Soft tissue generation company $ARX posted their 4C today.

4C Report

While I don't hold $ARX, I follow its progress and performance as part of my general monitoring of the dermal repair sector, as I currently hold $AVH.

Their Highlights

• Operating cash flow was NZ$2.1 million.

• Strong cash receipts from customers of NZ$23.5 million. •

Total cash on hand increased by $1.3 million, ending the quarter with a cash balance of NZ$23.4 million.

• Positive net cash flow for fourth consecutive quarter.

• FY26 guidance reaffirmed - total revenue of NZ$92-100 million and normalised EBITDA of NZ$5-8 million.

• H1 FY26 results to be released on Tuesday 25 November 2025.

• Highest recorded sales quarter for Myriad™ of NZ$10.2 million.

• Eight new peer-reviewed studies published during the quarter.

• Proposed changes to US outpatient wound care reimbursement policy present an opportunity for AROA’s Symphony™ product.

My Assessment

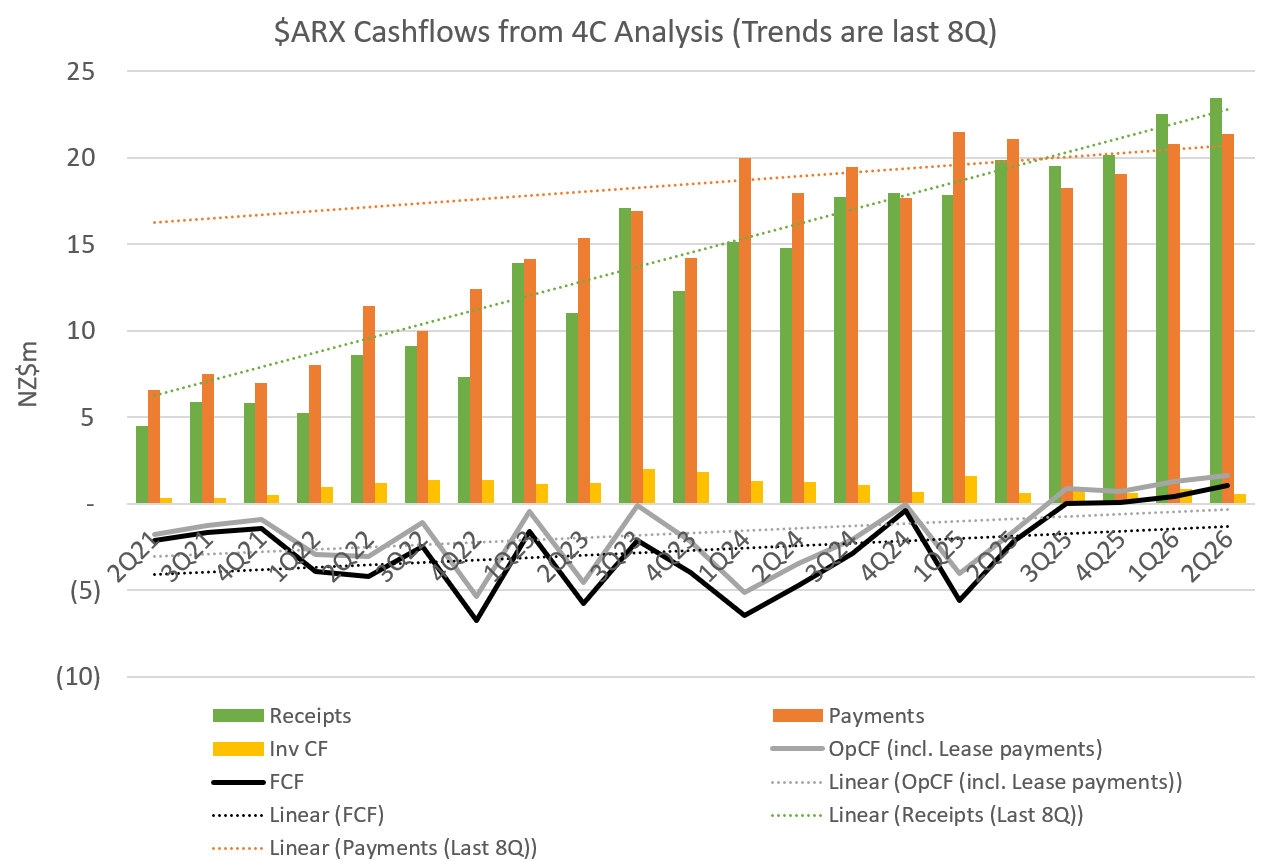

Below I included my casf flow tracker, where the trend lines plotted are over the last 8 quarterly reports.

Today's report is the 4th consecutive report of positive operating and free cash flows - an important milestone for the business indicating that it has passed through the inflection point to cash profitability.

Receipts grew +18% to PCP, with costs being well controlled with payments up only 1.2%. For now, the existing facilities are able to absorb demand growth - so capex is low, and there have been no announcements of any impending, significant new capex (although at some stage this will be required).

Without getting into a lot of detail, the company appears to be making steady progress across the product portfolio. Importantly, the recent rate of sales growth is consistently outstripping the rate of cost growth, which bodes well for sustainable profit growth - albeit at an unspectacular level. FY26 appears on track to deliver a maiden positive NPAT. Guidance for Revenue and EBITDA for the FY were maintained.

My chips are still very much on $AVH (assuming they work through recent misfortunes which have been covered amply on this platform).

$ARX appear to be well-managed, with a product portfolio that continues to gain traction in the US market - growing above the overall rate of growth of the dermal substitutes market.

My takeaway from this result as regards $AVH, is that there are no discernible changes in the overall trends in the dermal repair segment. So $AVH's result will be judged very much on its own merits, with the big uncertainty as to whether the CMS coding problem with ReCell has been fixed, and the extent to which customer behaviour has "normalised".

Disc: Not Held