Pinned straw:

hi @Slomo

Just having a quick flick through the annual report, as I haven't paid that much attention to the company

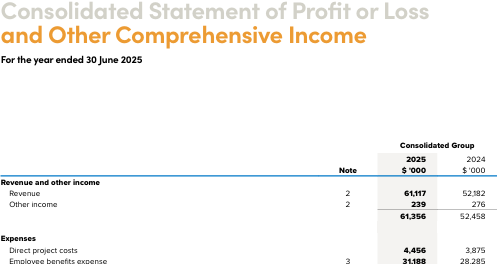

People costs seem to be pretty high for their revenue base, I was also expecting R&D to be a bit higher?

Just to add to the below, I like the way he thinks about the growing role of AI in this space.

In short, he’s a big proponent of a HIL (human in the loop) approach.

Having worked in capital markets (mainly interest rates, not energy) with traders who are the front line risk managers, it’s all about ownership and ultimate accountability.

So this makes intrinsic sense to me, despite the dream that AI can be more efficient at trading large volumes through the night without emotion, etc, etc (it no doubt can), it ultimately comes down to ownership of risk and then P&L downstream from that.

When something blows up as it inevitably does from time to time, who owns it?

Not the CEO sitting on top of an army of bots, it’s the desk heads and then traders if they can pass the buck that far down the line (depending on the size and shape of the blowup).

Also a good customer centric tell that they are AI focused but not AI first in their approach to customer success, CX, etc.

That should insulate them from a growing army of AI bots trying to spin up low cost apps / agents to replace legacy software businesses in the next few years.

Could just me more wishful thinking on my part tho, been doing a fair bit of that lately…

Disc: Held.