Company Overview

Adrad is an aftermarket suppler of heat transfer solutions for heavy automotive/transport and power generation via a wholesale distribution of standard parts or bespoke manufacture. Growth, improved margin and capital efficiency is expected from further movement of production to Thailand, range focus and opportunities in Asia.

Corporate History

· Founded in 1985 by Gary and Karen Washington with a focus on delivering reliable and efficient heat transfer solutions to the aftermarket segment that meet the needs of its customers across a broad range of industries including automotive, transport, mining, construction, agriculture and energy. Adrad has an established network of branches, workshops and manufacturing facilities across 8 main sites and 16 warehouses in Australia, New Zealand and Thailand. Adrad is headquartered in Beverley, South Australia and has approximately 500 employees

· Adrad IPO’s on the ASX on 30 September 2022 at $1.50 raising $22m from investors. $15m was for the sale of new shares and $7m the sale of SaleCo (The shareholders and directors of SaleCo are Mr Glenn Davis, Mr Gary Washington and Mr Donald McGurk and the Company Secretary of SaleCo is Ms Kaitlin Smith). Use of Funds:

- 5.3m - PP&E in Thailand & Australia (OE)

- 1.0m – Expand Thai manufacturing facility

- 2.0m – PP&E (Aftermarket)

- 4.3m – Working Capital

- 3.6m – Offer Costs

- 5.8m – Existing shareholder sales

· Harrop Engineering Australia Pty Ltd ACN 134 196 080 (Harrop engineering) is a related party of the Company. Harrop Engineering’s sole shareholder is the Existing Shareholder, and Mr and Mrs Washington are also directors of Harrop Engineering. Harrop Engineering was previously a wholly owned subsidiary of the Company. It was transferred to the Existing Shareholder as part of the restructure which occurred in October 2021, and is no longer part of the Group. The Company and Harrop Engineering are parties to a longstanding supply arrangement under which the Company supplies certain heat exchange products to Harrop Engineering. the price for products supplied to Harrop Engineering is calculated at cost plus a markup which equates to a relevant gross margin of approximately 24.8% for the Company there is no fixed term. FY21 sales were $1,071k (<1% of total sales).

· Related Party: The rent payable under the Harlaxton Leases and Arlyngton Lease increases by 4% per annum, subject to periodic market review.

Business Operations

· Adrad operates across two main segments:

- Distribution (Aftermarket) – Australian manufacturer, importer and distributor of radiators and other heat exchange products for the Australian automotive and industrial aftermarket.

- Heat Transfer Solutions (Original Equipment) – Designer and manufacturer of OEM industrial radiator and cooling systems from its facilities based in Australia and Thailand.

· Distribution (Aftermarket): automative and industrial heat exchange products of which around 2/3 are third party sourced and 25% sold via the Natrad franchise network of 46 stores (at IPO). Non-franchise pricing is flexible to react to landed cost and raw material cost changes to maintain margins. The supplier base is diverse with over 60 wholesale and parts suppliers, the top 10 accounting for approximately 46% in FY21. 16 distribution warehouses across Australian and New Zealand service the network.

· Heat Transfer Solutions (OE): address On Highway (Trucks) and Off Highway (Construction, Mining & Rail) mobile segment and stationary segment of Industrial (below 1MW in engine power) and Power/Energy Generation (above 1MW – remote power generation stations). Using lean and flexible manufacturing principles from one off projects to full just in time capabilities in Australian and Thailand as well as R&D capabilities to validate thermal performance. OE supply or project work may be from a few months to a few years but after sales service and repairs can extend 5-20 years. There a few formal fixed-term contracts and Adrad employs Business Development and Sales teams to both prospect for business and manage customers.

Strategy and Direction

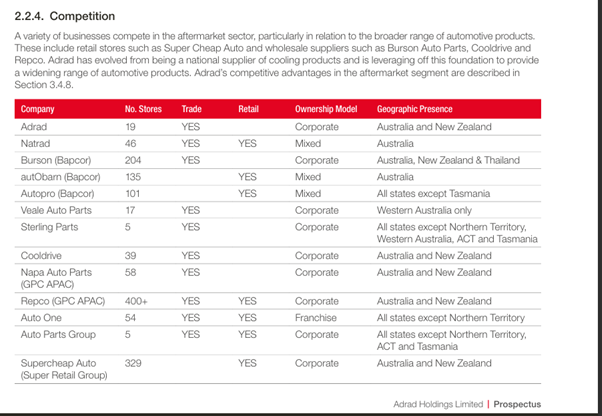

· Investment Decisions: Adrad is transitioning from a Privately owned and run company with loose investment decision criteria to one focused on return on funds invested under new management. “Sweeting Assets” to reduce working capital and target a 15-20% return on funds invested and a focus on PBT & EBITDA outcomes rather than just sales growth should see operating leverage improve but sales growth will be modest.

· Power generation: Data centres provide an opportunity for OE colling systems for generators and some traction exists in Australia but the Asia market will require the development of a lower cost product and take time to penetrate.

· Aluminium: radiators and cooling systems are moving from Copper/Brass based to aluminium due to weight and cost but aluminium expands and contracts significantly more with heat so requires specialist design to fit and for connecting parts which Adrad is leading on developing. Not worth patent protecting, but trade secrets and processes provide competitive protection of sorts.

· Thailand: Adrad has had basic operations in Thailand for around 10 years, but is now in the process of transferring all manufacturing there, leaving design and engineering in Australia. The manufacturing footprint in Thailand is growing and the equipment is being upgraded or transferred from Australia. There is currently a period of duplication of inventory and costs while this transfer takes place but once finished there should be significant efficiencies that improve EBITDA and operating leverage.

Market and Competition

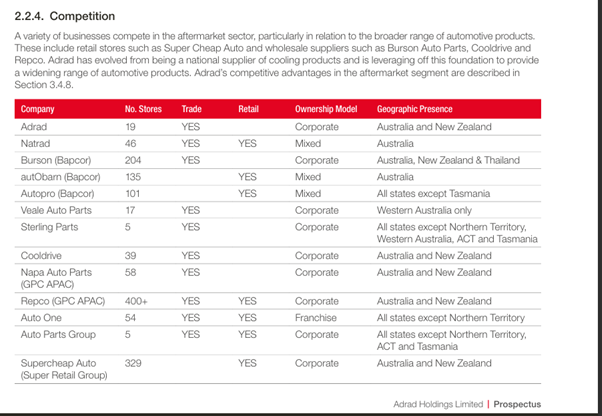

· Distribution (Aftermarket): Adrad is concentrating on heat exchange products and being the go-to supplier of these products rather than a generalist supplier. IPO talked to expanding the product range but this has been abandoned for lack of competitive edge and the lack of cash and operating efficiency in pursuing this in a crowded market.

· Distribution is a crowded market with large dominant players in Trade and Retail. Adrad’s edge lies in specialising in cooling and as a channel for it’s OE manufactured parts at the high end.

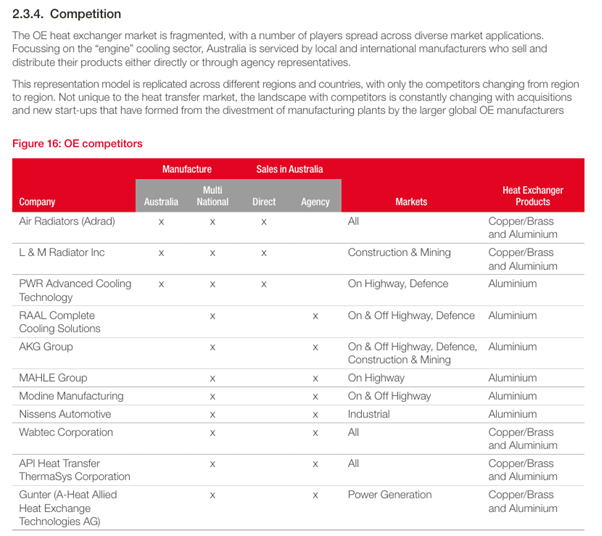

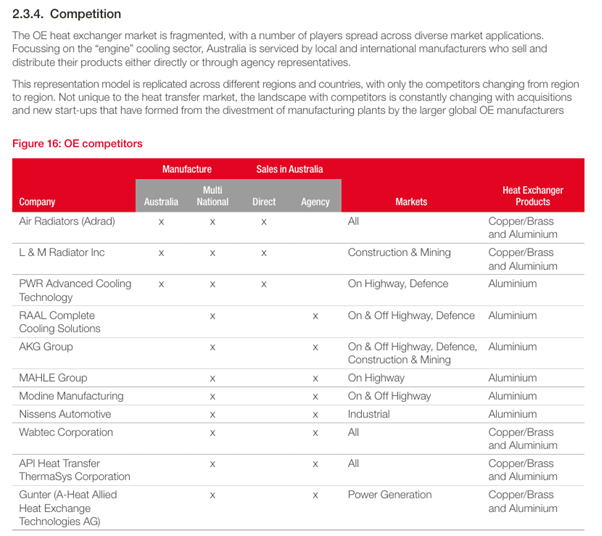

· Heat Transfer Solutions (OE): Adrad is the largest and only significant supplier of large scale OE equipment in the Australian market. Specialising for designing and building for the Australian conditions (of which there are many).

· Kenworth: Adrad has been the specialist supplier of radiators to Kenworth Australia for 45 years via the brand Air Radiators.

· Alu Fin: A specialist aluminium cooling system for large (mega) underground mining trucks, Adrad is developing this specialist equipment for CAT in Australia which take time due to design and manufacture complexities but once established provides a long opportunity which can be expanded to other manufacturers of this equipment.

People & Ownership

Leadership Team:

· CEO: Darryl Abotomey (ex-Bapcor CEO of 10 years) who joined as a Director in April 2023 and from August 2023 has been acting in this role pending a replacement (Kevin Boyle who will start in April 2024 from 6 years as CEO at Blue Lake Milling a private company, but he has 20 years of manufacturing management and operations experience). The previous CEO was Donald Cormack and ex-E&Y partner was in the role for 15 years.

· CFO: Rod Hyslop joined in November 2022, good ASX listed experience, some manufacturing and GM, mostly Energy and started in industry then audit with AA.

· Chair: Glenn Davis, legal background with M&A, appointed in January 2022 for the ASX listing (Director of Beach Energy since 2007) – governance rather than operating skill set.

Director Ownership:

- · Gary Washington (Founder/ED): 49.3m shares (61%)

- · Donald McGurk: 0 shares

- · Glenn Davis: 0 shares

- · Darryl Abotomey: 0 shares

Disc: I own RL