The recording for today's chat is now live on the Meetings page and you can interrogate the transcript here:

DBI Transcript October 2025.pdf

As mentioned, DBI strikes me as a low risk affair -- Provided, that is, they retain balance sheet and CAPEX discipline.

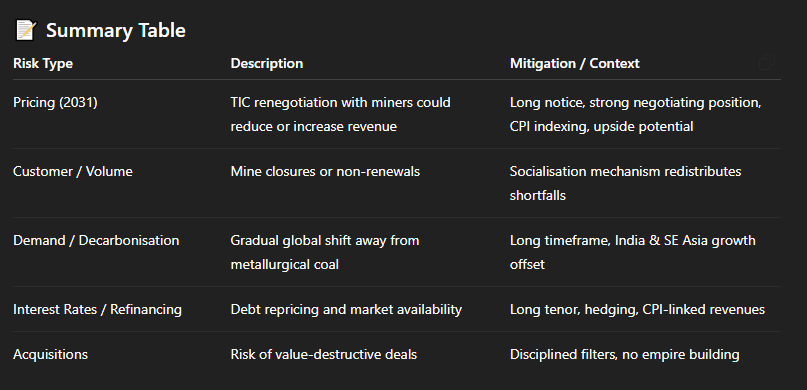

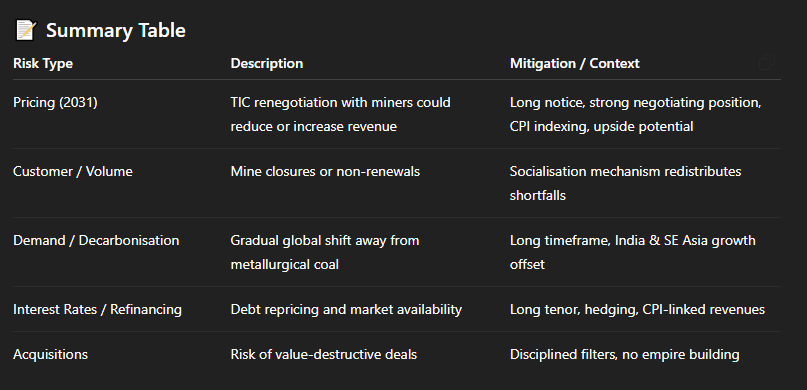

Here's a condensed summary of the risks from AI, which I asked to review the transcript:

Coal is undoubtedly a sunset industry, but it’s a very long sunset. The transition will take decades to play out, and metallurgical coal is likely to be the last segment to decline. Electric arc furnaces are part of that shift, but smelters typically don’t upgrade until their existing blast furnaces reach the end of their useful lives (often 30-40 years). In the meantime, countries like India are expected to prioritise the lower-cost, traditional (and dirtier) blast furnace route to support their rapid steelmaking expansion.

A 5.6% yield, (roughly 60% franked), with the dividend expected to grow between 3-7%pa sums to a very tidy return (*if* that's what they are able to deliver). Plus, if you like your divvies, they pay distributions quarterly.