Disc: Held IRL and in SM.

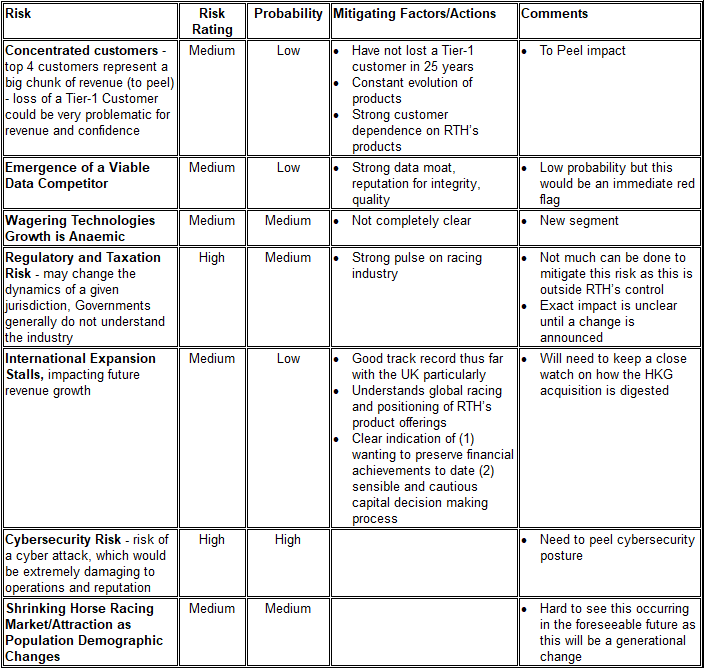

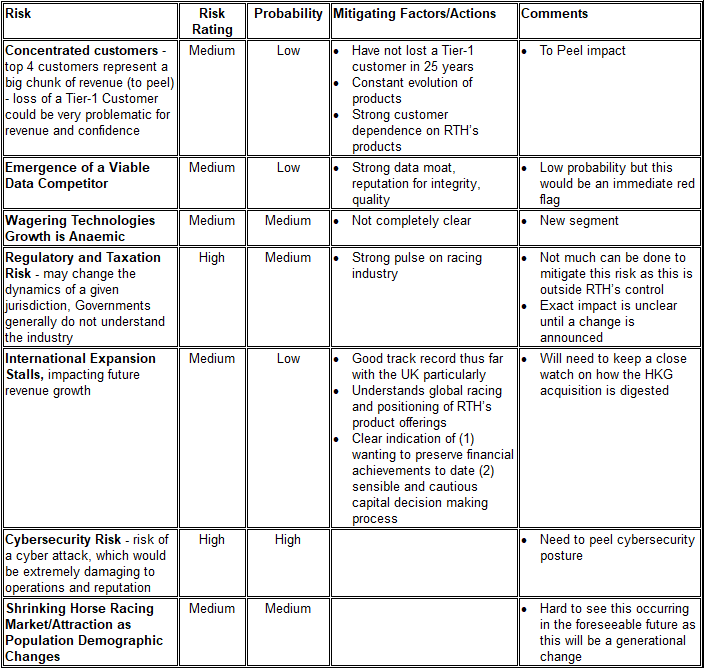

Included a Risk Table - there ARE absolutely risks to watch out for!

THE MOAT

- Have the largest database of racing data in the planet, not just raw data but curated, normalised and standardised data for global racing - this is a very strong moat

- Widely acknowledged that those who try to copy what RTH does, does not do it as well - services the lower end of the markets, Tier-1 customers are not interested

- Very hard to replicate what RTH does, at scale, given the sheer volume of races that occur - RTH does it for 30 countries, reliably, every day

- Very hard to transition to another provider - exercise to transition out will be a big and risky exercise for the customer - no impetus to change as there is nothing 10x better to warrant the change

- Big piece of upfront technical integration work for both RTH and customer to enable data mapping, data flow - adds to the moat

- RTH has all the data, all the analytics and the predictive models - Use AI across all RTH data, models to create nuanced-products that are very much backed by data and by science - Competitors who use AI without those data assets are essentially regurgitating whats already in the market, creating a lower quality product - products are pretty basic and generic, won’t stand up over time. AI is almost useless without a source of intelligence behind it

- Owns all the tech IP

MANY WAYS TO WIN

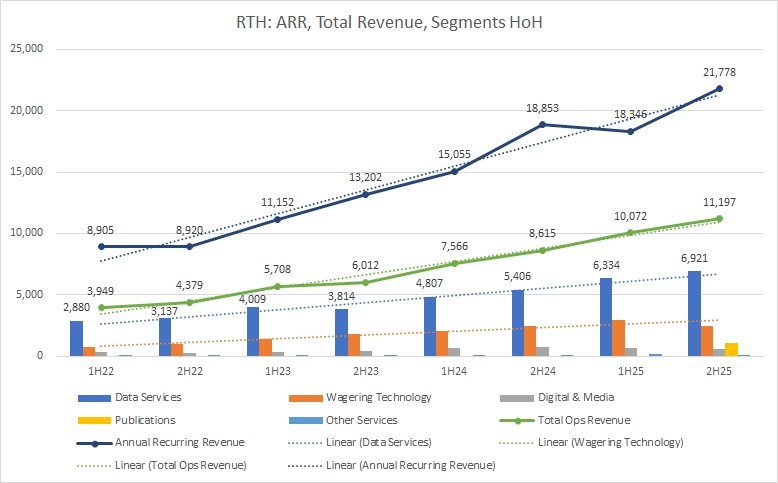

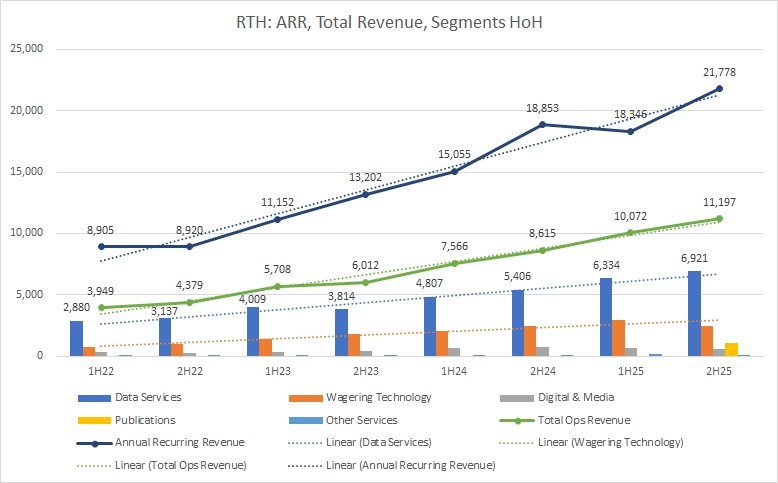

- From this strong data base, RTH has diversified into different ways to upsell and win - Wagering Technologies and Managed Trading Services, Digital Media, Managed Trading Services, Digital & Media, all segments have been growing, albeit at different rates

- Growth drivers - international expansion to other racing jurisdictions

FINANCIALS

- Inflection point into profitability - Revenue, ARR, EBITDA, NPBT all growing - 2 consecutive years of NPBT

- Strong focus on using AI/automation to increase operational efficiency

- Growth has been mostly organic, bar the latest HKG acquisition

- Steady growth of high margin ~81%, sticky tier-1 racing customers revenue - have never lost a Tier-1 customer in 25 years

- Long duration contracts - 2+2 or 3+3 that typically just rollover

- Cash $5.6m, no debt - clean balance sheet, no immediate need for additional capital. Little immediate risk of a capital raising

RISKS

TRIGGERS FOR EXIT

- Loss of a Tier-1 customer would be a cause of huge concern on the integrity of RTH’s moat

- Emergence of a viable data competitor which directly threatens RTH’s data moat

- Regulatory and Taxation Change which would threaten the viability of the racing industry in the key jurisdictions which RTH operates in

- Clear evidence of shrinking Horse Racing attraction

POSITION SIZE

3.0 to 3.5% over time

CHART POSITION, ENTRY POINTS

RTH’s share price is slightly below the mid-point between its all time high of 1.84 on 25 Nov 2021, just post listing, and its all-time low of 0.37 on 2 May 2023.

It has also been hovering around to 50% retracement level at 0.975 from the last major rally from May 2023 to Sep 2024 - not a bad entry point

Ideal Buy zone is between 0.84 to 0.89 which is both a historical support/resistance area as well as the 61.8% retracement area

Have opened the position at 0.961 which is a decent entry point, but will continue to average down on weakness below this point when the opportunity presents