Introduction

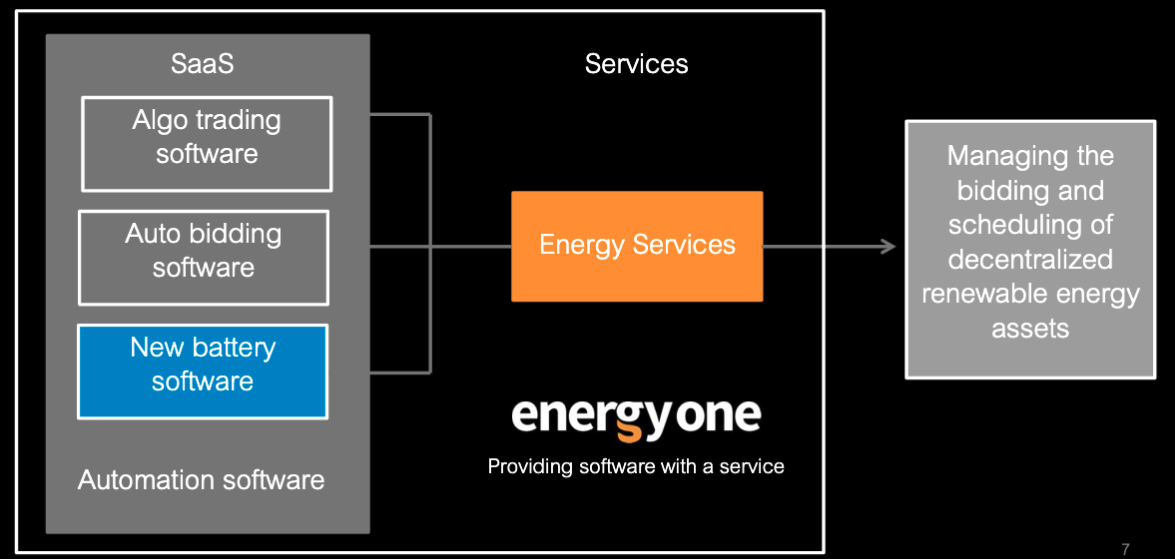

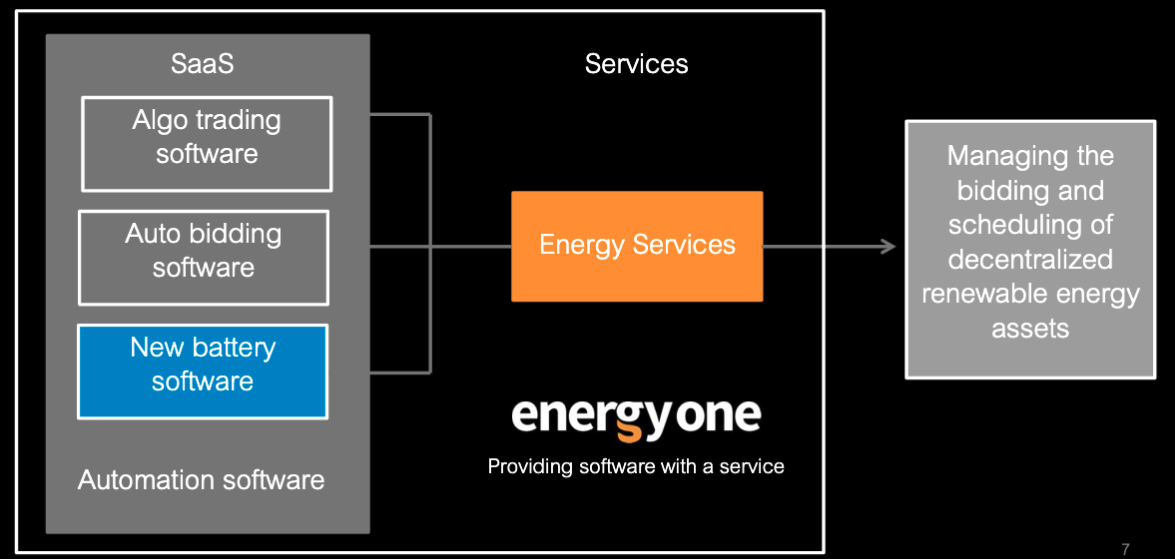

What does the company do?

We facilitate the entry of new generators into the market, enabling them to monetise their energy and assist our existing customers to make the transition to renewable energy without interrupting current operations.

Provide software and services for selling energy into markets.

“Energy One has cemented its position in the 24/7 operational energy services market being the number two provider in Europe and wit h the acquisition of CQ energy the number one provider in Australia” ; said Shaun Ankers, Group CEO.

None of our traditional competitors are providing 24/7 operational services and to this end we believe we have cemented a strong first mover advantage.

Combining our software with a premium service offering gives us an enviable position in facilitating the entry of renewable energy into national electricity markets

Services to generate high quality revenue with ~60-80% of revenue recurring

For example when a new grid scale battery is built they operator may contract out the management of dispatching its capacity into a national energy market.This is done via a contract for service and can be for a fixed term of 3,5 or 10yrs which is then renewed annually on an evergreen basis.This is important considering these assets typical have useful lives of 20-30 years.

How does it make money?

- Recurring revenue on software for suppliers, traders and retailers in energy markets

- Project revenue )1-2) projects per year - about 15% of total revenue

- About to launch business outsourcing model where they provide the 24x7 back office (ie people/services)

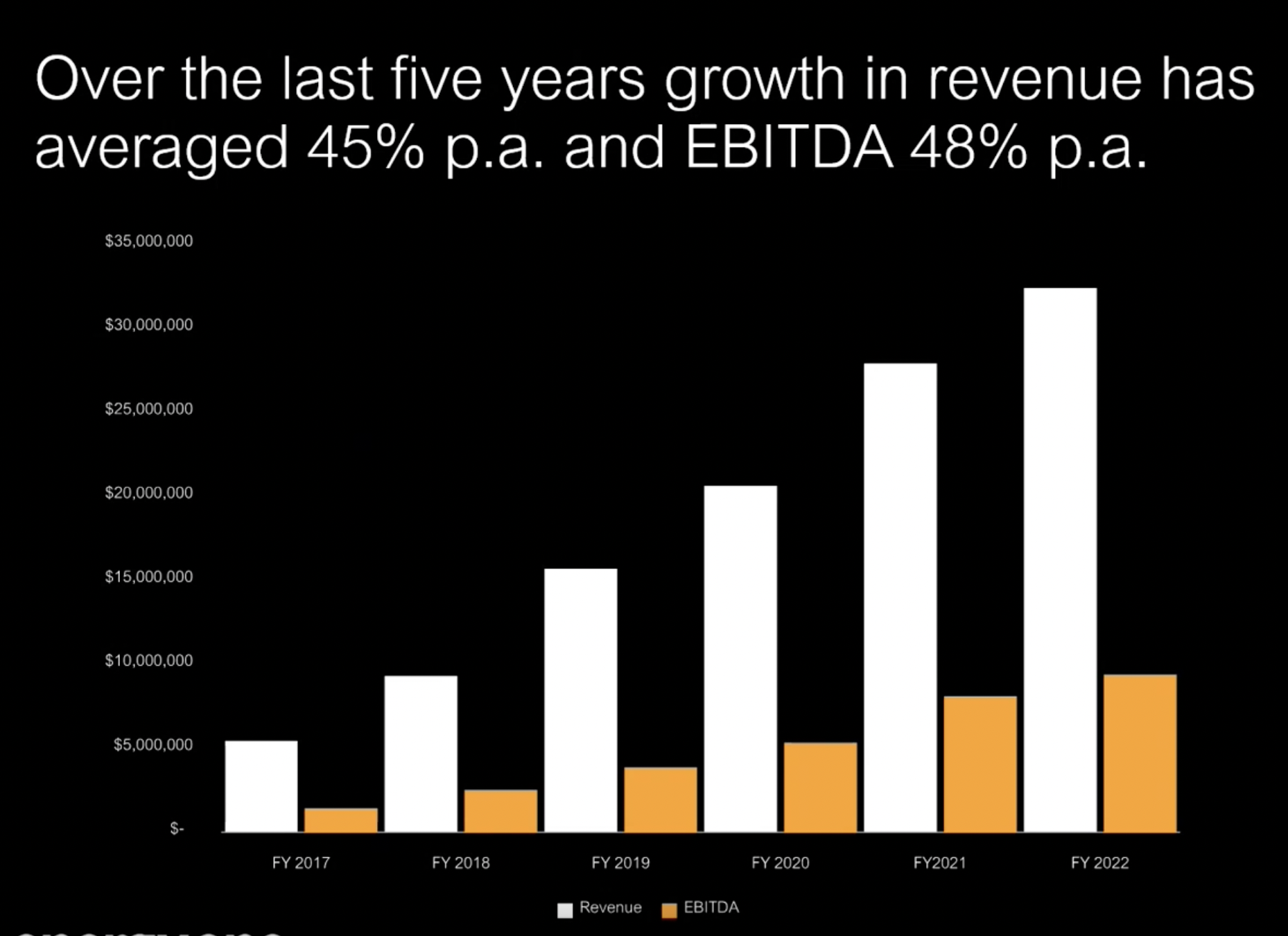

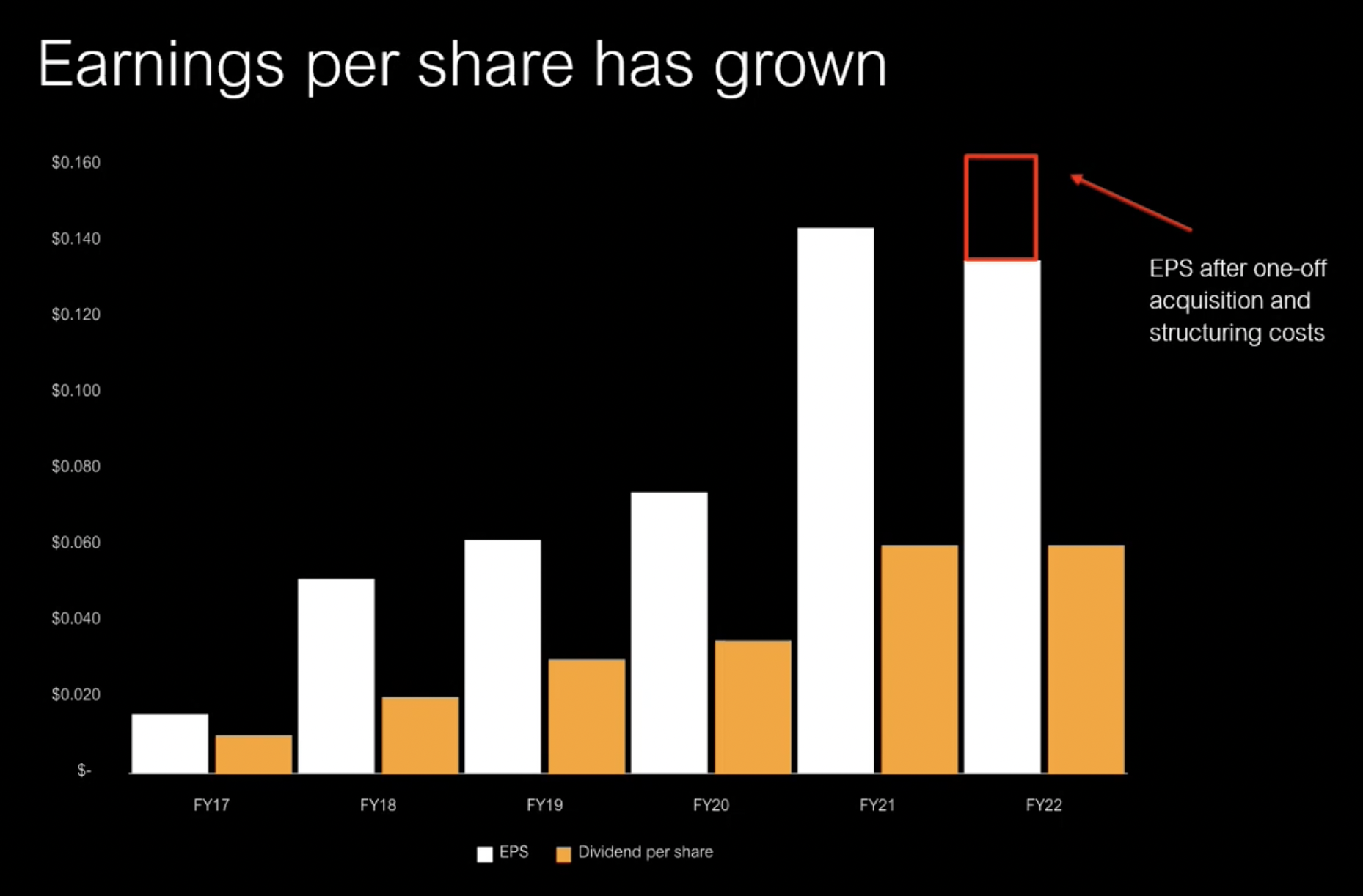

What are it's future prospects?

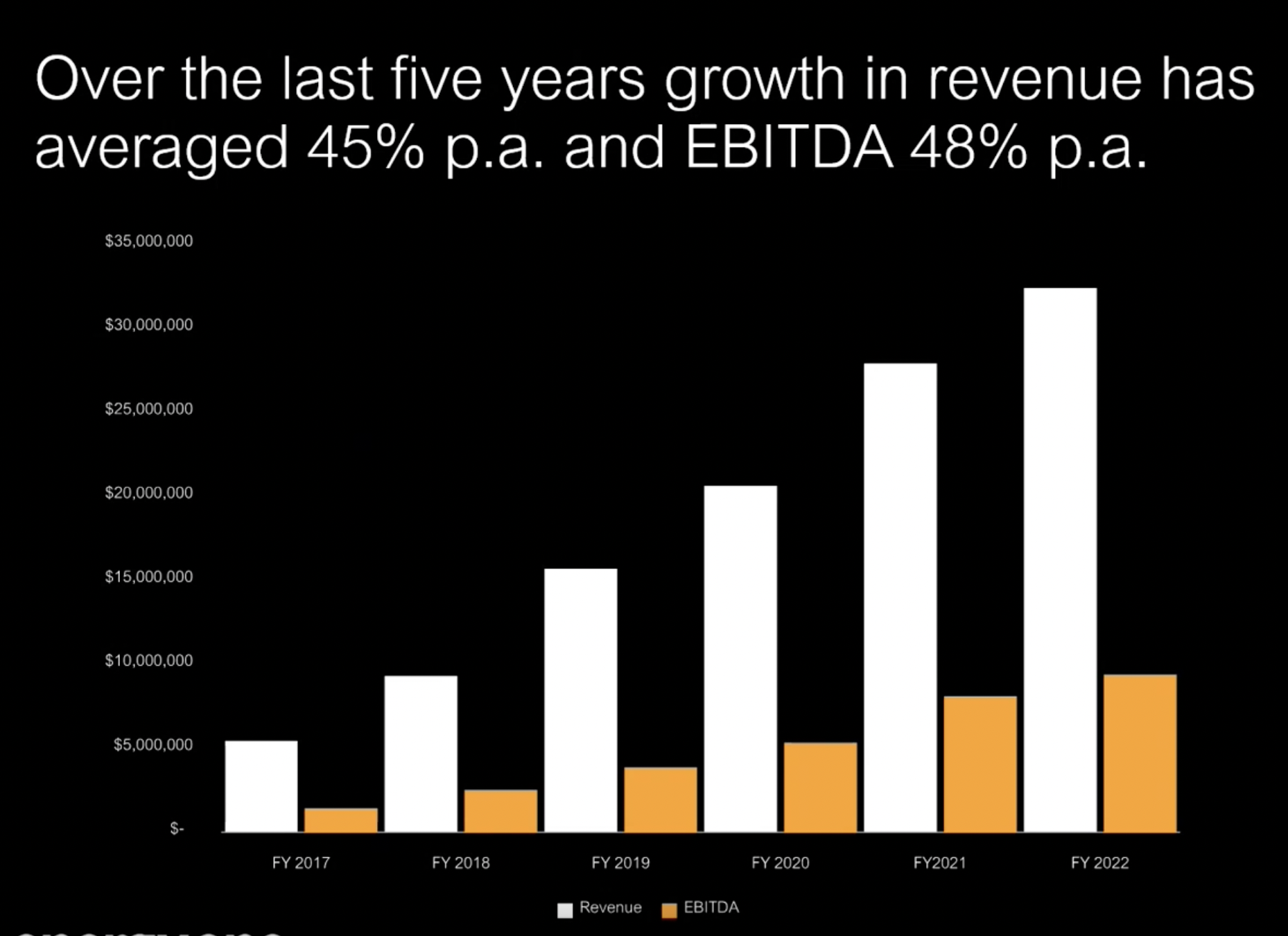

Very strong. By 2031 Australia needs to triple its current electricity production (Aus Climate Council report). Europe adds to its grid each year about the same current capacity of the Aus grid (Energy One CEO).

In AUS they have 50% of the market and grew revenue 16% last year without any major projects.

In EUR they have less than 10% of market.

EOL research has shown that In Australia (since 2015), 94% of new electricity generation has been via renewables (wind, solar etc) and Europe is similar. They claim that 87% of the added capacity in AUS has been from new entrants not aligned or part of big industry players. They argue that the large number of new, smaller players is a step-change in the market and these players will want the fully outsourced model because they aren't big enough to have their own 24x7 trading desk. EOL say they have first mover advantage for this new market.

Is the company experiencing headwinds or tailwinds?

Tailwinds

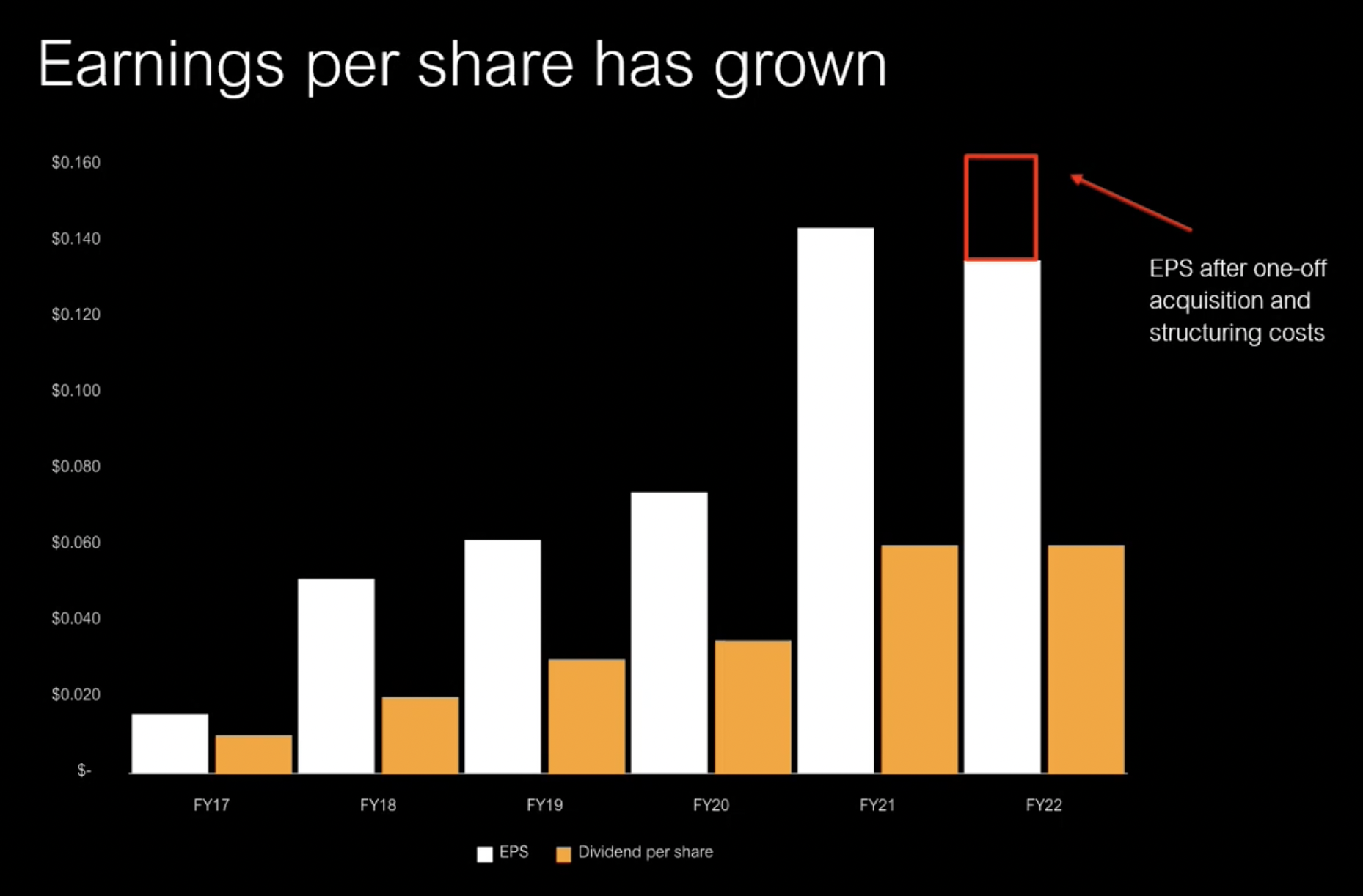

Has the company achieved growth organically or through substantial acquisitions?

Acquisitions

Whilst there has been good organic growth, acquisitions have really kicked it along because customers are so hard to win.

Cash flow positive?

Yes

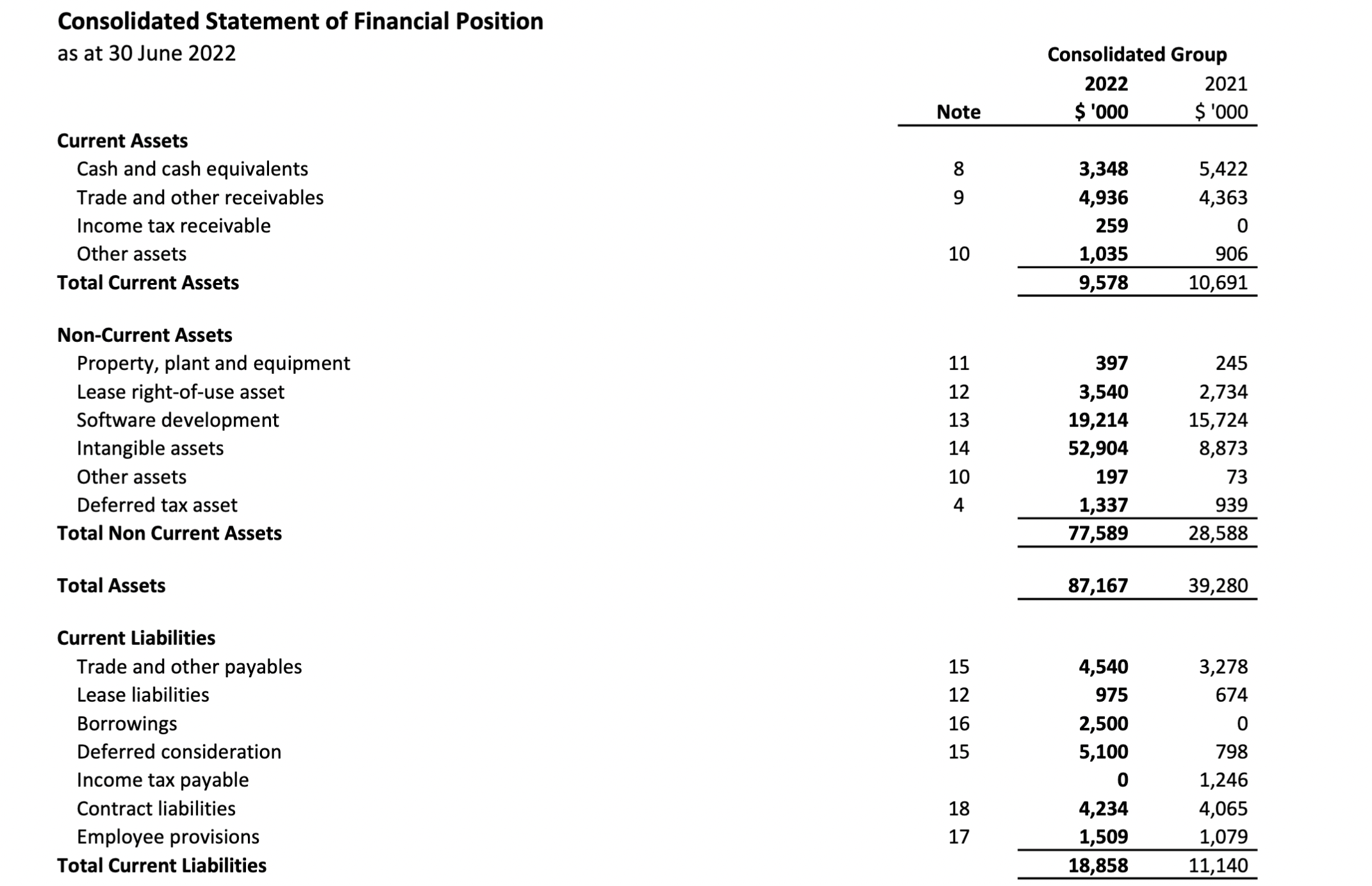

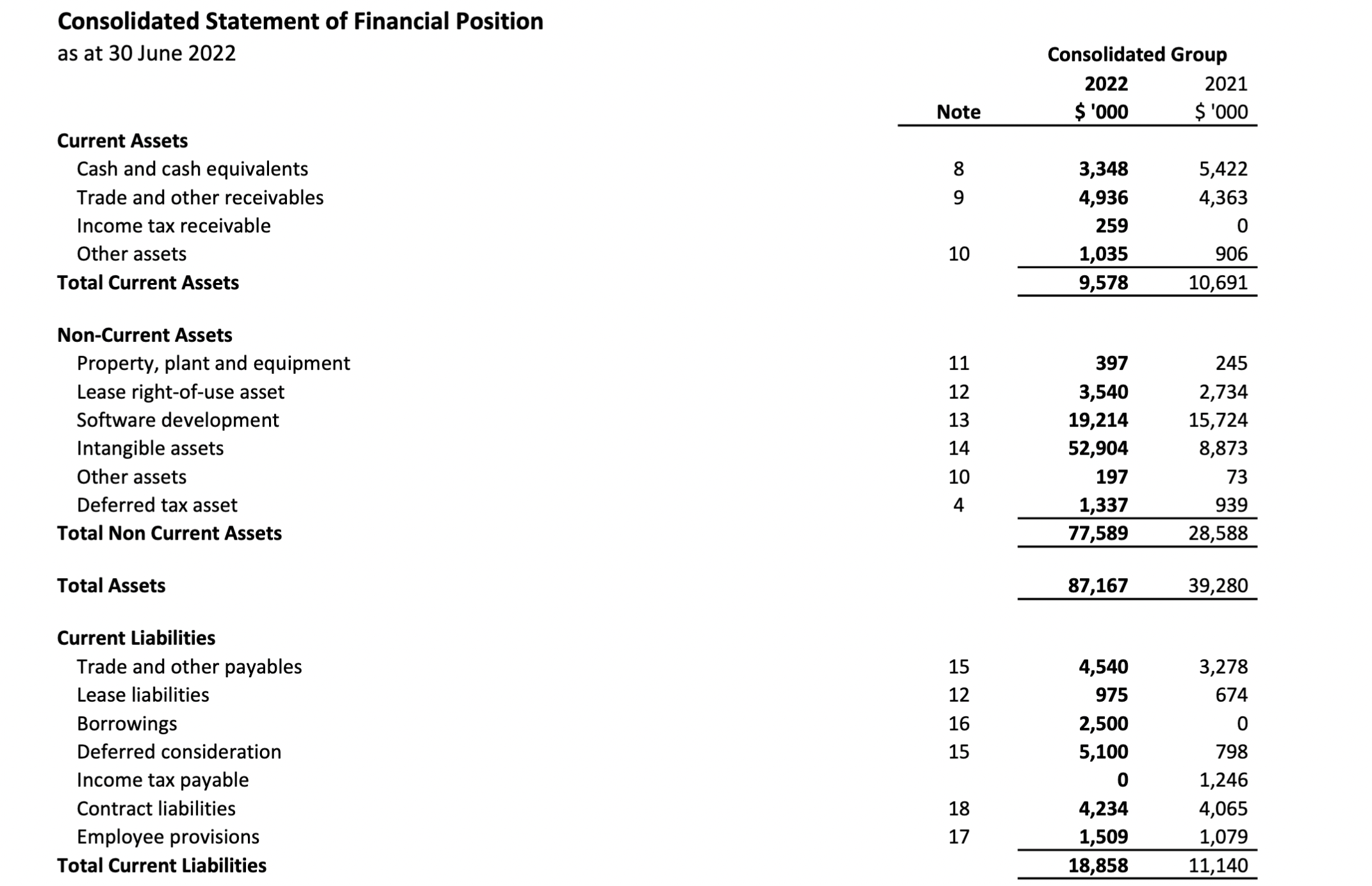

What is the debt/equity?

90%

Does the company only rely on its own revenue and not grants or capital injection?

Yes

Is the balance sheet clean without any significant intangibles (eg capitalised software or goodwill)?Comments

No

A lot of intangibles. Given their high debt, If their revenue drops the lenders can come knocking (bulldozing)