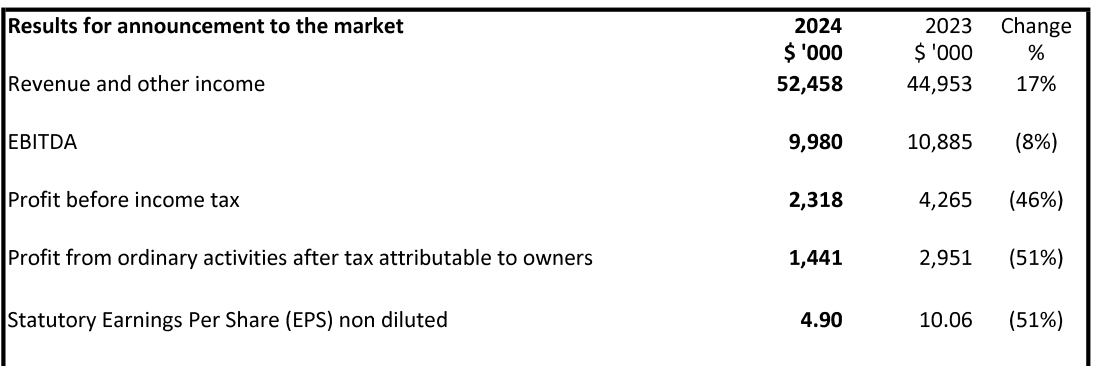

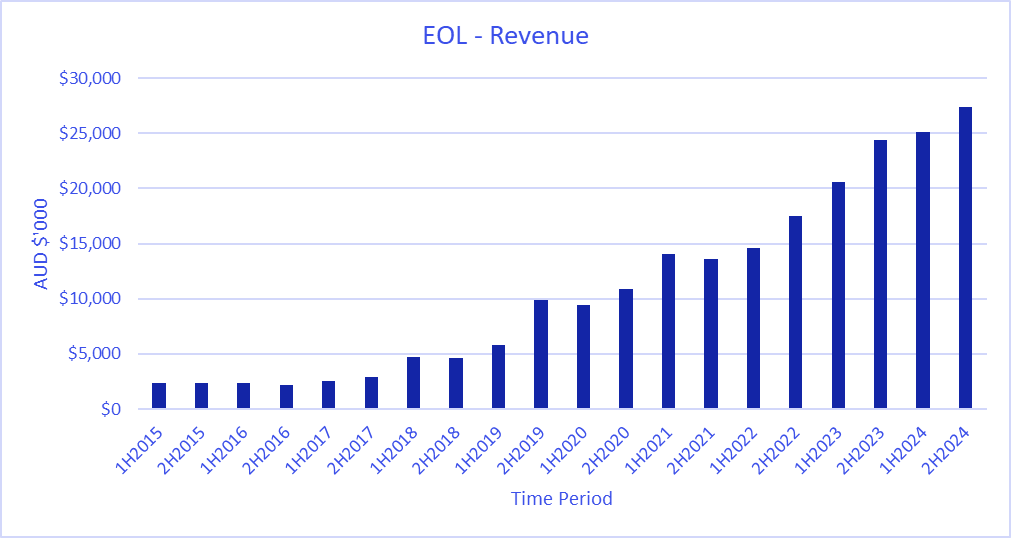

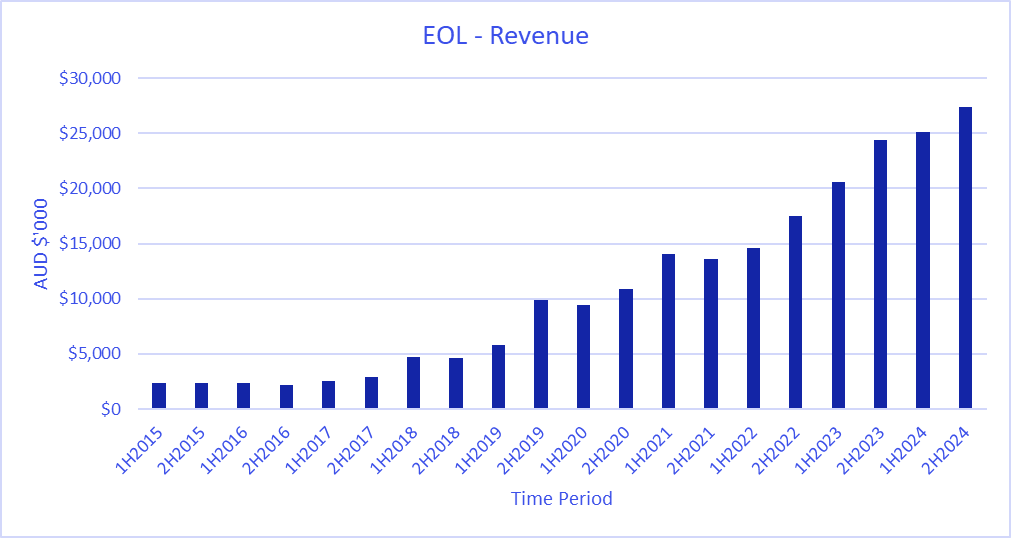

Energyone provided an FY24 result update. Optically it looks terrible thanks to very weak 1H ( that was already known to the market)

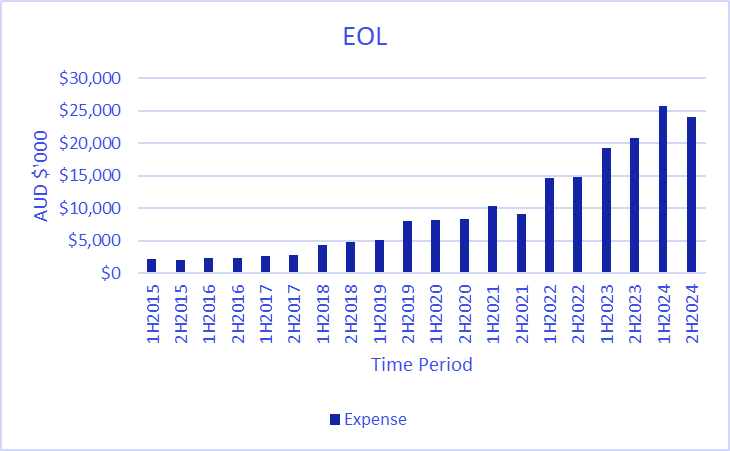

Now if we look at the result and compare half-on-half

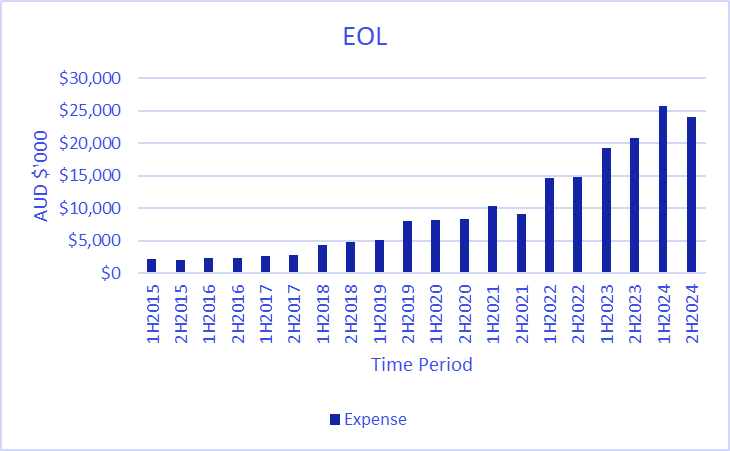

If we look at the expenses, 1H shows some one-off charge ( 1.8m worth). Although Salary cost increased to 28% in FY24 compared to FY23

Debt has been reduced from 22m to 16m ( they did capital raise in 2H and as a result Share count has increased from 27m to 31.5m)

It is roughly trading at 135m market cap

with 52m Revenue ( 89% recurring revenue) in FY24

There is a con call tomorrow ( unfortunately, I won't be able to attend)

FY25 guidance or commentary will be important for the valuation.

Hopefully, all one-off will be behind them, 1H FY25 should be much much better than 1hFY24