Consensus community valuation

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

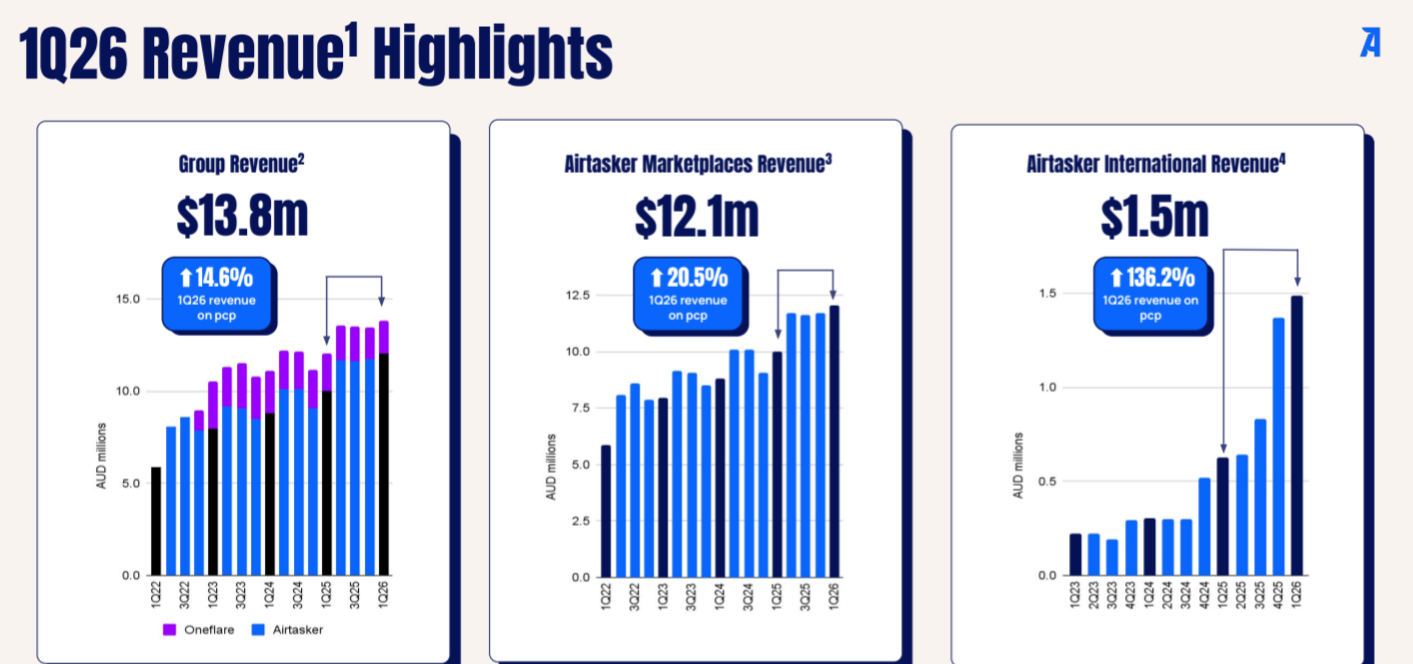

ART have slipped some quarterly figures for Q1 2026FY into the cap raise presentation

Pretty solid revenue growth in all markets. Australia ticking along nicely, with exponential (although early stage) growth in the UK and USA:

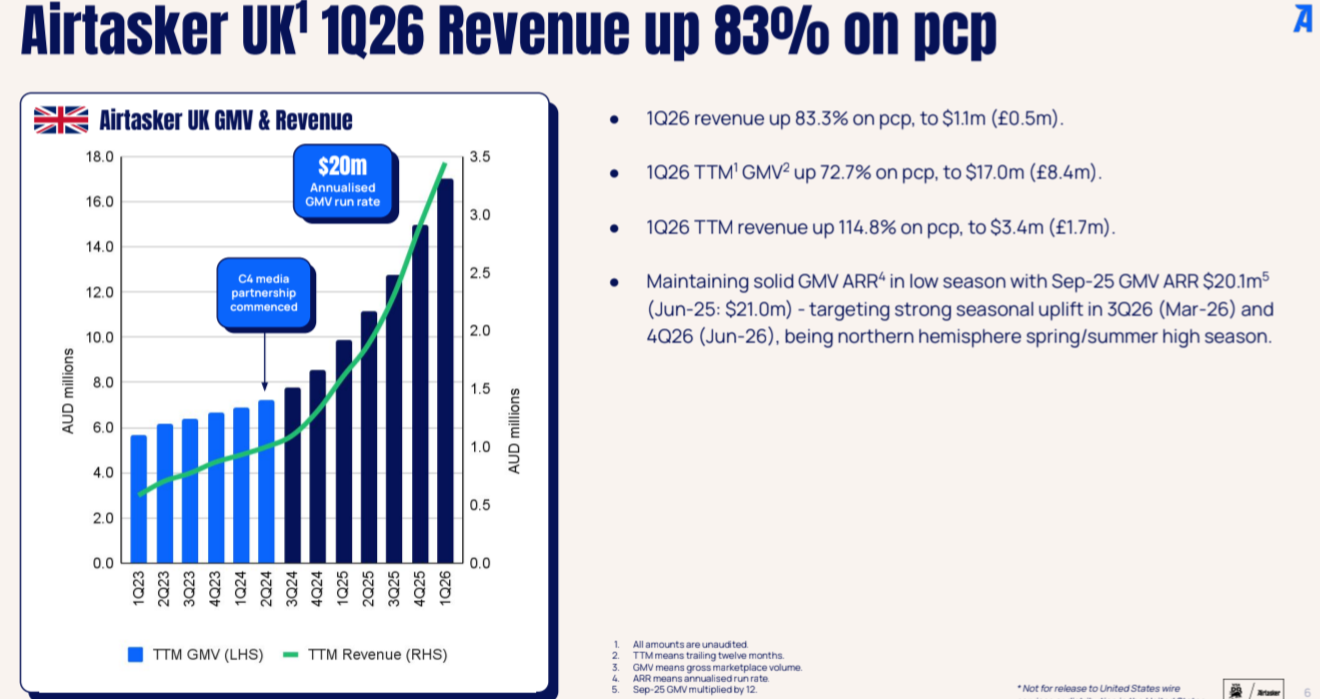

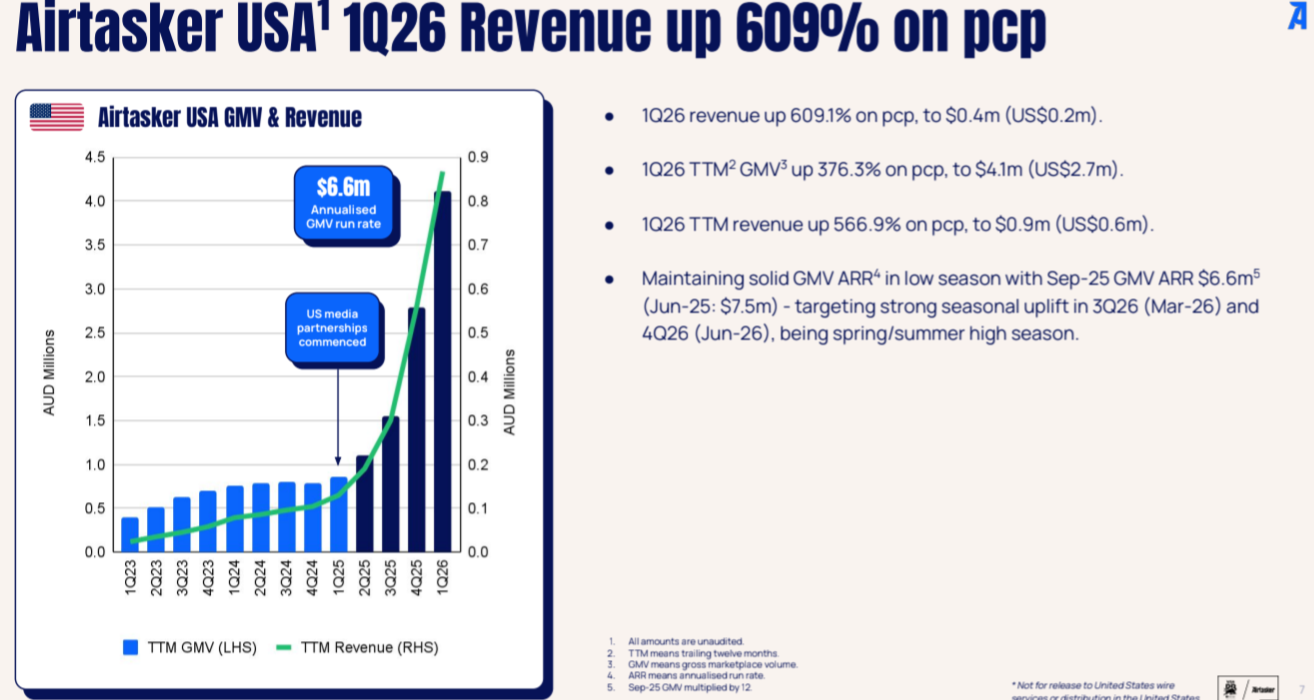

Yes it is still embryonic in the USA. But the signs are positive in both markets. UK in particular is continuing to move rapidly towards critical mass.

The big question for ART in my opinion, is whether this international growth is sustainable. Currently they are spending fairly big on marketing, mostly by media partnerships (which have to be paid back one way or another) and also by using the cashflow from the AU business. So far IMO, things are on track. There seems no reason why the relatively successful AU marketplace wouldn't be replicable in UK/US. I will be monitoring closely in upcoming quarters, but there is reason for optimism in this presentation.

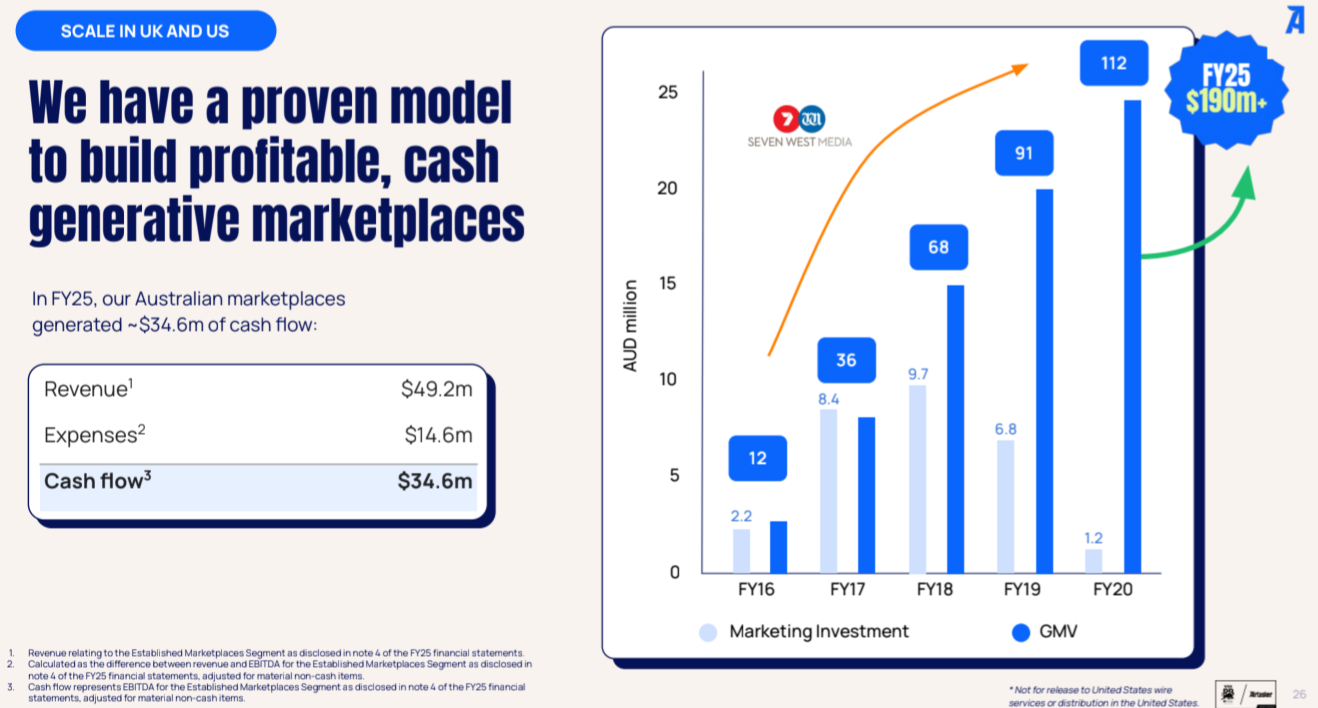

This slide, for me, is the most important. It illustrates what happened in Australia during and post investing in marketing via media partnerships. We are in the early to middle stages of a similar journey in UK/USA

Conclusion

I view this as a buying opportunity. The market never likes discounted cap raises, but the cash is being deployed appropriately by invested, incentivised management. The signs are there that the overseas markets are getting traction. Investment case on track

The market cap is only $140 million. The Australian marketplace alone is probably worth more than that. It threw off $15 million of cash (after all head office costs) last FY and is still growing at solid double digit+ rates. The international markets are essentially being priced as free lottery tickets

Some interesting announcements from ART.

There is another US $5 million "strategic partnership" with iHeartMedia. This is similar to previous deals, which I have discussed on SM in the part. In short, it is unconventional, but makes sense IMO for ART and follows a playbook that achieved success in Australia. So no surprises, and no problem here for me.

A bit more surprising, is a $10 million cap raise. Backed by institutional investors, including iHeart Media, as well as Exto partners (a related party of one of the directors). It's good to see a vote of confidence from iHeartMedia. Presumably they have good visibility with relation to the product and it's success, and it also increases alignment (ie they have a good incentive to make sure that their advertising of ART is effective). Also good to see Exto partners (which is a "related party" of one of the directors) taking $500k worth of shares. The cap raise is reportedly for "marketing investments in the US and UK and balance sheet flexibility".

I am a little surprised, and a little disappointed that this cap raise was needed, in addition to the media partnerships. It is at the discounted price of 30 cents and of course retail shareholders aren't able to participate. Although we will probably be able to buy shares on the market at the same or even cheaper prices.

I am prepared to trust managements judgement on this. It basically seems that they are doubling down on the UK and USA. Signs from both markets are positive. Management have lots of skin in the game

They have also slipped some new quarterly figures (for Q1 2026) into the presentation for the cap raise. I will do a separate post for these. In short, they are quite positive. Growth is on track in all markets and the investment case is intact

Been doing some more thinking

I have invested a small-moderate amount in ART (see previous posts for my investment case)

The thing that is stopping me putting more in is simple:

FEES

ART charges fees to both sides of the transaction. The "tasker" (ie person doing the job) gets charged a "service fee" of 20% (although this can reduce for taskers who do a LOT of jobs and have good feedback, see below). There is also a "connection fee" paid by the customer of 15.95%, minimum $4.95, maximum $49.45.

So for a typical $250 job, the tasker will pay a $50 fee and the customer will also pay a connection fee of $40. The customer pays $290, the tasker gets $200 and ART gets $90.

To be fair, there are tiers for the service fee. But the requirements are pretty onerous. To get Silver tier you need to have earned over $880 on the platform in the past 30 days, PLUS have "okay" completion in your past 20 tasks. For that, you get to pay "only" 18.5%, instead of 20%. To qualify for the best "Platinum tier" with a 12.5% service fee, you need to have earned at least $5300 on the platform in the past 30 days, PLUS have "excellent" completion.

Even if the tasker is "Platinum", the breakdown for a $250 job would look like this: customer pays $290, tasker gets $218.75, ART gets $71.25

Things are slightly better (but still too high IMO) for a $500 job. The customer pays $549.45, the tasker gets between $400 and $437.50, depending on tier, and ART makes between $111.95 and $149.45.

TOO EXPENSIVE ?

I would love to get other opinions on this. For me these fees just seem too expensive. Am I being a tight arse? Does anyone want to make the case that fees like that are reasonable?

OR DOESN'T MATTER?

To make the counter-argument, the fees do include 3rd party liability insurance. Plus I suppose if you phone up a company to get someone to come and do a job at your house, they probably take a higher percentage than ART. And you will be paying that fee again for any repeat business. Perhaps the argument can be made that ART is expensive because it is essentially just an introduction service. You pay a high fee for the first job, but if you are happy with the work, you just contact the person directly for sebsequent jobs (and pay no fees).

The other major argument against fees being too high, is that the business has been performing. Despite these fees, the Australian business has been growing and profitable, and the overseas businesses are showing promise. The proof is in the pudding, and recently the pudding has been pretty good.

CONCLUSION

I still can't help thinking that ART could do so much better with a different (lower) fee structure. The marginal costs of running the website are pretty low. If fees were lower, I really believe that the platform would get a LOT more use. Less advertising would be required and I wouldn't be surprised if profits ended up higher.

I really hope that Tim (the founder/CEO) agrees to an interview. I would love to hear his response.

Also it would be great to get some other opinions from SM. I am genuinely conflicted about this one.

It is hard to go all in on something that feels like a bit of a rip-off.

I have had a pretty good look at ART over the past week or so

For me it's a high conviction buy

I think the progress in the business is being overlooked by the market for the following reasons:

- The stock got overhyped post IPO. The IPO price was already expensive. Then it went a lot higher. Then the "weighing machine" kicked in and the share price dropped something like 85% over around 2 years (2021 - 2023).

- The profitability of the underlying business is masked by the fact that they are investing all of the Australian profits in overseas expansion

- Not many analysts cover the stock, due to its small market cap. It is not in any major indices

- It is not as high quality a business as other digital marketing businesses (eg REA, Carsales)

BUT

Despite all of the above. Despite the fact that it is more like a "dating service" (it earns a fee for the initial introduction, but then the tasker and client can connect directly for subsequent jobs). Despite the fact that peeple try to exchange contact details and then cancel the job to avoid fees. Despite all of this, the business is performing. Plus it is at an inflexion point. Current revenue covers costs (sort of). Future revenue increases will mostly flow straight into profit.

Here is total revenue for the last 4 financial years:

2021 $26571

2022 $31469

2023 $ 44171

2024 $46643

2025 $52700

There was disruption by COVID, and the Oneflare acquisition in 2022 (which added around $6 million of annual revenue). But the overall trend is pretty good. This was during a period that was not easy for the business (with pandemic lockdowns etc)

The vast majority of revenue (over $49 million) is still from the Australian business. The latest quarter showed growth of over 20% in revenue from the AU business (vs PCP). Revenue growth from the core Airtasker marketplace is even better than this (Oneflare, with annual revenue around $8 million, actually shrank slightly). Growth in the Australian business is actually accelerating, due to a combination of improvements to the pricing model and increased marketing. Even including the extra spend on marketing, the Australian business is throwing off cash. EBITDA was $2.5 million for the quarter and $8.1 million for the FY (for the AU business). This is after deducting all head office costs and AU marketing. Some of the marketing is "non-cash" (see below), so the free cash flow from the AU business is even higher ($4.8 million for the quarter)

The Australian business alone is almost certainly worth more than the current market cap ($159 million). Growing rapidly, throwing off cash and only valued at a little over 3 times revenue. Plus they have $19 million in cash and no debt (although there are share repurchase liabilities, see below).

ART is founder-led. Tim Fung still owns over 10% of the company. He appears to have a long-term focus. Most of the marketing is "above the line" brand marketing, aimed at increasing brand awareness. This takes longer to pay off than some other forms of advertising, but is the right thing to do for the long-term.

Airtasker's overseas expansion is mainly focussed on the UK and the USA. It has been slower than might have been hoped initially. But real progress has occurred in the past 12 months, particularly in the UK business. Increased marketing and platform improvements are starting to work. UK revenue for the trailing 12 months was $2.9 million, an increase of 123%. The US is up over 400% for the same period, but much earlier stage (TTM revenue $560k).

It is important to understand that some of the increased marketing has been funded by equity sales and convertible notes. Details are in a previous post. There was $53 million in "share repurchase liabilities" in the last HY report. Only around half of this money has actually been spent to date (we will see exactly how much when the annual report comes out shortly). It will have to be repaid over the next few years (or converted to equity at a discount). But it is important to note that the liabilities are held against the overseas businesses only, and the expiry dates are staggered over several years. It was a way for ART to obtain cheap funding to "kick-start" the overseas marketing, by allowing partners to share in the upside. And there is good evidence that it is working

Conclusion

So in conclusion, you have an Australian business growing well and profitable, which is investing in an overseas expansion that is starting to work. The Australian business alone is worth more than the current market cap. Overseas is the cream on top

If the trends of the past 12 months continue (or even get close) ART can easily multi-bag. Even if it stagnates in Australia and fails overseas, you are still not going to lose all your money. Risks skewed to the upside IMO

This is actually surprisingly good

I had pretty much written off this business. Last time I took a look, it was growing too slowly, unprofitable, and not really getting traction overseas (UK and USA)

Things have improved.

Now they are cash flow positive. Basically generating cash from the more mature Australian business and investing it in the UK and USA.

Overall, group revenue up over 20% for the quarter (vs PCP). It's even better for the core Airtasker marketplace business (the Oneflare acquisition is not performing as well). Australia is growing quite strongly and generating cash. UK is growing rapidly (from a small base) and USA is growing even more rapidly (but from a tiny base, still very early days).

Current EV is only $125 million (even after a big jump today), which is around 2.5 time revenue. They have cash on hand and basically no debt.

This is a multibagger IF they can maintain the trend of the last few quarters. It's a big IF, but the signs are there

Definitely worth a look IMO

The hero slide is this one I guess and I hold for pretty simple reasons... If they can grow revenue (and cut back on advertising once their brand is well established) these businesses should have very attractive economics...

Airtasker’s quarterly report confirms positive free cash flow of 1.2 mil for FY24. I assume the market was looking for more given the drop in SP but pretty illiquid I guess.

I like the deals with Australian media to get advertising and re-new the focus on Aussie growth.

The growth of the platform of 14% is pretty good too. Looking forward to many years of double digit growth (I hope).

held in a very small allocation IRL

33

ABN 53 149 850 457 ASX ART

Quarterly Activity Report and

Appendix 4C Quarterly Cash Flow Report 30 June 2024

Lodged with ASX under Listing Rules 4.7B and 4.7C. www.airtasker.com

ASX Announcement

30 June 2024 - Quarterly Activity Report

Full year positive free cash flow as

FY24 Airtasker platform fee revenue grows 13.9% and 4Q24 UK revenue grows 76.3%

4Q Highlights

● FY24 positive free cash flow $1.2m, an improvement of $8.8m 115.3%) on pcp1

● FY24 Airtasker platform fee revenue up 13.9% on pcp

● UK 4Q24 revenue up 76.3% on pcp

● $17.8m in cash and term deposits on balance sheet

● $11.0m in advertising from oOh!media and ARN to accelerate Australian revenue growth in FY25

Airtasker Limited

ABN 53 149 850 457

29 July 2024

1 Prior comparative period.

1

Full year positive free cash flow of $1.2m

Airtasker has delivered on its promise with FY24 positive free cash flow of $1.2m, up $8.8m 115.3%) on pcp and FY24 positive operating cash flow of $3.1m, up $13.9m 128.1%) on pcp. This strong cash flow result was achieved by delivering solid FY24 Group revenue of $46.6m, up 5.6% on pcp and achieving strong operating eiciencies across the business through reductions in headcount costs of $9.5m (down 31.8%) on pcp and increased eiciency in administration and corporate costs with a reduction of $3.3m (down 31.9%) on pcp.

Cash flow from operating activities in 4Q24 improved $1.9m on pcp while the 4Q24 versus 3Q24 movement reflected the timing of a $2.8m increase in marketing expenditure to invest in brand awareness in Australia and the UK and an $0.8m increase in payments associated with the timing of annual software subscription renewals for FY25.

Airtasker finished the financial year in a solid financial position with $17.8m in cash and term deposits on its balance sheet.

Airtasker platform fee revenue up 13.9%

In FY24, Airtasker platform fee revenue, which includes the newly introduced cancellation fee, increased 13.9% on pcp to $34.1m.

Despite challenging macroeconomic conditions, this solid growth was achieved through a successful program of investment into platform reliability which saw cancellations reduce by

Airtasker Limited

ABN 53 149 850 457

2

Airtasker Limited

ABN 53 149 850 457

26.3% on pcp, reflecting a decrease in platform leakage and an all-time record in completed task volumes.

In FY24, Airtasker marketplaces total revenue grew by 9.8% on pcp to $38.1m. Marketplaces total revenue includes breakage revenue, which decreased as a result of a higher task completion rate and a correspondingly lower volume of cancellations. The breakage revenue trend is pleasing as it indicates an improved customer experience and higher earnings quality. Overall, the monetisation rate2 in FY24 improved by 13.7% on pcp to 20.0%.

Media partnership delivers 76.3% increase in UK revenue

In June 2023, Airtasker formed a 5-year media-for-equity partnership with Channel 4 in the UK which provides Airtasker with £3.5m (A$6.7m) in media advertising and access to Channel 4’s reach of 47 million UK people 78% of the UK population).

Following the successful release of the UK television advertising campaign ‘Airtasker. Yeahtasker!’ in October 2023, UK marketplace demand accelerated over the balance of the financial year with 4Q24 GMV up 34.9% on pcp, to £1.5m (A$3.0m) and revenue up 76.3% on pcp, to £250k (A$0.5m). Seasonally, marketplace activity in the northern hemisphere is strongest in the first and fourth quarters of the financial year, principally during spring and summer.

In FY24, Airtasker’s UK marketplaces demonstrated strong performance with GMV up 20.0% on pcp to £4.5m (A$8.6m) and revenue up 41.1% on pcp to £682k (A$1.3m) as a result of increased brand awareness.

2 Monetisation rate represents Airtasker’s revenue in a given financial period, expressed as a percentage of gross marketplace volume GMV in the same period.

3

Airtasker Limited

ABN 53 149 850 457

In Airtasker’s US marketplaces, FY24 GMV increased 9.4% on pcp to US$520k (A$791k) and FY24 revenue increased 73.7% on pcp to US$69k (A$104k). In the US, Airtasker continues to see healthy growth in marketplace activity while maintaining a disciplined approach to marketing investment as it continues to explore several media partnership opportunities.

Australian media partnerships to provide $11m to turbocharge growth

In late June and early July 2024, Airtasker announced two new media partnerships in Australia with oOh!media Limited ASX OML (oOh!media) and ARN Media Limited ASX A1N) (ARN) for the provision over two years of $6.0m in out-of-home advertising services and $5.0m of audio advertising services, respectively.

oOh!media is a leading provider of out-of-home advertising in Australia. The partnership will enable Airtasker to scale in a capital eicient way through access to oOh!media’s over 35,000 sites across Australia including billboards, street furniture, airports, oice towers and retail centres.

ARN is a leading provider of broadcast and on-demand audio advertising in Australia. Airtasker will access ARN’s extensive Australian network of 58 radio stations including KIIS FM, Pure Gold and CADA - which feature popular Australian media talent including Kyle & Jackie O, Will & Woody and Jonesy & Amanda - as well as the world’s fastest growing digital entertainment platform iHeartRadio.

This planned resurgence in brand investment in Australia in FY25 follows two years of reduced - and predominantly digital - marketing spend. Airtasker will support this increased brand focus through out-of-home and audio advertising with continued complementary online marketing strategies, including search and social.

The terms of the partnerships involve Airtasker issuing each of oOh!media and ARN with two year $5.0m unsecured convertible notes with a 5.8% annual coupon payable at maturity (Notes). At maturity, the Notes are convertible into ordinary shares at a 10% discount to Airtasker’s 30-trading day volume-weighted average share price or redeemable in cash, at the option of Airtasker.

Commenting on the results, Airtasker Founder and CEO Tim Fung said, “I’m super pleased to announce that Airtasker has delivered on our promise of positive full year free cash flow of $1.2m. During FY24 we focussed on platform reliability which saw cancellations decrease 26.3% and Airtasker platform fee revenue grow 13.9%. This now lays the foundation for re-acceleration of Australian revenue growth in FY25, with the support of our recently announced media advertising partnerships with oOh!media and ARN.

4

Airtasker Limited

ABN 53 149 850 457

In the UK, we’ve been blown away by the results of our ‘Airtasker. Yeahtasker!’ campaign and partnership with Channel 4 which has delivered a 76.3% increase in 4Q24 revenue, and 41.1% increase in full year revenue, as we enter the UK summer season!”

Relatedpartypaymentsin4Q24totalled$662k. Thepaymentscomprised$113ktonon-executive directors for director’s fees, superannuation and expense reimbursements, $239k to Tank Stream Labs Pty Ltd for leases, utilities and cleaning costs related to oice facilities and $310k to Channel Four Television Corporation for VAT related to media advertising services.

All numbers are unaudited.

For further information, please contact:

Media Enquiries

Andrea Philips [email protected]

About Airtasker

Ends–

Investor Relations

www.investor.airtasker.com [email protected]

Airtasker Limited ASX ART is Australia’s leading online marketplace for local services, connecting people and businesses who need work done with people who want to work. With a mission to empower people to realise the full value of their skills, Airtasker aims to have a positive impact on the future of work by creating truly flexible opportunities to work and earn income. Since launching in 2012, Airtasker has put more than $550m into the pockets of workers (payments made after all fee revenue is deducted) and served more than 1.3m unique paying customers across the world. For more information visit www.investor.airtasker.com.

This announcement was approved for release by the Board of Directors of Airtasker Limited.

5

Appendix 4C

Quarterly Cash Flow Report for Entities Subject to Listing Rule 4.7B

Name of entity

Airtasker Limited (the “Company”)

ABN

53 149 850 457

Consolidated statement of cash flows

1. Cash flows from operating activities

1.1 Receipts from customers

1.2 Payments for

Quarter ended (“current quarter”)

(a) research and development

(b) product manufacturing and operating costs

(c) advertising and marketing

(d) leased assets

(e) staff costs

(f) administration and corporate costs

1.3 Dividends received (see note 3)

1.4 Interest received

1.5 Interest and other costs of finance paid

1.6 Income taxes paid

1.7 Government grants and tax incentives

1.8 Other (GST and FBT)

1.9 Net cash from operating activities

2. Cash flows used in investing activities

Current quarter A$’000

12,204

- (1,522) (4,630) (2) (4,987) (2,212) - 419 (35) - - (675) (1,440)

Year to date (12 months) A$’000

49,446

- (4,621) (11,231) (8) (20,430) (7,062) - 614 (147) - (78) (3,433) 3,050

- - - -

(1,948) (13,000)

2.1 Payments to acquire or for:

(a) entities -

(b) businesses -

(c) property, plant and equipment -

(d) investments -

(e) intellectual property

(f) other non-current assets

(investment of surplus cash in term deposits)

(260) -

Quarterly cash flow report for entities subject to Listing Rule 4.7B

1

30 June 2024

Appendix 4C

Consolidated statement of cash flows Current quarter A$’000

2.2 Proceeds from disposal of:

(a) entities -

(b) businesses (non-core business disposals) 41

(c) property, plant and equipment 4

(d) investments -

Year to date (12 months) A$’000

- 461 11 - - 13,503

- - -

(973)

- - - -

- - - -

(877)

(877)

16,052 3,050 (973) (877) (24) 17,228

(e) intellectual property

(f) other non-current assets

(receipts from maturing term deposits)

2.3 Cash flows from loans to other entities

2.4 Dividends received (see note 3)

2.5 Other (provide details if material)

2.6 Net cash used in investing activities

3. Cash flows used in financing activities

3.1 Proceeds from issues of equity securities (excluding convertible debt securities)

3.2 Proceeds from issue of convertible debt securities

3.3 Proceeds from exercise of options

3.4 Transaction costs related to issues of equity securities or convertible debt securities

3.5 Proceeds from borrowings

3.6 Repayment of borrowings

3.7 Transaction costs related to loans and borrowings

3.8 Dividends paid

3.9 Other – lease liabilities

3.10 Net cash used in financing activities

4. Net decrease in cash and cash equivalents for the period

4.1 Cash and cash equivalents at beginning of period1

4.2 Net cash from operating activities (item 1.9 above)

4.3 Net cash used in investing activities (item 2.6 above)

4.4 Net cash used in financing activities (item 3.10 above)

4.5 Effect of movement in exchange rates on cash held

4.6 Cash and cash equivalents at end of period1

1. Excludes investment of surplus cash in term deposits.

- 11,000

- - -

10,785

- - - -

- - - -

(219)

(219)

8,134 (1,440) 10,785 (219) (32) 17,228

Quarterly cash flow report for entities subject to Listing Rule 4.7B

2

Appendix 4C

5. Reconciliation of cash and cash equivalents

at the end of the quarter (as shown in the consolidated statement of cash flows) to the related items in the accounts

5.1 Bank balances (item 4.6 and item 4.1)2

5.2 Call deposits

5.3 Bank overdrafts

5.4 Other (provide details)

5.5 Cash and cash equivalents at end of quarter (should equal item 4.6 above)2

2. Excludes investment of surplus cash in term deposits.

6. Payments to related parties of the entity and their associates

Previous quarter A$’000

8,134 - - - 8,134

Current quarter A$'000

6.1 Aggregate amount of payments to related parties and their associates included in item 1

6.2 Aggregate amount of payments to related parties and their associates included in item 3

Note: if any amounts are shown in items 6.1 or 6.2, your quarterly activity report must include a description of, and an explanation for, such payments.

(499) (163)

7. Financing facilities

Note: the term “facility’ includes all forms of financing arrangements available to the entity.

Add notes as necessary for an understanding of the sources of finance available to the entity.

7.1 Loan facilities

7.2 Credit standby arrangements

7.3 Other - convertible security3

7.4 Total financing facilities

7.5 Unused financing facilities available at quarter end

7.6 Include in the box below a description of each facility above, including the lender, interest rate, maturity date and whether it is secured or unsecured. If any additional financing facilities have been entered into or are proposed to be entered into after quarter end, include a note providing details of those facilities as well.

3. On 25 June 2024 the Company issued an unsecured convertible note in the amount of $5,000,000 to oOh!media Limited with a maturity date of 25 June 2026 (oO!hmedia Note). The consideration for the oO!hmedia Note is the provision of non-cash out-of-home advertising services to the value of $6,000,000 (ex GST).

On 4 July 2024, subsequent to the end of the quarter, the Company issued an unsecured convertible note in the amount of $5,000,000 to ARN Limited with a maturity date of 4 July 2026 (ARN Note). The consideration for the ARN Note is the provision of non-cash audio advertising services to the value of $5,000,000 (ex GST).

The oO!hmedia Note and ARN Note both pay a coupon of 5.8% per annum to be settled at maturity and at maturity both are convertible into ordinary shares at a 10% discount to the 30-trading day volume-weighted average share price or redeemable in cash, at the option of the Company.

Quarterly cash flow report for entities subject to Listing Rule 4.7B 3

Total facility amount at quarter end A$’000

Amount drawn at quarter end A$’000

- - - -

5,000

Current quarter A$’000

17,228 - - - 17,228

-

- 5,000 5,000

Appendix 4C

8. Estimated cash available for future operating activities

8.1 Net cash from operating activities (item 1.9)

8.2 Cash and cash equivalents at quarter end (item 4.6)4

8.3 Unused finance facilities available at quarter end (item 7.5)

8.4 Total available funding (item 8.2 + item 8.3)4

8.5 Estimated quarters of funding available (item 8.4 divided by item 8.1)

A$’000

(1,440) 17,228 5,000 22,228

15

Note: if the entity has reported positive net operating cash flows in item 1.9, answer item 8.5 as “N/A”. Otherwise, a figure for the estimated quarters of funding available must be included in item 8.5.

8.6 If item 8.5 is less than 2 quarters, please provide answers to the following questions:

8.6.1 Does the entity expect that it will continue to have the current level of net operating cash flows for the time being and, if not, why not?

Answer: N/A

8.6.2 Has the entity taken any steps, or does it propose to take any steps, to raise further cash to fund its operations and, if so, what are those steps and how likely does it believe that they will be successful?

Answer: N/A

8.6.3 Does the entity expect to be able to continue its operations and to meet its business objectives and, if so, on what basis?

Answer: N/A

Note: where item 8.5 is less than 2 quarters, all of questions 8.6.1, 8.6.2 and 8.6.3 above must be answered. 4. Excludes investment of surplus cash in term deposits.

Compliance statement

1 2

Date:

This statement has been prepared in accordance with accounting standards and policies which comply with Listing Rule 19.11A.

This statement gives a true and fair view of the matters disclosed. 29 July 2024

Authorised by: The Board of Directors

(Name of body or officer authorising release – see note 4)

Notes

1. This quarterly cash flow report and the accompanying activity report provide a basis for informing the market about the entity’s activities for the past quarter, how they have been financed and the effect this has had on its cash position. An entity that wishes to disclose additional information over and above the minimum required under the Listing Rules is encouraged to do so.

2. If this quarterly cash flow report has been prepared in accordance with Australian Accounting Standards, the definitions in, and provisions of, AASB 107: Statement of Cash Flows apply to this report. If this quarterly cash flow report has been prepared in accordance with other accounting standards agreed by ASX pursuant to Listing Rule 19.11A, the corresponding equivalent standard applies to this report.

3. Dividends received may be classified either as cash flows from operating activities or cash flows from investing activities, depending on the accounting policy of the entity.

4. If this report has been authorised for release to the market by your board of directors, you can insert here: “By the board”. If it has been authorised for release to the market by a committee of your board of directors, you can insert here: “By the [name of board committee – eg Audit and Risk Committee]”. If it has been authorised for release to the market by a disclosure committee, you can insert here: “By the Disclosure Committee”.

5. If this report has been authorised for release to the market by your board of directors and you wish to hold yourself out as complying with recommendation 4.2 of the ASX Corporate Governance Council’s Corporate Governance Principles and Recommendations, the board should have received a declaration from its CEO and CFO that, in their opinion, the financial records of the entity have been properly maintained, that this report complies with the appropriate accounting standards and gives a true and fair view of the cash flows of the entity, and that their opinion has been formed on the basis of a sound system of risk management and internal control which is operating effectively.

Quarterly cash flow report for entities subject to Listing Rule 4.7B 4

Appendix 4C

Airtasker Acquisitions

· May 2022 Acquires Australia 3rd largest local services platform Oneflare. A$9.8m. Oneflare will strengthen marketplace network effects, offering more job opportunities to Service Pros (including both independent Taskers and verified businesses) whilst providing customers with access to a greater range of services, skills and faster response times.https://announcements.asx.com.au/asxpdf/20220504/pdf/458p2pw94h0p6j.pdf

· May 2021 Acquires US local service marketplace Zaarly ~$3.4m. The acquisition of Zaarly provides Airtasker with more than 597,000 registered users (Customers) and 900+ verified service providers (Taskers) to jump start expansion in the US. https://announcements.asx.com.au/asxpdf/20210521/pdf/44wpbcx801vq08.pdf

Capital Raises

· May 2022Raised $6.25m fully underwitten placement at an issue price of $0.43 per share.

· May 2021 Raised $20.7m via a fully underwritten share placement to insititutional, sophisticated and professional investors at $1.00 per share.

· IPO March 2021 at $0.65 Raising $83.7m

First valuation of airtasker after initial model - company is turning to EBITDA profitability (and ultimately pure profit in the next 18-24 months). They continue to grow top line revenue, albeit at slower rates than other companies.

Have just posted a straw today with bull case breakdown - the valuation was $0.46. This is stretching it at the moment (don't think the market oversold it THAT much), and will be going back over the model. Despite its recent tick up in share price I do believe there is more to run and aiming to hold to around the $0.50 mark (long term).

Online Marketplaces Australia

- Hipages (ASX: HPG) - Local service in building trades

- Freelancer (ASX: FLN)

- Oneflare (Private) - Local services

- ServiceSeeking (Private)

Online Marketplace USA

- Angi Home Services (Nasdaq: ANGI) USA

- Fiverr (Nasdaq FVRR)

- Mechanical Turk (Owned by Amazon)

- Pro Referral (previously Red Beacon - USA Private owned by Home Depot)

- TaskRabbit (Private USA - owned by IKEA in 2017)

- Tumbtack (Private USA)

- Upwork (NYSE: UPWK Global)

Online Marketplace UK

- PeoplePerhour (Private)

- Rated People (Private)

- Once a customer and a Tasker Connect there's nothing stopping them from exchanging phone numbers and not going though the platform for repeat tasks

- Data breaches and other data security incidents - Airtasker and its suppliers collect data and other confidential information from Airtasker’s users and store that data electronically

- New technologies

- Changes to laws and regulations

- Use of Airtasker’s marketplace

- Competition