Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Disc: Held IRL 1.75% and in SM

The DBI chart is sweet as ... (1) an almost perfect 30-degrees-ish ascending trend line going left to right in regular waves (2) the long term trend 200 day simple moving average following suit (3) after the last all-time high of 4.93, the price has corrected and recovered nicely and (4) after today’s pop, the price is about to test the all-time high of 4.93. In many ways, this is a much more perfect chart than XRF’s ...

This is no stodgy “dividend/defensive play” holding ... its a “highly stable growth” company ....

$4.60 should provide decent downside support, failing which $4.35 should provide much stronger support as it is the coming together of the 50% retracement level, the ascending trend line and support going back to mid-July 2025.

Once it goes past $4.93, we will be in completely unchartered clouds ...

Haven’t fully built out my DBI position yet, so will be topping up if/when it goes back to ~$4.35. But its looking to be a bit of a tough ask, given the momentum ...

09-Dec-2025: DBI-achieves-financial-close-on-$107bn-refinancing.PDF

Expected. Positive. That's $1.07 billion, not $107 billion; They can't include decimals in the middle of file names.

Holding DBI in my SMSF (5% weighting).

20-Nov-2025: https://investors.dbinfrastructure.com.au/DownloadFile.axd?file=/Report/ComNews/20251120/03025613.pdf

That link above may download a .PDF file to your device rather than open the file in your browser, but if you have any issues with that link, you can use the one below and click on "ASX Announcements" and then "Investor Presentation - Dalrymple Bay Terminal Site Visit"

Source: https://investors.dbinfrastructure.com.au/investor-centre/

Nine Sample Slides:

I hold DBI in my SMSF and I topped up the position today. I originally added DBI to my Super after watching the second (and most recent) meeting here between Andrew and DBI's CEO Michael Riches.

On September 30th DBI announced that their Board had appointed Michael Riches as DBI's MD, in addition to his role as CEO, so his title is now ‘Managing Director and Chief Executive Officer’.

DBI has a compelling business case, even though they are not a growth story that is going to shoot the lights out. With their quarterly partially franked dividends DBI is a dependable income provider with some growth as well, that is a solid inclusion for an income portfolio or just as a place to park cash while waiting for better opportunity to deploy that cash, IMO.

I have trimmed some of my gold producer positions today (NST, CMM, EVN) and fully exited CSC (Capstone Copper) and have re-initiated positions in ARB and TNE - both of whom have fallen enough recently to provide some double digit percentage gains if they trade back up to where they were trading just 5 to 6 weeks ago. I don't believe they are worth less today than they were 5 to 6 weeks ago, and while I do understand that they both had quality / management premiums in their share prices then, so would have looked expensive to many, I believe those premiums were well-deserved.

I view TNE and ARB as two of the highest quality companies on the ASX, and ARB in particular as having one of the best management teams, and I'm always happy to add them back into my SMSF when they have share price falls like they have had in recent weeks. Both are up today, so I'm hoping the selling is over with both of them, but even if it's not, happy with these prices I paid today. I looked at MAQ as well, but the near-to-mid-term upside looks greater with ARB and TNE.

DBI is not in the same league as ARB and TNE (or MAQ), not by a long shot, but DBI do provide me with some diversification which I reckon I need when my SMSF is so heavily weighted to gold companies.

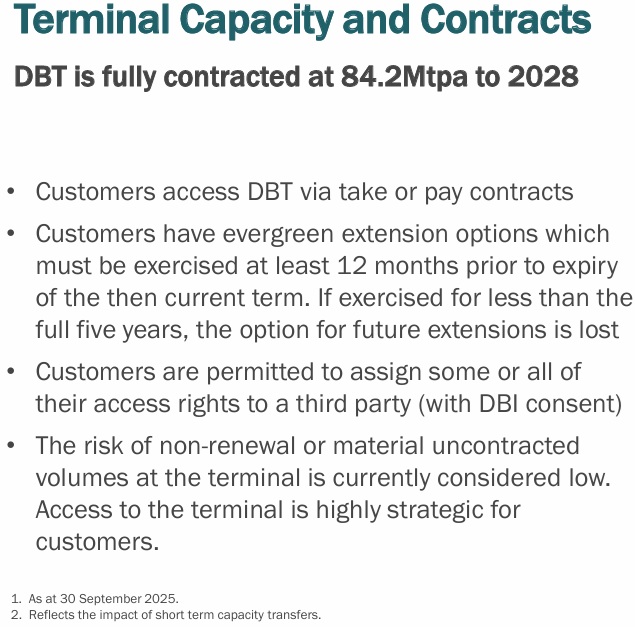

DBI is a solid defensive position in my view, as evidenced by the fact that their SP either didn't drop at all, or dropped less when it did drop, during the market's recent "down" days. DBI is actually a very well structured infrastructure play with very little downside over the next few years because of their structure and the fact that they are fully contracted via take or pay contracts and they have a waiting list for any spare capacity they may have in the future, so I rate them as a great place to park cash.

Discl: Held IRL and Pending in SM

Following the very good SM meeting with the DBI CEO Michael Riches and my notes last night, I opened a 0.65% position on DBI this morning at $4.34. my immediate buy level. Have also opened a position on SM which is pending.

This was another holding where I gained strong conviction as soon as I wrapped up listening to the SM meeting, and decisively pulled the trigger early this morning. The following is my thesis.

CURRENT PORTFOLIO CONTEXT

- 18 companies + 2 ETF’s vs portfolio limit of 20 companies + 2 ETF’s

- Significantly fast growth, technology skewed

- Dividends is not a current explicit focus or investment objective, although 6 of 18 companies plus both ETF’s are active dividend/distribution payers - 40% of the portfolio companies are dividend/distribution. This is not expected to change despite not being too far from entering SMSF pension phase

- Hold no commodity miners, only critical/essential pick and shovel services to the mining industry

DBI INVESTMENT THESIS

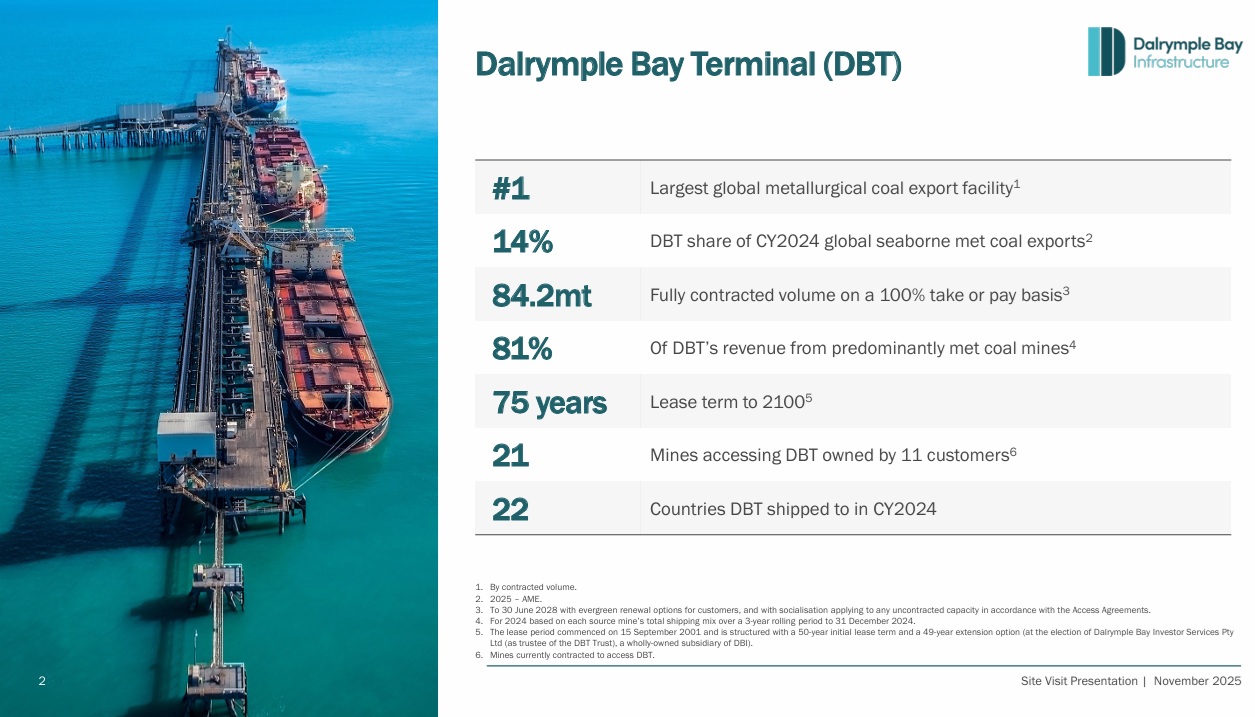

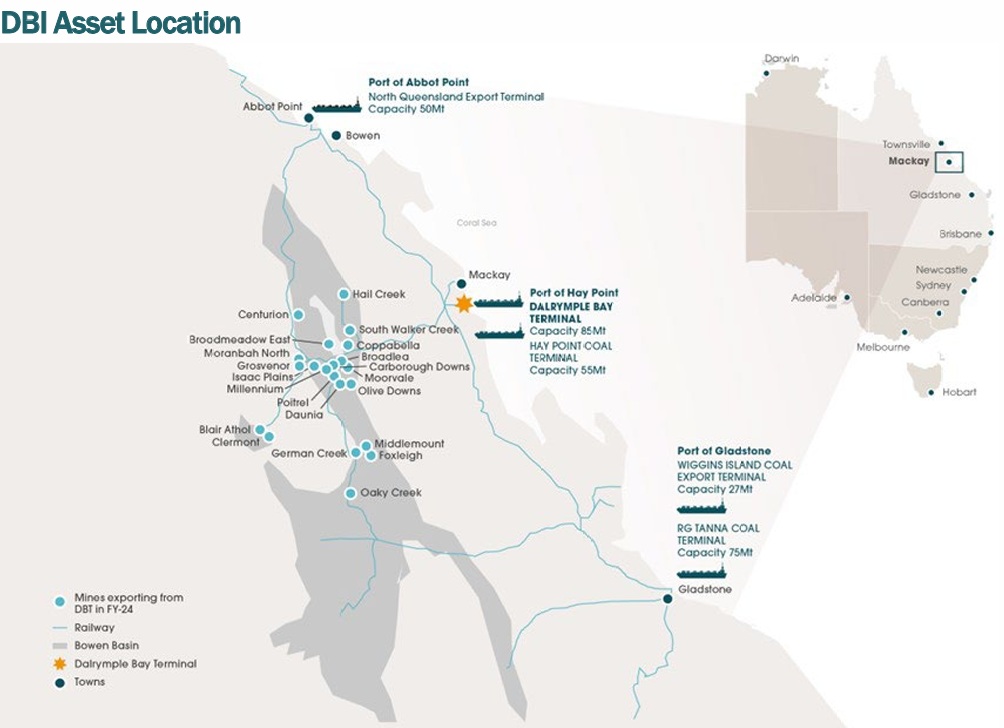

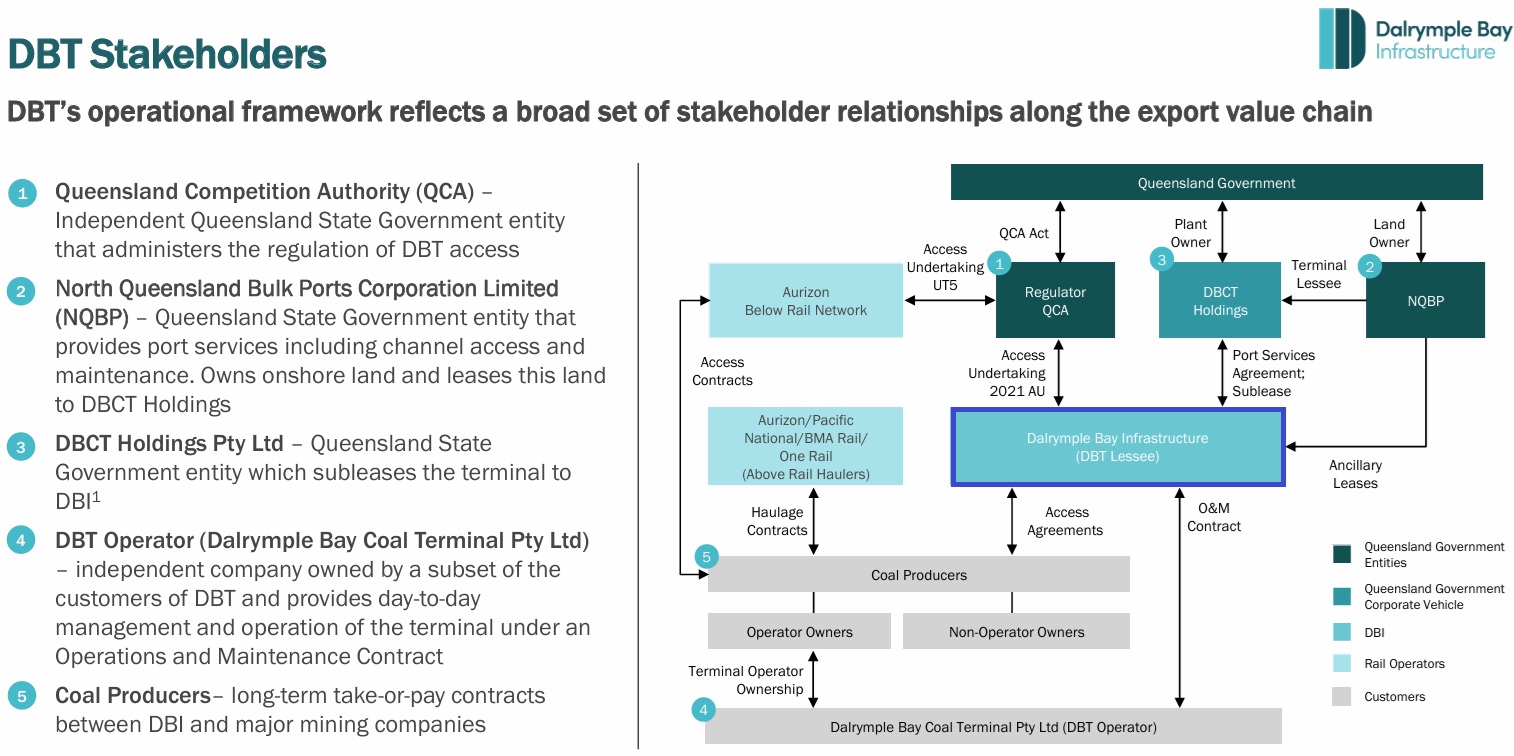

- Very significant and tight investment moat in the Dalrymple Bay Terminal (DBT) as it relates to the Bowen Basin met coal miners - the alternative ports of Gladstone and Port of Abbot Point are much further and add significant cost

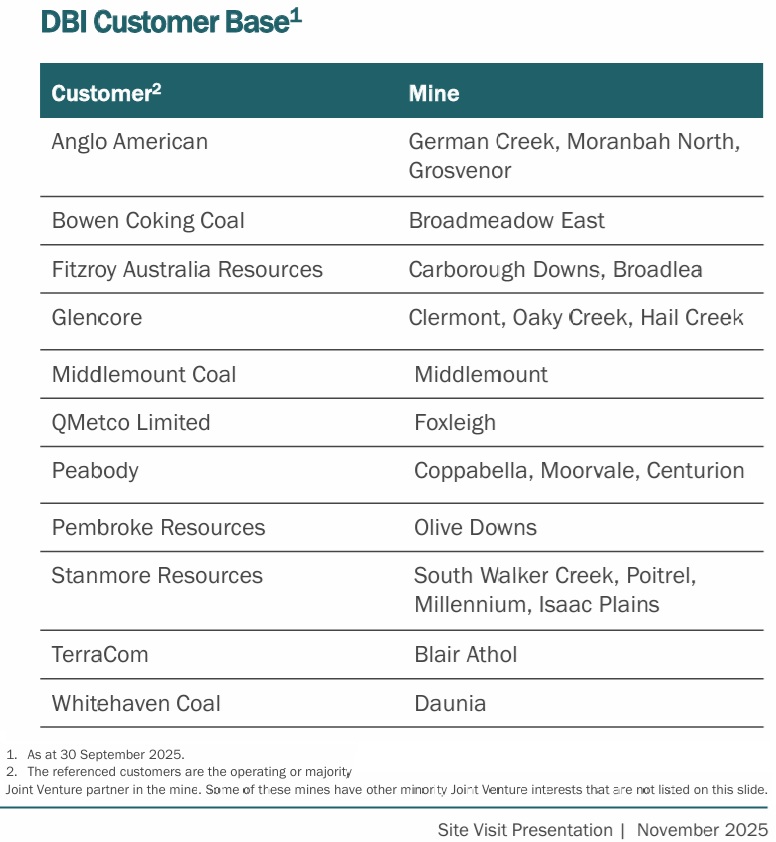

- The miners have direct skin in the game in the running and financials of the DBT, and are locked in as customers for a very long time given mine life spans, further entrenching the moat

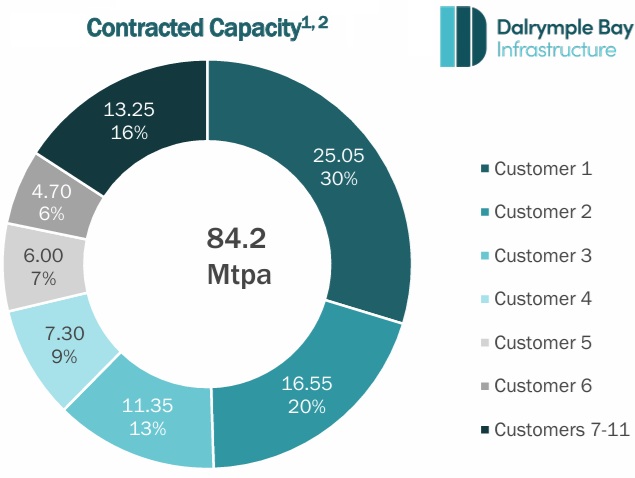

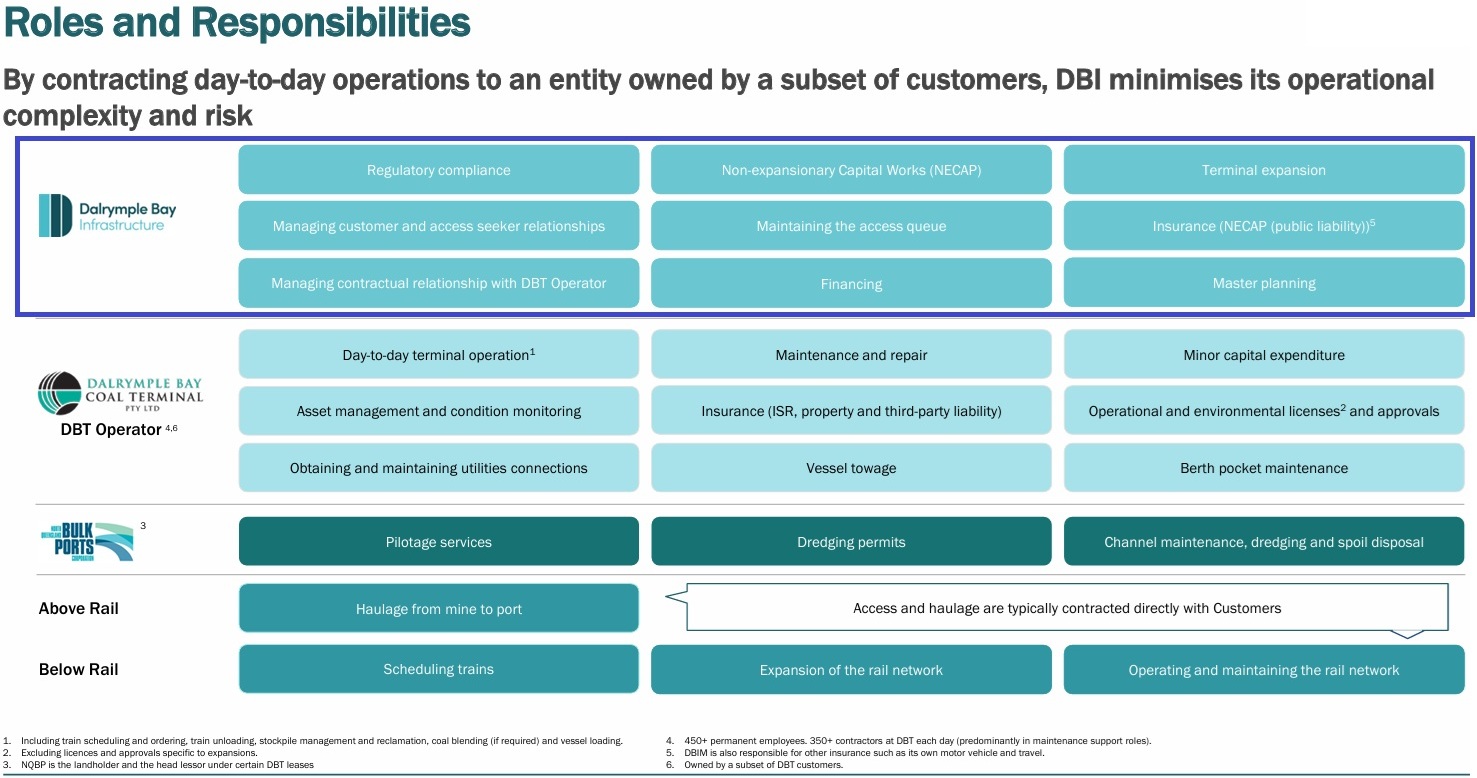

- High revenue and cost certainty - pricing, capacity, cost pass thru’s are all locked in through to 2031, any risk of non-recontracting of capacity is mitigated by the cost being spread to remaining contracted customers - this is ALMOST risk-free, given how the arrangements are contracted

- High dividend yield certainty and growth - fixed deposit-like as capex requirements are well understood, well managed, cost is hedged, all capex is essentially cost recovered from customers. There is very little to no-risk that there will be sufficient funds to sustain the growing dividends in the foreseeable future. Dividends are likely to grow every 1-2 years given historical trajectory - nothing to suggest this trajectory will remain as the base case, with all the upside of higher dividends as revenue improves

- Good upside opportunities in the share price from any small incremental improvements that are made to the facilities when they directly impact revenue as any capex improvements come with virtually no cost uplift to DBI given the cost recovery arrangements. The revenue profile will also likely see a step up once the 8x Project is delivered to add further capacity to the Port. This is reflected in the long term up trend of the share price.

- Good and likely to be strong price downside support as falls in the share price increases the dividend yield, assuming no change in the business fundamentals

- Risks of global decarbonisation are noted, but this still feels like a long way away - mitigated by the increased demand expected from newer steel making countries India, Vietnam etc.

DBI is thus a truly investment-grade, high certainty holding, that will add significant ballast and good diversification to the current high fast-growth Technology centric portfolio skew.

POSITION SIZE

Expect to build this out to a 2.0 to 2.5% holding over time.

APPROACH TO BUILDING POSITION

Because of the yield implications, the DBI position needs to be built more carefully than previous holdings - over paying will reduce the dividend yield and thus, the attractiveness of the DBI investment.

- Opened a 0.65% in DBI today at $4.34 as the price briefly fell to this level, which locks in a 5.64% yield on FY26 distributions - this is a higher than my usual opening position size

- Next attractive top up levels will be ~$4.21 (5.82% Yield), then $3.99 (6.14% Yield)

- Will need to be decisive in topping up if price falls below $4.34 on no negative change to the business fundamentals

The recording for today's chat is now live on the Meetings page and you can interrogate the transcript here:

DBI Transcript October 2025.pdf

As mentioned, DBI strikes me as a low risk affair -- Provided, that is, they retain balance sheet and CAPEX discipline.

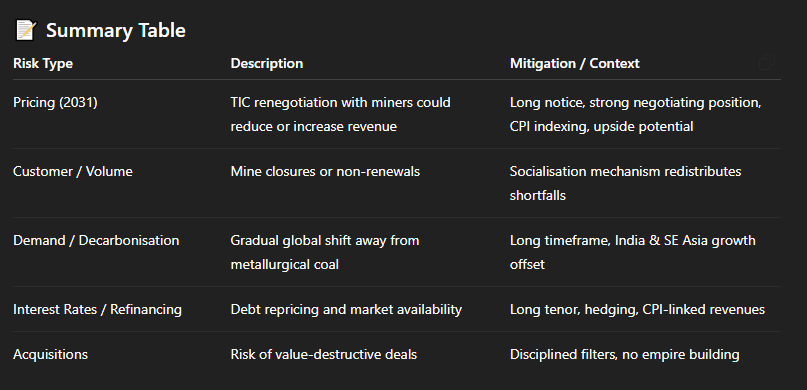

Here's a condensed summary of the risks from AI, which I asked to review the transcript:

Coal is undoubtedly a sunset industry, but it’s a very long sunset. The transition will take decades to play out, and metallurgical coal is likely to be the last segment to decline. Electric arc furnaces are part of that shift, but smelters typically don’t upgrade until their existing blast furnaces reach the end of their useful lives (often 30-40 years). In the meantime, countries like India are expected to prioritise the lower-cost, traditional (and dirtier) blast furnace route to support their rapid steelmaking expansion.

A 5.6% yield, (roughly 60% franked), with the dividend expected to grow between 3-7%pa sums to a very tidy return (*if* that's what they are able to deliver). Plus, if you like your divvies, they pay distributions quarterly.

A huge thank you to Strawman for making available this week's interview with Dalrymple Bay Infrastructure CEO via a link on the Saturday email.

My older computer no longer has audio which is clear, so I have not been able to hear the interviews for some time.

With the link today, I could enjoy the interview on my mobile phone, while doing other things. This flexibility was much better than being stuck in front of my computer for the hour of the interview.

Great interview , by the way. Excellent deep dive into the company. Thank you Andrew.

Dalrymple Bay Infrastructure is a bit different from the usual companies we discuss — not just in size ($1.8 billion market cap) but in how it makes money.

The value prop here is all about stable cash flows and dividends. In fact, at the current price, and based on what Michael said, you can expect a forward yield of about 6%, of which 2/3rds franked (so a gross yield of ~7.6%). Paid quarterly, too.

You can watch the full recording on our meetings page, but here are some key highlights from our conversation with CEO Michael Riches:

- DBI’s biggest selling point is the predictability of its cash flow. The company owns Dalrymple Bay Terminal (DBT), which exports metallurgical coal used in steelmaking.

- It’s a regulated infrastructure business, meaning:

- 84.2 million tonnes of contracted capacity, locked in until at least 2028.

- Take-or-pay contracts ensure DBI gets paid regardless of how much coal actually ships.

- No direct exposure to commodity prices. miners take the risk, DBI just collects fees.

- No weather risk -- even if a cyclone shuts the terminal, DBI still gets paid.

- Of course, longer-term, the business is still tied to metallurgical coal demand, and in turn global economic activity, but it is sheltered from much of this in the medium term.

- Also, its revenue is inflation-linked which might be interesting to those that have concerns on that front.

- $394 million in capital projects (NECAP, or non expansionary capex) means higher future fees, as there is a set return linked to this expenditure.

- The 8X expansion project could increase capacity, but it’s still uncertain and dependent on miner demand.

- DBI has $1.8 billion in debt, which is actually manageable given the asset backing and mandated cash flows, but refinancing at higher interest rates could impact profitability longer term.

- While DBI exports to China, Japan, and South Korea, Michael stressed that geopolitical tensions and trade disputes have had little impact on terminal operations.

- Even during China’s 2020-2023 ban on Australian coal, miners simply redirected shipments to other markets, demonstrating the flexibility of global demand. Still, it's something to be mindful of.

- Michael also pointed out that tariffs and policy changes in export markets have not significantly affected DBI’s customers. Since steelmakers need high-quality metallurgical coal, they have few viable alternatives, meaning demand has remained strong across various markets.

- DBI operates under a regulated pricing framework until 2031, providing clear earnings visibility for the next several years. But after 2031, pricing will be renegotiated with customers, although Michael believes any future agreements will continue to support strong cash flows.

- While metallurgical coal is essential for steelmaking, some miners are exploring lower-carbon alternatives. However, Michael was confident that demand for high-quality Australian coal will remain strong for decades, given the lack of commercially viable alternatives at scale.