Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Director Sale of shares

Mr Ian Ferrier, a director of the Company, sold a proportion of his holdings on 25 August 2025. At

that time has announced in the Appendix 3Y that he “did not intend to dispose of any shares in the

following 12 months.”

Mr Ferrier now intends to sell a further circa 315,000 shares to finance the purchase of a home.

He has no immediate intention to sell any of his remaining 5.0 million shares in Energy One

Limited.

Approved for release by the Board.

----

Given the man is in his 80s, fair dinkum to him. If today's drop is based on reaction to this alone, it seems overdone.

What's not-so-nice is selling shares after saying he has no intention to dispose any over the year, but hey, life happens.

New CEO Ben Trainer is being paraded in front of shareholders and analysts at 9:30am AEDT tomorrow (Wed) morning.

Internal hire - GM from their European operations.

Link via this announcement.

https://www.marketindex.com.au/asx/eol/announcements/eol-appoints-ben-tranier-as-ceo-2A1627047

Seems like a well credentialed operator. Joined a year ago and must have impressed. They picked him up post the MA&A approach when they restructured their operations to better fit their growth aspirations, along with ISO certifications, enhanced cyber chops, etc.

Has youth on his side (current CEO Ankers is effectively retiring in Feb-26 but will remain as ED, then NED) and deep European experience.

Still, it's good to know Shaun is still around for a long hand over and then board oversight.

Here's a recent interview in which he comes off as knowledgeable on the market and EOL. A good primer on EOL too.

https://www.time2market.net/time2talk/time2talk-207-benjamin-trainer

Looks like a good fit, should know more after tomorrow's interview...

Disc: Held.

CEO has notified the market that he has sold ~50% of his holdings!

Pretty significant offload on the back of an impressive share price run up and positive reporting.

Plenty of reasons to sell, only one reason to buy

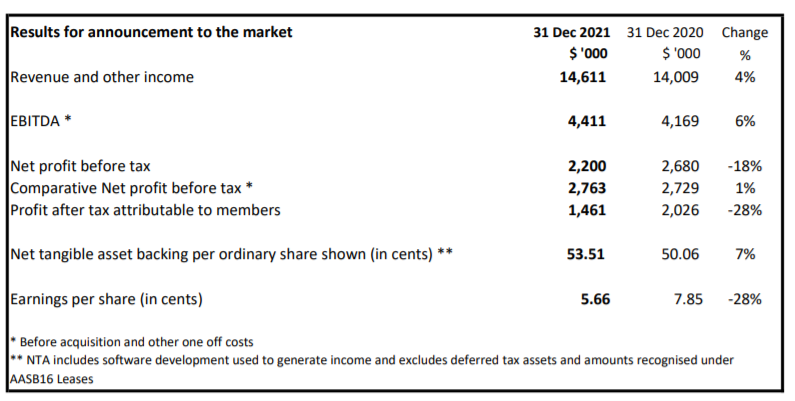

Overall great results. Again. Revenue growing in both Europe (20%) and Australia (13%). Operating leverage is kicking in with profit and cash up. To note that part of increase in Europe revenue due to foreign exchange tailwind so removing that, it would probably be closer to 10-15% revenue growth than 20%.

Why are they paying a dividend (7.5 cps)? Answered in call, they are following policy of 40% of net profit and also don't want to build a war chest. I'm comfortable with their level of debt and makes sense not to hold too much cash.

One negative is that Cybersecurity certification is still not yet complete (they had a breach a few years back).

What's not to love about this business, 90% re-occurring revenue, high margin and >10% top line growth in a great sector. Importantly, they are still investing for growth in both people and technology.

So, a boring report, no need to dig deeper here imo - continuing to deliver.

Valuation wise, ~8 x ARR, and PE of ~80 so not cheap, but now with the low debt it's in-arguably a quality business.

Things to watch:

- Acquisitions - they said they are open to acquisition in US and likely to be similarly funded as previously (debt/placement). A bad acquisition has ended many a great business.

- CEO transition (Shaun after 15 years retiring December 2025)

Earnings per growth..outstanding

Return (inc div) 1yr: 221.20% 3yr: 39.25% pa 5yr: 27.94% pa

Leadership for EOL's next Era

Energy One Limited (“The Company”) announces that the current Chief Executive Officer, Mr

Shaun Ankers, has informed the Board of Directors of his intention to retire by age 60, at the end of

calendar 2026 (i.e. in approximately 15-18 months).

Mr Ankers is providing an extended notice period to enable the Company to conduct an effective,

orderly and extended transition to a new CEO. During this time, Mr Ankers will remain fully

engaged and will support the leadership team throughout the transition.

The Company is already well-managed and increasingly diversified, talent-wise, having invested in

building capability throughout the organisation to support our global ambitions. This has included

appointing new C-Level roles, strong managers and implementing a global matrix-type

organisation structure, ongoing empowerment of local business units, investing in improved

corporate systems and in best-practice operational methods. The Company operates with an

Executive and Country Leadership Team distributed globally, reducing key person risk and

empowering autonomy for long-term growth.

Accordingly, the Company is well-placed to prepare for the next phase of its growth, capitalising

upon its current strong position, health, and opportunity.

The Board has commenced a process to appoint a new Chief Executive Officer with a mandate to

continue our trajectory of growth and has engaged Riverstone Associates to lead an international

search for a high-calibre leader who will enhance and accelerate Energy One’s growth strategy.

We expect the search will take several months. Mr Ankers will participate in the selection process

with other Board members and will continue to remain on the Board when the new CEO is

selected.

The extended transition and handover will ensure the leadership change is appropriately

supported, with no disruption to the Company’s strategic focus or momentum.

Mr Ankers commented; “Strategic initiatives tend to operate best in multi-year phases. We have

explained that our current strategic mission is well underway (i.e. the globalisation pivot, ~2 years

in) and we are reaping the benefits. Our trajectory for the current horizon is one of growth and

operational leverage. This remains true.

The Company is in the best shape it has ever been in. It is a wonderful collection of high-quality

people, great products and services, definable and sustainable competitive advantages, and a

global, once-in-a-generation structural tail wind.

The next phase for the Company is about stepping up from being an effective global operator to

becoming a global powerhouse. It is an exciting time, and one that I believe is best led by the next

chapter of leadership. With a highly capable Executive team already in place, we are well

positioned to appoint a CEO who will bring fresh energy and vision to take full advantage of the

opportunities ahead.

I look forward to working with the new CEO to help them fine-tune their strategy and mission to

build upon what we have achieved thus far and help to set them up to achieve maximum success.

For me personally, it has been a privilege to have been part of building the business to where it is

today. Stepping aside to pursue other interests is only possible because we have a well-managed,

thoughtful succession and transition process in place. Until then, I remain fully committed to

delivering on our current initiatives, including driving both organic and inorganic growth and

expansion.”

Andrew Bonwick, EOL Chairman commented; “We anticipate releasing the full year result on

August 20. The result will be consistent with the trajectory and medium term target we outlined in

February and will provide a good platform for the new CEO. Shaun Ankers has led Energy One for

15 years, and we all are looking forward to the next 15 years of the EOL journey.

Shaun Ankers has indicated he will retire at the end of 2026, giving the company plenty of time to search for a replacement. He will be 60. Seems pretty civilised.

They also took the opportunity to reinforce that the August full year report will be consistent with the trajectory indicated for the business in February. Again, pretty civilised. Bless you, Claude.

Expect a rushed ASX announcement from EOL this morning.

Looks like the CEO may be leaving the role if the below is close to accurate.

https://www.capitalbrief.com/article/energy-one-ceo-expected-to-step-down-and-transition-to-board-022e695a-9504-469c-b0ee-2668c170986c/preview/

This might help explain the recent drop after a huge run up.

If this is how it plays out it sounds like an orderly transition with CEO moving to a board role (NED?) and sticking around for another 6+ months to transition.

Shame it was leaked, never a good sign (hopefully just a disgruntled, unsuccessful candidate?).

Disc: Held

Article from the AFR

Behind paywall. I'm assuming the article is about setting up some sort of defence from takeover.

[held]

Well, the answer is out. Obviously, the EOL SP has gone up a lot since the result, but the question has been who is buying and selling? The result was fine, and the outstanding feature, IMO, was the guidance of ongoing strong growth as opposed to actual strong growth. Positive, but justifying a climb from $4 to $11?

Well the share register changes are out with Vaughan Busby, a seller, and the Wilson group (Geoff that is) as buyers.

As a s/h and with now a meaningful position I must admit to being a bit unsettled by this. of course we could say VB is now feeling disenfranchised after the t/o episode, but he also knows the business very well. as to WAM/WAX etc make your own assessment.

im a profit taker until more evidence emerges of sustainable growth, i find the industry still a bit opaque, although i like the story. so will maintain a holding.

could be wrong as always

Seems like a decent result from Energy One.

Revenue up 14% to $28.8M with a return to profitability ($2.46M NPAT vs. a prior loss). Growth seems driven by recurring revenue and improving margins, which is always nice to see.

Also good to see them add 47 new customer installations, with some cross-sell success.

Their guidance suggests continued organic growth with a 15-20% ARR target and further margin expansion. The second half is expected to be stronger, but they didn’t provide specific forecasts.

The cash balance is $2.5m against $15.5m in debt, most of which matures in just over two years. They are operating cash flow positive (+$4.4M in H1), but after investment and debt repayments, there's not a huge amount of wriggle room.

Forward PE is ~46x, which is high, but if they can sustain double-digit revenue growth and margin expansion, that multiple should drop quickly. Doesn’t seem like the price is silly to me, assuming they continue to drive top line growth and margin expansion.

Earlier last year I sold CMM for EOL.

Thought it was a great move until I saw CMM hit the all time high of $7.90 this week. Not sure how that happened.

So overall it was a bad call selling CMM which is the least followed stock (and possibly the most "hated" stock on Strawman) versus the more popular stock Energy One.

Goes to show some mining companies can sometimes be better investments than tech companies.

Meanwhile I'll need to do further research why EOL still feels unloved.

The only thing I can think of is their exposure to Europe which I think is still a "dud region" for energy and technology markets. I guess the past cyber hack doesn't help either.

[held]

Anyone got any idea why Energy One is running so hard?

THIS IS FROM ONE OF MY FEEDS—pretty much what we know. It may be helpful for newbies to the stock, but the competition part was interesting for me.

Forwarded this email? Subscribe here for more

EnergyOne: Deep Dive

Compounding energy software solution provider

Nov 11

I’m continuing with the theme of compounders in this month’s deep dive, looking at the energy trading technology company EnergyOne that is listed on the ASX.

EnergyOne has managed to grow revenue every year for almost a decade. They’ve grown profits every year, except this year when they posted a reduced profit to invest in the globalisation of the business.

But hey, if you’re profitable and coming from this history, you’ve earned the right to invest like this.

Summary

EnergyOne provides software solutions for energy trading. This could be for an energy retailer but it could also be for one of the many organisations involved in the energy supply chain, like energy generators, pipelines, and financial traders.

EnergyOne has built itself on organic growth and M&A.

Let’s dive in.

About EnergyOne

EnergyOne was founded in 1996 and became an independent energy retailer selling to small to medium-sized businesses as well as residential customers.

EnergyOne listed in 2006, driven primarily by Ian Ferrier (of Ferrier Hodgson, the insolvency firm, fame) and Vaughan Busby (a former Ferrier Hodgson Director).

The IPO prospectus touts their “sophisticated IT system”, a sign of things to come because the company would eventually exit energy retail in 2008 to focus on providing software solutions to organisations that trade energy.

The exit from retail came after a volatile year in energy when wholesale prices were between 732% and 1000% higher compared to prior year prices. The Chair’s 2007 annual report letter finishes with we would “like to resume retailing electricity to consumers.”

A year later, volatility in the retail energy market continued, and the company pivoted completely to software, winning its first customer for its software and acquiring an energy trading and risk management solution.

Since then, primarily under the leadership of the current CEO Shaun Ankers, EnergyOne has acquired 7 more companies while managing to post growth in revenue and profit each year.

Business Model

EnergyOne’s business model centres around its suite of software and services for organisations trading energy. Their suite covers the full spectrum of organisations that trade energy large businesses, small traders, electricity generators, gas pipelines, energy retailers, and wholesalers.

They find customers through a traditional, direct go-to-market strategy combining sales, trade shows and events. Market access and local market insights appear to be a key aspect of the model (e.g. access to various pipelines a business may need to trade on).

Market

EnergyOne’s market can be defined broadly by any organisation engaged in the trading of energy however, in practical terms, it is more tightly constrained to organisations trading energy in the markets EnergyOne has access and localisation for.

The diagram below helps bring these constraints to life:

And this market map helps show all the types of organisations that might trade in energy:

Sizing the Market

With that context, we can now broadly size the market.

It would be too time consuming, for the purposes of this publication, to get an estimate of the number of organisations that trade energy because of the diversity of organisations involved. So, we will use energy utilities as a proxy, knowing that this represents just a portion of the total number of firms that trade energy.

Globally, there are 8,000 energy utilities (from our analysis of Gentrack).

This then narrows to their accessible market of Europe and Australia. In Europe, there are 4,600+ electric utilities. In Australia, there are between 43 and 114 energy providers (according to the Australian Energy Regulator and an energy comparison site respectively).

Competition

EnergyOne’s competition comes in two forms, energy-focused trading platforms and broader platforms. Broader platforms here includes commodity trading platforms, financial services firms and capital markets software.

Customer Value Proposition

EnergyOne has a wide suite of offerings that target a variety of different customers, which makes it inappropriate to apply one broad customer value proposition.

These tables provide the best way to understand EnergyOne’s customers and what problems they solve for them:

Products & Solutions

The products and solutions of EnergyOne are interrelated but service a different customer segment or customer problem:

- Energy Balancing, Scheduling & Nomination: solutions for the logistics of energy

- Energy Trading & Risk Management: solutions for buying and selling energy

- Gas Transmission: solutions for managing gas

- Market Analytics: solutions to provide insights on the market more wholistically

- Outsourced Trading: a service, utilising EnergyOne’s solutions, to run trading operations on behalf of a customer.

Go-to-Market

EnergyOne’s go-to-market appears to be a fairly vanilla, direct enterprise sales model supported by your usual activities like trade show booths and social media.

There wasn’t much detail beyond this to provide deeper analysis here. What we can say is that this model appears to be working given their continued revenue growth.

Finances

Compounding Profits and Revenue

For every year, except the most recent year, EnergyOne has managed to grow profits and revenue. But even in the most recent financial year EnergyOne grew revenue and was profitable.

The recent year’s lower profits are attributed to investments in global growth. They’ve got the profitability to make these calls.

Key Insights

There are some key insights to take away from EnergyOne:

- Energy markets, while similar on the surface, are highly localised.

- You can grow revenue and profits.

- Industry focus and an industry-wide view of solutions has made for a differentiated offering.

- You need services wrapped around software solutions for medium-to-large or non-technical customers (this is a running theme on mopoke at the moment).

In the spirit of @PortfolioPlus respectfully questioning what he sees as price exuberance in a popular stock and @Strawman‘s appeal for energetic push back (while playing the straw, not the man), here are some Risks for EOL that I see.

Please come back with any risks you think I may have missed. I’ve tried to call out what I see as risks here but likely have blind spots as It’s a large position for me that I want to see do well.

Growth, Margins and Valuation

EOL have seen falling margins in recent years as they invest for growth.

Margins have also been impacted in FY24 by adverse effects in the cyber attack which required remediation and investment to improve defences as well as a failed (and poorly handled) opportunistic takeover attempt, and interest rates raising their debt servicing requirements despite falling debt levels.

This saw Statutory NPAT fall 51% in FY24, after falling in both FY23 and FY22 by 18% and 3% respectively.

So despite growing Revenue at an average of 24% p.a. over the last 3 years, NPAT has fallen by 61% over that period.

During this time they raised debt and equity to fund M&A which has added scale but potential fragility to operations and financials.

Financial objectives of growing revenue AND margins could be ambitious as these are often competing objectives to be traded off against each other.

There is a risk that this is a perpetual ‘Jam tomorrow’ story, where the jam never arrives.

One reason for the current market pricing may be a tug of war between believers like myself who have faith in managements ability to realise the obvious potential and sceptics looking at a trailing PE multiple of 98x and wanting to see proof of NPAT margin growth, debt repayment and all the other good things management are projecting.

Funding – Debt & Equity

Multiple Equity Raises – some for M&A, some for Debt paydown – have diluted shareholders over time and the return on these investments is not transparent.

Debt is high for a company of this size – and the recent interest rate rises have increased the debt servicing burden by 25% having a relatively large impact on the bottom line.

This net debt of $14.2m is due to be paid in FY27 but the CFO plans to repay it by FY26 requiring a big uplift in FCF that does not look imminent based on recent financial trajectory.

M&A cuts both ways

Lots of acquisitions in the past – how well these have been bedded in remains unclear. If there’s a level of tech debt built up through this, it will hopefully be addressed by the new IT systems being implemented at present. However, these are also not without risk – as we’ve seen from outages by Optus and Microsoft / Crowdstrike.

The takeover attempt in 2023 at $5.85 seriously contemplated by the board, then scaled back to $5.15 and rejected by the board highlighted a few cracks which are now being remedied, predominantly with IT spend.

This included losing experienced, aligned (16% holding) board member Vaughan Busby in the process as he (rightly in my opinion) opposed the takeover from the start.

Key Person Risk

The long tenure of board and management with skin in the game can be a real asset while it lasts but can create a void when a key person leaves.

If CEO Sean Ankers were to leave or Chair Ian Ferrier were to leave or sell his holding, this would be a big red flag.

In smaller, fast growing businesses, management can have an outsized impact compared to larger, more established, stable businesses.

There has also been an Org Restructure that has resulted in senior country heads departing and effectively being replaced by new functional heads. This kind of restructure can lead to a loss of corporate memory that has been built up over many years.

It also places a lot more focus on the CEO to get the new hires up and running, aligned with culture, etc.

Regulated Industry

Energy Industries are heavily regulated to ensure adequate, affordable supply in the advanced markets that EOL operates in.

This means that solutions may need to accommodate different regulatory frameworks / industry dynamics across different markets.

Also, the reg requirements in any given market are prone to change with elections, lobbying, etc.

Populist backlash from right of centre parties in Europe playing on cost of living pressures and xenophobia have the potential to eliminate / soften climate forward policies which could slow the transition to renewables that EOL supports and benefits from. The CEO indirectly called this risk out in the FY24 earnings call with reference to the on again off again transition policies implemented / cancelled by Australian governments.

For example, Government funded, large scale nuclear would likely suppress renewable investment and thereby opportunity for EOL to service a large number of renewable start ups.

Barriers to entry

Adjacent technologies pointed at a large energy markets could make inroads.

I’m often cautious of small companies chasing big markets – as these large potential profit pools can attract well resourced players seeking growth from adjacent / core markets.

A big competitive barrier is the in-house systems used by large players. If these are expanded / made available to smaller players this could represent a threat – however, these systems are likely specific to a particular vertical / geography so may have limited scope.

I attended the EOL FY24 Call today. They said a recording will soon be up on their IR site. Here are my thoughts.

It’s not a wildly complex business but there are a lot of moving parts. Happily they are all pointing in the same direction - hoping to catch a huge tailwind and take a large share of a small but growing niche. That being as “A leading independent global supplier of energy trading and risk management (ETRM) software systems and services”.

They are well diversified across customer, geography and industry segment. So as long as energy generation remains a large (and hopefully evolving) industry they should not be overly subject to customer / industry issues like some other picks and shovels providers are.

EOL seems very deliberately well positioned to benefit from the drive to renewables – there's some reg / sovereign risk in all of this but they are yet to enter the US where this reg risk appears most acute.

Costs

The One-Off Costs impacting 1H 24 are really thought about as investments as are the increase in run rate costs (except for the increase in interest costs due to rates rising), mainly the uptick in employee expenses.

They are very much building for the future to capture the growth they see coming down the pipe.

The 28% increase in employee costs (vs 17% Revenue growth) in FY24 is seen as a one off and includes an Org Restructure. From here on in, employee costs should grow as a % of revenue growth as they continue to invest in people but with cost discipline to grow margins – so this should not be a drag on Op Leverage going forward. Something to watch…

On the interest costs / debt, they plan to repay the debt in full by FY26 meaning they will need to generate FCF to clear the (net) drawn $14.2m (of a $25m facility) in the next 2 years.

This is a big step up from the $1.9m FCF in FY24 ($1.2 in FY23, 2.0 in FY22).

Their financial focus is on growing both revenue and margins so if they are successful higher FCF should be a happy byproduct and reducing debt will cut out ~$2m of interest p.a. adding to the momentum.

Presentation

The 36 page Preso was detailed and they called out a number of items in it - https://www.marketindex.com.au/asx/eol/announcements/energy-one-fy-2024-investor-presentation-2A1542127.

Net Revenue Retention of 108% with Churn remaining low at 3.5% (up slightly from 2.6% in FY23). I take this to mean existing customers spent 12% more in FY24 (108/96.5). If I'm right about this, it should give a level of confidence in Revenue growth as long as churn remains low and as new products come to market to up / cross sell into existing client base.

Interesting to see LTV/CAC up to 41x (vs 38.1x in FY23, 29.4x in FY22, 28.9x in FY21). They are refocusing their efforts on marketing but it’s not clear to me if this is driving higher LTV or because of it.

Competition & Market Penetration

They seem to have a first mover advantage on offerings like "one stop shop" and ‘follow the sun’ support services. They also have greater coverage of European and Australian markets than competitors – who tend to be more single country focused.

Australia is a larger, “very profitable” and more mature market for them but Europe is where the growth runway is – I think of this as parlaying their stable Australian earnings into a bigger opportunity in Europe. Also using their Australian expertise (well developed energy market) and products to service European customers.

Slide 24 of the Preso gives a good breakdown of their Australian operations. Namely:

- 50%+ of installed energy in the National Energy Market (NEM) passes through their software

- They are effectively 4th largest generator in the NEM – although they are only a broker, so don’t take any energy price risk.

- ~13% of east coast gas market volume managed by EOL - excluding LNG.

Management

Management talk calmly but enthusiastically about the business - they seem to know it very well, and gave plenty of time for investor questions.

They also seem to understand the market and their customer needs very well. At the risk of stating the obvious, staying very close to this changing industry and their customers seems key as the shift to renewables gains pace – the electricity grids in developed economies need to triple in coming years to cope with the electrification required to hit climate targets!

However, their competitive position and value prop compared to peers is hard to validate from an outside view (for me at least). Mgmt tenure and skin in the game give some comfort in this regard.

Disc: Held – 7% position.

@Valueinvestor0909 gave a good, visual summary of the results that EOL dropped while everyone was at lunch today.

I'll attend the conf call 11am tomorrow and feed back if anything material arises there.

Here's my thoughts while they're fresh / unfiltered...

The good

89% Recurring Revenue, 93% Gross Margins - both stable over the last 3 years.

Revenue Growth 16.5% - all organic.

The not so good

NPAT halved as cost growth outpaced Revenue growth for the third year in a row (by my measure). I look at what I call "Net OpEx". This is effectively EBIT minus Gross Profit, to capture all operating expenses by removing COGS, Interest and Tax).

Tough year including failed (cynical) M&A Approach, Cyber attack, Org Restructure, expensive skilled recruitment.

The context

NPAT down 51% partly due to $1.8m one-off costs, would have been up 10% otherwise, and up 27% if interest rate rises did not increase finance costs by 25% / $0.5m (vs 17% Revenue Growth - there's the Op Leverage).

Built out corporate infrastructure, incl CRM, cyber defences, etc as well as follow the sun support capability to support future growth.

Essentially front loading costs to support bigger scale and generate growth in organic revenue – that may still be augmented by M&A.

As they already have debt (albeit recently restructured so that 85% of it is maturing in 2.5 years), they will probably need another Cap Raise if future M&A opportunities arise.

Having debt for a business of this size (and in tech) is not ideal, however with 90% recurring revenue and 2.2x Interest coverage (down from 3.9x in FY23) and Debt / Equity of 36% (down from 51% in FY23), I’d say it’s manageable but not expandable.

That said, they are likely now becoming a more attractive target for acquisition as they complete their cyber security ISO certification and corporate infrastructure build out – commensurate with their growing size / focus on organic growth / emerging maturity.

This little business is growing up

This is still a small business with a market cap of $135m (at a SP$ of $4.50), revenue of $52m, but has been profitable for a decade, has aligned management with 35% ownership and average Board tenure of 16 years.

Price/Sales of 2.6x is in the bottom quartile (18%) for it’s last 5 years but Statutory PE is 94x. Adjusted for One-Offs PE is 42x so still lots of expectation baked in for a business growing organically at 17%.

That said, it should have stable NPAT Margins of 10%+ over time (got to 13% in FY21 & 1% in FY22). If the perceived long runway for growth can support a PE of 25x (8 year average PE is 32x), a 10% RRR would only need a 5 year Revenue CAGR of 13% and it’s not been that low in the last 8 years at least, albeit aided by M&A in many of those years.

It’s been a wait for this business to show its potential and the wait goes on but it is looking better to my eyes.

There are growing pains for sure and the failed / bounced lowball M&A approach last year highlighted to management where they were lacking from a corporate structure POV which they are remedying. The Cyber attack was not as bad as could have been (dumb luck?) but showed where they need to tighten up.

They are doing the things you would hope in response to these issues and being as proactive as their size and growth profile permit.

Disc: Held – 7% position.

Energyone provided an FY24 result update. Optically it looks terrible thanks to very weak 1H ( that was already known to the market)

Now if we look at the result and compare half-on-half

If we look at the expenses, 1H shows some one-off charge ( 1.8m worth). Although Salary cost increased to 28% in FY24 compared to FY23

Debt has been reduced from 22m to 16m ( they did capital raise in 2H and as a result Share count has increased from 27m to 31.5m)

It is roughly trading at 135m market cap

with 52m Revenue ( 89% recurring revenue) in FY24

There is a con call tomorrow ( unfortunately, I won't be able to attend)

FY25 guidance or commentary will be important for the valuation.

Hopefully, all one-off will be behind them, 1H FY25 should be much much better than 1hFY24

Capital Raising - explains the recent run up in price. Always insider knowledge...

At least its a fair raising albeit disappointing that they put themselves in a position that they need to do it - The fully underwritten capital raising will be comprised of a non-renounceable non-accelerated 1 for 28 pro-rata entitlement offer (“Offer”) at an offer price of $4.05 per share (“Offer Price”).

- EOL confirms that it expects to meet (or exceed) revenue guidance issued at the H1 FY2024 report.

- EOL has returned to profitability from January 2024.

- EOL is launching a fully underwritten A$4.3m Capital Raising to strengthen its balance sheet and has received credit approval from its lender National Australia Bank (“NAB”) regarding the extension of its financing facility to be executed prior to 30 June 2024.

Key points

- revenue increased 23%

- NPAT dropped from $1.2M to loss of $508k

- organic growth is strong. They used to rely on one or two big projects per year. This is changing as they get cross-sell opportunities in Europe. Customers starting to see them as an integrated provider of multiple solutions

- restructure will save $2M/year starting FY25

- Labour costs increased substantially because salaries grew substantially and they wanted to invest for growth. Salaries were high in Australia because of the volatility of energy prices and profits on offer to other market participants in trading and operations.

- learnt a lot from the STG 'mooted' acquisition. Close scrutiny of business helped them identify some changes to make.

- Full year revenue is forecast to be $51M with $45M recurring.

- Confident of return to material profitability but no forecast given.

Their summary of costs

On a statutory basis EBITDA of $3.3M was $1.7M lower than the comparative period. Whereas revenue was up $4.6M (on pcp), we experienced additional costs in the half, primarily related to:

- Investment in both existing and new staffing of $3M.

- Acquisition costs related to the mooted STG transaction of $0.4M

- Restructuring costs (explained below) of $1.1M

- Cyber incident (non retrievable) costs of $0.3M.

- From a profit / (loss) perspective, additional finance costs of $0.2M and depreciation and amortisation of $0.3M impacted that result.

Whilst the result is unwelcome, this hasn't changed my thesis or confidence in management. I just read the Half Year Reports and accounts. It carries the same, usual, frankness in their view of the business. It's not a glossy presentation. It is a CEO report. A few pages of text providing some detail. I'd encourage anyone interested to read it.

HELD

Assume 3 scenarios of growth from 30% - 10% over next 5 years. Share count increasing to 42.7m and Net margins 15%. Blend together and discounted I come up with valuation $7.32.

Recently brought in after CEO Shaun Ankers on market purchase.

Inside Ownership Ordinary Shares % DDR Issued Net Value at $4.07

Andrew Bonwick 555,105 1.85% 2,259,277m

Ian Ferrier 7,063,548 23.51% 28,748,640m

Vaughan Busby 4,265,394 14.20% 17,360,154m

Leanne Graham - 0.00% -

Executives

Shaun Ankers -CEO 1,034,837 3.44% 4,211,787m

Guy Steel -CFO 229,997 0.77% 936,088m

Dan Ayers - CEO Australasia 229,997 0.77% 936,088m

Simon Wheeler - CEO Europe 54,224 0.18% 220,692m

Total 13,433,102 44.72% 54,672,725m

*Vaughan Busby Resigned 13 September 2023

Andrew Bonwick - Chairman

Andrew was the Managing Director of ASX-listed Australian Energy Limited (now called Power Direct) and prior to that was the Marketing Director of Yallourn Energy for six yearsHis career has included roles in senior management, institutional equity research and management consulting.

Shaun Ankers -Chief Executive Officer / Executive Director

Mr Ankers has more than 25 years of business experience, focused on the growth and development of technology businesses, including sales and marketing experience with utilities and major clients.

Guy Steel -Chief Financial Officer & Company Secretary

Guy is a Chartered Accountant who has over 30 years of executive finance and business leadership experience across both Australian listed businesses as well as US listed companies. Guy most recently has worked as Interim CFO for MYOB and Quad Lock, a well-known Australian based eCommerce business. Prior to this Guy was Asia Pacific CFO for US fintech WEX Inc. Guy also worked as Deputy CFO for ASX Listed CSG Limited and was the Finance Director of GE Capital’s Motor Solutions business. Guy brings a wealth of experience in complex and high growth businesses.

Ian Ferrier - Non-executive Director

Ian Ferrier has over 40 years of experience in corporate recovery and turnaround practice. Mr Ferrier is also a director of a number of private and public companies. He is also a fellow of The Institute of Chartered Accountants in Australia.

Leanne Graham - Non-executive Director

Leanne’s early career was in a number of enterprise ERP software companies in New Zealand in both senior management and sales roles. She was the co-founder and sales and marketing director of Enprise Software. Leanne joined Xero at a pivotal time in its history where she was responsible for a successful the design and execution of the go to market strategy, taking the company from 4,000 customers to over 120,000 customers and expanding globally. She is currently a director of listed software companies ArchTis and Bridge as well as a private New Zealand software company Nomos One.

There is some interesting insight offered by the CEO presentation to the AGM today.

A year ago the board was advised they could get $6/share so they embarked on a sale process. They ended up rejecting the offer and it has had the effect to divert management attention in the year after they had a major expansion into Europe and it will impact this years result. They will announce the impact with the 1st half results in Feb.

From the transcript.

NBIO Process

As announced, the Company has experienced inbound interest in a variety of corporate transactions over recent years. About a year ago the Board formed a view following advice from advisers that we could conduct a successful sale at or about $6.00 per share. Therefore, we embarked upon a sale process. The process, which was all consuming for our small group of executives and the Board, was undertaken while the company embarked upon our innovative expansion of our global offering of our SAS business in the northern and southern hemispheres.

The result of the sale process was disappointing with an offer emerging of $5.15, rejected by the Board last month.

Looking forward

The distraction of management time from running the business to dealing with due diligence etc. was very costly and the outcome was further impacted by the hacking which took place during August due to the need to protect the customer and employee data and manage the Company’s response. Now, with certain changes to management, we have resumed normal business.

The distraction of the sale process and set-back will have adverse consequences for this years result compared to our initial budget but the Board has confidence in its core management and market position. We will resume the previous upward trajectory, the benefits of which will continue to become apparent over the next 12 months. The timing of the attempted sale was unfortunate and costly with the consequence that there will be no dividend for 2023.

The Board will consider providing an FY24 outlook after the release of the 2024 1H results in February.

Some good industry analysis in the attached 30 min pod.

Should provide some strong tailwinds for EOL in particular.

https://player.fm/series/inside-the-rope-with-david-clark/ep-156-matt-rennie-the-energy-transition-its-challenges-opportunities

Disc: Held

Announcement from EOL this morning regarding their takeover offer from STG.

Looks like STG cheekily revised their offer down from $5.85 per share to $5.15 per share.

The Board has essentially said "yeah, nah" and terminated discussions with STG.

You'll likely see the SP slowly retrace now back to circa $4, which is what it was prior to the offer.

I'm pretty happy with this as I see this one as a long term compounder.

Energy One has signed its largest software deal in Europe to date.

https://www.energyone.com/energy-one-closes-deal-increasing-coverage-in-cee-the-baltics-and-southern-europe/?utm_content=267231833&utm_medium=social&utm_source=linkedin&hss_channel=lcp-101417

Congrats to EOL holders -- it's been a tough run of late, but news of a potential takeover does help validate the view that there was good value to be had.

I saw this on Twitter today, which some might find helpful:

https://twitter.com/brody_fn_/status/1695965151508222347

Energy One has been hit by a cyber attack.

ASX announcement:

Details are rather thin. Is this a loss of customer data, or has it impacted the operations of clients? Depending on the severity of things, it could mean a knock to reputation.

We'll have to see what the investigation turns up. Seems like it's still an ongoing issue.

EOL provided guidance for for the FY 2023

Rev 44.5m up 37% c/w FY22

EBITDA $12.3m up 36% c/w FY 22

Assuming operating margins remain at approximately 28%will see Net Profit increase to 5.1m from 3.58m in 2022.

Earnings expectations fro FY23 to be 17-20c equating to a PE of 18 at the top end.

This sees growth on an earnings pre share basis rise by 20% at top end of guidance.

Awaiting the FY results to see the details re growth but expecting this to be 15% in revenue and net profit going forward.

Historically a fair PE for Energy One has been in vicinity of 30, so i am applying this the share price in reaching $6

Disc Held in RL and SM

New article published

Few interesting points

- Energy One Europe has now successfully consolidated all the acquired brands such as Contigo, eZ-nergy and EGGSIS, and the European operation is now working as one seamless entity

- Simon also reported that it had just signed a larger ETRM deal for its Contigo software in the UK for a firm trading in European markets and has recently signed new deals on the scheduling and logistics side of the business.

- Energy One is also offering managed services in several areas and seeing significant growth and opportunities in that area of its business. It now has over forty customers using its managed services ranging from trading on behalf of as per agreed strategies, to out of hours and weekend balancing, dispatch, and auctioning services. “We have some smaller clients who use our managed services extensively and a number of larger ones who use our services for weekend and out of hours coverage,” he told me. “With our follow the sun structure and operations, we can offer all day shifts.”

A lot of publicity following the Shell announcement and Ausbiz exposure - and a bounce on very low volume.

Until today there has been a large cross trade. Hopefully whoever wants out is out - I'd like to know who it was and if it was Regal or not.

EOL seem to be making progress. Announcements over the past 6 weeks have said

- Energy One Ltd (Energy One) has entered into a long-term framework agreement with Shell Energy Australia (Shell) to use Energy One’s solutions for its growing portfolio of battery, demand response, renewable and other generation assets.

- They are also in have a POC with a large European energy generator with a mid-year decision about whether they are successful.

- They have their first European customer using Australia as a night shift

- Website and sales capability have been improved now they have their 24/7, Euro/Australia service model

- Have maintained their full year guidance even though half-year result was lower than expected. FY23 of revenues increasing 37% over FY22 to be in excess of $44M, and EBITDA growing 33% over FY22 to $12.5M and re-iterate that outlook.

They are the positive aspects.

On the risks side

- The really large acquisition is reported to be going will but it is still early days

- Debt is high because of acquisition

- Intangibles are high because of acquisition and history of capitalising software dev costs

- They are reporting EBITDA so they can exclude higher interest and amortisation which will impact NPAT

· January 2021 CQ Energy (Australia) A$36m - is the leading provider of operational energy services to the Australian gas and electricity sector. They provide similar 24x7 operational services as our European businesses eZ-nergy and Egssis, as well as running a sophisticated risk transfer/broking business. https://www.asx.com.au/asxpdf/20220131/pdf/455g3dpmf9lpld.pdf

· October 2021 EGSSIS NV (Belgium) Approx A$6.8m - a significant provider of energy scheduling and nomination software and associated 24/7 trading services to European gas and power market participants. https://www.asx.com.au/asxpdf/20211001/pdf/4515935zlsk2t6.pdf

· December 2019 eZ-nergy €4m - a French company selling Software as a Service (SaaS) to utility customers across Europe. The software developed by eZ-nergy is written in the same language as Contigo’s software and the two product-sets are highly complementary and will allow Energy One to immediately extend its geographic presence into Europe. https://www.asx.com.au/asxpdf/20191224/pdf/44cvxwb35sy78x.pdf

· November 2018 Contigo Software (UK) £4m - Contigo Software provide energy trading risk management (ETRM) solutions to customers across Europe. Contigo is a leading supplier of Energy Trading and Risk management (ETRM) solutions that simplify contract and physical energy trading across Europe’s complex and sophisticated energy trading landscape. https://www.asx.com.au/asxpdf/20181127/pdf/440nj7hhgpljt9.pdf

· May 2017 Creative Analytics Pty Ltd $3m - - a business selling energy trading and market analytics software to customers in Australia, New Zealand and Singapore. Creative Analytics is a leading supplier of energy market data and analytics via its NemSight data analytics Software-as-a-Service platform. The company also offers SimEnergy, an Energy Trading and Risk Management solution along with other market alerting and trading tools. https://www.asx.com.au/asxpdf/20170531/pdf/43jmg2v9vjwwj6.pdf

· August 2016 pypIT software business from Sydac Pty Limited $1.5m- is a business providng software and services to Australia’s major gas transmission gas pipelines. pypIT software allows customers of gas (gas shippers) to place order nominations of bulk gas, to have those nominations scheduled and to receive and settle invoices for transportation. The pypIT software is used by major pipelines located in NSW, Victoria, SA and WA. Approximately 40% of Australia’s domestic gas flows through these pipeline. https://www.asx.com.au/asxpdf/20160825/pdf/439ml5j2mgnldy.pdf

· January 2021 CQ Energy (Australia) A$36m - is the leading provider of operational energy services to the Australian gas and electricity sector. They provide similar 24x7 operational services as our European businesses eZ-nergy and Egssis, as well as running a sophisticated risk transfer/broking business. https://www.asx.com.au/asxpdf/20220131/pdf/455g3dpmf9lpld.pdf

· October 2021 EGSSIS NV (Belgium) Approx A$6.8m - a significant provider of energy scheduling and nomination software and associated 24/7 trading services to European gas and power market participants. https://www.asx.com.au/asxpdf/20211001/pdf/4515935zlsk2t6.pdf

· December 2019 eZ-nergy €4m - a French company selling Software as a Service (SaaS) to utility customers across Europe. The software developed by eZ-nergy is written in the same language as Contigo’s software and the two product-sets are highly complementary and will allow Energy One to immediately extend its geographic presence into Europe. https://www.asx.com.au/asxpdf/20191224/pdf/44cvxwb35sy78x.pdf

· November 2018 Contigo Software (UK) £4m - Contigo Software provide energy trading risk management (ETRM) solutions to customers across Europe. Contigo is a leading supplier of Energy Trading and Risk management (ETRM) solutions that simplify contract and physical energy trading across Europe’s complex and sophisticated energy trading landscape. https://www.asx.com.au/asxpdf/20181127/pdf/440nj7hhgpljt9.pdf

· May 2017 Creative Analytics Pty Ltd $3m - - a business selling energy trading and market analytics software to customers in Australia, New Zealand and Singapore. Creative Analytics is a leading supplier of energy market data and analytics via its NemSight data analytics Software-as-a-Service platform. The company also offers SimEnergy, an Energy Trading and Risk Management solution along with other market alerting and trading tools. https://www.asx.com.au/asxpdf/20170531/pdf/43jmg2v9vjwwj6.pdf

· August 2016 pypIT software business from Sydac Pty Limited $1.5m- is a business providng software and services to Australia’s major gas transmission gas pipelines. pypIT software allows customers of gas (gas shippers) to place order nominations of bulk gas, to have those nominations scheduled and to receive and settle invoices for transportation. The pypIT software is used by major pipelines located in NSW, Victoria, SA and WA. Approximately 40% of Australia’s domestic gas flows through these pipeline.https://www.asx.com.au/asxpdf/20160825/pdf/439ml5j2mgnldy.pdf

FH23 a bit lower due to costs, imo. company talks about some delays in large projects and looks like large capability build for 24/7 trading pushing costs up. the financials not too bad versus some other micros but benefits kicked down the track which may disappoint. company increased TAM (its huge) and also mentioned US acq possible for the first time but not soon. meeting 10am tomorrow. disc held as spec position

sorry--my 6 month rev (lhs)/pbt/cfo (grey) --note widening of rev and the other lines recently due to capacity build

Interesting this company has not had any shares sold short in the last 12 months- except for a fat finger short position of 2,110 shares taken out on 29 December and closed the next day.

Some sizeable cross trades going through at the cap raising price.

I wonder how this plays out for EOL if this becomes a trend, as looks like it might be in Europe.

Victorian Premier Daniel Andrews’ plan to “bring back” the government-owned State Electricity Commission to reverse the decades-long privatisation of Australia’s energy market will chill private investment and hurt ordinary investors and workers, the CEOs of Woodside Energy, Alinta Energy and Australian Energy Council warn.

The state Labor government said it would spend $1 billion to develop its own renewable energy assets, as it announced tough new emissions targets that are likely to end coal power generation in the state by 2035 - earlier than expected. The state would invest directly to control renewable energy projects, including wind and solar, with a focus expected to be on its ambitious offshore wind targets.

I finally caught up with the $EOL meeting. Thanks to @Strawman for asking my questions and to Claude Walker (sorry, don’t know your SM handle) for clarifying my question on cohort revenue reporting. I wasn't able to make the live meeting unfortunately.

In summary, the meeting confirmed my view that $EOL is a company to keep on the watch list. However, it is not one I will invest in at the current price. I’ll explain.

Market Leadership – Outside of Australia I don’t understand where $EOL sits

It is far from clear they will succeed in the transition from “Regional Leader” to “Global Player”. Shaun Ankers gave a clear segmentation of the competitive landscape: Local Heroes, Regional Leaders, and Global Players. What he didn't convey is just how fragmented the market is within this. (I am still searching for a reasonably recent picture.)

Their recent acquisitions provide a solid beach-head in UK & Europe, and it will be interesting to follow their progress here over time. The progress over the next 2-3 years will demonstrate whether they have a competitive advantage as a "Regional Leader". As always with M&A you have to judge this over time.

To be a Global Player, they will need a presence in the US market. My understanding is that several historically Regional Leaders in the USA have become Global Players over the last decade via acquisition of European “Local Heroes” and “Regional Leaders”.

As with many other global markets, the US energy market is very important. This is in part due to its scale, but also its maturity as a place where you can trade and do business. Furthermore, many potentially material energy markets are closed and are likely to remain closed (e.g., China, Russia etc.) Most companies with the aspiration of being a global energy player at some time have a serious tilt at the US market. So, any global player looking to a strategic energy systems software partner would expect a US market capability. If I was on the procurement screening panel, it would be a “must have” criterion.

There are a lot of “Local Heroes” and smaller “Regional Leaders” in the USA, and I have no doubt that $EOL are looking for the right fit: scale, capabilities, culture etc. However, $EOL appear to be conservatively managed, so I don’t expect this to happen any time soon. They will need to be confident that the European acquisitions are integrated and performing well. Furthermore, it is conceivable that more Europe acquisitions may be required to build out the desired market footprint and I would expect the prudent $EOL management not to take on too many frontiers at once. It would be a red flag if they did.

Unlike many firms in the SaaS space on the ASX where we have seen explosive growth lead to the cycle of market exuberance and disappointment (for many), I believe $EOL will be a slower burn - partly because of prudent management and partly because there is little alternative in this space where operational excellence is everything. It is a testament to the capital disciple of $EOL that SOI have only grown from 2007 to today from 20m to 27m, despite multiple acquisitions. Of course, this is a positive for them as a long term investment.

Market Evolution

Shaun confirmed our discussions in the “Deep Dive” that the industry is seeing a burst of new entrants driven by the energy transition. This is something that is going to continue for years, and $EOL is well-positioned to serve new-entrants both in Australia, UK and Europe.

However, Shaun confirmed our discussions that consolidation will take place, and that “1+1=1” means that consolidation will act as a potential headwind when it starts to kick in. (“We’re not there yet.”) Missing form the discussion was the recognition that it is therefore critical to be the provider of solutions to the large and medium-sized market players, as customer acquirers of non-customers will grow existing accounts.

On the question “how do you measure market share?” I have the following observations. Using a “Funds Under Management” analogy is not helpful. In funds management every $ has one manager (as I understand). In energy management, every electron or gas molecule passes through several hands. Consider this thought experiment. Imagine a market of 100GWh with one generator and one retailer. The size of the market is 100GWh. If Company X provides all the software to the generator, can it claim 100% market share – since every electron passes through its systems? No. In this I can only claim 50% share, because the retailer on the other side of the transaction will also have their solution.

But in energy markets it is even more complex. A business I was historically associated with in the USA had traded volumes of gas that were c. 10x the physical flows. In electricity, it is even more complicated, as you have market interactions over different timeframes, you have energy and capacity products, as well as “ancillary services”.

To cut a long story short, I am not convinced with Shaun’s definition of their market share in Australia, and he didn’t even attempt to answer the questions for UK and Europe. One thing I can agree with $EOL, is that their European market is “<10”. (Sorry, I couldn't resist.)

In writing all this, I don’t mean to detract from their stated position of being a “Regional Leader” in Australia. Doubtless they are and my industry contacts confirm this. I am just none-the-wiser about the materiality of their UK and European positions.

Conclusions

I did not intend in this straw to be negative about $EOL. There is a lot to like.

First, the track record of revenue growth, eps growth, and stable share count speaks for itself. This distinguishes it from many other SaaS firms we follow on this forum.

Second, management are aligned and appear very capable and prudent.

Third, as it scales it will grow its competitive moat. The capabilities embedded in the highly specialised workforce (energy market professionals; trading software engineers) and the code itself are not easily replicated.

Fourth, as a mission critical software company you need a quality customer list to even be considered for new work. They have a quality customer list in Aus, UK and Europe and this is a great asset.

There is every chance that in 10 years time as investment today in $EOL will be well-rewarded, even if it gets acquired along the way. Energy systems is a very active space for M&A, and $EOL would be a tempting target for a US “Regional Leader” looking to become a “Global player”.

However, I do not believe that the Australian business on its own supports a long term growth investment thesis. OK - obvious statement, as their own strategy clearly agrees. But this means that evidence of progress to develop a Regional Leader position in Europe is a pre-requisite for me taking a stake.

The bar is high. ASX has several global software leaders ($ALU, $PME, $WTC) and challengers big and small ($XRO (big), $NEA and $JIN (medium) and $3DP and $IKE(small)) as well as Regional Leaders looking to expand (e.g., $TNE). I don’t know where $EOL sits on the global leaderboard in its industry. It needs to show market leadership in Europe (a top 3 or 4 position) because this is a highly competitive industry with a highly-fragmented market structure when looked at globally.

So $EOL is on my watch list.

Because I believe that it is well-managed and has a strong Australia position and because I believe its Europe entry now makes it an attractive M&A target for a North American player, I would acquire shares on significant SP weakness (depending on the reason for the pullback). Beyond that, I will patiently monitor the progress in Europe. As Shaun made clear, the current turmoil in this market is lilely to present a lot of opportuniy.

Disc: Not held.

Footnote: The combination of the Deep Dive and the CEO Meeting has really deepened my understanding of this company. What a great formula!

Here is a handy link for someone like me who never had anything to do with industry to understand the basics.

I really enjoyed listening to the recording of the $EOL Deep Dive. I have been following it for a while (ever since Claude Walker put it on my watch list professing it to be his "Stock to Change Your Life"eary last year.) All things energy are the core of my "wheelhouse", although currently I hold no energy stocks, but have enjoyed great gains over the last 2 years, offsetting some of my other losses visible here to all!

@Strawman opened the deep dive by summarising $EOL from revenue growth 2017 to 2022 and outlook for 2023. He rightly noted that there have been a number of acquisitions. This finally prompted me to attempt an analysis of the impact of the acquisitions, as management have consistently stated how much revenue (and EBITDA) contribution each of the 4 acquired businesses was expected to make in the first full financial year after closing.

In constructing the table below, for each year I taken Revenue and Other Income, and from that listed the contribution of revenue from each acquisition in its first full financial year, as announced on deal completion. Note that I have not made any corrections for the impact of FX movements between announcement and the FY results. So it is a ballpark analysis only.

Furthermore, I have kept the contribution of each acquisition to the 'Acquisition Contribution" total constant in subsequent years. This means that in the second full financial year after acquisition, growth in the acquisition is deemed to contribute to organic growth.

Table: Analysis of Organic and Inorganic Revenu Growth for $EOL (A$000)

I have then in the rightmost two columns calculated the revenue CAGRs. The one I place most significance on is the period 2019 to 2023 (Forecast numbers), as these are the most recent 4 years where Year 1 is purely organic. The reason for doing this is that you often get big CAGRs when you start from a very small revenue base. It is a trick growth company CEOs are adept at doing ... go back far enough and your CAGR is infinite!

$EOL has over the period by my estimation delivered an organic revenue CAGR of c. 10%. I will be looking for evidence that they can leverage the acquisitions to drive higher revenue growthin future. For all the talk of industry tailwinds, their organic growth by my estimation is modest.

One reason I do not hold $EOL is that it is unclear to me whether they will achieve strong growth. My understanding is that the market for energy management software solutions in competitive. It was 10+ years ago when I was a "buyer" and I have no reason to believe that has changed. Claiming "15%" (UK) and "less than 10%" (Europe) market shares does not in my mind demonstrate a strong starting position. (Question for managment meeting: How are they measuring market share?)

I will expand on some of these points further, connecting to the discussion and questions from the "Deep Dive".

Big Customers v. Small Customers

The Deep Dive discussion debated $EOL's customer mix, and the role of large and small customers in the future. As discussed, existing customers in a market are one criterion considered by prospective new clients. In Australia, $EOL has strong credentials with AGL, Energy Australia and Alinta Energy among the client base. The European acquisitions have also brought some big customers into the portfolio: Centrica and SSE in the UK and EON (Europe or UK?) as at early 2021. There will be more as a result of the eZ-Energy and Egssis acquisitions. We don't know how many of these customers have multiple products - this is important.

For me, success is all about the ability to acquire new large customers organically. I would see newsflow on this as a positive BUY signal, and I am waiting for it.

What is my obsession with big customers? Simple - to win in energy you have to win these. True, during the energy transition, many smaller players and new market entrants are going to build A LOT of standalone energy assets (wind farms, solar farms, battery installations, pumped hydro, peaker plants etc. etc.) and we will continue to see the entry and exit of suppliers/retailers as market fortunes ebb and flow. But energy is a scale game. This is because medium and large players in any market will over time acquire businesses and individual assets of the new entrants and developers. This is how competitive (i.e. open) energy markets have evolved. You need medium and large customers in your customer base because they will do the lion's share of acqusition and owns the lion's share of the addressible market.

If the acquirer is a new market entrant, then they might adopt the systems used by the target, otherwise they are likely to impose their systems. For example, Shell recently acquired ERM to enter the Australia electricity supply market as part of its global strategy to transition from hydrocarbons to electricity. As this was one of the early moves by Shell of this kind, it will be unteresting to know whether they adopted $ERM's electricity trading systems. I expect they will have for some, but of course Shell has existing and developed systems for its gas, LNG and oil trading. I've never seen the $EOL promotions use Shell or ERM badges, so that's a key one to win in Australia and globally! Shell will in time become a big global electricity generator, distributor, trader and supplier.

Pricing is clearly also a scale game. I expect $EOL's pricing will be driven by numbers of products (x-of-12), number of seats (licences) per product, and potentially even number/scale of assets managed perhaps measured by MWh, (Question for Management Meeting - What is the Contracted Revenue Model?). If you go into the trading room of one of the large utilities, you'll find a large open plan space with traders and analysts, including the operation team that works shifts, 24/7/365. One large utility with have 10 to 20 or more times the revenue opportunity of a smaller asset developer. Furthermore, asset developers will often contract all the offtake to one of the integrated players via a PPA (power purchase agreement), in which case they are unlikely to use any/many systems at all. So tracking the number of new energy projects, while an indicator or market growth, perhaps overstates the market opportunity for $EOL.

If we think of $EOL as an early stage player aspiring to be the $WTC of the energy industry, then we just have to look to the kinds of metrics that $WTC touts: e.g. 41 out of 50 of the world's largest logistics firms are customers.

So for me, big customers are what it is all about.

(Note: this contrasts to other enterprise software providers like $XRO and $ELO, where the market for SME enterprises is huge and measured in millions. Industry structure in energy is different.)

One area that I'd like to understand better is the contract energy trading services model. This is a niche which probably only makes sense for small and medium size customers, as big customers are likely to do the work in-house because it is a core capability. It will be interesting to see what growth the CQ Energy acquisition can drive in Australia. I am unclear how material this can be.

It would also be good to understand the extent to which existing customers grow revenue over time. I wonder if we could persuade $EOL to adopt cohort revenue reporting, as many of our favourite SaaS companies do?

Conclusion

$EOL is a small player in a big global pool. The portfolio of products is impressive and should position them well to compete. But at the moment, I don't see a compelling growth investment proposition at the current valuation.

I am closely monitoring:

- Organic wins of new large customers, particularly in Europe

- Evidence that revenue synergies from acquisitions lead to an uptick in revenue growth. Organic growth of 15% p.a.+ up from 10% CAGR estimated would be a good start

- Better understanding of the potential of the contract operations service opportunity, so will tune in to future results calls when I can

- Evidence of better capital management. Given their global aspiration, paying a dividend now is just plain dumb, when you have to go cap in hand for more capital. (If they have advisors on this, they should change them!)

I am minded to agree with @PinchOfSalt 's bear case valuation of $3.00 ballpark. I'll add mine when and if I get to it.

Disc: Not held in RL and SM, but watching closely.

Before capital raising valuation.

Historically traded at an average of around15x EV/EBITDA, was as low as 6.5x at one point, but using that as a guide.

Management guiding for $12.5M EBITDA in FY23

$12.5 x 15 = $187.5M

$27.5M Debt.

$160M Equity / 26.95M shares = $5.94.

I don't see any reason for multiple compression, yes higher discount rates (as rf rates increase) but plenty of growth and maybe less of a illiquidity discount as EOL gets larger. Strengthened market postion as it grows and good tailwinds.

Could be upside next 2 years as backlog from one off implementation projects due to COVID restricitons cleareing with also more projects due to and the energy crisis in Europe sees new renewable projects fast tracked.

I think there will be more cap raising and acquisitions so not even going to attempt doing a DCF as think it will be wildly off.

The moats are very strong.

- regulated market

- clients need a high level of trust in the service provider because that is their source of revenue. They need to trust that EOL will reliably execute the clients rules. CEO said this trust is hard to build in the industry

- clients are very sticky

Interesting that they have flagged an equity raising because in their recent investor update the chairman said the board is very cognizant (wary?) of dilution. In the same update the chairman was also mindful that their debt was 'manageable' given on their highly sticky customers and recurrent revenue. Their debt has increased because of one major acquisition last year.

My guess is that they are buying something else and don't want to go into any more debt.

https://www.energyone.com/investors/investorpresentation/

Day for the review - trading halt this morning and cap raising.

every year energy one wants one or two big contract wins

but at the moment, volatile energy markets are confusing things

will the inflating energy markets make big wins hard to close?

If so, it may leave shareholders feeling quite morose.

In FY2017 the Energy One group was joined by pypIT a business platform that is responsible for facilitating the transmission of 40% of Australia’s gas through pipelines. (This 40% figure is still quoted on the EOL website currently).

No break down in annual reports indicating revenue or growth. So it would seem to be a steady revenue stream in a fairly tightly held market with no obvious signs of growth other than through acquisition and expansion of the overall market. One would imagine that it is also sticky and unlikely to experience churn, disruption permitting.

The Gas market is expanding see below "Australia’s Gas-Fired Recovery Plan"

Dave Flower Product Manager 6yrs and 16 Yrs with Sydac Pty Ltd acquired in 2016 and BHP IT before that. Works out of the University of Adelaide integrating pypIT into the EOL suite of products.

pypIT acquisition ($1.50M) was financed entirely with cash reserves. One Limited completed the acquisition of the pypIT software business from Sydac Pty Limited on 25 August 2016 for the acquisition price of $1,500,000.

pypIT business continues to serve gas pipeliners and their customers in the evolving wholesale gas market, performing vital business transactions enabling users to effectively and efficiently transport gas.

For the operators of gas pipelines the need to receive trade orders from their customers is a mission-critical activity - as is the scheduling, messaging, reconciliation and settlement (billing) of those shipments. pypIT is the largest independent platform in Australia serving 40% of the country’s bulk gas transmission. As such it used by a number of Australia's blue-chip infrastructure companies.

pypIT is a business providing software and services to Australia’s major gas transmission gas pipelines. Australia’s major energy companies utilise gas transmission pipelines to fulfil their end use or retail gas supply requirements. The pypIT software allows customers of gas (gas shippers) to place order nominations onto the pipelines for the transmission of bulk gas, to have those nominations scheduled and to receive and settle invoices for transportation. It is used by major pipelines located in NSW, Victoria, SA and WA accounting for approximately 40% of Australia's domestic gas flows

Overview of gas markets. Detailed information here. East Coast and West Coast and Northern.

https://www.aemc.gov.au/energy-system/gas/gas-pipeline-register

Australia’s Gas-Fired Recovery Plan

The government’s Gas-Fired Recovery agenda supports energy reliability, security and affordability to stimulate Australia’s economic recovery, enable industry growth and support Australian jobs.

This plan focuses on 3 key action areas:

- unlocking gas supply

- ensuring efficient transportation

- empowering consumers.

The government committed $50.3 million in funding in the 2022-23 Budget under the Accelerating Priority Gas Infrastructure measure. This measure includes investment in:

- Seven infrastructure projects that support National Gas Infrastructure Priority (NGIP) priority actions, for early works support, and

- Feasibility studies and options for CO2-carrying pipelines from major gas and industrial hubs to prospective sites for carbon capture and storage.

This is in addition to the commitment of $58.6 million in funding in the 2021-22 Budget. The 2021-22 Budget measures were designed to enable our gas market to continue to accelerate Australia’s economic recovery and guarantee our competitive advantage in key industries. These measures included:

- The release of the National Gas Infrastructure Plan: Interim Report

- $38.7 million of early works support for critical gas infrastructure projects

- $3.5 million for the development of a long-term Future Gas Infrastructure Investment Framework

- $4.6 million to develop initiatives that empower gas reliant businesses to negotiate competitive outcomes, which includes developing a voluntary standardised contract framework with industry

- $6.2 million to design, consult and implement reforms to continue accelerating the development of Wallumbilla as Australia’s Gas Supply Hub

- $5.6 million to develop a further National Gas Infrastructure Plan for 2022.

https://www.energy.gov.au/government-priorities/energy-markets/gas-markets

Competitors

https://www.gastrading.com.au/about-us

Gas Trading Australia Pty Ltd (gasTrading) was established in 2007 to assist in the smooth and efficient operation of gas sale and purchase contracts. The increasing cost of natural gas, and the reduced flexibility of gas contracts, has made the management of these contracts a vital part of corporate planning for any company which uses natural gas.

Gas Trading Australia Pty Limited (“gasTrading”) has operated in the Western Australian market for over 10 years and is regarded as the premier gas supply manager in Western Australia, employs 12 expert staff members to manage the gas supply of its clients; has a large Perth presence and an established Melbourne office; has over 300 TJ/d of gas under management each day; provides Gas Supply Management Services to 30 clients across multiple States and Territories and across various industries including mining, power generation, manufacturing and gas production; manages gas supply on all Western Australian pipelines, the Amadeus Gas Pipeline, Northern Gas Pipeline and the Carpentaria Gas Pipeline; broad and diverse transport position in own right; and is the operator of the gasTrading Spot Market:

A need to manage the under and over supply positions of clients led gasTrading to develop a Spot Market. By offering a platform for the sale and purchase of natural gas between clients, potential win-win outcomes were realised. The gasTrading Spot Market has grown considerably since its inception in July 2009. Almost every shipper on the major pipelines in WA has now contracted in some way to use the gasTrading Spot Market.

- By the middle of each month, Sellers provide gasTrading with an indication of the gas volumes they anticipate they will have available for sale for the next month and the minimum price they will accept for that gas.

- gasTrading aggregates the volumes of gas available for sale and, in the middle of the month, sends to all interested parties an Invitation to Treat setting out the anticipated Available Gas for each day of the next month.

- Parties interested in purchasing gas in the next month are invited to respond to [email protected] with an Offer or Offers to Buy. Offers to Buy must specify a volume of gas, typically quoted in TJ/d, the days on which the gas is required and the price the Purchaser is willing to pay for the gas. Purchasers are encouraged to bid a price that reflects the ‘value’ of the gas to them

https://www.gastrading.com.au/spot-market/how-it-works

SGM Trading was founded by Brendan Dillon who has been operating within the East Coast Gas Market for over ten years and has an in-depth understanding of each of the markets and how they influence each other. We work with gas producers, retailers and industrial gas users to manage long and short gas positions on their gas supply or demand positions.

I have attempted a valuation on EOL based on the financial achievements between 2018 and 2022.

Based on the 4 year growth rates for revenue, cost base and share count I am projecting forward to 2031 as follows:

Rev CAGR 34.4% reducing to 9% at 2031.

Expenses CAGR 35.6% reducing to 5% at 2031.

Share count CAGR 5.5% reducing to 5% at 2031.

The modelled growth rate calibrates well against the FY23 guidance provided with the FY22 results.

PE of 25 at 2031. Discount rate 15%.

Valuation today $7.30

EPS growth ~ 5% down EOL Could be in the right market ..Government Policy Electrifying all things.

Total liabilities / Total tangible assets: Debt/ Equity has increased so less profitable while the Debt is high.

Should be able to Leverage the offering scale up ect.

Australia

• Australian revenue up 6% despite drop in project revenue

• However, organic ARR grew by ~16% in the year.

• Recurring revenues were up 13% • EBITDA margin remained strong (up from 31% to 32%).

• Good sales pipeline. Need to sign 1-2 projects each year (20% project related revenue)

• In June 2022, we welcomed CQ Energy (Adelaide) to the Australian business group