Ahhh dear, this was nice and humbling. For context, I sold 60% of a very concentrated position last month (with the share price just over $20). This followed 2x previous sales of my position at $15.00. With all of this, I am left with a remaining position of around 25% of my initial position holding.

In my wisdom, my decision making was based on shares having run too high. At each point, the market cap had reached 3b, and then 4b. This is a brilliant business – one of my favourite on the ASX in fact – but everything has a price. Well, well done Rocket6, you have missed a heap of upside and a stock that looks like it is now being driven by both fundamentals and ‘momentum’, a powerful force on the share market that knows no bounds!

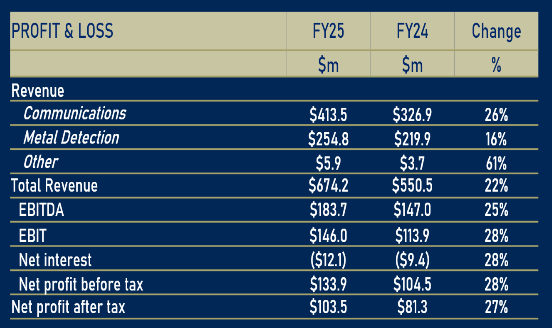

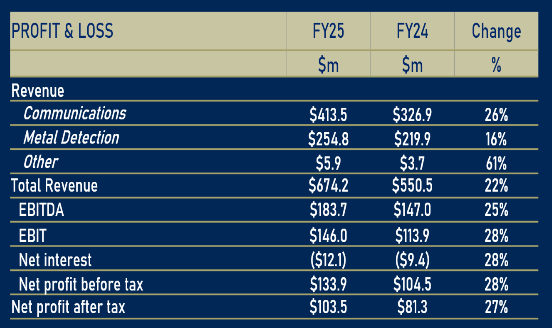

Codan released their FY25 results yesterday. My favourite PA has summarised the results for me. See below:

- Group results: Revenue $674.2m (+22%), EBIT $146.0m (+28%), NPAT $103.5m (+27%).

- Cash generation: Operating + investing cash flow (ex-acquisitions) $146.6m (vs $106.5m FY24).

- Dividends paid: 24.5c fully franked (12.0c final paid Sep-24; 12.5c interim paid Mar-25).

Segments

- Communications (DTC, Zetron, Kägwerks): Revenue $413.5m (+26%); segment profit $107.9m (+34%); orderbook $253m (+28%). Targeting ~30% segment margin by end FY27. Kägwerks contributed $24m revenue in 7 months post-acquisition.

- Metal Detection (Minelab): Revenue $254.8m (+16%); margin 39% (up from 35%). Africa ~$115m revenue; four new products slated for FY26; Gold Monster 2000 soft-launched for Q1 FY26.

Outlook (management commentary)

- Communications targeting 15–20% FY26 growth with ~$155m already in the orderbook as at 30 Jun; Minelab expecting growth with four FY26 launches and supportive conditions.

What our good friend Chat GPT didn’t include above is EPS (which was 57.1c) – a 27% increase on FY24 – which quite frankly is remarkable. All main profit/revenue metrics increased between 20-30% YoY.

As above, re: their segments, it is their comms business that is doing the heavy lifting – which has been a focus of management to diversify their business operations and reduce reliance on a cyclical metal detection market. While they have done this in a remarkable way, they are also now a truly global operation with a diversified customer and revenue base – selling their products in more than 150 countries, with 15 sites across 10 countries. No one continent is responsible for more than 50% of revenue.

In fairness to what is now several terrible decisions to sell, shares are NOT cheap. Assuming a market cap of just under 5b, they are trading on a forward PE of 44x and a P/S of 8x. This indicates some lofty expectations in future growth. A quick and dirty DCF over a five year period, using a net margin of 15% and 20% YoY revenue growth, with a 10% discount rate, returned a share price of $16.

If we increase revenue growth expectations to 30% YoY, only then does the share price range reach around $25.00. Just to clarify, it is very unlikely they achieve this – management are guiding for 15-20% from comms for FY26, and a good year would be 25%. A wonderful business, but an overpriced one.