I think too much focus has been put onto the Sudan situation. It is a negative short term and no one wants to give up $40-50M of sales but I don't think it really matters that much to the broader multi-year investment thesis. Minelab now accounts for only 54% (vs 80 previously) of the total buisness, due to the expansion of the communications segment, with the Zeftron and DTC aquisitions. From the contract announcements and the commentary around these businesses it suggests that they are being assimilated very well and I like how they have added depth to CDC and enabled it to transistion away from a products business to an end to end communications solutions business. Commentary around this business segment seems very positive and I am expecting an underpromise over deliver scenario regarding the lack of specific full year guidance, even though they are tracking ahead of the initial forecasts.

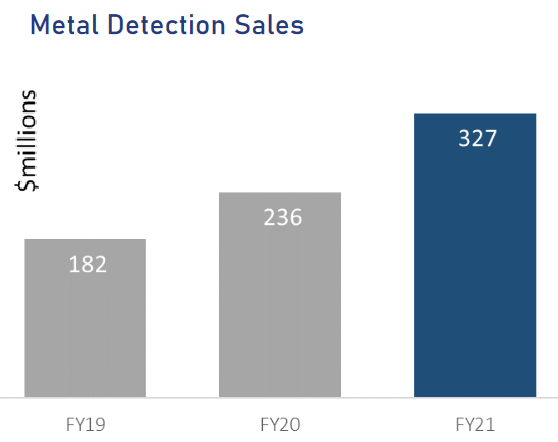

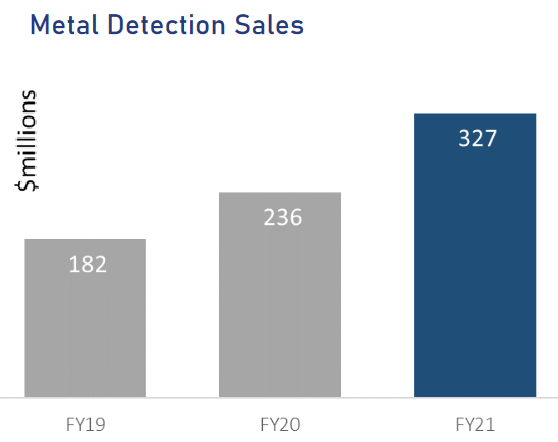

No sales from Sudan occurred in H1FY22, but Minelab sales were $138M, with the recreation and countermine segments sales maintaining their record FY21 levels. Countermine doubled from PCP. Sales are definately trending in the right direction overtime and even if we take 50M of sales off the FY21 result and assume no growth in the other metal detector markets during H2 then sales should be around $267M for Minelab in FY22. H1 sales were $138M without Sudan. They did comment in the call (you can relisten from their website) that the 1st 6 weeks of this year were equivalent to H1 rates. They also managed to achieve a record $50.1M profit in H1 without Sudan.

One comment from the investor call that was interesting was that there new gold detector GPX6000 was specifically designed for the african market but they did say they were happy with the launch and seeing good sales of this unit at around 5-600/wk vs an exptation of around 1000 if Sudan was open.

Other markets are also being developed with Brazil and Mexico are growing well and India being expanded into, so I think over time the Sudan loss will be made up in time by these other markets and when/if Sudan settles down then the sales will flow again through that channel.

I have been buying slowly in small packets in real life since it dropped below $10 and I keep looking for a reason why I am wrong about this buisness and what will stop it from continuing to pump out solid results into the future. I can't find any company specific reason why it isn't a buy for me.

They plan to maintain a 50% dividend payout rate and their ROE has ranged between 20-30 over the last 5 years. It is currently on a PE of 12.7, I think 15-20 is more appropiate for this business over the longer term and that give us a price target of $8.25-11, this assumes no profit growth on FY21.