Good to look at micro, company-specific matters, to take a break from the chaos of the maro world!

Discl: Held IRL and in SM

SUMMARY

1HFY25 results were disappointing.

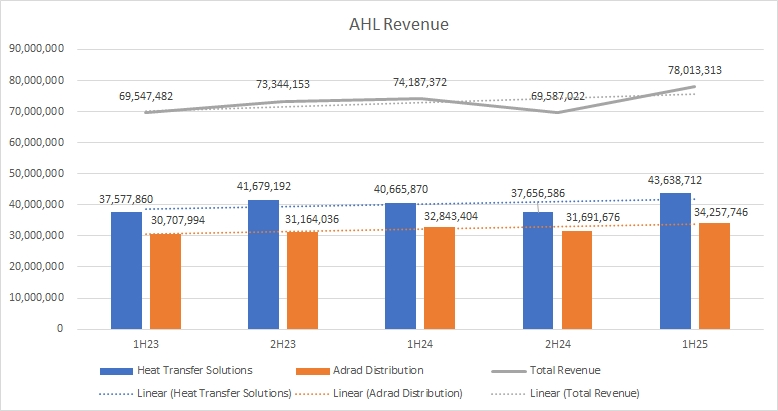

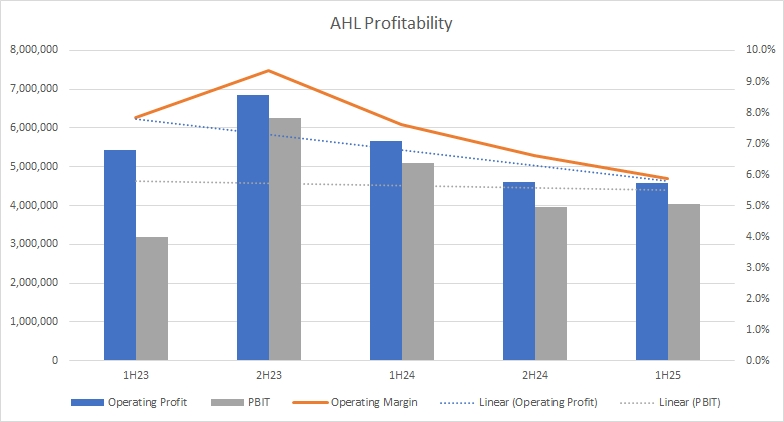

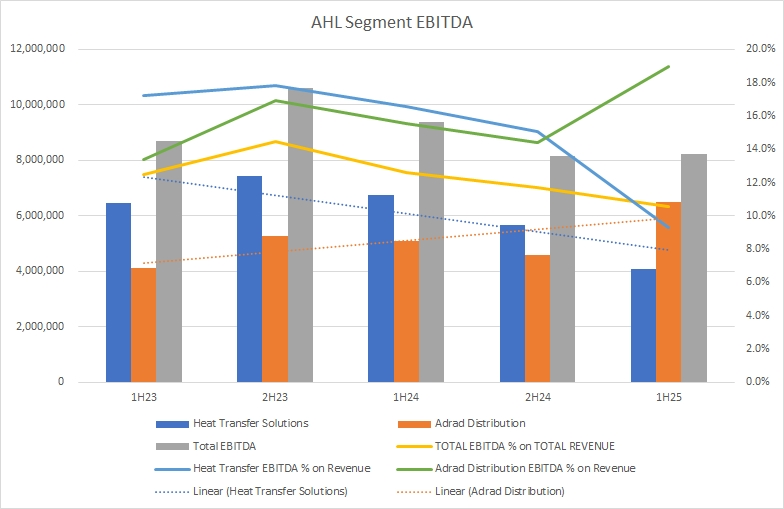

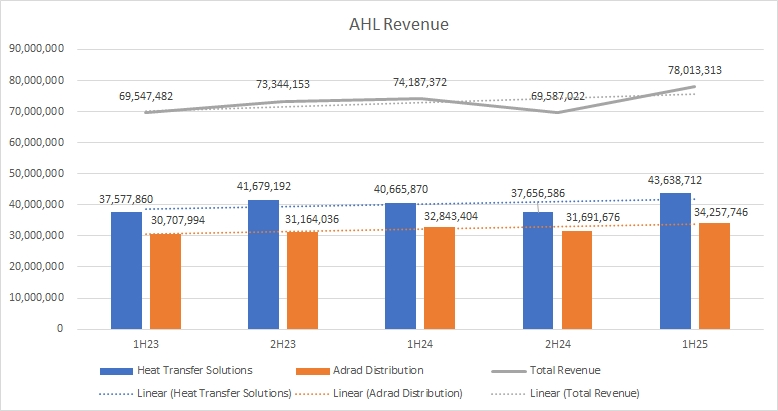

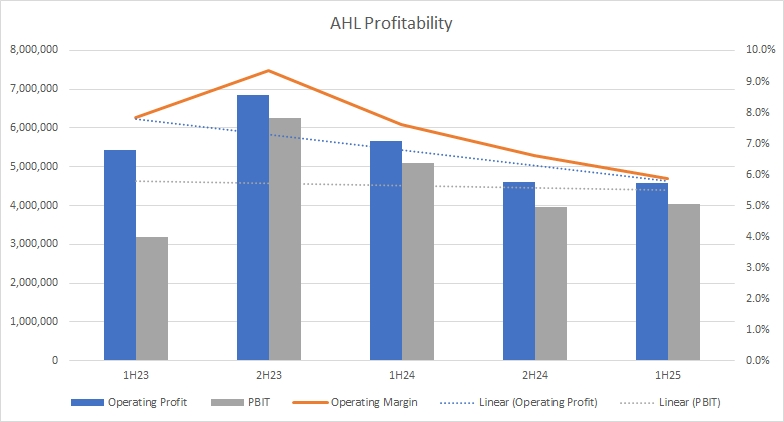

A steady 6% increase in revenue was more than offset by higher raw material and employee expenses, resulting in lower EBITDA (16.9%) YoY, lower NPAT (9.7%) and a drop in Operating Margin from 7.6% 1HFY24 and 6.6% in 2HFY24 to 5.9% in 1HFY25.

However, my revenue-focused thesis is playing out. HOLD.

POSITIVES

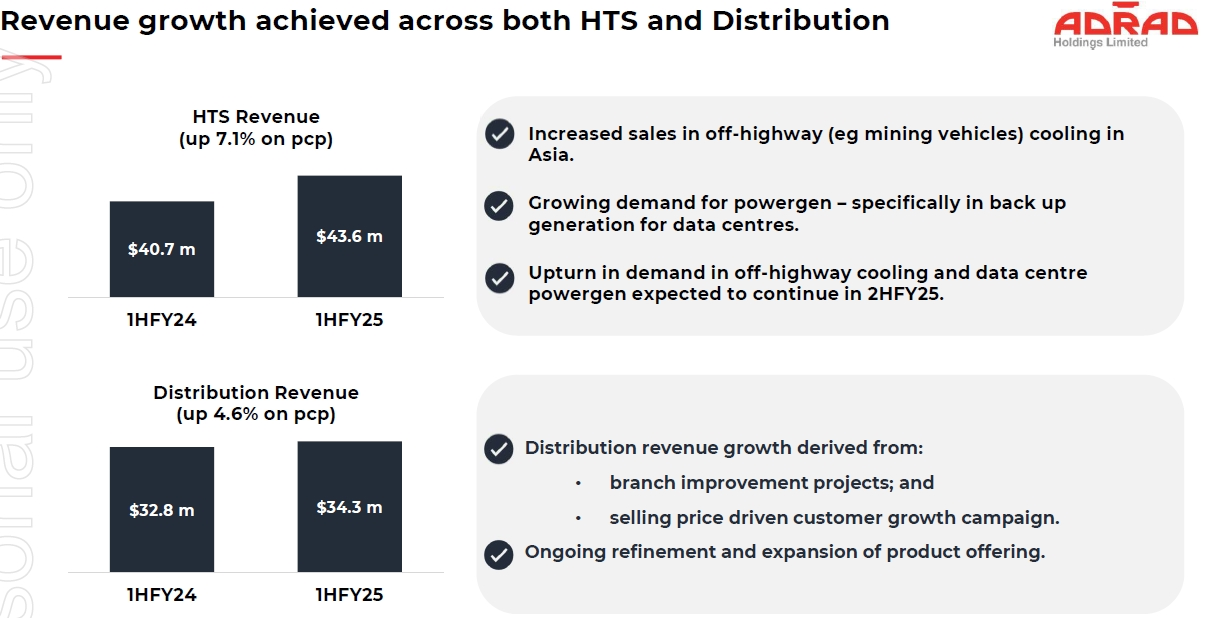

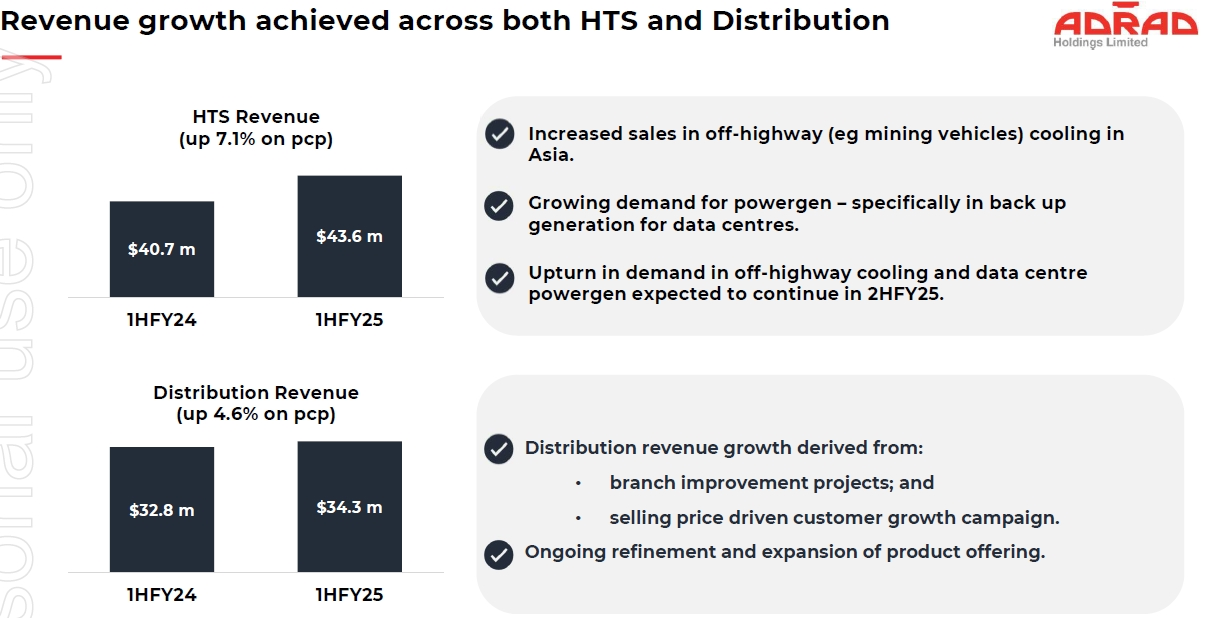

Revenue continues to grow nicely across both segments

HTS - up 7.1% vs pcp

- Traction in Asian Rail project, which is the outcome of an increased focus in Asia from AHL’s Thailand operational base - 1st Asian rail project won and will commence in 2HFY25

- 1st Orders for AluFin - prototype for above ground mining vehicles - good traction in AluFin, primary target market $15m-$30m revenue

- Rail Service - $9m orderbook expansion to replace cooling units in Victorian trains

Distribution - up 4.6%

- Branch improvement projects

- Selling price driven customer growth campaign

Continued good cash generation - $10.1m of cash from operations, $3.3m net increase in cash after (2.9m) capex spend, ($0.7m) debt repayment and ($1.3m) FY24 dividends paid

Balance sheet remained in good shape and strong - $19.1m cash, $0.7m borrowing's (down from $1.4m 1HFY24), Inventory flat $0.4m increase to $47.7m as Distribution stock reduced from increased turns offset by higher HTS raw materials in preparation for uplift in 2HFY25 manufacturing activity

Thai manufacturing facility is now complete - lower manufacturing economics should start to flow through more clearly - will facilitate insourcing

DISAPPOINTMENTS

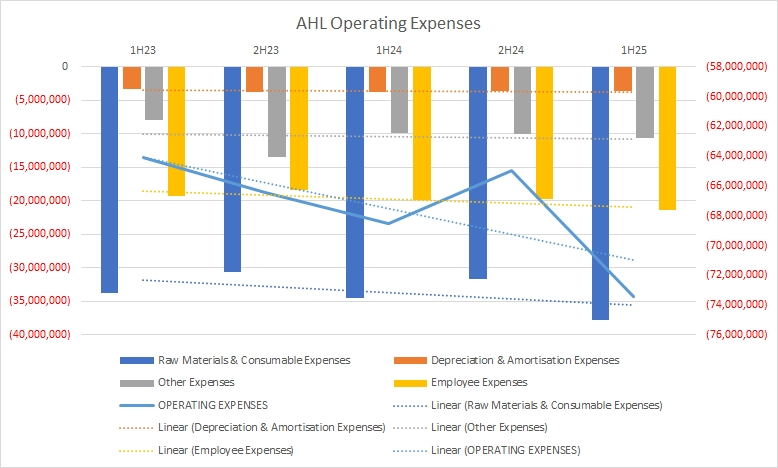

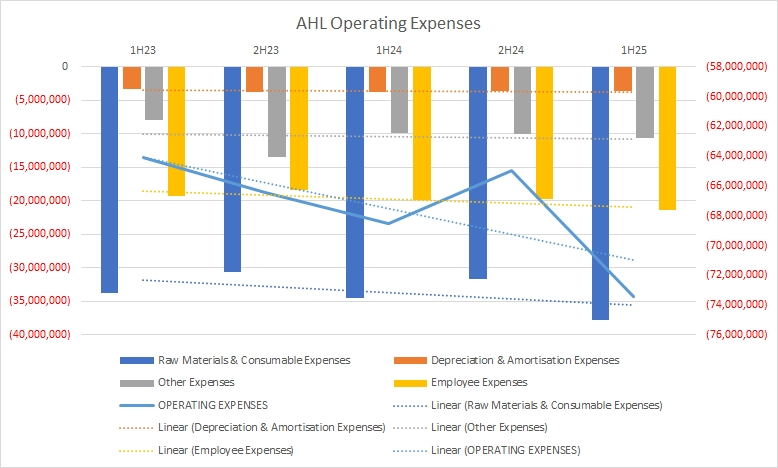

After good cost improvement in 2HFY24, Operating Expenses have increased back to the overall cost increase trendline:

Raw Materials & Consumables are now in a noticeable upward trend:

- Deteriorating AUD purchasing power

- Increased direct input costs

Employee Expenses are also in an upward trend, although not as steep as Raw Materials & Consumables:

- Wage & Super uplift from 1 Jul 2024

- Sales team boost has kicked in

Additional Insurance costs, doubtful debt provisions, FX costs have also added to costs.

Customer Growth campaigns in FY24 to reduce pricing to grow customers, now returned to pre-campaign normal pricing - seeing revenue increase from increased volume from increased customers

Management understands the reason for cost increases and have taken action - need to see this filter through in 2HFY25.

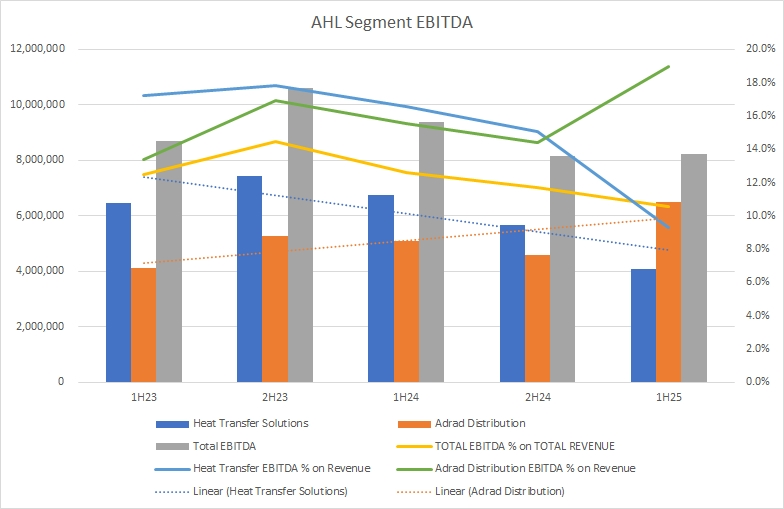

Distribution EBITDA is on a clear upward trajectory, HTS EBITDA continues to trend downwards as the cost increases impact HTS directly.

THESIS REVIEW

Thesis was predicated on:

- Revenue growth from HTS given dominant market position on Industrial Cooling, domestically and in Asia - tick

- Growth from AluFin taking off - good positive greenshoots, tick

- Thai manufacturing facility would give AHL an Asian base, from which to deepen penetration to Asia - tick

- Thai facility will also lower cost - cautious tick on this, the issue this half was more raw materials/AUD driven - without the Thai facility, the cost increase could well have been worse

Cost advantages was not an explicit part of the thesis, although arguably, there was an implicit assumption that costs would stay under control and contained - the cost increases this half has knocked this assumption around a bit

- Management is aware of the challenges and have and will continue to focus on cost management

- Pricing increases will have kicked in in 2HFY25, expecting ~$2.5m to kick in - $1m from Distribution and $1.5m from HTS

In summary, while the cost increases have impacted EBIT and NPAT, and the downward trend of both is not great, the revenue-related thesis is actually playing out.

Still too early to call this result a thesis breaker, but will need to see improvement in cost increases to arrest the increasing trajectory.

2HFY2025 OUTLOOK

Need to see:

- Continued revenue growth from both HTS, from Data Centre demand, and Distribution

- Continued manufacturing leverage from the Thailand facility move

- Cost containment measures kicking in to rein costs back in

Portfolio Action

HOLD. Current allocation of 2.98% is about right