Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

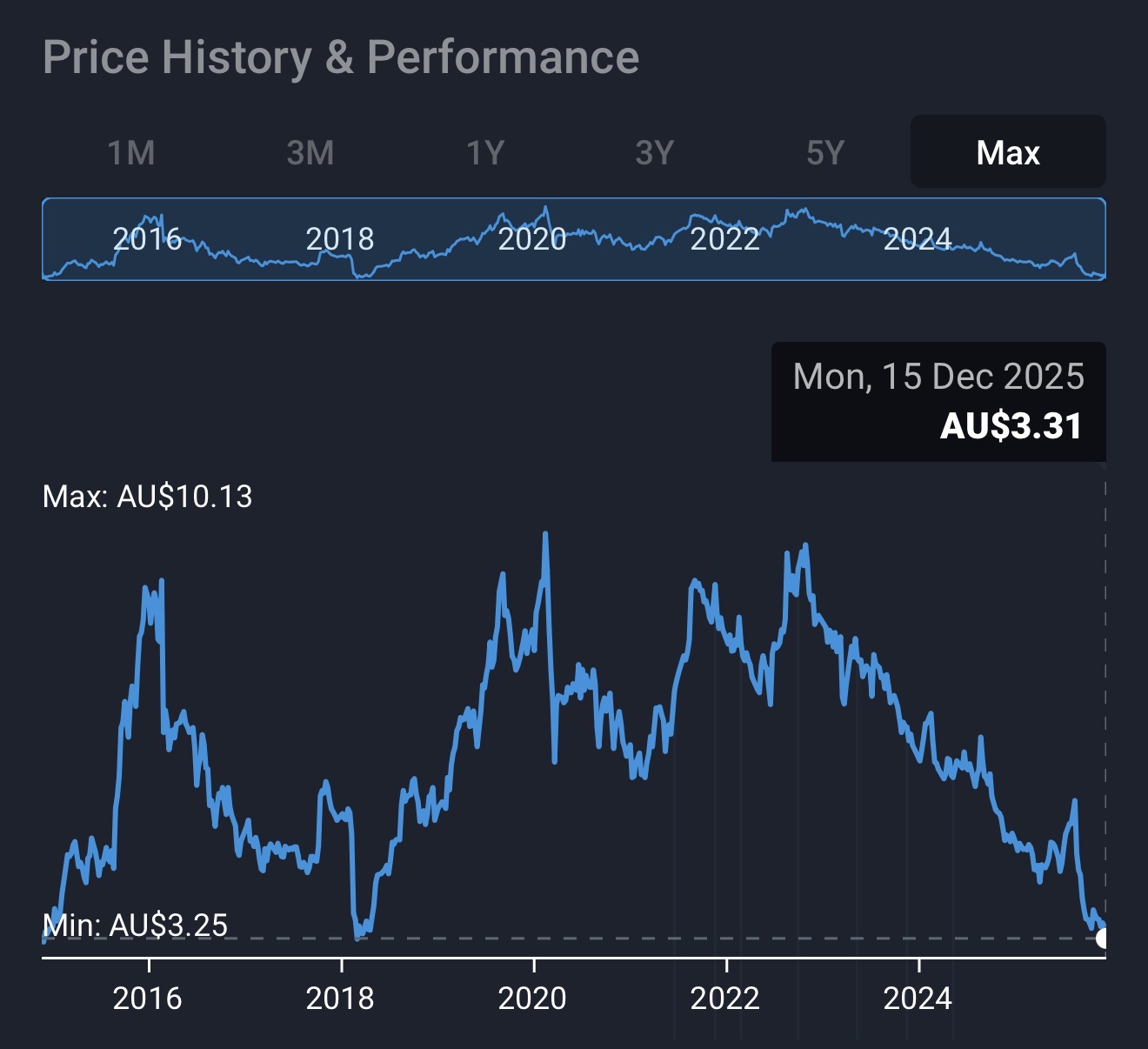

There are a few things having an impact on the IPH share price since my previous straw, resulting in the share price declining 8% from $3.59 to $3.30. Earlier this week the share price hit $3.23, which was an eleven year low!

I think the negative sentiment and a shocking chart is definitely having an impact. This is also being exacerbated by a few other things lately.

In the S&P Dow Jones Index Quarterly Rebalance announced on 5th December, IPH will be booted from the ASX 200 prior to the open on 22nd December 2025. If the passive fund money hasn’t already been withdrawn from the IPH share register, it soon will be. This will put further pressure on the share price.

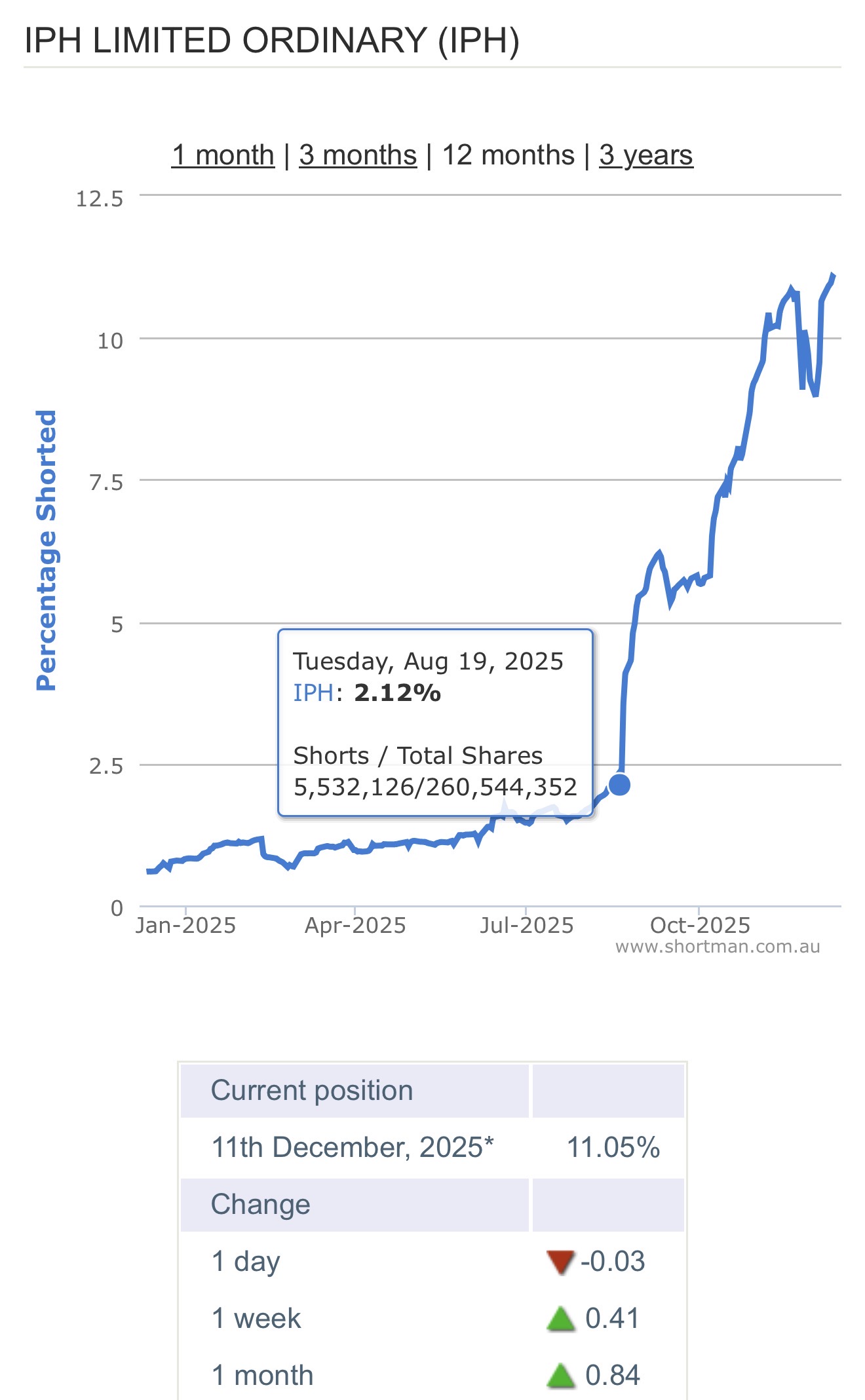

I think short sellers were already anticipating IPH would be booted from the ASX 200 and started shorting IPH during in late August. As of the 11th December there were short positions on 11% of IPH shares (top ten on shortman.com).

The IPH trading update on the 20th November did nothing to prevent further short positions during December.

I thought the trading update for the first 4 months of FY26 was reasonably positive for the overall business:

- Unaudited IPH Group Revenue was $241.7 million, up 7% on the same period last year

- Group Underlying EBITDA of $72.4 million, up 13% on the same period last year.

Positives

Growth was a result of the prior year acquisition of Bereskin & Parr, organic revenue growth in both Asia and Canada as well as a positive movement in foreign exchange rates. The average AU$/US$ exchange rate for the first four months of FY26 was 65.4 cents compared to 67.0 cents for the PCP.

The Group Underlying EBITDA improvement was also assisted by a reduction in corporate costs, which will remain a focus across the rest of the financial year and beyond.

Negatives

Most of the negatives are associated with Australia and NZ which contribute 43% of the group’s earnings.

Earnings decline continues in Australia and NZ, impacted by lower US PCT filings and the economic downturn in NZ (Australia and NZ contribute 43% of earnings).

IPH member firms have a significantly higher exposure to US clients relative to the market, and IPH’s Australia/NZ segment is impacted by the decrease in market filings from US applicants.

The Australian patent market has also included an unusually high number of self-filed provisional applications (i.e. applications which are not attached to a filing agent) which have increased by 222% for the year-to-date period compared to the PCP. At this stage, it is unclear what is driving this somewhat unusual activity.

FY26 Focus

While the macro environment has been challenging, we are focused on driving organic growth and generating operating efficiencies.

Given the ongoing decline of US PCT filings into Australia and NZ, we are re-focusing our business development activities to target second tier associate firms for filings into our member firm jurisdictions.

We have also deliberately re-focused and significantly boosted our business development activities to target Western Europe, Japan, South Korea and Chinese incoming filings.

Our focus in Canada is to leverage our integrated platform and to harness the beginnings of a recovery in patent workflow following the CIPO systems issues to deliver growth.

While in Asia, we are building on the current filing momentum to deliver revenue and earnings growth.

As we detailed at our full year results, we have realigned our cost base to drive operational efficiencies which will deliver annualised cost savings of $8-10 million from FY26.

My Take

Yesterday IPH shares closed at $3.30 per share. I think the risk/reward for this business at $3.30 is attractive and I have added more to our holding. The share price could fall further yet because of the short selling and poor sentiment. The chart doesn’t show much support above $3.30 per share.

Fundamentally, the ROW business is showing signs of growth and the temporary issues in Canada are now resolving. ROW makes up 57% of the groups earnings and this is likely to continue growing slowly. The business also has consistent strong cash flows which are forecast to continue. Earnings per share is forecast to be higher in FY26 at 39 cps, up from 26 cps in FY25 (analyst consensus), putting IPH on a forward PE of 8.5, which seems incredibly cheap! Based on forecasts the FY26 ROE could be 14%. Not amazing, but reasonable.

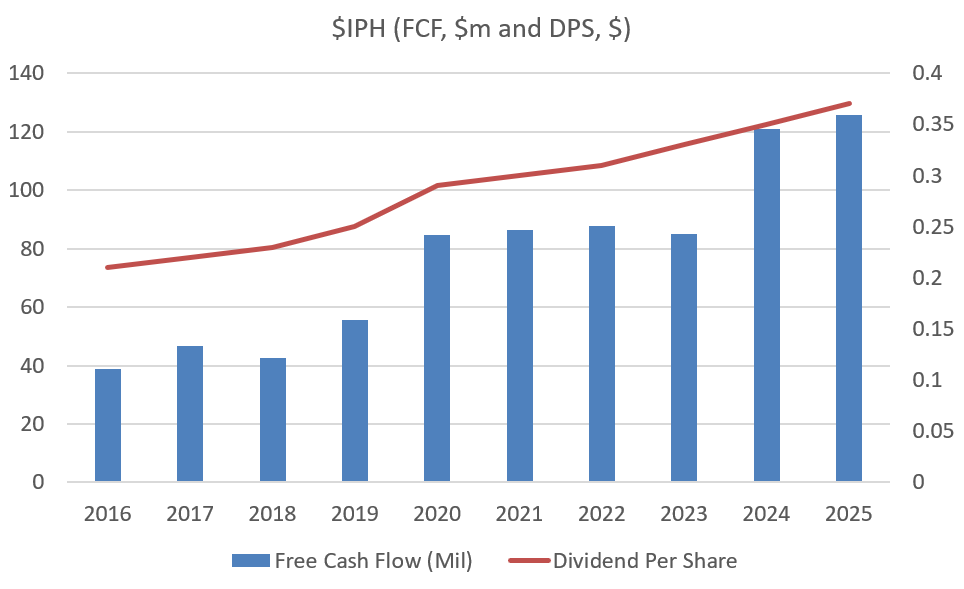

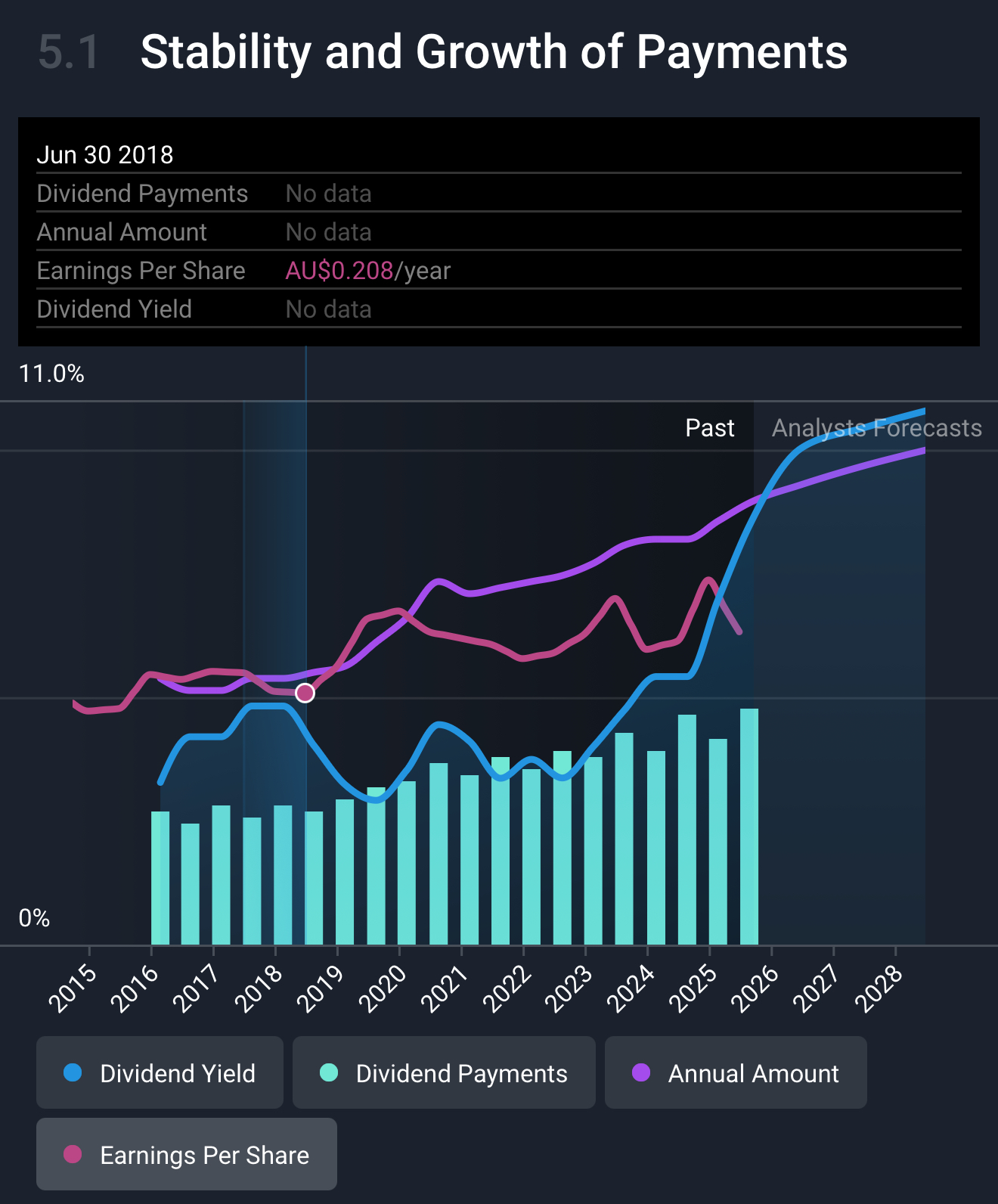

It is feasible for IPH to continue paying a solid dividend, possibly 37 cps. IPH has a track record of increasing dividends every year for a decade. At the current share price I am anticipating a yield of over 12% (including 25% franking credits for the Australian component). Over the next 15 months (3 dividend payments) it’s feasible IPH will pay shareholders 54 cps in partly franked dividends.

There are a lot of ‘if’s’, ‘but’s’ and ‘maybe's’ with my thesis, and the short sellers could turn out to be right! The analysts and the short sellers seem to be poles apart on their views for the business. I’m working on the 4 month trading update continuing for FY26, with earnings and cash flow both higher than for FY25.

Held IRL and SM

I don’t want to jinx it, but the sentiment could be changing for IPH.

@Rick first up, thank you for your thorough and characteristically thoughtful analysis of $IPH. I have also been thinking about this one, since you first asked the question (as it wasn't really on my radar screen before then).

I wanted to make two observations here:

- The long term track record of the business, and how to consider the current valuation in that context. (Is the bottom in? Risk?)

- AI - headwind, tailwind, both, neither?

This post simply tries to capture some thoughts stimulated by your work that ahve been rattling around in my head for the last week. I've not yet reached a conclusion on whether I am going to invest in $IPH - mainly because it is not in the class of businesses that normally fit with my investing style and "circle of competence" (or relative lack of incompetence!!)

1. Performance over the long term ("Being Paid to Wait ... But Waiting for What?")

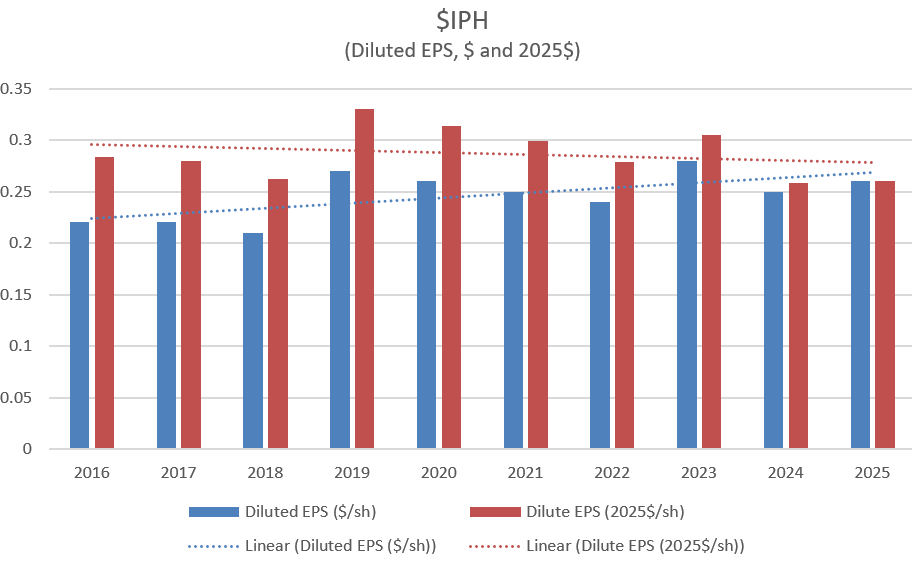

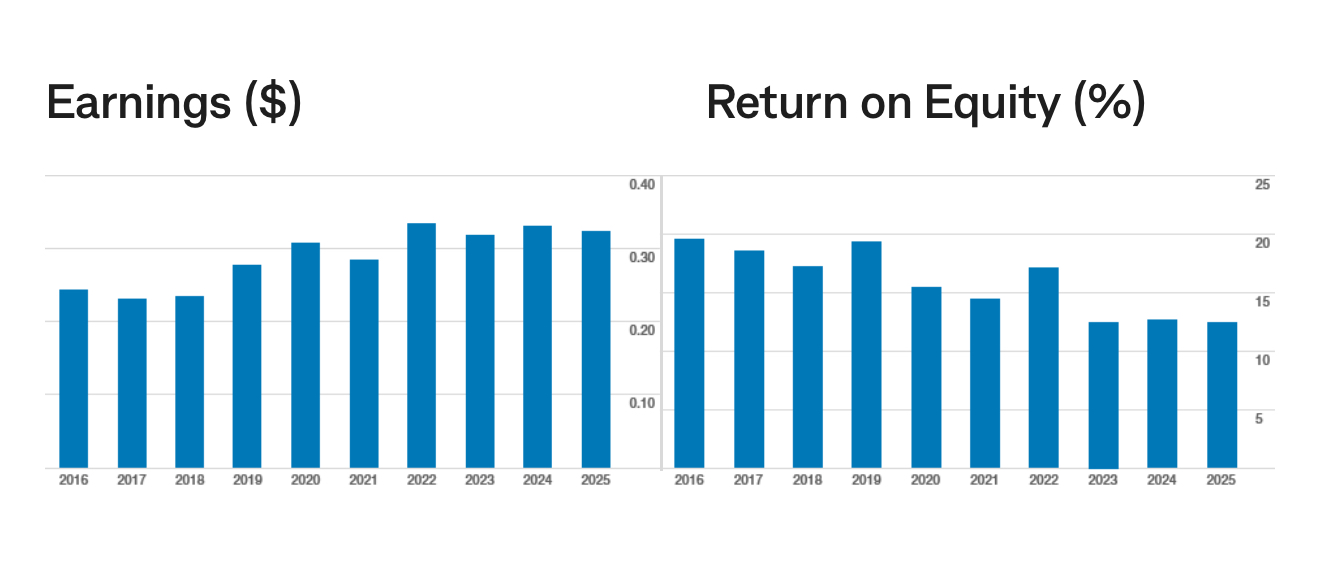

As is often the case with roll-ups, EPS growth over the long term provides a good indicator of value creation.

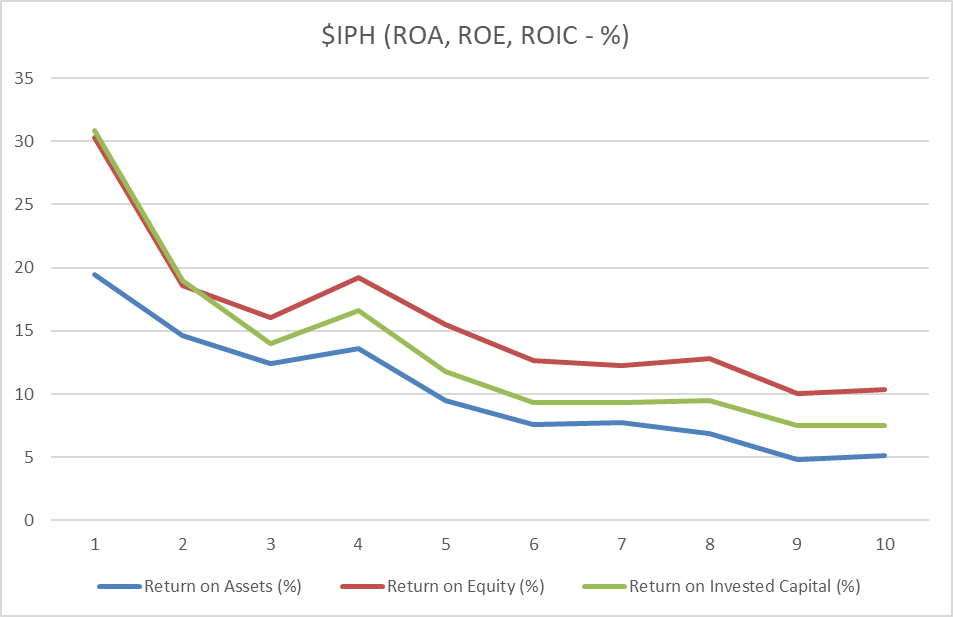

And this is where IPH can be seen to be a laggard. Diluted EPS was $0.22 in FY16, and only advanced to $0.26 by FY25, a material decline in REAL terms (as shown below).

For me, this demonstrates that $IPH is not a high quality business. It is not something I would normally consider investing in for the long term.

However, that doesn't mean that the business isn't materially undervalued today. And do I am interested in the potential thesis of whether it represents a short/medium term value recovery idea.

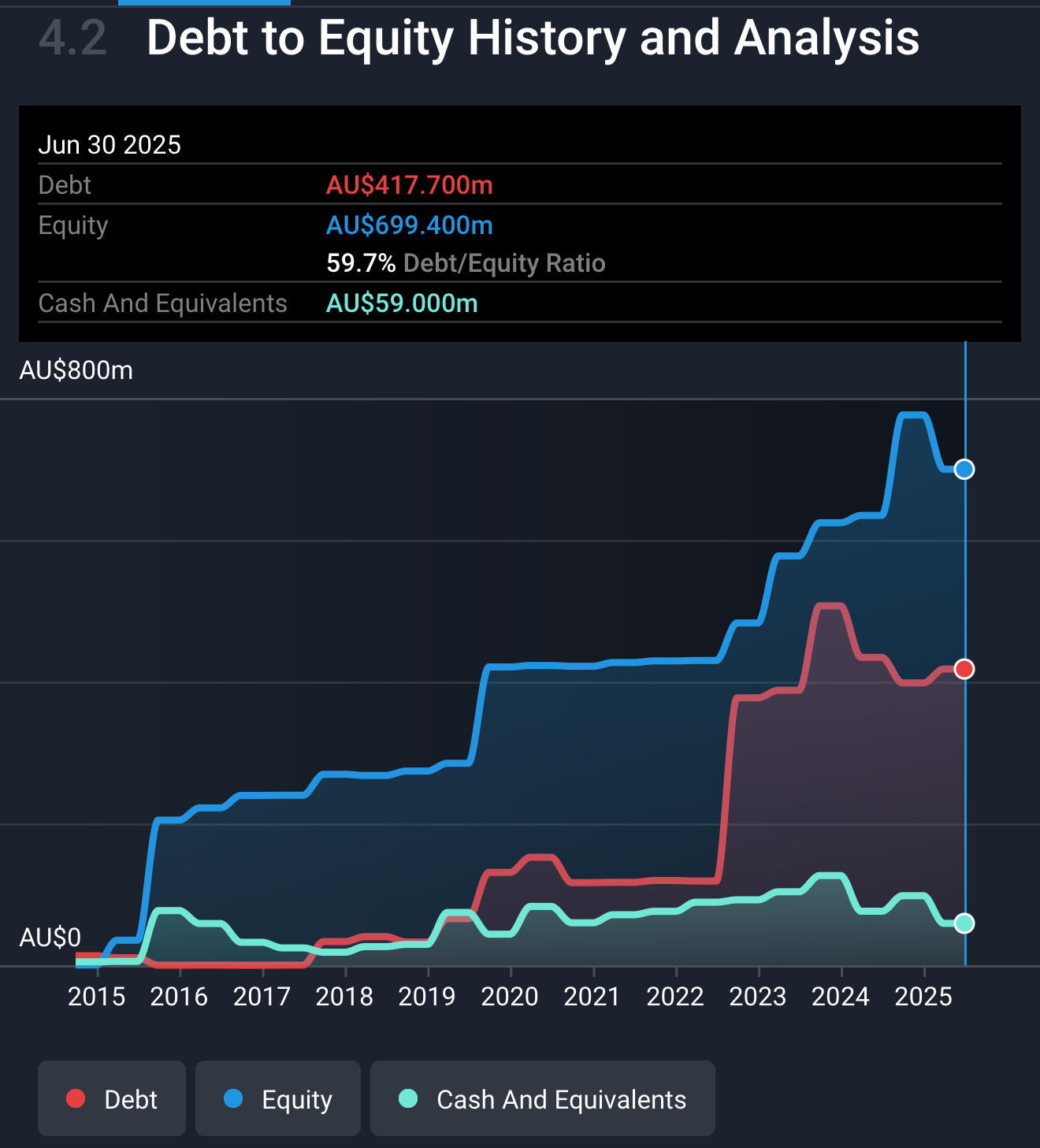

Over the last decade FCF and DPS have grown steadily - underscoring that if the furture looks like the past, then this can be expected to be a solid performer on these metrics. As you've noted, the dividend yield is attactive, and it looks reasonable secure. (The business is not unduly leveraged, and so can flex to protect the payout if needed in the short term).

The arguable disconnect between the poor EPS progression and the cash and dividend metrics can be seen in the returns performance - a steady deterioration over time as the business has scaled through acquisition.

Arguably, management have been reinvesting rationally, until recently. If you consider that the WACC for this business is around 7.5% to 8%, than ROIC has fallen to the WACC, and so you'd expect a strong payout ratio, unless they can lift the returns of the operating business.

Note: The current ROE I have pulled from the Morningstar Quant. report (the source for all the above numbers) is 10.34, is a bit lower than yours.

I agree that this is the kind of stable business well-suited to using McNiven's Valuation method, and I note your recent valuation assumes that ROE will rise to 14%, a level which according to the numbers above we haven't see for quite a few years.

So my question, in considering this as a short/medium term recovery investment, is: are the following factors are enough to drive ROE enabling the re-rating of the business?

- leveraging #1 positions in ANZ/SG

- growing Canadian scale

- strong cash conversion and disciplined leverage

- apparent FY26 tailwinds: Asia filings, CIPO normalisation, cost-out, Canadian synergies.

I don't know the answer to these questions. But I think there are enough levers and also enough confidence from the historical performance that it is probably safe to say the bottom is in, and that indeed with a stable dividend we can "get paid to wait"?

My remaining question is therefore "wait for what"?

Which then turns me to my second point - a completely different point. And it is, how is the increased use of generative AI going to impact this business?

2. Generative AI - Headwind, Tailwind, Neither, Both?

The rise of generative AI is set to reshape demand for intellectual property services in complex, offsetting ways.

For firms like $IPH Limited, the most immediate impact will be in patent filing, where generative AI is driving a surge in new inventions and accelerating R&D productivity. This expands the pipeline of patentable ideas, while a shortage of qualified patent attorneys suggests underlying demand will continue to outstrip supply. However, AI will also automate much of the routine drafting and prosecution work, cutting billable hours and pushing clients to expect lower costs, creating margin pressure even as filing volumes rise.

Trademark services are likely to experience more modest effects. Their demand will still track overall business formation, branding activity, and e-commerce growth. AI tools will improve search and filing efficiency, and the explosion of AI-generated content may require new trademark strategies, but the overall impact is expected to be stable to slightly positive.

We can expect significant growth in IP defense and litigation. Generative AI introduces unsettled legal questions about ownership, copyright infringement, and the legality of training data, all of which are already fuelling lawsuits. As AI-related patents proliferate, so too will infringement disputes, freedom-to-operate analyses, and litigation over data use. Courts will actively set new precedents. This will drive strong demand for contentious IP work and high-value strategic advice.

For IPH, this evolving environment presents both opportunities and challenges. While overall volumes will likely grow, especially in AI-related patents and litigation, routine services will become more commoditised and margins thinner. Firms that invest in AI tools, reposition toward higher-value strategic and advisory work, and build expertise around AI-specific IP issues will be best placed to capture the upside. Done well, the growth in complex, premium work should more than offset any efficiency-driven compression in traditional revenue streams.

So, how is $IPH positioning itself in this area?

To date, it has said little. But we can glean a few clues from statements made over the last two years.

While $IPH Limited has not announced a sweeping AI strategy, it appears to be steadily positioning itself for an AI-driven future through incremental, practical steps. It has introduced a Group AI Usage Policy, begun developing in-house AI tools, and is assessing their financial impact, signalling a clear intent to embed AI into workflows to improve productivity and client service.

Alongside these moves, $IPH is advancing a broader digital transformation: upgrading case-management systems, standardising processes across practices, and expanding digital platforms like Applied Marks and IPHQ News. These initiatives will facilitate deeper AI integration over time.

Overall, $IPH’s approach appears to be cautious and deliberate. Rather than headline-grabbing announcements, it is quietly preparing its operations, services, and infrastructure to harness AI’s potential, enhance efficiency, and strengthen competitiveness in a rapidly evolving IP services market.

My Overall Conclusions

In the knowledge economy, using generative AI is going to become table stakes, if we are not already at that point.

Whether AI forms part of a value recovery thesis for $IPH in my mind depends on the interplay between two factors - external and internal:

1. The macro impact of AI driving innovation/ R&D and increasing the demand for IP services (both IP creation and IP defence)

vs.

2. The extent to which IP service providers like $IPH adopt AI to improve their own efficiency and productivity, and become able to do more for less.

The annual $8-10m cost out delivered through FY25 and flowing into FY26 contains a component of efficiency from embedding AI into workflows and broader platform optimisation. However, this seems a modest impact compared with the potential increase in demand for services that may be coming. On the face of it, it looks like $IPH is simpling putting up the table stakes, rather than creating a competitive advantage.

So, while it might not outperform its sector, if 1, (above) >> 2. (above), then we could see a marked improvement in performance over over the next few years.

No answers from me today, but I thought I'd share my thoughts.

Disc: Not Held (but considering)

According to an article by James Mickleboro from The Motley Fool today (02/10/2025) Macquarie is forecasting a 60%+ return over the next twelve months (ie. dividends and capital appreciation).

While I think Macquarie’s forecast is entirely feasible, I would consider it my bull case.

I’ve been accumulating quite a few IPH shares in our portfolios over the past few days. I like IPH because it fits one of my favourite investment strategies, “Getting paid to play while you wait!”

With the shares currently trading at $3.60 per share, I am expecting a 30%+ return over the next twelve months, based on a conservative valuation of $4.35. I think the risk/reward proposition for IPH is highly attractive at the current share price.

Held IRL 2.9%, SM 1.8%

James Mickleboro, The Motley Fool (02/10/2025) https://www.fool.com.au/2025/10/02/macquarie-tips-60-return-for-this-asx-all-ords-stock/

Key points

- Macquarie forecasts a potential 54% share price increase for an ASX All Ords stock, combined with high dividend yields.

- Despite recent challenges, the stock's attractive valuation and operational improvements present a compelling buying opportunity.

- Investors can expect generous dividend yields of 10.9% for the coming years, enhancing the overall return potential.

If you are hunting a combination of major upside and a big dividend yield, then read on

That's because Macquarie Group Ltd (ASX: MQG) has just named one ASX All Ords stock that it believes will deliver both.

Which ASX All Ords stock?

The stock that Macquarie is feeling bullish about is IPH Ltd (ASX: IPH).

It is an intellectual property (IP) services group with a network of member firms working throughout 26 IP jurisdictions. The ASX All Ords stock notes that it works with a diverse client base of Fortune Global 500 companies and other multinationals, public sector research organisations, small businesses, and professional services firms.

Its group includes leading IP firms AJ Park, Griffith Hack, Pizzeys, ROBIC, Smart & Biggar, and Spruson & Ferguson, as well as online automated trade mark application platform, Applied Marks.

Macquarie notes that data shows that the ASX All Ords stock has been battling tough trading conditions. It said:

IPH's sustained lower filing activity saw market share in Aust 26.5% for September prior to seasoning. IPH PCT filings remain volatile, down -8% YoY in Sep-25. Global activity (12-18mth lead indicator): US PCT activity growth remains negative (-7.1% qtr rolling, -5.0% annual rolling to Jun-25). Allowing for a 12-18mth delay between primary market filings (US) and secondary market filings (Aust), current Aust activity correlates with the historical weak US activity.

However, it is worth noting that things were better than previously expected in recent months. This has led to positive revisions to initial filing estimates for June through to August. Together with its attractive valuation, underlying improvements, and cost outs, Macquarie sees this as a buying opportunity for investors.

Big returns

According to the note, the broker has retained its outperform rating and $5.55 price target on its shares.

Based on its current share price of $3.61, this implies potential upside of 54% for investors between now and this time next year.

But the returns won't stop there. Macquarie is forecasting partially franked dividends of 39.5 cents per share in both FY 2026 and FY 2027. This equates to very generous dividend yields of 10.9% for both years.

Combined with its potential share price gains, this means that a total 12-month return of approximately 64% is on the cards for buyers at current levels.

Commenting on its recommendation, Macquarie said:

Outperform. Despite disappointing operating performance in FY25, the cost-out, underlying improvement in FY26e and cash generation remain attractive. Catalysts: Recovery in filing volumes and improvement in US PCT filings.

Investing.com - IPH Limited (ASX:IPH) stock rating was downgraded from Buy to Hold by Canaccord Genuity on Friday, with the firm also lowering its price target to AUD4.95 from AUD5.75.

The downgrade follows a 20% share price decline after IPH released its fiscal year 2025 results, which Canaccord described as "broadly in-line" with expectations but insufficient to prevent the stock’s drop.

Canaccord cited IPH’s declining Australia and New Zealand patent filing share as a continuing problem, noting it fell below 30% during fiscal year 2025, while U.S. patent filings remain "lacklustre" as a leading indicator.

The research firm also identified rising competitive pressures in both the Australia-New Zealand market and in Asia as factors in its decision to lower earnings per share estimates for fiscal years 2026 and 2027.

Canaccord stated that "catalysts seemingly thin on the ground" contributed to the rating change, suggesting limited near-term growth drivers for the intellectual property services company.

IPH had some issues with the Canadian segment during FY2025, but I think these issues are temporary. Lower NPAT margins were attributed to a temporary CIPO (the Canadian Intellectual Property Office) backlog caused by upgrades to the CIPO system (see my separate straw for details on the CIPO backlog issue).

Once these backlogs have cleared, and the planned cost savings have been implemented, this should boost both revenues and margins in Canada. Canada makes up 41% of IPH’s revenue, so any improvements here will be significant to overall margins and NPAT for the business. The market might not be seeing these current issues as temporary, so this could be an opportunity to buy a decent dividend paying business at a reasonable price.

However, the business has underperformed for 6 years now. EPS has grown by a mere 2% and ROE has declined from 18% to about 12.5%.I think we’ll see ROE begin to improve again this year and be back to about 14%-15% by 2027.

Source: Commsec

The current NPAT consensus for FY2026 is $84 million (8 analysts, Simply Wall Street). It would appear that consensus is based on the CIPO backlog clearing soon, the $8-$10 million in promised cost savings being realised, and some organic revenue growth. I think $84 million ($0.33 per share) is a reasonable NPAT assumption for valuation purposes.

PE valuation

Based on these estimates, and with the current share price of $3.66, IPH shares are trading of a PE of 14 times FY2025 earnings and 11 times FY2026 earnings. This is the lowest PE ratio in a decade. Until FY2025, the PE ratio was typically over 20. IPH no longer deserves a PE ratio of 20, but 11 seems too low.

Simply Wall Street

For valuation purposes I’m going to assume a PE of 14 and FY2026 EPS at 33 cps, or a valuation of $4.62.

Valuation using McNivens Formula

Assuming FY2026 EPS is 33 cps, and ROE lifts to 14% over the next year, a payout ratio of 90%, and a required return of 10% per year, I get a valuation of $4.35 which is only a 19% upside to the current price. However, if you add the 10% partially franked dividend, that’s a reasonable return in 12 to 18 months. I think this is possible.

Morgan’s valuation

In a note shared by James Mickleboro on 24 September 2025, the team at Morgans thinks that IPH could be an ASX dividend share to buy now.

It is an intellectual property (IP) services company that operates across the globe through brands such as AJ Park, Smart & Biggar, and Spruson & Ferguson.

Morgans highlights that "IPH's valuation is undemanding (<10x FY26F PE), however investor patience is required given the delivery of organic growth looks to be the catalyst for a sustained re-rating."

In respect to income, the broker is forecasting fully franked dividends of 37 cents per share in FY 2026 and FY 2027. Based on the current IPH share price of $3.73, this will mean dividend yields of approximately 10% for both years.

Morgans has an add rating and $6.05 price target on its shares.

https://www.fool.com.au/2025/09/24/buy-these-asx-dividend-shares-for-4-to-10-yields/

Held IRl and SM

The IPH share price has copped a real hammering since management released its FY2025 results on 21st August 2025. The share price has lost 34%, falling from $5.60 to $3.71 today (22/09/2025).

I believe the key reason is market disappointment following a miss on analyst consensus. This miss was questioned by the ASX watchdog.

In response, IPH said that as of the 17 July 2025 (i.e. before their results release), the market consensus estimates for FY25 were as follows:

- “Underlying EBITDA for FY25 was only 1.4% less than consensus and Underlying NPATA was 4.1% less than consensus.”

- For Statutory NPAT, IPH notes that its result was 12.2% less than consensus, still within what they regard as a “materially acceptable” variation (i.e. within 15%)

- The company remarks that the difference versus consensus was not large enough to be surprising and that they did not view the variance as having materially damaged investor expectations.

This may have satisfied the ASX watchdog, but it obviously didn’t go down to well with investors. I consider a 12% miss in statutory NPAT a significant disappointment!

What was behind the 12% miss in Statutory NPAT?

One of the key reasons reported by IPH was the “Underlying EBITDA margin was down 2.9pp reflecting the reduced margin in the Canada segment arising from the CIPO (the Canadian Intellectual Property Office) disruption to patent workflow, impact of the lower margin B&P acquisition completed during the year (ahead of integration synergies activated in the second half of the year) and lower Canada legal/litigation revenue. The chart below shows the impact on workflow as a result of CIPO delays during 2025 (shows Smart & Bigger only).

Source: IPH results presentation

In Canada, the Underlying EBITDA margin fell from 30.5% (FY24) to 25.9% (FY25), a drop of 4.6 percentage points. This is significant considering 41% of the total revenue is coming from Canada. In comparison, EBITDA margins in ANZ and Asia are 35.4% and 42.6% respectively.

What is going on with the CIPO? (ChatGPT’s summary)

CIPO (the Canadian Intellectual Property Office) is actively trying to reduce the backlog. Below is a summary of the current situation and forecast, along with caveats — and then my best estimate of when “clearance” might occur (or at least when the backlog may shrink to manageable levels).

Current status & recent improvements

Patents

- CIPO launched a new portal, MyCIPO Patents, in July 2024 as part of its “Next Generation Patents” modernization initiative, and by October 2024 most of its functionality was live.

- But the rollout has been rocky: there are delays in correspondence processing, fee payments, and status updates.

- As of May 2025, CIPO is still working through its backlog of incoming correspondence (from mid-2024) and processing final fee payments.

- Patents granting was paused for several weeks during the conversion, but has since resumed.

- However, CIPO has not provided a clear “finish date” for clearing the backlog, and status corrections (e.g. erroneous “abandoned” labels) may continue to take time.

In short: the patent backlog is being worked on, but it’s not yet “cleared,” and many delays remain.

Trademarks

- The trademark backlog has been more publicly discussed in terms of backlog “clearance.”

- At one point, CIPO had backlog levels of ~185,000 pending trademark applications awaiting examination.

- CIPO has stated that by the end of 2025 it hopes to reduce the backlog to ~65,000.

- Some commentators expect that the “first examination” lag (for non-“picklist” (pre-approved goods/services) applications) may drop from the current multi-year wait to roughly 1 year by March 2026.

- For applications that use only pre-approved goods/services (the “picklist”), the waiting time to first examination is forecast to be ~13 months.

- Some legal commentary suggests that the backlog may not be fully “cleared” (i.e. zero backlog) but could be reduced to acceptable levels by late 2025 or early 2026.

Estimate & caveats

Given all that, here’s my reasoned projection:

- For trademarks, it seems plausible that CIPO might reduce its backlog significantly (though not eliminate it entirely) by end of 2025, with “manageable” first examination times (e.g. ~12–18 months for many filings).

- For non-picklist (i.e. more complex) trademark filings, full normalization might extend into early 2026.

- For patents, because of difficulties with the portal transition, unprocessed correspondence, and status corrections, it may take until mid to late 2025 to see backlog substantially reduced, but full “clearance” is harder to predict (and may stretch into 2026 in edge cases).

So overall: late 2025 to early 2026 seems a reasonable window for significant backlog relief, though “clearance” in an absolute sense (i.e. no backlog) may take longer.

How much is the CIPO backlog affecting IPH’s NPAT Margins?

I asked ChatGPT to calculate how much the CIPO delays in Canada are effecting overall NPAT margins for IPH, and assuming the backlog clears within 6 months, what is the likely NPAT for FY2026?

Here is ChatGPT’s response:

“I pulled together IPH’s FY25 numbers and the company commentary on the CIPO issue, then ran a simple, transparent model to estimate the FY26 NPAT impact if the Canadian backlog clears within ~6 months. Below I show the data I used, the assumptions, the step-by-step maths, and a final point estimate plus a small sensitivity range.

Key facts / sources used

- FY25 group results: Revenue A$710.3m; Underlying EBITDA A$207.2m; Statutory NPAT A$68.8m.

- Canada margin change: Canada Underlying EBITDA margin fell from 30.5% (FY24) to 25.9% (FY25) (a drop of 4.6 percentage points). IPH states this was partly from the CIPO disruption and the B&P acquisition.

- Canada scale: Management has said Canada represents roughly ~41% of group revenue (annualised for current acquisitions). (HY25 commentary / Appendix) — I use 41% as the working share.

- Cost savings: IPH expects annualised cost savings of A$8–10m from FY26 (program activated as of July 2025).

Approach / assumptions (explicit)

- Canada revenue (FY25 basis): assume Canada ≈ 41% of Group revenue → Canada revenue ≈ 0.41 × 710.3 = A$291.2m. (rounded)

- CIPO effect on Canada EBITDA margin: FY25 Canada margin 25.9% vs FY24 30.5% → margin shortfall = 4.6pp (we treat that shortfall as largely caused by the CIPO backlog + acquisition timing).

- If backlog clears within 6 months: assume Canada margin recovers back to FY24 level (30.5%) during FY26 (this is the base case). That gives a one-off/annualised EBITDA improvement equal to 4.6% × Canada revenue.

- Add FY26 recurring cost savings: use midpoint A$9m (range A$8–10m).

- EBITDA → NPAT conversion: use FY25 group conversion ratio as a guide. FY25 Underlying EBITDA A$207.2m → Underlying NPATA A$120.6m ⇒ conversion ≈ 120.6 / 207.2 = 0.582. I apply that multiplier to incremental EBITDA to estimate incremental NPATA/NPAT contribution (this implicitly folds in tax, depreciation, interest and amortisation patterns similar to FY25).

Note: these assumptions are intentionally conservative and transparent — in reality conversion from extra EBITDA to NPAT depends on mix (service vs disbursement), interest, tax timing, and amortisation of acquired intangibles.

The maths (step by step)

- Canada revenue (estimate):

- 0.41 × 710.3 = A$291.2m

- EBITDA uplift if Canada margin returns to 30.5%:

- Margin uplift = 30.5% − 25.9% = 4.6%

- EBITDA uplift from Canada = 4.6% × 291.2 = A$13.4m (rounded)

- Add cost savings (midpoint): A$9.0m

- Total incremental Underlying EBITDA (FY26): 13.4 + 9.0 = A$22.4m

- Convert incremental EBITDA → incremental NPATA (using 0.582):

- 22.4 × 0.582 = A$13.0m incremental underlying NPATA/NPAT contribution

- Apply to FY25 baseline NPAT:

- FY25 statutory NPAT = A$68.8m → + incremental ~A$13.0m → ≈ A$81.8m

- Alternative (conversion via NPATA → statutory NPAT ratio):

- FY25: statutory NPAT 68.8 vs underlying NPATA 120.6 ⇒ ratio ≈ 0.57. If we instead add 13.0m to NPATA (120.6 → 133.6) and apply 0.57 → ~A$76.2m statutory NPAT. This gives a similar order result (reflecting method risk).

Final estimate (base case)

- Likely FY2026 statutory NPAT ≈ A$76m – A$82m, with a best single estimate ~A$79m.

- I report a range because conversion assumptions (NPATA→NPAT), timing of the backlog clearance inside the year, and whether clients refile immediately all cause variance.

Sensitivity / alternate outcomes

- If recovery is only partial in FY26 (margin recovers only half the 4.6pp): incremental EBITDA ~A$6.7m (half of 13.4) + A$9m savings = A$15.7m → incremental NPATA ≈ A$9.1m → FY26 NPAT ≈ ~A$78m (lower side).

- If recovery is faster + some valuation/volume upside (margin returns and Canada revenue grows modestly): incremental EBITDA could be larger (say +A$18–25m), pushing FY26 NPAT into the mid-to-low A$80m to A$90m area.

- If CIPO recovery slips / litigation revenue stays low: the uplift could be smaller or nil; FY26 NPAT could remain near FY25 (~A$68–72m).

Main risks / caveats

- Canada revenue share assumption (41%) is management guidance (annualised); if actual FY25 Canada revenue is materially different the numbers change proportionally.

- EBITDA→NPAT conversion depends on amortisation of acquired intangibles (NPATA adjustments), tax timing, and finance costs — I used FY25 group ratios for a pragmatic estimate.

- The model assumes the backlog clearing drives immediate recognisable billable activity in FY26 — real world timing and client re-filing behaviour may spread revenue into later periods. CIPO operational issues could also cause timing differences.

Short answer you can act on

- If the backlog clears within ~6 months and cost savings of A$8–10m are realised, IPH’s FY26 statutory NPAT is most likely in the A$76m–A$82m range (best estimate ≈ A$79m).

- If recovery is slower / partial, expect NPAT closer to FY25 (A$68–75m).

- If Canada outperforms on re-filing and synergies exceed expectations, NPAT could exceed A$85m.”

My Take (Rick)

It would appear that lower NPAT margins in Canada can be partly attributed to a temporary CIPO backlog caused by upgrades to the CIPO system. This is a temporary issue out of IPH’s control and has been impacting both revenues and margins in IPH’s Canadian business this year. Once these backlogs have cleared, and the cost savings have been implemented, this should boost both revenues and margins in Canada. Canada makes up 41% of IPH’s revenue, so any improvements here will be significant to overall margins and NPAT for the business. The market might not be seeing these current issues as temporary, so this could be an opportunity to buy a decent dividend paying business at a reasonable price.

The current NPAT consensus for FY2026 is $84 million (8 analysts, Simply Wall Street). It would appear that consensus is based on the CIPO backlog clearing soon, the $8-$10 million in promised cost savings being realised, and some organic revenue growth. I think $84 million ($0.33 per share) is a reasonable NPAT assumption for valuation purposes, but I’ll leave that for another straw!

Source: Simply Wall Street

Disc: Took a nibble today IRL and SM. Might add more pending further research?

I don’t own IPH Limited…thankfully! The shares have lost nearly 65% of their value in 3 years!

Source: Simply Wall Street

Despite this, the business is paying a whopping 9.8% partially franked dividend, and it has done OK! It’s a hard one to fathom because many of the indicators have grown!

Over 8 years sales have nearly tripled, EPS is up by 40%, dividends have grown by 70%, book value per share has more than doubled, and the ROE is not too shabby!

On the negative side ROE has declined from 18.6% down to 12.4%: This may be the result of decreasing profit margins over time which is a worry!

Source: CommSec

Debt has grown with net gearing increasing from -10% to +58%.

Source: Simply Wall Street

FY2025 Results Summary

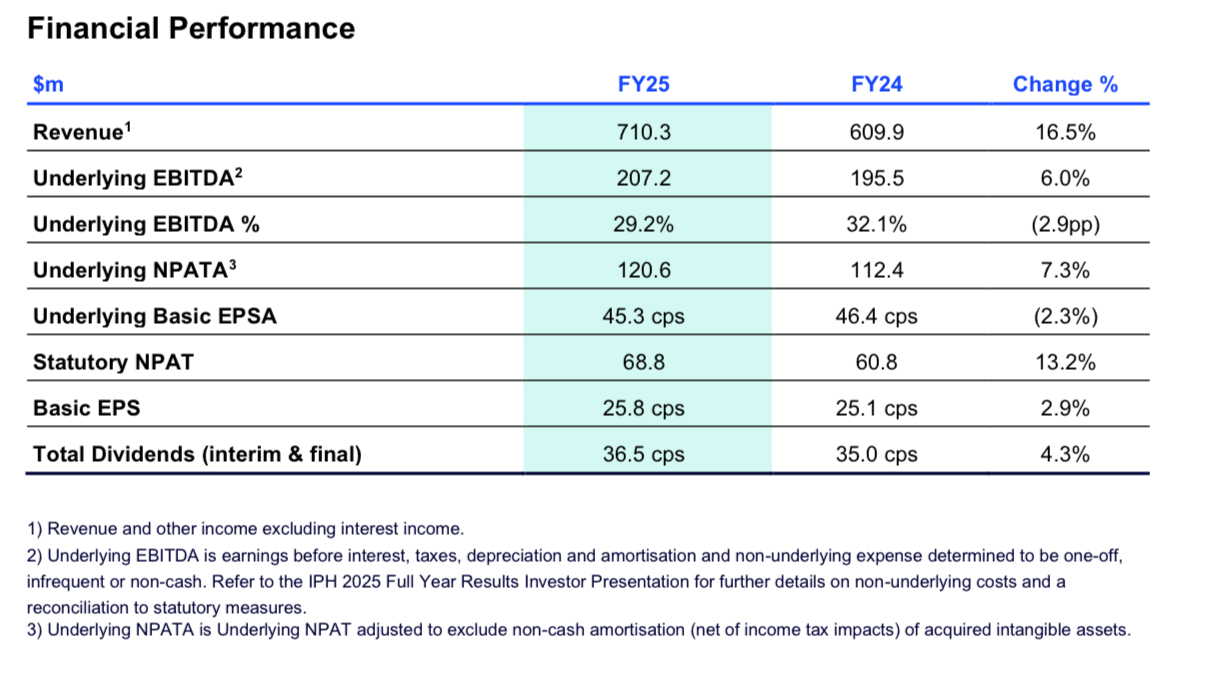

• Revenue up 16.5% and Underlying EBITDA up 6.0% year on year; reflects acquisitions in Canada

• Underlying NPATA of $120.6m, up 7.3%; equating to Underlying Basic EPSA of 45.3 cps (FY24: 46.4cps)

• Statutory NPAT $68.8m, up 13.2%; equating to Basic EPS of 25.8 cps (FY24: 25.1cps)

• Continued strong operating cashflow generation – cash conversion ratio of 103%

• Final dividend declared of 19.5 cps; total dividends for FY25 of 36.5 cps (FY24: 35.0 cps)

• Organic revenue growth achieved in ANZ despite lower market patent filings

• IPH Asia patent filings up 16.5% in FY25 – supports future revenue and earnings

• CIPO issues delayed revenue in Canada – emerging signs of recovery in FY26 as systems are restored.

About IPH Limited

IPH Limited, together with its subsidiaries, provides intellectual property (IP) services and products. It operates through three segments: Australian and New Zealand IP, Canadian IP, and Asian IP. The company offers IP services related to the provision of filing, prosecution, enforcement, and management of patents, designs, trade marks, legal services, and other IP.

It serves Fortune Global 500 companies, multinationals, public sector research organizations, SMEs, professional services firms, universities, foreign associates, and other corporate and individual clients. IPH Limited was founded in 1887 and is based in Sydney, Australia.

Morgan’s Take

Here is a recent note (10/09/25) shared by James Mickleboro from The Motely Fool: https://www.fool.com.au/2025/09/10/these-top-asx-dividend-shares-offer-huge-7-to-9-yields/

“Over at Morgans, its analysts think that intellectual property company IPH could be an ASX dividend share to buy.

While its performance wasn't great in FY 2025, Morgans feels positive about its outlook and sees its current valuation as cheap. The broker explains:

On a like-for-like basis, IPH reported flat FY25 revenue and EBITDA -4% on pcp. Each geography recorded marginal LFL EBITDA pressure, a mix of lower filings (ANZ); cost inflation (Asia); and some temporary issues (CAD). Whilst organic growth is still challenged, the FY26 outlook for each division looks relatively stable or marginal incremental improvement. A cost out program (A$8-10m in FY26) will assist. IPH's valuation is undemanding (<10x FY26F PE), however investor patience is required given the delivery of organic growth looks to be the catalyst for a sustained re-rating.

As for dividends, Morgans is forecasting fully franked payouts of approximately 37 cents per share in FY 2026 and FY 2027. Based on its current share price of $4.24, this would mean dividend yields of 8.7%.

The broker has a buy rating and $6.05 price target on its shares.”

My Take

While I’m not quite ready to jump in yet, but I have added IPH to my watch list. The chart looks shocking! It has been a relentless downward trend for over 3 years. I do have a feeling that the share price might be close to a turnaround. I think the shares have gone from being way too overvalued to undervalued!

My valuation using McNivens Formula (https://strawman.com/forums/topic/8371) comes out at $4.20 (aiming at a 15% return on investment). At the current price of $3.80, I would be expecting a 16% return over the next 3 to 5 years. This is based on consensus earnings growth over this time period.

Source: Simply Wall Street

Analysts are also forecasting forward dividends of approx 10% partly franked next year! The risk/reward opportunity is looking very attractive at the current share price!

Source: Simply Wall Street

Any thoughts out there! What other negatives can you see going forward? Here’s one from the results summary to start with:

“As performance of the Group is subject to variability from impact of foreign exchange movements as well as acquisitions part way through financial years, the Company presents financial performance on a like-for-like basis.

On a like for like currency adjusted basis, revenue was flat on the prior year with variability in geographic markets.

On a like for like currency adjusted basis, Underlying EBITDA was 3.9% down on the prior year as the flat revenue, coupled with incremental costs, impacted earnings and margin. During the second half of the year the Group implemented a corporate cost reduction program to better align costs to revenue.”

Not held.