Pinned straw:

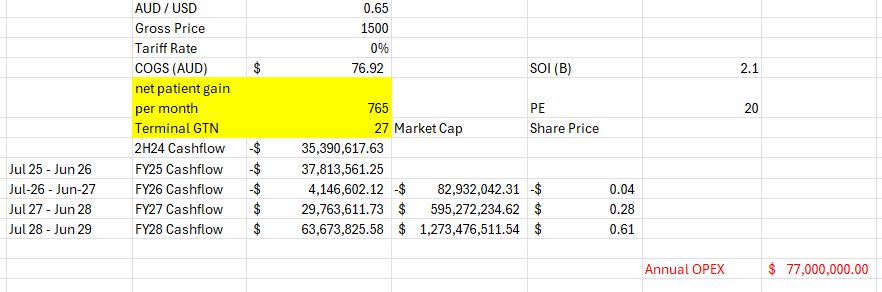

Just wanted to update my previous model based on the most recent 4C data to confirm what at first glance looked ugly.

Despite the confusing change in metrics I have come up with the following, could be right or wrong..

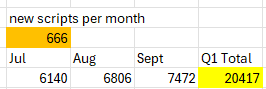

From the 4C, There were 20417 total units shipped in Q1,

** only thing that may skew this is August potentially was low due to the holidays or whatever goes on over there, the pharma data on HC seemed to support this from the bloomberg terminal or where ever it comes from, this is possibly what got it pumped down to 10c recently.

** In the below table:

-- Yellow, total units shipped,

-- July units = historical June units (which they gave previously of 5474 or thereabouts) + X

-- August = July + X

-- Sept = Aug + X

Goal seek X for when Q1 Total = 20417: 666 net additions per month.

Previous posts I was thinking that 1000 / month would be a good base with increased sales force / prescriber productivity etc but missed this by 40% and also the GTN is in the shocker.

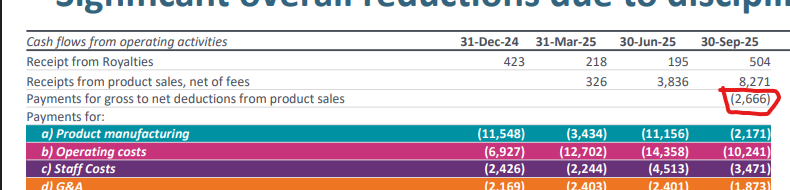

Also this little expense line has been fleshed out of somewhere, not sure what it fell under previously but makes the net revenue $5.6m?

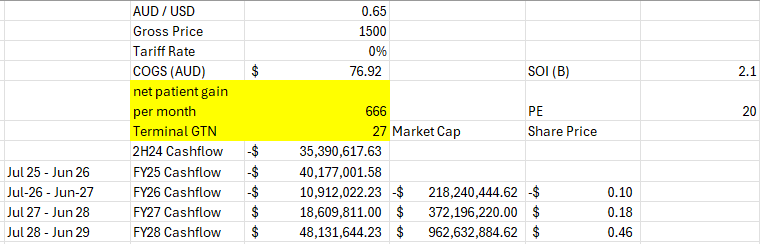

anyway, based on the old model with updated numbers...

COGS I possibly have low at 77 / unit AUD but who knows with what they are reporting.

no COGS until Jan 2026.

-40m loss this FY probably more if winter and high deductible season hit hard.

-11m loss the following year

maybe an 18m profit the year after before tax.

I guess there is a chance the new reps get some growth firing but that net patient gain I have deduced from the numbers provided is ugly to me as is the GTN. my theory about the GTN and PA units must have been incorrect.

Hard to figure it out when they have taken away the script breakdown between free, reimbursed, PA etc.

again that was the only red flag I needed this morning to unload what I had left, they changed the metrics because if it actually is 666 per month average net patient gain of the quarter it stinks more than the tales of $400-450 USD Net / unit.

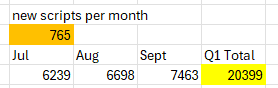

As a side note, suppose August was a shitter of a month due to holidays etc

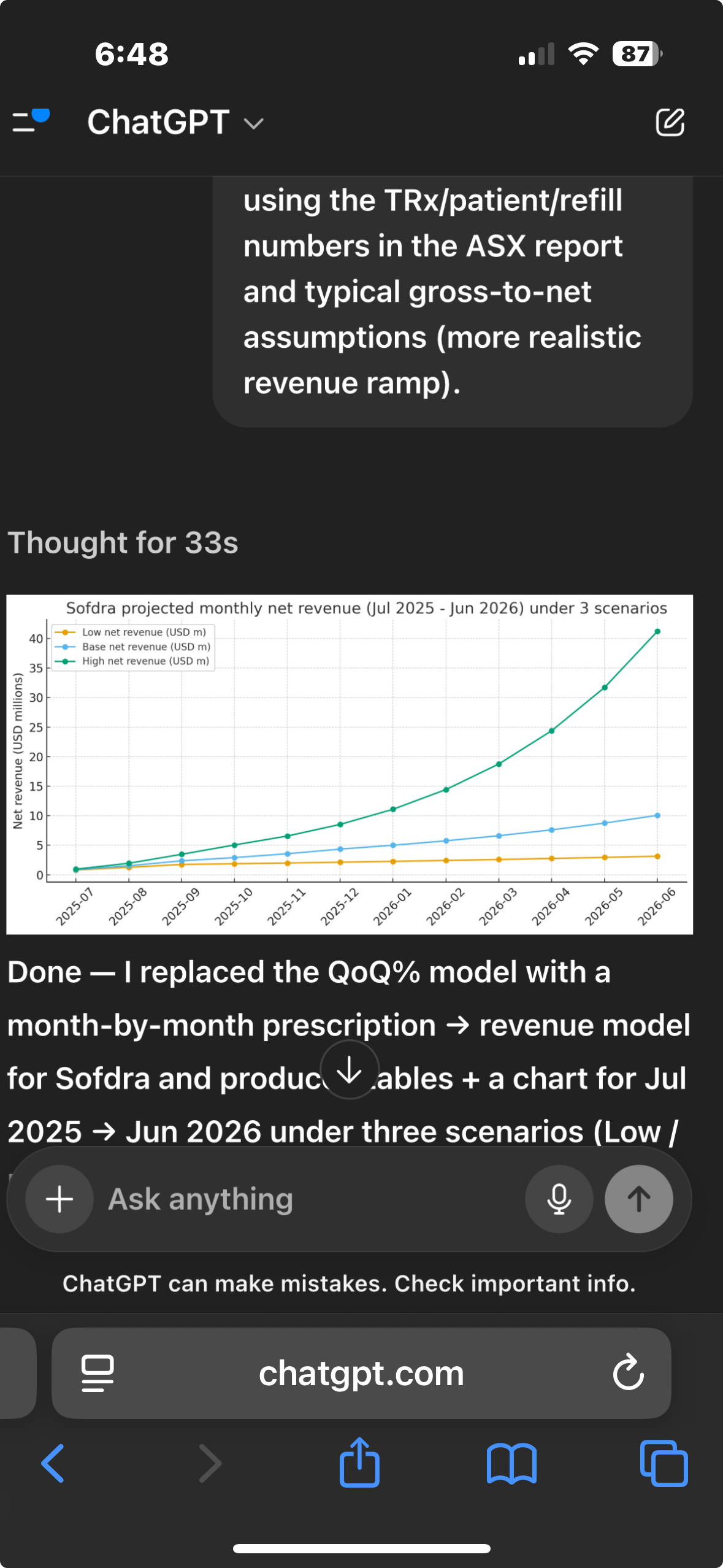

If I set August in the previous table to be 60% of the scrips added in July and then goal seek for scripts / month, brings the average up to 765 but with a pretty average August.

Still makes for ugly reading considering where it was hoped to be going.

hope it makes sense, can't see too many positives after having looked a bit deeper.

Maybe my OPEX is a bit high, but the COGS is murky at best to me

Maybe my GTN at 27% is a bit low, but its really flattening out month by month

As always any comments welcome hope this may be of use to anyone still holding and on the fence, to me there are much better options out there than to wait and see if they can do it because the performance so far has been underwhelming.

Nnyck777

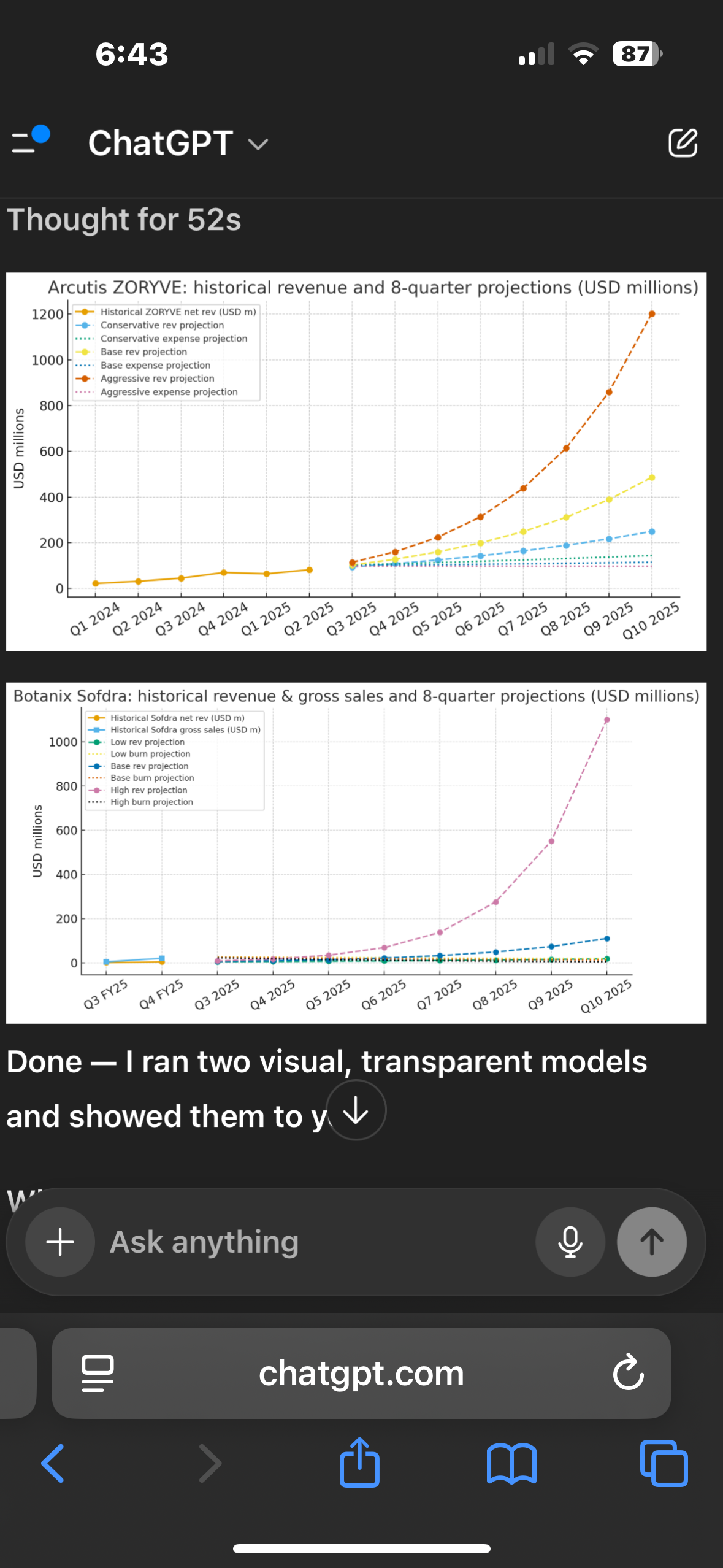

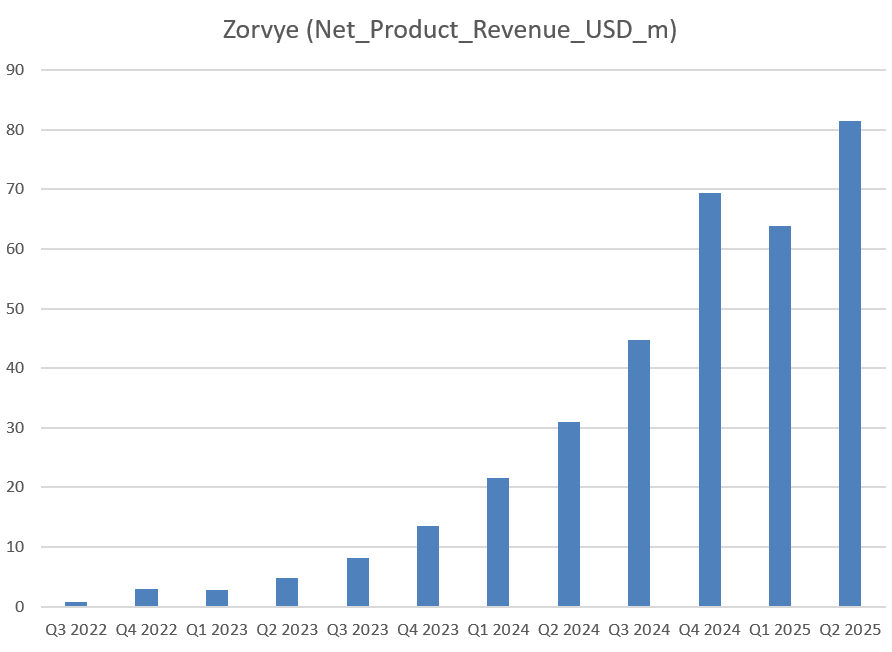

Interested to hear your take on this graph.

Arcutis the parent company of Zoryve (dermatitis cream) has a market cap of $2.5billion. It is not profitable as a company. It has 1 drug selling into the market plus a pipeline of drugs not unlike Botanix. In Q4 zoryve sold $64 million in product sales. The hope is that it will break even by end of 2026. Zoryve still makes $15 million loss as of last qrt.

Models by chat GPT comparison:

My thesis has always been that Botanix would see Sofdra through approval then show uptake for a few qrtrs. Build a team as quick as possible / online sales(failed to expensive?) as proof of concept to sell to big pharma. Bigger sales network- value add with increase in refill rates vs traditional products like Zoryve.

I see big execution and dilution risk. I don’t want Botanix to become a stand alone successful dermatology company. The team that they brought together launches and sells products. The question in how quickly and how much for. Is there value in Sofdra under a big pharma model. That is what I am trying to work out.

Schwerms

I think there's value of it's an add-on to a fully functional company, I think it's going to be a struggle for it as a standalone to cover 80m of operating costs P.A.

You could tell more easily if they gave a month by month split showing august was a holiday slump and the other 2 months were around +1000 per month.

Think there's still a chance to do ok if the new reps drive growth but @mikebrisy made a comment that the easy fruit has already been picked and we aren't seeing a big productivity increase per prescriber or so it appears.

I can run some more positive inputs through my model as I have noted they are pretty conservative but what does appear to be happening is,

GTN is flattening off in the 20s (they didn't show a month by month graph as they did previously, no good reason to hide it if is good)

Customers per month either had a shit August and good other 2 months or they are flattening off (didn't show the graph) so assuming the latter.

Still have inventory spend of 2m related to 7m net sales and also a new cost line for GTN that hasn't been seen before.

In the case they go for more products in the pipeline it's going to cost and they will need to raise?

To me it looks like a narrowing path to profitability and I'm not going to give them the benefit of the doubt considering what's happened so far, would be really happy for them to succeed but I'll be watching from the sidelines..

I've taken the loss and started over, it is what it is and ripping the bandaid off isn't that bad.

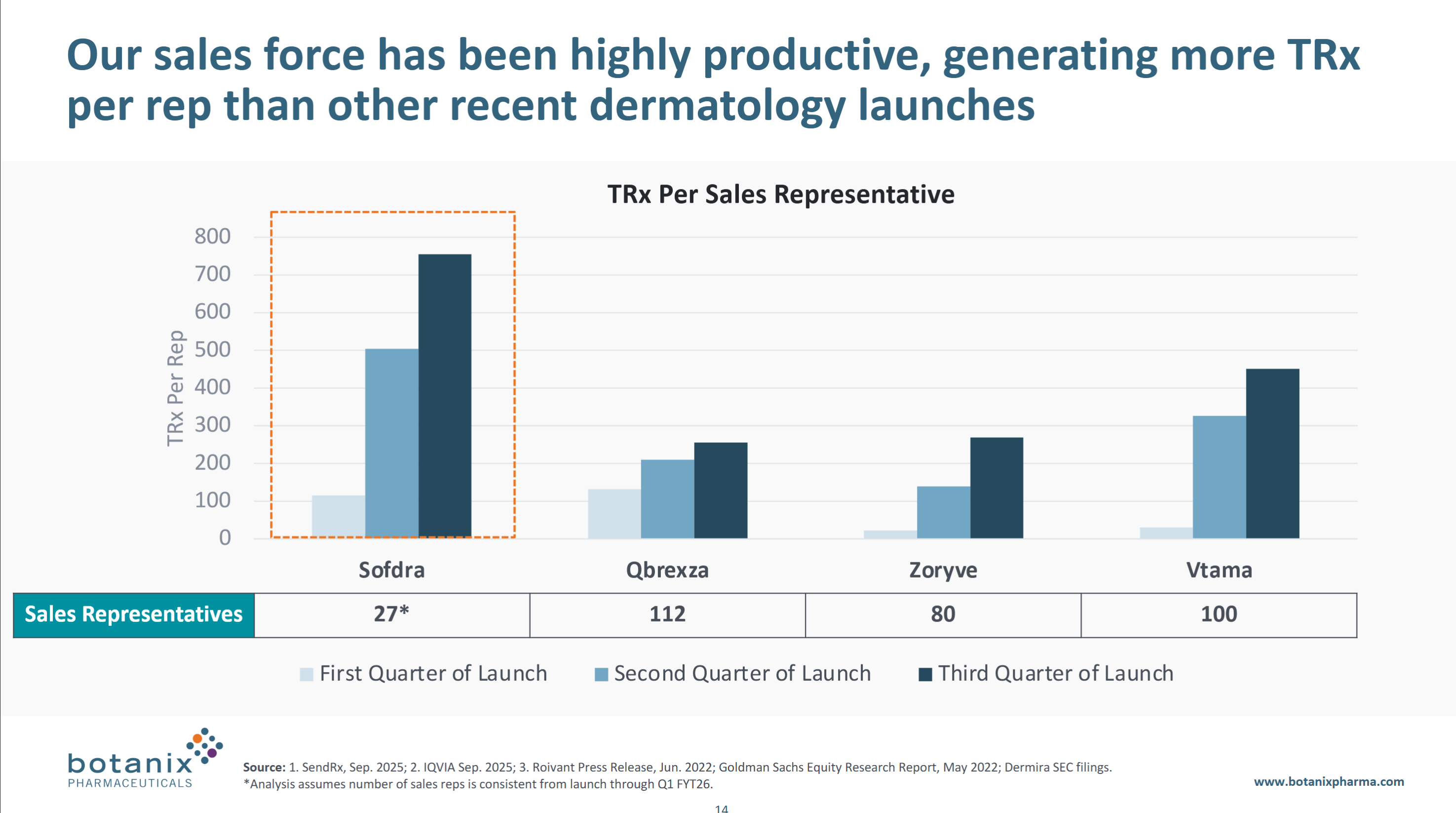

Our sales team might be very productive but our GTN is a lot lower than zorve as well, think they got to the 40-50 range and we are topping out in the 20s.

Unsure how management were forecasting 400-450GTN. Even MC fibbed to us when he was on in April suggesting it was more around the 400 mark than 450 in the interview when he knew full well GTN was at that stage 10-15%

I'll make a link to that sheet if you want to input various scenarios to see how they play out?

Nnyck777

Hi @Schwerms that would be great. It is hard to reckon the disparity in GTN. Was it willfully misleading or genuinely a shock that the ticket clipped was so high along the way. Yes I saw Zoryve has managed a GTN around 50%. What a difference that would have made to Botanix numbers if similar.

I am certainly considering significantly lightening my load of shares. I am curious to see whether roadshows like Canaccord raise any institutional interest.

Schwerms

I don't think they anticipated having to do so many non reimbursed units, and there was what looked like an accounting discrepancy with when the PA units revenue was recognised that artificially lowered the GTN or so I thought.

And now there is only quarterly data is hard to pick apart. I'll make a link to that file tonight and put it up here.

I think if the GTN was on a linear trend we would have seen a few points higher this quarter.

Chance still for a good return now I guess but it's like heads I get 20-30% tails they raise more and more and it's a loss so not worth the risk for me vs other options.

mikebrisy

@Nnyck777 I agree that it is right to raise the comparison with Zoryve, and if the Sofdra experience follows Zoryve, then late-FY26 and early-FY27 would likely be transformational for $BOT and, in that event, today's SP is a bargain, and I've bailed out prematurely.

There are some interesting points about Zoryve.

Revenue Growth

Zorvye initially achieved only a slow burn but built very strongly in year 2.

Q1 2023 shows the typical "deductibles dip", but the Q4 2022 to Q2 2023 progression was modest. (See below)

I'd have probably sold out at that point. I mean Arcutis really rolled the dice big time - their Operating Cashflow was -US$258m in 2022!!!

However, Arcutis were spending a lot of money on sales and marketing, as well as product development. And so it could be that additional formulations and indications helps drive the sales in year 2. (I need to look further at this.)

GTN (using the Botannix definition of GTN)

Zoryve does offer a glimmer of hope for Sofdra on GTN. For example, in its second year Zorvye achieved GTN of c. 35% but it appears to have built this progressively to 50%-55%, towards the end of its third year.

Prescriber Base

Arcutis have been able to materially broaden their prescriber base. For example, in their Q2 2025 result, they reported that 18,000 providers prescribed Zorvye, What appears to have enabled this is that, in addition to their own sales force of 110 targeting adult and pediatric dermatologists, they have an agreement with Kowa to access their network of 220 additional primary care reps, since 2023.

So the effective field force promorting Zorvye is 330, compared with the 50 for Botannix. The Kowa deal was put in place in 2023 (year 2), and seems to be the factor responsible for accelerating the revenue growth. (But interestingly, it didn't erode the GTN!)

Indications

Another clue lies in the fact that Zorvye has over time gained a wider range of indications. These included both adult and pediatric plaque psoriasis, mild to moderate atopic dermatitis (I think regular GPs can prescribe for this), and seborrheic dermatitis. And the product can be applied across many different parts of the body.

Overall, my BA has estimated that the total prevalent population in the US for all the conditions for which Zorvye is applied to be up to 30 million.

Efficacy and Advantages

Overall, Zorvye has pretty decent efficacy data. And of course it has the advantage of being applicable for conditions commonly treated by steroidal creams. So it has the advantage both of being non-steroidal and also having evidence of being effective in some indications where there has been an inadeqaute response to steroids.

My Overall Assessment

Zoryve appears to be following a path to peak sales in a period of 5 to 6 years post launch, and appears likely to hit peak sales (net revenue) of US$600m in 2028.

It's path to peak appears slower than the typical 3 to 5 years, because of 1) widening indications, 2) multiple formulations and 3) multiple sales channels built over the first 2 years.

Assuming $600m net revenue in 2028, applied a P/S of 5x and discounting back 3 years, gets a market cap of $2.25bn (compared with today's close of $2.5bn).

Contrast with Sofdra

It is early days for Sofdra, and perhaps there is a promising path ahead.

But the fact that the TRx trajectory came in below my LOW case, leads me to conclude that SOFDRA looks likely its peak sales are going to some in less than A$200m, and maybe a lot less.

Compared with Zorvye it looks to have narrower indications, lower efficacy in its area, a small prescribing base, and the company seems to be having to give away more revenue to get it into the market - without a positive trend discernible at this stage.

Even if Sofdra ends up be a 3 x QBREXA (the other antocholinergic), that's not a great outcome.

What about Big Pharma

Big Pharma want blockbusters (>US$1bn peak sales).

Eli Lillly acquired Demira in 2020 to strengthen their dermatology franchise. But they ended up getting rid of parts of the pipeline, including selling QBREXA to Journey Medical. So although Dermira sold Qbrexa to Journey Medical, they were already owned by Eli Lilly, so Eli Lilly didn't see a fit for Qbrexa.

The Qbrexa's of this world are destined to be owned by Small Pharma. Drugs like Zoryve are getting close to being of interest to Big Pharma - what will be more interesting to Big Pharma will be the Arcutis pipeline. (I don't have a point of view on that.)

Sofdra appears at the moment to sit somewhere between Qbrexa and Zorvye.

So one thing I am wondering is whether the demeanour of Vince and Howie (i.e., forever looking like the cat just swallowed their pet goldfish, ever since "The Nightmare on ..." broke) is that they perceive their strategy of building Botannix and flipping it for several $billions is fading away, and they are seeing their destiny as a 3 X Journey Medical plodder.

At that point, retention of senior staff starts to become a potential issue. After all, they know this business well and where things are likely to head.

My Conclusion

I've constructed quite a negative narrative here. And I could be completely wrong. But when I try and do fact-based analysis, and these kinds of narratives fall out of the numbers, it just adds up to too much risk for me to hold on.

I do wish the company well. And maybe Year 2 will be transformative. If that's the case, the patient investor might still be richly rewarded.

And of course, because I might be wrong, I'm going to continue to watch this one. If the TRx trajectory ticks up, then, ... as I said yesterday "When the facts change ..."

Disc: Not held

edgescape

Also Zorvye has more indications so it would make sense to have a larger sales force.

You can almost consider Zorvye as a platform treatment and yes I am aware the word platform is very overused in lots of places!

Interesting comparison with Sodfra though.

Nnyck777

Sofdra may extend to Palmar, plantar and hyperhydrosis of the head. This is perhaps an increase use extension. How long that would take who can say.

Geez101

Think from memory there was also mention of potentially offering a lower strength over the counter option down the line.

mikebrisy

Yes, a supplemental NDA should be reasonably straightforward comprising:

- a pharmacokinetic study to show equivalence of systemic absorption across sites

- a limited tolerability study to show there is no adverse reaction at the new site

- a clinical rationale to make the case for the extension from an efficacy standpoint.

I don’t know enough about hyperhidrosis to venture a guess as to what would be entailed in detail, but it would be a lower bar to pass than the original NDA.

The problem $BOT faces is that they are in cash preservation mode. Ideally, they need operating cash flows to fund reinvestment, but with the current metrics, it’s going to be a slog to get there.

As to the lower strength variant registration, that’s also possible, but there are other products for less severe sweating, so they’d need to assess the commercial opportunity. It potentially expands the TAM as a lower strength product might be suitable for primary care or even OTC.

But it all comes back to the question, is the product good enough?

Schwerms

There was talk In the last SM interview that they might not need to directly pursue it due to derms just experimenting themselves and prescribing offlabel, there was the odd Reddit post for people saying they had been giving it for feet / hands

wonkeydonkey

Hi,

I bit the bullet and sold BOT today, sold on strawman on Monday. Guaranteed to go up exponentially now ha ha

wonkeydonkey

I think I am officially banning myself from acquiring any more biomed companies. It's by far the sector I have underperformed in the most

I will continue to hold PAR and MVP to their natural conclusion, but OPT, PNV and BOT (despite initial optimism) have only contributed to tax losses ;-)

Shapeshifter

@wonkeydonkey I stopped investing in biotechs a couple of years ago when I realised I wasn't very good at it.

The conclusion I came to was outcomes are often binary with a high failure rate and unless you are very close to the action outcomes are difficult to predict. Also the SP of these companies swing vertiginously on market sentiment. I booked a few losses and took my bat and ball and went home.

But I know that people can do very well on these as well. It's a weird and wild world of investing.

wonkeydonkey

Hey @Shapeshifter , yes, I think I was holding on to deluded hopes and probably should have taken my bat and ball away much sooner and concentrated on areas where I have performed well. Never too late to learn another investing lesson ;-)

edgescape

I guess the price action displayed by the candle on the results day was all I needed to know?

It didn't hold 17c for very long and after reading the updates I just waited till end of the day before getting out.