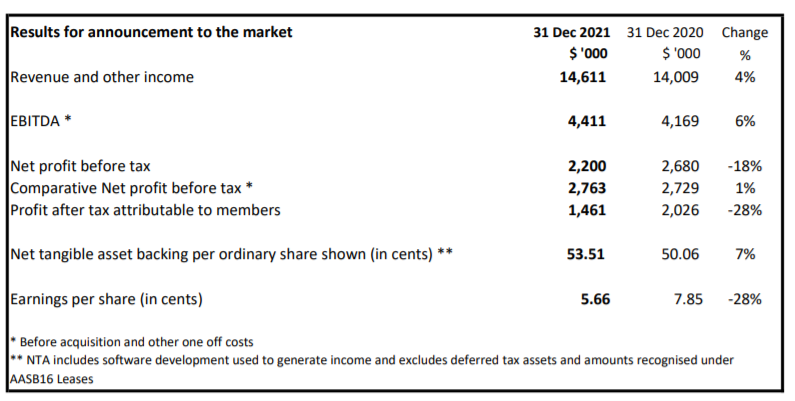

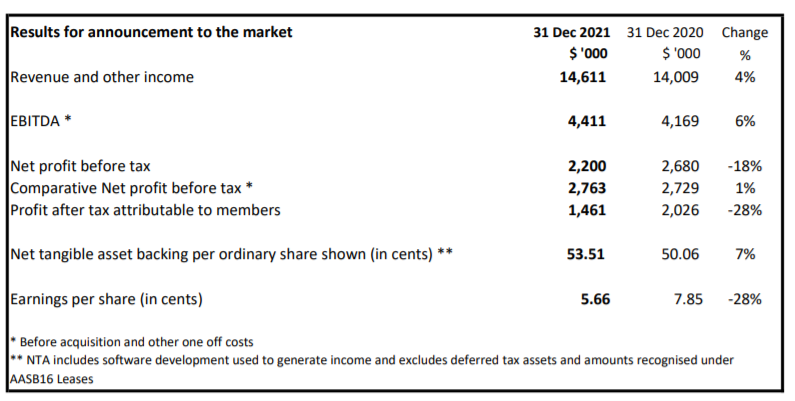

Energy One released their results for 1H FY22 yesterday. From their release:

Revenue was fairly flat and management have stated this was due to covid travel restrictions minimising their ability to win big clients. I see this half as a half of consolidation for the business as they try and bed down their recent acquisition of Egssis and their entrance into the European energy markets. CQ was also acquired although this will be reflected in the coming half year.

EOL operate in a sector with large tailwinds with the transition towards green energy. They have mentioned that they will be operating as a Software-with-a-service model (Swas) once the CQ acquisition has been completed so it will be interesting to see if they will be able to scale well given the tailwinds afforded to them. Management have stated that they will continue to "profitably grow" but I expect their results to be a bit lumpy over the course of the next few halves/years.

Guidance for the FY22 was given:

- Revenue = $32m

- EBITDA (excluding any more acquisitions and one off costs) = $9.5m

Disc: Held IRL and on Strawman.