Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

A line in the sand for DRO board of directors..

MSP.

Last

$3.01

Change

0.280(10.3%)

Mkt cap

$2.484B

Just listened to the Financial Review podcast with Jonathan Shapiro, highly recommend. He provides a clear overview of the latest developments regarding DroneShield.

https://podcasts.apple.com/au/podcast/the-fin/id1649633861?i=1000738559437

Another quick and dirty valuation exercise.

This valuation reflects an entry price where I would consider re-entering.

If, and this is a big if, Droneshield can materialise even a fraction of the sales they have been saying are in the pipeline, I think Droneshield becomes interesting again at around $0.8-0.90.

Cash in the bank is $200m (about 20c/share), cash burn was 65m in the year to Sep 2025, so it can sustain 3 years of constant burn without bringing in any new money.

Contract value for last 12 months was 193m, which gives a current P/S of around 11 which is not terribly demanding. Much less so than a month ago. But definitely not cheap.

Assuming steady sales (not yet proven) and a discount for margin of safety with management and macro concerns, assuming a P/S of 5 being an acceptable risk level, we have an entry price of $0.80-0.90.

DroneShield at Dubai Airshow 2025: Notes, Impressions and Concerns

The theme of investing in anti-drone technology continues to look like a major long-term opportunity. Even outside military applications, the civilian use cases alone are expanding quickly as drones become cheaper and more capable. Airports, prisons, government buildings and critical infrastructure all need protection.

At the Dubai Airshow 2025, DroneShield had a stand in the Australian pavilion. It was one of the busier displays, helped along by a free barista, but the conversations were genuinely useful. I spoke with one of their UAE-based sales reps and walked away with a clearer view of where the company stands, along with a few concerns that remain.

Staff, Scale and the Catalogue

DroneShield now employs roughly 360 to 380 people, which is more than many investors realise. According to the rep, demand is still roughly split between civilian and military enquiries.

One detail that stood out was that around 40 employees work full-time on evaluating new civilian drones as they arrive on the market. They analyse radio signatures, frequencies and behaviours, and then add them to DroneShield’s detection library. The company owns or has tested a huge collection of drones, which helps them keep the detection database up to date.

This is reassuring, although it highlights something important. Success in this space depends on constant R&D. If they slow down, they risk becoming irrelevant very quickly.

Detection Limits

I asked about tethered drones and home-built systems like those appearing in Ukraine and Russia where factories produce customised drones without standard signatures. The rep explained that radar systems can detect tethered drones, and in theory DroneShield detection can be paired with something like EOS, who were presenting next door, to neutralise them.

He also admitted that a knowledgeable operator can build a drone that is harder to detect, although he said it is difficult to do. It still raises a clear question. If a drone is not in DroneShield’s catalogue, is it less detectable? What about someone building a drone in a garage with no standard radio profile?

The takeaway for me is simple. They must continue investing in R&D or the technology edge will disappear.

The Oleg Question

I used to be a shareholder when the company traded around 26 cents, and I sold when Oleg dumped his shares the first time. Naturally I asked about this. The sales rep even joked that Oleg is at least consistent when it comes to selling.

My concern is straightforward. If you truly believe your company’s best days are in the future, why would you and the board sell your stock at the earliest opportunity?

The rep insisted Oleg is still deeply involved. A couple of years ago he was personally handling most of the company’s sales, and although he has stepped back from that role, he is still calling the team every day during the airshow and trade shows etc to follow up. His involvement sounds genuine and committed.

Even so, selling everything leaves a poor impression. Selling enough to buy a house in Sydney or even a boat makes sense. Selling the lot feels different.

Final Thoughts

Management questions aside, the drone sector itself feels like it is only in its early stages. The airshow was filled with drone technology. Dubai is pushing ahead with drone taxis, and droneports are already being built.

Anti-drone technology will remain essential and demand is likely to grow. The real question for investors is whether DroneShield can stay ahead as drones evolve at high speed.

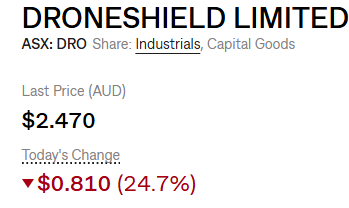

Any got any Idea as to why we see this today?

Disc Not held - am looking for a re-entry at some stage though.

3 November 2025 ASX Announcement $25.3 million Latin American contract.

$25.3m contract from a defence end customer in a Latin America (LATAM) country.

Delivery and payment is expected through calendar Q4 2025 and Q1 2026 DroneShield Limited (ASX:DRO) (DroneShield or the Company) is pleased to announce it has received a $25.3 million contract from a privately owned in-country reseller that is contractually required to distribute the products to a Government defence end customer in a LATAM country.

DroneShield expects to deliver all equipment throughout Q4 2025 and Q1 2026, with cash payment expected in Q4 2025 and Q1 2026.

No additional material conditions need to be satisfied. DroneShield has previously received 7 standalone orders from this reseller between March 2019 and July 2025, totalling approximately $2.9 million.

DRO released its 3Q25 results today, to what seems a ho-hum reaction. Price slid 2.6%, possibly due to trimming by FMR LLC - which looks to be a consortium of all sorts of major banks and investment houses.

That said, FMR still hold 7.49% of the company.

To my mind, the SP is now approaching something reasonable, more like where it ought to be.

Results:

As a long-term shareholder. I’m entirely happy with that.

One comment on Oleg’s recent chat with us: I initially watched him present in mid-2021, when the company was just getting off the ground. I watched another interview in 2022, then watched the latest with Strawman. Each time, Oleg has “grown” in terms of projecting the sense that he is truly on top of everything that’s going on with DRO. His confidence, his “ease-in-his-own skin,” has significantly increased, and his focus on where DRO is going and how in an area that’s still evolving very rapidly is reassuring, at least to me.

Discl: Held IRL and on SM.

The recording for today's chat with Oleg is now live, and you can access the transcript here: DRO Transcript OCT 2025.pdf

Beyond all the "meme stock" hype, it is hard not to be impressed with what the business has achieved. Not only have they maintained an incredible rate of top-line growth, but the swing to profitability is noteworthy given all the investment they are making and the huge ramp up in headcount.

Oleg strikes me as rather grounded, and certainly didn't try and hype up the opportunity. The business has a great first mover advantage, and established and critical relationships with key players. They also seem to be staying focused on their core strengths and not deviating into other areas (which I imagine would be a temptation for most).

The sales pipeline is massive and continues to grow very fast, and historically it's been a good indicator of future sales. And given what he said about gross margins and fixed costs, they have the potential to really demonstrate some attractive operating leverage.

Still, a forward Price-to-sales of ~30x, and a forward PE of (say) at least 200x is not for the timid (and not for me). Still, *if* they continue to scale as he suggested, they really could be on a pre-tax profit of ~$100m in a few years, and that changes things a lot.

I'll keep it on a watchlist for now.

What’s the lesson here…?

Never underestimate the upside of a bbq-hype share ?

Never sell a holding ?

Always invest in companies with “cool names”..lol

My brain is trying to forget that I sold at $1.75.

i would have been able to buy a home for my little family if I held on….lol

i still have almost zero conviction in this company though.

i think sales could fall off a cliff at any point.

who REALLY knows what’s happening with drones or droneshield.

they could be made obsolete in the blink of an eye and weapon tech could move in a diff direction

Morning all,

@Strawman its' been 2 years since we last spoke with Oleg at DroneShield, a lot has happened in that time.

US and European expansion, Russian drones breaching NATO airspace, Drone wall discussions in Europe, Land 159 deals , Five Eyes deals, European manufacturing, the list goes on.

Would you mind sending another invite to chat?

Cheers

Disc hold IRL & SM.

DroneShield Expands U.S. R&D Operations to Drive Next-Gen Counter-Drone Solutions

No surprises that Droneshield are increasing their US footprint. Smart move IMO.

Disc: Held

Next Generation AI learning with no lag.

Hardware and software upgrades constantly required.

Additional American Offices

Amsterdam European base

the list goes on.

6 minute Interview

Drone technology evolving at an unprecedented pace - DroneShield CEO

Now i understand that CEO's talk a good story, i kind of believe him, they have delivered so far.

Disc Hold IRL & SM

DroneShield Announcement

They company maybe over valued to some, however i only see this company gong from strength to strength purely based on the changing and challenging World we live in today.

Actually wish it was a better World.

Disc Hold IRL and SM

Unsurprising, but Droneshield entering ASX200:

I don’t know the company and never looked at it at all but i know it has been a very hot stock.

This blog raises some questions on the financials. Not sure anything completely damming but orange flags for sure.

https://open.substack.com/pub/crashcapital69/p/droneshield-dro-au?utm_campaign=post&utm_medium=web

I don't own ASX:DRO, unfortunately.

As a thought experiment I wondered just how much it would have to grow to get justify its current SP.

DroneShield Limited’s operating margin for the half-year ended 30 June 2025 is approximately 7.2%, say in 3 years time it improves to well above industry averages of 10-13%, say 15%. Perhaps the SaaS segment does increase significantly to account for this

If we assume the share price goes nowhere and apply a PE of 40 (high growth company) then revenue would need to be a whisker under $500m to give NPAT of ~$72m. Their presentation states an aspirational pipeline of $5 billion for 2028. I'm assuming that is for revenue.

So, if you believe that there will be no disruption from other technologies and they will hit that aspiration, it's a bargain! Unless my maths is wrong, which it might be!

For those that do hold, I would love to hear your thoughts.

I read recently that the authorities will spend $1.2 B protecting the Brisbane 2032 Olympics from threats of drones. I haven't seen anything explicitly linking DRO in this but I noted use of their technologies in the speil. You would think being local lads they would get a decent portion of this perhaps? Something to be announced at some point?

24 July 2025 ASX Announcement

- Hon Pat Conroy, Minister for Defence Industry, has today announced the initial LAND156 contract awards

- DroneShield has received approximately $5 million in orders, of $16.9 million total

- DroneShield Limited (ASX:DRO) (DroneShield or the Company) is pleased to share the announcement by the Hon Pat Conroy MP, Minister for Defence Industry, regarding the award of a contract under Project LAND156 to supply handheld counter-drone equipment to the Australian Defence Force.

- DroneShield was awarded approximately $5 million of a $16.9 million in contracts (across 11 vendors, including 5 Australian Companies).

- The contract involves the provision of portable drone detection and defeat systems designed to support ADF personnel in identifying and mitigating unmanned aerial threats. This procurement forms part of the Commonwealth’s broader initiative to accelerate the acquisition of counter-drone capabilities.

- DroneShield will deliver equipment in accordance with the contract terms and project timelines.

- In addition to this equipment delivery, DroneShield stands ready to support the ADF as Systems Integration Partner under the broader LAND156 program. With deep expertise in sensor fusion, electronic warfare, and command-and-control integration, DroneShield is well positioned to contribute to the development of scalable, interoperable counter-drone architectures that meet Defence’s evolving operational requirements.

- Image: Minister Conroy’s LAND156 announcement

- DroneShield Limited ABN: 26 608 915 859 ASX:DRO 1 Level 5, 126 Phillip St, Sydney NSW 2000

LAND 156 – Initial Contracts Announcement

Hon Pat Conroy MP, Minister for Defence Industry, has commented, ”Australian industry is critical to delivering this technology, and they are demonstrating world leading innovation while creating Australian jobs.”

"We welcome the opportunity to support the Australian Defence Force through Project LAND156. This contract reflects the growing operational need for portable counter-drone capabilities and DroneShield’s continued role in delivering solutions aligned with Defence requirements," said DroneShield Chief Executive Oleg Vornik.

The full ministerial release is available here: https://www.minister.defence.gov.au/media- releases/2025-07-24/accelerating-acquisition-drone-counter-drone-technology

This announcement has been approved for release to the ASX by the Board.

For enquiries, please contact:

Oleg Vornik

CEO and Managing Director

E: [email protected] P: +61 2 9995 7280

About DroneShield Limited

DroneShield (ASX:DRO) provides Artificial Intelligence based platforms for protection against advanced threats such as drones and autonomous systems. We offer customers bespoke counterdrone (or counter-UAS) and electronic warfare solutions and off-the-shelf products designed to suit a variety of terrestrial, maritime or airborne platforms. Our customers include military, intelligence community, Government, law enforcement, critical infrastructure, and airports.

To learn more about DroneShield click here: www.droneshield.com/about

TLDR - Fidelity Asset Management have been buying steadily over the last few days.

Now at 7.6% of ownership. It will be very interesting to see what price they have been paying, esp as the price surged past $4 yesterday.

Either it's a pathway to a takeover, or they see a big future for DRO. Both are good news for holders.

Disc: Held

Let's say, in a humble brag kind of way, that I bought my son DRO shares at 31cents for his 11th birthday. I also bought for myself IRL and on SM the same day.

Today DRO have closed at $3.24. Is that ~9.5 bags or 10 bags and change?

$0.31 * 10 = $3.10.. but at that price you're making $2.79 profit on a 31c investment which is only a gain of 900%.. So, which is it?

As a long-term investor this is the definition of a stupid question.. I really don't care, except my investment style has been pretty conservative, while I've been investing since turning 18 (last century), I've never come close to a genuine, short term, capital gain only type, 10-bagger..

I've generally only invested, as much as I could stomach, in boring blue chips that had a run of bad news but where my research and conviction pointed to there not being any real danger. Think BHP after Brazil, RMD after Ozempic, FMG @ $4 after almost going tits up. Over the years I've only invested in one or two start-ups like AR9, so I didn't really give myself a chance, although AR9 will get there one day!!

It was only after becoming a Strawman member in Sept 2023 that I was introduced of the likes of DRO and many other small to mid-cap opportunities.

Despite DRO's rapid gains I’m just going to continue to lean into Scott Phillips’ advice on the Pod Machine last week that I do nothing.. literally nothing.. As a lazy investor it works well for me, I don’t mentally bank the paper gains and I don’t mourn the paper losses, because I’m not smart enough to ever time the top or bottom of the market.

At some point DRO will retreat well below today’s level and that’s completely fine, I think I've got my 10-bagger badge.. What really matters is my thesis that it will be a MUCH bigger company in 5 years than it is today.

Well this is huge!!!!

Disc hold IRL & SM

Could Fiber-Optic Drones Disrupt DroneShield's Tech?

I came across something interesting that might impact DroneShield in the future.

During a recent conversation about the large drone strike on Russian airfields, one of my colleagues mentioned new drones being used with fiber-optic cables attached. I hadn’t heard of this before, so I looked into it — and sure enough, it's real.

This recent article https://www.nzz.ch/english/new-fiber-optic-drones-are-changing-the-war-in-ukraine-ld.1875752covered how fiber-optic drones are now being deployed in Ukraine and Russia. These drones are guided through long fiber-optic cables up to 20km making them immune to traditional jamming or radio interference, which is exactly what systems like DroneShield's DroneGun are designed to target.

That raises an important question:

Can DroneShield's current tech actually stop these types of drones?

Right now, it looks like no — not effectively. Because there's no RF signal to jam, standard electronic warfare systems are useless. The only countermeasures seem to be physical like cutting the cable with shotguns or nets, or using visual/radar detection followed by kinetic takedown.

Still early days, but something worth watching closely if you're tracking DroneShield or defense tech investments.

It’s been an interesting space to watch over the last few years. My incomplete understanding is that jamming techniques have essentially been bypassed for small and FPV drones either by effective counter-jamming techniques or using spools to communicate directly.

Not sure if DRO is at all involved in microwave technology but great article summarising the current state of play. It’s entirely possible DRO gets completely left in the dust by this development.

Science & technology | Battle of the beams

Microwave blasters can down even jam-proof drones

America’s army is already deploying the technology

Illustration: Timo Lenzen

Jun 11th 2025

O

n April 28th Bray McCollum, a USArmy captain, was tasked with conducting a military exercise in the Philippines. His job was to test a new weapon, the army’s first specifically designed to down a swarm of drones with a single shot. The Leonidas IFPC-HPM, as the system is called, fires intense pulses of microwave radiation that “disrupt or destroy” electronic componentry in drones, says Captain McCollum. It worked.

Engineers have experimented with such weapons for many years, with mixed results. But the devastation wreaked by cheap drones in the Russo-Ukrainian war (including Operation Spider Web, in which Ukrainian quadcopters launched from lorries on June 1st struck at airfields deep in Russia) has concentrated minds.

Most attempts to disrupt drones rely on electronic warfare, in which radio signals jam datalinks to remote operators. These techniques are useless against newer drone types, notes Captain McCollum, some of which are controlled through unspooling fibre-optic wire, whereas others use on-board artificial intelligence to navigate and select targets. With the stakes high, the pace of spending on R&D has picked up, as have technological advances.

The US Army currently has a handful of Leonidas weapons, manufactured by Epirus, a defence-tech startup based in Torrance, California. Trailer-mounted and powered by a diesel generator, they are located in the western Pacific and either in or near the Middle East. Officials are mum on the weapons’ range, but Andy Lowery, Epirus’s boss, says it is several hundred metres. A souped-up version, due this summer, should offer a range of more than 1km. The new model will also be able to draw power from a roughly 300kg battery pack.

The microwaves do not typically fry electronic circuitry to a crisp. Instead, the energy they deposit can generate unwanted currents, overheat sensitive components and interfere with normal function. The net result, Mr Lowery explains, is a flood of electromagnetic “noise” that means a drone can no longer “hear itself think”. This causes crashes.

Upfront costs are high. The army’s initial contract for four Epirus microwave blasters, including services, exceeded $66m—roughly enough to buy half a dozen new Abrams tanks. But because microwave air defences only need electrical power to run, rather than ammunition, they are far cheaper to operate.

Other contractors are designing similar kit. Thales, a European giant, has developed RapidDestroyer, a container-size microwave blaster mounted on a lorry. At a test range in Wales in mid-April, the British army used RapidDestroyer to down drone swarms with “near-instant effect”, according to the defence ministry. Its range is thought to be up to 1km.

Another supplier is Leidos, a defence firm based in Reston, Virginia. By early next year Leidos expects to provide America’s Air Force Research Laboratory with an operational microwave blaster called Mjölnir, in a nod to the Norse god Thor’s hammer. Mjölnir’s power output and range are classified, but the system will “screw up” microchips and other electronics in a drone swarm at operationally useful distances, says Billy Schaefer, Leidos’s head of directed energy. Leidos is also designing a shorter-range system that could be carried by two soldiers. Its battery pack could also fire a few shots.

RTX, a big American defence contractor, is developing shipping container-size counter-drone microwave systems: one, called PHASER, that will work over short ranges; and another, called CHIMERA, that will work over longer ranges. Lockheed Martin, an American defence company, is refining MORFIUS, a small microwave weapon packaged in a roughly 14kg drone. The system, a spokesperson says, is designed to fly into an attacking swarm, emit microwave blasts, and return to base.

Microwave blasters pose problems for drone designers. Richard Fisher of the International Assessment and Strategy Centre, a think-tank in Potomac, Maryland, says a race is on to protect drones with reflective metal shielding. Such attempts are unlikely to be entirely effective. For one thing, microwaves heat up the surfaces they reflect off, potentially heating them to temperatures they cannot tolerate.

Microwaves can also produce electrical charges in conductive and semi-conductive protrusions (such as antennae or camera lenses) that can turn into damaging currents. Mjölnir’s ability to change the wavelength of its microwave radiation could allow it to tune beams that slip through gaps between shielding panels or even holes in mesh.

Though the ends are clear, manufacturers are tight-lipped about the technology needed to achieve them. Most systems use variations of the magnetron technology found in microwave ovens, in which electrons moving through vacuum tubes emit microwaves when exposed to a magnetic field. Epirus has taken a different approach, relying on bespoke microchips made with gallium nitride, a semiconductor material. When fed electrical energy, these chips can produce microwave blasts with durations in the millisecond range, compared with the nanosecond range of magnetron emitters.

Unlike drone design, none of this is for tinkerers. The technical challenges are extreme: for one thing, targets must be detected and accurately tracked, a task which typically involves radar and electro-optical systems working in tandem. The weapon’s microwave antenna must also be aimed so that one’s own electronics and, especially, munitions are not accidentally zapped.

One country that would like to get its hands on such kit, and fast, is Ukraine. So says Oleh Donets, who leads projects for the development of non-kinetic air defences at Brave1, a government technology accelerator in Kyiv. Russian forces now often dispatch groups of five or more drones to destroy a single target, he notes. Not long ago, single-drone attacks were the norm.

At least two Ukrainian firms are devising counter-drone microwave weapons. One is Transient Technologies, a maker of ground-penetrating radar systems in Kyiv. It kick-started the weapon programme, quietly, in the wake of Russia’s full invasion. But the firm’s boss, Volodymyr Ivashchuk, laments they are only at the “proof-of-concept stage”. The other is First Contact, a firm in Kyiv that built the drones flown in Ukraine’s raids of June 1st. Its boss, Valeriy Borovyk, says technical assistance from a German defence contractor is being arranged, and a prototype could be ready for testing later this year.

Brave1, for its part, is seeking microwave blasters from allies to test in combat and tweak as required. So far none has arrived. Epirus did request the American government’s permission to send its technology to Ukraine, but failed to obtain it. Recently, however, Mr Lowery was contacted by an official who encouraged Epirus to resubmit its paperwork. The official said that Donald Trump’s thinking on the subject had shifted in favour of granting licences for export to Ukraine.

All this is exciting stuff. The hope, says Mark Montgomery, a former US Navy rear admiral, is to eventually design microwave blasters with the oomph to down drones, and possibly even subsonic cruise missiles, from 10km away. At such ranges, interceptors could still be launched if the blasts fail. For now, though, microwaves offer a promising last line of defence

Droneshield up 14% on no news.

Any ideas ???

Disc - Hold IRL and SM

Odd that we have more than doubled the price in two months on barely any news.

The only thing that I can guess is that there has been as escalation in conflicts recently that has brought Droneshield into the public mind.

I don't think they have made any material announcements on manufacturing capacity to keep up with demand if it keeps growing.

I'm putting this down to sentiment.

In which case, I am going to lighten the load when it starts looking too good to be true.

Disc: held.

I rarely watch mainstream news, however it happened to be on in the background this evening.

A story regarding the sad passing and funeral of Pope Francis was on, they were talking about the security measures, I saw a drone detection gun being held.

Can anyone confirm if it was a Droneshield gun.

Disc hold IRL and SM

So DRO published their FY24 report today. I’d been wondering when it would drop because a) they hadn’t said, and b) the SP had started to rise from mid last week. Hit a high of 0.90 this morning, then drifted lower to currently 0.80. Up from 0.60 on 18 February, so roughly a 50% rise, dropping to ~30% at close of day.

So I looked at the numbers, and ouch. They went from 0.020 EPS in FY23, to -0.002 in FY24. So why the SP rise?

The answer, I think, is in the Chairman’s (Peter James’s surprisingly cogent and to the point) letter.

This is the relevant section:

FY2024 has seen a slower rate of revenue growth due to a number of pipeline projects taking longer to complete than expected. This was driven by a number of factors, including still-nascent procurement processes for the counterdrone industry and a greater number of approval steps for larger sized customer contracts. However, the FY2024 revenue was driven by smaller customer contracts, reducing risk by diversifying the customer base. This model also helps mitigate reliance on a few large customers, making the business more resilient to market changes. FY2023 had a $33 million deal, while all of the FY2024 revenue was earned via smaller customer contracts, with the largest being $13.5 million.

FY2025 is off to a strong start, including $51.6 million of revenue already either recognized ($18 million recognized year to date) or under committed Purchase Orders.(for delivery in FY2025) as of 18 February 2025 (with approximately 10 months of the year to go).

FYI, the revenue in FY2023 was $54 million and in FY2024 was $57.5 million.

So I’m wondering if the SP rise was pure speculation or…did someone know something?

Held in RL and on SM, so I’m happy enough either way.

· January 2025 - $11.8m Asia Pacific Contracts a set of three separate contracts from an in-country reseller for delivery to a military end customer in an Asian Pacific country, to counter the Chinese drone threat. The systems are for both vehicle-mounted and fixed Counter-UxS systems. https://announcements.asx.com.au/asxpdf/20250129/pdf/06dy1wzdfx7mzn.pdf

· December 2024 - $8.2m European Government agency a repeat order for dismounted and vehicle-mounted systems Counter-UxS systems. https://announcements.asx.com.au/asxpdf/20241205/pdf/06c8n4ftpn5rkt.pdfhttps://announcements.asx.com.au/asxpdf/20241205/pdf/06c9cxzfm5r3vs.pdf

· October 2024 - $13.5m US Government Contract - for a number of its dismounted Counter-UxS (C-UxS) systems. https://announcements.asx.com.au/asxpdf/20241008/pdf/068vgzjqzqs3b9.pdf

· September 2024 - $3.1m US Government Contract – a repeat order for a number of its counterdrone (C-UxS) Systems. https://announcements.asx.com.au/asxpdf/20240911/pdf/067r89r0tf1rlh.pdf

· June 2024 - $4.7m new non-government Swiss International Customer to provide multiple vehicle-based counterdrone-drone (C-UxS) systems. https://announcements.asx.com.au/asxpdf/20240620/pdf/064rw8bbxbxb2c.pdf

· May 2024 - $5.7m U.S. Government customer for a number of its C- UxS (Counter-UxS) systems. C-UxS refers to counterdrone systems targeting multi-domain aerial, ground and maritime surface drones. https://announcements.asx.com.au/asxpdf/20240522/pdf/063sygpdnwg7s9.pdf

· March 2024 - $4.3m U.S Government Contract, a repeat order for a number of it s handheld C-UAS systems. https://announcements.asx.com.au/asxpdf/20240314/pdf/061h3755bg8jzs.pdf

· November 2023 - $2.2 European Government customer for multiple fixed site DroneSentry counterdrone system. The initial order from this European Government customer was announced on 1 Sep 2022. https://announcements.asx.com.au/asxpdf/20231116/pdf/05xdxdhzwhy49l.pdf

· October 2023 - $10.4m Aid Package from the Australian Government to Ukraine https://announcements.asx.com.au/asxpdf/20231026/pdf/05wj1j0szx0f40.pdf

· July 2023 - $33m US Government Contracts award consists of DroneShield equipment and multi-year services. https://announcements.asx.com.au/asxpdf/20230717/pdf/05rpgq7cbcgps9.pdf

· July 2023 - $9.9m Five Eyes DoD award follows DroneShield successfully completing a $3.8m contract announced on 4 June 2021 with the same customer. https://announcements.asx.com.au/asxpdf/20230704/pdf/05r8q46qvkss7g.pdf

· April 2023 - $2.2m US DoD and another US Federal Government agency for a number of its handheld systems, including the recently launched DroneGun Mk4 portable drone countermeasure product. https://announcements.asx.com.au/asxpdf/20230418/pdf/45nr9980p3lk7f.pdf

· March 2023 - $600,000 Unmanned Traffic Management Project in Europe. For a quantity of RFOne longe range drone tracking systems and associated software, whch comes as a SaaS model with quarterly updates. https://announcements.asx.com.au/asxpdf/20230306/pdf/45mbwvtf41j74q.pdf

Previous Order history before March 2023 see my previous Straw!!!

Price at time of writing is 75.7 cents/share, represents a trailing PE of 39.55.

Market cap of 693 mil.

October 25th 4C recorded 238 mil in cash. I suppose the value you place on that cash depends on what you think the business will do with it...

Not a lay down misere yet but definitely keeping an eye on the fundamentals. The run up was overdone but will the run down be too?

slowdown in revenue, huge drop in SP (from peak) and also in chat! We used to be very interested in this stock as a community… just a heads up to keep it on your radar, might reach value again if it continues on current SP path…

30 September 2024

Quarterly Report

For the period ending

DroneShield Limited (ASX:DRO)

ASX Release

ABN 26 608 915 859

Image: DroneSentry-X Mk2 on a vehicle

DroneShield Limited ABN: 26 608 915 859 ASX:DRO

Level 5, 126 Phillip St, Sydney NSW 2000

1

25 October 2024 ASX Announcement

Quarterly Activities/Appendix 4C Cash Flow Report

DroneShield Limited (ASX:DRO) (“DroneShield" or the “Company”) is pleased to release its

business update and Appendix 4C for the three-month period ended 30 September 2024.

Highlights

Notes:

1. Revenues from existing orders relate to existing orders scheduled to be delivered and recognised as

revenue in 4Q24. Excludes revenues for any additional sales to be made and delivered for the remainder

of 2024.

2. Results for YTD 3Q24 are preliminary estimates. The audited results are due in February 2025, as part of

the 2024 Annual Report.

• 1Q-3Q 2024 cash receipts of $30.5 million, up 20% vs 2023 ($25.5 million) – noting the 2023

1Q-3Q period included $2.4 million in R&D tax incentive (now received as a tax offset)

- Highest 1Q-3Q cash receipts in DroneShield’s history

- 3Q24 customer cash receipts of $9.1 million, up 18% vs 3Q23 ($7.7 million)

- Highest 3Q customer cash receipts in DroneShield’s history

• 1Q-3Q 2024 revenues of $31.1 million

- 1Q-3Q 2023 revenue was $39.0 million – difference with 1Q-3Q 2024 due to the delivery

of a material amount of the $33 million order announced in July 2023, during the 3Q2023

- There are material deliveries already delivered and scheduled for 4Q2024 from existing

orders, of which an additional $24.1 million in revenue is estimated for 4Q2024, resulting

in an estimate of $55.2 million in 2024 revenue only from the existing orders, prior to

any additional new orders to be received and delivered prior to year-end (vs $54.1 million

total revenue in 2023)1

• DroneShield is well placed to deliver orders at short notice prior to year-end, with $240

million in existing inventory (completed and in progress/long lead items) by sale value held

- The technology obsolescence is managed by providing quarterly AI software updates to a

number of products, as well as forecasting inventory requirements by comparing sales

pipeline vs the timeframe of release of the next generation of hardware across its products

- The hardware carries sophisticated componentry (assisting high margins and

differentiation), driving the requirement for componentry purchasing in advance due to the

build time of 3-4 months

- Customers have urgent requirements and are unable to wait months for delivery

- The sales team is focussed on maximising revenues prior to the calendar year-end, with

October marking the start of the US new fiscal year

1 Estimate only, and should not be considered as guidance.

DroneShield Limited ABN: 26 608 915 859 ASX:DRO

Level 5, 126 Phillip St, Sydney NSW 2000

2

• Robust pipeline of $1.1 billion2 (as at 25 October 2024)

- Buyers of C-UxS systems are aware of the need to fulfil their requirements, and are

gearing up for large acquisitions of C-UxS equipment, following earlier smaller

purchases and trials

- Significant ramp up in the Asia region (especially countries neighboring China), as multiple

Governments are commencing C-UxS programs against the threat of small Chinese

drones conducting surveillance of sensitive areas, harassment and potential attacks

- The US is expected to continue to be the largest market for DroneShield (70% of 2023

revenues, and 60% for 2024 YTD), with a growing customer base across numerous

government agencies, including military and non-military agencies

- Drones are continuing to play a major role in the Ukraine war, including C-UxS foreign

military aid into Ukraine

- In Europe, the NATO framework agreement awarded to DroneShield is expected to drive

material sales, both directly and via the “halo effect” of being selected by the NATO

authorities

- With the larger C-UxS program acquisitions, the procurement times to award are longer for

larger projects, due to additional probity requirements associated with larger deals. There

are currently 34 separate sale opportunities, each in excess of $5 million, in the $1.1 billion

sales pipeline. Some may be potentially awarded prior to year-end.2

• Strong cash balance as of 30 September 2024 of $238.3 million, no debt or convertibles

- Up from $145.5 million as of 30 June 2024, and including the proceeds from the $120

million Placement in August 2024

- This also includes cash outflows of $19 million during the quarter on inventory

- There is currently $40 million in additional inventory payment commitments

- Key areas of spend going forward will be R&D investment to stay ahead of innovation in

the drone technology, as well as a gradual build out of inventory

• Current team of 220 staff includes 140 engineers to drive the technology development with

quarterly AI software updates and 2-3 year hardware development cycles

- 300 staff including 220 engineers planned by the end of 2025

- A number of hires are recent, with productivity expected to get a further significant boost

as they ramp up their contribution to the business

- DroneShield receives significant amounts of cutting-edge tech intelligence on drone trends

from Ukraine, Middle East and elsewhere globally via its network of tier 1 customer and

partner relationships

- Ramp up in Europe, with 3 experienced senior sales hires (all with ex-C-UxS competitor

background) in Denmark and Germany, as well as an experienced senior sales hire in the

Middle East. Two senior ex-Australian Defence Force (ADF) Australian hires (VP Strategy

and a senior adviser) have joined the business engaging on ADF’s C-UxS deployments,

which are expected to ramp up significantly. They are supported by other ex-senior ADF

staff as advisers where appropriate

- DroneShield has also hired Kacey Lam-Evans as its Government Affairs Director, based

in Canberra, who was in the original team at Pyne and Partners with Hon Christopher Pyne,

as the Company expects Australia to commence large C-UxS programs in near term

• Ukraine, Middle Eastern and other global conflicts substantively use small drones

- This is driving significant innovation in the small drone warfare, and as a result innovation

in counterdrone (C-UxS) systems. DroneShield does not consider itself competing with

other C-UxS companies in the market, but rather the drone technologies themselves

• 1H24 SaaS revenues of $1.3 million, up 93% vs 1H23 ($663k)

- SaaS revenue update incl 3Q and 4Q will be available as part of the 2024 full year results

- Customers require the Company’s latest AI software engines, upgraded quarterly on SaaS

basis, in response to a rapidly evolving drone threat

2 There is no assurance that any of the Company’s sales opportunities will result in sales.

DroneShield Limited ABN: 26 608 915 859 ASX:DRO

Level 5, 126 Phillip St, Sydney NSW 2000

3

- As the hardware becomes more flexible/open-ended with each generation of the product,

the software updates will play an increasing role, critical to effectiveness

- Additional SaaS based solutions planned for launch in the next 12 months

• $42 million contracted backlog

- Increasing amount ($28 million in 2Q24), and with $24.1 million expected to be delivered

this quarter and recognised as revenue

• Further expansion of DroneShield’s Sydney facility and its supply chain network, which is

expected to increase the manufacturing capacity from the current $400 million p.a. to $500

million p.a.

- Signed lease for a significant additional 1,800sqm space at the current Sydney HQ facility,

from the current 2,100sqm, for the combined total of 3,900sqm, with the move into the

expanded space planned to occur prior to 2024 year-end

- Expected to provide additional revenue opportunities (through higher production capacity)

- Majority of the expanded space is for DroneSentry-X Mk2 production (multi-mission

vehicle/fixed site/vessel detect and defeat system), which is expected to drive significant

revenue in 2025 and beyond

- The associated increase in annual lease cost (and other costs) is not material. The fitout

is expected to be covered via the landlord fitout incentive. DroneShield’s own operations

do not have substantial capex outlays associated with them, as only the final assembly and

testing part of the manufacturing is performed at the Company’s own facility, and the

remainder is outsourced with strict specifications

Outlook and Key Themes

As the geopolitical environment deteriorates, small drones continue to be used by bad actors,

both State and non-State alike. C-UxS market remains at a low saturation.

The C-UxS program managers are seeing the rapid evolution of drones on the battlefield, which

drives a degree of delay in larger acquisitions, for the concern of the purchased equipment not

being fit for purpose within a couple of years. DroneShield is approaching this concern in a number

of ways, including building a higher degree of flexibility in its hardware (with software updates

driving the technology), as well as commercial structures in its engagement that reflect the

fast changing technology landscape. The Company also benefits from having a wide range of

products, including handheld solutions, deploying AI on edge (in contrast with the server farms in

the cloud, which is the more traditional deployment of AI, however not suitable for battlefield

applications with no readily available network access at all times).

In terms of the evolution of drones, over the last 12 months, there appears to be penetration of

military technologies into what was originally a consumer technology space for small

drones, with a key focus to avoid detection and defeat of C-UxS systems on both sides of the

Ukraine conflict. Ongoing technology effort is required to keep up with this challenge. DroneShield

is well placed to meet this challenge due to its culture of rapid technology development.

While today the majority of hardware purchases are by customers who require additional

equipment to what they may already have (or it’s their initial purchase), in the next 5-10 years

significant sales are expected to be driven by the customers moving from the older to the latest

generation of hardware. For some customers, this may also lead to C-UxS-as-a-Service model,

with longer term contracts which include hardware purchase and refreshes, regular software

updates, installation and field support. This is positive, as it reduces the lumpiness of cashflows.

While today the military is majority of DroneShield’s customer base, over time the civilian segments

are expected to go through rapid acquisition cycles, likely triggered by incidents. The spread of

such acquisitions will be assisted by the cooperative nature of information sharing of such

customers (as opposed to militaries).

DroneShield Limited ABN: 26 608 915 859 ASX:DRO

Level 5, 126 Phillip St, Sydney NSW 2000

4

The C-UxS sector is continuing to consolidate in 2024, with Axon acquiring Dedrone,

Bridgepoint acquiring MyDefence and High Point acquiring Radio Hill, this year alone.

DroneShield remains the only publicly listed pure-play C-UxS company globally, as well as

one of the last original C-UxS pioneers in this space.

DroneShield’s Positioning

As a pioneer and global leader in the C-UxS sector, DroneShield has a number of technical and

commercial differentiators compared to its competitors. These differentiators have been developed

over years and are challenging to disrupt. On the commercial side, this includes deep trusted

relationships and being written into multi-year requirement plans with key customers across the

US Department of Defense (“DoD”) and other organisations directly, and the defence prime

contractors working with the DoD, to support current and coming priorities. Global primes are often

customers and partners, as opposed to competitors for DroneShield, as they prefer to leverage

DroneShield’s ability to deliver at the required speed of innovation.

With numerous customers and supporting several different C-UxS use cases, DroneShield is

poised for continued diversified growth. The Company is actively progressing opportunities, both

directly and as a subcontractor, across all of its major accounts.

With a large and agile team of hardware and software engineers (estimated as the largest C-UxS

engineering team globally), and a decade of solving C-UxS technology problems as they continue

to rise in complexity, DroneShield is rapidly innovating and building on its unique differentiators.

Payments to related parties of the entity and their associates

Board fees paid to Non-Executive Directors and salary to CEO amounted to $561,483.

This announcement has been approved for release to ASX by the Board.

For enquiries, please contact:

About DroneShield Limited

DroneShield (ASX:DRO) provides Artificial Intelligence based platforms for protection against

advanced threats such as drones and autonomous systems. We offer customers bespoke

counterdrone (or counter-UAS) and electronic warfare solutions and off-the-shelf products

designed to suit a variety of terrestrial, maritime or airborne platforms. Our customers include

military, intelligence community, Government, law enforcement, critical infrastructure, and airports.

To learn more about DroneShield click here: www.droneshield.com/about

ENDS

For more information

Oleg Vornik

CEO and Managing Director

P: +61 2 9995 7280

ASX Listing Rules Appendix 4C (17/07/20) Page 1

+ See chapter 19 of the ASX Listing Rules for defined terms.

Appendix 4C

Quarterly cash flow report for entities

subject to Listing Rule 4.7B

Name of entity

DRONESHIELD LIMITED

ABN Quarter ended (“current quarter”)

26 608 915 859 30 September 2024

Consolidated statement of cash flows Current quarter

$A

Year to date

(9 months)

$A

1. Cash flows from operating activities 9,086,328 30,411,925

1.1 Receipts from customers

1.2 Payments for

(912,178) (2,371,213)

a) research and development

b) product manufacturing and

operating costs

These costs correspond to more than the

current period of sales, due to advanced

inventory purchases (19,017,571) (50,823,288)

c) advertising and marketing (892,815) (3,963,073)

d) leased assets - -

e) staff costs (6,991,794) (17,769,651)

f) administration and corporate costs (2,187,586) (6,663,455)

1.3 Dividends received (see note 3) - -

1.4 Interest received 1,474,537 2,156,999

1.5 Interest and other costs of finance paid

Interest paid relating to the lease liability for

DroneShield’s Office lease in Virginia and

Sydney. Payments for the Sydney office

commenced in July 2024. (84,819) (105,175)

1.6 Income taxes paid - -

1.7 Government grants and tax incentives 97,629 124,804

1.8 Other - -

1.9 Net cash from / (used in) operating

activities (19,428,269) (49,002,127)

ASX Listing Rules Appendix 4C (17/07/20) Page 2

+ See chapter 19 of the ASX Listing Rules for defined terms.

Consolidated statement of cash flows Current quarter

$A

Year to date

(9 months)

$A

2. Cash flows from investing activities

- -

2.1 Payments to acquire or for:

a) entities

b) businesses - -

c) property, plant and equipment

$879k relates to leasehold

improvements at DroneShield’s

new Sydney premises. IT

equipment, vehicle and production

tools contribute to the remainder of

the balance (2,332,311) (4,529,256)

d) investments - -

e) intellectual property - -

f) other non-current assets - -

2.2 Proceeds from disposal of:

- -

a) entities

b) businesses - -

c) property, plant and equipment - -

d) investments - -

e) intellectual property - -

f) other non-current assets - -

2.3 Cash flows from loans to other entities - -

2.4 Dividends received (see note 3) - -

2.5

Other

Leasing incentives received in relation to

DroneShield’s Sydney premises. 422,476 1,123,344

2.6 Net cash from / (used in) investing

activities (1,909,835) (3,405,912)

3. Cash flows from financing activities

120,062,501 243,414,473

3.1 Proceeds from issues of equity securities

(excluding convertible debt securities)

3.2 Proceeds from issue of convertible debt

securities - -

3.3 Proceeds from exercise of options - 1,432,528

3.4 Transaction costs related to issues of

equity securities or convertible debt

securities (5,400,000) (11,993,820)

3.5 Proceeds from borrowings - -

3.6 Repayment of borrowings - -

ASX Listing Rules Appendix 4C (17/07/20) Page 3

+ See chapter 19 of the ASX Listing Rules for defined terms.

Consolidated statement of cash flows Current quarter

$A

Year to date

(9 months)

$A

3.7 Transaction costs related to loans and

borrowings - -

3.8 Dividends paid - -

3.9 Other

Lease liability principal repayments relating

to DroneShield’s Office lease in Virginia and

Sydney. Payments for the Sydney office

commenced in July 2024. (242,384) (365,882)

3.10 Net cash from / (used in) financing

activities 114,420,117 232,487,299

4. Net increase / (decrease) in cash and

cash equivalents for the period

145,540,681 57,889,056

4.1 Cash and cash equivalents at beginning of

period

4.2 Net cash from / (used in) operating

activities (item 1.9 above) (19,428,269) (49,002,127)

4.3 Net cash from / (used in) investing activities

(item 2.6 above) (1,909,835) (3,405,912)

4.4 Net cash from / (used in) financing activities

(item 3.10 above) 114,420,117 232,487,299

4.5 Effect of movement in exchange rates on

cash held (288,238) 366,140

4.6 Cash and cash equivalents at end of

period 238,334,456 238,334,456

5. Reconciliation of cash and cash

equivalents

at the end of the quarter (as shown in the

consolidated statement of cash flows) to the

related items in the accounts

Current quarter

$A

Previous quarter

$A

5.1 Bank balances 56,158,487 38,493,207

5.2 Call deposits 861,377 841,726

5.3 Bank overdrafts - -

5.4 Other (Term Deposits) 181,314,592 106,205,748

5.5 Cash and cash equivalents at end of

quarter (should equal item 4.6 above) 238,334,456 145,540,681

ASX Listing Rules Appendix 4C (17/07/20) Page 4

+ See chapter 19 of the ASX Listing Rules for defined terms.

6. Payments to related parties of the entity and their

associates

Current quarter

$A

6.1 Aggregate amount of payments to related parties and their

associates included in item 1

Payments to CEO and Non-Executive Directors

561,483

6.2 Aggregate amount of payments to related parties and their

associates included in item 2

-

7. Financing facilities

Note: the term “facility’ includes all forms of financing

arrangements available to the entity.

Add notes as necessary for an understanding of the

sources of finance available to the entity.

Total facility

amount at quarter

end

$A

Amount drawn at

quarter end

$A

7.1 Loan facilities - -

7.2 Credit standby arrangements - -

7.3 Other (please specify) - -

7.4 Total financing facilities - -

7.5 Unused financing facilities available at quarter end -

8. Estimated cash available for future operating activities $A

8.1 Net cash from / (used in) operating activities (item 1.9) (19,428,269)

8.2 Cash and cash equivalents at quarter end (item 4.6) 238,334,456

8.3 Unused finance facilities available at quarter end (item 7.5) -

8.4 Total available funding (item 8.2 + item 8.3) 238,334,456

8.5 Estimated quarters of funding available (item 8.4 divided by

item 8.1)

12.27

Note: if the entity has reported positive net operating cash flows in item 1.9, answer item 8.5 as “N/A”. Otherwise, a

figure for the estimated quarters of funding available must be included in item 8.5.

8.6 If item 8.5 is less than 2 quarters, please provide answers to the following questions:

8.6.1 Does the entity expect that it will continue to have the current level of net operating

cash flows for the time being and, if not, why not?

Answer: N/A

8.6.2 Has the entity taken any steps, or does it propose to take any steps, to raise further

cash to fund its operations and, if so, what are those steps and how likely does it

believe that they will be successful?

Answer: N/A

ASX Listing Rules Appendix 4C (17/07/20) Page 5

+ See chapter 19 of the ASX Listing Rules for defined terms.

8.6.3 Does the entity expect to be able to continue its operations and to meet its business

objectives and, if so, on what basis?

Answer: N/A

Note: where item 8.5 is less than 2 quarters, all of questions 8.6.1, 8.6.2 and 8.6.3 above must be answered.

ASX Listing Rules Appendix 4C (17/07/20) Page 6

+ See chapter 19 of the ASX Listing Rules for defined terms.

Compliance statement

1 This statement has been prepared in accordance with accounting standards and policies

which comply with Listing Rule 19.11A.

2 This statement gives a true and fair view of the matters disclosed.

Date: 25 October 2024

Authorised by: Board of Directors

Notes

1. This quarterly cash flow report and the accompanying activity report provide a basis for informing the market about the

entity’s activities for the past quarter, how they have been financed and the effect this has had on its cash position. An

entity that wishes to disclose additional information over and above the minimum required under the Listing Rules is

encouraged to do so.

2. If this quarterly cash flow report has been prepared in accordance with Australian Accounting Standards, the definitions

in, and provisions of, AASB 107: Statement of Cash Flows apply to this report. If this quarterly cash flow report has

been prepared in accordance with other accounting standards agreed by ASX pursuant to Listing Rule 19.11A, the

corresponding equivalent standard applies to this report.

3. Dividends received may be classified either as cash flows from operating activities or cash flows from investing

activities, depending on the accounting policy of the entity.

4. If this report has been authorised for release to the market by your board of directors, you can insert here: “By the

board”. If it has been authorised for release to the market by a committee of your board of directors, you can insert

here: “By the [name of board committee – eg Audit and Risk Committee]”. If it has been authorised for release to the

market by a disclosure committee, you can insert here: “By the Disclosure Committee”.

5. If this report has been authorised for release to the market by your board of directors and you wish to hold yourself out

as complying with recommendation 4.2 of the ASX Corporate Governance Council’s Corporate Governance Principles

and Recommendations, the board should have received a declaration from its CEO and CFO that, in their opinion, the

financial records of the entity have been properly maintained, that this report complies with the appropriate accounting

standards and gives a true and fair view of the cash flows of the entity, and that their opinion has been formed on the

basis of a sound system of risk management and internal control which is operating effectively.

Oleg's 20 minute presentation at the recent ASX Small and Mid-Cap Conference September 2024 is now available on Youtube

ASX Small and Mid-Cap Conference September 2024 | DroneShield Limited (ASX:DRO)

In todays AFR: DroneShield: a capital markets plaything or the real deal?

For those not inside the paywall ...

DroneShield: a capital markets plaything or the real deal?

Even as sceptics question its valuation, the drone detection and jamming group has a near $1 billion market capitalisation.

DroneShield, the drone detection and jamming technology group, seems to have it all: a rocketing share price (even after it halved), an impressive ability to raise equity and a whiff of geopolitical intrigue.

That alone has garnered it an enthusiastic investor following.

“It’s captured the zeitgeist perfectly,” says one small cap analyst, explaining how this near $1 billion company in market capitalisation terms (first-half revenue: $24.1 million) has attracted investor interest with products that stop drones flying over war zones, airports and stadiums.

It’s why an analyst call with chief executive Oleg Vornik, a former banker, spends as much time ruminating on global conflicts as the push to lock in recurring revenues. In one such call, Vornik covered Chinese drone surveillance, as well as Ukraine and US military spending cycles.

There’s secrecy too. Vornik told investors on the same call that competition risk was minimal, as many of their government contracts were too sensitive to be put out to tender.

DroneShield in technical language owns and sells the technology to stop unmanned aerial vehicles (drones) from communicating with their controllers. The products use sensors to detect drones and radio frequencies to stop them flying or transmitting images. The most popular product is its DroneGun, which can “fire” signals at drones, rather than be mounted on buildings and vehicles.

But scrutiny on the stock has kicked up another notch after last week’s surprise equity raising at $1.15 a share, well below the company’s $2.60 a share high in July.

And it was the group’s second trip to the equity market in just four months; the company raised $115 million back in April at 80¢ a share. DroneShield closed the week at $1.14.

Driving the debate in the sharemarket is this question: is DroneShield turning into another capital markets plaything, or is it setting itself up to be the real deal?

Even with the share price fall, DroneShield investors have had an incredible run. Shares in the micro-cap have increased more than six times since the start of the year, and then, even quicker, have halved in value.

The combined equity raises along the way put the company among the top 20 equity issuers on the ASX this year.

It is the second raising that has thrown some believers, fearful this may be another serial capital raiser.

The company said $20 million or so had been earmarked for acquisitions, while $90 million is for developing technology “due to anticipated increase in AI [software as a service] offerings and higher sales pricing for the underlying hardware”.

Hefty multiple

The SaaS offering is a key part of the group’s plans to generate recurring revenue, and the technology spend is aiming to use that for drone jamming equipment. Right now, the SaaS offering only applies to detection.

The existing tech sells well, and will continue to sell for the next several years, Vornik has said, but he wants to “skate where the puck is going”.

Whatever the pipeline, for detractors it’s hard to look beyond the top line: according to Capital IQ, consensus is for revenue in 2024 of $95.5 million. That’s expected to grow to $129.8 million in 2025.

The stock is trading at high multiples – 13.6 times forward revenue, 53 times forward EBITDA, according to Capital IQ.

But there may be another game afoot: index rebalancing.

The next index inclusions are due in the September quarterly rebalance. Often, investors try to front-run the potential promotions, knowing that index buying will inevitably follow any index entrant.

There’s another side, too – shorts often move in just as quickly, partly because more institutional investors means more stock is available to borrow and bet against. Investing wisdom also suggests many new entrants propelled into the big indices by retail enthusiasm flame out when faced with institutional scrutiny.

DroneShield is a possible contender for inclusion in the S&P/ASX 300. According to Wilsons, it’s the third pick to get into the 300 following coal miner Yancoal and biotech favourite Clarity Pharmaceuticals, which also just raised capital.

The broker anticipates there are at least 13 “strong removal candidates”, which include TerraCom, Renascor Resources and Grange Resources, boosting the case for new entrants.

Even if the valuation debate wasn’t a factor, the group’s rapid growth has put governance questions front and centre.

Like many other fast-growing companies, there is concern that the group isn’t moving quickly enough to accommodate its enlarged scale.

For starters, its board has just three members – Vornik, Jethro Marks, the co-founder of retailer Nile Group, and chairman Peter James.

Directors sell shareholdings

Vornik said in an email the company is looking for another director and several candidates were being considered. “We would be looking for experience in fast-moving technology environments and the ability to scale up; a good cultural fit, potentially with global experience,” he said.

All three board members were selling their shareholdings in late February, when DroneShield was trading closer to 70¢. Vornik sold 10.5 million shares over the following week, netting him $7.2 million. Almost half were loan-funded shares, with Vornik paying $1.6 million back to DroneShield.

Marks sold 1.3 million shares, also partly loan-funded, while chairman James sold 5.6 million, repaid a loan and banked $2.8 million.

Insider selling is always a market obsession, particularly if all board members act together.

But neutral observers point out that of even more concern from a governance perspective was the issue of options at the June 3 annual meeting at 80¢. The holders of those shares are sitting on instant paper profits of around $23 million based on the last traded price.

The 3 amigos running this outfit are: Oleg, Jethro and Pete.

Director talk:

“DRO’s market leading software, hardware and engineering capabilities provide the platform opportunity to entrench its market leadership and facilitate future growth.”

Director actions:

19/1/24

Jethro Marks awards himself 1,500,000 zero cost options expiring Jan 2029

Peter James awards himself 3,000,000 zero cost options expiring Jan 2029

Oleg awards himself 15,000,000 zero cost options expiring Jan 2029

6/3/24:

Oleg cashes all his 10,456,000 shares for $7.2m

Peter James cashes 5,612,000 of his 6,532,000 shares for $3.8m

Jethro Marks cashes all his 1,292,901 shares for a miserable $889k.

(I can only think that poor little Jethro during the financial orgy must have been sent out to get the grapes and so missed out of most of the fun)

Why does Droneshield need to spend tens of millions to hunt down baddies when they have so much work to do inside their own boardroom?

You couldn’t make this stuff up.

In the AFR Street Talk yesterday morning:

Divisive small cap DroneShield, which plunged 43 per cent within a week after having its valuation questioned in a news interview, was out rattling the tin on Wednesday morning.

Street Talk understands Bell Potter, Macquarie Capital and Shaw and Partners were shopping a $120 million placement at $1.15 per share, which was a 17.3 per cent discount to the last close and 18.9 per cent lower than the five-day volume-weighted average price. It represented 13.7 per cent of shares on issue.

Term sheets sent to fund managers said DroneShield would spend $90 million on its technology development plan and $20 million on strategic bolt-on acquisitions. It has said it has a $1.1 billion pipeline, and is capitalised at $1 billion on the ASX – but only made $55.1 million revenue and $9.3 million profit last year. Bids were due 5pm Wednesday.

The raise would take DroneShield’s cash balance from $146 million to $266 million. Shares in the drone detection and defence company last traded at $1.39 apiece to be up 266 per cent this year.

It last raised $100 million at 80¢ a share, which was a 28 per cent discount to the last close and 19 per cent lower than the five-day volume-weighted average price. That raise, done in April, was used to accelerate delivery of its counter-drone systems to meet customer demand.

Some strong numbers from Droneshield today -- but not strong enough for the market, which has already priced a lot of growth in.

Contrasting Q1 and Q2, we saw $16.4 million vs $7.4 million, respectively, in terms of revenue. This could be due to timing of large orders or contracts.

Cash receipts were a lot stronger ($7.1m vs $14.2), reflecting the lift in Q1 sales.

From a SaaS perspective, we saw Q1 $561k vs Q2 $721k, showing continued growth in recurring revenue.

Cash Balance up massively, due to the >$100m cap raise in the quarter.

Inventory was up 75% as the company prepares future sales.

Likewise, we saw significant team expansion: In March we had 120 team members (95+ engineers), now 151 team members (114 engineers)

As well as more manufacturing capacity: going from $400m pa to $500m pa.

Sales Pipeline growth was massive -- pretty much doubled to $1.1 billion. The contracted backlog was about the same though suggesting steady order intake and delivery rates.

The operating cash outflow (going from -$10.7 million to -$18.9 million) seems to reflect the inventory build-up and team expansion.

You can see the full preso here.

My take remains the same -- the company seems to be enjoying incredible growth and the future looks bright -- but that (and more) is already captured in the price.

Good it be that our highly-esteemed leader and overlord of this forum (aka @Strawman ) yesterday called "peak $DRO"?

What say you, @Saiton ? (Is this the start of a "down wave" or is there another term, like "down Niagara Falls")

01:53pm AEST

Security Code: DRO

Pause in Trading

Trading in the securities of the entity will be temporarily paused pending a further announcement.

OK, my valuation of $1/share from only 3 months ago is now looking overly conservative -- or, as many have pointed out, the current market pricing is rather exuberant..

I'll leave the previous rationale below, but let's try a super optimistic valuation just to test how much growth is needed to justify the current price ($2.56)

Droneshield have said for a while that they have a FY2028 target of $300-$500m.

Let's assume they exceed the top end of that range and do $600m. Let's also assume the do a very healthy 15% net margin.

That gives a FY28 NPAT of $90m, which based on a fully diluted share count of 818.5m shares is an EPS of 11cps.

Now, if we wanted a 10%pa capital gain between now and the end of FY28 (remembering they report on a calendar year basis), we'd need the share price to be $3.93 at that point in time. And the company's market cap to be ~$3.2b.

If the EPS is 11c, then we need a FY28 PE of at least 35.

Yeah, all that is possible. But again, it rests on a 20% beat to the top end of already aggressive revenue targets, high net margins and a decent PE.

For context, the average net margin for the major listed military hardware companies is usually less than 10% (eg Raytheon and Lockheed are at ~10%, BAE Systems is 8%)

At present, these companies are all on a PE of less than 25 at present. Most less than 20. Ok, maybe they dont have the same growth potential as a much smaller company with a longer runway, but it is notable.

If, for contrast, we apply a 10% net margin and PE of 25 to our $600m FY28 revenue target for DRO, and then discount back by 10% per annum, we get a current valuation of $1.20 -- less than half the current price...

The point isn't to suggest these assumptions should be relied on -- maybe DRO is doing $700m in revenues at a 20% net margin in FY28! -- but it does show that we need to see a lot of things go right for the current price to make sense.

Remember too, we're only demanding a 10% compound annual return with these valuations. So the company absolutely knocks it out of the park and my return is essentially on par with the long run market average...

It's just not that appealing to me, and I think the only way you can rationalise a big position in DRO right now is if you expect some combination of significantly higher than forecast revenues & margins, and/or the market maintains a very high earnings multiple (which, btw, happens all the time -- but it's not something I like to reply on)

For the sake of drawing a line in the sand for my Strawman valuations, I'll go with FY28 revenues, margins and PE of $500m, 10% and 40 (respectively) to get a valuation of $1.60

OLD VALUATION FROM APRIL 2024

Time for an update on this 8 month old valuation. (41c previously, based on FY28 revenue of $300m, a 5% net margin and terminal multiple of 35)

As i said at the time, there's a rather wide range of trajectories here, but given recent wins, sales momentum and order book growth, I'm probably justified in baking in more optimistic assumptions.

I'll take the mid-point of their FY target of $400m in sales. Last year they were already on an underlying net margin of 5.7% (once you take away R&D incentives and tax deferred tax benefit), so at scale this should improve. For the sake of conservatism i'll go with 7.5% to get a FY28 NPAT of $30m.

Given the implied growth, a terminal earnings multiple of 30 doesn't seem outrageous, and that gives us a market cap of $900m, or $1.32/share.

Discounting back to today, at a 10% discount rate, and remembering they operate on a calendar year basis, that's a valuation of 82c. Exactly double the old valuation!

For the sake of argument, if Droneshield hits the top of their revenue target ($500m) and did a 10% net margin, you'd get a valuation of $1.37 with everything else held steady.

Or $400m in revenue and a 10% net margin and a PE of 35 gets you $1.27.

As you can see, and is often the case fort high-growth companies, it's rather easy to produce a valuation you want without tweaking things too aggressively.

As someone who very much prefers the "roughly right" approach to valuation, what it really boils down to for me is that Droneshield is probably somewhere around 'fair value' IF you have any confidence in their medium term revenue aspirations, and that they can operate at a reasonable margin.

Of course, a major acquisition or a single large deal could change everything very quickly. But so long as we continue to see genuine progress in orders, sales, earnings and cash flows, it's a "hold" for me at the current price ($1.10), and i'll nominate a nice round $1 valuation as my current best guess of fair value.

Possible disruptor? Article on ABC. In short: South Korea has announced plans to deploy lasers to shoot down drones sent by North Korea.

Officials say the technology is invisible, noise-free, runs on electricity alone and costs $AU2.15 per shot.

What's next? The"Block-I" system technology is set to be rolled out this year.

Laser Anti-Aircraft Weapon

This is a high-energy laser weapon system capable of providing protection against small unmanned aerial vehicles and multicopters at key facilities. The application of a mobile platform and increased power/precision will help better deal with more advanced threats.

Small Laser Weapon

As a small, lightweight high-energy laser weapon system capable of providing various laser output levels through modular design, this is available for infantry and mounted on mobile platforms.

The technology has successfully achieved a 100 per cent shoot-down rate in previous tests, and with future improvements, it could become a "game-changing" weapons system capable of countering aircraft and ballistic missiles in the future, DAPA said.

But some analysts like Senior Researcher at the Korea Institute for Military Affairs, Hong Sung-pyo, said it was too early to be sure about the weapon's capabilities.

"Laser weapons have not yet been put to practical use worldwide, and further verification and more time are needed to determine whether they can be utilised as a practical weapon system," he said.

not directly impacting this company but strikes me as a terrible decision hugely expensive ($100k) single use drones vs FPV commercial drones for $ 200

Goes against all data and real life use evidence

Details Soon at 10:45am

Using Revenue Target of 300-500m by 2028 as mentioned by the company.

Looking at 2023 margins of 9.3m NPAT off 55m Revenue = ~16% and extrapolating out to the targeted revenue.

2028 NPAT = 48m (300m revenue)

= 700m shares / 48m

= 6.9c eps

@ PE 30 = $2.07

@ PE 40 = $2.76

@ PE 50 = $3.45

2028 NPAT = 80m (500m revenue)

= 700m shares / 80m

= 11.4c eps

@ PE 30 = 3.42

@ PE 40 = 4.56

@ PE 50 = 5.70

Investors can decide on what discount you wish to assign today.

I am using PE 50 at 300m which so happens to be similar to PE 30 at 500m so let’s say 3.40 and discounted back at 10% per annum to give me ~2.00 today.

I think that’s right.

Anyway thought I would give this a go to give myself a sense of a valuation.

I know you're supposed to let your winners run, however looking at Droneshield over the last month you've got to start asking the question when will this madness end?

Commsec shows a huge buy side in stark contrast to the sell side as below.

How much is priced in for future revenue, expected growth etc.

I can no longer attach a value to this.

Hold IRL and SM

What do you make of this ASX : C. Listing Rule 3.1, which requires a listed entity to immediately give ASX any information concerning it that a reasonable person would expect to have a material effect on the price or value of the entity’s securities.

Thinking...Closing the SPP early not good for ones missing out and the offering, was over subscribed anyway so extra 3 to4 days open would not matter. Then do the scale-back on the over subcription.

Peter James Number acquired: 15,323 (via SPP)

NOW Holds 935.3Mill units / shares ..Solid Holding.

Investor Relations — DroneShield Ltd (ASX:DRO) — Droneshield

Chart: left to right direction, Good

SPP substantially exceeded the maximum capped raising amount of $15 million set by the Company, with DroneShield receiving total applications for fully paid ordinary shares (Shares) for $40 million

The initial Plan: (The capital Raising has exceeded DOR wildest expectations)

18 April 2024 ASX RELEASE $70m Fully Underwritten Placement and up to $5m SPP

Net proceeds raised from the Placement and SPP will be used to build up inventory to support DroneShield’s strong pipeline of high-quality customer opportunities as well as the scaling of the engineering team to accelerate development of in-house artificial intelligence (AI) and machine learning (ML) engines and capabilities for enhanced detection, identification and response of drone threats

- Net Profit Margin expected to be Strong

The Good

- Quarterly revenue of $16.5m which has been on a solid upward trend over the last 18 months. What is also positive is that this revenue is only made up of one significant contract announcement ($4.3m in March) which highlights that there is an increasing volume of smaller orders being received. This annualises out to $66m which is dangerous with the type of order flow that droneshield experiences, but is indicative that they are on the right track to exceed FY23.

- Relocation to the new facility has been completed. The new capacity hasn’t been fully realised as can be seen by the drop in product cost spend on last quarter. This has also contributed to the increase in staff (120 up from 105) and administration costs. With the recent capital raise for a further $70m to support build up of inventory. Based on this should expect a ramp up of product and staff costs over the coming quarters.

- Pipeline now up to $519m with an increase in the number of projetcs since February. However, also looking at from where they are preferred or better, it looks like it is for smaller value orders (based on average value)

The Not So Good