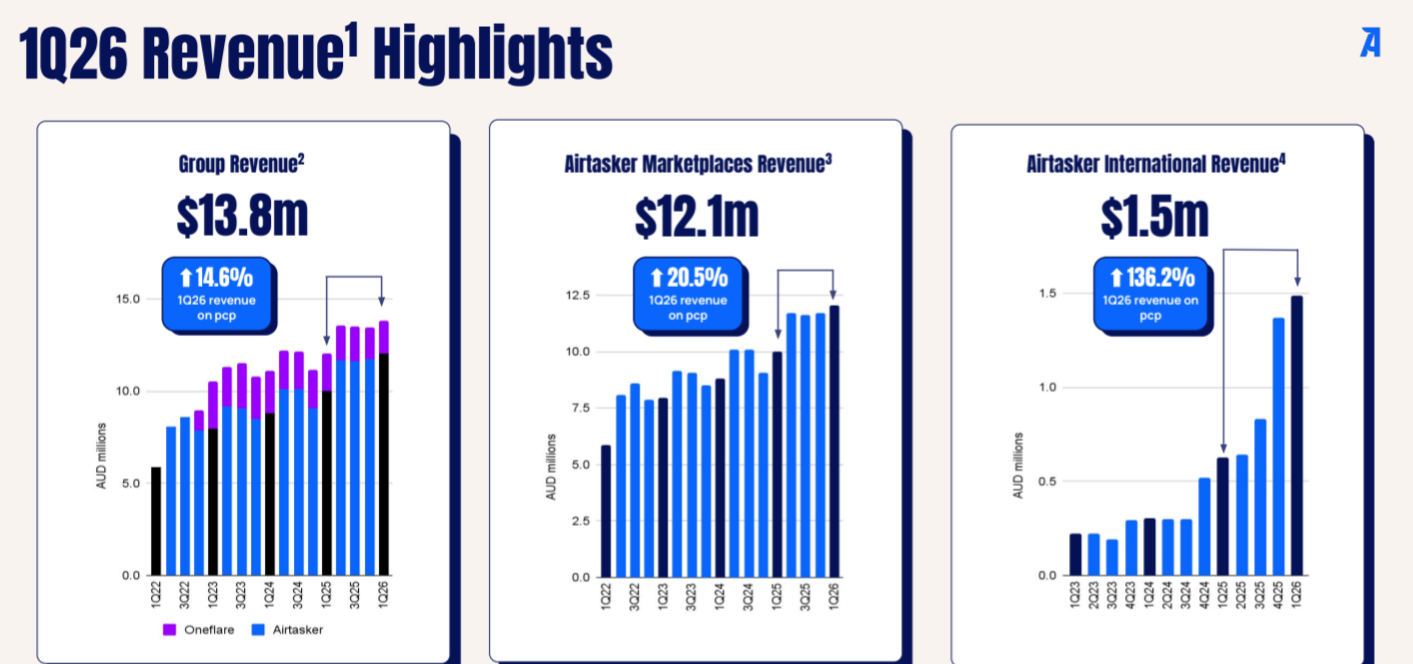

ART have slipped some quarterly figures for Q1 2026FY into the cap raise presentation

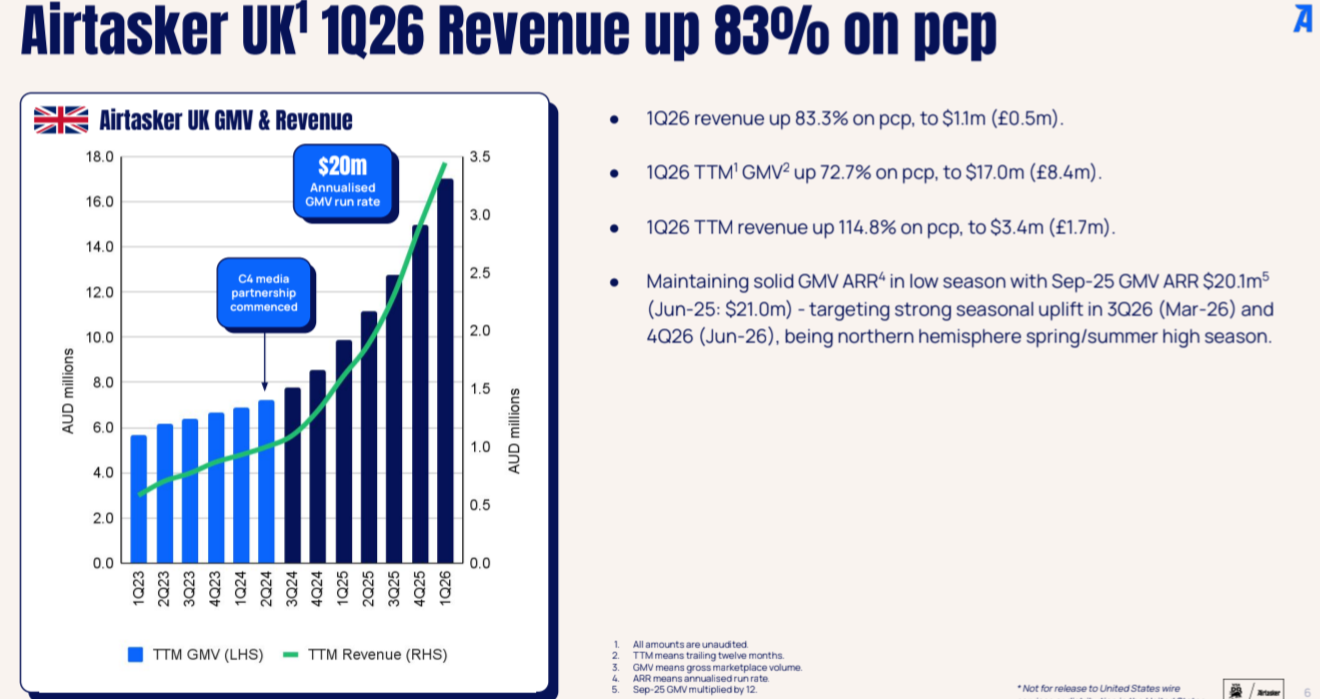

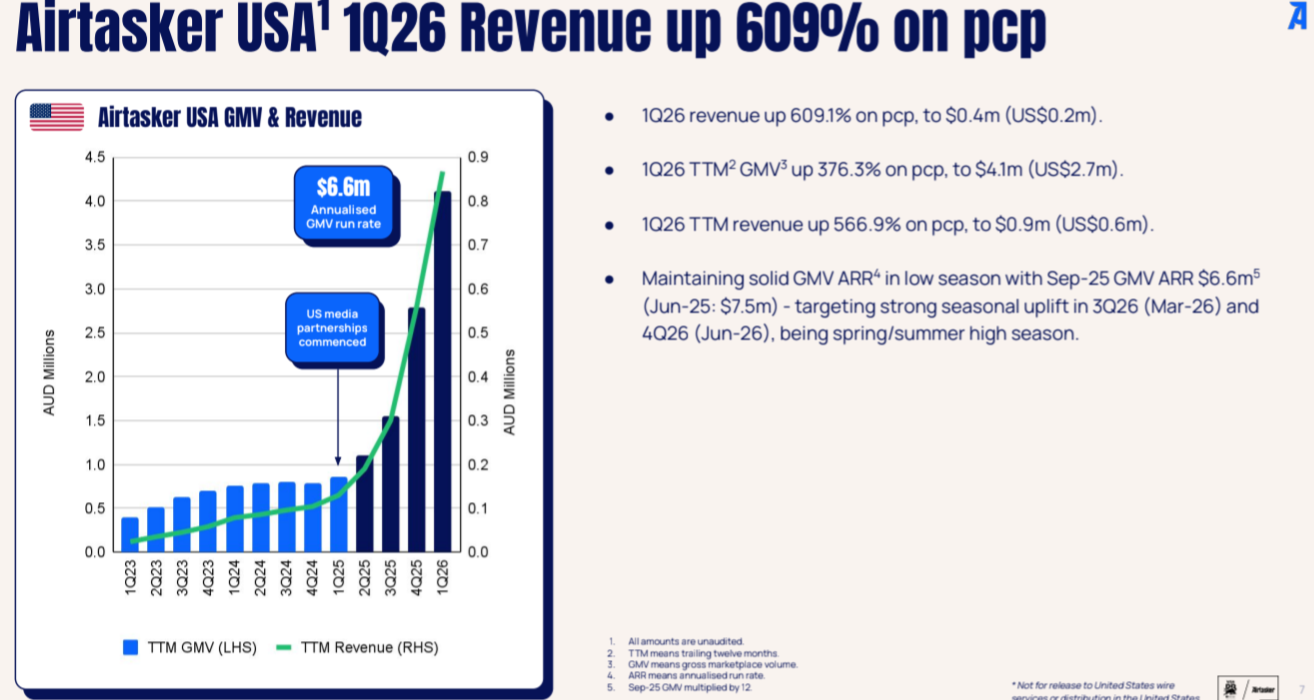

Pretty solid revenue growth in all markets. Australia ticking along nicely, with exponential (although early stage) growth in the UK and USA:

Yes it is still embryonic in the USA. But the signs are positive in both markets. UK in particular is continuing to move rapidly towards critical mass.

The big question for ART in my opinion, is whether this international growth is sustainable. Currently they are spending fairly big on marketing, mostly by media partnerships (which have to be paid back one way or another) and also by using the cashflow from the AU business. So far IMO, things are on track. There seems no reason why the relatively successful AU marketplace wouldn't be replicable in UK/US. I will be monitoring closely in upcoming quarters, but there is reason for optimism in this presentation.

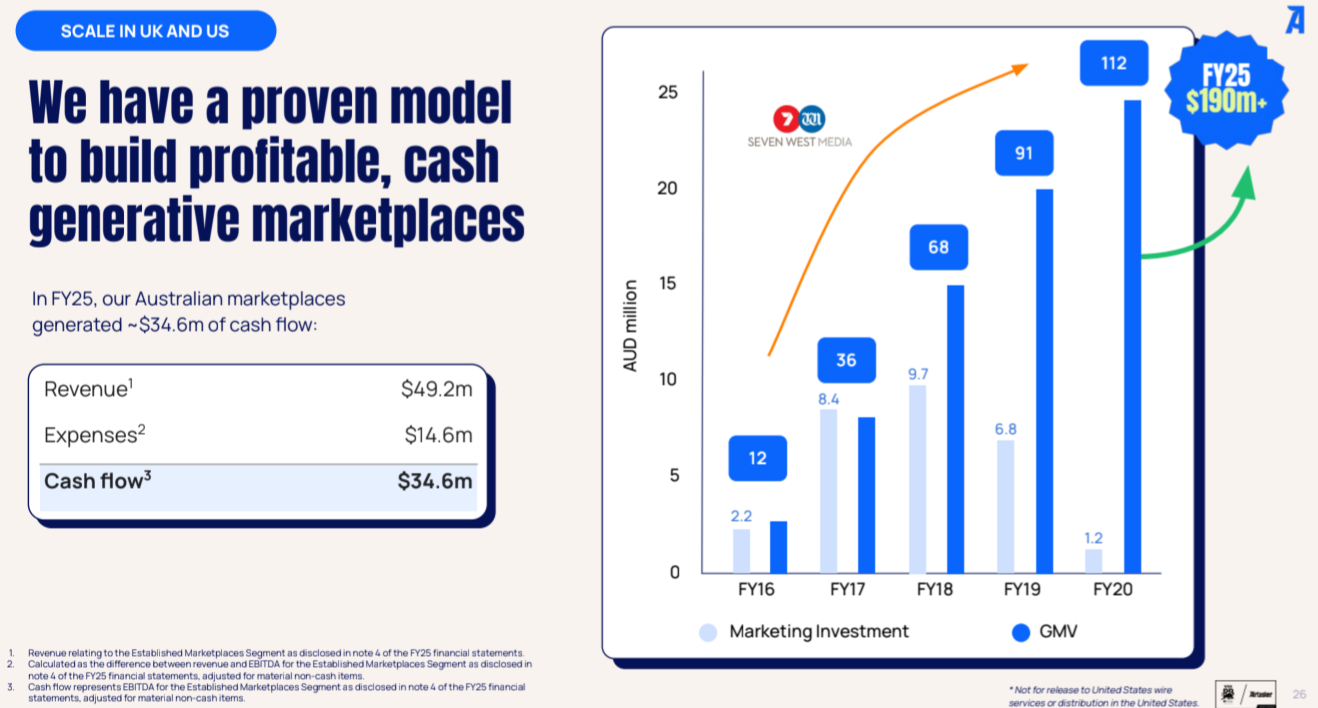

This slide, for me, is the most important. It illustrates what happened in Australia during and post investing in marketing via media partnerships. We are in the early to middle stages of a similar journey in UK/USA

Conclusion

I view this as a buying opportunity. The market never likes discounted cap raises, but the cash is being deployed appropriately by invested, incentivised management. The signs are there that the overseas markets are getting traction. Investment case on track

The market cap is only $140 million. The Australian marketplace alone is probably worth more than that. It threw off $15 million of cash (after all head office costs) last FY and is still growing at solid double digit+ rates. The international markets are essentially being priced as free lottery tickets