While doing some research into the current board of directors and levels of share ownership I noticed that ex CEO, David Singleton still owned 5.23% of the business, currently worth $9.7 million. David is the second largest shareholder in Austin behind Thorney Investment Group which owns over 20%.

David Singleton - Ex CEO and the instigator of the “Austin 2” turnaround.

David was the instigator of the “Austin 2” strategy in 2021 which has been the key contributor to repositioning the business globally and for the growth and vast improvements in the business fundamentals over the past 4 years.

When David took over as CEO of Austin Engineering the shares were trading at around $0.12 per share. Over three years the share price climbed to a high of $0.67 (July 2024).

While some observers have speculated that David’s departure as CEO on 30 June 2025 is a “Red Flag” , the change of guard was planned back in June 2024. The share price has steadily declined since June 2024 and that could be the “Red Flag”! However, the business fundamentals remain solid (apart from the Chilean factory issues which are largely back on track).

With some help from Chat GPT I’ve pulled together a detailed profile of David Singleton’s background, his role at Austin Engineering Ltd (ASX: ANG), and what his appointment and transition mean for the company. I’ve also tracked his share trading.

Background & Career

- David Singleton holds an Honours degree in Mechanical Engineering from University College London, and he is also an Honorary Doctor of Engineering from Edith Cowan University.

- Early in his career he was involved in the UK defence & technology sectors: notably, he was Group Head of Strategy, Mergers & Acquisitions for BAE Systems in London; he also served as Chief Executive of Alenia Marconi Systems (Italy).

- He moved into Australia and held senior roles including:

- CEO & Managing Director of Clough Ltd (engineering & project services) between ~2003-2007.

- CEO & Managing Director of Austal Limited (shipbuilder) from April 2016 to December 2020.

- His résumé shows extensive international business experience (Europe, USA, Asia) and exposure to heavy manufacturing, engineering, strategy & M&A.

Role at Austin Engineering

- David Singleton joined Austin Engineering as a Non-Executive Director in 2019.

- On 14 July 2021, he was appointed CEO & Managing Director of Austin Engineering.

- Under his leadership from 2021 onward: the company undertook a strategic review and launched what has been referred to as “Austin 2.0” to reposition the business globally.

- The company states that during his tenure: “group revenue has nearly doubled, with profitability up circa 2.7 times” according to the company announcement.

Transition & Current Status

- In July 2024 Austin announced that David Singleton would retire from the CEO & MD role on 30 June 2025, and he would then remain on the Board as a Non-Executive Director.

- A handover period commenced on 1 May 2025 with incoming CEO & MD Sybrandt Van Dyk formally commencing on 1 July 2025. Singleton remains as non-executive director thereafter.

- From 1 July 2025 onward: Singleton has shifted from executive leadership to a non-executive governance role.

Significance & Implications

- Strategic impact: Singleton’s appointment in 2021 signified Austin’s drive to enhance operational discipline, global expansion and strategic capability, leveraging his engineering/manufacturing & M&A pedigree.

- Transition phase: The deliberate lead-time (announced ~2024 for the mid-2025 handover) suggests the board sought continuity and stability in leadership during a growth phase.

- Governance stance: By moving to a Non-Executive Director role, Singleton continues to contribute to oversight while relinquishing day-to-day execution – a good governance practice for leadership succession.

- Market perception: Given Singleton’s track record of revenue/profit changes under his tenure, investors may view the leadership change as a key inflection point for the company’s next growth leg.

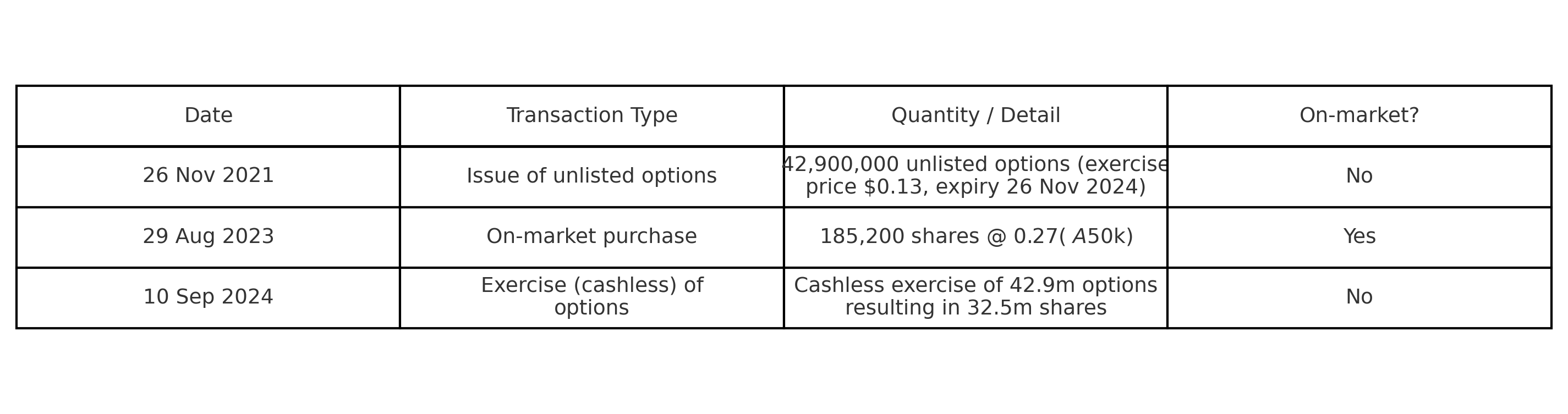

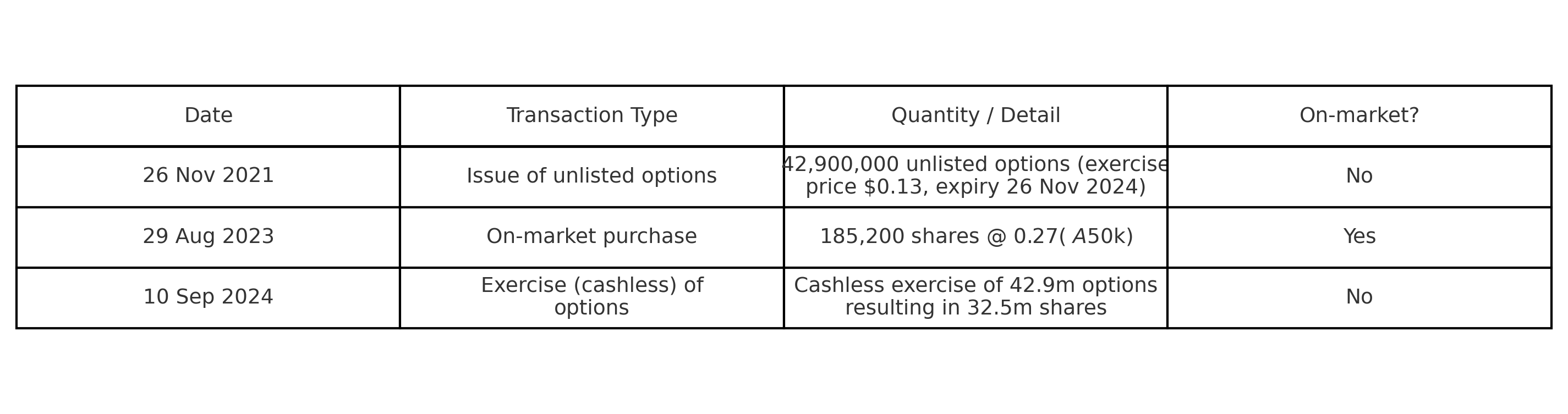

Share transactions while CEO

David Singleton acquired most of his shares by exercising options at $0.13 per share, although he did buy 185,200 shares on-market at $0.27 per share on the 29th August 2023. David has never sold any shares that I am aware of.

What to monitor

- How the business performs in FY 26 under the new CEO Sy Van Dyk — whether the foundations laid under Singleton convert into further growth.

- Any changes in strategic direction post-Singleton’s shift to non-exec, and how the board and management communicate them.

- Singleton’s influence as non-exec director: whether his engineering/manufacturing expertise continues to shape the company’s strategic choices.

- Market reaction in ASX announcements and media regarding his transition — this could signal investor sentiment around leadership change.

Orange Flag

David Singleton selling shares below $0.40 per share (my current valuation).

Green Flag

Any of the directors adding to their share holdings through on-market purchases. FY26 ROE >20%. Margin improvement. Double digit EPS growth.

Held IRL (3%) SM (4.8)