A quick disclaimer: this company won’t be for everyone. Racing and Sports (RAS) works closely with wagering companies in the horse and greyhound racing industries. If that doesn’t align with your personal ESG standards, you may wish to stop reading here.

@Wini wrote an excellent article about the company recently, which covers the background of the company, investment case and the risks in detail. I recommend reading this first: https://www.merewethercapital.com.au/blog/backing-a-microcap-software-winner-in-the-global-horse-racing-wagering-industry/

RAS Technology is interesting because it has grown and executed exceptionally well since its IPO in late 2021. It shares many traits with high-quality software businesses, yet the current share price suggests the market remains highly skeptical — both of the quality of the business and whether even a moderating growth rate can be sustained over the medium to long term.

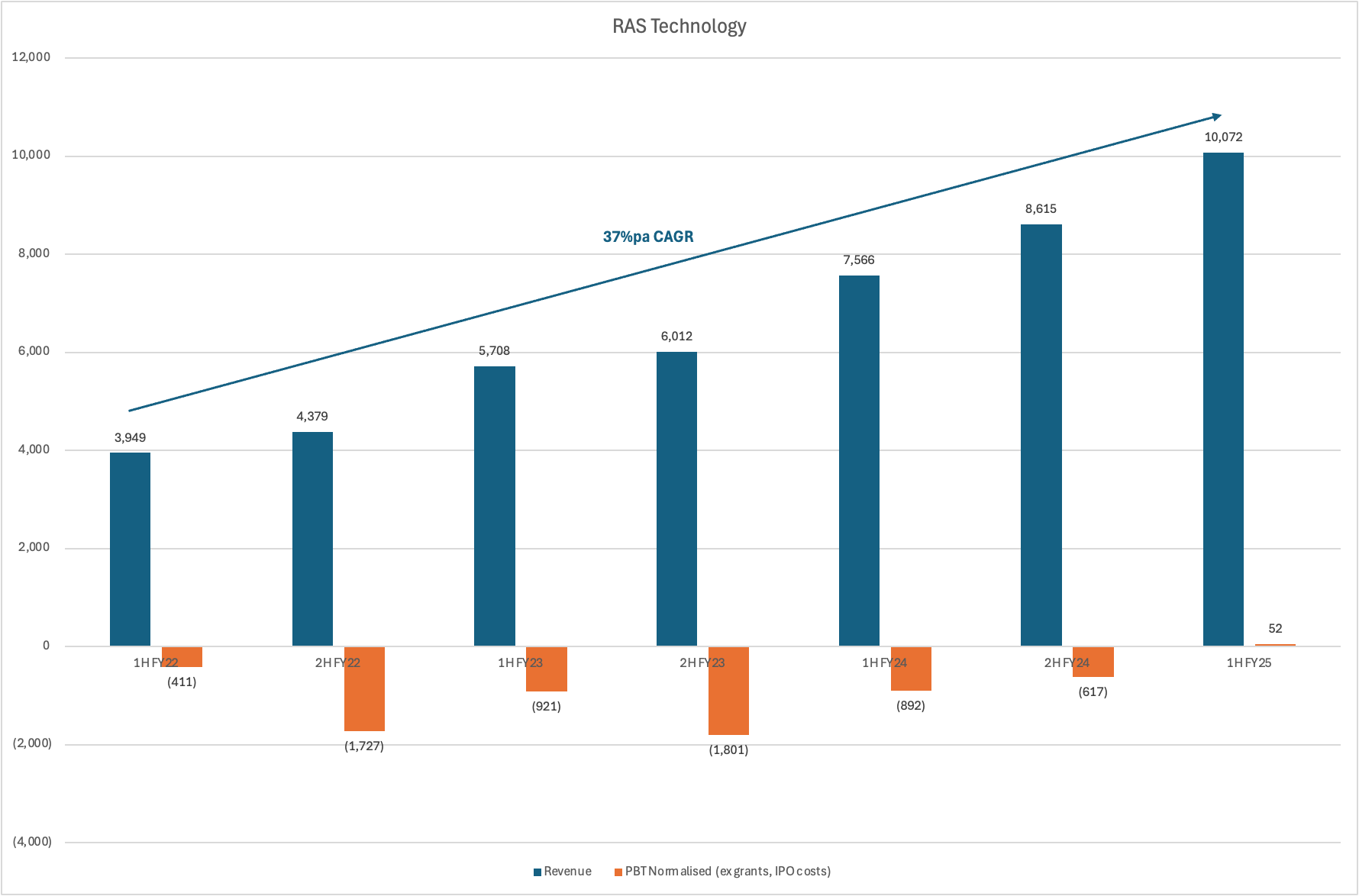

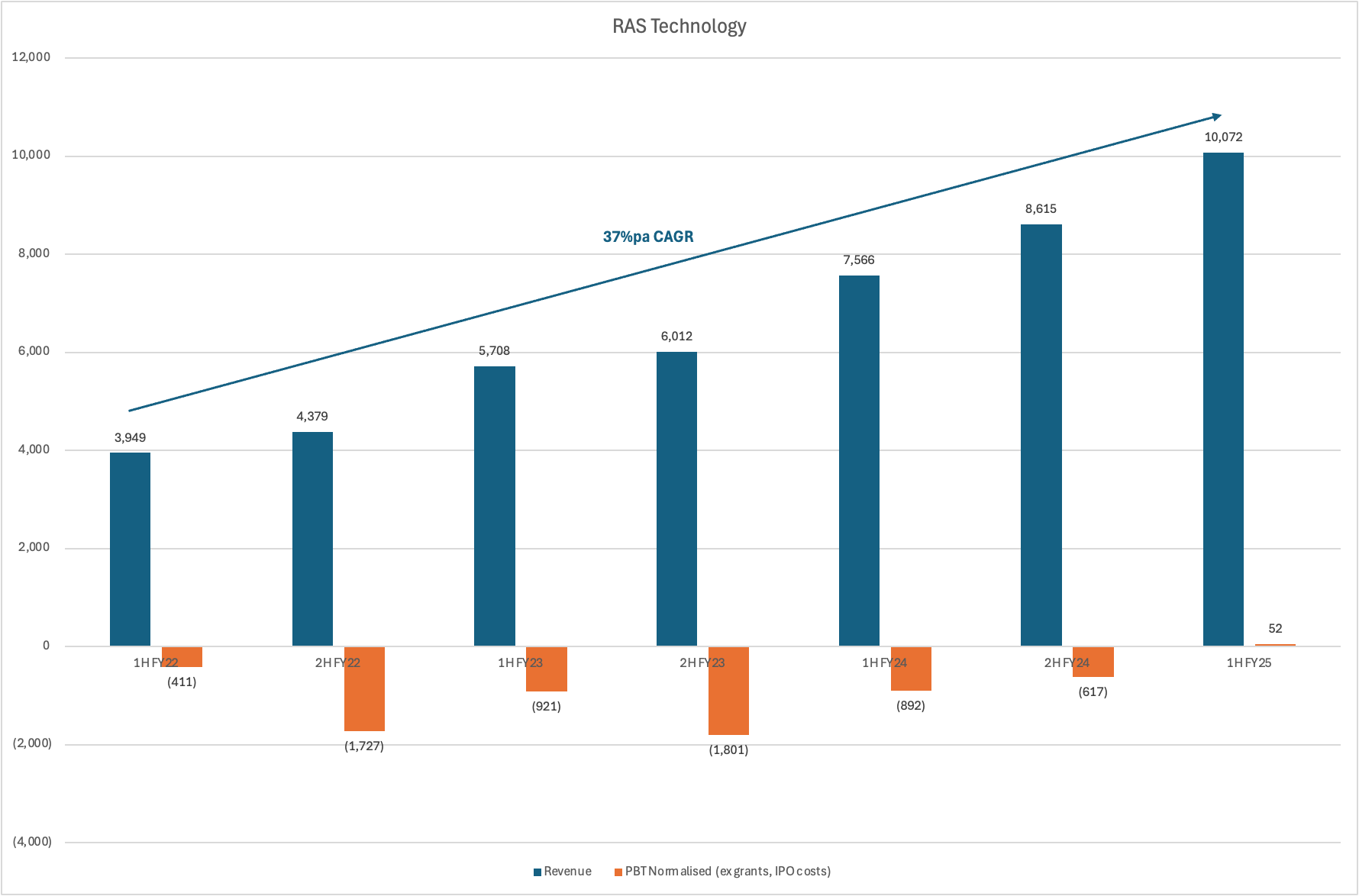

The growth over the past three years has been impressive across a few dimensions:

- It’s been entirely organic — winning more clients and larger contracts.

- The key goals of listing was to expand internationally and grow the wagering technology division. Since IPO, these areas have achieved top-line growth of 2.1x and 4.1x, respectively.

- Opex needed to scale quickly to support the expansion - growing geographically, establishing a wagering operation, and “corporatising” the business beyond its heavy reliance on its two founders. Despite this investment, the company only burned $4.8m over three years and is now inflecting back into profitability, with free cash flow to follow.

Strong organic growth is evident. But even more important to my bull case - I don’t see Racing and Sports being too dissimilar to other recurring revenue software companies with sticky tier 1 customers.

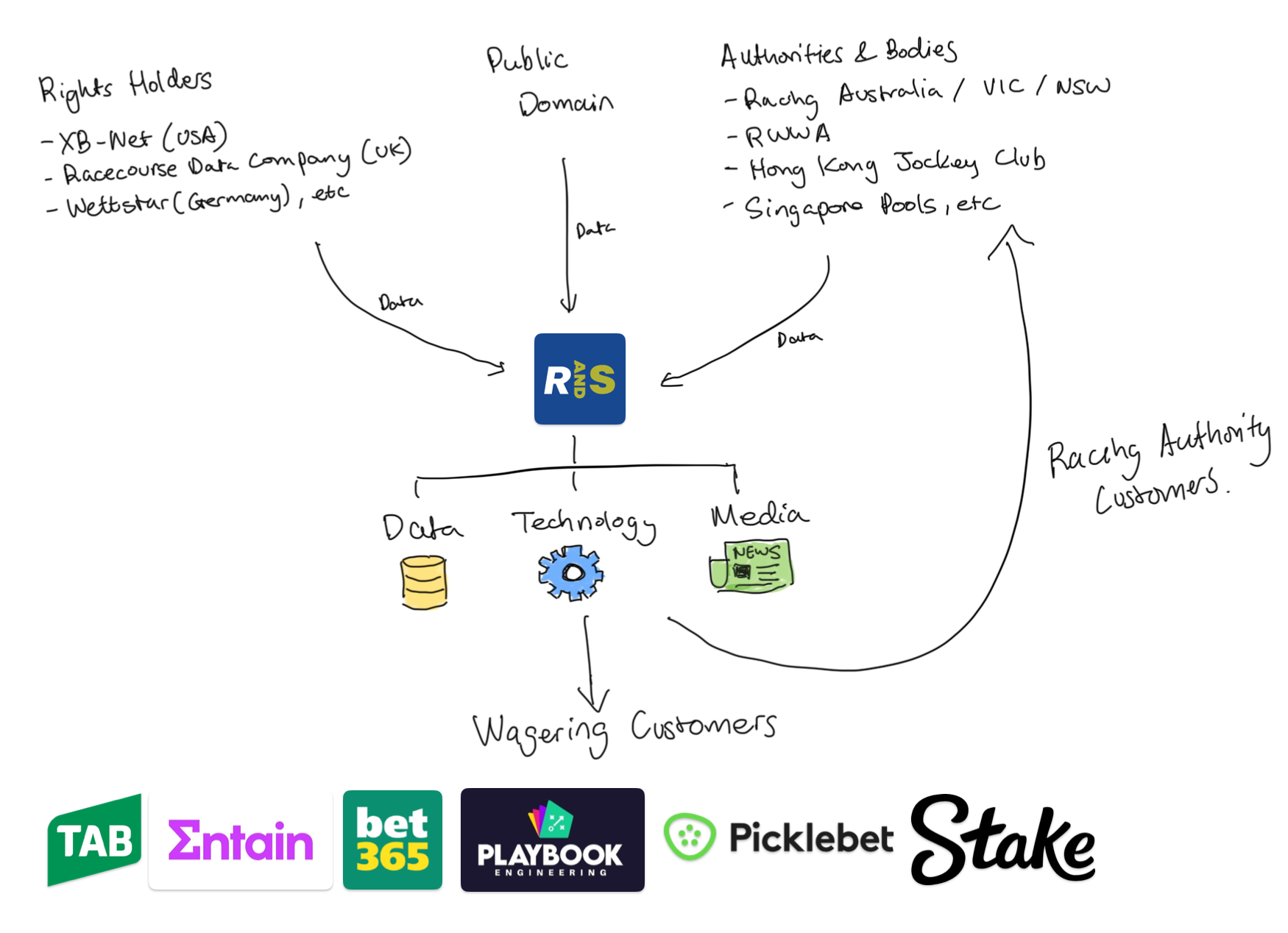

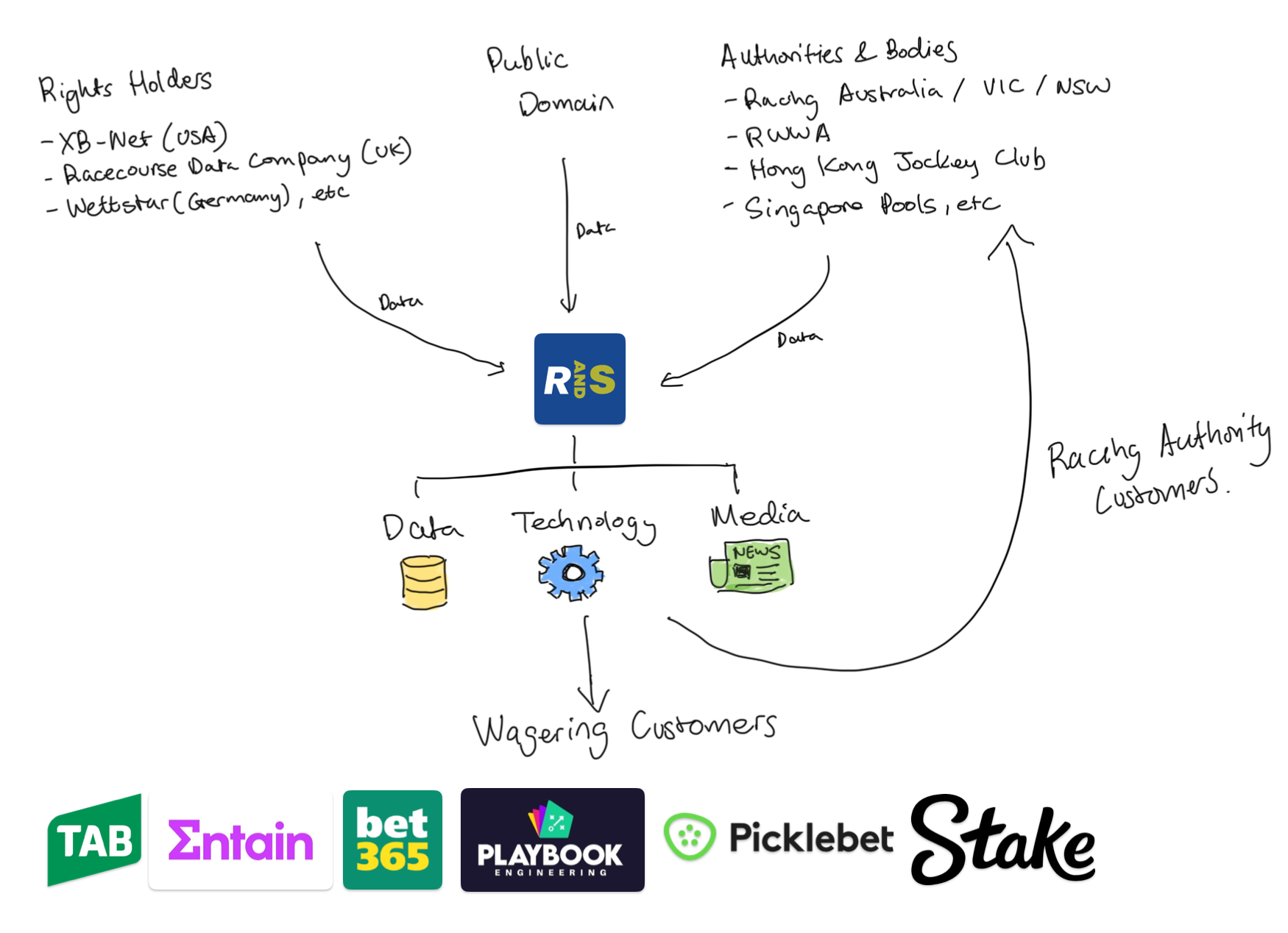

Today, the revenue split is 63% Data and Content, 29% Wagering Technology, with the remainder from Media revenue.

Data and Content revenue are multi-year subscription contracts signed with wagering customers. The data is used to power the consumer facing apps and websites - form guides, race history, and other tools to help end users make better-informed decisions.

The Wagering Technology division provides back-office software and operations functions. This can range from data used to inform the pricing of bets, to software that facilitate trading, risk management and customer management to complete turnkey solutions that allow customers to completely outsource their entire wagering operations. These contracts are also multi-year and generate a combination of subscription and transactional (percentage of betting volume) revenue.

These are all recurring revenue streams that are not dissimilar to those of an enterprise software company. The data and software are deeply integrated - they are sticky products that are a pain to replace. Management notes churn is very low, and in 26 years, they’ve never lost a tier 1 customer.

Finally - I get the sense the company simply knows what they’re doing. They understand what customers want and execute technically, which has allowed them to expand quickly both internationally and into new verticals. Meanwhile, key competitors have struggled. BetMakers (ASX:BET), the main competitor in Australia, has found it difficult to grow without aggressive acquisitions and heavy cash burn. PA Media, the incumbent in the UK and Europe, has lost several contracts to Racing and Sports.

So to recap. Strong organic growth (37%pa CAGR over 3 years), high gross margins (~80%), now inflecting into profitability, a business model with strong recurring revenue characteristics, and led by operators who know what they’re doing.

And it’s currently priced at an EV/S of around 1.35x. The market clearly doesn’t agree with a lot of what I’ve just said.