Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

Soft tissue generation company $ARX posted their 4C today.

While I don't hold $ARX, I follow its progress and performance as part of my general monitoring of the dermal repair sector, as I currently hold $AVH.

Their Highlights

• Operating cash flow was NZ$2.1 million.

• Strong cash receipts from customers of NZ$23.5 million. •

Total cash on hand increased by $1.3 million, ending the quarter with a cash balance of NZ$23.4 million.

• Positive net cash flow for fourth consecutive quarter.

• FY26 guidance reaffirmed - total revenue of NZ$92-100 million and normalised EBITDA of NZ$5-8 million.

• H1 FY26 results to be released on Tuesday 25 November 2025.

• Highest recorded sales quarter for Myriad™ of NZ$10.2 million.

• Eight new peer-reviewed studies published during the quarter.

• Proposed changes to US outpatient wound care reimbursement policy present an opportunity for AROA’s Symphony™ product.

My Assessment

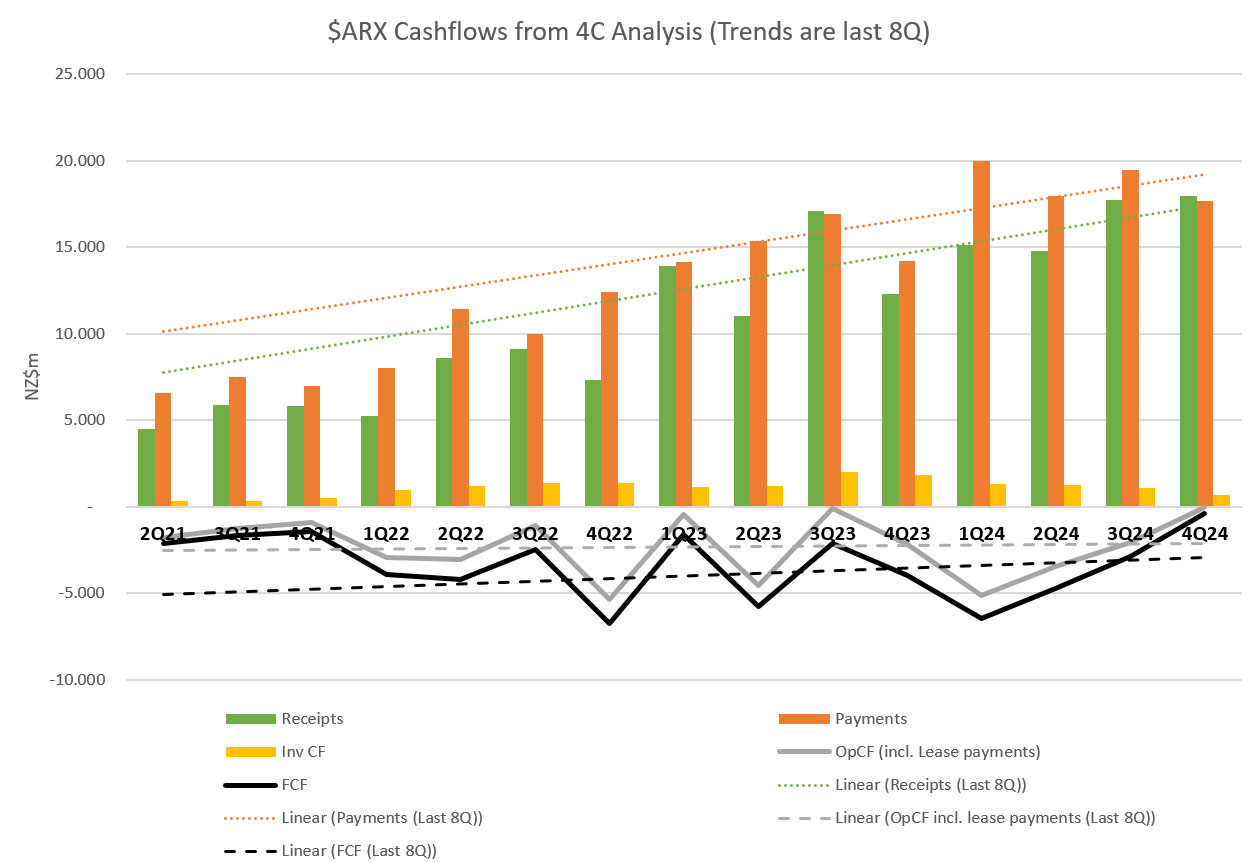

Below I included my casf flow tracker, where the trend lines plotted are over the last 8 quarterly reports.

Today's report is the 4th consecutive report of positive operating and free cash flows - an important milestone for the business indicating that it has passed through the inflection point to cash profitability.

Receipts grew +18% to PCP, with costs being well controlled with payments up only 1.2%. For now, the existing facilities are able to absorb demand growth - so capex is low, and there have been no announcements of any impending, significant new capex (although at some stage this will be required).

Without getting into a lot of detail, the company appears to be making steady progress across the product portfolio. Importantly, the recent rate of sales growth is consistently outstripping the rate of cost growth, which bodes well for sustainable profit growth - albeit at an unspectacular level. FY26 appears on track to deliver a maiden positive NPAT. Guidance for Revenue and EBITDA for the FY were maintained.

My chips are still very much on $AVH (assuming they work through recent misfortunes which have been covered amply on this platform).

$ARX appear to be well-managed, with a product portfolio that continues to gain traction in the US market - growing above the overall rate of growth of the dermal substitutes market.

My takeaway from this result as regards $AVH, is that there are no discernible changes in the overall trends in the dermal repair segment. So $AVH's result will be judged very much on its own merits, with the big uncertainty as to whether the CMS coding problem with ReCell has been fixed, and the extent to which customer behaviour has "normalised".

Disc: Not Held

@Strawman my question for the $ARX meeting is a bit more complex than usual, so I thought I'd post it here rather than on Slido.

[Sadly I can't make the meeting today, as I have 6 days work this week and next on my side hustle. :-( ]

Anyway, this morning a LinkedIn post by David Williams congratulating the team at $AVH on the FDA approval of ReCell-GO and stating "... looking forward to seeing more of you product on top of ours ..." or words to that effect go me thinking. When we consider the repsective investment propositions of $IART, $ARX, $AVH and $PNV etc etc. and when we compare metrics, it is easy to fall into the trap of thinking of them as competitors. Sometimes they are, but often they aren't as DW's post exemplifies.

So, I'd find it super helpful if Brian Ward could take a step back and go through each of the main products in the $ARX commercial and development portfolios and simply explain:

- What the product is and how it works

- What are the main indications to which it is being targeted

- In those indications in the US, what is the current Standard of Care

- What is the main advantage of the $ARX product vs. the SoC (and the evidence to support this)

To lay my cards on the table, I am a former holder of $ARX and a few years ago sold my holding and put it into $PNV, simply because I could never develop a super-clear answer to these questions, as well as that the %GM, Revenue growth, and exploding breadth of applications for $PNV's BTM lead me to decide to back that horse and go "all in".

I don't know if its possible to do that, or if other StrawPeople would like that understanding as well, but it would be wonderful in this rare, long-format interview to get beyond the one slide, general high level summary.

Hope the meeting goes well, and I look forward to catch up with the recording in any event.

Dermal and wound repair company $ARX published their quarterly today.

Overall, incremental progress on all fronts. I don't hold (RL or SM) but continue to monitor as part of my focus on the sector, where I have a significant holding in $PNV.

Some lumpiness in results is driven by the restocking behaviour of their US Partner TELA Bio.

Improving (i.e. reducing) cash burn appears driven more by government grants and a lower rate of investment in new facilities than the product growth itself. (See bottom of post for my cash flow analysis.)

I have held previously, but won't because growth trajectory is modest compared with sector peers, and cash generation is not in sight. Overall revenue growth appears to be in the range 20-30%, having declined from 40-60% over FY22 and FY23.

What I do like about management is their level-headed and balanced reporting. For example, they could have highlighted that Q4 reciepts were up 46% to PCP, but they didn't because that would be cherry-picking a favourable prior period and lumpiness.

$ARX follows a Mar-Mar FY, so financials will follow in a few weeks.

Their Highlights

Financial Highlights

• Strong cash receipts from customers of NZ$18.0 million, reflecting a continuation of the prior quarter’s step-up in Myriad™ and OviTex™ /OviTex PRS sales.

• Positive net cash inflows from operations of NZ$0.3 million, exceeding Q4 breakeven expectations.

• Net cash outflows from investing activities reduced to NZ$0.7 million, reflecting continued planned investment into additional manufacturing plant & equipment capacity with completion expected by Q3 FY25.

• The Company achieved a 71% reduction in quarterly cash burn to ~NZ$1 million, ending the year with a strong closing cash balance of NZ$29.5 million.

Operational Highlights (My tuncated list)

• Continuing expansion in Myriad sales access during the quarter, with Myriad active accounts increasing from 205 to 218 during the quarter.

• Strong CY23 OviTex™ PRS and OviTex sales, with TELA Bio, Inc. (‘TELA Bio’) reporting CY23 revenue of US$58.5 million (41% ‘pcp’ 3 growth) and providing CY24 revenue guidance of US$74- 76 million (27-30% pcp growth).

• Product shipments to TELA Bio continue to re-align with its sales trajectory (following a reduction in shipments during H1 FY24) with H2 FY24 cash receipts from TELA Bio increasing 20% compared to H1 FY24.

• US launch of OviTex IHR, a new AROA ECM™ product specifically designed for use in laparoscopic & robotic-assisted inguinal hernia repair and co-developed with TELA Bio under the parties’ existing license arrangement.

• Enrolments completed for two clinical studies; the pilot study assessing Enivo™, AROA’s new tissue apposition platform technology, and the Myriad Augmented Soft Tissue Regeneration Registry (‘MASTRR’), AROA’s largest prospective study to date. AROA expects to commence publishing study results from Q3 FY25. AROA’s Symphony™ randomised control trial continues to progress well, with a total of 90 patients enrolled by the end of the quarter (n=120).

• A peer-reviewed publication of three case reports indicates that Myriad Matrix™ and Myriad Morcells™ may complement existing negative pressure wound therapy (‘NPWT’) protocols, reduce the frequency of dressing changes associated with NPWT usage in abdominal soft tissue defects and decrease the overall healing time of complex abdominal defects.

My Cash Flow Analysis

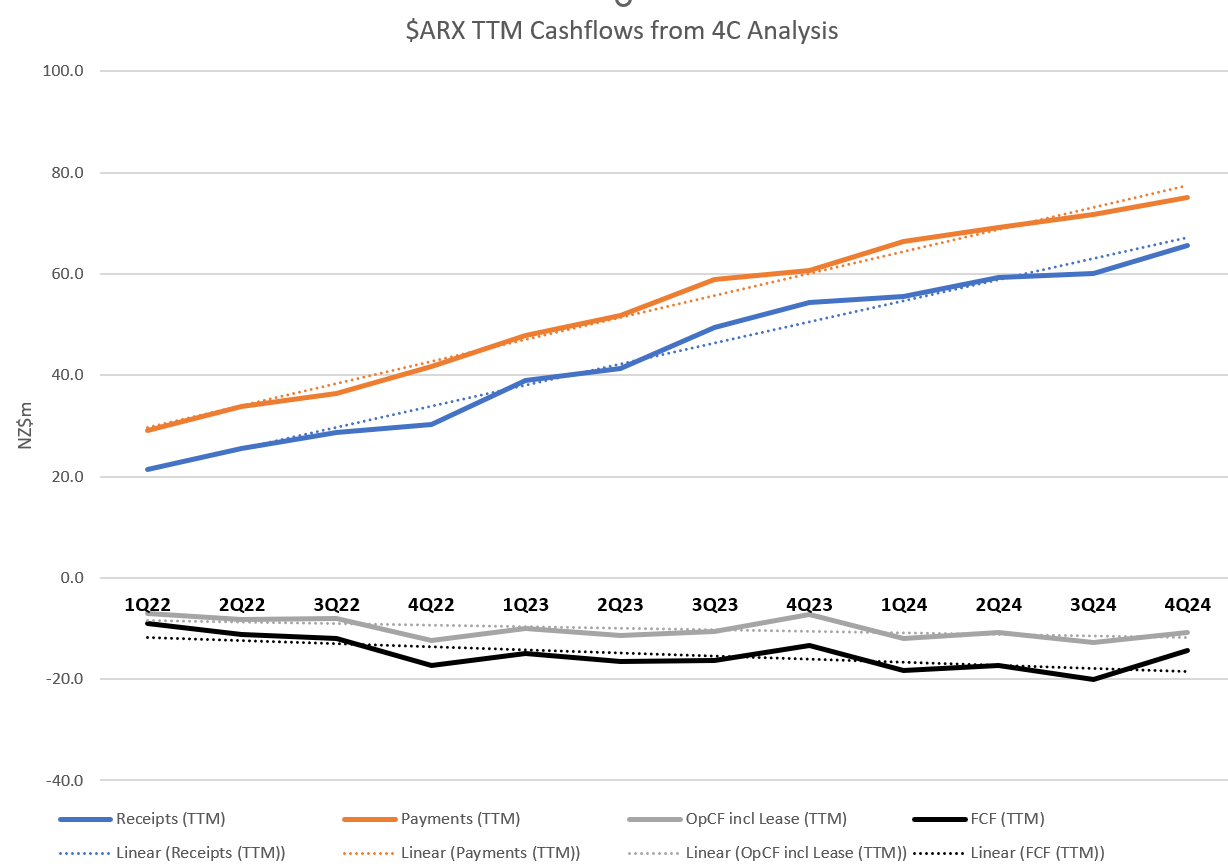

While there is a weak positive trend toward FCF generation emerging over the last 8Q, the improvement of the last 3-4 quarters is driven more by reducing investment and some government grants, than underlying strength in the operating economics. That said, the last year has seen improvements in cost control, while growth is continuing.

Quarterly view below in Fig 1, and TTM pic in Fig 2. On the quarterly plot, the trend line is last 8Q only.

Figure 1

Fig 2

Disc: Not held

$ARX announced their 4C this morning.

While no longer a holder, because I have a significant holding in $PNV I continue to follow $ARX for insights on the other firms working in the dermal repair space. (Also $IART) But to clarify, for many indications these firms are not direct competitors, but they are playing in the same general space.

Their Highlights (I've selected only the more significant, as its a LONG list)

Financial Highlights

• Strong ~20% increase in quarter-on-quarter cash receipts from customers, to NZ$17.7 million.

• Continued quarter-on-quarter progress towards breakeven operational cashflows, with net cash outflows from operations decreasing to NZ$1.7 million from $3.2 million in the prior quarter.

• Net cash outflows from investing activities of NZ$1.1 million for the quarter, reflecting further investment into additional manufacturing plant & equipment capacity.

• Strong cash balance of NZ$30.5 million as at 31 December 2023, and the Company is debtfree.

Updated FY24 Full-Year Guidance

• Guidance reduced to NZ$67-70 million total revenue, NZ$66-69 million product revenue, 85% product gross margin and a normalised EBITDA1 loss of NZ$1-3 million.

• One-off (H2 FY24) decrease in expected revenue from TELA Bio, Inc. (‘TELA Bio’) due to a previous overestimation of AROA’s revenue share (non-cash) on inventory supplied to TELA Bio and a delay to a joint product development project. OviTex™3 and OviTex PRS remain on a strong growth trajectory.

• Robust Myriad™ sales performance, with 10% growth in Myriad active accounts from Q2 to Q3, comparable field sales productivity and a revised forecast of 70-85% year-on-year growth (full-year).

Operational Highlights

• US FDA (‘FDA’) 510(k) clearance received for a new product, a resorbable dental barrier developed and manufactured from the Company’s proprietary AROA ECM™ platform technology. The Company is actively pursuing a new partnership to commercialise this product.

• The FDA has reviewed AROA’s 510(k) application for Myriad Flow™, a new soft tissue regeneration product that could be commercialised in combination with Enivo™, and requested additional pre-clinical and clinical data to support a clearance. Both studies appear to be less complex than anticipated with regulatory clearances expected within 24 months.

• To date, six patients (n=10) enrolled in the pilot clinical study for Enivo, AROA’s new tissue apposition platform technology, have undergone a unilateral mastectomy and completed followup care, with no clinically relevant seroma or complications reported.

• 36 patients enrolled in AROA’s Myriad Augmented Soft Tissue Regeneration Registry (‘MASTRR’) during the quarter, taking the total number of participants to 268 (n=300).

•Enrolments in AROA’s multi-center Symphony™ randomised control trial approximately doubled during the quarter, with a total of 86 participants enrolled to date (n=120).

My Analysis

I'll keep it brief, with the cash flow trend analysis below telling its own story.

From my perspective, my thesis that this is not looking like an investible business is continuing to be supported with each quarter.

While you might think an 85% gross margin gives you a lot to play with on the expense side, the fact is that medical devices and pharma is a tough gig. The high costs of sales and marketing together with the ongoing and necessary burn of development expenditure quickly eats up the profit.

Despite the management key messages, there is no discernible trend towards operating or free cash generation. In 24 months we've seen cash shrink from $65m to $35m, with the last Q burning about $3.5m.

$ARX has some good technology, and they are using it to develop multiple platforms with many indications, evidenced by their continuing clinical program. However, the fact appears to be that none is making material headway into the ostensibly large addressible market.

Perhaps management are taking a longer term view? However, your view cannot be too long term. Competitor innovation means that products necessarily have a finite life cycle. At some point, you have to have a product that generates serious cash, and I can't see where this is coming from at $ARX. And if they continue to burn cash at the current rate, in about another 2 years time they'll be raising again. Its not an imminent issue, but with the trend it may be unavoidable unless something changes.

$ARX is playing in a competitive market. 20% top line annual growth won't cut it, and it highlights just how strong $PNV is with >90% GM and >60% topline growth now pushing $100m, enabled by a more focused product suite.

Disc: Not held in RL or SM

Kiwi dermal repair company $ARX issued its 4C report today. I didn't attend the call, but the report is very detailed. I haven't held $ARX for some time, but still follow it (along with $AVH and $IART) to better understand the space in which my core holding $PNV competes. As I said, the report is very detailed, so I am only reproducing their financial highlights, we there is nothing very standout operationally.

Their Financial Highlights

• Increased cash receipts from customers of NZ$15.2 million during the quarter, compared to receipts of NZ$12.3 million for the prior quarter.

• In line with expectations, net cash outflow from operations of NZ$4.8 million for the quarter, compared to the prior quarter outflow of NZ$1.9 million. This primarily reflected typical postfinancial year payments and a planned operating loss for the quarter. Net cash outflow from investing activities was NZ$1.3 million for the quarter, reflecting further investment into additional manufacturing plant & equipment capacity.

• Strong cash balance of NZ$38.5 million as at 30 June 2023.

• FY24 product revenue guidance maintained at NZ$72-75 million (25-30% increase on FY23 on a constant currency basis ).

• FY24 product gross margin guidance maintained at 85%.

• FY24 normalised EBITDA profit guidance maintained at NZ$1-2 million

My Analysis

Overall, there are no surprises that I can see from a quick read of the results - all aspects of guidance are maintained.

I have updated my usual CF analysis below, showing the last 8Q trends.

While receipts are on a clear uptrend, so are costs. In fact, both OpCF and FCF are on a slight negative trend.

With closing cash of NZ$38.5m, the balance sheet is strong. However, it is important to note that the since capital was last raised in 3Q22, over the 7 quarters since, the average cash burn has been NZ$3.8m per quarter.

Yet again there are reports about investment in expanding facilities. Evidence that these biologics are both more capital intensive and lower margin than synthetic BTM.

Of course Gross Margin is only one element. The release also provides some detail about the number of sales reps with sales greater than NZ$750,000 p.a. Interesting to note that DW and $PNV sets his sights on the higher A$1m for their top salesmen - a significantly stronger contribution margin. Just anecdotal, but interesting to me anyway.

My Key Take Aways

I took the decision to exit $ARX in June 2021 because of my clinical bias towards synthetics, the stronger growth rate of $PNV, and its higher margin. Over the last two years, while $ARX is sustaining top line growth, there is no sign of sustainable - let alone attractive - economics.

Bottom line, this looks like a good product with a growing number of indications, variants and clinical supporting evidence, but not a business.

According to Tradingview, the company is covered by 5 analysis with PTs ranging from A$1.325 - A$1.635, vs. todays A$0.90. It's on a much lower revenue multiple than its sector peers, however, with no trend towards favourable economics it probably deserves its current value and I don't understand where the 5 analysts are coming from.

With economics like this, it won't be bringing any pricing pressure to bear in its sector anytime soon. Which is good news for $PNV.

Disc: Not held

$ARX reported their 1H FY23 Results. Continue good progress on all fronts. No surprises given 4C updates. Upgraded guidance for FY23 is maintained.

I observe that over the last 6 months a few more fundies have started to notice and indicated they are doing research on it.

With a cash balance of $50m, the cash burn for the half of <$7m is not a concern, as i continues to fall.

Their highlights.

Financial Highlights

• H1 FY23 Product sales were up 44% to NZ$28.8 million compared to H1 FY22 (NZ$20.1 million), and up 20% compared to H2 FY22 (NZ$24.0 million), on a constant currency basis.

• Product gross margin % of 84%, representing a 6% increase compared to H1 FY22, and a 5% increase compared to H2 FY22, on a constant currency basis.

• Total reported H1 FY23 revenue inclusive of project fees was NZ$29.3 million.

• H1 FY23 Myriad™ product revenue grew 242% on H1 FY22 and 147% on H2 FY22 (on a constant currency basis) to NZ$5.6m million.

• H1 FY23 normalised EBITDA (unaudited) was positive.

• Upgraded FY23 guidance maintained at NZ$62-64 million.

• Strong cash balance of NZ$50.1 million as at 30 September 2022 and the Company is debt free.

Operational Highlights

• The Company continues to gather clinical evidence, including publication of a pre-clinical study demonstrating the potential of AROA’s new Enivo™ system, as well as ongoing recruitment of patients for the Myriad Augmented Soft Tissue Regeneration Registry.

• On 4th November, the Company submitted an application for regulatory approval to the US Food & Drug Administration (‘FDA’) for the first product in the Enivo range.

• The Company is planning a full launch of Symphony™ in April 2023 and expects to be well-positioned for pending reimbursement changes.

• Regulatory approval for Myriad Matrix™ in the Australian market was gained in September.

• Seasoned Medtech Executive and long-time entrepreneur Dr. Catherine Mohr joined AROA’s Board on 1 November as a Non-Executive Director.

• Due to headcount growth, additional office space has been secured in Auckland, New Zealand.

Disc: Held in RL and SM

$ARX reported their 4C and due to their reporting cycle gave partial unaudited results for 1H23.

Their reported highlights:

Financial Highlights Q2 FY23

• Cash receipts of NZ$11.0 million received from customers during the quarter.

• Net cash flow outflow from operations of NZ$4.3 million for the quarter.

• Net cash outflow from investing activities was NZ$1.2 million for the quarter, reflecting AROA’s investment into additional manufacturing plant and equipment capacity.

• AROA ended the quarter with a strong cash balance of NZ$50.1 million as at 30 September 2022

Financial Highlights H1 FY23

• H1 FY23 product revenue (unaudited) grew 44% on H1 FY22 and 20% on H2 FY22 (on a constant currency1 basis) to NZ$28.8 million. H1 FY23 total revenue (unaudited), inclusive of project fees was NZ$29.3 million.

• H1 FY23 product gross margin (unaudited) was 84%.

• H1 FY23 Myriad™ product revenue (unaudited) grew 242% on H1 FY22 and 147% on H2 FY22 (on a constant currency basis) to NZ$5.6m million.

• H1 FY23 normalised2 EBITDA (unaudited) was positive.

Upgraded Guidance FY23

• Guidance upgraded to reflect AROA’s improved FY23 performance expectations including significant movement in the actual US$/NZ$ exchange rate.

• Total revenue guidance for FY23 of NZ$62-64 million (including NZ$2 million of project and license fees) on the revised constant currency basis (up 39-43% on FY22 on a constant currency basis). Previous product revenue guidance (on prior exchange rate) was NZ$51-55 million.

• FY23 guidance for product gross margin upgraded to 84% on the revised constant currency basis.

• FY23 normalised EBITDA expected to be approximately breakeven.

My Key takeaways

Overall, a weaker cash performance (see graph below), however, the Q-on-Q receipts tend to be very lumpy, so not reading too much into this one result. No concerns on liquidity given cash position, overall growth trend and strong %GM.

1H23 GM of 84% is a positive vs. FY22 of 76% and previous forecast FY23 of 77%. However, this is also an FX beneficiary.

Myriad accelerating its growth albeit off a low base.

Upgrade is a positive, however most of the headline impact is due to a FX impact (US$0.62=$NZ1 from US$0.70=$NZ1). Still, positive.

The operational report is largely positive, including a modest upgrade from partner Telebio.

Overall happy with this and expect a modest positive reponse.

Disc: Held in RL (1.3%) and SM (5.4%) - held mainly as an alternative ASX read on $PNV market

https://newswire.iguana2.com/af5f4d73c1a54a33/arx.asx/2A1389983/ARX_CEO_Presentation_AGM

I attended the $ARX virtual AGM yesterday. The CEO's presentation gives a good overview of the company's progress. As in the case of $PNV, it is expanding rapidly driven by USA market support by a rapidly expanding category and growing surgeons awareness. The presentation provides a good overview of their current portfolio and development work.

There was nothing exceptional to report other than the following which I found interesting.

CEO Brian Ward was asked in Q&A how $ARX were finding things competing with $PNV, which is also expanding rapidly in the USA. Somewhat suprising for me, Brian said (and I paraphrase) that $ARX doesn't see $PNV as a competitor. They believe $PNV is more focused on burns whereas $ARX is more focused on dermal repair (incl. DFU) and reconstruction. He also said that he believes that biologics have clear advantages in deeper dermal repair where certain properties of biologics (indicated in the presentation) promote the healing process. Brian believes Integra is actually more of a competitor to them.

For those of us who follow both what Brian and David Williams say, they are somewhat at odds with each other: witness 1) yesterday's announcement of $PNV DFU clinical trial and 2) DW's reports of surgeons innovating and using BTM in a wider range of applications. As you'd expect DW also promotes the superior properties of synthetics in reducing risks of infection and rejection.

Now, I am not an expert, but I suspect (and perhaps other StrawPeople are better-informed) that both sets of comparisons lack a factual clinical foundation because, to date, the clinical studies are being referenced to the current standard of care and not comparing the different novel therapies head-to-head? It will be interesting if one day someone does a may comparative study.

At this stage, I am not concerned because of the large TAM and expanding category. There is room for both. I find holding and following both deepens my understanding of the sector.

Disc: both $ARX and $PNV held IRL and on SM.

Aroa Biosurgery reported Quarterly Results today. In this straw I'll post first the company's own highlights and then some of my own reflections on the results following the very brief 15minute call this morning with the CEO and CFO. (Not many instos or fundies following this).

Top line summary: Good progress, no surprises either way. Need to keep an eye on margins. HOLD

Highlights

• Cash receipts of NZ$13.9 million from customers during the quarter.

• Net cash flow outflow from operations of only NZ$0.2 million for the quarter, down from NZ$5.1 million in the previous quarter.

• Net cash outflow from investing activities was NZ$1.1 million for the quarter, reflecting AROA’s investment into additional manufacturing plant & equipment capacity.

• AROA ended the quarter with a strong cash balance of NZ$55.4 million as at 30 June 2022.

• FY23 product revenue guidance maintained at NZ$51-55 million1 (up 30%-40% on a constant currency basis on FY22).

• Improving US sales performance with 95 Myriad™ active accounts at the end of Q1 FY23 (a 32% increase on the previous quarter) and two representatives with a current average run rate of over US$850,000 per annum.

• Progress is tracking well for AROA’s ENIVO™ range of dead space management products, with submission to the US Food & Drug Administration for the first product planned in December 2022.

• All participants in AROA’s Symphony™ pilot clinical study (n=10) have completed treatment. Work is underway to set up a randomized controlled trial evaluating Symphony in the treatment of 120 non-healing diabetic foot ulcers in the US.

• Progress is also tracking well on AROA’s Myriad Registry study, the Company’s largest prospective study with 48 patients enrolled to date.

My observations

Good results in line with guidance. Don't get excited about the step up in receipts and stepdown on cash outflow over the prior Q - this was flagged last quarter as due to a delay in key payments, which have been included in the quarter. A pity this was not quantifed - I should have asked!

Staff and corporate costs have increased quite sharply although there tends to be Q-o-Q noise around the growth trend. CEO said they are seeing some inflation, but they still expect to see margin expansion through this year due to sales mix tending towards a higher proportion of the higher margin MYRIAD product.

Steadily growing the US sales force, although expect to be behind their planned numbers. CEO said this was because they are focusing on salesforce productivity, but I sensed some awkwardness on this so I don't know if there is any underlying staff churn or recruiting challenges in a tight market - neither was mentioned.

Indicated they are pleased to be getting $850k sales from their top agents. (This is well behind $PNV and their saleforce is about 50% the size of PNV).

As shown in the 4C trend graph below over 8Qs, $ARX is not yet showing operating leverage, but the cash burn is low (FCF now -$1.3m compared with cash available of $55m). So there is time for revenue growth, margin expansion and sales force productivity to develop. I'm prepared to be patient.

Good updates on product development pipeline, publications and line extensions, all being managed at a constant investment cash flow of $1m to $1.5m per Q.

Overall, nothing exciting, Steady progress. I continue to hold a 1.2% portfolio position IRL. My major holding is $PNV.

To increase my position I'd want to see: a) revenue growth acceleration, b) margin expansion, c) operating leverage, d) continued positive news in development pipeline.

Valuation

I don't hold a valuation on ARX, but on a comparable basis of Market Cap to Sales, it is at a significant discount to $PNV (-42% when I last did the analysis).

EXHIBIT: Analysis of last 8 x 4C Cash Reports

Disc: Held in SM and IRL

Aroa announced their FY22 and FY23 Outlook today.

HIGHLIGHTS FY22 Results

• Audited full year product revenue of NZ$39.2 million, reflecting an 81% increase on FY21. On a constant currency1 basis, product revenue was NZ$37.7 million (an increase of 84% on FY21), exceeding the Company’s upgraded constant currency guidance of NZ$34-37 million. Total revenue (inclusive of project fees) was NZ$39.7 million, representing growth of 78%.

• Product gross margin of 76% (75% constant currency), representing an 8% increase on FY21.

• Result delivered despite COVID-19 continuing to impact access to hospitals and procedure volumes in the US.

• Normalised EBITDA loss for FY22 was NZ$1.5 million, compared to a loss of NZ$3.3 million in FY21. Normalised loss before income tax was $5.2 million (NZ GAAP Loss before income tax of NZ$8.3 million) compared to NZ$7.5 million in FY21 (NZ GAAP Loss before income tax of NZ$19.1 million).

• Strong cash balance of NZ$56.1 million with no debt. FY23 Outlook

• Product revenue guidance of NZ$51-55 million, to deliver 30-40% growth on FY22.

• Product gross margins are expected to improve to 77% due to increased sales of higher margin Myriad™ products and improving manufacturing efficiencies (despite increased indirect overheads from the new manufacturing facility).

• AROA is continuing to invest in its US salesforce and product development to drive growth in FY23 and beyond. As a result, it is forecasting an EBITDA loss for FY23.

• Given the dynamic and evolving impact of COVID-19, guidance is subject to no material decline in US medical procedure numbers or sustained disruption to AROA’s manufacturing or transportation activities and TELA Bio, Inc. delivering on its revenue guidance of US$40-45 million in CY22.2 It also assumes an average NZD/USD exchange rate of 0.70.

Link to the presentation https://wcsecure.weblink.com.au/pdf/ARX/02524264.pdf

-------

My reflections

Given the sales growth over FY22 of 81%, the outlook for FY23 of 30-40% appears undemanding, and you'd think there was room to outperform.

Aroa are continuing to invest for growth in i) manufacturing facilities, ii) direct sales force, iii) new market registrations, iv) product extensions and v) development of the innovative dead-space management product, which they hope to file for FDA approval later this year. The believe this could take anything from a year to 2+ years for approval, but claim that it would essentially be a unique solution in an uncontested market of c$1bn. For me, this is the blue sky in the valuation.

Some further info provided on the call (for those who follow related commentary by $PNV), in terms of sales force addition, they see new starters becoming cost neutral by end of the first year and achieving peak performance over 3 years.

There have strong cash reserves as a result of the raising last year, no debt and a modest cash burn as they transition to cash flow positivity over the next two years, but they are currently in an investment phase as noted above.

EV/Revenue is a modest 8x compared with 19x for PNV and, while overall margins are not as strong as for $PNV, there are giving a strong focus on the Myriad product suite, which has gross margins 90-98%, compared with the overall portfolio GM achieved of 76%. As a result they are forecasting improving GM over time with an outlook for 77% in FY23.

Now only in its second year from listing, management come across as understated, on top of all aspects of the business, and are progressively building a track record of delivering on their promises.

If they continue to deliver and outperform I expect they will start to get onto more analysts radar, and when you start doing comparable valuations in the sector, they look cheap. So in addition to underlying performance, there is the potential for a re-rating. But I am getting ahead of myself here.

I have held since shortly after IPO and am currently about 30% underwater on a small position. Am not in the least bit concerned by this, as the longer I get to know management, the company and the product suite, the more confortable I get. Will be increasing my position in line with my assessment of falling execution risk.

Disc: Held IRL and SM.

Post a valuation or endorse another member's valuation.