Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

Current Market Cap $224.2m

Management Bio's

Jim McLean

James (Jim) McLean is the Chair of the Board of Directors of Aroa Biosurgery.He is a resident of New Zealand and has been a Director of Aroa Biosurgery since August 2011. For 25 years he has served as either Chair, Director, or an executive of research and technology businesses for both commercial and New Zealand Government organisations. In addition to Aroa Biosurgery, Jim is also Chair of Prevar Limited. Jim was Chair of the New Zealand Institute of Plant & Food Research and Chair of its predecessor HortResearch, as well as several private businesses and start-up companies. He served on the board of the then Foundation for Research, Science, and Technology including five years as deputy Chair. Jim was an executive and director of Genesis Research & Development Corporation Limited during its early stages through public listing.Before specialising in science and technology businesses, Jim held management positions with an international manufacturing business and spent thirteen years as a partner at chartered accountants, EY. His time at EY was focused on business strategy and included two years’ secondment to EY’s Washington DC office. Jim has a BSc (Hons) in Chemistry from University of Otago and a Post Graduate Diploma in Accounting from Victoria University of Wellington. Jim is considered by the Board to be an independent Director and is a member of the Audit and Risk Committee and Remuneration and Nomination Committee.

Brian Ward

Brian is the Founder and Chief Executive Officer of Aroa Biosurgery. He is a resident of New Zealand and has been a director of Aroa Biosurgery since September 2007. He has held senior corporate roles in life sciences and health care companies over the last 25 years. He has extensive management experience in life science companies spanning clinical, technical, sales, marketing, corporate development and strategy having worked for a number of multinationals including Baxter, Beecham and SmithKline Beecham throughout the world. He has managed investments into New Zealand technology companies for the Foundation for Research Science and Technology, served as the founding CEO of NZBio, and has sat on a number of government and industry expert panels. Brian has been responsible for leading the Company’s growth from start-up through to becoming a vertically integrated medical device business with substantial US sales and a developing international presence.He is a graduate from Massey University with a Bachelor’s degree in Veterinary Science, a Member of the Royal College of Veterinary Surgeons (UK), and holds a Masters degree in Business Administration graduating with distinction. Brian is the managing director and chief executive officer of the Company and a substantial shareholder in the Company and as such he is considered by the Board to not be an independent Director.

Catherine Mohr

Catherine is a Non-Executive Director of Aroa Biosurgery. She is a New Zealand citizen and resident of the United States and has been a director of Aroa Biosurgery since November 2022. Catherine’s diverse background spans several areas, including surgery, medical technology, engineering, product development and design, intellectual property, U.S Food & Drug Administration compliance and education, global entrepreneurship, automotive and aerospace. Currently, Catherine is the President of the Intuitive Foundation, the corporate Foundation of Silicon Valley based Intuitive Surgical, pioneers in the field of robotic-assisted surgery and maker of the da Vinci surgical robot system. Prior to leading the Foundation, Catherine held several senior roles at Intuitive Surgical, including Vice President of Strategy and Director of Medical Research. Catherine is on the board of directors for FINCA International and has been involved with several successful emerging companies in medical technology and other areas, notably co-founding VeriSure, where she invented the LapCap™, the first of a new category of laparoscopic surgery enabling products.Catherine holds a Bachelor of Science and Master of Science in Mechanical Engineering from Massachusetts Institute of Technology (MIT), and a Doctor of Medicine from the Stanford University School of Medicine.

Phil McCaw

Philip (Phil) McCaw is a Non-Executive Director of Aroa Biosurgery. He is a resident of New Zealand, is the Founding Partner of Movac, one of New Zealand’s leading venture capital funds. He led the original investment round into AROA in 2008 and has worked closely with the Company and has served on the Board since then. He is currently the Executive Chair and CEO of Author-IT Software Corporation, a software company that delivers component authoring solutions, enabled by AI, for the largest global pharmaceutical companies. He was also Chair of the New Zealand Government’s Startup Advisors’ Council, established to help identify and address the opportunities and challenges facing high growth start-up businesses. Phil has over 20 years’ experience investing into New Zealand technology companies and helping to guide their growth. He was an early investor in Trade Me, New Zealand’s leading on-line trading community, which was sold to Fairfax in 2006. Phil was also an early investor into PowerByProxi, a wireless power technology spin-out John Pinion Outside of Movac, Phil remains an active angel investor and maintains a personal angel investment portfolio. He is a strong advocate for the development of the entrepreneurial and early-stage investment eco-system in New Zealand and was the past Chair of the Angel Association of New Zealand. Prior to starting Movac, Phil spent 10 years with Deloitte Consulting working in New Zealand and the US. As a substantial shareholder in AROA, Phil is considered by the Board to not be an independent director. Phil has a Bachelor of Business Studies (Senior Scholar) from Massey University.

Paul Shearer

Paul is a Non-Executive Director of Aroa Biosurgery. He is a resident of New Zealand and joined AROA’s Board in October 2025. Paul is an accomplished global healthcare executive with extensive experience in the medical device industry and a proven record of leading international sales growth. Paul’s most recent role was as Senior Vice President – Sales & Marketing at Fisher & Paykel Healthcare, which he held for over 20 years. Before joining Fisher & Paykel Healthcare, Paul held roles at ICL Limited and Computercorp Limited. Paul is a current director of Skellerup Holdings, a New Zealand manufacturer and global exporter of rubber and polymer products. Paul holds a Bachelor of Commerce (Marketing) from the University of Canterbury.

Darla Hutton

Darla is a Non- Executive Director of Aroa Biosurgery, She is a resident of the United States and has been a director of Aroa Biosurgery since March 2024. She has more than 25 years of medical technology experience, including global leadership expertise in commercial strategy, operations, sales, marketing, healthcare analytics, lean and enterprise consulting. Darla is currently Vice President, Asia Commercial Operations and Marketing at Intuitive, pioneers in the field of robotic-assisted surgery and maker of the da Vinci surgical and ION diagnostic robot systems. Throughout her tenure at Intuitive, Darla has held commercial roles of increasing responsibility including Regional Sales Director, Vice President of Corporate Accounts-US, and Vice President Marketing, Market Access & Custom Hospital Analytics. In these roles, she has contributed to the expansion of Intuitive’s commercial operations capabilities and range of global offerings. In addition, Darla has served as a member of Intuitive’s Inclusion and Diversity Executive Council. Prior to Intuitive, Darla held commercial positions at other successful medical technology, pharmaceutical, and biotech companies, including Boston Scientific and GlaxoSmithKline, and spent her early professional career in the cardiac-thoracic nursing field. Darla holds a Bachelor of Science and Master of Science from the University of Tampa.

John F Diddams

John is a Non-Executive Director of Aroa Biosurgery. He is a resident of Australia and joined the Board in November 2019. John has over forty years’ experience as a CFO, CEO and director of both private and publicly listed companies. John has extensive knowledge and experience in the practical application of ASX Listing Rules, Australian corporations’ law, international accounting standards and corporate governance principles. He heads a CPA firm providing corporate advisory services to SME and mid-cap companies and has managed the listing process, secondary capital raisings and ASX listings in a number of diverse industry sectors, including oil and gas, food and retail, telecommunications, adventure tourism, biotechnology, and the dental and medical sectors. John holds a Bachelor of Commerce from University of NSW, is a Fellow of the Australian Society of CPAs and a Fellow of the Australian Institute of Company Directors. John is currently Chairman of the Board of xReality Group Limited (ASX:XRG) as well as a non-executive director of New Zealand based Volpara Health Technologies Limited (ASX:VHT), Surf Lakes Holdings Limited and DIT AgTech Limited. John is considered by the Board to be an independent Director and is Chair of the Audit and Risk Committee.

Results out for ARX this morning.

I'm still digesting, but on first glance a good result. ARX was FCF positive for the first time, and we can see the start of the operating leverage at play with a much improved net loss (down to $921k from $3.5m - normalised). Actual loss was $1.2m vs $3.9m - the main normalisation being FX changes.

Revenue was up 14% year on year and still has a pristine balance sheet - cash of $23m vs $22m PCP. Only LT debt are some leases of $7m. My thesis has always been that ARX has valuable technology, which is superior to others for a number of common applications in wound management. I like that all their presentations focus on developments in the products, not financials, etc. Demand is growing and it's doing a good job of developing new products. It's US distribution deal has always held the company back, but the fears of the US distributor failing appear to be easing (a little). Also note all the above is quoted in NZ$, so take care in considering valuation (which is AUD, given it's ASX listing).

Might be time for an update @Strawman from the CEO...

Owned IRL.

Soft tissue generation company $ARX posted their 4C today.

While I don't hold $ARX, I follow its progress and performance as part of my general monitoring of the dermal repair sector, as I currently hold $AVH.

Their Highlights

• Operating cash flow was NZ$2.1 million.

• Strong cash receipts from customers of NZ$23.5 million. •

Total cash on hand increased by $1.3 million, ending the quarter with a cash balance of NZ$23.4 million.

• Positive net cash flow for fourth consecutive quarter.

• FY26 guidance reaffirmed - total revenue of NZ$92-100 million and normalised EBITDA of NZ$5-8 million.

• H1 FY26 results to be released on Tuesday 25 November 2025.

• Highest recorded sales quarter for Myriad™ of NZ$10.2 million.

• Eight new peer-reviewed studies published during the quarter.

• Proposed changes to US outpatient wound care reimbursement policy present an opportunity for AROA’s Symphony™ product.

My Assessment

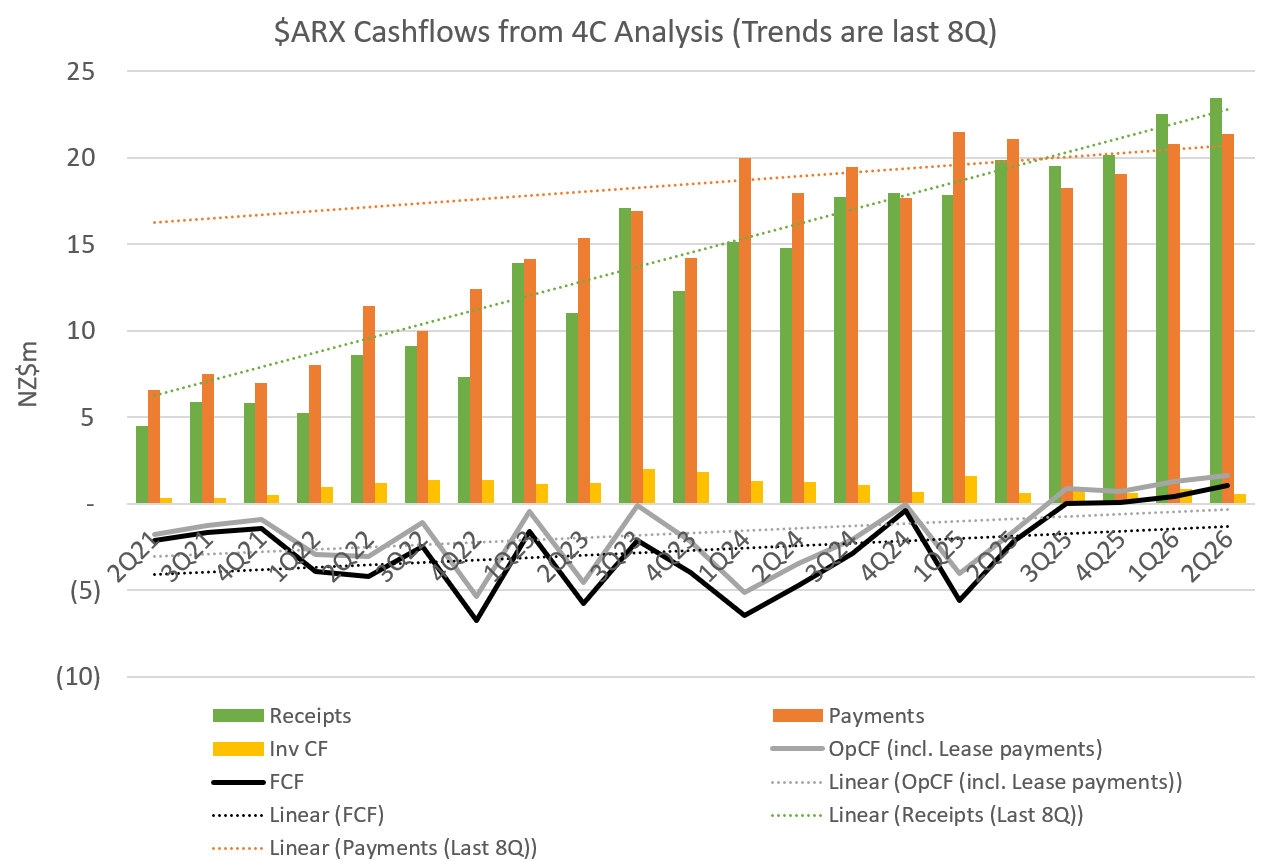

Below I included my casf flow tracker, where the trend lines plotted are over the last 8 quarterly reports.

Today's report is the 4th consecutive report of positive operating and free cash flows - an important milestone for the business indicating that it has passed through the inflection point to cash profitability.

Receipts grew +18% to PCP, with costs being well controlled with payments up only 1.2%. For now, the existing facilities are able to absorb demand growth - so capex is low, and there have been no announcements of any impending, significant new capex (although at some stage this will be required).

Without getting into a lot of detail, the company appears to be making steady progress across the product portfolio. Importantly, the recent rate of sales growth is consistently outstripping the rate of cost growth, which bodes well for sustainable profit growth - albeit at an unspectacular level. FY26 appears on track to deliver a maiden positive NPAT. Guidance for Revenue and EBITDA for the FY were maintained.

My chips are still very much on $AVH (assuming they work through recent misfortunes which have been covered amply on this platform).

$ARX appear to be well-managed, with a product portfolio that continues to gain traction in the US market - growing above the overall rate of growth of the dermal substitutes market.

My takeaway from this result as regards $AVH, is that there are no discernible changes in the overall trends in the dermal repair segment. So $AVH's result will be judged very much on its own merits, with the big uncertainty as to whether the CMS coding problem with ReCell has been fixed, and the extent to which customer behaviour has "normalised".

Disc: Not Held

This morning ARX released and presented their March Quarterly Update:

ARX maintained their FY25 sales guidance of NZ$81 - $84m.

Reported positive cash flow for the quarter of NZ$1.1.m and cash of NZ$22m.

Myriad sales were up 11% from prior quarter and up 32% from prior year.

Ovitex CY 24 US sales of $69m up 19% on CY23 up 17% on previous corresponding period

Followers of the stock will know the Ovitex sales are about half total sales, and are exclusively undertaken by Telabio in the US. This relationship with Tela can be looked at as a potential weakness for ARX, given Tela losing money for many years and continues to do so.

I asked CEO Brian Ward about the poor Tela quarterly results released on the 21/3/25, including the loss of a significant number sales staff due to resignations and sackings and fierce competition. (This appeared to at odds with ARX reporting a 17% increase in Ovitex sales from the previous corresponding period.)

Brian responded with: “I would not see it as bleak as that…..” and went on to say, (as you might expect) that he expected good growth in Ovitex sales, up from the previous year and expected continued growth over the next 12 months. The CFO went on to say without providing further sales numbers, Tela sales were soft in the December quarter, March quarter was strong and next quarter was going well.

Overall Summation: Higher Myriad and Ovitex sales, ARX being cash flow positive and having $22m in the bank are big positives. ARX appears to be making progress in billing code reimbursement for the Myriad product and ongoing clinical evidence trials.

Questions still remain about the ongoing viability of Tela and implications for Ovitex sales. The market liked what it heard, at one point pushing up the share 10%. There is some comfort knowing ARX is unlikely to go broke. Though whether ARX ever ends up with sufficient earnings in this very competitive medical product segment to justify its $160m market cap is anyone’s guess.

In the 2025 first half ARX sold around $18.5m of product to their US distribution partner Telabio (Tela). This was a little less than half ARX’s total sales of $39.1m. Tela is a NASDAQ listed company with a current market cap of around US$90m. Tiny Tela are based in Pennsylvania and market a particular ARX product called Ovitex which is used mainly for hernia repair. So the financial health of Tela is very important to ARX, and an underlying market concern was always the strength of Tela.

Tela itself has been a disaster for shareholders. In the years 2020 to 2023 they averaged losses of around US$34m per year. In the FY24 they lost $38m.

How have they stayed afloat? By going back to the market and raising capital on the promise of: “Hey we are close to break even and making it big! Come on guys chip in a few more mil, we’re nearly there!” And back in October last year US investors duly put in another US $43m. A lifesaver for them.

Today Tela released their quarterly update which said in part:

“Revenue was $17.6 million in the fourth quarter of 2024, an increase of 4% compared to the same period in 2023. The increase was due to an increase in unit sales of our products resulting from the addition of new customers and growing international sales. This growth was partially offset by a decrease in average selling prices caused by product mix as the share of smaller-sized units increased following the introduction of robotically compatible OviTex IHR and our increased focus in growing market share in high-volume minimally invasive and robotic procedures.”

Revenue for the full 2024 year was $69.3m an increase of 19%.

As part of the commentary they indicated: “Our fourth quarter results fell short of our expectations due to a confluence of disruptions, some of which we believe are transient and others that have already been redressed.”

"2025 Financial Guidance:

Full year 2025 revenue is projected to range from $85.0 million to $88.0 million, representing growth of 23% to 27% over full year 2024. First quarter 2025 revenue is projected to range from $17.0 million to $18.0 million, representing growth of 2% to 8% over the first quarter of 2024. 2025 operating expenses are expected to be flat to 2024.”

In the FY 2024 they lost $37.8m. Worse, the Q4 sales growth was an anaemic 4%.

Why?

The CEO Antony Koblish spent nearly all the conference call trying to explain. He put it down to the mass resignation of Territory Managers and their support staff that took place in the November and December of last year + the US East Coast hurricane. Tela lost 11 key TMs and got down to just 71 and are now back up to 88, and want to get to 97 by the end of the year. The CEO said smaller companies had been very aggressive in chasing market share and had poached the staff. No mention of who these companies were (PNV, AVH?).

Antony talked about the remedies now in place to fix including: changes to staff renumeration, sales organisational changes, expanding products (“Liquifix”), more clinical data, more conferences and more inroads into breast reconstruction market. He stated the surgeon and industry trends were away from synthetics.

The CEO statement about getting costs further under control was at odds with his obvious problem of not sufficiently renumerating his sales staff.

Tela have $52m cash as at the end of December and CEO when asked about the cash drain, said: “We are confident we can get there with existing liquidity”. Well he would wouldn’t he. I will say however Antony can talk, and it is hard not to be beguiled by his optimism and win attitude. He is not defeated, or at least did not sound defeated. Antony made David Williams sound like an introverted adolescent. It is interesting he also let slip: "We are not at the stage where the product sells itself".

Brian Ward (CEO ARX) said in a December 2024 Strawman interview Tela would be “breakeven” when its sales hit $120m/yr and when that happened he would get drunk for a week. (He didn’t actually say that aloud, but you could hear him think that).

Optimistically it would seem Tela will not reach breakeven sales until early CY 2027, assuming further sales growth rate of 25% beyond this calendar year. The $52m of cash may or may not see them through. However you would think if they are in a jam, at some point optimistic US investor would be there to stump up more cash assuming Tela at that time looks any sort of a proposition.

What’s it all mean for ARX?

Well, if Tela is squeezed they will squeeze ARX with inventory levels and pricing. Not good. And who knows if ARX are about to get smacked with a 25% tariff soon.

You might think of Tela as a ARX dialysis life support machine, with two clear 3mm diameter plastic tubes running from the suburbs of Philadelphia across the US and under the Pacific Ocean all the way to Auckland and CEO Brian Ward’s skinny forearm. Well the blood is still flowing, but this morning it is like someone just sat on one of the little plastic tubes and constricted them a little.

Not good news, and no one wants to see Brian Ward become nauseous and slowly turn yellow. (Outside of some weirdo Shorters or maybe secretly David Williams).

Yes rh8178 I saw the quarterly update and like you was left wondering at the severity of the sell off. On the 26/11/24 ARX released guidance of Revenue NZ$80m - $87m and normalised EBITA NZ$2m-6m. Released yesterday were guidance figures of NZ$81m - $84 and NZ$2-$4m. Down, however you would not think a disaster, though these things are all about expectations.

Unfortunately there was a power outage in my area and I did not get to hear the conference call and so do not know if there were any clangers revealed there. In the absence of that taking place I can only think the 24% price drop and further 5% at the time of writing is telling as you indicated, just how jumpy the market is. We have seen the same with NEU, with it rising 32% in the last 12 days on the back of no news that you would think would justify such a massive change in valuation. Remembering ARX has a market cap of only $270m, so it would not take much selling to push the price around.

The albeit self-promoted Myriad study was also released yesterday, and showed the product to be both clinically and cost wise top of the (self selected) competitor pack.

I like the management at ARX and the financials appear to have stabilised with ARX having cash of $A20m. I see the main short term risk to ARX is the viability of its US sales partner Telabio. Telabio accounting for almost half ARX sales and sales to them were down.

As to the ARX business I like to look at it like this: If you took away the top 10% and the bottom 10% of surgeons and compared their work over say 100 procedures then I suspect there would be very little difference in patient outcomes. All surgeons are egomaniacs. So, if you can convince them a particular product is superior, and I think there is some justification that ARX products are, then they are unlikely to stop using them. The uniqueness of the ARX sheep guts product and accompanying story, I suspect may feed into the surgeons own sense of self. Only my subjective opinion. We will see what time brings.

(By way of context. Two weeks ago my wife had a bad case of appendicitis and post the operation the surgeon would do his rounds at about 7:00am each morning. I would be there, and on one occasion questioned him as to why the TAZOCIN IV antibiotic was being terminated after 3 days when the product sheet says: “….. should be given for at least 5 days, and for 24 hrs after all signs of illness and fever have gone.”

A reasonable person might have responded with something along the lines of: “Well what you say is true, however when the CRP readings are below 100 and going down and you continue with a course of oral antibiotics straight after the IV dose, it will be just fine. This is standard practice, and have had no relapses in the last x years I have been doing this”. Instead Napoleon chewed me out for having the temerity to question him. No wonder these guys get sued).

@Scoonie wondering what you thought of latest from ARX - seems to me to be a very small adjustment down in FY25 guidance but a massive whack to share price? My theses was similar to your last thoughts - not a world beater but definitely an interesting company crossing to positive cash flow and profitability (which it actually did this quarter). Good product that clearly is showing efficacy - My view would be Mr Market was manic today and it may be a buying opportunity - what did you think?

A big concern with ARX was the possibility their US partner TelaBio could go under. Tela is responsible for around half of ARX’s sales. This was put to Brian Ward in today’s SM interview and he made the comment Tela had recently raised capital and when Tela sales hit $120m/yr this would be breakeven organisation for Tela (BW did not say if this was cash or profit breakeven).

Tela is listed on NASDAQ and of course all accounts are public.

So the question is whether the above statement made by BW today is reasonable or not. Very roughly, very roughly and with a lot of assumptions the following can be figured out:

Tela reported revenue of $19.0 million (all figures US$) in the FY24 third quarter, representing growth of 26% over the prior year period

Tela reiterated full year 2024 revenue guidance of $74.5 million to $76.5 million, representing 27% to 31% year-over-year growth.

If Tela continues to grow around 30% in FY 25 they will have revenue of $97m. At the same growth rate by sometime in Q3 FY26 they will have breakeven revenue of around $120m/yr.

Or put another way, at current growth rates, it will take them around 8 quarters to reach breakeven.

Net loss was $10.4 million in the third quarter of 2024, compared to a net loss of $11.0 million in the same period in 2023.

Say average loss over the 8 quarters are around $5m/qtr then Tela will burn around $40m to get to breakeven.

As at 30/9/24 Tela had $17m cash in the bank. Tela last month undertook an underwritten public offering and raised a net $43m.

Call it all up around $60m cash.

So it is not unrealistic to believe Tela will not have to raise capital again and is on its way to be on a reasonably sound financial footing. The fact they were able to raise the $43m says something.

Coming back to ARX itself, there is a lot to like:

i) FY24 first half sales of $39m (all NZ$) up 27% on the previous half. Tracking to full year guidance of $80 - $87m. BW indicated today ARX would be EBITA & cash flow positive by end of second half. (A point of caution: I suspect BW was talking operating cash flow. ARX are capitalising around $1m of cash flow and spending around $3m/yr on plant & equip)

ii) As at 26/11/24 has cash of $21m. No LT debt.

iii) CEO BW founded the business and owns around 10%

iv) BW on the SM interview today pointed out behind the scenes initiatives that include further statistical based data on the clinical and financial benefits of ARX product, a realigned sales force and bolstered medical affairs team. Doesn’t sound a big deal, but these things are central to the business and add up to a big deal.

v) Recall reading elsewhere they have NZ plant capacity for $200m of sales

vi) Wound healing is a highly competitive market and many investors are familiar with two of the Australian companies operating in the market AVH and PNV. The likes of PNV may always have a cost advantage over biologics like ARX. However it seems as though a large part of sales will be down to the personal preference of the surgeon. Hard to get sales, but likely very sticky once there.

vi) A confident and upbeat CEO. Rising sales back up his optimism.

You can’t go near a Livewire article or similar fund manager forum without encountering gushing words about CU6 & TLX and to a lesser extent (now the share price has come off) NEU. Likely ARX will never have the market beating power and market cap of those companies. However if ARX can get to cash flow positive next year, then if Mr Quiet Achiever Brian Ward can push it further along from there, ARX will look cheap at today’s market cap of $220m.

Very good interview Strawman, as usual. My points were:

- CEO Brian Ward (BW) indicate ARX are tracking to FY25 guidance. Later in interview said there was a 95% confidence that upper/lower guidance would be met.

- BW indicated ARX would be both EBITA and cash flow positive in second half

- Better Clinical Data. BW indicated in the past clinical data was almost anecdotal often only being based on around 6 patients. This is getting better. Soon ARX will have a 120 patient lower limb study results, with preliminary results looking ‘fantastic”.

- Capex. BW indicated ARX was past the worst of it. Said another $10m needed to get to $100m sales. From then on should track around 10% of sales.

- Main focus of markets is the US. Will continue to concentrate in US as is biggest and most lucrative.

- Competition. BW stated general case for biologics - more expensive however less complications, better wound healing, “biologics material recognised as self”, no rejection, less scaring, less infection. (presumably the clinical studies BW spoke of will further favourably prosecute the biologics and especially the ARX case). BW indicated ARX “now similarly priced to synthetics”. Talked about hospital all up costs – with ARX needing only the one application + lower infection rates. (I am not at all clear how this all squares off with PNV, AVH and the many other wound care products out there. Suspect in the end their will be a place for them all, with some hospitals / surgeons favouring one over the other, when they all do a pretty good job in their respective applications).

- Financial Stability of TelaBio.

i) BW acknowledged they had raised capital now for over 10 years and in the US investment market there was more of a “swing for the fences” mentality. Pointed to the November cap raise of US$41m and indicated Tela now well placed to get to the needed sales of $120m and break even.

ii) Also indicted the sales mix will in time tilt away from OviTex to the other ARX products ie less reliance on Tela.

iii) BW indicated in the event of a Tela failure, they had a solid contract with them as far as retaining the OviTex rights. Indicated the business had value in its own right particularly to a competitor in the hernia and breast areas and any commercial arrangement would survive.

8) Changes to Sales Team. Had promoted a successful regional manager to overall sales manager. More training to reps and rationalisation of sales Regions. ARX had invested further in the medical affairs team (currently 4 staff) to promote the study publications to surgeons.

9) Symphony. Indicated changes to reimbursement was afoot. Would mean for ARX to continue in this market would need to continue with further trials. Myriad would be the main growth driver.

10) Envio. Had been to FDA with product. Sleeve was the issue. Working with FDA now on the design of the study. Study would commence next calendar year.

11) Catalysts to Growth. BW spoke of “the pieces coming together, really pleased at what we see” Said they should in time win “the whole of hospital”. Feels there is a disconnect between the market and what is happening internally.

12) Previous ARX stumbles. Last year ARX missed guidance – this created uncertainty and was punished for this. TelaBio performance & balance sheet was a ARX headwind.

13) Other BW comments: ARX now have a much better hospital financial case. Focus on total would care – ie the claim is ARX products need less applications and have less complications. ARX has/will have soon better clinical and financial data on all this.

Importantly BW did not appear frazelled as he should have at the end of a long outwardly crappy (share price wise) year. BW was chipper and upbeat for the full 45 minutes. No outward signs of defeat in this CEO.

ARX may well have turned the corner and be on the way to being a $1+ share.

Still catching up on updates but this is one I bought after reading the straws.

Have business in the US but I don't think tariffs will affect their products.

Seems like a positive update.

[held]

You'll find the link for the interview on the Aroa company page and also the Meetings page.

But here's a summary of the meeting:

Here is a more detailed summary of the interview with Brian Ward, CEO and founder of Aroa Biosurgery:

1. Introduction and Company Overview (0:00 - 5:30)

- Aroa Biosurgery is a soft tissue regeneration company using proprietary extracellular matrix (ECM) technology derived from sheep forestomach.

- The company has 4 commercial product families and key partnerships, with 95% of sales in the US market. Total addressable market estimated at $3B+.

- Aroa is at an inflection point, with FY24 product sales of NZ$68m (up from NZ$20m in FY21), gross margins of 85%+, and approaching profitability.

2. ECM Technology, Manufacturing and IP (5:30 - 13:00)

- Aroa's ECM technology enables regenerative healing using a unique bioscaffold with an open structure and key biological signals. This acts as a framework for rapid cell infiltration and tissue growth.

- ECM is processed to remove components that cause rejection while retaining a scaffold for repair. This is then fabricated into specific device designs for each product (e.g. Myriad, OviTex).

- Manufacturing involves isolating specific tissue layers from sheep forestomach, decellularization, and conversion into products. Capacity is being expanded ahead of demand to support up to $200m revenue.

- IP covers the ECM material, production process, and specific product designs. The process is highly scalable with long shelf life and room temperature storage.

3. Commercialization Strategy and Progress (13:00 - 21:00)

- Aroa started with simpler wound products and has built clinical evidence over time to drive adoption in more complex reconstructive procedures. 6M+ patients treated to date.

- The company uses a mix of direct sales in the US (expanding KOL accounts) and a partnership with TELA Bio for hernia/breast products. TELA Bio deal provides capital-efficient growth.

- Surgeons are conservative but sticky once adopted. Aroa has seen increasing clinical acceptance, with a comprehensive GPO contract position and maturing sales force.

- Estimated 18-24 month lag between building commercial team and seeing full productivity. The company is focused on growth initiatives to expand US revenue.

4. Product Advantages and Clinical Evidence (21:00 - 28:30)

- Aroa's products enable one-step procedures with faster healing, fewer complications and lower costs than standard of care. Clinical studies are underway to build further evidence.

- Myriad (soft tissue reconstruction): Faster healing and less complications than biologics or negative pressure wound therapy. Key focus in complex limb salvage and trauma cases.

- Symphony (diabetic/venous ulcers): Combines Aroa ECM and hyaluronic acid. Randomized trial underway vs standard of care, with results expected early 2025.

- OviTex / OviTex PRS: Hernia and breast reconstruction products sold via TELA Bio. Prospective studies show significant reduction in complications vs standard of care.

5. Financial Position, Capital Management and Outlook (28:30 - end)

- Aroa has 85%+ gross margins and prices 20-30% below competitors. Scale benefits and mix shift expected to drive further margin expansion. No pricing pressure seen.

- The company is balancing growth investment with the path to profitability and aims to be cashflow breakeven in the near term. FY25 guidance of NZ$80-87m revenue.

- Multiple factors support an inflection in growth: maturing sales force, GPO coverage, growing clinical evidence, and new product pipeline. R&D projects include new platforms and indications.

- The CEO sees a long runway for Aroa to disrupt the regenerative medicine space and build a successful global company. Key focus in the near term is execution to drive US commercial growth.

@Strawman my question for the $ARX meeting is a bit more complex than usual, so I thought I'd post it here rather than on Slido.

[Sadly I can't make the meeting today, as I have 6 days work this week and next on my side hustle. :-( ]

Anyway, this morning a LinkedIn post by David Williams congratulating the team at $AVH on the FDA approval of ReCell-GO and stating "... looking forward to seeing more of you product on top of ours ..." or words to that effect go me thinking. When we consider the repsective investment propositions of $IART, $ARX, $AVH and $PNV etc etc. and when we compare metrics, it is easy to fall into the trap of thinking of them as competitors. Sometimes they are, but often they aren't as DW's post exemplifies.

So, I'd find it super helpful if Brian Ward could take a step back and go through each of the main products in the $ARX commercial and development portfolios and simply explain:

- What the product is and how it works

- What are the main indications to which it is being targeted

- In those indications in the US, what is the current Standard of Care

- What is the main advantage of the $ARX product vs. the SoC (and the evidence to support this)

To lay my cards on the table, I am a former holder of $ARX and a few years ago sold my holding and put it into $PNV, simply because I could never develop a super-clear answer to these questions, as well as that the %GM, Revenue growth, and exploding breadth of applications for $PNV's BTM lead me to decide to back that horse and go "all in".

I don't know if its possible to do that, or if other StrawPeople would like that understanding as well, but it would be wonderful in this rare, long-format interview to get beyond the one slide, general high level summary.

Hope the meeting goes well, and I look forward to catch up with the recording in any event.

Dermal and wound repair company $ARX published their quarterly today.

Overall, incremental progress on all fronts. I don't hold (RL or SM) but continue to monitor as part of my focus on the sector, where I have a significant holding in $PNV.

Some lumpiness in results is driven by the restocking behaviour of their US Partner TELA Bio.

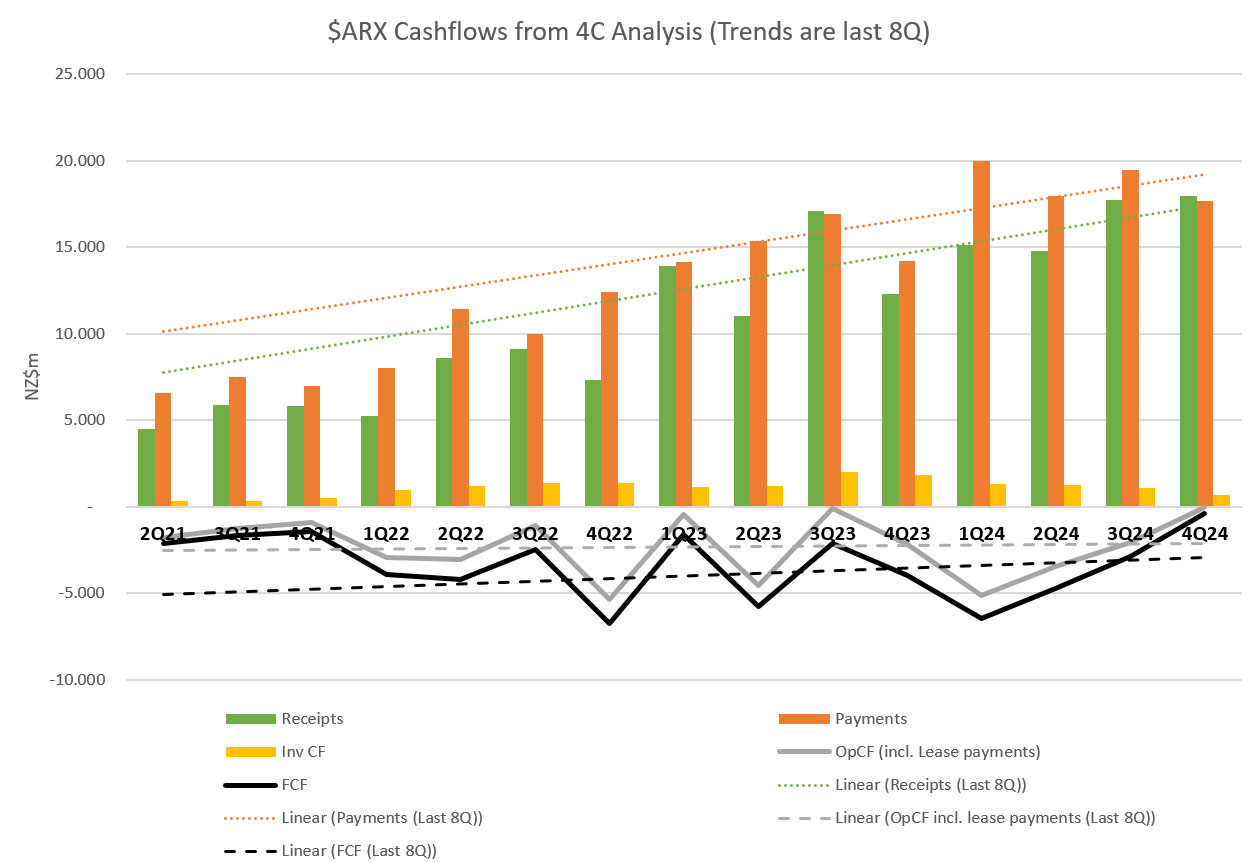

Improving (i.e. reducing) cash burn appears driven more by government grants and a lower rate of investment in new facilities than the product growth itself. (See bottom of post for my cash flow analysis.)

I have held previously, but won't because growth trajectory is modest compared with sector peers, and cash generation is not in sight. Overall revenue growth appears to be in the range 20-30%, having declined from 40-60% over FY22 and FY23.

What I do like about management is their level-headed and balanced reporting. For example, they could have highlighted that Q4 reciepts were up 46% to PCP, but they didn't because that would be cherry-picking a favourable prior period and lumpiness.

$ARX follows a Mar-Mar FY, so financials will follow in a few weeks.

Their Highlights

Financial Highlights

• Strong cash receipts from customers of NZ$18.0 million, reflecting a continuation of the prior quarter’s step-up in Myriad™ and OviTex™ /OviTex PRS sales.

• Positive net cash inflows from operations of NZ$0.3 million, exceeding Q4 breakeven expectations.

• Net cash outflows from investing activities reduced to NZ$0.7 million, reflecting continued planned investment into additional manufacturing plant & equipment capacity with completion expected by Q3 FY25.

• The Company achieved a 71% reduction in quarterly cash burn to ~NZ$1 million, ending the year with a strong closing cash balance of NZ$29.5 million.

Operational Highlights (My tuncated list)

• Continuing expansion in Myriad sales access during the quarter, with Myriad active accounts increasing from 205 to 218 during the quarter.

• Strong CY23 OviTex™ PRS and OviTex sales, with TELA Bio, Inc. (‘TELA Bio’) reporting CY23 revenue of US$58.5 million (41% ‘pcp’ 3 growth) and providing CY24 revenue guidance of US$74- 76 million (27-30% pcp growth).

• Product shipments to TELA Bio continue to re-align with its sales trajectory (following a reduction in shipments during H1 FY24) with H2 FY24 cash receipts from TELA Bio increasing 20% compared to H1 FY24.

• US launch of OviTex IHR, a new AROA ECM™ product specifically designed for use in laparoscopic & robotic-assisted inguinal hernia repair and co-developed with TELA Bio under the parties’ existing license arrangement.

• Enrolments completed for two clinical studies; the pilot study assessing Enivo™, AROA’s new tissue apposition platform technology, and the Myriad Augmented Soft Tissue Regeneration Registry (‘MASTRR’), AROA’s largest prospective study to date. AROA expects to commence publishing study results from Q3 FY25. AROA’s Symphony™ randomised control trial continues to progress well, with a total of 90 patients enrolled by the end of the quarter (n=120).

• A peer-reviewed publication of three case reports indicates that Myriad Matrix™ and Myriad Morcells™ may complement existing negative pressure wound therapy (‘NPWT’) protocols, reduce the frequency of dressing changes associated with NPWT usage in abdominal soft tissue defects and decrease the overall healing time of complex abdominal defects.

My Cash Flow Analysis

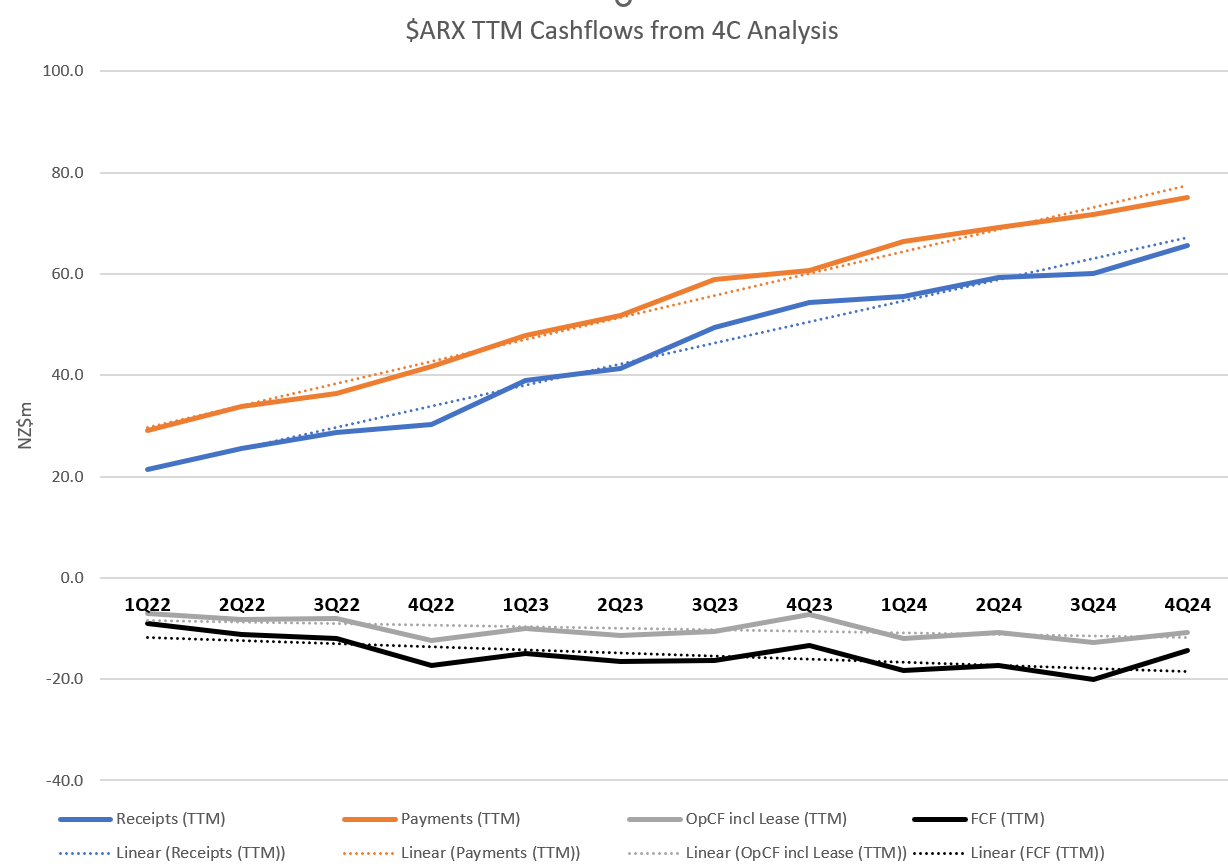

While there is a weak positive trend toward FCF generation emerging over the last 8Q, the improvement of the last 3-4 quarters is driven more by reducing investment and some government grants, than underlying strength in the operating economics. That said, the last year has seen improvements in cost control, while growth is continuing.

Quarterly view below in Fig 1, and TTM pic in Fig 2. On the quarterly plot, the trend line is last 8Q only.

Figure 1

Fig 2

Disc: Not held

Some SM members are already familiar with ARX, some are not. In short ARX are a NZ based company that produces sheet wound products for hernias, chronic wounds, traumas etc. Product is made from the forestomach of sheep. It has a market cap of around $340m and they have been going for about 14 years and have been listed on the ASX for nearly 3 years.

The CEO Brian Ward started the company and owns about 10%. Annual sales to the 31/3/23 were $62m. It lost $1.7m and had operating cash outflow of $3.7m. For the first time this year time some of the R&D was capitalised - $1.3m versus $10.6m that was expensed. Still very conservative accounting.

Looks highly likely will turn cash flow positive in the 2024 year. It has around $45m in cash, so is not going to go broke.

The focus is on US sales so there are lots of issues in getting this happening around sales teams, surgeon acceptance, contracts with healthcare providers and product reimbursement. There is a lot in the presentation material released on the 1/6/23 - much of it you have to take their word for it, unless you are an industry insider.

However a clearer picture of this company is emerging:

- Their product appeared superior in certain applications

- Their products are cheaper than the existing biologic mesh’s on the market. (It is a crowded market with pig and human tissue products, as well as fully synthetic products)

- The management all have their working lives and money locked into it and are pushing it very hard. You cannot say they are not trying.

- They are not going to go broke

What is further convincing however is if you take out their R&D for their new product Envio (a product that fills up dead space inside a wound cavity, a way off getting to market) they are $8.5m EBITA positive. So you could argue this is a medical device company is already profitable selling roughly on a PE of about 80. Still no one substantive (read sizable Fund Manager) at the present time will touch it. All too scared. Hence the current share price drift.

The next 12 months will be critical, however it is not beyond possibility with demonstrated recurring sales and earnings growth ARX could well double in the next three years. If not the downside should be limited, due to the established sales position, IP and earnings.

I think the odds are currently in the investor’s favour, and it is a BUY

$ARX reported their 1H FY23 Results. Continue good progress on all fronts. No surprises given 4C updates. Upgraded guidance for FY23 is maintained.

I observe that over the last 6 months a few more fundies have started to notice and indicated they are doing research on it.

With a cash balance of $50m, the cash burn for the half of <$7m is not a concern, as i continues to fall.

Their highlights.

Financial Highlights

• H1 FY23 Product sales were up 44% to NZ$28.8 million compared to H1 FY22 (NZ$20.1 million), and up 20% compared to H2 FY22 (NZ$24.0 million), on a constant currency basis.

• Product gross margin % of 84%, representing a 6% increase compared to H1 FY22, and a 5% increase compared to H2 FY22, on a constant currency basis.

• Total reported H1 FY23 revenue inclusive of project fees was NZ$29.3 million.

• H1 FY23 Myriad™ product revenue grew 242% on H1 FY22 and 147% on H2 FY22 (on a constant currency basis) to NZ$5.6m million.

• H1 FY23 normalised EBITDA (unaudited) was positive.

• Upgraded FY23 guidance maintained at NZ$62-64 million.

• Strong cash balance of NZ$50.1 million as at 30 September 2022 and the Company is debt free.

Operational Highlights

• The Company continues to gather clinical evidence, including publication of a pre-clinical study demonstrating the potential of AROA’s new Enivo™ system, as well as ongoing recruitment of patients for the Myriad Augmented Soft Tissue Regeneration Registry.

• On 4th November, the Company submitted an application for regulatory approval to the US Food & Drug Administration (‘FDA’) for the first product in the Enivo range.

• The Company is planning a full launch of Symphony™ in April 2023 and expects to be well-positioned for pending reimbursement changes.

• Regulatory approval for Myriad Matrix™ in the Australian market was gained in September.

• Seasoned Medtech Executive and long-time entrepreneur Dr. Catherine Mohr joined AROA’s Board on 1 November as a Non-Executive Director.

• Due to headcount growth, additional office space has been secured in Auckland, New Zealand.

Disc: Held in RL and SM

September Quarterly Results Webinar

Soft tissue regeneration company Aroa Biosurgery Limited (ASX: ARX)) is pleased to announce that it will hold a webinar with CEO Brian Ward and CFO James Agnew on Tuesday 25 October at 1.00pm AEDT to discuss the September Quarterly Results which will be released pre-market the same day

Investors and interested parties can register for the webinar via the following link:

https://us02web.zoom.us/webinar/register/WN_vIDjJfx5QWmoIBNdbohrnA

Investors can submit questions prior to the webinar to [email protected] or do so via the Q&A functions on Zoom

https://newswire.iguana2.com/af5f4d73c1a54a33/arx.asx/2A1389983/ARX_CEO_Presentation_AGM

I attended the $ARX virtual AGM yesterday. The CEO's presentation gives a good overview of the company's progress. As in the case of $PNV, it is expanding rapidly driven by USA market support by a rapidly expanding category and growing surgeons awareness. The presentation provides a good overview of their current portfolio and development work.

There was nothing exceptional to report other than the following which I found interesting.

CEO Brian Ward was asked in Q&A how $ARX were finding things competing with $PNV, which is also expanding rapidly in the USA. Somewhat suprising for me, Brian said (and I paraphrase) that $ARX doesn't see $PNV as a competitor. They believe $PNV is more focused on burns whereas $ARX is more focused on dermal repair (incl. DFU) and reconstruction. He also said that he believes that biologics have clear advantages in deeper dermal repair where certain properties of biologics (indicated in the presentation) promote the healing process. Brian believes Integra is actually more of a competitor to them.

For those of us who follow both what Brian and David Williams say, they are somewhat at odds with each other: witness 1) yesterday's announcement of $PNV DFU clinical trial and 2) DW's reports of surgeons innovating and using BTM in a wider range of applications. As you'd expect DW also promotes the superior properties of synthetics in reducing risks of infection and rejection.

Now, I am not an expert, but I suspect (and perhaps other StrawPeople are better-informed) that both sets of comparisons lack a factual clinical foundation because, to date, the clinical studies are being referenced to the current standard of care and not comparing the different novel therapies head-to-head? It will be interesting if one day someone does a may comparative study.

At this stage, I am not concerned because of the large TAM and expanding category. There is room for both. I find holding and following both deepens my understanding of the sector.

Disc: both $ARX and $PNV held IRL and on SM.

Thanks for the excellent summery, @mikebrisy

I was also on the investor call this morning and agree with your management assessment. Over time my impression of management is competent, straight talking and not overly promotional.

I think their outlook is worth mentioning, the understated comment that “the environment looks to be improving”’ translates into greater hospital access, product synergies and enough clinical data to drive sales. Given other companies in the health space have failed to get traction in the States over the past 2 years I think this is a positive for management in navigating difficult situations.

Their stated core reasons for listing, to build a commercial operation in the US, increase sales and continue with R&D, seems to be on track so far.

I did a side-by-side comparison to PNV, it’s over a year ago now so the figures are out of date but at the time it struck me that the $ spend on R&D for ARX was higher than PNV despite the big difference in market cap, etc. (I’ll try and update the comparison if I get a chance.)

It will be interesting to listen to the PNV meeting Friday and compare management impressions

Held RL