Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

Discl: Held IRL 2.21% and in SM

Dad Gary and Son Stephen sold down another 44% of the shares they both intended to sell last, 210,194 shares averaging $0.985 and $0.973, respectively.

Another 12.2% or 58,340 shares left to go.

Price continues to be impacted, but volume has tapered off. The $0.93 level is just above the 200 SMA’s $0.91 and near the 61.8% retracement of $0.895, so nice downside technical support at these levels ... Time for one last bite in the next day or so, me thinks, as this looks to be wrapped up soon, unless both back off from selling, to let the price float upwards before selling the last lot at higher levels ...

Discl: Held IR 1.44% and in SM

Continue to track closely, the ongoing sales of RTH Directors, Gary Crispe (Co-Founder) and Stephen Crispe CEO - another Sale Tranche occured in the last week, as announced yesterday.

As of yesterday:

- 37.3% of the flagged volume to sell has been sold, 62.7% or 268,534 shares remaining to sell

- Given the $1.02x price and remaining shares, it looks like the RTH price will be capped at these levels until this block is cleared - the spikes in trading volume are quite noticeable

- Feels like young Stephen is in a bit of a rush to raise cash, old man Gary is playing it a bit more cool ...

I want their shares, but at as low a price possible! As the recent sharp fall in price is really going against much improved business fundamentals, this window is still looking to be my best shot at getting to my target allocation of 2.5%. Once this volume is absorbed, I can't quite see any reason for the price to stay at this levels.

Am probably not going to get greedy, and will wrap up my top up in the next week or so.

All bets are off (pun intended), if there is a positive announcement in the meantime ...!

Discl: Held IRL 1.49% and in SM

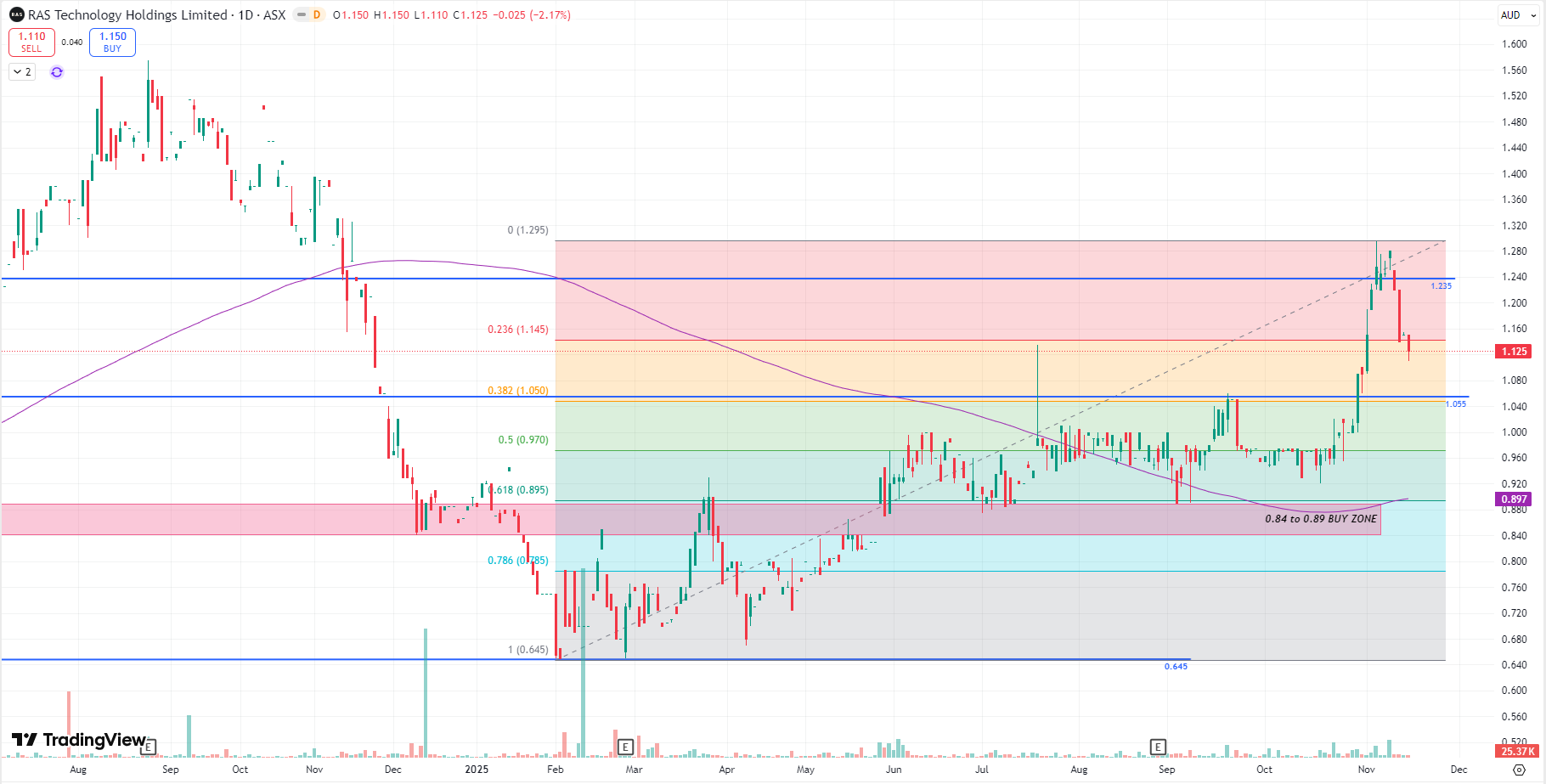

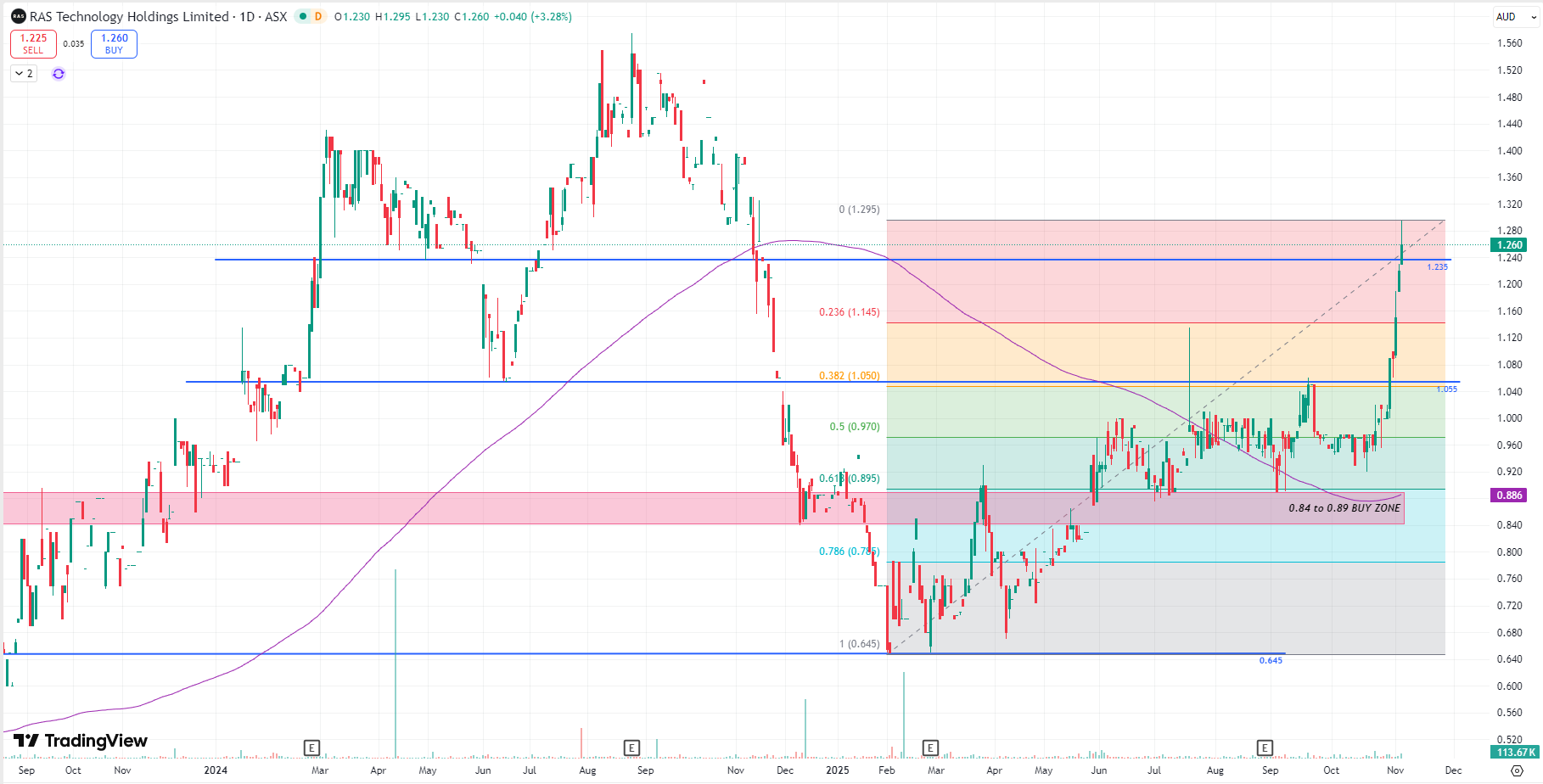

The RTH price has been in a nice top up zone these past 2 days, and I took the opportunity to take 2 bites, yesterday at 1.03 and today at 1.00 as it fell below my watch 1.055 level. The price is now in my top up zone between the 38.2% (1.05) and 50% (0.97) retracement zones.

Buying in thirds, and given current volatility, saving some powder for a drop to ~0.905, which is where it should find 200 SMA support, and possibly into the 0.84 to 0.89 zone, where I will absolutely be backing up the truck to load up, if it gets to that level.

Other than pre-announced orderly Director selling, it has been good news all round, so for me, this price drop does not reflect the great RTH business fundamentals at all ...

Discl: Held IRL 0.86% and in SM

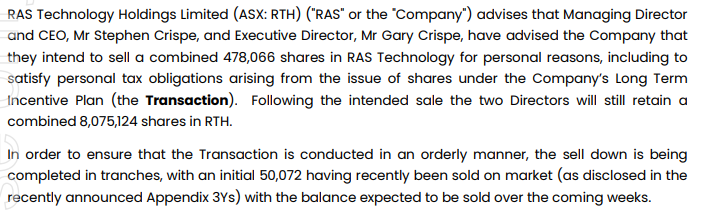

RTH announced way past beer o’clock today, the following Share Sale by Directors, which immediately invoked a bad DRO-Oleg-like vibe.

TLDR - looks orderly, not a DRO-Oleg saga at all ...

A pretty horrible time to be selling I thought, hence the “coming weeks” - am hoping it will add a bit more liquidity as it has been hard getting a decent chunk of volume.

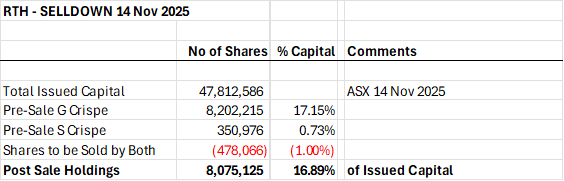

Had a closer look to see at the Director Share Sales track record.

Overall Impact

1% of their combined holding - doesn't trouble me at all, they still hold 16.89% combined.

G Crispe

- This is the 3rd time old man Gary is selling - this tranche is the smallest of the 3

- Gary has sold down the last 2 tranches with Co-Founder Robert Vilkaitis, in equal shares

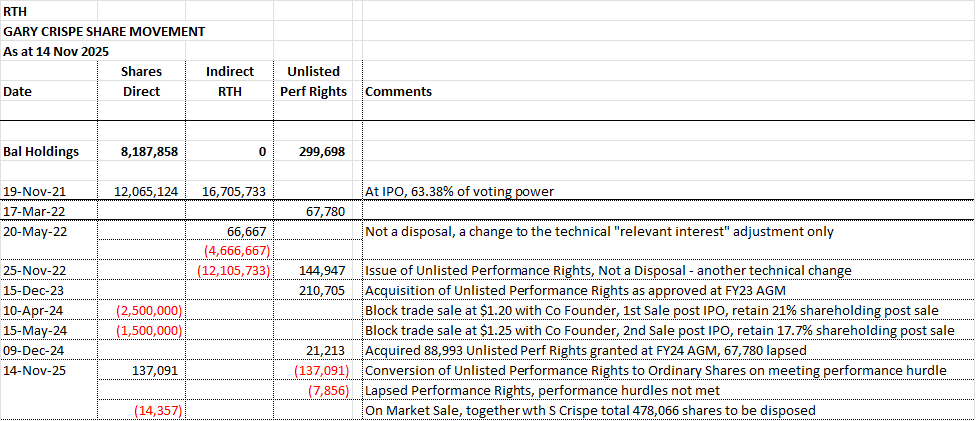

S Crispe

First time Stephen is selling down - after years of toil in the business, this is probably well deserved. With the much smaller quantities of shares, it does feel that young Stephen isn't being handed anything on the platter.

Chart

My top up zone is around ~$1.05, the 38.2% retracement zone from the recent run up .

Discl: Held IRL 0.85% and in SM

Very nice deal announced today, amidst a sea of read ...!

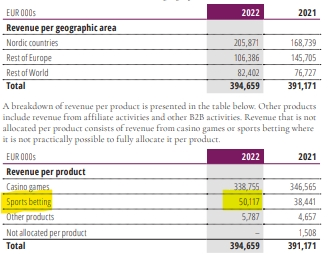

From Wikipedia, LeoVegas is:

- A Swedish mobile of online casino and sports betting services such as table games, video slots, progressive jackpots, video poker and live betting to a number of international markets founded in 2011

- Areas served: Nordics, UK, Europe

- Products: LeoVegas Casino, LeoVegas Live Casino, LeoVegas Sportsbook

- Revenue: EUR327.8m, 930+ employees

- A subsidiary of MGM Resorts International, was acquired in 2022

- LeoVegas experienced rapid growth due to the overriding increase in smartphone use and the "mobile first" mentality of its founders. Hagman stated that the company "was born out of the smartphone, which today is the fastest-growing channel for entertainment."

There were no numbers but key for me:

- Looks like another Tier-1 company, given that LeoVegas is a subsidiary of MGM Resorts International

- Won through global tender and due dilligence - further evidence that RTH's products are world class

- It is wide scope deal with 2 RTH pillars at play - Data, Analytics + fully Managed Trading Services, taking over the delivery of the Racing service for its brands in the UK

- Extends the UK racing reach to Sweden, Norway, Denmark and Sweden - LeoVegas’ core markets outside of the UK

- My buddy Chat notes that other than the UK, Sweden has a “relatively strong horse market”

- LeoVegas’ last publicly available financial statements was FY2022 - it did EUR50m in Sports Betting as a whole, growing 30% YoY from FY2021’s EUR38.4m

I can see how the deal makes sense to LeoVegas: (1) Sports Betting is ~13% of its revenue, but growing at a fast clip, horse racing will be a further fraction of that - not big but not small either (2) RTH has the data products and the MTS expertise for LeoVegas to farm these out, possibly saving them cost.

It is also further evidence of RTH’s strategy playing out nicely - Data, Data Analytics, then MTS ...

Chart Review

Share price was relative muted amidst a not-great day for tech stocks. News of the deal must have leaked as RTH has moved a good ~20% in the past week ahead of the deal.

Bit of heat in the price now. Staying above 1.235 will be a bit of a challenge I suspect, support should be good around 1.055 and any sideways consolidation between these ranges would be healthy indeed.

Disc: Held IRL and in SM.

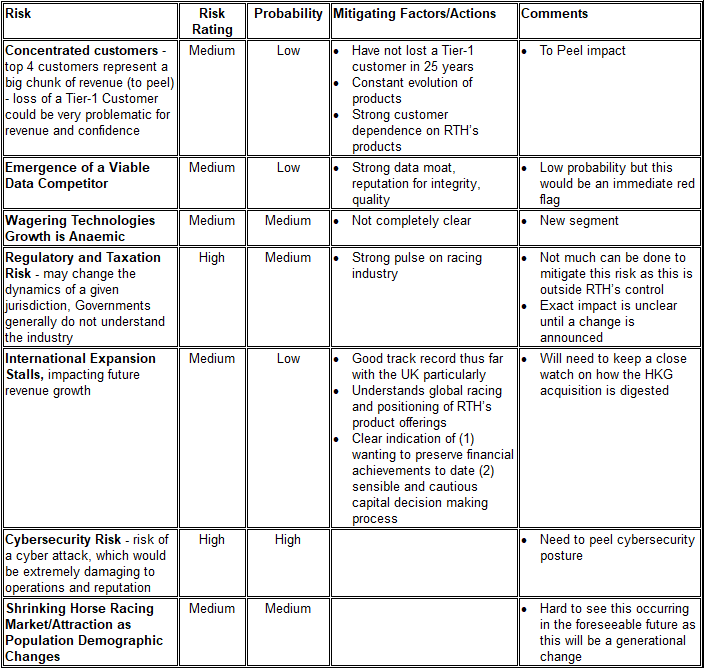

Included a Risk Table - there ARE absolutely risks to watch out for!

THE MOAT

- Have the largest database of racing data in the planet, not just raw data but curated, normalised and standardised data for global racing - this is a very strong moat

- Widely acknowledged that those who try to copy what RTH does, does not do it as well - services the lower end of the markets, Tier-1 customers are not interested

- Very hard to replicate what RTH does, at scale, given the sheer volume of races that occur - RTH does it for 30 countries, reliably, every day

- Very hard to transition to another provider - exercise to transition out will be a big and risky exercise for the customer - no impetus to change as there is nothing 10x better to warrant the change

- Big piece of upfront technical integration work for both RTH and customer to enable data mapping, data flow - adds to the moat

- RTH has all the data, all the analytics and the predictive models - Use AI across all RTH data, models to create nuanced-products that are very much backed by data and by science - Competitors who use AI without those data assets are essentially regurgitating whats already in the market, creating a lower quality product - products are pretty basic and generic, won’t stand up over time. AI is almost useless without a source of intelligence behind it

- Owns all the tech IP

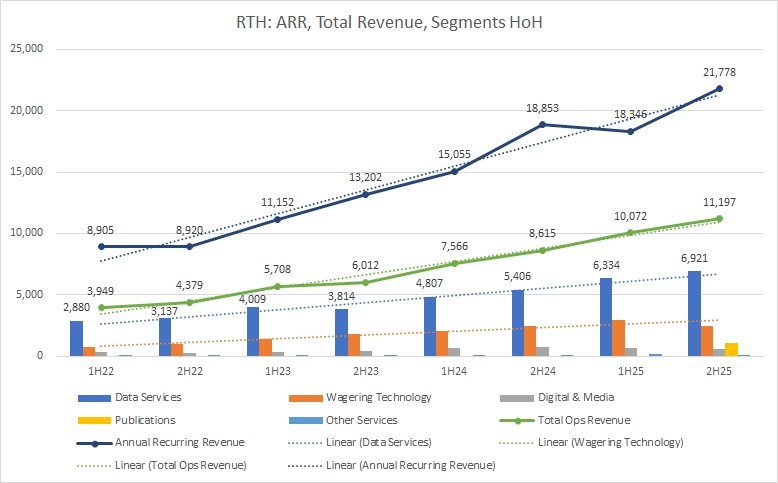

MANY WAYS TO WIN

- From this strong data base, RTH has diversified into different ways to upsell and win - Wagering Technologies and Managed Trading Services, Digital Media, Managed Trading Services, Digital & Media, all segments have been growing, albeit at different rates

- Growth drivers - international expansion to other racing jurisdictions

FINANCIALS

- Inflection point into profitability - Revenue, ARR, EBITDA, NPBT all growing - 2 consecutive years of NPBT

- Strong focus on using AI/automation to increase operational efficiency

- Growth has been mostly organic, bar the latest HKG acquisition

- Steady growth of high margin ~81%, sticky tier-1 racing customers revenue - have never lost a Tier-1 customer in 25 years

- Long duration contracts - 2+2 or 3+3 that typically just rollover

- Cash $5.6m, no debt - clean balance sheet, no immediate need for additional capital. Little immediate risk of a capital raising

RISKS

TRIGGERS FOR EXIT

- Loss of a Tier-1 customer would be a cause of huge concern on the integrity of RTH’s moat

- Emergence of a viable data competitor which directly threatens RTH’s data moat

- Regulatory and Taxation Change which would threaten the viability of the racing industry in the key jurisdictions which RTH operates in

- Clear evidence of shrinking Horse Racing attraction

POSITION SIZE

3.0 to 3.5% over time

CHART POSITION, ENTRY POINTS

RTH’s share price is slightly below the mid-point between its all time high of 1.84 on 25 Nov 2021, just post listing, and its all-time low of 0.37 on 2 May 2023.

It has also been hovering around to 50% retracement level at 0.975 from the last major rally from May 2023 to Sep 2024 - not a bad entry point

Ideal Buy zone is between 0.84 to 0.89 which is both a historical support/resistance area as well as the 61.8% retracement area

Have opened the position at 0.961 which is a decent entry point, but will continue to average down on weakness below this point when the opportunity presents

Final part of my notes on RTH, ahead of the much anticipated call!

Discl: Not Held

COMPANY PROFILE AND GLOBAL REACH

Racing and Sports (RAS) is a publicly listed (ASX: RTH) Australian company that offers integrated data, analytics, content, and wagering technology for the global racing and wagering sectors. It has been operating since 1999 and is headquartered in Canberra, with additional offices in Sri Lanka, the UK, New Zealand, and the United States.

They process data from over 1,000 racing centres across 30+ countries, spanning thoroughbred, harness, and greyhound racing.

SERVICES & CAPABILITIES

Enhanced Information Services: B2B solutions including premium analytics, predictive animations, infographics, and betting content delivered via APIs to operators and racing bodies worldwide.

Wagering Technology & Trading Platforms: Offers SaaS-based trading solutions (e.g., Trading Manager Platform) and fully managed trading services (MTS).

Digital & Media: Operates a content-rich website with 3+ million unique users annually and 60+ million page views, offering news, racecards, form guides, and digital advertising reach globally.

The Wholesale Data, Content & Distribution segment contributed to 64% of its revenue around its IPO in late 2021, highlighting its core strength in data services

CUSTOMER FOOTPRINT

RAS serves a diverse roster of prominent clients including major wagering operators and racing entities:

- Global bookmakers: Entain (Ladbrokes, Neds), Flutter (Sportsbet, Paddy Power, Betfair), Bet365, Singapore Pools

- Australian racing bodies: Tabcorp, Racing Victoria, Australian Turf Club

- Major international operators: Hong Kong Jockey Club

This underlines RAS’s credibility and presence across several key betting markets.

In the UK, RAS continues to gain market share in data and trading services, securing exclusive agreements — for example, as the sole racing data/trading provider for Pragmatic Play (servicing brands like DAZN Bet and Quinn Bet)

GLOBAL STANDING & MARKET POSITION

Extensive global coverage: With data from 30+ countries and over 1,000 venues, RAS has a strong breadth of form and racing data.

Prestigious clientele: The fact that they serve leading operators like Entain, Flutter, Bet365, and HKJC matches them with the top tier of racing data providers.

Expanding reach: Strategic wins (e.g. Pragmatic Play in the UK) and ARR growth indicate they’re competitively scaling in key betting jurisdictions. Acquired Hong Kong racing publications via Racing and Sports Asia (RASA), boosting regional presence in a high-growth (17%) APAC market

WHAT GIVES RTH THE EDGE OVER COMPETITORS

- Integrated Service Offering - RAS bundles enhanced data (15B+ data points), SaaS wagering technology, and media/digital reach—all under one roof. This holistic approach is rare among competitors

- Global Footprint & Diverse Code Coverage - RAS covers 1,000+ race centers across 30+ countries, spanning thoroughbred, harness, and greyhound racing. Not many rivals offer this breadth

- High-Profile Client Base - RAS serves major operators and racing bodies—including Entain (Ladbrokes, Neds), Flutter (Sportsbet, Paddy Power, Betfair), Bet365, HKJC, Tabcorp, Racing Victoria, Singapore Pools. These are some of the largest brands in global wagering

- Tech-Driven Products & Partnerships - Offers creative tools like predictive animations, infographics, and fully automated trading platforms (SaaS and Managed Trading Services). Partnerships with Stake, Matchbook and XB Net showcase RAS’s strong trade integration and launch capabilities for new markets

- Media & Digital Platform Synergy - RAS isn’t just B2B; its consumer-facing platforms draw 3M+ unique users annually with 60M+ page views, creating cross-sell opportunities and brand visibility not offered by pure-data providers

In that light, RAS is a leading global provider, especially for form analytics, digital content, and integrated wagering tech. While not as dominant as Equibase in the US or Timeform in the UK, RAS stands out through its holistic approach and growing client base.

Racing and Sports (ASX: RTH) is firmly positioned among the top global racing-data suppliers, with considerable scale, diverse services, and key client relationships. Their competitive edge is their integration of data, technology, and media — making them a serious player globally, especially for operators seeking comprehensive wagering and form solutions across multiple jurisdictions.

RTH’S CLOSEST COMPETITORS

RTH sits in the data, analytics, and wagering services niche, not the tote hardware business. Its direct competitors are other racing data, analytics, and pricing feed providers, rather than the big tote operators.

Racing and Sports competes most closely with Timeform, Equibase, and BetMakers in the data & content supply niche, while also differentiating itself by being independent + globally integrated.

Discl: Not Held, In Thesis Building Mode

Getting my head around the different Horse Racing technology platforms, the space which RTH's 2nd biggest and growing segment. Becoming clearer within the overall technology space, where RTH plays and does not play.

Types of Horse Racing Betting

This is important to understand to position RTH’s competitors in the Wagering Technology space and where RTH plays.

1. Tote Betting

Also referred to as parimutuel or pool betting, tote betting offers an alternative to fixed odds betting and as a result can yield massive dividends to the right wager.

Short for totalisator, a “tote” is a cumulative pool where all bets of the same type for an event or race are placed.

This pool is then divided among the winning bets, so the more money betted on a race, the bigger the tote, the bigger potential dividends.

Tote odds are determined by the amount of money placed on each outcome. Therefore, the outcomes that attract the most money will have the shortest odds, while the least supported wagers will return the highest dividends.

Tote odds are constantly fluctuating in accordance with the amount of money being wagered. As a result, final potential dividends are only known once the betting market has closed, which coincides with the start of the race.

Odds on any given result can change significantly from the time a bet is placed to the time betting closes. This is why some punters prefer fixed odds as they cannot change on you after you have placed your bet.

2. Fixed Odds

Unlike Tote bets, fixed odds are locked in once you place your bet. The value of fixed odds are set by the bookmaker, for example a horse can be $2.20 to win a race. Once you place money on that horse to win, your dividend will be your wager times the odds when you placed the bet.

Tote bets are different because the return will fluctuate based on the number of punters who have put money into the pool.

3. Advance Deposit Wagering (ADW)

"Advance deposit wagering" or "ADW" means a system of pari-mutuels wagering in which wagers and withdrawals are debited and winning payoffs and deposits are credited to an account held by an authorized ADW provider on behalf of an account holder

Advance-deposit wagering (ADW) is a form of gambling on the outcome of horse races in which bettors must fund their account before being allowed to place bets. ADW is often conducted online or by phone. t typically involves betting on horse or greyhound racing. Wagering may take place through parimutuel pools

WAGERING TECHNOLOGY PROVIDERS

This is about the technology providers that power horse racing wagering platforms (not the bookmakers themselves, but the B2B companies supplying the tote systems, betting engines, digital platforms, and data integrations).

- US Tote Market: A three-way split — Sportech (BetMakers), AmTote, United Tote

- BetMakers and SIS are increasingly global, supplying data + digital wagering technology beyond tote.

- Racing and Sports (RTH) is smaller in market share but carves out a niche in analytics + content services, giving it a differentiated role versus legacy tote providers.

- Hong Kong Jockey Club and Japan Racing Association run proprietary in-house wagering technology, meaning third-party providers have little penetration there.

- Global Expansion: BetMakers is the most aggressive internationally, blending tote + fixed-odds

- Content Powerhouses: SIS and XB Net control distribution of UK/IRE and US racing respectively

- Specialist Niche: Racing and Sports (RTH) is not a tote operator but differentiates via analytics, form, and data-driven wagering tools, increasingly valuable in digital markets

Discl: Not Held, In Thesis Building Mode

Continuing my notes:

F. LEADING BOOKMAKERS & BETTING GROUPS - GLOBAL REACH/TOTAL REVENUE

Here’s how the top horse-racing bookmakers and betting groups rank globally by overall revenue or reach — noting, however, that most operators aren’t breaking out horse-racing–specific figures separately.

These figures reflect overall betting revenue, not solely from horse racing. However, big operators like Flutter, Bet365, Entain, and William Hill derive a meaningful portion of their activities from horse-racing markets (fixed odds, pools, exchanges, broadcast partnerships).

Horse racing remains especially significant in regions like the UK, Australia, and the U.S., where bookmakers typically highlight these events with live streaming, commingled pools, and special markets

1. Flutter Entertainment

Overview: The world’s largest online betting company. In 2023, total revenue reached $11.8 billion. This includes horse-racing exposure via brands like Betfair, Paddy Power, and FanDuel. (TIME)

Notable Expansion: Flutter acquired stakes in Brazil’s NSX Group and Italy’s Snaitech—underscoring its global footprint. (MarketWatch, Reuters)

Leads by a wide margin as the largest global betting company, with extensive horse-racing operations embedded across its brands.

2. Bet365

Overview: One of the most profitable betting companies globally. For fiscal year ending March 2024, group revenue was £3.72 billion (~$4.65 billion). (Betting US, iGB, gamblinginsider.com, SBC Americas)

Context: Though not as large as Flutter, Bet365’s sheer scale rivals top-tier operators.

Powerful standalone operator with strong horse-racing integration and broadcast rights, particularly in the UK and increasingly in the U.S.

3. Entain Group (Paddy Power/Ladbrokes / Coral)

Overview: Major bookmaker with global presence and strong horse-racing offerings. While not stated here, it’s regularly listed among the industry's top five. (Betting & Gaming Council)

Holds a top-three position globally, with major racing wagers running through its brands.

4. William Hill (now part of 888)**

Overview: In 2023, revenue was around £1.2 billion (~$1.5 billion). (iGaming Express, Covers.com)

Horse-Racing Exposure: Historically, horse-racing accounted for about £1.4 billion in turnover back in 2017. (Andrew Cetnarskyj)

Smaller but still a major force, especially in UK racing cycles

5. Other Noteworthy Players

Betfair / FanDuel (part of Flutter but notable on their own): Betfair Group’s standalone revenue is estimated at £340 million historically, while current numbers are embedded within Flutter’s results. (Tracxn, bloodhorse.com)

Crypto Operators (e.g., Stake): Not traditional bookmakers, yet emerging players like Stake reported $4.7 billion GGR in 2024. (Financial Times)

Emerging players like crypto-based operators are starting to shift the competitive landscape, although their horse-racing penetration remains limited.

----------------

Have circled RTH's existing customer which are highlighted above. Its a decent overlap, which gives me confidence that RTH is indeed playing with the Tier-1's, particularly Flutter, Bet365 and Entain, the Top 3.

G. GLOBAL HORSE RACING DATA & CONTENT PROVIDERS

This is RTH's biggest segment.

“Data & Content” here covers official entries/results/past-performances, live video/simulcast, live odds/price feeds, trading/odds engines and editorial/form/rating services.

No clean global market-share number is publicly published. Providers report customers, volumes (events/day, data points) or revenue segments — but they rarely publish a standardized “% of global racing data market” figure. Market share must therefore be inferred from: (a) official status in jurisdictions (e.g., Equibase in US; JRA in Japan; PMU in France), (b) customer counts and geographic coverage (e.g., SIS claims ~400 customers in 50 countries), and (c) commercial footprints of sportsbook platform vendors (Betgenius, Sportradar, Kambi/OpenBet) in operator technology stacks. (SIS, Equibase, Timeform).

--------

Each of the main horse racing jurisdictions has its own clear owner of data. And from @mushroompanda 's diagram, we know that RTH ingests data from these governing bodies as one of its inputs into the RTH Data & Analytics that RTH eventually publishes to its customers.

The 3 questions in my mind that I would want to ask management around this topic:

- "What is the RTH value add/enrichment/amalgamation from other sources, either in process, content and/or analytics, that makes the RTH Data & Analytics valuable to its customers".

- How is this value add executed - humans or AI (it will be both), and in what proportion

- How is this value add important/critical to the success of its key customers, particularly the handful that makes up a significant chunk of RTH's revenue base

The answers are not immediately clear to me ... this is quite key to gain an understanding off, as I think this will provide insights on the moat and the strength of the moat. It will also allow for an assessment of risks around customer concentration.

I have started a deep dive into RTH following the brilliant writeups from @mushroompanda and @Wini .

The thing I am focused on most is working out RTH's moat and the strength of that moat. I like the moat of my companies to be such that the broader industry has to depend on what my companies supply to operate so that once in, the keys get thrown way and customers are highly and as completely dependent as possible - muahahaha-like ...... SDR, AIM, XRF, CAT, C79 are my core holdings from this perspective.

I am still working out exactly what RTH's moat is. Currently, I see this as "essential service provider to the horse racing industry".

Hence the deeper dive into the broader horse racing industry to work out how and where RTH plays. The following is what I have found via ChatGPT. Have not validated every point, but have asked the question from multiple angles and the same answers emerge ... Am going from big picture, then narrowing down to key players, RTH's offerings and RTH's positioning.

I have very little understanding of the gaming, waging and horse racing industry, so this was/is a highly insightful exercise to gain a better understanding.

Will post in parts to make each post manageable as I work through each part.

A. MAJOR HORSE RACING JURISDICTIONS (Ranked by Global Importance)

Horse racing is highly regional, and the “major jurisdictions” are usually ranked by betting turnover, prestige of races, and international reach. Here’s a breakdown of the leading jurisdictions:

1. United Kingdom & Ireland

- Why important: Historical home of modern racing, huge calendar of flat and jumps races.

- Turnover: Among the largest globally; betting turnover ~£10–12 billion annually.

- Key Events: Royal Ascot, The Derby (Epsom), Cheltenham Festival, Grand National.

- Global Influence: Major source of breeding (Newmarket, Ireland’s Coolmore), media rights, and content exports.

- Deep media, form/trading ecosystem (Timeform, Racing Post), significant retail and online betting culture.

2. Japan

- Why important: Japan Racing Association (JRA) is one of the richest racing bodies in the world.

- Turnover: Exceeds US$25 billion annually, making Japan the single largest wagering market.

- Key Events: Japan Cup, Arima Kinen, Tokyo Yushun (Japanese Derby).

- Global Influence: Ultra-strong betting pools, world-class horses (Deep Impact, Equinox), and highly regulated integrity model.

- Extremely large pari-mutuel handle (JRA + NAR combined), high local attendance and strong domestic industry economics. (Horse Racing in Japan)

3. Australia

- Why important: Huge domestic engagement; racing is a major national sport.

- Turnover: Approx. A$25–30 billion annually across thoroughbreds, harness, and greyhounds.

- Key Events: Melbourne Cup (“the race that stops a nation”), The Everest, Cox Plate, Magic Millions.

- Global Influence: Leader in tote and fixed-odds betting integration, data exports, and digital wagering.

- TAB systems and major racing events (Melbourne Cup) create major seasonal spikes; Tabcorp is a large local player.

4. Hong Kong

- Why important: Hong Kong Jockey Club (HKJC) is the most profitable racing organisation globally.

- Turnover: ~HK$300 billion (~US$38 billion) annually in racing and football betting combined. Racing alone contributes over US$20 billion.

- Key Events: Hong Kong International Races (HKIR), Champions Mile.

- Global Influence: Model of efficiency, integrity, and technology-driven betting. Limited number of race meetings but massive liquidity in pools.

- Very high turnover per capita; HKJC is a global wagering hub and uses simulcast/commingling heavily. (corporate.hkjc.com)

5. United States

- Why important: Huge racing history, though fragmented across states.

- Turnover: US pari-mutuel handle ~US$12 billion annually (mostly thoroughbred).

- Key Events: Kentucky Derby, Preakness, Belmont Stakes (Triple Crown), Breeders’ Cup.

- Global Influence: Source of speed-oriented bloodlines; challenges include integrity and declining on-track attendance.

- Fragmented (track-level pools, ADWs, simulcast networks, and newly expanded sports-betting ecosystems) with big commercial data businesses (Equibase, DRF). (Equibase)

6. France

- Why important: Central to European racing and breeding.

- Turnover: ~€7 billion annually (via PMU).

- Key Events: Prix de l’Arc de Triomphe, Prix du Jockey Club.

- Global Influence: Strong breeding industry, major role in international commingling pools.

- PMU is one of Europe’s largest pool operators and central to trotting & gallop betting in EU. (SBC News)

7. Middle East (UAE, Saudi Arabia, Qatar, Bahrain)

- Why important: Wealth-driven racing centres with huge prize money.

- Turnover: Smaller domestic betting markets (betting largely restricted), but massive investment in prize money.

- Key Events: Dubai World Cup, Saudi Cup (world’s richest race, US$20 million).

- Global Influence: Draws the world’s best horses and boosts international prestige, even without betting-driven turnover.

8. Singapore (declining)

- Why important: Once a strong Asian jurisdiction. Singapore Turf Club ran the Kranji Mile.

- Turnover: Falling; racing is being phased out (final meeting held in 2024).

- Global Influence: Once a hub, now diminished.

9. Other Notable Regions

- South Africa: Strong local breeding and racing, with key events like the Durban July.

- South America (Argentina, Chile, Brazil): Rich bloodstock history, particularly Argentina. Betting turnover is smaller but horses are internationally respected.

- Korea: Expanding jurisdiction with rising betting volumes.

Ranking Summary (by Turnover & Influence)

- Japan – #1 in betting turnover (~US$25B+)

- Hong Kong – Highest per-race turnover (~US$20B+)

- Australia – Massive turnover (A$25–30B) + global data/content hub

- UK & Ireland – Historic prestige + large turnover (~£10–12B)

- United States – Big races, fragmented regulation (~US$12B)

- France – Strong betting pools (~€7B) + Arc prestige

- Middle East – Prize money powerhouse (Saudi Cup, Dubai World Cup)

- South Africa, South America, Korea – Regionally strong, smaller global influence

So: Japan, Hong Kong, Australia, UK/Ireland, and the U.S. are the “Big Five” racing jurisdictions that dominate by turnover, prestige, and global reach.

B. KEY INDUSTRY REVENUE DRIVERS

Betting turnover / pari-mutuel pools — on-course and (increasingly) off-course/mobile wagering is the single largest cashflow for racing ecosystems; commingling / world-pooling increases liquidity and revenue. (Example: major racing authorities report tens of billions in annual turnover). (corporate.hkjc.com, Horse Racing in Japan)

Takeout / commission / GGR — operators and race authorities keep a percentage (takeout) from stakes; variations in tax and takeout policy substantially affect industry economics.

Broadcasting & streaming rights — live race feeds and race-day video feed licensing (to bookmakers, streaming platforms, media) are a growing revenue line.

Data & analytics licensing — selling live feeds, historical data, form, ratings, odds feeds and APIs to operators, tipsters, exchanges and media.

Sponsorship, hospitality & first-day/event income — marquee races (Derby, Melbourne Cup, Dubai World Cup, Breeders’ Cup) generate ticketing and sponsor revenue.

Ancillary tech & services — trading/odds engines, pools management, integrity/ADIS services, virtual/virtualisation products (e.g., virtual racing, simulcasting) and now NFTs/metaverse experiments.

C. SIZE OF THE INDUSTRY

Market-size estimates vary widely depending on scope (just wagering? include breeding/prize money? hospitality? global GDP impact?). Selected published estimates show the variance: some industry reports place the global horse-racing market in the low hundreds of billions USD (e.g., ~USD 430–490B range for mid-2020s in some market reports), while others show larger or faster growth projections depending on inclusion of related segments and aggressive CAGR assumptions. Expect large but methodological variance between providers — use specific definitions for precise planning. (deepmarketinsights.com, Dataintelo)

Quick takeaway: wagering/GGR is the biggest single measurable line; national turnovers like JRA and HKJC are telling indicators because a few jurisdictions account for a large share of global racing handle.) (corporate.hkjc.com, Horse Racing in Japan)

D. MAJOR BETTING/RACING PLAYERS WHO ACTUALLY DRIVE TURNOVER

Racing authorities & public operators (often among the largest single-jurisdiction turnovers):

- Hong Kong Jockey Club (HKJC) — one of the world’s largest single-jurisdiction wagering operators by turnover. (corporate.hkjc.com)

- Japan Racing Association (JRA) — huge pari-mutuel turnover (trillions JPY; JRA publishes detailed annual stats). (Horse Racing in Japan)

- PMU (France), Australia TAB / Tabcorp, UK Tote / British Racing, USA (track-level pools + ADWs like NYRA Bets / TwinSpires) — all major national anchors.

Private/global bookmakers & betting groups who take significant horse racing handle: Flutter (Paddy Power/Betfair), Entain, Bet365, Caesars/William Hill, FanDuel (via its sportsbook brands), BetMGM — these companies use horse content to drive engagement across sportsbooks (fixed-odds + exchanges + pools).

Specialist pools/retail ecosystems — many jurisdictions retain national monopolies or dominant pools (eg PMU in France, Tabcorp in parts of Australia, HKJC in Hong Kong). (SBC News)

E. TECHNOLOGY AND INDUSTRY TRENDS TO WATCH

Commingled world pools & simulcasting — increases liquidity for big races and lets smaller jurisdictions plug into global turnover (HKJC/World Pool model). (corporate.hkjc.com)

Streaming + in-bet live video — operators paying for high-quality feeds; data+video sold as a bundle.

B2B trading & odds automation (AI/ML for pricing, liability management) — reduces margin leakage and improves margins on live betting.

Integrity tech — demand for real-time monitoring, geo-fencing, anti-fraud and betting-integrity solutions is rising.

Virtual & NFT experiments (ZED RUN and similar) — new fan engagement products and secondary markets, though niche vs. core wagering. (Axios)

What this means if you’re a vendor / investor

Sell liquidity + content: the best commercial propositions bundle live video + reliable data + commingling options. (Operators prioritize liquidity and reliable odds.) (corporate.hkjc.com)

Regulatory & tax regimes matter: jurisdictions’ takeout, taxes and legal framing (pari-mutuel vs fixed-odds) materially alter market opportunity. (See France, India local issues.) (BloodHorse, The Times of India)

Platform reliability & scalability are table stakes — big events and pools generate huge transaction spikes (OpenBet, Kambi cited as scale-capable platforms). (Wikipedia, Kambi)

Post a valuation or endorse another member's valuation.