Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Discl: Held IRL 2.86% and in SM

Good to see Gary and Karen Washing, the co-founders buying about $59k of AHL stock on market. A few interesting points about this purchase:

1. It is barely 0.13% of the the 49.3m shares they currently own.

2. This is the first time that the Founders have transacted on AHL shares since AHL’s listing in Sep 2022 - shares were released from escrow in Mar 2023, 2.5 years ago, and they chose to buy

3. It also comes on the back of the CEO’s small on-market purchase on 19 Nov 2025

Could this be a sign that the Co-Founders are comfortable with Paul thus far, I wonder? I ask this as they could have got a significantly better entry point to add shares in the last 1.5 years, since July 2024, during which 2 CEO's came and went, but they chose to do it now when the share price is moving to levels not seen for some time.

Regardless, as small a purchase as this is, given their track record of no transactions in the past 3 years since listing, this can’t be but a good sign ...

Discl: Held IRL 2.86% and in SM

Nice to see Paul Proctor, AHL’s latest CEO, buy some AHL stock on-market with his own coin between 7 Oct and 6 Nov.

Not a huge purchase - 13,107 shares for $11.2k, average cost $0.85, but given the many recent AHL management exits, Paul buying a bit is much better than Paul not buying or heaven forbid, exiting ...

A small confidence boost that perhaps Paul is liking what he is seeing since he joined in end-July, enough for him to put some coin in. He would have had 2 full months to have a good look at the business.

Not much new in the AGM material today. Paul Proctor’s now properly in the CEO seat with a focus on tightening operations and lifting profitability -- which is pretty much the core of the investment thesis for me. Let's see if he can deliver..

They’re continuing the SE Asia push with low-cost prototypes in testing and building out data centre exposure, which is a really interesting space right now. The order book’s grown and capacity’s doubled, so keen to see how that plays out. The new Alu-Fin line’s in field testing, with mining validation trials pencilled in for 2H FY26. Also worth noting they picked up Caterpillar’s Supplier Excellence award again (second year running!).

On the distribution side, they’ve launched a GPS delivery tracking app, the e-catalogue revamp kicks off in 2H FY25, and the pricing analytics plus freight recovery work seem to be helping margins. They’ve wrapped up the NZ exit and are planning new branch openings in FY26.

Overall tone was upbeat.. strong order book, steady demand from data centres and remote power, and early Q1 FY26 trading apparently backing further profit growth.

[Held]

Adrad is profit and cashflow positive with every expectation of remaining so and has a very undemanding PE under 10. Growth is anaemic but positive with several catalysts in play to maintain or grow it (Alu Flue, Data Centres, Thailand margin and Asia market options), but management changes, operational execution and founder over hang (60% shareholder) are areas of concern that seem to have let the share price wallow for the last few years and may continue to impact investor returns.

So in reviewing the business, I compare to my thesis from when I bought in in 2023, it had IPO’s less than a year earlier and was down on the IPO price by over 30%. Darryl Abotomey had stepped in to fill an CEO void and brought credibility and a good track record to a company that had little of either on the ASX. His departure as CEO was not an issue as he took a place on the board, but now he has left the board the gap is telling – so does this break the thesis?

Reviewing the key thesis drivers from when I originally invested:

1. Management acuity: Darryl was the key element of this, the alternative was that post his departure that enough of his influence was culturally embedded that it was less of an issue. But the recent turnover of CEO and Chair kills that possibility and I have little insight into the founder who owns a lot of the company and I assume is a key voice on the board that may be why Darryl left.

2. Established Niche Leader: Adrad is the leader in Heat Transfer Solutions in Australia, this seems to be maintained but we don’t see any tangible improvements in the business based on this leadership. The increase in data centre work is promising as is the Alu Flu, but noting to get excited about yet so it’s hard to attribute any value to these or expectation of growth.

3. Profitable: The company remains solidly profitable, the problem however is profit growth is lacking due to costs have increased 17% in the last 2 years, sales by 7% but thanks to improved gross margins, gross profit has improved 10%. So Net Profit % has dropped from 3.9% to 3.7%. Costs have gone up 12.0m (ignoring IPO costs), 4m in straight employee costs but another 3.1m “employee type” expenses (Labour hire & Trave, training,…) have been added to other expenses.

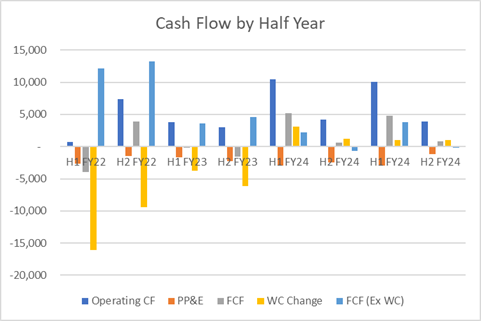

4. Cash: Working capital changes have impacted this over the years but in general FCF has been solidly positive. There is also $18m of cash on hand, so the business is well funded and almost a third of the market cap is backed by cash.

5. Operating Leverage: Gross margins have improved as anticipated, but we are not seeing operating leverage due to operating costs. It could be a case of settling the cost base of the business over the last couple of years to that suitable for a listed company, but this has been a problem. Fixing it is an opportunity for operating leverage, but there is no evidence of it happening or being prioritised strongly. The NZ operation exit earlier this year will help it should be noted, but more is needed.

Conclusion

Thesis is mostly busted.

I no longer intend on holding Adrad to wait for the thesis play out, but am not dumping my shares in a rush. I view it as undervalued even if the thesis doesn't play out, with a value of almost double the current price if top and bottom line can grow at 5% and the PE lifts to around 15 over the next few years. Even at the current PE it’s worth $1.10 on those assumptions at a 11% discount based on modelling I have done (acknowledging this is ball park, but a clear margin of safety).

I am also not rushing because it is very thinly traded and that also flags a major issue I will be more mindful of in the future. Namely the 60% odd holding by the founder and also the lack of shares held by other directors or KMP’s or used in CEO incentives. I suspect control issues with the founder based on this, which may be the reason for Darryls and the previous CEO’s departure, but simply not knowing much about the founder who controls the company is an issue.

Disc: I currently own but intend on selling due to thesis concerns and seeing better opportunities.

First crack at using @Strawman 's Intrinsic Value approach.

- I used 3 scenarios, assumptions are laid out underneath each scenario

- Rather than use EPS, I used FY25 Operating Profit instead as that felt like a "purer" view of earnings

- Stayed with current PE of 8.82x, as it is conservative, undemanding and reflects current cost concerns

Appreciate feedback/reactions to the approach taken! Doing the valuation helped put the AHL FY25 results in better perspective and was an extremely valuable exercise.

Discl: Held IRL and in SM

Finally had a chance to have a closer look at AHL’s results. Also used the AHL results to work through a PE-based valuation, which I will post separately.

OVERALL

- Operations are chugging along and revenue growth from operations is 8.9%

- HTS continues to spearhead growth - consistent comment on backup generation for Data Centres driving HTS growth and this looks like it will continue

- The issue is cost - cost increases have dented profitability, but the increases are not really thesis breaking:

- Inventory increased 2.6% to support the Data Centre projects - this, plus evidence of higher Contract Assets in the Balance Sheet, up 114.7% from $2.8m to $5.9m YoY, provides good comfort that HTS is indeed firing

- A good ~$1.6m is due to a on-off Impairment of $1.0m and $0.6m of Forex losses, both these alone accounted for 1.2% of the 10.0% YoY cost increase and 1.1% of Margin

- Forex movement has been more favourable in 2H, and looks to have continued into FY26

- Cash position remains healthy - up $2.3m, 14.8%, $18m cash balance, $0.6m borrowing's - balance sheet is in decent shape

- Dividend 3.48cps, up 18% from, 2.94cps, 50% of FY25 Statutory NPAT

- An ongoing concern is the churn in CEO’s

AHL was intended to be a steady-grower-with-dividends ballast to my growth-centric portfolio and remains so. While the rising costs remain a concern, my thesis, which is predicated on (1) revenue growth, underpinned by AHL’s monopoly-like position in the Industrial Heat Cooling space (2) increasing demand for Data Centre cooling is still intact.

Have valued AHL at $0.86, based on the current undemanding PE of 8.82x, which is mostly held back by the ongoing cost concerns, so this appears more less “fairly valued” now.

The share price has stayed “recovered” despite the cost concerns, crossing and staying very much above the 200SMA. It does seem that the market is being patient and settling for the long haul ...

Am already at ~3.0% allocation, so will take no action.

OPERATIONS

Chugging along

HTS

- Nothing to not like in HTS

- Ingredients are in place for Asian expansion - Sales capability, prototypes, manufacturing facilities

- AluFin is progressing

- Strong demand in data centre cooling

Distribution

Nothing negative, but this is probably unexciting, in relative terms.

FINANCIALS

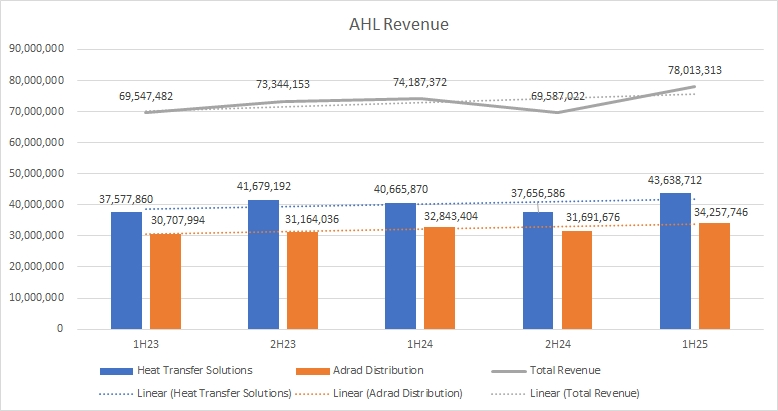

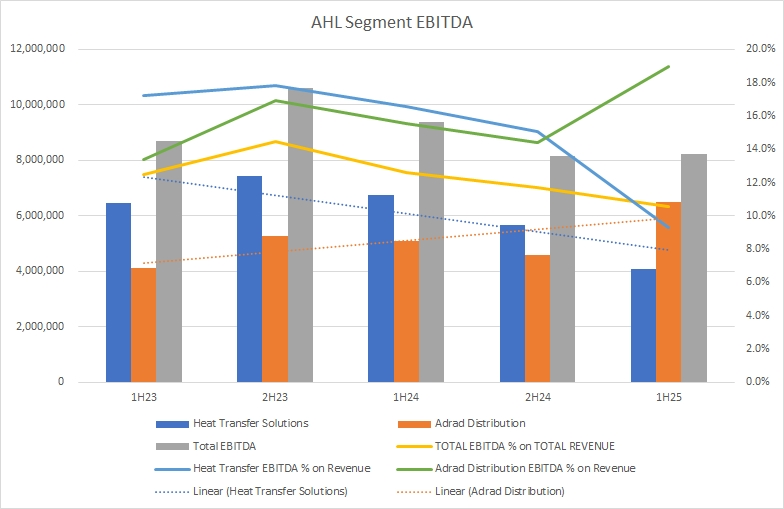

Total Revenue rose 8.9% YoY - Both segments have contributed to the increase in revenue but Heat Transfer Solutions revenue has risen more than Distribution revenue

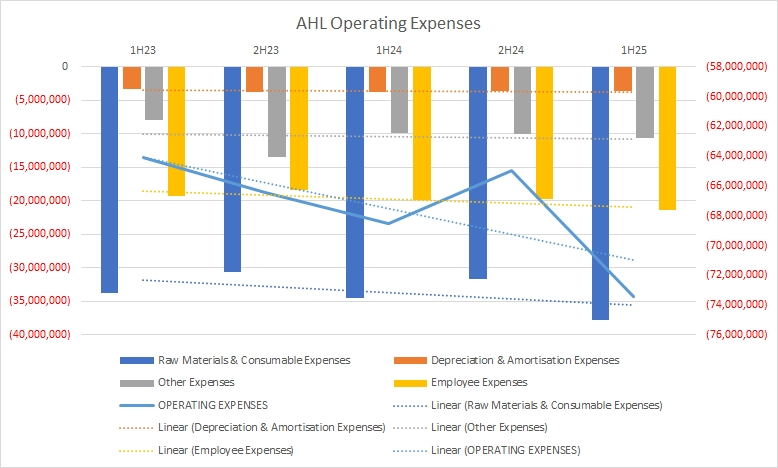

Costs have increased 10% YoY:

- The pace of Raw Materials & Consumable Expenses growth is greater than both Employee Expenses and Other Expenses

- Despite improving 6.8% HoH, Raw Materials & Consumables Expenses have increased 12.5% YoY

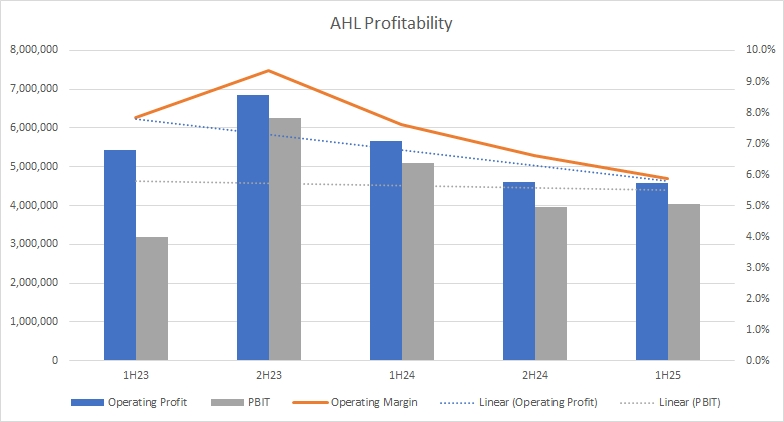

Revenue has been steadily increasing, but increasing costs have steadily eroded profitability and profitability margins. This is really not a pretty picture and one that troubled me. But it is clear that the issue is not revenue, it is cost-driven.

3 things stuck out when having a closer look at the P&L detail

AHL Took a R&D Impairment of $1.0m in FY25 - this related to the building of new equipment where it was found that the materials used in the prototype were not suitable for subsequent product manufacturing in commercial quantities - asset will be retained, to be revisited later.

There was a loss of $0.5m of Other Income comprising (1) ($0.2m) of Grant Income (2) ($0.1m) of Net Franchisee Fees (3) ($0.1m) of IT rebates (4) ($0.1m) Other Income - despite this, Total Revenue still rose 8.3%, driven by the 8.9% increase in Sales to External Customers - this normalising of Other Income from FY24 continues the downward trajectory of Other Income from FY22 (FY22: $1.3m, FY23:$1.7m; FY24: 0.9m; FY25: $0.2m)

Other Expenses rose $2.2m YoY driven by (1) $0.9m increase in Impairment Loss (2) $0.4m of Forex Loss (3) $0.16m IT Cost (4) $0.4m Other Expense - as the AUD strengthens, and there is no further impairment, expenses could decrease between $0.9m to $1.3m in FY26, all things being equal.

The picture looks much better when the $1.6m Impairment and Forex Loss is added back to to Operating Expenses

- The YoY expense increase drops 1.2% from 10.0% to 8.8%

- Margins come in at 7.2% instead of 6.1%

- Once these 2 mostly uncontrollable costs are stripped out, the cost increases feel a lot more palatable

- 5.1% fall in Cash flow from operating activities but more than offset by a 21.8% fall in Cash Flow from Investing activities

- $2.3m increase in cash, up 14.8%

- Dividend 3.48cps, up 18% from, 2.94cps, 50% of FY25 Statutory NPAT

- Contract Assets is up 114.7% to $5.9m - data centre and project orders pending customer delivery

- Inventory increased 2.6% to support the Data Centre projects

Assuming Adrad can maintain a 5% compound annual growth rate in revenue (consistent with its performance over the past few years) its top line would grow from $142.9 million in FY24 to approximately $165.4 million by FY27.

If operating leverage and strategic initiatives help the company expand its net margin to 5% over that period, this would translate to a net profit after tax (NPAT) of roughly $8.3 million in FY27.

Applying a conservative P/E multiple of 12, that implies a future market capitalization of around $99.2 million. Dividing this by 90m shares on issue (currently at 83m) gives a FY27 shares price of $1.10, which is 91c if you discount back to today at 10% pa

That's a good deal above the current price, and i feel it's based off pretty conservative assumptions.

As with Stealth, a lot is based on the expectation for widening margins. If that doesnt happen, this valuation is shot.

Full year results for $AHL were released today.

Here's my view along with my assistant (Gemini).

Summary of FY25 Results Presentation:

The presentation details $AHL's financial and operational performance for FY25, focusing on its two main segments: Heat Transfer Solutions (HTS) and Distribution.

Key Financial Highlights (FY25 vs FY24):

- Sales Revenue: Increased by 8.9% to $153.1 million.

- Pro forma EBITDA: Decreased slightly by 2.8% to $17.7 million, primarily due to higher material/consumable costs, increased employee costs, and rising insurance costs.

- Pro forma NPAT: Rose by 2.9% to $7.2 million, attributed to a lower effective tax rate.

- Operating Cash Flow: $13.9 million, with a cash conversion ratio of 79% (down from 81% in FY24) due to increased inventory for data center orders.

- Capital Investment: $4.2 million (down from $5.3 million in FY24) following the completion of the Thailand office and factory re-lay.

- Net Tangible Assets per Share: Increased by 7.7% to $1.05.

- Dividends: Total FY25 related dividends of 3.48 cps (fully franked), an 18.4% increase from FY24, representing 50% of statutory NPAT.

Segment Performance:

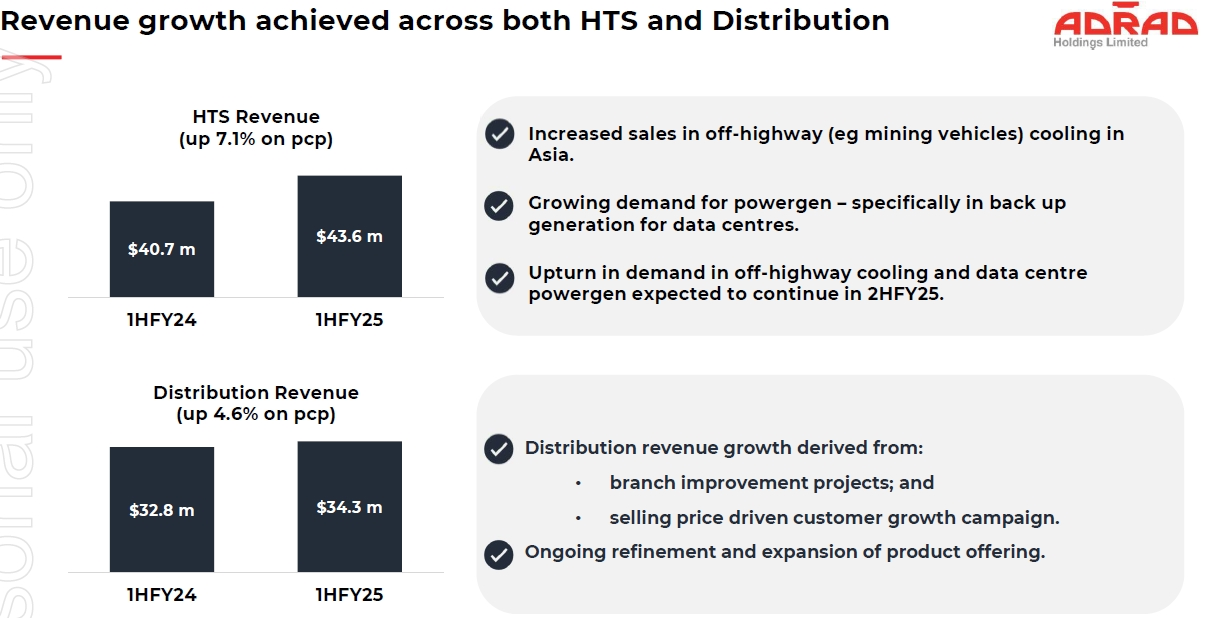

Heat Transfer Solutions (HTS):

- Revenue increased by 14.8% to $89.9 million.

- Growth driven by increased sales in off-highway units in Asia and growing demand for data center backup generation.

- New power generation projects initiated in FY25 for FY26 delivery.

- Strategic actions include hiring an Asia regional sales director, delivering Alu Fin prototypes for in-field testing, developing low-cost units for SE Asia, optimizing the Thailand manufacturing facility, and doubling output capacity at the Lara site to meet data center demand.

Distribution (ADRAD):

- Revenue increased by 1.5% to $63.2 million.

- Revenue and margin growth in the second half due to refined pricing strategy, branch effectiveness activities, and range expansion.

- Growth initiatives include launching a delivery tracking app, initiating an e-catalogue revamp, growing the trade customer base by 6.5%, and finalizing the rollout of new analytics for price strategy and cost recovery.

- Branch expansion (Phase 1) and continued product range expansion are planned for FY26.

Balance Sheet:

- Robust financial position.

- Increase in contract assets reflects pending data center and project orders.

- Inventory growth supports data center and project delivery.

- Right-of-use assets and lease liabilities decreased due to lease management decisions and payments.

Outlook (FY26):

- Management is confident of improved business performance.

- Expected drivers include a strong order book, growing data center demand, anticipated increase in remote Powergen demand, efforts to grow the order book in SE Asia, and strategic initiatives for cost and efficiency improvements.

Opinion on the Report:

Overall, this is a good and positive report. Here's why:

- Revenue Growth: A healthy 8.9% increase in sales revenue indicates strong market demand and effective sales strategies.

- Strategic Focus: The clear articulation of strategies for both HTS and Distribution segments, and the progress made on them (e.g., expanding into Asia, data centers, product development, improving distribution channels), shows a well-managed and forward-thinking company.

- Resilient NPAT Growth: Despite headwinds like increased material and employee costs, the company managed to grow its pro forma NPAT, albeit modestly, which is a positive sign of underlying profitability and cost management efforts (or tax efficiency).

- Strong Balance Sheet: The description of a "robust financial position supported by operating cash flows" is reassuring for investors. Increases in cash and net tangible assets per share further reinforce this.

- Dividend Increase: An 18% increase in dividends signals confidence from management in future performance and a commitment to returning value to shareholders.

- Positive Outlook: The optimistic outlook for FY26, backed by a strong order book and growing demand in key areas like data centers and remote power generation, suggests continued positive momentum.

Areas to note (not necessarily negative, but points of attention):

- EBITDA Dip: While pro forma NPAT increased, the slight decrease in pro forma EBITDA indicates some pressure on operational profitability, mainly from cost increases. The company has identified these cost drivers (materials, wages, insurance), and their strategic initiatives for cost and efficiency improvements in FY26 aim to address this.

- Cash Conversion Ratio: The slight dip in the cash conversion ratio (from 81% to 79%) is attributed to increased inventory. This is understandable given the strong data center orders and project delivery, but it's something to monitor to ensure efficient working capital management.

In conclusion, $AHL appears to be navigating a challenging cost environment effectively while executing its growth strategies. The report paints a picture of a company with strong fundamentals and a positive trajectory for the upcoming fiscal year.

DISC - Held IRL & SM portfolios

In a clunkily worded announcement, (AHL announcement.pdf) the company has stated that CEO Kevin Boyle is resigning "to pursue other opportunities." He only took the job at the start of 2024.

The new head appears to be an interim appointment, and from what I can tell, he’s an external hire.

The company listed with Don Cormack as CEO, who led the business from 2006 through to 2023. Darryl Abotomey held the role on an interim basis for about six months before Kevin Boyle took over.

Not great that they are having such trouble filling this role.

Still, shares are up quite a bit today, although this is a hyper illiquid stock and it only took about $16k of buying to push the price 13% higher. That move likely has more to do with the guidance, which was almost buried at the end of the announcement. As far as I can tell, it is the first time the company has provided anything specific. Namely, that "Adrad expects underlying FY25 earnings performance to be within a range of 95 to 100 percent of underlying FY24 earnings performance."

I assume they are referring to EBITDA, but they don’t actually say. If we go with that, it suggests FY25 EBITDA of $17.2 to $18.1 million.

Now, no one likes to see earnings fall, especially underlying earnings, but the reason the market seems to like it is because it suggests a decent recovery from the first half and a solid pick-up over the second half of FY24.

First-half FY25 EBITDA came in at $8.2 million, implying $9.0 to $9.9 million in the second half. That’s a decent lift from the first half, and compares well to $8.2 million in the second half of FY24, suggesting that the recent pricing actions, cost controls and contract renegotiations may be starting to have an effect. That’s encouraging given the margin squeeze they were facing earlier in the year.

I’m a little dismayed by the churn at the top, but it’s good to see things turning around from the first half. The thesis here remains the same -- a decent, albeit slow-growing, business that took a hit from outside factors that don’t reflect long-term earnings potential. These seem to be getting addressed, and the business is just plain cheap at the moment, trading on a forward EV/EBITDA of around 2.5 times based on the low end of guidance (excluding lease liabilities) or 5x if you include them -- which you probably should. More simply, the forward PE is probably around 9x.

Adrad doesn’t make the most glamorous products -- it’s in the business of radiators and heat exchange systems. But while it may not sound thrilling, cooling systems are absolutely critical infrastructure for everything from heavy machinery to data centres. Without effective thermal management, engines overheat, electronics fail, and operations grind to a halt. It's the kind of behind-the-scenes necessity that just quietly keeps the world moving.

The company operates through two main divisions. Its Heat Transfer Solutions arm designs and manufactures custom cooling systems for demanding applications like mining trucks, power generators, and rail locomotives. These are engineered products, often tailored to specific customers and environments, and they sit in high-barrier segments with strong recurring demand. Then there’s the Distribution business, which imports and sells a wide range of automotive aftermarket parts across Australia and New Zealand. This part of the business is more volume-driven and serves workshops, mechanics, and resellers.

Adrad’s roots go back to 1985, starting as a small radiator repair shop before gradually evolving into a full-scale manufacturer and distributor. It listed on the ASX in 2022 at $1.50 per share, with revenue at $134 million and NPAT at $12 million. Fast forward to the most recent full financial year (FY24), and revenue is up to $143 million. But profit has been cut in half, down to $6 million. The market hasn’t looked kindly on that... shares now trade around 60 cents.

But the devil (as always) is in the detail. The market is only looking at the drop in NPAT without really understanding what's behind it. And, to my mind, there's nothing structurally wrong here.

First, inflation has driven up input and labour costs, and that’s crimped margins. But more importantly, Adrad has been going through a bit of a transformation -- investing in new equipment, consolidating operations, upgrading systems, and generally dragging itself out of the “family-run business” era into something more efficient and scalable. That stuff takes time and money. It hurts margins in the short term, but it's the right kind of hurt if you're thinking long term.

The company just ate the cost increases initially, but it’s been re-pricing its contracts and passing costs on where it can. A key OEM contract was successfully renegotiated in January 2025, and that should begin to show up in the numbers from the second half of FY25 onward. Meanwhile, they’ve been consolidating manufacturing in Australia and ramping up production at their expanded Thailand facility, which should help a lot on the cost side too.

Moreover, capacity has been increased, and so long as volumes continue to grow, we should see a good deal of operating leverage emerge. Rising gross profits against largely stable fixed costs can do wonders for the bottom line!!

This is a solidly profitable business with a strong balance sheet. It even pays a very attractive dividend (7.5% grossed-up, thank you very much, which is generated off just a 40% payout ratio). Adrad sits on $7.9 million in net cash, which is about 16% of its total market cap.

On a trailing 12-month basis, the business is trading on an EV/EBITDA multiple of 2.5x (not a typo). Not terrible for a company with consistent and steadily growing revenues, positive cash flow, strong cash conversion, and loads of real assets.

As operating margins normalise, you don’t just get earnings growth, but also the potential for multiple expansion as well.

This setup is reminiscent of Stealth Group a few years ago: small, underfollowed, temporarily depressed margins masking solid fundamentals and a growth plan already in motion. Adrad isn’t flashy, but it’s building something real. If management executes and the market wakes up, the rerating could be meaningful.

The "smart" money can’t really touch it for now..it’s just too small and illiquid. But us mere "retail investors" can front-run them... assuming revenues do indeed continue to march higher and margins improve with scale.

That could take a few years, but at least there’s a tidy dividend to receive along the way.

Good to look at micro, company-specific matters, to take a break from the chaos of the maro world!

Discl: Held IRL and in SM

SUMMARY

1HFY25 results were disappointing.

A steady 6% increase in revenue was more than offset by higher raw material and employee expenses, resulting in lower EBITDA (16.9%) YoY, lower NPAT (9.7%) and a drop in Operating Margin from 7.6% 1HFY24 and 6.6% in 2HFY24 to 5.9% in 1HFY25.

However, my revenue-focused thesis is playing out. HOLD.

POSITIVES

Revenue continues to grow nicely across both segments

HTS - up 7.1% vs pcp

- Traction in Asian Rail project, which is the outcome of an increased focus in Asia from AHL’s Thailand operational base - 1st Asian rail project won and will commence in 2HFY25

- 1st Orders for AluFin - prototype for above ground mining vehicles - good traction in AluFin, primary target market $15m-$30m revenue

- Rail Service - $9m orderbook expansion to replace cooling units in Victorian trains

Distribution - up 4.6%

- Branch improvement projects

- Selling price driven customer growth campaign

Continued good cash generation - $10.1m of cash from operations, $3.3m net increase in cash after (2.9m) capex spend, ($0.7m) debt repayment and ($1.3m) FY24 dividends paid

Balance sheet remained in good shape and strong - $19.1m cash, $0.7m borrowing's (down from $1.4m 1HFY24), Inventory flat $0.4m increase to $47.7m as Distribution stock reduced from increased turns offset by higher HTS raw materials in preparation for uplift in 2HFY25 manufacturing activity

Thai manufacturing facility is now complete - lower manufacturing economics should start to flow through more clearly - will facilitate insourcing

DISAPPOINTMENTS

After good cost improvement in 2HFY24, Operating Expenses have increased back to the overall cost increase trendline:

Raw Materials & Consumables are now in a noticeable upward trend:

- Deteriorating AUD purchasing power

- Increased direct input costs

Employee Expenses are also in an upward trend, although not as steep as Raw Materials & Consumables:

- Wage & Super uplift from 1 Jul 2024

- Sales team boost has kicked in

Additional Insurance costs, doubtful debt provisions, FX costs have also added to costs.

Customer Growth campaigns in FY24 to reduce pricing to grow customers, now returned to pre-campaign normal pricing - seeing revenue increase from increased volume from increased customers

Management understands the reason for cost increases and have taken action - need to see this filter through in 2HFY25.

Distribution EBITDA is on a clear upward trajectory, HTS EBITDA continues to trend downwards as the cost increases impact HTS directly.

THESIS REVIEW

Thesis was predicated on:

- Revenue growth from HTS given dominant market position on Industrial Cooling, domestically and in Asia - tick

- Growth from AluFin taking off - good positive greenshoots, tick

- Thai manufacturing facility would give AHL an Asian base, from which to deepen penetration to Asia - tick

- Thai facility will also lower cost - cautious tick on this, the issue this half was more raw materials/AUD driven - without the Thai facility, the cost increase could well have been worse

Cost advantages was not an explicit part of the thesis, although arguably, there was an implicit assumption that costs would stay under control and contained - the cost increases this half has knocked this assumption around a bit

- Management is aware of the challenges and have and will continue to focus on cost management

- Pricing increases will have kicked in in 2HFY25, expecting ~$2.5m to kick in - $1m from Distribution and $1.5m from HTS

In summary, while the cost increases have impacted EBIT and NPAT, and the downward trend of both is not great, the revenue-related thesis is actually playing out.

Still too early to call this result a thesis breaker, but will need to see improvement in cost increases to arrest the increasing trajectory.

2HFY2025 OUTLOOK

Need to see:

- Continued revenue growth from both HTS, from Data Centre demand, and Distribution

- Continued manufacturing leverage from the Thailand facility move

- Cost containment measures kicking in to rein costs back in

Portfolio Action

HOLD. Current allocation of 2.98% is about right

These results from Adrad aren't great, but the issue seems to lie with factors (mostly) outside the companies control. I

High level numbers are:

Revenue: $77.9m (+6.0%)

Gross Profit: $40.1m (+3.3%)

Statutory NPAT: $2.8m (-7.7%)

Operating Cash Flow: $10.1m (-3.7%)

Cash Balance: $19.1m (+6.9%) -- (the balance sheet is in great shape btw)

The main culprits were higher material and employee costs, foreign exchange losses from a weaker Australian dollar, bad debt provisions for an overseas customer that may not pay, and rising insurance expenses due to expanded coverage. All of this squeezed margins, leading to a drop in earnings.

In terms of employee costs -- wage inflation was a factor, but they also boosted the sales team.

In resposne, Adrad is going to try its best to pass on higher costs to customers. It has raised prices in its distribution business and renegotiated a major contract in its industrial cooling segment. The company is also cutting freight costs, tightening foreign currency management, and shifting more manufacturing to Thailand, where costs are lower. These changes should help restore profitability.. but we'll see. The operating margin is only 10% or so, so things can move around a lot here

Like AVA, the EV/EBITDA ratio is rather undemanding -- less than 5x at present, although Adrad isnt growing like AVA is.

This is a boring business, but in general one with reasonable (if not exciting) prospects. A big part of the thesis for me was the potential for significant efficiency gains -- but these have not yet appeared. Stripping away things that are beyond their control, it's still hard to see much progress on that front.

Let's see what they can do in the current half to make this a leaner, more efficient operation. If there's no obvious progress, I'll have to concede the thesis busted.

In a quick review of AHL's AGM material and speech, picked up 3 subtle points to note to manage expectations:

- Strong order book for data centre power generation - significantly higher than FY24

- FY24 deferred projects commenced - this was as guided previously, but good to confirm

- Full year FY25 revenue and earnings weighted to 2HFY2025, presumably from the revenue of deferred projects and data centre projects hitting later in the year given the longish gestation period for these sorts of projects. Implies 1HFY2025 growth could be flattish

Have been trying to top up around $0.75 these past few months but there has been very little decent volume of above 5,000 units available to make a purchase worthwhile. Patience is absolutely needed!

Discl: Held IRL and in SM

My notes on AHL's FY24 results. As I was reviewing the Annual Report, the following 2 longer term growth areas for HTS crystallised, particularly the commentary around Caterpillar recognition, both of which now forms the core of my refined AHL thesis. Am trying to get more information on AHL's relationship with Caterpillar to work out how far it could potentially go with AluFin.

Discl: Held IRL and in SM

KEY LONGER-TERM GROWTH AREAS FOR AHL

Cooling systems for Data Centres - demand for AHL’s cooling solutions will grow as demand for Data Centres grow globally driven by the AI boom. Thailand manufacturing facility is well place to support growth in this area in the Asian region

Battery powered above ground mining equipment is set up for significant growth once the cooling technology matures.

- Supplier recognition by Caterpillar is a really good positive sign

- Cat appears to be targeting 2028 for the production rollout of Cat battery-operated trucks - the mining industry is under increasing pressure to transition to green technology and there is a whole existing fleet of mining equipment which will require upgrading to battery-operated operations once the battery-powered technology matures

- An efficient and cost effective cooling system is an integral part of the green equipment which is where AluFin is targeted at

FINANCIALS

Weaker 2HFY24 and weaker FY24 overall, but no surprises as guidance was provided in May 2024

FY24 earnings issues in HTS appear to be transitory, not permanent due to customer project slippage which is anticipated to be restarted in FY25 - expect to see some recovery in HTS in FY25

Revenue of $142.8m came above the midpoint of revenue guidance of $140m to $144m

EBITDA Proforma came in at $18.1m, at the lower end of the $18m-$19m guidance - HTS One off $1.5m costs were incurred, impacting EBITDA, also previously flagged

BALANCE SHEET

Strong cash generation from operations continues

Inventory reduced by $7m - focus in this area bearing fruit

Capex investment makes sense in terms of Thai plant expansion

OPERATIONAL UPDATES

Senior Leadership Team is now fully in place with the onboarding of the new CEO Kevin Boyle in Apr 2024

Internal re-organisation completed with key segments being (1) Heat Transfer Solutions (2) Distribution and (3) Group Support

This is the ongoing maturing of the AHL organisation that Daryl Abotomey discussed during the SM meeting.

HEAT TRANSFER SOLUTIONS

Positive Developments:

- Expanded the scope of our after sales service offering by providing more services for our customers’ equipment along its path from manufacturing and commissioning and throughout its serviceable life

- Off-highway segment continued its positive trajectory

- Continue to pursue operational efficiencies as we finalised construction of the factory extension and new offices, factory floor re-lay and new equipment commissioning at our Thailand plant.

- Continued progress on AluFin product development with a number of global mining players on multiple fronts- field testing in underground mining equipment, developing a prototype for above ground mining dump trucks, field testing units in on road transport and service testing of an auxiliary cooler module for battery electric powered above ground mining equipment -

- Awarded the Supplier Excellence Recognition award by Caterpillar; an award which recognises top-performing suppliers who have met or exceeded rigorous requirements and achieved world-class certification levels under Caterpillar’s Supplier Excellence Recognition program

Negatives offsetting the positives:

- Continued negative volume pressure in our OEM mining vehicle market in Asia.

- Conditions in the Australian domestic mining and energy sector saw a number of projects with their associated demand for cooling applications deferred.

- We expect most projects to progress in FY25 and we retain a positive outlook for this sector

DISTRIBUTION

Inventory reduction was a big management focus in FY24

Another year of top line revenue growth from a greater volume of sales across the range of categories we supply to the industrial and automotive aftermarkets.

Continued to emphasise our primary focus on cooling applications in industrial and vehicular sectors but also added to our product range with the introduction of fuel pumps and harmonic balancers amongst others.

More actively engaged in dynamic pricing to be more competitive across our product ranges and drive continued market share growth.

GROWTH OPPORTUNITIES

THESIS REVIEW

No change in thesis - business is steadily improving and growing, albeit with FY24 headwinds in HTS - these appear to be transitory

Positioning early for the longer term growth in HTS from Data Centre growth and AluFin opportunities in mining, especially when the global mining equipment players complete the current development phase of green technology equipment and massive fleet replacements from combustion to green technology occurs

Happy with 2.8% position size. Will top up position to 3.5% on any weakness below 75c, which is an attractive entry point given AHL’s all-time low price of ~64.5c

This is a note to myself, sharing in case it resonates with anyone else.

I was reading the story of the AirTrunk $2.4b deal which has been all over the news, particularly the explosive demand on Data Centres from "AI, and how AirTrunk was setting up Data Centres all over Asia and Australia.

It help crystallise for me, the AHL longer-term thesis around "AI". AHL's industrial cooling systems business has seen good demand growth from data centres as AHL's systems are a key requirement for good data centre design. That AHL has moved a chunk of its manufacturing facilities to Thailand positions it well for Asia-based data centre opportunities.

Cheap sale might be on from Monday onwards, will be a good time to add ...

Discl: Held IRL and in SM

The last FY results from Adrad weren't spectacular, but not unexpected and revealed some cause for improvement. Maybe that's far from a glowing endorsement, but when shares are on a single digit PE you dont need to expect a lot -- and it seems the market's reaction reflects this. Moreover, beyond any specific 12 month period, the business still remains sound with potential for decent growth. At least in my opinion.

So 1.2% growth in revenue is essentially flat, reflecting stable growth in the distribution segment (revenue up 4.3%) which is offset by project deferrals in the Heat Transfer Solutions (HTS) segment (a drop of 1.2% in revenue) -- which largely seem like a timing issue as they are expected to recover in FY25

The 10.9% drop in EBITDA isnt what you want to see, and while that partly reflects higher warranty claims, a big part is due to their product upgrade program -- about $1.5m worth. Excluding this, which you would hope is building the foundations for future growth, EBITDA would have been only 3.4% lower.

(Statutory NPAT was up, but largely due to favourable comps when you look at IPO related costs. Pro Forma NPAT was down 23%)

Also, the Thailand facility expansion required new equipment and a restructuring of the engineering and sales teams. These investments are expected to improve operational efficiencies, reduce costs of goods sold (COGS), and support future growth by increasing capacity to manufacture products locally rather than importing them.

They also talked about an ERP upgrade (probably needed, but always makes you a bit nervous), as well as improved IT infrastructure.

Remember, the plan here is to transform a solid, but somewhat inefficient legacy business into a leaner, more optimised operation (something Darryl Abotomey has serious form in.)

We saw improved margin in distribution, inventory reduction thanks to improved processes, and range expansion. And customers continue to grow:

Speaking of inventory reduction, that drop in working capital helped boost operating cash flows from $7m to $14.7m (there was also a $2m tax benefit)

It was good to see the balance sheet improve -- cash increased 13.7% to $15.8m, while debt reduced 51.5% to $1.4m. The company paid out 40% of profit as a dividend, or 2.94cps. That gives a backwards yield of ~4% fully franked. Based on pro forma profit the PE is 9.3x (even after today's 9% pop).

I cant really see too much wrong with this picture. They will continue to modernise this old family business, build more capacity and capture more share. It's profitable, dividend paying and with a strong balance sheet. Yeah, capital orders will always be lumpy, but this is a proven business that has operated across many cycles, and I think low double-digit profit growth is absolutely in play for the next few years. (perhaps mid single digit revenue growth, boosted by efficiency gains -- and there's a good deal of low hanging fruit here)

I know it sounds a bit like a PE-type play, which is more about financial engineering rather than enhancing operational effectiveness and product-market fit, but based on what Darryl said when he spoke with us, this is much more about operating smarter and more efficiently, while still remaining focused on delivering value for customers.

Happily Held.

Adrad has a new significant shareholder. This fund appears to be an active investor in Australasian SMEs, both private and public. They have some recognisable names on their website, including Big River, Yumi's Quality Foods (the dips you can find at the supermarket), and the notorious Appen.

So I took a small position because, well, Appen :P

Chart update

I see droppings to the 0.61-0.67 range

From the AFR:

Street Talk understands veteran Bapcor chief executive Darryl Abotomey was canvassed by the Mike Murphy-led Bain Capital about being involved in the buy-out. Bapcor disclosed it had received a $1.83 billion non-binding, indicative offer from Bain via scheme of arrangement on Tuesday, following a report by Street Talk. Abotomey did not respond to requests for comment.

Sources said Bain Capital was among a number of private equity firms that had tested the appetite of the former Bapcor boss. Of some note, it is understood shareholder John Wylie, who is leveraging a 6.45 per cent ownership to call for a board shake-up, had also reached out to Abotomey about his interest in taking the chairman’s role under a new owner.

The proposed Bain takeover offer of BAP could impact AHL a bit. This plan to involve Daryl in BAP 2.0 sounds like it has been brewing for a while and makes perfect sense. The timing is very interesting vis-a-vis AHL (1) the BAP downgrade (2) Kevin coming onboard AHL (3) Daryl handing over and being totally non-commital on his involvement in AHL post Kevin when SM interviewed him a few months back.

I can't see Daryl just stumping out capital to partake in the buyout and do nothing else ...

Given that BAP would be a competitor of sorts to AHL's parts distribution, not sure how Daryl can still be involved in AHL as a non-Exec director, if he is actually going to be involved in BAP 2.0.

Doesn't change my thesis for AHL, but I would probably temper my enthusiasm a bit, unless Kevin turns out to be a dud ...

Discl: Hold AHL IRL and in SM, Do Not Own BAP

Fri 31.05.24

I'll update this chart along they way

Darryl introduced the new CEO Kevin Boyle who started in April and spoke well for the short time in the business and the team seemed relaxed and at ease with each other and the call.

The downgrade is centred around the Heat Transfer Solutions (HTS) business, with Australian mining and powergen customers mostly deferring projects to FY25 rather than cancelling.

The Distribution (Aftermarket) business is also softer than expected but will still beat the segments last years Sales ($69.6m) and EBITDA ($10.2m). Added the figures because an analysist on the call asked for them and was told to check last years accounts have these figures… maybe he was just testing their knowledge (got-ya questions).

Additional $1.5-2.0m investment required to meet current and future customer needs is an additional cash outlay, but they had $17m in the bank in December, so hardly an issue.

A question was asked if the HTS business was servicing Data Centres, the answer was yes they formed a significant part of current and expected future sales.

Investor Day will likely now be after FY24 results to allow Kevin more time to settle in and to avoid complications of previewing results – which I think is sensible and should have always been the case.

The CEO appeared to be open and honest (noting it’s easy to do at the start), the company is profitable and has a lot of cash. The issues seem to be market rather than company related and they continue to focus on lowing costs to increase margins.

Have bought more on the dip, but would be concerned if market conditions deteriorated significantly more or worse that they started to have operational issues.

Disc: I own RL+SM

DOWNGRADED GUIDENCE:

Over recent months AHL has seen a softening of demand across its businesses.

The Heat Transfer Solutions business specialises in the development of custom designed and manufactured products predominately for the Australian environment.

As part of new product development there are continuous innovations leading to improvements in design.

One particular product for a high growth market has required an upgrade to enhance its performance.

In conjunction with the customer, HTS has been undertaking an upgrade program, which will incur an additional one-off cost of ~$1.5m to ~$2.0m in the FY24 year.

This additional investment is expected to secure orders for this product into the future.

Over the last few months there has been a deferral or cancellation of a number of projects such that the revenue from these projects will no longer be included in the FY24 results, with the majority of these projects expected to move into the FY25 year.

Demand in Distribution market has also softened, particularly for industrial radiators.

Overall AHL now expects that FY24 Forecast Revenue will be~$140m to $144m, being flat to ~3% above FY23 actual.

FY24 EBITDA (post AASB16) is forecast to be between $18m and $19m, which is between 6% and 10% below FY23 actual.

Heat Transfer Solutions revenue is forecast to be ~1% below FY23 actual owing to customer deferrals or cancellations of projects as outlined.

Many of these projects are expected to come to fruition in FY25.

FY24 EBITDA is forecast to be ~20% below FY23 actual due to the combination of the deferrals of projects and product upgrades as outlined above.

Distribution is forecast for revenue to increase ~5% above FY23 actual with forecast EBITDA ~10% above FY23 actual.

AHL has weakend in the past 2 weeks on no news. The thin volume makes it very hard to buy a meaningful number of units to make the brokerage worthwhile. Took the only super-short window available today to top up at 0.93 as there was some decent volume on offer as well as the price being smack bang at the 38.2% rectracement level - both rare occurences!

If it weakens further, the next entry point that I am looking at is ~0.885, which is the 50% retracement and 200 Daily Moving Average.

Discl: Held IRL and in SM.

For anyone interested in Andrew making comment on Adrad, Friday’s Baby Giants (29 Mar 24) has a good discussion, and he mentions it as an investment idea at the end of the MF Money podcast for today (31 Mar 24) in the last 10 minutes.

Motley Fool Money on Apple Podcasts

Disc: I own IRL and it’s super illiquid.

Investment Thesis & Valuation

Thesis

The following key factors are being relied upon for this investment:

1. Management acuity: without Darryl I lack the confidence that there will be rigorous business discipline in operating and investing decisions. Provided he remains a director he can guide and supervise the new CEO starting in April. After a few years it will be come less of an issue as the company management culture should have absorbed his experience. The founder on the board also provides an important industry experience skill set which needs to be maintained if he leaves to ensure technical engineering matters are understood by the leadership.

2. Established Niche Leader: Adrad is the leader in Heat Transfer Solutions in Australia, maintaining this with innovation, business and operational efficiency is critical. Opportunities in Asia are important but more important is dominating it’s base market to provide leverage overseas. A change in the relationship with Kenworth Australia is a specific risk.

3. Profitable and Cash: There is no good reason for the business to go into losses other than it’s in major trouble, no large growth opportunity worth chasing by making losses and burning cash to reach. WC will impact FCF as it has to date (see graph), but should become less of a factor going forward and when taken out FCF should be strong.

4. Operating Leverage: With modest sales growth expectations and opportunities, a significant amount of value (EBITDA) growth is going to come from margin improvement and cost management. Operational changes underway and planned are expected to deliver these over the coming years, my bear case excludes these improvements and has a value under the current price as a result, so they are critical.

Other factors of note: Orange rather than red flags if they go negative

· Ownership: The founding director owns 61% of the company and other directors and KMP don’t own any. I like the skin in the game of the founder but don’t know him at all (but longevity of the business is a big plus) and would like to see other directors and KMP have stakes in the company that are economically important to them.

· Earning Stability: The OE business has long lead and tail work timelines and once established as a supplier, very sticky revenue. This is a bit like a SAAS business in it’s recuring nature and stability. Changes in technology to shorten the development cycle will challenge this stability.

· Alu Fin: setbacks and delays in this opportunity would lead to questions of what will grow sales and how strong their leadership is.

· Margin: I expect a slow but continued improvement in margins from the switch to Thailand and the reduction in duplicated costs. FY24 isn’t likely to show much but if guidance for FY25 doesn’t suggest noticeable improvements then deeper questions on the progress of efficiency improvements need to be answered.

· Working Capital: AR and AP will require attention but are expected to grow with sales. Inventory should either shrink or grow at a much lower rate than sales to reflect improved management and turns as guided.

· Acquisitions: Small add on’s within the specialist area are fine, but large acquisitions or those that expand operations out of Adrad’s niche will need a full review of the investment Thesis.

· Free Float: The lack of liquidity on market is both an opportunity and threat for small investors, but the bigger issue is how they “fix” it… 20% of the shares came out of escrow in February, so how this is handled will also give some indication on how shareholders are treated.

· Electrification: Not an imminent threat or opportunity for EV’s, Hydrogen opportunity is low odds, EO market supporting data centres and electric infrastructure is the tangible current opportunity. A space to watch to see how technology, markets and legislation develops.

· Warranty: H1 FY24 high warranty expense relates to issues that have supposedly been corrected. Ongoing high warranty expense would signal operational issues that will impact margins and may spill into brand damaging sales impact.

Valuation

Using a terminal year of FY28 for DCF and PE based calculations my base case valuation is $1.53 (IRR 17.5% at current price of $0.90). Growth is in line with FY24 guidance at 7% but modest given the expansion options across the market. Margins are expected to improve and so I increase these to 55% by FY28 but see this improving or Opex growth being below my 5% estimate given their focus on EBITDA% improvements. Assume EBITDA% reaches 20% and NPAT% reaches 11% by FY28.

Working capital will soak up cash as sales grow, but improved inventory management and ranging I expect should keep this to around 2% or well below sales growth. With a discount of 11% and PE assumption of 12.5 the value ranges from $1.60 to $1.45 on the bases case.

Summary

A stable, profit making, cash generating business with a long history that is expanding operations under experienced and credible management taking advantage of new market opportunities. Not a 10 bagger but a possible 3-5 bagger at current prices in the next 5 years on an un-demanding rate of growth adding to operating leverage from scale and operational efficiencies.

Expect 3+ year investment time frame to realise value. Comparables to IPO years and current year operational transitions are going to provide a muddy financial view for investors that may be discounted by the market until a few consecutive halves show consistency.

Disc: I own RL

Company Overview

Adrad is an aftermarket suppler of heat transfer solutions for heavy automotive/transport and power generation via a wholesale distribution of standard parts or bespoke manufacture. Growth, improved margin and capital efficiency is expected from further movement of production to Thailand, range focus and opportunities in Asia.

Corporate History

· Founded in 1985 by Gary and Karen Washington with a focus on delivering reliable and efficient heat transfer solutions to the aftermarket segment that meet the needs of its customers across a broad range of industries including automotive, transport, mining, construction, agriculture and energy. Adrad has an established network of branches, workshops and manufacturing facilities across 8 main sites and 16 warehouses in Australia, New Zealand and Thailand. Adrad is headquartered in Beverley, South Australia and has approximately 500 employees

· Adrad IPO’s on the ASX on 30 September 2022 at $1.50 raising $22m from investors. $15m was for the sale of new shares and $7m the sale of SaleCo (The shareholders and directors of SaleCo are Mr Glenn Davis, Mr Gary Washington and Mr Donald McGurk and the Company Secretary of SaleCo is Ms Kaitlin Smith). Use of Funds:

- 5.3m - PP&E in Thailand & Australia (OE)

- 1.0m – Expand Thai manufacturing facility

- 2.0m – PP&E (Aftermarket)

- 4.3m – Working Capital

- 3.6m – Offer Costs

- 5.8m – Existing shareholder sales

· Harrop Engineering Australia Pty Ltd ACN 134 196 080 (Harrop engineering) is a related party of the Company. Harrop Engineering’s sole shareholder is the Existing Shareholder, and Mr and Mrs Washington are also directors of Harrop Engineering. Harrop Engineering was previously a wholly owned subsidiary of the Company. It was transferred to the Existing Shareholder as part of the restructure which occurred in October 2021, and is no longer part of the Group. The Company and Harrop Engineering are parties to a longstanding supply arrangement under which the Company supplies certain heat exchange products to Harrop Engineering. the price for products supplied to Harrop Engineering is calculated at cost plus a markup which equates to a relevant gross margin of approximately 24.8% for the Company there is no fixed term. FY21 sales were $1,071k (<1% of total sales).

· Related Party: The rent payable under the Harlaxton Leases and Arlyngton Lease increases by 4% per annum, subject to periodic market review.

Business Operations

· Adrad operates across two main segments:

- Distribution (Aftermarket) – Australian manufacturer, importer and distributor of radiators and other heat exchange products for the Australian automotive and industrial aftermarket.

- Heat Transfer Solutions (Original Equipment) – Designer and manufacturer of OEM industrial radiator and cooling systems from its facilities based in Australia and Thailand.

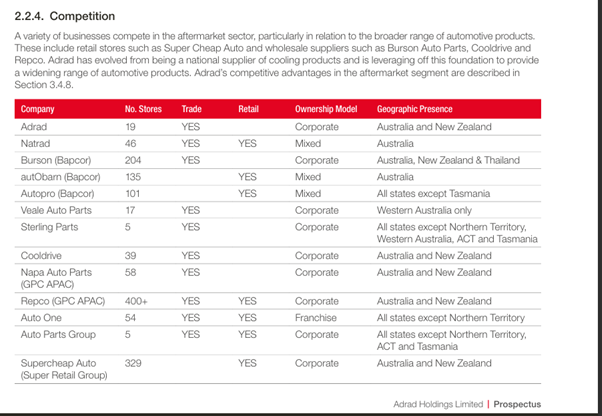

· Distribution (Aftermarket): automative and industrial heat exchange products of which around 2/3 are third party sourced and 25% sold via the Natrad franchise network of 46 stores (at IPO). Non-franchise pricing is flexible to react to landed cost and raw material cost changes to maintain margins. The supplier base is diverse with over 60 wholesale and parts suppliers, the top 10 accounting for approximately 46% in FY21. 16 distribution warehouses across Australian and New Zealand service the network.

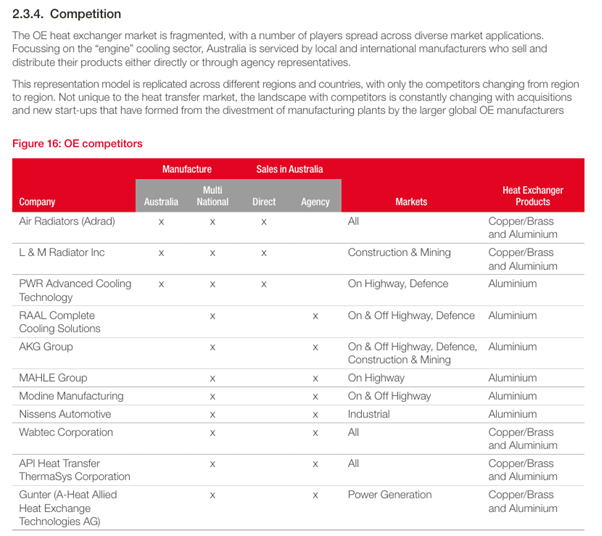

· Heat Transfer Solutions (OE): address On Highway (Trucks) and Off Highway (Construction, Mining & Rail) mobile segment and stationary segment of Industrial (below 1MW in engine power) and Power/Energy Generation (above 1MW – remote power generation stations). Using lean and flexible manufacturing principles from one off projects to full just in time capabilities in Australian and Thailand as well as R&D capabilities to validate thermal performance. OE supply or project work may be from a few months to a few years but after sales service and repairs can extend 5-20 years. There a few formal fixed-term contracts and Adrad employs Business Development and Sales teams to both prospect for business and manage customers.

Strategy and Direction

· Investment Decisions: Adrad is transitioning from a Privately owned and run company with loose investment decision criteria to one focused on return on funds invested under new management. “Sweeting Assets” to reduce working capital and target a 15-20% return on funds invested and a focus on PBT & EBITDA outcomes rather than just sales growth should see operating leverage improve but sales growth will be modest.

· Power generation: Data centres provide an opportunity for OE colling systems for generators and some traction exists in Australia but the Asia market will require the development of a lower cost product and take time to penetrate.

· Aluminium: radiators and cooling systems are moving from Copper/Brass based to aluminium due to weight and cost but aluminium expands and contracts significantly more with heat so requires specialist design to fit and for connecting parts which Adrad is leading on developing. Not worth patent protecting, but trade secrets and processes provide competitive protection of sorts.

· Thailand: Adrad has had basic operations in Thailand for around 10 years, but is now in the process of transferring all manufacturing there, leaving design and engineering in Australia. The manufacturing footprint in Thailand is growing and the equipment is being upgraded or transferred from Australia. There is currently a period of duplication of inventory and costs while this transfer takes place but once finished there should be significant efficiencies that improve EBITDA and operating leverage.

Market and Competition

· Distribution (Aftermarket): Adrad is concentrating on heat exchange products and being the go-to supplier of these products rather than a generalist supplier. IPO talked to expanding the product range but this has been abandoned for lack of competitive edge and the lack of cash and operating efficiency in pursuing this in a crowded market.

· Distribution is a crowded market with large dominant players in Trade and Retail. Adrad’s edge lies in specialising in cooling and as a channel for it’s OE manufactured parts at the high end.

· Heat Transfer Solutions (OE): Adrad is the largest and only significant supplier of large scale OE equipment in the Australian market. Specialising for designing and building for the Australian conditions (of which there are many).

· Kenworth: Adrad has been the specialist supplier of radiators to Kenworth Australia for 45 years via the brand Air Radiators.

· Alu Fin: A specialist aluminium cooling system for large (mega) underground mining trucks, Adrad is developing this specialist equipment for CAT in Australia which take time due to design and manufacture complexities but once established provides a long opportunity which can be expanded to other manufacturers of this equipment.

People & Ownership

Leadership Team:

· CEO: Darryl Abotomey (ex-Bapcor CEO of 10 years) who joined as a Director in April 2023 and from August 2023 has been acting in this role pending a replacement (Kevin Boyle who will start in April 2024 from 6 years as CEO at Blue Lake Milling a private company, but he has 20 years of manufacturing management and operations experience). The previous CEO was Donald Cormack and ex-E&Y partner was in the role for 15 years.

· CFO: Rod Hyslop joined in November 2022, good ASX listed experience, some manufacturing and GM, mostly Energy and started in industry then audit with AA.

· Chair: Glenn Davis, legal background with M&A, appointed in January 2022 for the ASX listing (Director of Beach Energy since 2007) – governance rather than operating skill set.

Director Ownership:

- · Gary Washington (Founder/ED): 49.3m shares (61%)

- · Donald McGurk: 0 shares

- · Glenn Davis: 0 shares

- · Darryl Abotomey: 0 shares

Disc: I own RL

Just finished watching the AHL meeting video. Will need to do a deeper dive to full understand the company but rather than get stuck with analysis paralysis as I normally do, have opened a small position both IRL and in SM today.

Thesis

Main thesis points for me from the call as well as @Strawman and @Tom73 's points:

- The focus of the business is way, way beyond radiators - as Daryl put it "anything to cool anything down". So cooling systems for trucks, data centre gensets, power generation stations, VLine diesel trains etc. and the strategic direction is to remain very focused in this space (vs veering into more general aftermarket parts, which they are trying to reign back)

- Very well positioned for the cooling system-end of hydrogenisation and electrification of machines, trucks, cars - cooling is a huge issue and requirement in the greening of industrial machines, vehicles etc

- AHL has no direct peer in the manufacturing of "big stuff" cooling within Aust for Aust conditions for the range of products that AHL supports

- Are deep into AluFin technology, using aluminium instead of copper as the basis of the cooling systems

- Sticky customers for the main Original Equipment manufufacturing business

- Laser focused on improving Working Capital (lots of passion on improving inventory turns), Retun on Invested Capital and EBITDA instead of pure revenue-driven "prosperity without profit".

- Tailwind from moving of manufacturing facility to Thailand which is not only more cost effective, but also opens up access to Asian markets down the road.

- Stacks of cash, dividend paying, providing some stability to my current heavily-skewed-to-growth-centric portfolio - very nice to hear that they do not need an equity issue as they have "so much cash".

- Share Price has come well off the highs of $1.625, with the low thus far of $0.67, $0.90 seems like a decent entry point

Some Immediate Risks

- Not all its products are IP-protected - not cost effective. A concern initially, but they have a 40-50 year track record of existence, and Daryl took great pains to say that it takes a heck of a long time for AHL to get a OE product from design to operations, which in itself, is a moat.

- Low free float - they are recognising this as a "problem" and have some focus on striking a better balance on this.

I didn't realise how much I missed Daryl from BAP, until you hear/see him back in action again, motivated to get AHL on the rght track as a public company and setting them up nicely to grow.

Discl: Held IRL and opened trade in SM

Radiators aren't a sexy product, but I must say Darryl did a good job of building some enthusiasm for me.

This is a profitable company with a well established presence and some real potential for genuine efficiency gains. And having followed Darryl since the Bapcor days (and Burson before that), I think he's definitely someone who can help drive those improvements.

Some notes from the meeting:

- Adrad has two main business segments: manufacturing and supplying radiators and other heat transfer solutions, and distributing automotive parts for the aftermarket.

- The company has a long history, with one arm celebrating 50 years and the other 40 years in business. They are the sole supplier of radiators for Kenworth trucks in Australia since 1974.

- Adrad manufactures bespoke cooling solutions for various applications including trucks, trains, data centers, power generation, and mining equipment.

- The company is developing new aluminum radiator technology which is cheaper than traditional copper/brass. This requires extensive engineering and testing to get the specifications right for different operating conditions.

- Aftermarket parts are a significant portion of sales. Adrad aims to be the go-to supplier of cooling parts for the automotive aftermarket in Australia.

- The company is focused on improving inventory turns and return on invested capital. Current inventory levels are considered too high.

- Manufacturing is being shifted from Australia to a lower-cost facility in Thailand. This will improve margins while still allowing them to service the Australian market. Asian markets provide an additional growth opportunity.

- Electric vehicles are not seen as a major threat in the foreseeable future given the slow turnover of the car parc. Adrad is developing cooling solutions for EV and hydrogen applications.

- Some of their bespoke solutions have very long sales cycles of 5+ years from initial development to volume production. Securing the first major customer is key.

- Corporate costs are being tightly controlled as the company grows by keeping most staff in the business units rather than centralizing.

Shares seem decent value too. I'll post a rough valuation seperately.

Guess it is up to me to read the prospectus...

Other Equipment

Aftermarket

Despite the glowing story of Adrad's sector and the small market cap, maybe these tables explain why some of the financial metrics are still remaining in single digits.

Even more divided on this than before I think. Probably need to do more reading before deciding.

Valuation based on 9c EPS and 8% growth rate for next 5 years with a PE of 12. (Limited history as it's a newer listing but PE of 12 is well below the market average and the bottom end of the range for comparator companies.

Why would I own it?

# Founder led and very experienced Board for the current size of the business, with Directors who have recently been CEO's at other very successful ASX listed companies.

# Manufacturer and distributor of cooling systems for auto and industrial use, with over 7000 customers. They have two divisions. One is Aftermarket that supplies repairers, mechanics and franchises including Natrad who they acquired 20 years ago of “Nip into Natrad” fame!

The other division supplies Original Equipment (OE) manufacturers for their heavy vehicles including CAT, Kenworth and Hitachi. The industrial customers include Rail networks, power generators, mine sites etc.

Revenue is about 50/50 between the two divisions but the OE division is twice as profitable as the aftermarket division.

# Have their own in house R&D and manufacturing facilities including two in Thailand that were purpose built, to ensure they are well prepared for future growth and to lower costs. They also have 16 warehouses across ANZ to service Aftermarket customers.

# This manufacturing facility investment has impacted FY23 and FY24 profit but should see a quick improvement in FY25 as the spend drops.

# Planning to expand in South East Asia from Thailand base, especially within Industrial segment.

# Have been adding new talent to the management team, who can hopefully leverage their experience and manufacturing capabilities.

# Low debt to equity of 30% and healthy cash position despite recent investments in manufacturing. ROE/ROC is only 6% and 8% however I would expect that to double in FY25 as capital expenditure drops while revenue grows.

# Gross margin and net margin have both been improving nicely for a few years in a row now.

# MOS is good at 90c share price in Mar 2023, on a trailing PE of 10. Expecting high single digit p.a. earnings growth for the next 5 years, so should be able to achieve our 15% p.a. return target with a little multiple expansion. Paying dividends at approx. 35% payout ratio.

# There are quite a few examples of companies like this doing well in Australia after listing and adding talent – for example ARB, PWR Holdings, Supply Network and Bapcor which have all been solid multibaggers for early investors.

What to watch?

# Founder or Board members selling down or leaving early.

# Profitability and ROE/ROC not improving significantly in FY25 if revenue grows as expected.

# Loss of major customers in the OE division.

What about the risk in the move to EV’s and the impact on traditional cooling systems for automotive business?

They are aware of this and plan to address as follows –

The very popular SUV’s (Ford Rangers, Toyota Hilux, Mitsubishi Triton, etc.) are likely to move towards plug in hybrid technologies meaning that a conventional internal combustion engine will still be utilized along with battery power.

Large horsepower engines (trucks etc) are moving towards hydrogen as a fuel source and the OE team is already working on multiple projects for cooling hydrogen fueled engines.

Hydrogen fueled engines present a significant opportunity for the OE business as the demands on the cooling systems are greater than for conventional diesel or gas fueled engines.

EVs will continue to require service parts (heaters, condensers, evaporators, compressors brakes, filters, etc.) as well as thermal management systems for the battery packs all of which are traditional products supplied by Adrad.

With the thought of NextDC still fresh on my mind

Not sure if "heat transfer" products would solve the cooling issue from DCs but one hopes that this could be a potential application.

Apart from that a few other "tidbits" I found since having this on my watchlist for 6 months but no time to write about it yet

Apologies for being too brief.and cryptic But worth spending your time understanding this company.

Hopefully I've piqued some interest, but don't mind if you give this straw a pass.

Not held but still thinking.