Pinned straw:

AFR also ran this one.............https://www.afr.com/rear-window/droneshield-s-oleg-vornik-goes-mia-20251118-p5ngb6

DroneShield’s Oleg Vornik goes MIA

The tech company’s share registry isn’t the only place the chief executive has vanished from. Meanwhile, investors are desperately seeking answers.

Hannah WoottonColumnist

Nov 18, 2025 – 6.17pm

roneShield chief executive Oleg Vornik hasn’t been afraid of the spotlight. He’s a frequent speaker on the start-up events circuit, and there have been glowing profiles on how he fled Russia and conscription to start a new life in New Zealand, including in this publication.

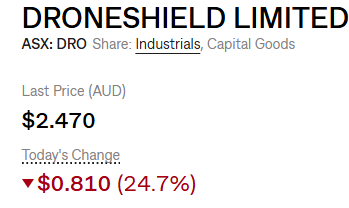

Yet he’s gone to ground since the tech company’s share price plummeted 31 per cent last Thursday, wiping $1 billion off its market cap. This hardly surprises, given it was the offloading by Vornik, chairman Peter James and director Jethro Marks of nearly $70 million of their own stock in DroneShield that caused the crash.

Oleg Vornik was a mysterious absence at Forbes magazine’s flagship business summit last Thursday. Louie Douvis

He’s not just refusing to answer the phone to journalists. He’s also cancelling his public appearances. On Tuesday, that was supposed to include a “captivating fireside chat” at an Australian Computer Society event.

According to the event invitation, he was going to talk to the tech lobby group about “the evolution of DroneShield” and its “journey and mission since its founding”, including its “future outlook – what’s next for DroneShield”.

This is the question everyone, including his own investors, is seeking answers to. Google searches of DroneShield even come up with a prompt that “people also ask: does DroneShield have a future?”

Yet at close of business on Monday, the event was cancelled without explanation. It was also deleted from the ACS website. The group even deleted a month-old LinkedIn post spruiking it! It was Vornik, not the ACS, who pulled the pin on it.

Vornik was a mysterious absence at Forbes magazine’s flagship business summit last Thursday, too. Promotional material for the event promised discussions on “new frontiers in defence-tech” and urged readers to “join the minds” behind DroneShield and a slew of other companies for “a day of executive-level networking and strategic insight”.

Vornik was supposed to feature on a panel and would, according to an Instagram post by the publication, discuss “where does explosive growth truly begin: with the market or with the mindset of the founder leading it?”

His name disappeared from the agenda before the event started. Little wonder, given that same day DroneShield’s shareholders were realising that, when it came to explosive crashes at least, the mindset of the CEO led the market.

And the plot thickens:

see Margin Call article in the weekend Australian.

Director Jethro Marks loans Oleg a big pile of cash to re-mortgage and renovate his just purchased $7.2m house.

Documents witnessed by another independent director: Richard Joffre.

Optics seem to be getting worse.

Heading to the Dubai Airshow next Monday and Tuesday, so if anyone has questions for DroneShield, feel free to post them or just message us. They’ve got a presentation/stand at the show, and I’ll be dropping in to check out the tech and ask whatever the community wants to know.

Happy to relay anything (in a nice manner), technical or otherwise. I’m from an aviation background, not drones, so don’t hold back on the detailed stuff. I’ll also be checking out the rival drone-tech companies while I’m there.

Last Dubai Airshow, Oleg was there in person, so it’ll be interesting to see who fronts it this time. I used to be a holder myself but sold when Oleg and management dumped their holdings the first time.

Droneshield directors echoing Ruslan Kogan here.

Hard to believe the directors would be selling every last share if several hundred milion in orders is imminent.

Really hard to see how management can be trusted moving forward with the horror show that we have seen this week.