hadn't actually received the NST shares yet when they wrote that - because the NST takeover of DEG had only completed the week that this document was being written - i.e. the last three days of April and first two days of May, but they anticipated being given 49,258,234 NST shares for their 19.99% of GOR. Based on NST's share count today (1,430,447,066 according to the ASX) that would mean GOR would own 3.444% of NST, which is close to my 3.486% estimate above, which I arrived at by working backwards from that 88c value based on a $19.17 NST SP that GF & GOR have used.

I note that NST announced on May 19th that they had completed a $300 Million on-market share buy-back which included 5 days from May 13th to 16th (inclusive) that NST lodged "Update - Notification of buy-back - NST" notices indicating that their share buy-back was active on each of those 5 days, and they also issued a lot of new shares on May 6th to settle the DEG acquisition, so the NST share count was changing between then and now.

But yeah, GOR owns 3.444% of NST and if GOR had exactly the same number of SOI as NST, then the value of that holding would be worth 3.444% of the NST share price for each GOR share on any given day, but because GOR have 0.7595 as many shares on issue as NST, or to put it another way, NST have 1.317 times as many shares on issue as GOR do, the percentage ownership of NST per GOR share is greater than 3.444% of NST's SP because there are less GOR shares to divide that value up between, so that's where the ratio between the SOI of each company comes into play, and I calculate that ratio to be aproximately 1.31668658393 (or 1.317), so if we multiply that 3.444% by 1.317, we get 4.53578%, which is in the ballpark of the 4.59% that they (GF & GOR) appear to be using on the NST SP when it was $19.17 to get an 88 cent value. $19.17 x 4.53578% = 86.95 cents, so one cent less (than 88 cents), so, yeah, in the ball park.

Anyway, hopefully, for those few who have lasted all the way through this long straw, that may help explain why the GOR share price tends to move up when the NST has a decent rise, and vice versa.

Disclosure: Holding GOR and NST.

P.S. Here's their indicative timetable:

Scroll down - latest updates are at the end:

2019: Old price target was 80c. They've blown through that.

New price target = $1.20. They're already above that, but I'm not sure they're worth $1.30 to $1.40 - where they're at currently. I don't own any GOR shares.

28-Jan-2020. OK, new PT = $1.60, provided A$ gold price stays over $2,200/oz. I don't follow GOR closely, and still don't hold any, but I recall that they had/have plenty of gold, mostly low-grade, but close to surface and easy to get at and cheap to process. Now that they are producing successfully, with no major headaches or bottlenecks in the processing plant during the ramp-up phase apparently, I think they will start to appeal to a wider audience. I note they're now in the ASX200 and therefore BlackRock and Van Eck are both substantial holders now (with each of them owning 8% to 9% of GOR). GOR have the potential to become a similar gold miner to Regis Resources (RRL), who also have relatively low grades, but similar low costs because the ore is so easy to get at and cheap to process. Regis has been a wealth winner for their shareholders for a long time now, with many more years left to go. They're no Northern Star (NST), but they're still pretty decent. However, it's worth remembering that GOR only own 50% of Gruyere - with Gold Fields owning the other half. Gold Fields Limited is one of the world's largest gold mining firms. Headquartered in Johannesburg, South Africa, the company is listed on both the Johannesburg Stock Exchange (JSE) and the New York Stock Exchange (NYSE). There is always the possibility that Gold Fields could at some point look to buy out GOR, but then the latest trend is for larger goldies that are based and listed outside of Australia to actually divest their Australian mines. Most of them are now focussed elsewhere, like Canada. But I digress. Must be the red wine. GOR will probably go higher. They've broken through my last two price targets, so here's my new one. Let's see if they can get to that one.

28-July-2020: Yep, they blew through that $1.60 price target also. The rising gold price has a lot to do with it. My new PT is $2.20. It's not very ambitious, and it's based on nothing more than momentum really, but I think they can get there. I've had a close look at GOR a few times in recent months, but still don't own any. I hold a heap of others though.

27-Jan-2021: Adjusting PT down due to sentiment shift since July/Aug last year. I added RMS and GOR shares to my SMSF portfolio in the second half of 2020, and I like Gold Road (GOR) for a number of reasons but particularly for the vast exploration upside potential in their extensive tenements. And their market leading low AISC (All-In Sustaining Cost per ounce of gold produced). However the market isn't too interested in them at this point, so a lower PT seems warranted. $2.20 is still OK for a 5-year view, so by January 2026. My one year PT is now $1.77.

04-Aug-2021: Update: Happy with $1.77. No change to the investment thesis. Still holding GOR in my super, and on my Strawman.com scorecard/portfolio.

12-Feb-2022: Update: Marked as stale again, but I don't think I need to change that price target. I had set that $1.77 PT as a 12 month PT back in January 2021, so to occur by 27-Jan-2022, and that didn't happen. GOR got up to $1.67 in November, but that was 10 cents short of my PT. The gold price ran out of steam and has been tracking sideways mostly, a little up, a little down, but no strong trend in either direction of late. It wouldn't take much to see GOR back over $1.77; they reached $1.90 in July 2020. I'm happy with that PT, and I still hold Gold Road shares both here and in my SMSF. No change to the investment thesis. Same PT, but new timeframe - so... by March 2023. That would be a 30% return from the $1.36 level they closed at today. I'd be happy with that. I think they'll get there. I've just got to be patient. One foot in front of the other... Down that yellow brick road.

17-April-2024: Update: I haven't updated this one for over two years - and my thinking has changed. GOR have been above my previous $1.77 price target multiple times in the past year, however I sold my GOR out of my SMSF today and also out of my Strawman.com portfolio. I thought there were going to buy something, but I really didn't want them to go offshore, as NST did with Pogo and EVN did with Red Lake. GOR's interest in Greenstone Gold Mines in Canada was leaked (probably by a rival bidder) to the media prompting this response by GOR: Response-to-Media-Speculation.PDF

Looks like Gold Road were angling to buy the 40% of Greenstone that is owned by Orion Resource Partners. TSX-listed Equinox Gold (EQX.tsx) own the other 60% and are the mine's operators, so if this one went through, Gold Road would be the junior partners - and non-operating partners - in two mines, Gruyere in WA (majority owned and operated by South African based Gold Fields), and Greenstone in Ontario, Canada (where Equinox would remain the majority owners and operators).

Greenstone is a BIG gold project.

According to The Australian, on Monday (15th April 2024), Orion is seeking a A$1 billion-plus (about US$648 million) valuation for Greenstone from Gold Road Resources and the article in The Australian suggested that GOR would require a "monster capital raising" if they were to proceed with the acquisition, which seemed to spook the market.

Gold Road’s shares dropped 6.6% to A$1.70 by the end of Monday’s trading, surpassing the losses seen by other gold companies. This movement in the stock price suggests that investors are, in fact, expecting a fundraising effort.

Gold Road had A$143.8 million in cash and A$465 million in investments by the end of 2023, with a significant portion represented by its 19.9% stake in gold company De Grey Mining (ASX: DEG).

Shares in De Grey also fell by 4.7% on Monday, further suggesting that some market players believe Gold Road may sell its stake in De Grey to generate the necessary funds to acquire Orion’s 40% in Greenstone Gold Mines.

Greenstone owns a portfolio of pre-production gold claims in Ontario, including its namesake flagship open-pit gold project. The mine, scheduled to begin production in May, is expected to produce approximately 400,000 ounces of gold per year.

Source: https://www.mining.com/gold-road-seeks-stake-in-greenstone-gold-mines/

See also: https://www.mining-technology.com/news/gold-road-eyes-stake-greenstone/

The Money of Mine (MoM) lads covered this very well on their show on Monday:

And, yeah, nah, I'm out.

Plenty of good management teams doing more sensible things in the Aussie Gold Sector at this point in time, and I'm invested in a few of them, so don't see any reason to remain in this one any longer.

Tuesday 6th May 2025: Update:

What's changed is that Gold Road (GOR) have yesterday announced that they have agreed to be acquired by Gold Fields Ltd, who are Gold Road's 50/50 JV partners in the Gruyere Gold Mine in WA.

See here: Scheme Implementation Deed entered into with Gold Fields [5 May 2025]

The offer is all cash, so no shares, which is to be expected from a South African listed company like Gold Fields Ltd (GF). Australian investors generally prefer cash than shares when an overseas-listed company acquires their Australian-listed company.

I've today raised my valuation for GOR to $3.55 because I value this offer @ just over $3.55 based on NST's closing price on Friday and that NST are trading higher than that today. The reason why NST's SP is relevant is that GOR held 19.99% of De Grey Mining (was DEG.asx, now removed from the list) and the acquisition of DEG by NST in an all-scrip (shares for shares) deal completed last week, so GOR now hold NST shares instead of those DEG shares that they held.

GF is offering: A$2.52 fixed cash consideration less any special dividend paid prior to implementation of the Scheme, plus a variable cash consideration equal to the full value of each Gold Road shareholders’ proportionate holding in Northern Star (NST), calculated by reference to the date the Scheme becomes effective - so valued at A$0.88 per share if the Scheme was effective on 2 May 2025, i.e. last Friday, being the last trading day before this agreed scheme was announced by GOR.

So, as at 2 May 2025, the total cash consideration equates to A$3.40 per share.

I have added another A$0.15 (i.e. 15 cps) onto that number to give my estimate of current value of GOR shares as A$3.55. That 15 cents is roughly the value of the franking credits that are expected to be attached to the 35 cps FF special dividend (spec div) that GOR are guiding that they intend to pay their shareholders prior to the date this scheme becomes effective, but likely after the date the scheme is voted up at the relevant shareholder meetings of both companies and the scheme becomes unconditional and binding, so a few months away yet. The scheme may not become effective until as late as October this year.

This additional 15 cps is only of value to Australian taxpayers who can use those franking credits to either reduce their own tax payable to the ATO or effect a tax refund from the ATO, and I am one of those people, so the franking credits are of value to me.

Importantly, while GF is going to reduce their $2.52 fixed cash consideration by the amount of the dividend, which is expected to be 35 cps, GF are NOT going to apply any reduction in respect of those attached franking credits, so the franking credits are additional value that is above and beyond the cash that GF is going to pay GOR shareholders for their GOR shares.

Risks: Three main risks: The first is that the deal falls over, for any one of a number of reasons, including if the deal is blocked by FIRB - because GF is a South African company - however I consider that a very low probability considering that GF already own half of Gruyere, with the other half of Gruyere being GOR's main asset, and GOR's only gold producing asset. Additionally, GF are the OPERATORS at Gruyere already, with GOR being the silent partners.

The second risk is that the share price of NST declines significantly between now and the date the scheme becomes effective, which would proportionately reduce the 88 cps slice of the cash consideration, 88 cps being the value of those NST shares held by GOR last Friday - which are already worth over 90 cps because NST's share price is now higher than Friday's close.

The third risk is that the estimated 35 cps FF spec div is based on GOR's franking account balance of $163 million as at 2 May 2025, and they state in the document that the final amount of any Special Dividend to be paid is ultimately dependent on Gold Road’s financial performance up until the date the Scheme becomes effective.

However, my view is that the spec div is entirely about releasing those franking credits prior to the change of ownership to a company for which ATO franking credits are of zero value, so the only things that could scuttle the spec div are (a) the deal falling through or being blocked by FIRB (v. low probability), or (b) Gold Road finding themselves with insufficient cash to fund the dividend, which isn't going to happen unless something extra-extraordinary was to occur in the next few months, considering GOR are not the operators at Gruyere (GF are) and both GF and GOR want this deal to go through, so neither party are likely to do something really stupid to put the deal at risk.

GOR's franking credit balance is also not going to reduce unless they receive a tax refund between now and then. If anything there's the possibility that they might even generate even more franking credits by paying more tax, although I'm certainly not factoring that in.

The other possibility I should mention is not something I consider a risk, but a possibility with likely positive consequences for GOR shareholders, and that is that a superior offer is lobbed in by somebody else, however while that is always a possibility, it's unlikely in this particular case because anybody trying to come over the top of GF to acquire GOR are really trying to acquire the silent partner share of Gruyere - a gold mine that GF operate and already own half of, so to come over the top of GF here that hypothetical third party would be immediately establishing a confrontational and hostile relationship with their potential JV partners at Gruyere, not a very smart move IMO.

So while there could be interest from a third party, in the same way that SLR showed interest in SBM's assets when GMD was buying them a couple of years ago, the reality is likely to be that any third party interest is likely to just be an arbitrage play to try to force GF to up their offer further (as SLR's Luke Tonkin was trying to do with GMD back then).

However GF have already upped their offer from the earlier one in March/April, and they have stated that this one is best and final, subject to the absence of a superior proposal from somebody else, so if a third party tried to come over the top, GF could very well call their bluff and back out, which would most likely be a bad outcome for GOR shareholders, but that scenario has a low probability in my view. I don't think we are likely to see any third party action here.

This is similar to the RMS takeover of SPR, which is locked in by RMS already owning a bee's whisker under 20% of SPR before they launched their takeover, which Spartan has agreed to.

In GOR's case, it's the fact that it's their Gruyere JV partners that are acquiring them, and that GF are the operators at Gruyere, that is locking in this deal.

In NST's case, with their takeover of DEG, that was really a size thing; nobody here in Australia could raise over $5 Billion to try to come over the top of NST for Hemi, Australia's largest undeveloped gold project, with NST already being Australia's largest gold miner. And larger overseas players didn't want to take on such a big greenfields project here in Australia, so the NST acquisition of DEG sailed through with zero opposition, and settled last week.

So, while you should never count your chickens before they hatch, I have a reasonable amount of confidence that this T/O of GOR by GF is going to proceed, and I think there's some arbitrage there at yesterday's and today's prices for GOR, as long as NST's share price doesn't decline significantly over the next few months, as I explained above.

I hold NST both here and in my SMSF, so I was already bullish on NST, so my view is that they are more likely to be trading higher than lower later this year.

So I bought back into GOR yesterday in my SMSF and also here on SM, after this deal was announced.

I have been avoiding GOR for a little while prior to yesterday because I was concerned about their previous attempts to buy minority stakes in other mining operations where once again they would NOT be the operators of those assets.

Sure, those investments can pay off if there's a takeover that you sell into, as GOR did with their 19.99% stake in DEG when NST acquired DEG, but I prefer gold mining company management teams that control their own assets and are good at doing that, and can create value, rather than trying to make money by investing in other companies or assets and letting others control how those companies and assets are run. In short, I viewed GOR more as an investment vehicle than a gold miner.

With the benefit of hindsight, those who stuck with GOR have now done very well, however I've done well in other gold miners and while I've missed out on the recent gains in GOR's SP, I'm happy to now try to milk them for what I can get out of them over the next few months (if I don't exit sooner) now that much of the risk has been removed.

And by risk, I mean the risk of GOR management using their cash and liquidity to make overseas acquisitions of minority stakes in non-operated assets or companies like their attempt to buy 40% of Greenstone just over a year ago (in April 2024, discussed in my prior update in this "valuation" thread). I didn't want to own shares in a company whose management thought that was the best use of their capital.

That's no longer the case; that risk has been removed, so I'm now back in GOR for a shorter term trade.

- Observation:

- Checked GOR: Remarkably holding up here

- 8th Nov UBS had a Report: Gruyere H1CY24 Performance

- - Mining movement in CY2023 below plan

- - Rain event at the end of Q1 CY2024

- - Road closures for 7 weeks

- - Disrupted operations for 5 weeks

- - Focus on Stage 4 mining to increase ore availability

- Now looking forward:

- Uninterrupted access to Ore during 2025

- Planned Pre-strip

- of Stage 6 in 2025

- - 2025 waste stripping will concentrate on Stage 5 & 6 - setting Gruyere up for 2026

- GOR, Analyst:12, a revised EPS Forecast of: 32.05 % And Return on Capital looks robust now

Return on invested Capital YOY is rising.

Market Cap ($M): 1,853

https://hotcopper.com.au/threads/ann-agm-2024-ceo-presentation.8016870/

Not much 'hard' evidence of GOR outlook..

https://hotcopper.com.au/threads/ann-agm-2024-chairmans-address.8016864/

AGM 2024 Chairman's Address

Cash and equivalents of $146.2M on 31 March 20241

Free cash flow generated of $5.5M during the quarter despite rain impacts

Listed Investments valued at $469M on 31 March 20242

1.0 cent per share ($8.9 million) fully franked dividend returned to shareholders following record financial year (CY2023)

Return (inc div) 1yr: -8.01% 3yr: 9.05% pa 5yr: 12.86% pa

This year we have begun to align our reporting with the International Financial Reporting Standards (IFRS) S1 and IFRS S2, the new sustainability reporting standards issued in 2023 by the International Sustainability Standards Board (ISSB).

Investment portfolio market value ~$465M* Strategic 19.9% in De Grey Mining Prospective Greenfields exploration portfolio

a look bigger picture..

$US curreny Gold

Au up around historic highs..

Need to check this vs $AUD currency ..What do think?

GOR seems reasonable value.. 'GOR has dipped a little here.

LGold is mostly traded on the OTC London market, the US futures market (COMEX) and the Shanghai Gold Exchange (SGE). The standard future contract is 100 troy ounces. Gold is an attractive investment during periods of political and economic uncertainty. Half of the gold consumption in the world is in jewelry, 40% in investments, and 10% in industry. The biggest producers of gold are China, Australia, United States, South Africa, Russia, Peru and Indonesia. The biggest consumers of gold jewelry are India, China, United States, Turkey, Saudi Arabia, Russia and UAE. The gold prices displayed in Trading Economics are based on over-the-counter (OTC) and contract for difference (CFD) financial instruments. Our gold prices are intended to provide you with a reference only, rather than as a basis for making trading decisions. Trading Economics does not verify any data and disclaims any obligation to do so.

Qtr Result:

- 82,604oz produced at Gruyere (100% basis), up from 74,201 last Qtr

- AISC of A$1,399/oz, down from A$1,622 last Qtr

- Net cash $127.9m, A$150m undrawn debt facility (almost all is DEG)

- listed investments value A$480m at market 31/3

- 41,818oz sold (50% basis) at average price of A$2,764/oz Vs 37,295 @ A$2,476 last qtr.

Gruyere Outlook 2023 (100%):

- 340-370koz with grade increasing to 1.3g/t Au (from 1.15)

- Indices that average qlty production for the remainder of the year will be up to 90,799oz at the midpoint, so 10% up on Q1 for remaining quarters.

- AISC guidance A$1,540-1,660/oz.

Valuation: In line with current expectations so maintain base valuation of A$1.55 with a healthy Bull-Bear range of 2.44-0.98 and probable trim or sell over $2.

Disc: I own

Just a confirmation and small upgrade on Gruyere mine announced this morning:

· Production range of 335-375k ozpa (100%), increase on prior years due to higher head grades and improved throughput (third pebble crusher added late 2023).

· Requires minimal growth capital

· Sustainable production at 350k ozpa reaffirmed to 2032

· >1m oz mineral resource defined, opportunity to extend mine beyond 2032

The gold price now over US$2,000 is more likely to move the price today than this news.

Disc: I own

(31/3/23)

Reviewing my valuation taking into account the results released this month and considering the currently high A$ gold price and AISC which basically net off. As such I have not changed my valuation from around A$1.50 and view that it’s a trim or sell at $2.00 or more.

Valuation Adjustments:

· Listed Assets from DGO Gold take over: provided at 14.4% holding in De Grey Mining (DEG) which has been increased to 19.73% (308m shares, market value $460m). They own the Hemi gold project in the Pilbara which has similar characteristics to Gruyere. Other entities they have an interested in amount to less than $10m in market value (GMD, YRL, S3N). In total I have added A$467m to the EV to allow for this but the share dilution offsets it.

· Net Cash of A$74m - Debt free with a 150m facility undrawn.

· Unhedged as of Nov22 so full exposure to gold price.

· FY23 forecast production (attributable) 170-185koz at A$1,540-1,660 AISC. I have assumed 170koz at $1,660 AISC, they came in on the unfavorable side of range guidance for FY22 so I am taking worst in range to add some margin of safety.

· Gold price: Currently below A$3000/oz, I am assuming that the US$ gold price will rise but be partially offset by a rise in the A$ so allowed for a 4% a year appreciation in A$ gold prices. Below is a valuation table for variance in the A$ price from combined FX and US$ gold price moves.

I continue to assume a terminal value on the basis that current production will be replaced indefinitely, with exploration & allowance for development costs included in the valuation. There is probably some upside opportunity from all the current projects, but I will value it if and when it is more tangible.

It’s the only gold stock I own, so is my toe in the water for a spike in gold prices…

Disc: I own

GOR takeover of DGO Gold (4/4/22)

GOR announced today the off market takeover of DGO Gold (DGO) in an all script offer of 2.16 GOR shares for each DGO share or around $3.55 a share (A$308m). DGO is currently at $3.00 but has been as high as $3.90 in the last year.

DGO assets include listed holding with a market value of A$273m (14.4% DEG, 6.8% DCN, 20.1% YRL) and “an attractive portfolio of exploration tenements in the Pilbara, Yilgarn, Bryah and Stuart Shelf Provinces”.

The price looks to be ballpark reasonable, also as a script offer the large cash balance remains intact providing support to future dividends. However, on a shareholder value basis the dilution may be more costly over the long term.

The DGO board supports the offer and 80% of shareholder support is needed for the deal to proceed.

The GOR board have been hunting acquisitions, so this is no surprise, they fell short on offers for 2 last year so appear to be reasonably conservative on pricing to protect shareholder value. The expansion of it’s holdings in both exploration assets and production assets is making GOR more complex from a valuation prospective which will lead to a discount on the market.

Having just updated my valuation I am not making any changes given the acquisition price seems around fair value.

Gold-Road-Makes-Recommended-Takeover-for-DGO-Gold.PDF

Disc: I own GOR

Mar22 Valuation

See "FY21 Results & Valuation Review" straw for details:

Valuation Adjustments:

· $1.50 from $1.36 (Mar21)

· Gold price changed from US$1700 to US$1900 in FY22 (FX0.80 unchanged for A$2,375 price) and AISC to align with management expectation for FY22 (mid point $1,370) and to grow both at 4% rather than 2% inflation previously used.

· Extended and adjusted Gruyere mine output and AISC to mid-point of management’s expectations and for the additional life and production (stages 6 & 7 added).

· Retain an assumption that ignores exploration spend and potential cash from exploitation of new discoveries. Assume this net off and at the end of the Gruyere mine provide a perpetual replacement. Note about $0.75 of my valuation is the Gruyere mine for the current life through to 2032, above that is cash (15c) on hand and terminal value assumptions (60c) of replacement production into perpetuity.

Valuation Sensitivity: different values for different key assumptions

· $2.33 if FY22 Gold price is A$2,850 (US$2000 @ 70c)

· $0.90 if FY22 Gold price is A$2,000 (US$1800 @ 90c)

Mar21 Valuation

Gold Road is the first gold miner I have been interested in enough to value, which shows both my prejudice against them and inexperience in valuing them. As such I will walk through my logic in detail, which comes down to 3 key factors (Details in Straw): 1 Gold Price in A$ The sticking point for miners is that they mine a commodity and have no control over the price and it is difficult to predict. Hedging can be used over short periods, but the company valuation is based on many years past what can be hedged. So, I have make a call on the likely A$ price of gold, which means estimating FX rates and US$ Gold prices… Get this wrong by much and everything else doesn’t matter. I have assumed an average gold price of A$2,125 per oz, which assumes an average FX rate of US$0.80 to A$ and average gold price of US$1,700 per oz. The FX rate is around long-term average and current rate and the US$ gold price is US$300 less than recent highs but high for recent years. With a lot of money printing, inflation may lead to higher gold prices in coming years, so I feel there is a higher floor for gold prices than has been the experience over the last decade. 2 Current Opportunity Valuation This is the value of verified and probable deposits GOR is currently mining and as such likely cashflows can be calculated. GOR is in production via a JV at Gruyere which has a 10 year life based on 3.2Moz of gold, of which 50% is attributable to GOR. AISC (All-in Sustaining Costs) to mine it are expected to be around A$1,300 with up to 0.35Moz mined each year. Assuming an average sale price of A$2,125 per oz, A$10m a year in additional costs or other capex and 27.5% tax, with prices and costs increasing at 2% a year. Cash of $935m is generated with a PV of $583m at a 10% discount gives a value of $0.65 a share. Note this moves a lot if we change gold price assumptions. An FX rate of 0.7 and US$2,000 gold price increases the value to $1.29 (double), but an FX rate of 0.9 and US$1,500 gold price decreases it to just $0.25 (a third). I fully expect that in the next 10 years we will have both of these FX and price situations… So if we accept $0.65 as a fair value for the current operations and add cash on hand of $0.14 a share we get a base IV of $0.79. 3 Future Opportunity Valuation This is where we estimate new discoveries or the “recycle-ratio” for minable deposits and value future opportunities. Management point out that the current operations at 50% JV Gruyere site have potential beyond the current 10 years and 3.2Moz identified deposits. An addition $27m will be spent in 2021 exploring other sites owned by GOR including Goldern Highway Satellite pits which has 0.31Moz of proven and probable ore reserves and is 100% owned by GOR, as well as Yamarna also 100% GOR owned. In all there is another 1.0Moz of Measured, Indicated and Inferred gold deposits across existing sites and many of these are close enough to the Gruyere JV site to piggyback off processing capacity there, hence will require lower capex to tap. So I am going to assume that GOR can perpetually replace the maximum 175Koz (50% attributable to GOR of 350Koz) of production out of Gruyeve JV from other sites or operations. Which effectively doesn’t start adding to production until 2029 when Gruyeve starts to run down, but this will give GOR a cashflow projection to calculate a terminal value. This is a very bearish assumption so to offset it I will assume that exploration costs nil, net of additional productive capacity that I would expect to eventuate well before 2029. This leaves a simple business producing 175Koz from 2023 onwards, assume a 2% increase in prices, costs and share count (ESOP) each year and we get an IV of $1.36. Hence future opportunity has added $0.57 to the share price value on relatively conservative production assumptions. Conclusions IV of $1.36 I see has a base case, with a bear valuation of $0.71 and bull valuation of $1.81. GOR is in a very strong cash position and just announced its first dividend which is a great vote of confidence on future cashflow performance. However, it’s a gold miner so FX rates, gold prices and operation as well as exploration success all provide risks and opportunities which guarantees high volatility. I have taken a position in GOR, but see this as speculative and will most likely sell if the price returns to previous highs around $2 unless this is due to exploration success and likely increased future production. In the mean time I expect a 5%+ dividend yield as a minimum.

Processing interruptions during the year impacted the result, reducing production and driving up AISC to produce a poor result compared to the prior year. Exploration outcomes extending the Gruyere mine (50% attributable) for 2 years and a 70% increase in 100% attributed deposits were the bright spots. Gold prices have improved and the A$ remained relatively stable to provide a favorable position for GOR in FY22 assuming no further production issues.

Highlights:

· NPAT A$36.8m Vs A$80.8m LY, EBITDA A$120.2m Vs A$170.6m LY,

· 0.5c fully franked final dividend (Vs 1.5c LY), Cash of A$131.5m Vs A$126.4m LY

· Production of 246.5k oz was below revised guidance of 250-260k, and last year’s 258.2k oz production due to process plant interruptions

· Guidance for 350k oz production by 2023 (100% basis) remains.

· AISC of A$1,558 /oz was above revised guidance of A$1,425-1,525 and last years A$1,273 due to lower throughput from interruptions to processing and lower plant utilisation.

· JV Ore Reserve up 28% YoY to 4.45m ounces (109.1m tonnes at 1.27g/t Au), Gruyere’s mine life extended out to at least 2032 (2030 previously)

· 100% owned Mineral Resources increase by 70% to 6.4m tonnes at 2.44g/t for 0.51m ounces via exploration projects.

· No Inorganic growth due to being outbid on 2 offers during the year.

· 2022 Guidance: 300-340oz production (100% basis), AISC between A$1,270-1,470/oz due to improved grades being mined, improved mill optimisation and maintenance practices as well as state boarder openings not materially changing the current production and costs environment.

Opportunities/Risks

· Processing interruptions at Gruyere really hit the year hard, provided these are behind GOR then FY22 should be as good or better than FY20 was.

· Inflation impacts on costs is a risk to bringing AISC down and I expect that it will come in at the high end of guidance because of it.

· Gold price and FX rates as always will be critical, I think the gold price will increase with inflation (based on cost to extract increasing). On the downside I see the A$ as a commodity-based currency holding up well in inflation and possibly acting as a headwind.

· Gruyere mine reserves up 10% at year after extraction due to new discoveries. Nice to have more in a mine at the end of a year despite taking ore out all year long! (Magic pudding). 100% owned exploration work is also providing value accretion.

· It is good to see a continuing commitment to issue dividends, which for a gold company is an important distinction. The Chairman said, “Dividends are a key mechanism of the Board’s strategy to generate and return value for shareholders.”

Valuation Adjustments:

· $1.50 from $1.36 (Mar21)

· Gold price changed from US$1700 to US$1900 in FY22 (FX0.80 unchanged for A$2,375 price) and AISC to align with management expectation for FY22 (mid point $1,370) and to grow both at 4% rather than 2% inflation previously used.

· Extended and adjusted Gruyere mine output and AISC to mid-point of management’s expectations and for the additional life and production (stages 6 & 7 added).

· Retain an assumption that ignores exploration spend and potential cash from exploitation of new discoveries. Assume this net off and at the end of the Gruyere mine provide a perpetual replacement. Note about $0.75 of my valuation is the Gruyere mine for the current life through to 2032, above that is cash (15c) on hand and terminal value assumptions (60c) of replacement production into perpetuity.

Valuation Sensitivity: different values for different key assumptions

· $2.33 if FY22 Gold price is A$2,850 (US$2000 @ 70c)

· $0.90 if FY22 Gold price is A$2,000 (US$1800 @ 90c)

Uncertainty around FX rates and the gold price over the long term is my key issue with GOR and I would treat a spike in price of GOR should gold spike as an opportunity to exit. A price of $2 or more without an increase in deposits would probably be an exit point.

Dics: I hold GOR

This morning GOR announced that it will not engage in a bidding war with Ramelius (RMS) for Apollo (AOP), leaving their $0.56 a share offer unchanged in the face of RMS’s $0.34 + 0.1778 RMS shares offer (which at current price is worth about $0.54).

It is good to see they are holding the line, I was worried when they put in the offer that GOR was going the way of most miners and empire building rather than giving cash back to share holders. They still may go ahead given they have 20% of AOP if circumstances change, but I take comfort that it’s not “at any price”.

Dics: I hold GOR

Duncan Gibbs (CEO) Ausbuz Interview (4/8/21)

Gold Road now all clear to ramp up production on ausbiz

Interview Notes: Comments on Qtly update and Diggers & Dealers conference

· Production disruption a “speed hump”, remain confident on reaching the 350koz production

· AISC driven by production level, so once at 350koz target they will sit in lower quartile of producers for the life of the mine.

· Lab supply delays experienced but results coming through now.

· Don’t see any need for significant capital spend due to the cash positive nature of Gruyere.

· Eyes out for value accretive acquisitions but active growth pursued by exploration.

Conference Presentation (10Mb so too large to attach):

· No new big announcements of new greenfield sites unlike last year.

· Presentation doesn’t add a lot of new info, but interesting to see that Gruyere is the largest discovery in Australia since 2010 and represents over 10% of discoveries over the period.

No new news, but reassurance that production disruptions are a one off and that the 2023 production target of 350koz is still on track.

Lower production and higher AISC figures released today (unable to attach due to size) had been flagged in the Q4 Production Update released on 28 June, but we have a bit more detail and additional information on further drilling at Gruyere but no change to attributable mineral resources like the 20% increase announce last quarter.

Q2 Results (31 Dec year end):

· Gruyere (100%) 53,132 oz gold produced, down from 66,213 oz produced in Q1 due to previously flagged disruptions (Torn conveyor delays sourcing parts and Ball mill restart delays) and also lower head grade of 0.92 g/t Vs 1.12 g/t in Q1 due to mining in lower grade areas which is expected to improve in coming quarters.

· Ore minded was actually up considerably to 2,602kt Vs 1,946kt last quarter so it was the milling and grade issues that held gold production back.

· AISC of $1,659/oz, well up on $1,386/oz from Q2 and the long term target for Gruyere of $1,300, but this was due to the above mentioned production and grade issues which “should not” be an issue long term.

· Sales of 28,425oz were low (32,100oz in Q2) and an average sale price of $A/oz of 2,145 is well below current spot prices due to 36% of sales being hedged at A$1,823/oz. About 25% of expected production is hedged out to the end of calendar 2022 at an average of A$1,874/oz so high spot price are not fully reflected in sales.

· Cash is a healthy $129m, down on Q4’s $150m due to dividend payments and tax payments pushing operating cashflows negative on lower sales.

· Gruyere 12,000m deep diamond drilling showing promise and progressing to phase 2 and we should expect an update on the Ore Reserve in H2.

· Discovery work in Yamarna details provided with some encouraging results.

The production disruptions in Q2 at Gruyere are disappointing but don’t impact my valuation thesis which assumes they will be able to get to the targeted 350Koz product levels by 2023 and average an AISC of $1,300 with an average sell price of A$2,400 through to 2030. The thesis also assumes that gold reserves can be replenished through new discoveries (Gruyere & Yamarna) to provide perpetual value and this also seems reasonable based on their drilling work to date.

I hold GOR at current prices, but would probably trim or sell if it got to $2 without additional justification for a higher valuation

GOR production update for Q4 today (28/6/21) attached flags production down time due to equipment failures which amounts to a small profit downgrade for FY21, but only a minor drop so despite any market reaction today I am make no changes to my valuation.

· FY production remains within guidance of 260-300k ounces but at the lower end.

· AISC guidance increased from $1,225-$1,350 to $1,325-$1,475

I continue to hold GOR

Valuation details

08-Dec-2020: Gruyere to Expand with Renewable Energy Hybrid Microgrid

and: APA: APA Makes First Hybrid Energy Microgrid Investment

GRUYERE TO EXPAND WITH RENEWABLE ENERGY HYBRID MICROGRID

Highlights

- Gruyere JV installation of a renewable energy hybrid microgrid will increase the mine’s power capacity to enable plant throughput up to a targeted 10 million tonnes per annum (Mtpa)

- Phase 1 installation of an additional 4MW gas engine by mid-2021

- Phase 2 installation of a 13MW solar farm and 4.4MW battery energy storage system by the end of 2021

--- click on links for the full announcements by GOR and APA ---

[I hold GOR shares, GOR (Gold Road Resources) own 50% of the Gruyere Gold Mine in WA. The other half is owned by South-African-based Gold Fields Ltd.]

Further Reading:

https://goldroad.com.au/wp-content/uploads/2020/10/20201023-Quarterly-Activities-Report-Sept-2020_asx.pdf (23-Oct-2020)

https://goldroad.com.au/wp-content/uploads/2020/10/202010-Diggers-Presentation_ASX.pdf (12-Oct-2020)

https://goldroad.com.au/ (website)

28-May-2020: 2020 AGM CEO Presentation and 2020 AGM Chairman's Address to Shareholders