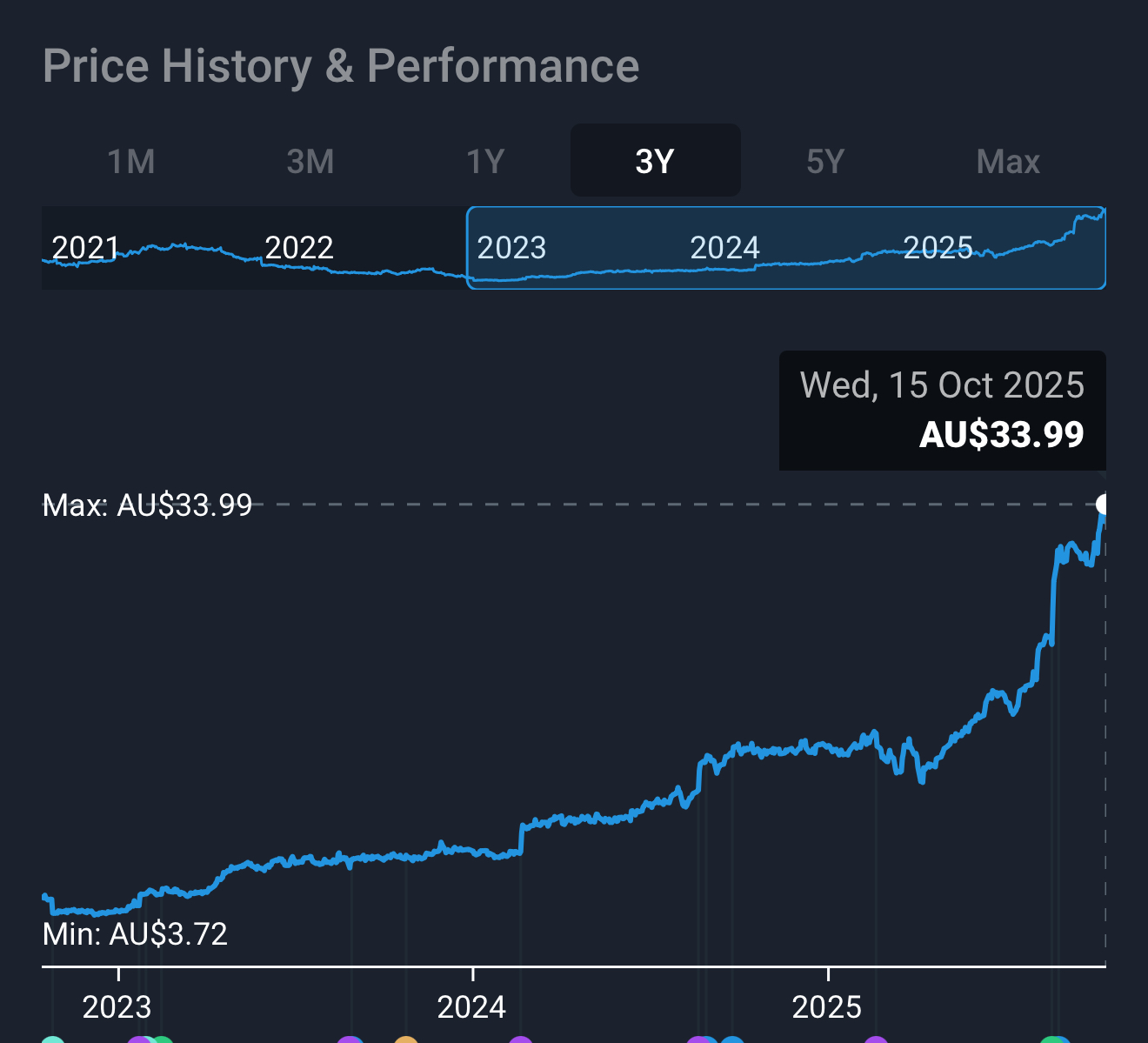

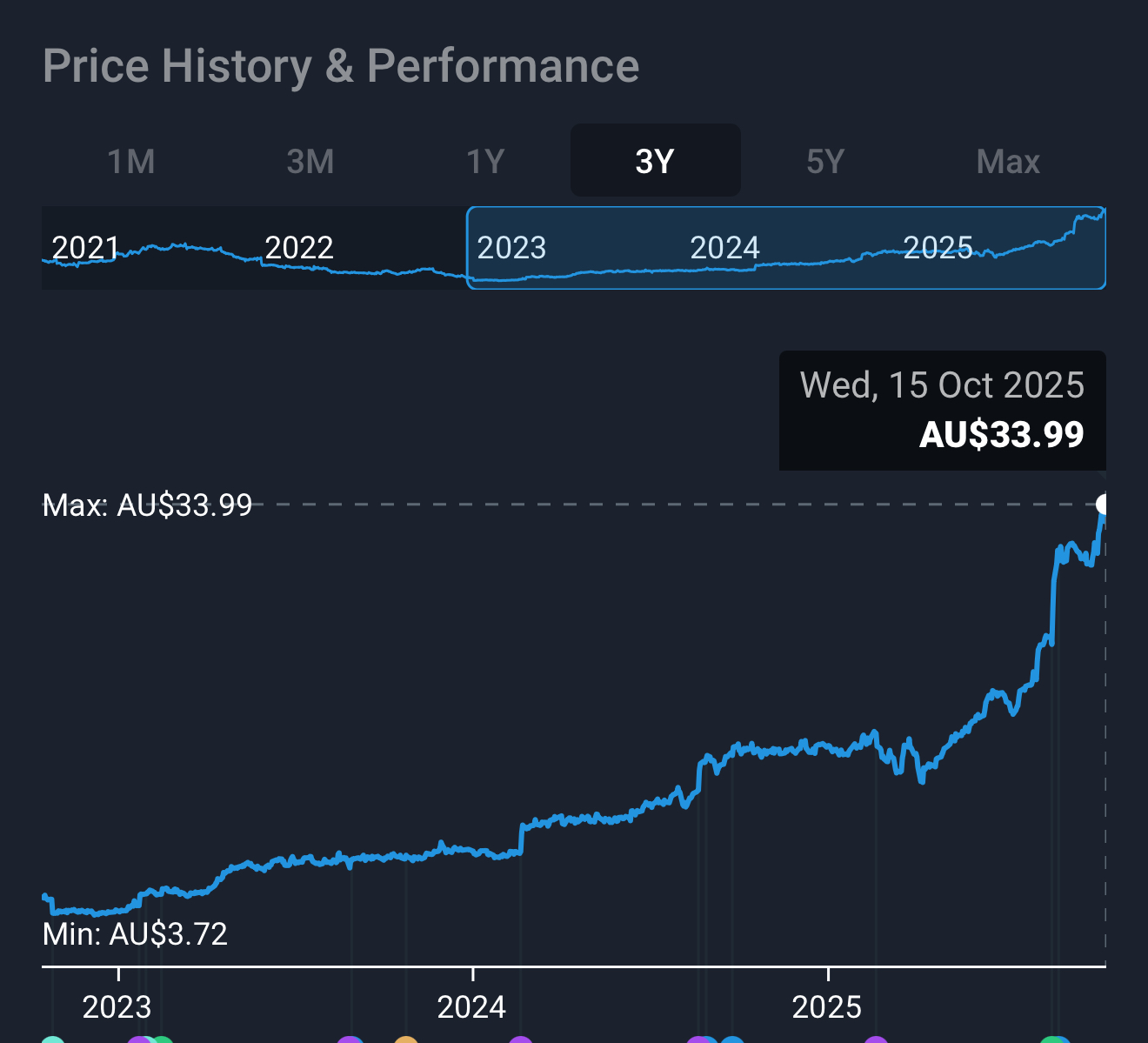

The share price momentum for Codan shares has me gobsmacked! The share price is now 9x its 3 year low back in December 2022. This is when the Minelab sales took a big hit due to the Russian Wagner Group taking over many of the gold mines in Africa, decimating the livelihoods of many of the African artisan gold miners. Back then, Minelab sales in Africa produced most of the earnings for the business. The business has now grown to be much more diversified.

The share price has now passed analyst consensus by $6 per share (12 month consensus of 7 analysts on Simply Wall Street is $28.40 per share).

Codan has definitely been my best ever stock pick, especially when you consider it has also paid fully franked dividends (although the yield has shrunk to less than 1% at these high valuations). Codan still remains my largest holding on SM and our second largest holding IRL despite my attempts to slowly reduce its weighting.

I think it’s very expensive at $34 per share, but in hindsight I shouldn’t have sold a single share! How long do you keep holding a business like Codan when it’s overvalued and on a red hot run like this? Obviously a long time if you are purely a technical investor. There’s a lot to be said for taking notice of the charts in your buy, hold and sell decisions. I’m still learning on this one.

My strategy at the moment is to keep riding with the momentum (while it lasts) while reducing the holding slowly. Codan is definitely riding on the wave of the record gold prices.