Pinned straw:

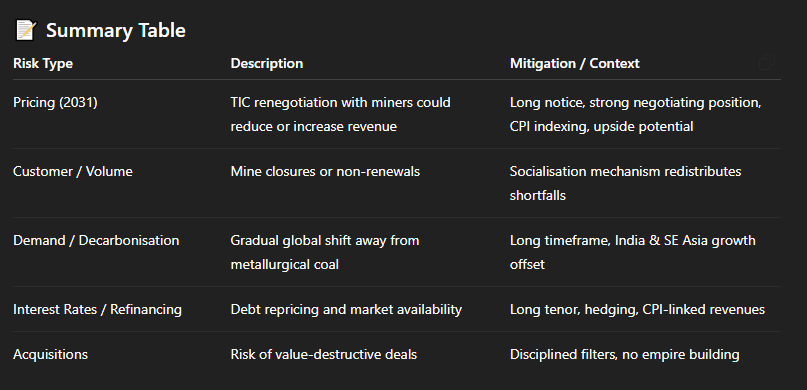

Great interview @Strawman . Simple business to understand, incredibly tight moat from the Port as the other port options are not cost-viable for the miners, high revenue and cost certainty and low risk. A "term-deposit-like return-with-incremental-capital-upside-opportunity" situation.

It is so, so far from my "fast-growth-small-cap" wheelhouse and "put-almost-all-cash-to-work" mindset that it is testing my risk-on mindset to the core ...! I need to think of this like insurance or adding Gold to my portfolio.

Given where the price is today, perhaps the approach is to start a position with ~5.3%-ish yield today, then progressively top up when the price dips around announcements where there is no change to the fundamentals, to improve the overall yield. Doesn't make sense to price-chase this company, so if it hits the buy entry points, need to decisively execute.

Discl: Not Held IRL or in SM

Cool. I look forward to listening to the interview. Keen to understand the possible drivers of dividend/earnings growth.