I don’t own IPH Limited…thankfully! The shares have lost nearly 65% of their value in 3 years!

Source: Simply Wall Street

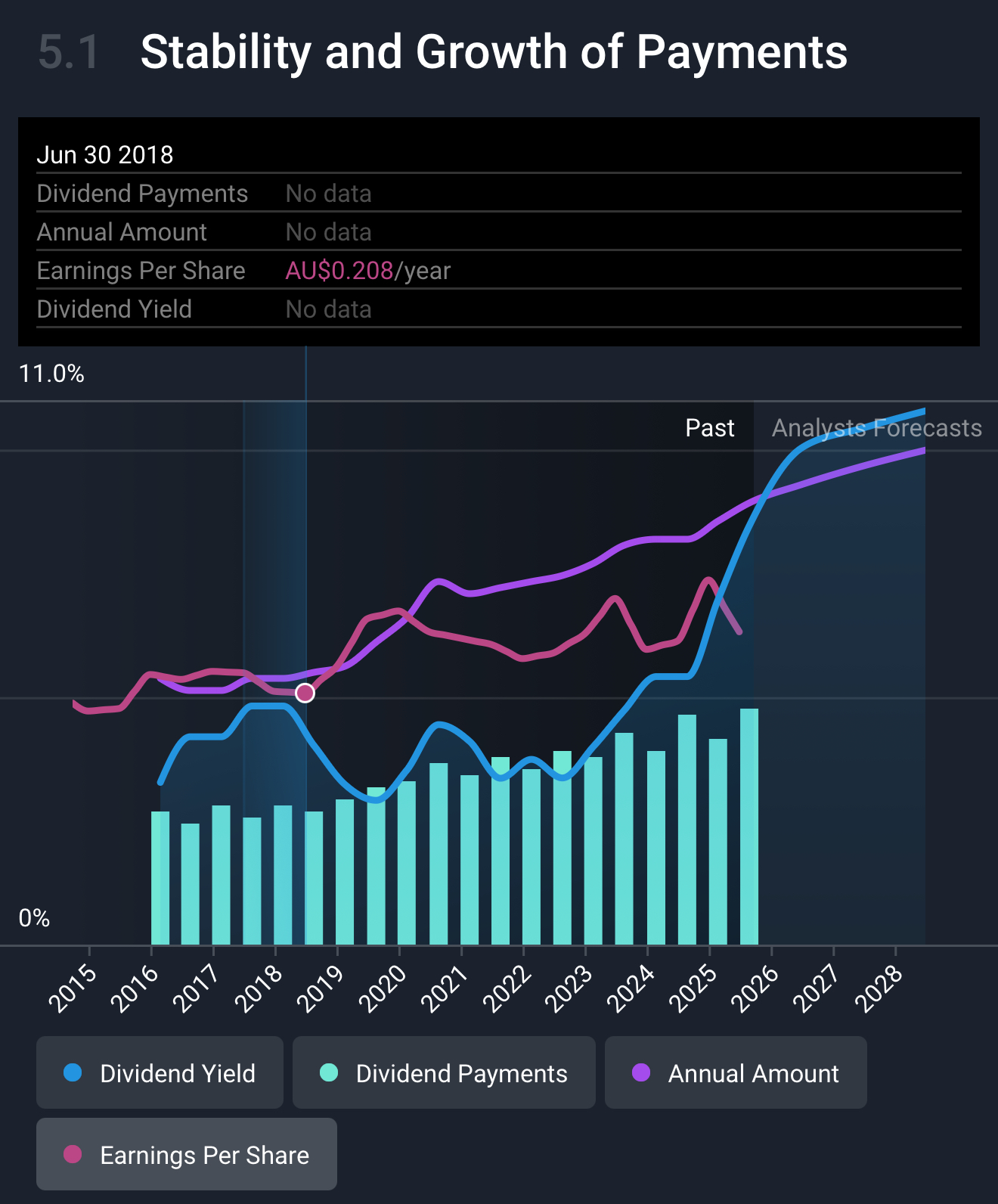

Despite this, the business is paying a whopping 9.8% partially franked dividend, and it has done OK! It’s a hard one to fathom because many of the indicators have grown!

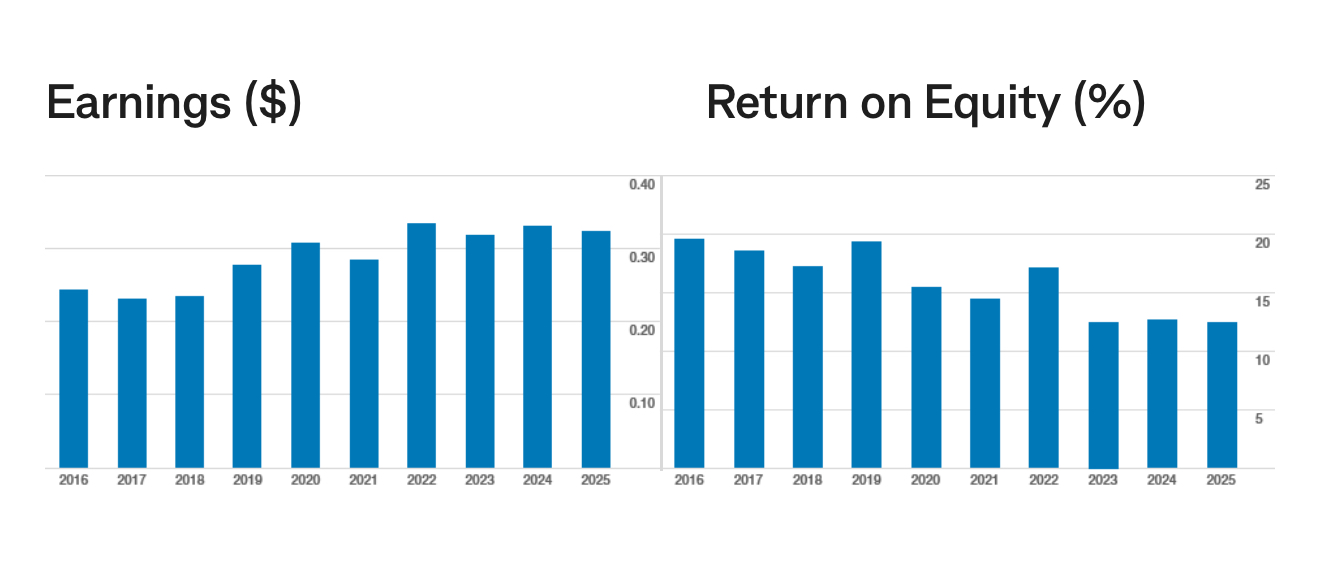

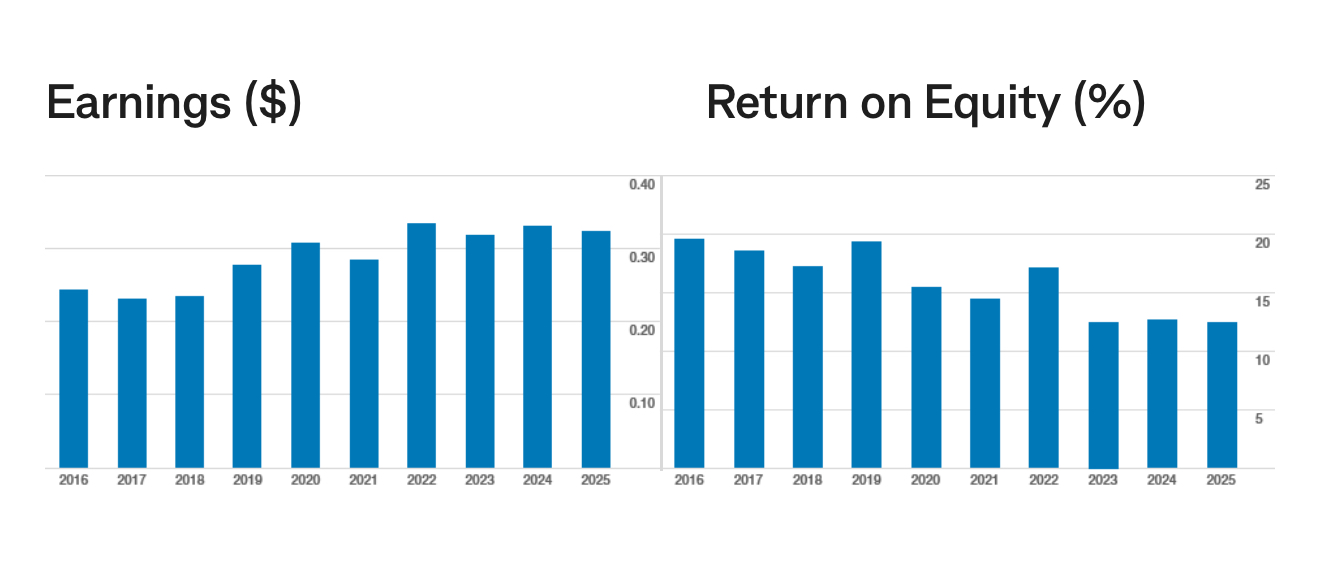

Over 8 years sales have nearly tripled, EPS is up by 40%, dividends have grown by 70%, book value per share has more than doubled, and the ROE is not too shabby!

On the negative side ROE has declined from 18.6% down to 12.4%: This may be the result of decreasing profit margins over time which is a worry!

Source: CommSec

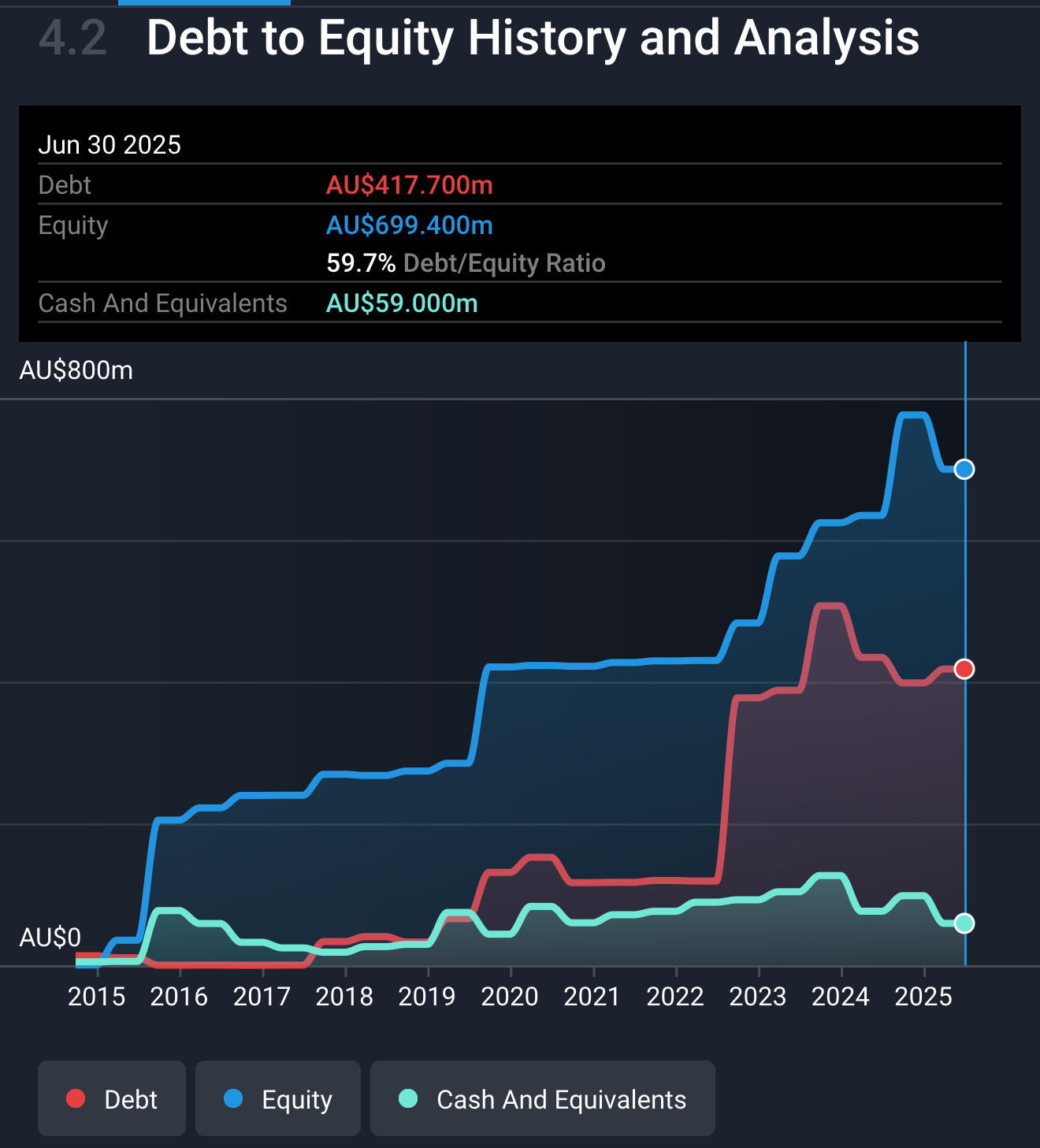

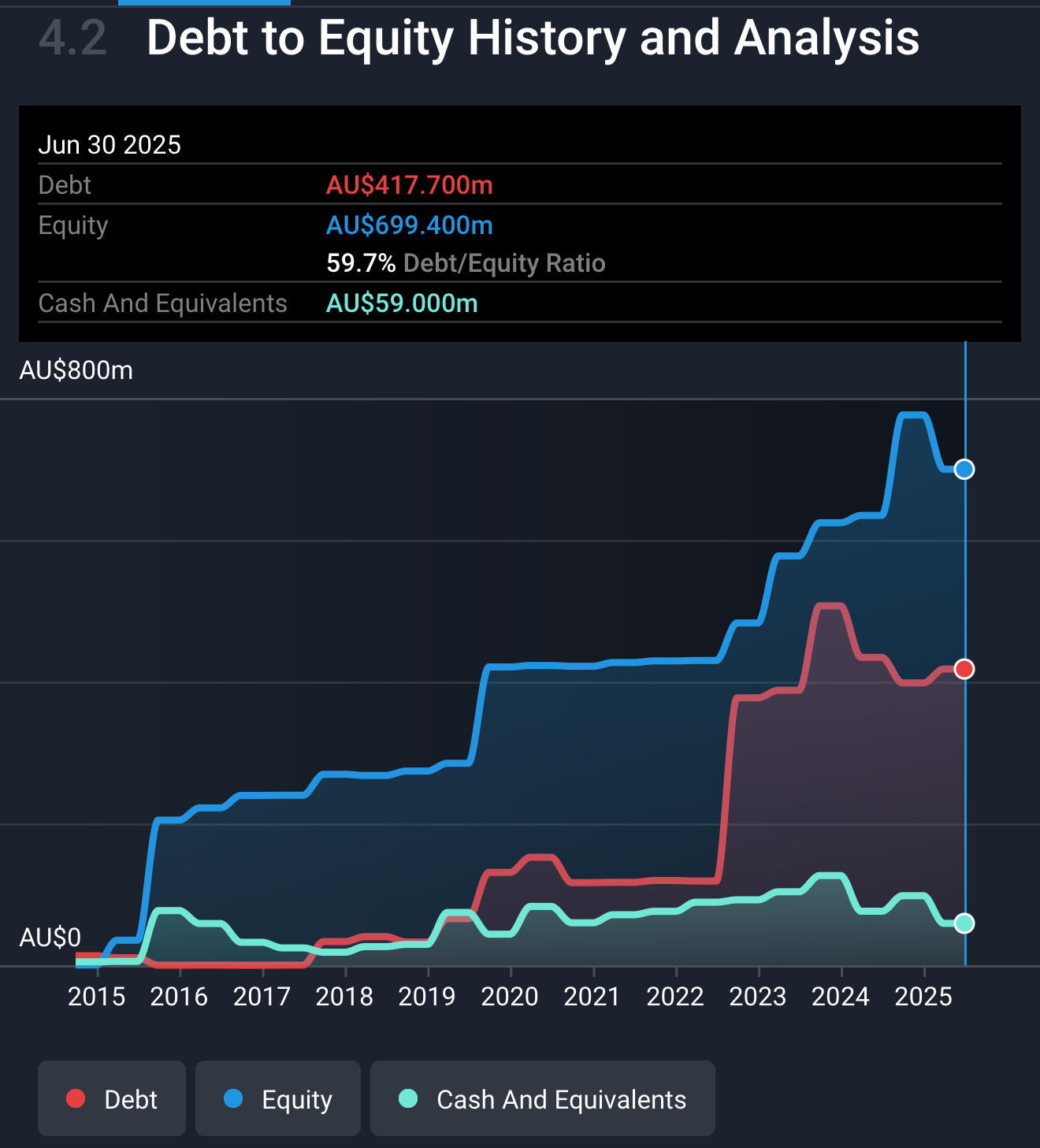

Debt has grown with net gearing increasing from -10% to +58%.

Source: Simply Wall Street

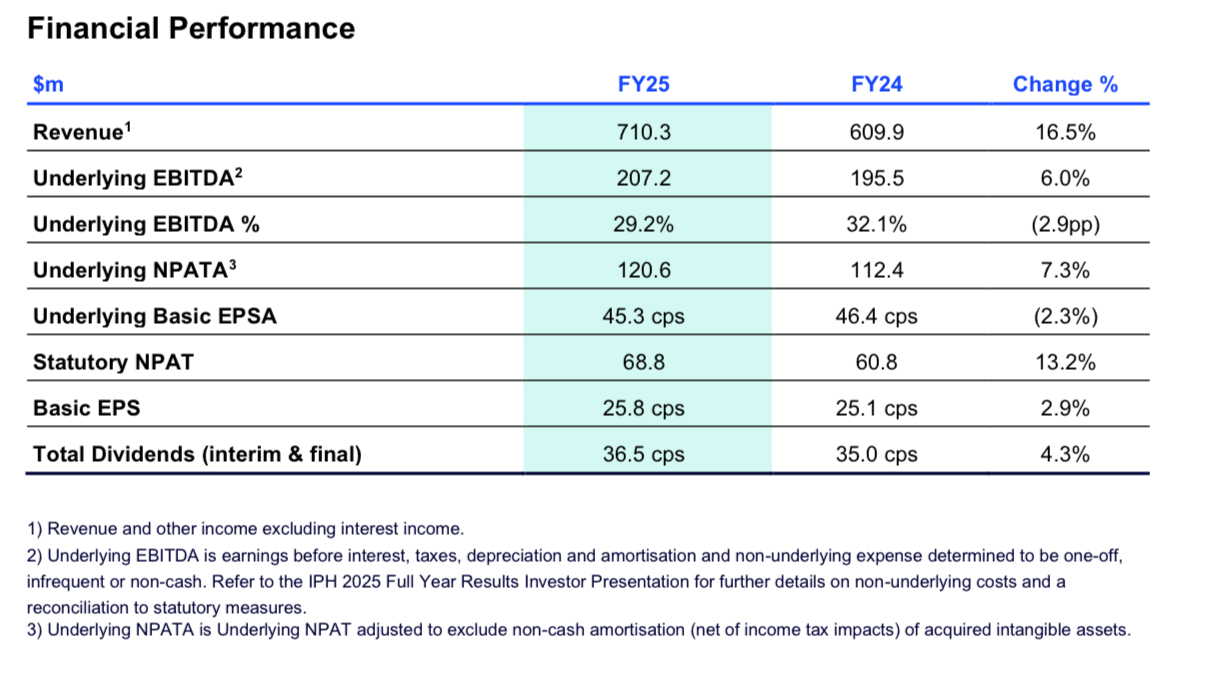

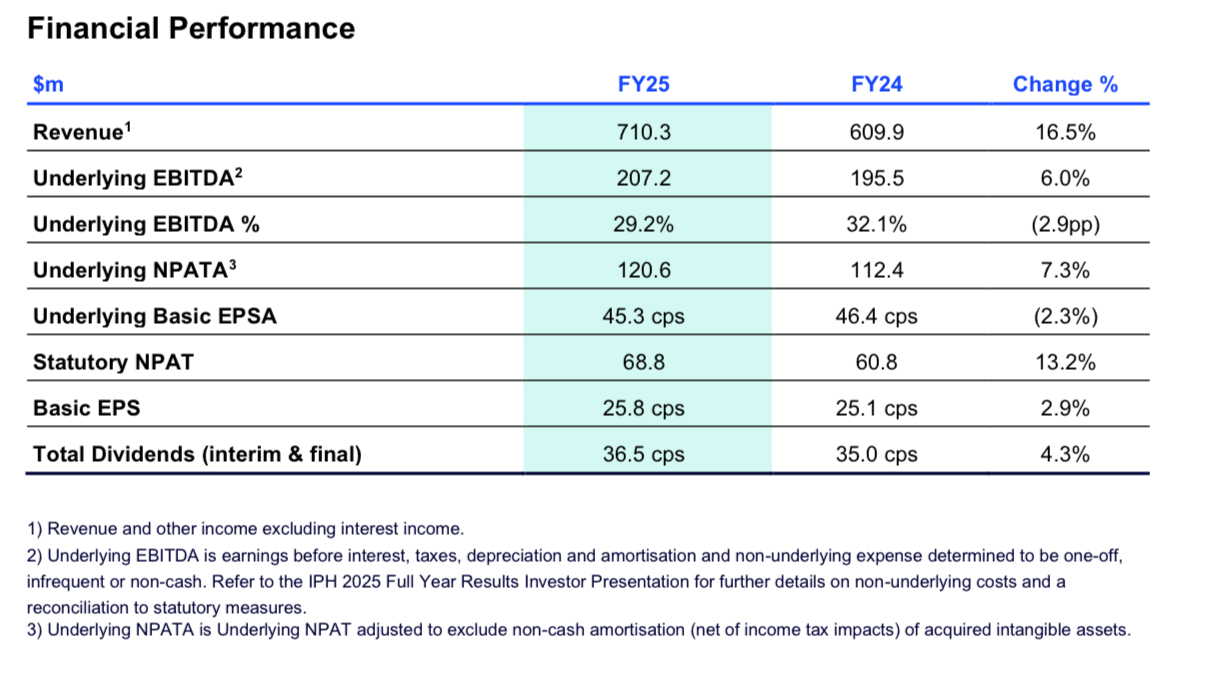

FY2025 Results Summary

• Revenue up 16.5% and Underlying EBITDA up 6.0% year on year; reflects acquisitions in Canada

• Underlying NPATA of $120.6m, up 7.3%; equating to Underlying Basic EPSA of 45.3 cps (FY24: 46.4cps)

• Statutory NPAT $68.8m, up 13.2%; equating to Basic EPS of 25.8 cps (FY24: 25.1cps)

• Continued strong operating cashflow generation – cash conversion ratio of 103%

• Final dividend declared of 19.5 cps; total dividends for FY25 of 36.5 cps (FY24: 35.0 cps)

• Organic revenue growth achieved in ANZ despite lower market patent filings

• IPH Asia patent filings up 16.5% in FY25 – supports future revenue and earnings

• CIPO issues delayed revenue in Canada – emerging signs of recovery in FY26 as systems are restored.

About IPH Limited

IPH Limited, together with its subsidiaries, provides intellectual property (IP) services and products. It operates through three segments: Australian and New Zealand IP, Canadian IP, and Asian IP. The company offers IP services related to the provision of filing, prosecution, enforcement, and management of patents, designs, trade marks, legal services, and other IP.

It serves Fortune Global 500 companies, multinationals, public sector research organizations, SMEs, professional services firms, universities, foreign associates, and other corporate and individual clients. IPH Limited was founded in 1887 and is based in Sydney, Australia.

Morgan’s Take

Here is a recent note (10/09/25) shared by James Mickleboro from The Motely Fool: https://www.fool.com.au/2025/09/10/these-top-asx-dividend-shares-offer-huge-7-to-9-yields/

“Over at Morgans, its analysts think that intellectual property company IPH could be an ASX dividend share to buy.

While its performance wasn't great in FY 2025, Morgans feels positive about its outlook and sees its current valuation as cheap. The broker explains:

On a like-for-like basis, IPH reported flat FY25 revenue and EBITDA -4% on pcp. Each geography recorded marginal LFL EBITDA pressure, a mix of lower filings (ANZ); cost inflation (Asia); and some temporary issues (CAD). Whilst organic growth is still challenged, the FY26 outlook for each division looks relatively stable or marginal incremental improvement. A cost out program (A$8-10m in FY26) will assist. IPH's valuation is undemanding (<10x FY26F PE), however investor patience is required given the delivery of organic growth looks to be the catalyst for a sustained re-rating.

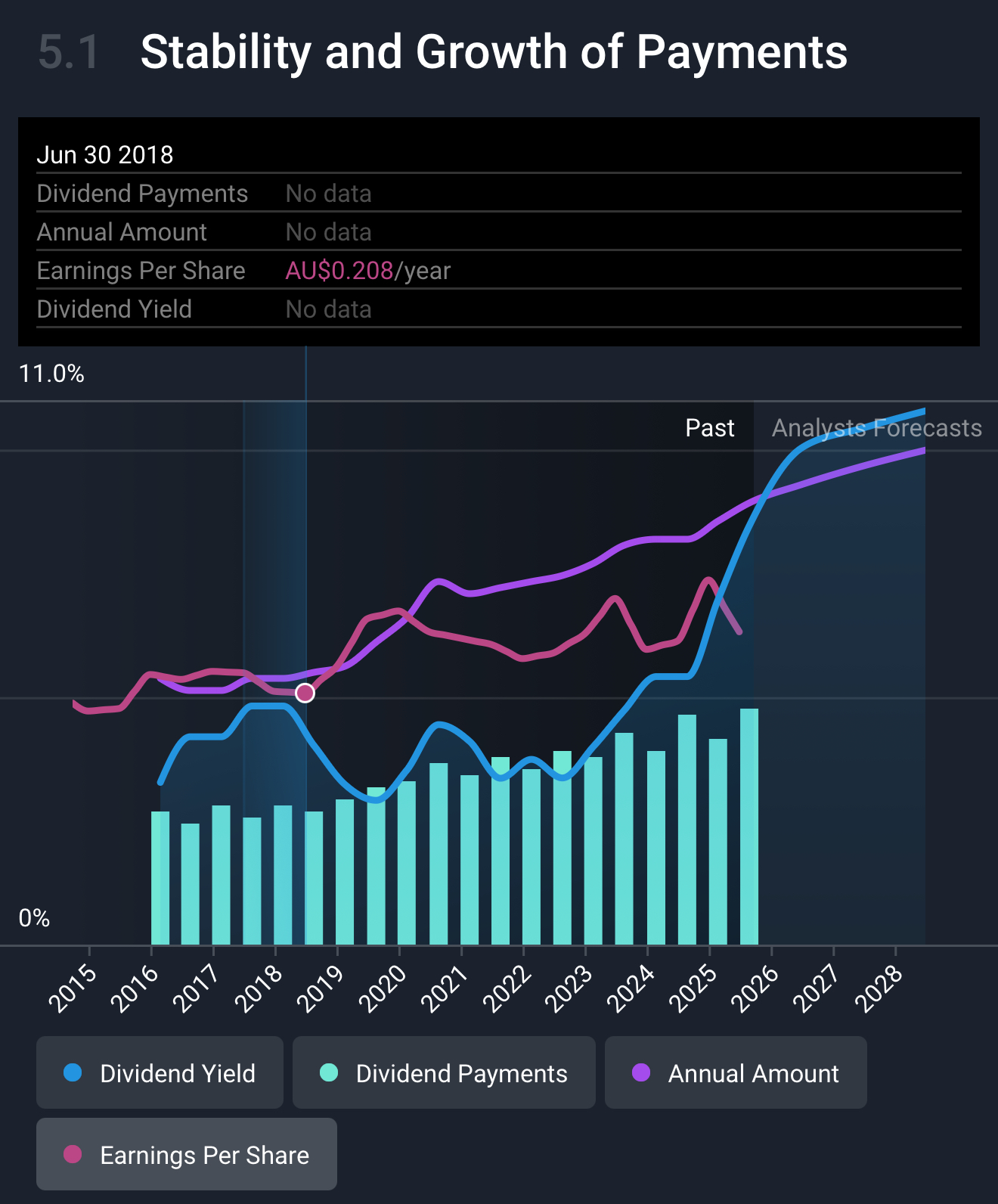

As for dividends, Morgans is forecasting fully franked payouts of approximately 37 cents per share in FY 2026 and FY 2027. Based on its current share price of $4.24, this would mean dividend yields of 8.7%.

The broker has a buy rating and $6.05 price target on its shares.”

My Take

While I’m not quite ready to jump in yet, but I have added IPH to my watch list. The chart looks shocking! It has been a relentless downward trend for over 3 years. I do have a feeling that the share price might be close to a turnaround. I think the shares have gone from being way too overvalued to undervalued!

My valuation using McNivens Formula (https://strawman.com/forums/topic/8371) comes out at $4.20 (aiming at a 15% return on investment). At the current price of $3.80, I would be expecting a 16% return over the next 3 to 5 years. This is based on consensus earnings growth over this time period.

Source: Simply Wall Street

Analysts are also forecasting forward dividends of approx 10% partly franked next year! The risk/reward opportunity is looking very attractive at the current share price!

Source: Simply Wall Street

Any thoughts out there! What other negatives can you see going forward? Here’s one from the results summary to start with:

“As performance of the Group is subject to variability from impact of foreign exchange movements as well as acquisitions part way through financial years, the Company presents financial performance on a like-for-like basis.

On a like for like currency adjusted basis, revenue was flat on the prior year with variability in geographic markets.

On a like for like currency adjusted basis, Underlying EBITDA was 3.9% down on the prior year as the flat revenue, coupled with incremental costs, impacted earnings and margin. During the second half of the year the Group implemented a corporate cost reduction program to better align costs to revenue.”

Not held.