Adrad is profit and cashflow positive with every expectation of remaining so and has a very undemanding PE under 10. Growth is anaemic but positive with several catalysts in play to maintain or grow it (Alu Flue, Data Centres, Thailand margin and Asia market options), but management changes, operational execution and founder over hang (60% shareholder) are areas of concern that seem to have let the share price wallow for the last few years and may continue to impact investor returns.

So in reviewing the business, I compare to my thesis from when I bought in in 2023, it had IPO’s less than a year earlier and was down on the IPO price by over 30%. Darryl Abotomey had stepped in to fill an CEO void and brought credibility and a good track record to a company that had little of either on the ASX. His departure as CEO was not an issue as he took a place on the board, but now he has left the board the gap is telling – so does this break the thesis?

Reviewing the key thesis drivers from when I originally invested:

1. Management acuity: Darryl was the key element of this, the alternative was that post his departure that enough of his influence was culturally embedded that it was less of an issue. But the recent turnover of CEO and Chair kills that possibility and I have little insight into the founder who owns a lot of the company and I assume is a key voice on the board that may be why Darryl left.

2. Established Niche Leader: Adrad is the leader in Heat Transfer Solutions in Australia, this seems to be maintained but we don’t see any tangible improvements in the business based on this leadership. The increase in data centre work is promising as is the Alu Flu, but noting to get excited about yet so it’s hard to attribute any value to these or expectation of growth.

3. Profitable: The company remains solidly profitable, the problem however is profit growth is lacking due to costs have increased 17% in the last 2 years, sales by 7% but thanks to improved gross margins, gross profit has improved 10%. So Net Profit % has dropped from 3.9% to 3.7%. Costs have gone up 12.0m (ignoring IPO costs), 4m in straight employee costs but another 3.1m “employee type” expenses (Labour hire & Trave, training,…) have been added to other expenses.

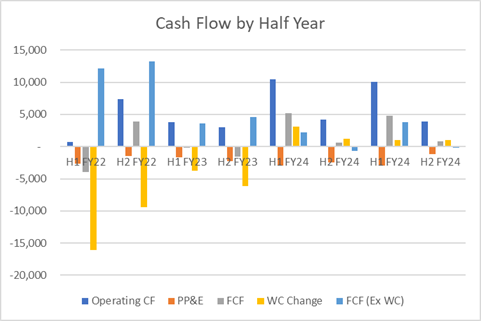

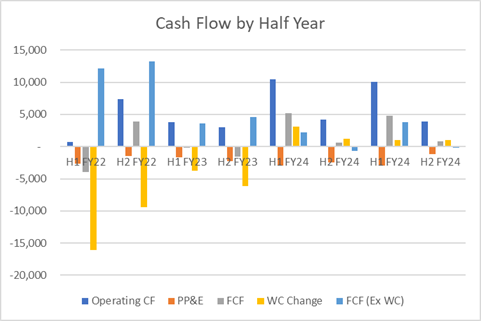

4. Cash: Working capital changes have impacted this over the years but in general FCF has been solidly positive. There is also $18m of cash on hand, so the business is well funded and almost a third of the market cap is backed by cash.

5. Operating Leverage: Gross margins have improved as anticipated, but we are not seeing operating leverage due to operating costs. It could be a case of settling the cost base of the business over the last couple of years to that suitable for a listed company, but this has been a problem. Fixing it is an opportunity for operating leverage, but there is no evidence of it happening or being prioritised strongly. The NZ operation exit earlier this year will help it should be noted, but more is needed.

Conclusion

Thesis is mostly busted.

I no longer intend on holding Adrad to wait for the thesis play out, but am not dumping my shares in a rush. I view it as undervalued even if the thesis doesn't play out, with a value of almost double the current price if top and bottom line can grow at 5% and the PE lifts to around 15 over the next few years. Even at the current PE it’s worth $1.10 on those assumptions at a 11% discount based on modelling I have done (acknowledging this is ball park, but a clear margin of safety).

I am also not rushing because it is very thinly traded and that also flags a major issue I will be more mindful of in the future. Namely the 60% odd holding by the founder and also the lack of shares held by other directors or KMP’s or used in CEO incentives. I suspect control issues with the founder based on this, which may be the reason for Darryls and the previous CEO’s departure, but simply not knowing much about the founder who controls the company is an issue.

Disc: I currently own but intend on selling due to thesis concerns and seeing better opportunities.