Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

This is Morningstar's valuation, not mine. This article makes a similar observation to one I made last week, that the current elevated PE is due to positive sentiment around the themes of high gold price and increased defence spending. There are nonetheless some useful nuggets of information in the article about the Zetron business, its target market, penetration and competition.

I am resigned to the fact that the pendulum will swing, that there will be PE compression in the medium term when the market moves on to the next shiny toy, but as long as the business keeps on growing profitably, that's all that matters to me.

@Rick good report here. Talking about superflated conviction stocks!

CDN in the right theme here.. 'Fremantle Doctor' in the sails..

'Nice one Gary' ( cricket)

Last

$36.83

Change

5.280(16.7%)

Mkt cap !

$5.737B

Debt/Equity: No Big Debt to pay off..

Return on Equity 21.32% growing each year.

Net Profit Margin 15.35% great margin here

Free Cash Flow PS 46

Pe ratio: 50% so priced to perfection!

Return (inc div) 1yr: 135.58% 3yr: 113.49% pa 5yr: 28.17% pa

Codan’s strong trading update today has taken the market by surprise and sent the shares up over 18% this morning. The outlook for FY26 looks to be stronger than analysts were expecting (consensus FY26 NPAT of $136 million) with underlying 1H26 NPAT now expected to be at least $70 million, up 52% on pcp. This is great news for shareholders. However, I think the shares are looking expensive at over $37 per share and I will likely sell a few more. I’ve been saying Codan is expensive for a while now but the share price just keeps finding new highs!

Codan expects its group revenue for the first-half of FY26 to be approximately $394 million* which represents growth of 29% over the prior corresponding period (pcp). Underlying net profit after tax is expected to not be less than $70 million, representing growth of approximately 52% over pcp. These results for the first-half of FY26 were underpinned by outstanding results achieved by the metal detection business and ongoing strong performance in the communications segment.

Metal detection delivered revenue of approximately $168 million which is growth of ~46% over pcp.

This growth was primarily achieved by gold detector sales in the African region, and metal detector sales in other key rest of world recreational markets achieved double-digit growth for the half versus pcp.

The communications segment achieved revenue of approximately $222 million which is growth of ~19% over pcp. This rate of growth is consistent with our stated expectation of growth at the upper end of the 15% to 20% growth target range for the first-half of FY26.

Codan will release its FY26 first-half results on 19th February 2026.

*includes ~$4m in revenue from legacy Minetec business.

Held IRl (8.5%), SM (25%)

According to Andrew Mitchell from Ophir Asset Management, the bull run for Codan is not over yet! Going on today’s record highs, he could be right! (AFR 23/10/2025 https://www.afr.com/markets/equity-markets/missed-the-gold-rush-fundies-tip-where-to-look-next-20251023-p5n4o8)

For Ophir Asset Management’s Andrew Mitchell, the standout pick for investors suffering from a bout of gold FOMO is Codan.

The $6.3 billion producer of metal detectors and drones has been on tear in 2025, surging about 112 per cent amid the raging gold price, and the Russia-Ukraine war.

Mitchell said while Codan had a high price-to-earnings multiple of 60 times, there was still room for growth, given the surging demand for gold detectors and booming global defence spend.

“Codan dominates the metal detector market in Africa at a time when people are leaving farming to go into artisanal gold mining, and that hasn’t yet been fully factored into their earnings,” Mitchell said. “As long as there is war in Ukraine and the gold price holds, it will grow at a really strong clip.”

Apart from some delays affecting the Zeltron business, CEO, Alf Lanniello painted a rosey picture ahead for Codan in his AGM report released this morning.

Outlook

The conditions observed at 30 June 2025 have largely continued into FY26, supporting Codan’s growth outlook across both Communications and Minelab.

Elevated defence spending and ongoing geopolitical tensions continue to support demand across Codan’s Communications markets, with the business remaining on track to deliver 15 to 20% revenue growth for FY26. Growth in the first half is expected to be at the upper end of this range noting that the first half of FY25 included Kägwerks for one month given the timing of that acquisition. Zetron’s business in the US continues to be affected by government shutdowns and funding delays. In September 2025, Codan received purchase orders under the Nett Warrior Program of Record for Kägwerks, totalling approximately $24.5 million, with deliveries scheduled across both the first and second halves of FY26, contributing to overall divisional growth through the year.

Sustained strength in the gold price is maintaining favourable conditions for Minelab, with the level of demand for gold detectors in Africa running above what was seen in the second half of FY25. As a result, Minelab’s overall revenues for the first quarter of FY26 have exceeded the monthly average achieved in FY25 by 16%. While revenues into Africa are typically weighted to the second half, given the strength of current-year first-half revenues, it is too early to determine whether the same seasonality will occur this year.

With continued balance sheet capacity, a renewed $250 million debt facility, and a disciplined approach to capital allocation, Codan remains well positioned to continue investment in the business and pursue future acquisitions that enhance the quality and predictability of its revenues.

Held IRL and SM (slowly trimming)

The share price momentum for Codan shares has me gobsmacked! The share price is now 9x its 3 year low back in December 2022. This is when the Minelab sales took a big hit due to the Russian Wagner Group taking over many of the gold mines in Africa, decimating the livelihoods of many of the African artisan gold miners. Back then, Minelab sales in Africa produced most of the earnings for the business. The business has now grown to be much more diversified.

The share price has now passed analyst consensus by $6 per share (12 month consensus of 7 analysts on Simply Wall Street is $28.40 per share).

Codan has definitely been my best ever stock pick, especially when you consider it has also paid fully franked dividends (although the yield has shrunk to less than 1% at these high valuations). Codan still remains my largest holding on SM and our second largest holding IRL despite my attempts to slowly reduce its weighting.

I think it’s very expensive at $34 per share, but in hindsight I shouldn’t have sold a single share! How long do you keep holding a business like Codan when it’s overvalued and on a red hot run like this? Obviously a long time if you are purely a technical investor. There’s a lot to be said for taking notice of the charts in your buy, hold and sell decisions. I’m still learning on this one.

My strategy at the moment is to keep riding with the momentum (while it lasts) while reducing the holding slowly. Codan is definitely riding on the wave of the record gold prices.

In regards to the FY results of Codan noted below:

Group results: Revenue $674.2m (+22%), EBIT $146.0m (+28%), NPAT $103.5m (+27%).

Cash generation: Operating + investing cash flow (ex-acquisitions) $146.6m (vs $106.5m FY24).

Dividends paid: 24.5c fully franked (12.0c final paid Sep-24; 12.5c interim paid Mar-25)

With a FY NPAT of $103.5 Million and earnings per share of $0.571 per share and using a PE of 40 which is a lot more than I would ever use gives us a valuation of $22.84 per share.

I know that CDA are starting to improve sales and their unmanned systems are moving ahead but still feel this is considerably overvalued at its current price of around $30, though I won’t be selling anytime soon in either my Strawman or actual portfolios as it is a definite Hold for me at the moment.

I was obviously wrong about Codan, when I said it was overvalued at $20.41. Fortunately, I do take more notice of the charts than I have previously and I have only sold a small portion of our holding IRL. However, I do primarily focus on the fundamentals and I will be reviewing our holding following the FY25 results.

For now my focus is elsewhere. My Mum passed away this week. Life changing events like this make you reflect on what is really important in life.

For now I’m happy to accept Bell Potter’s view shared by James Mickleboro from The Motley Fool https://www.fool.com.au/2025/08/22/up-20-in-2-days-are-codan-shares-a-buy-hold-or-sell/

“Codan Ltd (ASX: CDA) shares were on fire again on Friday.

The metal detector company's shares ended the session 8% higher at $28.34.

This means that its shares are now up 20% in the space of just two days following the release of its full year results.

Does this make it too late to invest? Let's see what Bell Potter is saying about this stock.

What is the broker saying?

Bell Potter doesn't appear surprised to see Codan shares rocket following the release of its full year results.

It notes that the company delivered a result well ahead of the market's expectations. It said:

CDA recorded FY25 group revenue of $674.2m (+22% YoY) ahead of both BPe (+7%) and VA consensus (+5%). Comms segment revenue ($413.5m) grew 26% YoY (BPe 21%), including organic revenue growth of 19%, well above the targeted range of 10% to 15%. Metal detection revenue ($258.4m) grew 16% YoY and 21% HoH, which was a major surprise considering management had previously flagged a 2H result similar to the 1H.

Group EBIT of $146.0m (+28% YoY) was again ahead of BPe/consensus and NPAT ($103.5m) grew 27% YoY. This strong performance delivered diluted EPS of 57.1c and a full-year dividend of 28.5c. CDA had a cash balance of $39.7m at 30-Jun25, and the net-debt position reduced to $78.3m.

A key driver of this outperformance was its unmanned systems (drones). This was supported by strong demand for metal detectors in Africa. It adds:

A key factor in CDA's strong performance was DTC's unmanned systems, which delivered ~$100m in revenue during FY25, more than double the FY24 result. Further, Minelab Africa sales rebounded to grow 54% vs 1H25 on the back of improved market conditions, with political instability in the region a key risk to Minelab performance. The growth in these areas more than offset slightly lower growth in the Zetron business than we forecast.”

Should you buy, hold, or sell Codan shares?

According to the note, the broker thinks that Codan shares are fully valued following its strong run.

This morning, Bell Potter retained its hold rating and lifted its price target materially to $27.80 (from $17.25). This is largely in line with where its shares are currently trading.

Commenting on its hold recommendation,

We have upgraded our revenue forecasts in-line with outlook targets of FY26 comms growth of 15% to 20% and longer-term segment growth of 10% to 15%. We now forecast FY26 group revenue of $772.6m (+14.5% YoY), EBIT of $182.9m and NPAT of $131.2m. Our EPS changes are +19%/+14%/+13% in FY26/FY27/FY28.

We have reduced the WACC we apply in the DCF to 9.7% and increased our EV/EBIT multiple to 30.0x to reflect the positive outlook and increasing defence exposure. Our updated PT of $27.80 is a <15% premium to the current share price so we retain our HOLD recommendation.

Held IRL and SM

Update - 22/08/25

Assuming a market cap of just under 5b, Codan are currently trading on a forward PE of around 44x and a P/S of 8x. This indicates some lofty expectations in future growth. A quick and dirty DCF over a five year period, using a net margin of 15% and 20% YoY revenue growth, with a discount rate of 10%, returns a share price of around $16.

UPDATE - 18/08/22

While I still have some digging to do, their full year results look darn impressive. The business has also trumped the projections I made below. While CapEx came in slightly higher than I anticipated (-25.8m), cash flow from operating activities was higher than the business projected, at 51.7m for the full year.

That has resulted in a FCF of almost 26m, which blows my 8m forecast out of the water. As for my other projections, net income was 100.7m (I forecasted 105m), while revenue was 506.1m (I forecasted 510m).

This was after a very ordinary H1 FY22 by Codan, who invested heavily in inventory and recorded a cash outflow of -12m (very rare for them). It also means their second half delivered in excess of 60m in cash flow from operating activities. Impressive.

As for the outlook, the business has warned Minelab's sales 'may not' reach the level achieved in H1 FY22, but they expect a strong H2. As for communications, an existing order book of 150m suggests plenty of demand for their services, noting total revenue from this portion of the business was 241m in FY22. Sales and implementation is much slower here, but these numbers are positive and suggest another strong year ahead.

As for my valuation, my FCF projections are starting to look increasingly conservative, but I will leave these for the time being and wait for the the H1 update to see how they are tracking.

I said it two months ago when the business was trading at around $7.00, and I will say it again as they trade around $8.50-9.00, I still think the risk/reward proposition is attractive at these levels.

_____________________________________________________________

June 2022

I figured now would be a good time to post my valuation of Codan (CDA) following the recent meeting with Alf -- the new CEO.

Disclosure, I hold in my super account. I will slowly start to take a position on Strawman to reflect my interest in the company.

Codan are impressive. I think the new CEO is no different and I was impressed by his conduct during the recent meeting. Currently, the business maintains a gross margin of more than 50%, with a net profit margin of around 20%. Their return on equity is equally impressive, at 30%. Even if this drops to the 20% range in the next 3-5 years like some analysts forecast, this is still more than most businesses (comfortably), let alone the industry they operate in. Lets take a look at their recent cash flow history:

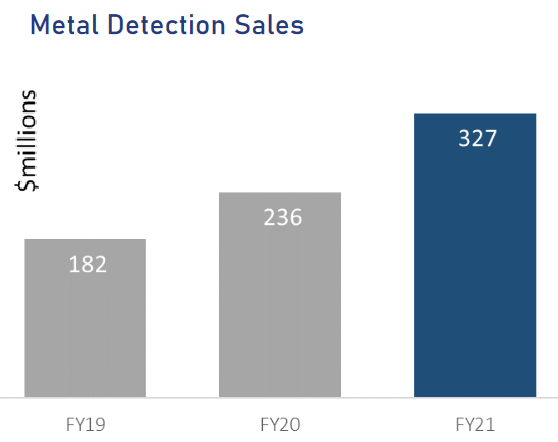

Codan has been a cash generating machine for the better part of 5 years. They have consistently generated increased cash flows since 2019, which has in turn seen their bottom line grow at impressive levels. See below, noting I have provided figures for FY19, 20 and 21.

They also pay an attractive dividend – the yield having steadily increased since 2015. (2% to 4ish% over that time).

Within my DCF, I have forecast FY22 results, made easier by the H1 report and the recent trading update which shared some light on cash flows and profit. On the face of it, H1 was a shocker. The cash flow machine that is Codan invested heavily in increasing inventory levels. This coincided with entering the FY with negative working capital having paid large customers to secure supply. This had a significant impact on cash flows, which went into the negative (to the tune of -12m). This was a big deal for Codan, having traditionally generated significant cash flow from operations. This further terrified an already terrified market. Consequently, they have been absolutely battered (share price wise) over the previous 12-month period.

But here lies the opportunity. At these levels, I think the risk reward proposition is an attractive one. The recent update, to the relief of shareholders, indicated Codan will again make record profits in FY22, with more than 41m being generated from operating activities in H2. They are also sitting on a heap of product, which will further reduce outgoing investment required in FY23. This should again benefit their bottom line nicely, but patience is required to see this play out.

Like Alf stressed, this is a more diversified, balanced business than it was a few years ago. Their acquisitions (which all appear to have added genuine quality to the business) have enabled this, increasing their competitive advantage and widening their moat. This is more than ever a business with pricing power, supported by their own IP – protected by encryption and just generally sophisticated by nature. It would be very difficult for new business to enter the space and compete -- there are innovation, technology and economic factors preventing this being easy.

Within my DCF, I have used a standard discount rate of 8.4%. I have projected FY22 net income of 105m, revenue of 510m and FCF of 8m. For the next four years, I think free cash flow will return to the 100m+ range, provided they keep their CapEx under control. I have gone with steady 8m+ increments per year, commencing in FY23 (at 110m) and ending in FY26 (at 134m). I think this is more than achievable. I reach a CV 2.24b. Divide this by shares outstanding (180m) and I reach a currently valuation of $12.40.

For a more traditional valuation, Codan is currently trading on an undemanding P/E of 12x. Simply Wall Street’s DCF reaches a fair value of around $14, while another tool I use (Finbox) shows a fair value of $9.90. I think whatever metric/process you use to value this business, most would arrive at the conclusion that shares are currently trading on a discount.

Ahhh dear, this was nice and humbling. For context, I sold 60% of a very concentrated position last month (with the share price just over $20). This followed 2x previous sales of my position at $15.00. With all of this, I am left with a remaining position of around 25% of my initial position holding.

In my wisdom, my decision making was based on shares having run too high. At each point, the market cap had reached 3b, and then 4b. This is a brilliant business – one of my favourite on the ASX in fact – but everything has a price. Well, well done Rocket6, you have missed a heap of upside and a stock that looks like it is now being driven by both fundamentals and ‘momentum’, a powerful force on the share market that knows no bounds!

Codan released their FY25 results yesterday. My favourite PA has summarised the results for me. See below:

- Group results: Revenue $674.2m (+22%), EBIT $146.0m (+28%), NPAT $103.5m (+27%).

- Cash generation: Operating + investing cash flow (ex-acquisitions) $146.6m (vs $106.5m FY24).

- Dividends paid: 24.5c fully franked (12.0c final paid Sep-24; 12.5c interim paid Mar-25).

Segments

- Communications (DTC, Zetron, Kägwerks): Revenue $413.5m (+26%); segment profit $107.9m (+34%); orderbook $253m (+28%). Targeting ~30% segment margin by end FY27. Kägwerks contributed $24m revenue in 7 months post-acquisition.

- Metal Detection (Minelab): Revenue $254.8m (+16%); margin 39% (up from 35%). Africa ~$115m revenue; four new products slated for FY26; Gold Monster 2000 soft-launched for Q1 FY26.

Outlook (management commentary)

- Communications targeting 15–20% FY26 growth with ~$155m already in the orderbook as at 30 Jun; Minelab expecting growth with four FY26 launches and supportive conditions.

What our good friend Chat GPT didn’t include above is EPS (which was 57.1c) – a 27% increase on FY24 – which quite frankly is remarkable. All main profit/revenue metrics increased between 20-30% YoY.

As above, re: their segments, it is their comms business that is doing the heavy lifting – which has been a focus of management to diversify their business operations and reduce reliance on a cyclical metal detection market. While they have done this in a remarkable way, they are also now a truly global operation with a diversified customer and revenue base – selling their products in more than 150 countries, with 15 sites across 10 countries. No one continent is responsible for more than 50% of revenue.

In fairness to what is now several terrible decisions to sell, shares are NOT cheap. Assuming a market cap of just under 5b, they are trading on a forward PE of 44x and a P/S of 8x. This indicates some lofty expectations in future growth. A quick and dirty DCF over a five year period, using a net margin of 15% and 20% YoY revenue growth, with a 10% discount rate, returned a share price of $16.

If we increase revenue growth expectations to 30% YoY, only then does the share price range reach around $25.00. Just to clarify, it is very unlikely they achieve this – management are guiding for 15-20% from comms for FY26, and a good year would be 25%. A wonderful business, but an overpriced one.

Three years ago I started writing about Codan on Strawman. Back then Codan was well and truly in the dog house! I found this old straw I penned at the time, #History repeats. Here is an extract from the straw:

“I’m a newcomer to Codan, having bought my first shares in January this year. However, for those who have held Codan for more than 8 years, you might be feeling an uncanny sense of déjà vu right now. I found this article from June 2014 (copied below). As you read through this article you could be forgiven for thinking you were in an 8 year time warp. The question on my lips now is…will history continue to repeat itself over the years ahead?

Following an 80% fall from its peak share price in April 2014, it took 5 years for Codan to reach its former peak, and then 2 years on from that the share price was more than 5 times higher than it’s former peak. I’d be happy with that!”

Well, guess what…Codan has done even better this time around! This time the share price is 5.5 times higher than its low of $3.72 just 2.5 years ago! Am I happy with that? You bet I am! But what now? Is Codan expensive? I would say yes and I’ve been taking some profits off the table.

Codan is still a high quality business. ROE is still good and improving (forecast 23%), but not as good as it was before the Russian Wagner Group all but destroyed the artisan gold mining industry in Africa. Metal detector sales dropped dramatically because half the metal detectors were being sold to African villagers.

Source: Commsec

Codan management were quick to focus their attention to growing the communications business, which they have. By FY26 Codan should achieve record EPS of approx 65 cps. That puts the current Codan share price ($20.41) on 31 x FY26 earnings. Earnings are forecast to grow at 15.7% and it has a net debt to equity of 25%, which has been increasing with acquisitions over the last 3 years.

So is it expensive? Here is a PE chart of Codan over the last 5 years. I think 31x FY26 earnings is getting up there!

Source: Simply Wall Street

Using McNiven’s formula and assuming forward ROE of 23%, current equity of $2.74 per share, 50% of earnings reinvested, and dividends paid at 1.6% fully franked, I come up with a forecast annual return of 7%. That’s probably OK for a very high quality low-risk business. I’m not sure Codan fits that category.

What do the analysts think? The consensus 1 year target price from 7 analysts on Simply Wall Street is $18.15. So the share price looks expensive here too.

Despite all this I don’t think there is a hurry to sell Codan in a big hurry either. I’m not an expert on technicals, but I think the chart still looks OK, and we all know the chartists rule! Just look at what happened to CBA…until it didn’t!

Of course the fundamentals will override everything when Codan delivers its FY25 financial results in August. Only time will tell.

Held IRL 10%, SM 25.5%. Reducing.

Scroll down for latest update...

August 2019: $4.77 was my 12-month PT, based on increasing gold detector sales, based on an increasing gold price, based on Trump primarily. . . . . .

24-Feb-2020: CDA Blew through my $4.77 PT quite quickly and went all the way to $8.49 (this past Friday). They're just under that now. I think $7 is a reasonable PT for them now. They're over that, but they have warned that the 2nd half will probably be softer because they probably won't be able to land another two large communications contracts like they did in the first half of FY20.

Their gold detector sales (their Minelab business) will keep kicking goals, but the extra detector sales may not be enough to compensate for lower earnings from their communications division, which can be quite lumpy depending on contract timing and the sizes of various contracts. All in all, I'm happy to keep holding Codan shares, but I've been trimming them, and I wouldn't be buying Codan up here.

23-Apr-2020: Lowering my 12-month PT for CDA to $6. Higher gold prices are a tailwind, but COVID-19-related restrictions are a definite headwind in the short to medium term. There's probably scope to increase that PT again later, and I still hold Codan, which were bought at much lower levels, but I think it's prudent to alter my PT and say that they look reasonably fully valued again here considering the current operating environment.

Good company. Good Culture. Good Products. Good Management. Most of that's already in the share price however.

01-Sep-2020: Codan is a company that just keeps on exceeding my own expectations, so I'm very glad that I hold them, and that I've held them for years Their FY20 report was another cracker. They beat all of their own previous records. They increased their final dividend by +47% (from 7.5c to 11 cps - fully franked of course). They make the best (Minelab) gold detectors in the world. Their communications division is also firing on all cylinders. They are Adelaide based (which makes two of us). And they keep creating excellent products which appeal to a global population that want to own and use the best available gear. I only have ONE regret with Codan, which is that I NEVER, EVER added them to my Strawman.com Scorecard...

02-Mar-2021: UPDATE: Increasing my PT (price target) to $17.20 now. Codan had a brilliant report on Feb 18th, after announcing a good acquisition two days earlier which strengthens their communication division significantly. They are acquiring US-based Domo Tactical Communications (DTC), from a Private Equity company. DTC is an established technology provider for high bandwidth wireless communications with specialist capabilities in MIMO Mesh networks (next generation software defined networks where multiple antennas stream data to and from devices across a network that is self-forming and self-healing). DTC is a trusted and long term supplier into more than 20 key United States government agencies as well as the “Five Eyes” intelligence communities. DTC’s MIMO Mesh products provide wireless transmission of video and other data applications to predominantly first world customers, including Military and Special Forces, Intelligence Agencies, Border Control, First Responders and Broadcasters. DTC is headquartered in the US, with locations in the UK and Denmark and has around 40 employees. The acquisition comprises an upfront payment of US$88m (approx. A$114m), with the possibility of an additional payment of up to USD 16 million if certain earn-out targets are achieved in calendar year 2021. The acquisition is on a cash free, debt free basis and is expected to complete by 30 April 2021, subject to a number of US and UK regulatory conditions typical for transactions of this nature. In the first full year of Codan’s ownership, DTC is expected to contribute approximately A$90m of sales, A$14m in EBITDA and A$9m of profit before tax (PBT). It will be earnings-per-share accretive from day 1. As a result of the transaction, Codan will acquire total assets approximately equal to the purchase price with no change to Codan’s shareholder equity. The acquisition will be fully funded from existing cash reserves. All good. Onwards and Upwards!

UPDATE - 31-Aug-2021: Codan have spent most of the past 5 months trading at or above my last (most recent) $17.20 price target, which I set back on 02-Mar-21 when Codan was trading at $14.93. They shot through my $17.20 PT in the first week of April, so 1 month later, then seemed to use it as some sort of support line for about 4 months before falling away in the 2nd half of August, since they reported on August 19th actually. I'm still holding Codan shares in RL. They've been one of my best performing investments over the past 3 years and 1 month. My average buy price was $2.88 (in July 2018). Codan have been sold down on their latest result, based on two factors. I believe the first one is the main one, which is that Donald McGurk, their CEO & MD has informed the board of his intention to retire within 9 to 12 months after a suitable replacement has been found. Mr McGurk is the main driver behind the very positive collaborative company culture that enhances their growing competitive advantage in metal detection - they own and manufacture Minelab metal detectors (who make the best gold detectors on the planet). They also have a communications business that provides around one quarter of their annual revenue. Donald is also a fine manager in many other respects, including with sensible capital allocation, and more specifically making good targeted strategic acquisitions and not overpaying. He will be missed, but Codan is more than just their CEO/MD. The second reason is that they have warned that due to recent developments in Afghanistan, they are aware that planned sales into Afghanistan of communication equipment will likely now not go ahead. For context, around 2% of their total FY21 revenue came from sales into Afghanistan, but that was around 9% of their communications division sales. I don't consider this to be particularly material seeing as Comms is not their main money earner - Metal Detection equipment is - and Codan have demonstrated in prior years that they can develop new products and sell into new markets. If Afghanistan is closed to them, they will concentrate their sales efforts elsewhere. It's not a thesis-breaker in my view. Another thing to keep in mind is that Codan thrive when the gold price is high, so it's something to keep in mind. The higher the gold price goes, the better they will do in terms of gold detector sales, which is their main revenue-driver. I hold Codan, and it helps that I'm also a gold bull. Codan has proved to be a great pick-and-shovel play on the gold industry, and on the gold price rising, or staying up at elevated levels as it has. I wouldn't be buying up here, they still look expensive, but I think they'll get even more expensive when gold goes for another run, and I'm therefore setting a new 2 year price target of $19.70 for Codan. So that's a PT of $19.70, by September 2023.

25-Jan-2022: Update: No change to price target. $19.70 by September 2023. However, when I typed that bit directly above about not buying them "up here", the SP was still over $15/share. They're now back under $10/share and I have been buying more Codan sub-$10. However, after today's positive Trading Update they might be back over $10 soon, if not by the close of trade today.

Noddy summed up my thoughts perfectly in his "Trading Update" straw this morning.

Ex-MD Donald McGurk above. New MD Alf Ianniello, below, pictured in his previous role as boss of Packaging firm Detmold Group. Codan and Detmold are both very successful Adelaide based companies.

Disclosure: I still hold Codan, and have been adding to my position sub-$10/share, and I have also recently added them (finally) to my Strawman.com portfolio.

18-Sep-2022: Update: I do hold this one. And I'm very bullish on them from here. They look very oversold, but I admit it could take time for the market to start getting interested in them again. The gold price hitting a new two year low earlier this week hasn't helped their cause either. They have indicated that they expect the bulk of their growth to come from their Communications (Comms) Division during the next year or two, and that makes sense, and they still make the best gold detectors in the world, and I can't see anyone taking that title off them any time soon, so when the gold price does go up again, by enough, their Metal Detection division will resume its growth also. I won't write much on them now, as I've written plenty about them previously, and there's not to much to add to that.

For now, I'm being realistic and taking my target price for Codan down to just under $10. In 5 to 10 years they could easily be trading at $20/share, perhaps sooner, but that could realistically take 5 to 10 years, so my current 2 year price target for CDA is now $9.70, so by mid-September 2024.

26-March-2023: Update: Yeah, this one has been marked as stale, so I'm refreshing it. No change to my $9.70 PT for CDA. There was nothing worrying in their H1 report for FY2023. In fact, it reassured me that the thesis was still on track. Quality company. Quality products. Good Management. Good capital allocators, especially when it comes to M&A - they tend to pay a fair price for strategic assets that add to their business and make it better. Which is what you want.

Their Metal Detection (Minelab) business has taken a back seat to their Comms business this year, which is good - to see the Communications division perform so well, however Minelab is far more than just gold detector sales into Africa. Minelab will grow sales as well in future years. A rising gold price won't do them any harm either!

10th October 2023: Update: Yeah, still good! Comms Division is flying! Metal Detection division (Minelab) will experience growth again soon enough, with or without Africa, Afghanistan, Russia, etc, etc. Happy to maintain a $9.70/share price target for now - they're getting up there:

The Codan share price (SP) has doubled in the past 11 months from just over $4/share to close at $8.18/share today. I believe the recovery will continue.

27-Apr-2024: Update: Yeah, the recovery DID continue; here we are with an SP up around $11/share now. I've raised my TP to $10.75, which is higher than my old one but below the current share price, because I think Codan may possibly have overshot to the high side again now. They tend to trend well, both up and down, and they get oversold, and occasionally overbought as well, which is where they are now I reckon.

Their most recent half year report (H1 of FY24) showed that Comms is still firing and Minelab (Metal Detection) is coming back too, without too much assistance from Africa, so - as I have been saying all along - I thought that the problems in West Africa - and Africa is general - were not a company killer, or even that serious for their Minelab division in the long term.

There will always be headwinds in various parts of the world for a company like this, but when you make the best gold detectors in the world and some of the best communication equipment (encoded radio and wireless video transmission equipment being just two examples) in the world, these sort of setbacks or obstacles will only ever be temporary in terms of the overall growth trajectory.

Above all, even with the change of CEO/MD, Codan still have very good management who are disciplined and make sensible and strategic capital allocation decisions. They also don't sit on their hands or rest on their laurels; they are always innovating and developing new and improved tech and releasing new models across both of their two divisions (Comms and Metal Detection).

I wouldn't be buying more Codan up here at over $10.50/share; in fact I have been taking some profits, but Codan remains one of the largest positions across my real money portfolios, and they are currently my fourth largest position here on SM, behind LYL, DVP and GNG and just ahead of my two favourites goldies, NST and GMD, but I do have a sell order in to trim the CDA position a bit more, so that may move them down a few positions.

My MO is to ride these high quality stocks up from oversold to overbought and then to take some profits and rotate that into some other companies that are oversold in my opinion. But I like to keep a core position as a general rule, not sell out completely, just tinker around the edges.

This is particularly necessary here on SM, because we have a fixed pool of capital that we can't add to except by capital gains and dividends or distributions, so it's always a good idea to rotate money out of stocks that have run hard and slowed down into stocks that have the potential to do the same with the right conditions.

However it's important to not keep moving down the quality curve in search of value, because it's the higher quality companies that tend to run the hardest from being oversold, in my experience, once they do start to run, because people remember the good old days; past investors are often eager to jump back onboard a ride they associate with happy past memories when it starts heading in the right direction again.

And also, sometimes, just when you thought a company was fully priced or better, they find another way to grow. NCK is a recent example.

22-August-2024: Update: Yeah, they keep growing all right!! No longer holding this one in real-money portfolios, and reduced my exposure here yesterday thinking that there was perhaps too much optimism priced in up near $13/share. Well, they've been up over $14.50 today on the back of these results and they're still trading at over $14 now (at about 2pm Sydney time) so the market has not only realised that Codan's metal detection issues are now behind them, the market is also now re-pricing Codan as a growth stock again, which means they don't look cheap.

They didn't look cheap yesterday, and they certainly don't look cheap today, but you can do worse than back a quality management team like this one.

I believe they can now go higher from here now, because the market is no longer concerned about any aspect of this company. I'm still not buying here, but I am holding CDA in my Strawman.com portfolio. It's one to buy on a pullback, if we get one, but we're certainly not getting one today!

Codan FY2024 Results Announcement

Because of their higher share price, the increased dividend (12 cps final div compared to 9.5 cps pcp) still puts them on a very low dividend yield - of around 1.6% (22.5 cps p.a. divs when you add the 10.5 cps interim to the 12 cps final div declared today vs an SP of $14.14 right now) but you don't buy Codan for income - you buy them for growth. That's what the market's telling us today.

17-Nov-2024: Update:

Reviewed, and Codan has been sitting above my old $14.77 price target and are trading sideways, or within a narrow range anyway, around or just below $16/share.

It seems the hype has has come out again and they're just trading as a quality company rather than a quality company that is growing at a rapid rate.

They're back on track now, and the market is no longer worried about them losing sales, such as they were in 2021 and 2022 in Sudan and other parts of West Africa, Russia and Afghanistan. It was a converging storm of issues across those countries a couple of years ago that caused them to confirm they would not be making Minelab sales there in the foreseeable future, and in the case of Afghanistan it was CDA's Comms equipment sales (secure remote communications solutions) that would cease there after the Taliban took back control of the country as the USA pulled out.

I said at the time they would find other ways to grow, and other places to grow sales into, and they did. They expanded their Comms division to the point where it became their largest revenue earner, and they kept innovating with Minelab so they have remained best-in-breed for gold detectors and mine detectors.

Anyway, that's old news. Since my last update here - after their FY24 results in August, they announced that they were being added into the ASX200 index from September 26th (2024) - Virgin-Money-UK-PLC-to-be-removed-from-the-SPASX-200-Index-and-Codan-to-be-Added.PDF and then in late September they announced another good strategic acquisition, of Kägwerks, a global leader in tactical operator-worn networking communications technologies that enable connectivity and integrated secure networking in a military environment. Another good add-on for their Comms division. I posted a straw here about that at the time of the acquisition. Here's the Acquisition-Announcement.PDF.

They then held their 2024 AGM on October 23rd - here's their Chairman's Address and CEO's Address from that AGM.

No causes for concern, however they look reasonably fully priced up here to me - I don't think they're worth more than $16/share until we get more positive news. They remain exposed to geopolitical risks in their markets around the world - but hopefully if we do get some global issues in one or more of their markets punters now won't overreact to the same extent as they did in that July '21 through December '22 period where the CDA SP dropped -80% from $19.33 down to $3.80/share.

Sure they were a little overbought at over $19/share in June 2021, but they were also VERY oversold at below $4/share in December 2022. I was buying at around $10 all the way down to below $4.

Up around $16/share is probably a fair price, so while I'm still holding some here, I lightened on the way up, and I sold out of Codan completely in June this year in my real money portfolios, at about $4/share below where they are now, so clearly I exited too early. I thought I'd found something better to invest in but I would have been better off leaving my money in Codan, with the benefit of hindsight, through until they hit $16 in late September anyway.

From here they'll probably move with the market absent any company-specific news, until we get their results FY25 H1 results in February. However if we get a guidance upgrade or downgrade from them between now and then and/or another acquisition announcement, that would certainly change things. But without that it's probably more sideways than up until Feb.

Disclosure: As at 17-Nov-2024, I'm still holding CDA here, but not currently in any real money portfolios.

Sunday 15th June 2025: Update:

I'm not holding this company at this point in time, other than a small legacy position here on SM - not holding in any real money portfolios.

Codan remains a Quality Company with Quality Management.

However, they are also not cheap up here:

So I would be buying Codan on a good pullback, like below $12/share, but I'm not paying over $16/share.

And they're up at over $19 now.

This is one of those "Quality always rises back to the top - like cream - when everything stops getting shaken up by volatility and negative sentiment" companies. And they've risen back up now, so not a "buy" for mine up here.

Of course, they can grow into their current valuation, and then be worth more, which is what some investors are clearly betting on, but I am seeing better opportunities elsewhere right now, just from a pricing perspective. Nothing wrong with this company, just too expensive for mine.

I don't follow Codan much, so I don't know if this is common knowledge, but the uni I work at (Adelaide) is offering a PhD scholarship funded by the company.

A lot of these type of scholarships are just philanthropic efforts, where the PhD project has to be in some vaguely-defined area related to whoever is funding it. But this one seems quite specific.

It looks like they want to attach one of their metal detectors to a semi-autonomous robot that can then go off and find stuff. As I said, I don't follow the company, so maybe already have some of these things, or maybe this a new project for them. In any case, they seem to be serious about it, as one of the PhD supervisors is their Chief Scientist (Phil Wahrlich), and the student needs to do 3 month internship at the company.

Anyway, I thought this might be interesting if you follow Codan.

Market Cap at $15.83 is $2.874B

Management Bio

Graeme Barclay MAICD, F Fin, CA, MA (Hons) Chairman

Graeme is a former CEO and Chartered Accountant with more than 35 years’ experience in professional services, investment banking, broadcast infrastructure and telecommunications.

Over the past 20 years Graeme has held Executive Chairman or Group CEO roles at BAI Communications, Transit Wireless LLC (New York), Nextgen Networks, Metronode data centres and Axicom group (formerly Crown Castle Australia), and for 8 years during this period was also an executive director in Macquarie Group’s infrastructure team. In these roles, Graeme was responsible for all aspects of strategy, M&A, sales and business development, contract delivery and operations, as well as implementing the appropriate capital structure and raising equity and third-party debt for these businesses in Australia, UK, Hong Kong, Singapore, Canada, USA and New Zealand.

Over the past 20 years in these businesses, Graeme led and completed more than 20 acquisition and divestment transactions including the sale of Nextgen Networks to Vocus for $820 million in 2016 and the sale of Metronode to Equinix for $1.04 billion in 2018. In his role as Chairman of Uniti Group Limited (ASX: UWL), he led the company from a market capitalisation of $30 million at IPO in February 2019 to the successful divestment via a Scheme of Arrangement to a consortium of investors led by HRL Morrison and Brookfield Asset Management at an enterprise value of $3.8 billion in August 2022.

Included in his prior board appointments are: Arqiva Limited (institutionally owned UK telecommunications infrastructure group), Chairman of the main board and of the Audit and Risk committee for Nextgen group (Ontario Teachers’ Pension Plan majority owned fibre network and data centre owner), NED and member of the Audit and Risk Committee of Axicom Group (institutionally owned mobile tower operator), and Chairman of Uniti Group Limited (ASX:UWL) (fibre to the premise network owner).

Graeme was appointed to the Codan board in 2015 and became Chairman in February 2023.Graeme holds an honours economics degree, is a Chartered Accountant, a fellow of FINSIA and a member of AICD.

Alf Ianniello - Managing Director and CEO

Wharton GCP, GradCertMgmt, BEng(Electronics)

Alf joined Codan as the Managing Director and CEO in January 2022, bringing with him extensive international experience in the packaging, defence and automotive industries.

Prior to this appointment, Alf was CEO of the Adelaide-based Detmold Group for 14 years and has held board positions with SME’s, Tertiary Institutions and Local Government.

Alf attended the Wharton Business School Global CEO Program at the University of Pennsylvania in 2012. He also holds a Graduate Certificate in Management and Bachelor of Engineering (Electronic Engineering) from the University of South Australia.

Kathy Gramp BA (Acc), CA, FAICD Independent Non-Executive Director and Chair of Board Audit, Risk and Compliance Committee

Kathy was appointed to the board of Codan in November 2015. She has had a long and distinguished executive career and over 24 years of board experience across a diverse range of complex organisations and industry sectors. She has significant experience as Chair of Audit & Risk Committees.

Prior to joining Codan, Kathy was CFO of Austereo Ltd. She joined Austereo in 1989 and retired in June 2011. In that time the company grew from 2 radio stations to the largest commercial radio network in Australia, and the leader in Digital and Online Media. Leadership roles and responsibilities included business planning & re-engineering, debt & equity raising, acquisitions & integration, capital investment, major IT projects, corporate governance, risk management, financial management, tax & accounting, change management and investor & key stakeholder relations. Further experience was gained through exposure to international markets such as Greece, UK, USA, South Africa, Argentina, Malaysia, and New Zealand.

Kathy was a Director of Uniti Group Limited (ASX:UWL), Chair of Audit & Risk Committee and member of the Nomination & Remuneration Committee until August 2022. Uniti, a diversified provider of telecommunication services, listed in February 2019 and through acquisition and organic growth, increased its enterprise value from around $30 million at the time of listing to $3.8 billion in August 2022 when the business was sold to a consortium of financial investors. She is a Director of QANTM IP Limited (ASX: QIP), appointed 11 May 2022 and also serves as Chair of the Audit and Risk Committee. QANTM is the owner of a group of leading intellectual property and trademark services businesses operating in Australia, New Zealand, Singapore, and Malaysia.

Kathy holds a BA Accounting, is a Chartered Accountant and a Fellow of the Australian Institute of Company Directors and is a member of Chief Executive Women.

Sarah Adam-Gedge BBus (Acc), CA, GAICD, Member IoD (NZ) Independent Non-Executive Director

Sarah was appointed to the Board in February 2023. She has expertise in digital and technology businesses with an executive background that includes 12 years at IBM Global Business Services, and 8 years as CEO of Avanade Australia, Publicis Sapient Australia and Wipro Limited Australia and New Zealand.

Sarah has extensive international experience as a result of leadership roles in global information technology companies, and significant experience driving growth initiatives, working with customers and in different markets. Prior to joining IBM, Sarah was a Consulting Managing Partner at PWC, and Audit and Business Consulting Partner at Arthur Andersen. Sarah is a Chartered Accountant and graduate of the Australian Institute of Company Directors.

She is a Director of Austal Limited (ASX: ASB) where she serves as Deputy Chairman, Chair of the Audit and Risk Committee and is a member of the Nomination and Remuneration Committee. She is also on the board of Cricket Australia as a member of the Audit and Risk Committee, and the National Aboriginal and Torres Strait Islander Cricket Advisory Committee.

Heith Mackay-Cruise BA (Econ), FAICD Independent Non-Executive Director

Heith was appointed to the Board in March 2023 and has been involved in the media, education and technology sectors over the past 25 years.

Heith is currently the non-executive Chair of Straker Translations Limited (ASX:STG), a global artificial intelligence and machine learning business, and a non-executive Director of Southern Cross Media Group Limited (ASX:SXL) where he is a member of the Audit & Risk Committee and Chair of the People & Culture Committee. Heith is also a non-executive National Director of the Australian Institute of Company Directors.

Heith is a previous non-executive Chair of LiteracyPlanet, hipages Group (ASX:HPG) and the Vision Australia Foundation as well as a previous non-executive Director of LifeHealthcare and Bailador Technology Investments (ASX:BTI). In Heith’s prior executive career, he was the founding CEO of Sterling Early Education, the Global CEO and Managing Director of Study Group, and CEO for PBL Media New Zealand. Heith also held senior executive positions with Australian Consolidated Press and worked in sales and marketing roles for PepsiCo around Australia.

Heith is a mentor with Kilfinan Australia, a Fellow of the Australian Institute of Company Directors and has a Bachelor of Economics degree from the University of New England.

Leadership Team

Ben Harvey - Executive General Manager, Minelab BA, MBA, AMP

Ben joined Codan in 2017 as the Minelab Vice-President, General Manager for the Americas and Europe, driving significant and sustained growth across several channels.

Ben brings a wealth of commercial acumen to Codan as evidenced by his more than thirty years of experience spanning Fortune 500 leaders such as Newell Brands and Masco Corporation, as well as private equity and entrepreneurial organizations. During his career, Ben has held various roles of increasing responsibility across business development, marketing and general management disciplines with a particular focus on the retail consumer space. Ben is a globally minded, highly impactful executive with a proven track record for generating breakthrough results via strategic development and implementation across diverse geographies and verticals.

Ben holds a Bachelor of Arts degree in International Business from Adrian College as well as a Masters of Business Administration from Wayne State University. In addition, Ben completed the Advanced Management Program at Harvard Business School in 2022.

Michael Barton - CFO and Company Secretary BA (Acc), FCA

Michael joined Codan in May 2004 as Group Finance Manager after a 14-year career with KPMG in their assurance division. He was appointed Company Secretary in May 2008 and in September 2009, Michael was promoted to the position of Chief Financial Officer and Company Secretary. Michael leads a team responsible for managing Codan’s financial operations as well as legal and commercial matters, investor relations, information technology and business systems.

He holds a Bachelor of Arts in Accountancy from the University of South Australia and was recently made a fellow of Chartered Accountants Australia and New Zealand.

Paul Sangster Executive General Manager, Tactical Communications BS, Chicago Booth AMP

Paul Sangster is the Executive General Manager of the Tactical Communications segment for Codan and has over 25 years of industry experience. He is responsible for business strategy, financial performance and operational execution covering a broad portfolio of products and services. Prior to leading the Tactical Communications segment, he led the global business development efforts for the Communications Division. Paul joined Codan in 2013.

Prior to Codan, Paul spent 12 years at Cobham Tactical Communications and Surveillance as the Vice President of Sales and Marketing, based in Washington DC.

He holds a Bachelor of Science in Management Studies from University of Maryland, Global Campus. He also completed the Executive Development Program and the Advanced Management Program at University of Chicago’s Booth Business School.

Marjolijn Woods - Chief Human Resource Officer BASc, GradDipHRM

Marjolijn joined Codan in 2018 and was appointed to the role of Chief Human Resource Officer in January 2023. Prior to this appointment, Marjolijn was the Global Human Resources Director for Codan | Domo Tactical Communications and has extensive experience with people and culture.

She holds a Bachelor of Applied Science from Deakin University and a Graduate Diploma Human Resource Management from the University of South Australia.

Scott French - Executive General Manager, Zetron BSc

Scott was appointed to the role of Executive General Manager, Codan Critical Communications in February 2019.

With the acquisition of Zetron in May 2021, Scott is now leading Zetron, headquartered in the USA with operations in Canada, Australia and the UK. Scott came to Codan highly recommended for his lateral thinking, strategic approach to business and for his strong leadership. He brings a wealth of experience gained from 30+ years with world-class organisations such as Motorola, Panasonic, Zetron and Codan.

During his time at Motorola, Scott made the transition from engineering leadership to overall go-to-market leadership for several lines of business, helping to transform Motorola into a solutions provider beyond land mobile radio (LMR). Throughout his journey, Scott gained a high-level appreciation of wireless technologies to include broadband, solutions, services and associated markets. At Panasonic, he continued his leadership by transforming the company from product to solutions sales, with focus on mobile devices and security, before assuming the role of General Manager, Americas for two years with Zetron, a command and control company.

In addition, Scott served as Vice Chairman on the state and local board of directors of TechAmerica, representing both Motorola and Panasonic, and was also the Chair of the State and Local Government and Education Executive Council of IT Alliance for Public Sector.

Scott holds a Bachelor of Science in Industrial and Systems Engineering from Virginia Tech, and undertook MBA studies with a focus on leadership at Loyola University Maryland.

Daniel Hutchinson Executive General Manager – Strategy, Corporate Development and M&A BCom (Hons), LLB (Hons)

Daniel brings almost two decades of investment banking and corporate advisory experience to Codan. Prior to his appointment, Daniel was a Managing Director at MA Moelis Australia (the Australian affiliate of Moelis & Company) where he advised on numerous M&A and capital markets transactions for Australian and international technology and growth companies. He also holds Board and advisory panel positions for Australian based e-commerce and manufacturing companies. Daniel holds a Bachelor of Commerce (Hons) and a Bachelor of Laws (Hons) from the University of Queensland.

Assume 3 Growth Scenarios ranging from growth of 10% - 20% over 5 year period. Share Count growing to 182m on issue and Net Margins of 15%. PE30 for High growth and 15% for low growth. Blended together and discounted get valuation of $13.44

25-Sep-2024: Codan (CDA) today announced the acquisition of Kägwerks in the USA: Kägwerks-Acquisition-Announcement.PDF

This sounds like another good strategic acquisition that broadens Codan's capabilities within their Comms Division (specifically tactical communications) even further, and bought at a good price, with payments staggered to ensure they get what they pay for - which is how Codan tend to do their acquisitions:

Excerpt:

ACQUISITION CONSIDERATION AND FUNDING: The acquisition consideration consists of an upfront cash payment of approximately $33.6 million together with royalty payments for 5 years post-closing. The quantum of the royalty payments will be calculated based upon agreed annual sales target thresholds ranging from 1% to an upper limit of 5%, conditional also on minimum gross margins being achieved. In the short to medium term, Codan expects the royalty rate to be between 1% to 2%. To hit the upper end, Kägwerks will have to be successful in entering other Program of Records and significantly increase its international product sales. Royalty payments will be funded from operational cashflow. The upfront acquisition consideration will be funded from Codan’s existing debt facility, which has been increased from $170 million to $200 million. This increased debt facility will continue to provide financial flexibility to support future acquisition or growth initiatives.

Subject to government procurement cycles and purchase orders, under Codan’s ownership in the first 12 months we expect revenue to be in the range $49 million to $57 million. If this level of revenue is achieved, Codan estimate CY25 EBITDA in the range of $8 million to $11 million. Based on the expected range of revenue and EBITDA forecasts for CY25 the acquisition is priced at between 3.1 to 4.2 times EBITDA and will be earnings-per-share accretive immediately. Integration and acquisition related costs are expected to be approximately $1 million in FY25.

Beyond CY25 Codan expects that the combination of complementary capabilities and the successful development of the next generation of Kägwerks technology to position Tactical Communications to compete in the global military communications solutions market, this is expected to generate strong growth as new products are launched.

--- end of excerpt ---

I tend to read these announcements backwards, so I start with what they are paying, when, and how (as above) which was towards the end of the announcement, and then I go back to the reason they are buying:

Excerpt:

STRATEGIC RATIONALE: Codan’s Tactical Communications radio and wireless communications technologies have application across the core target markets of military, law enforcement, unmanned systems, humanitarian and broadcast. The acquisition of Kägwerks is consistent with Codan’s growth strategy to develop or acquire complementary IP and technologies, in this case the technology being acquired includes a radio agnostic dismounted communications solution. This enables Tactical Communications to broaden its offering as a full tactical military radio solutions provider and to build capability, credibility and scale in the core markets it operates in.

The acquisition of Kägwerks, with its associated intellectual property and products, positions Tactical Communications as a US soldier communications solutions provider, as it provides immediate credibility and name recognition for Tactical Communications to compete in the US military marketplace, including throughout the US DoD, special operations community, Customs and Border Protection, law enforcement and first responders. Further, Codan expect considerable sales opportunities will arise from leveraging Codan’s existing global distribution network with an international export version of the DOCKTM products.

--- end of excerpt ---

If you want more, there's a link to the full announcement at the top of this straw. I don't hold Codan in real-money portfolios at this point in time, but I've made plenty of money from the company by holding them in prior years, loading up when they were low (like below $5/share a couple of years ago) and trimming the position as they rose through and above $10. They're now over $15.70/share.

I only sold out because I sold up an entire portfolio (in which I held CDA) in June to change the investment structure, and never re-bought Codan afterwards because they looked expensive. Well, their share price hasn't dropped since then. They've gone from below $12 to now over $15.70/share. I've got to back these high quality companies, even when they look expensive. The Art of Execution. This one is a long term hold. Still wouldn't buy them up here though, as I said about PME since they were around $100/share - now around $170/share...

At least I hold both Codan and Pro Medicus here on Strawman.com.

19-Sep-2024: Codan will be added to the S&P/ASX200 Index in one week - i.e. from the open on Thursday 26th September 2024 due to the removal of Virgin Money UK PLC - see here: Virgin-Money-UK-PLC-to-be-removed-from-the-SPASX-200-Index.PDF

I bought into CDA a couple of years ago with an average buy in of around $6.50 or so. I came across this company after reading @Bear77's in-depth dive into the company's fundamentals. Surprisingly I was already familiar with Minelab detectors as I have a family member that owns a store that sells the gear, I just had no idea that they were owned by Codan or publicly listed.

I always loved how CDA were so moderate with their guidance and expectations, but always end up blowing it out of the water. I ended up selling all of my IRL position at $11 to put the money onto my mortgage, and while it was the right move for me at the time, I will admit it hurts to see their price now after that last great result (although it was to be expected). Thanks to Peter Lynch, I know there's nothing stopping me from jumping back in if I think it's going to continue going up!

CODAN FY24 RESULTS

FY24 HIGHLIGHTS:

- Strong Group financial performance:

- Group revenue of $550.5 million, up 21% versus prior corresponding period (“pcp”);

- Earnings before interest and tax of $113.9 million, up 29% versus pcp; and

- Net profit after tax of $81.3 million, up 24% versus pcp.

- Strong Communications performance continues:

- Communications revenue of $326.9 million, up 19% versus pcp, segment profit of $80.5 million, up 19% versus pcp; and

- Expanding communications orderbook of $197 million, up 21% versus 30 June 2023.

- Strong metal detection performance:

- revenue of $219.9 million up 25% versus pcp, segment profit $77.9 million, up 37% versus pcp; and

- All divisions growing versus pcp.

- Net debt of $75.4 million as at 30 June 2024, having funded $37.2 million for acquisitions and $36.3 million of dividends paid during the year.

- Earnings per share of 45.0 cents, up 24% versus pcp.

- Annual dividend of 22.5 cents, fully franked (interim dividend 10.5 cents, final 12.0 cents) versus 18.5 cents in FY23.

- Results briefing was held at 11:00am AEST today, Thursday 22 August 2024.

Codan Limited (“ASX:CDA”, “Codan”, “Group” or “the Company”), the Australian-based technology company, today announced its full year results for the period ended 30 June 2024 (“FY24”).

Commenting on the results, Chief Executive, Alf Ianniello, said:

“Codan has delivered a strong FY24 result, with Group revenues up 21%, EBIT up 29% and NPAT up 24%. It is pleasing to see the business deliver sustainable growth across the last three consecutive halves. Our primary focus remains on strengthening the business to achieve sustainable, profitable growth for the future, reinforcing a stronger Codan.

"Our Communications segment remains core to our future growth and continues to perform strongly, with revenues up 19% versus pcp. Communications continues to strengthen its position in the market as a solutions provider, with the orderbook growing 21% to $197 million versus 30 June 2023. The Zetron UK and Wave Central businesses acquired during the reporting period are performing well with integration activities now complete. Our strategy remains to continue to invest in the Communications segment to drive revenue growth, enhance predictability and capitalise on opportunities in large addressable growth markets.

Our metal detection business also delivered a strong FY24, with each of Minelab’s divisions delivering increased revenues, collectively up 25% versus FY23. Our strategy remains to invest in metal detection technologies and distribution channels, to drive revenue growth and enhance financial returns.”

Click here to view the full results release

--- ends ---

Problems? What problems? All good here. [Back on track!]

Codan up over $14/share today and have been as high as $14.56. Pity I reduced my exposure here on SM yesterday...

Very good company with quality management. Not sure if they're cheap up here however, but they do seem to know how to keep growing.

Disclosure: Held here, but sold out of real-money portfolio in June (unfortunately).

I learnt first hand yesterday how true it is that we feel a loss much more acutely than a gain.

I sold out of JAN for a 68% loss, after holding patiently for 3 years, and felt really bad about it. Yet it was only a speculative and hence relatively small holding in my RL portfolio. On the same day my WTC holding gained more than double the dollar value that I lost on JAN, thanks to its excellent results announcement.

The fact that paper gains are ephemeral is perhaps the main reason why I feel the realised loss that much more acutely. After all the market panic of only 2 weeks ago has shown us how quickly things can change.

Still, it looks like the CDA result today is prompting the same market reaction as the WTC results yesterday. This is my longest held company (11 years). Maybe I am a genius after all.

In case, like me, you’re wondering why Codan’s share price was up 8% on no news this morning, the share price jump could have been driven by UBS initiating coverage on Codan with a BUY rating and a $13.10 price target. James Mickleboro from The Motley Fool shared this broker note out of UBS this morning:

“The Codan share price is up 8% to $11.53. This appears to have been driven by a broker note out of UBS this morning. According to the note, the broker has initiated coverage on the metal detector manufacturer's shares with a buy rating and $13.10 price target. UBS is feeling positive about the company's outlook and is expecting strong revenue growth and margin expansion to drive even stronger earnings per share growth. The broker also sees scope for value accretive acquisitions given its strong balance sheet and new debt facilities.”

Held IRL (9%), SM (16%)

With gold prices at record levels, and forecasted to continue to increase, Codan's metal detection business could be a beneficiary.

The next set of results will be interesting.

Updated valuation in Feb 2024 based on EPS of $0.41, PE of 19 and 9% growth rate. (PE of 19 is in bottom quartile of trailing 5 year history)

Why do I own it?

# Market leader with global business. Have approx 10% share of $2.5 billion global detector market. Have less than 1% share of $35 billion global military comms market.

# Spending 10% on R&D so they have a steady flow of new products and patents

# Consistently high ROE/ROC and EPS growth over past decade.

# Have diversified business recently with two comms acquisitions - seems to have gone well and they are now 50% of business

# They can deliver double digit revenue and earnings growth for 5 + years so the return should exceed our 15%p.a. + target

# The MOS is good at entry point given the PE and PS.

What to watch

# Recent increase in inventory and slow stock turn - has negatively impacted operating cash flow

# How Board renewal plays out - need better marketing skills and military replacement

# No regression in IP. FY22 was 39 patents, 13 design patents and 400 trademarks

Wow! Codan is up 16.6% today to $9.80. I must admit the market reaction has surprised me a little. When I looked at the results they appeared to be in line with analyst earnings forecasts (3 analysts, Simply Wall Street data) for FY24 of 43cps. Earnings for the half were 20.9cps, so it seems to be on track. Although Revenues look higher than FY25 consensus (Pro rata). Let’s look at the highlights from the Half Year Accounts.

• Group revenue of $265.9 million, up 26% versus prior corresponding period (“pcp”)

• Net profit after tax of $38.1 million, up 24% versus pcp

• Performance by Communications businesses in line with 10 to 15% revenue growth target range:

- Communications revenues of $153.6 million, up 12.5% versus pcp, segment profit $37.8 million, up 9% versus pcp

- Communications orderbook of $183 million, +12% versus 30 June 2023

• Metal detection revenues up 49% versus pcp, with all divisions contributing to this growth

• Net debt of $82.5 million at 31 December 2023, having funded $30.3 million for the Eagle and Wave Central acquisitions in the period

• Earnings per share of 20.9 cents, up 22% versus pcp

• Interim dividend of 10.5 cents, fully franked

Sourced from the Presentation

Perhaps all the excitement is over the strong communications order book of $183 million, and the Outlook statement (see below) where management expect to “continue targeting revenue growth in the 10 to 15% range. With the benefit of acquisitions made in FY24, Communications overall growth is expected to exceed the top end of the targeted range.”

…and the Outlook

“When considering the outlook for the balance of FY24:

• After normalising for the large Communications project delivered in FY23 (approximately $20 million), and excluding the benefit of acquisitions, the Company continues to target revenue growth in the 10 to 15% range. With the benefit of acquisitions made in FY24, Communications overall growth is expected to exceed the top end of the targeted range; and

• Minelab is targeting a second half result similar to the first half of FY24, with FY24 revenue growth of 20% versus FY23

The Company will continue to keep shareholders updated as H2 FY24 progresses.”

My View

I’m a big fan of Codan and I’m pleased to see the bounce in the share price today, but I’m still trying to get my head around such huge positivity. @Bear77 is a big fan of Codan too, and I’m keen to hear what he has say about the results.

I think shareholders might be looking back at historical PE ratios and thinking now the company is turning around its now worth a multiple of 23 x FY24 earnings? The last time Codan was trading at a PE of 23x was in 2021 before the Russian Wagner Group all but destroyed artisanal gold mining in Africa. The gold detector business has a higher return on equity than the communications business and we have seen ROE fall from 32% to 17% since 2021 as a result. If someone could get the gold plundering, murderous Russian paramilitary out of Africa then Codan would be back on ROE above 30%. Putin needs the gold to fund the Ukrainian war, so pulling out of Africa is highly unlikely, unless he ends up with some Novichock in his underpants! ( ‘Navalny’ free on SBS is a must watch! A great man murdered by Putin).

Codan is rebuilding and diversifying its business and I expect ROE to improve to low 21% over the next 3 years. I think the current PE multiple is looking a bit high.

Valuation

Once again I’ll use McNiven’s Formua to value Codan assuming ROE 21%, Equity $2.31 per share (1H24 balance sheet), reinvested earnings 50%, and a required return (RR) of 10%, I get a valuation of $8.60. There’s no doubt Codan is a high quality business, but it’s starting to look a bit pricey. It’s one of our largest holdings IRL (9%) and in my top three on SM (14.8%). However, I think it’s HOLD at these prices. I’m certainly not a seller.

29-Nov-2023: Codan have made an Acquisition-Announcement.PDF this morning. They are paying an upfront cash payment of $9.1 million plus additional payments of up to $12.2 million if certain earn-out targets are achieved over the next 3 years. The acquisition consideration will be funded from Codan’s existing debt facility, so there will be no CR.

Codan's wholly owned subsidiary, Domo Broadcast Holdings LLC, has entered into a binding agreement to acquire 100% of the shares of Wave Central LLC (Wave Central), with completion to occur on 1 December 2023. Wave Central’s founders and senior management have all joined Codan’s Tactical Communications Broadcast division, Domo Broadcast, and will remain in the Wave Central business. Wave Central is a leading North American systems integrator of wireless broadcast equipment and creates industry specific products integrated with Domo Broadcast’s technology for sports, cinema and broadcast applications. Their product portfolio consists primarily of wireless video camera links and high-quality broadcast products using core Domo Broadcast technology. Wave Central has been Domo Broadcast’s primary distribution channel into the North American market for 15 years.

This is another smart acquisition by a top-quality management team at Codan. As usual, the acquisition is small, it's a good fit, it adds capability within an area of core competency, and much of the acquisition cost is dependent on the acquired company continuing to perform within expectations as part of the larger Codan business. And, again, the people who built this company up are coming across with the company and will continue to run it.

The market seems a little unsure about this so far, based on the Codan share price movement today (no real strong move either way), but they have been in an upward trajectory lately, and I don't see this announcement derailing that uptrend in any way.

Another good acquisition!

10-Oct-2023: I received this email today: Domo Tactical Communications (DTC) and TrellisWare Technologies Partner to Deliver Multiple Waveform Capabilities to a Single Tactical Radio

I hold Codan shares and I've been impressed by the way they've growns their Comms Division while their Metal Detection (Minelab) division has experienced some headwinds (various issues in Sudan and other parts of Africa, Afghanistan, Russia/Ukraine, etc.). They have always found a way to grow, and they have proven recently that when one division faces headwinds, they can still grow their other division at a decent rate.

Interestingly, this news (in that email) does not appear to have been released to the ASX announcements platform this week, so probably had little to do with today's +2.89% SP rise, unless people who already hold Codan and are also on their email list were topping up...

It's a good looking graph, and we weren't saying that 11 months ago when they were trading at around $4/share.

Perspective, it's a wonderful thing:

So, still good, and certainly a superb 12 month chart, but that 5 year share price chart shows how far they have fallen, i.e. by about -80% from around $20 to around $4. I don't think they're currently worth $20/share, and they also weren't worth $20 share in 2021 when they got up there, but I think they'll certainly be worth $20/share in the future. They had too much growth already priced in during the first half of 2021, but they are now back to somewhere between cheap and reasonably priced, IMO. I'm happy to have them as my largest position here, and also either the largest or second largest position in my two largest real life (or real money) portfolios (one of which is my SMSF). Very well run, and they design, build and sell quality products that people need and buy. Lots to like!

The investor call this morning was a curiously muted affair, possibly because the results for the full year have already been announced so there were no surprises. (But the market still reacted negatively to the 10% drop in revenue and 33% drop in profit.)

The Communications segment now accounts for 60% of revenue, has seen its profit margin increase from 21% to 25%, with management targeting a 30% margin within the next 18 months. Revenues are expected to increase by 10-15% in FY24. There is already a forward order book of $163m, compared with the $274m achieved by this segment in FY23. It seems like most of these forward orders fall to the Zetron business. Most Zetron sales are in the US and Eagle has a dominant presence in the UK with complementary products, so Zetron has a significant cross sell opportunity into the Eagle customer base.