Pinned straw:

Discl: Held IRL 1.56% and in SM

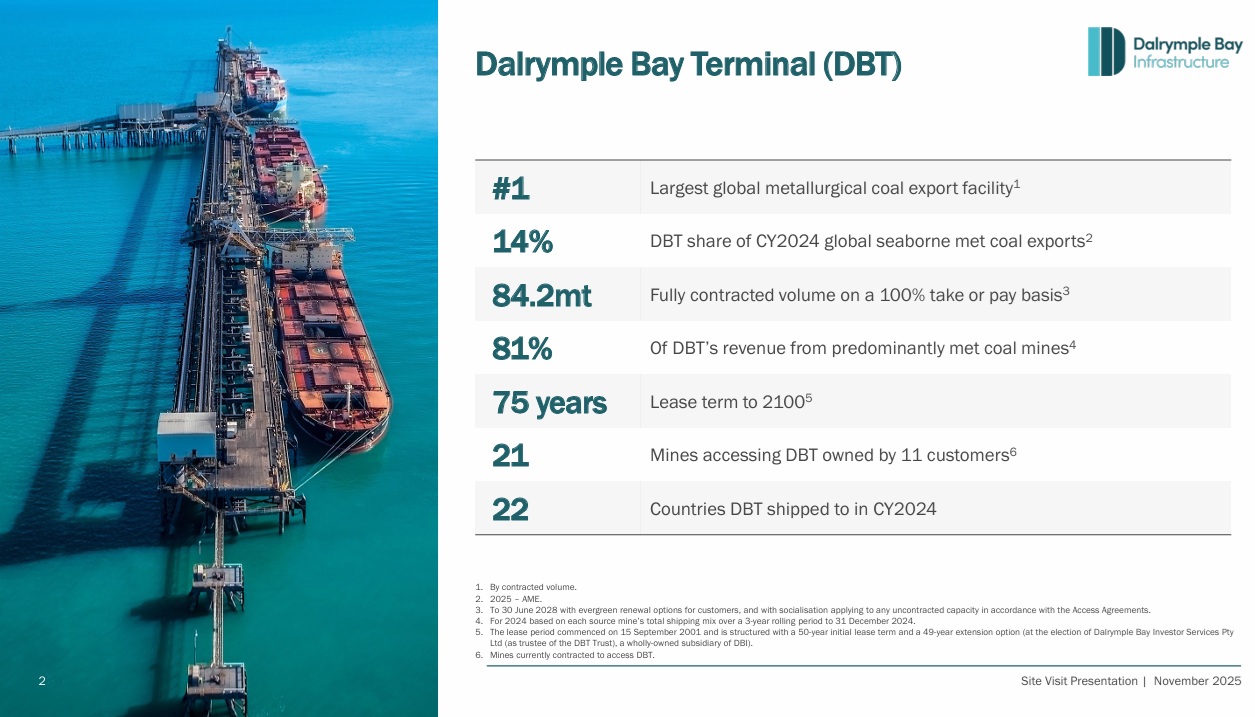

@Bear77, fully agree. It was a good slide pack which added/reinforced how good a position DBI is actually in:

- The Port has a clear history of Port Expansions and Non-Expansion Capital Expenditure (NECAP) to add incremental capacity and incremental improvement of the facilities - these result in revenue step up, with clear cost recovery mechanisms

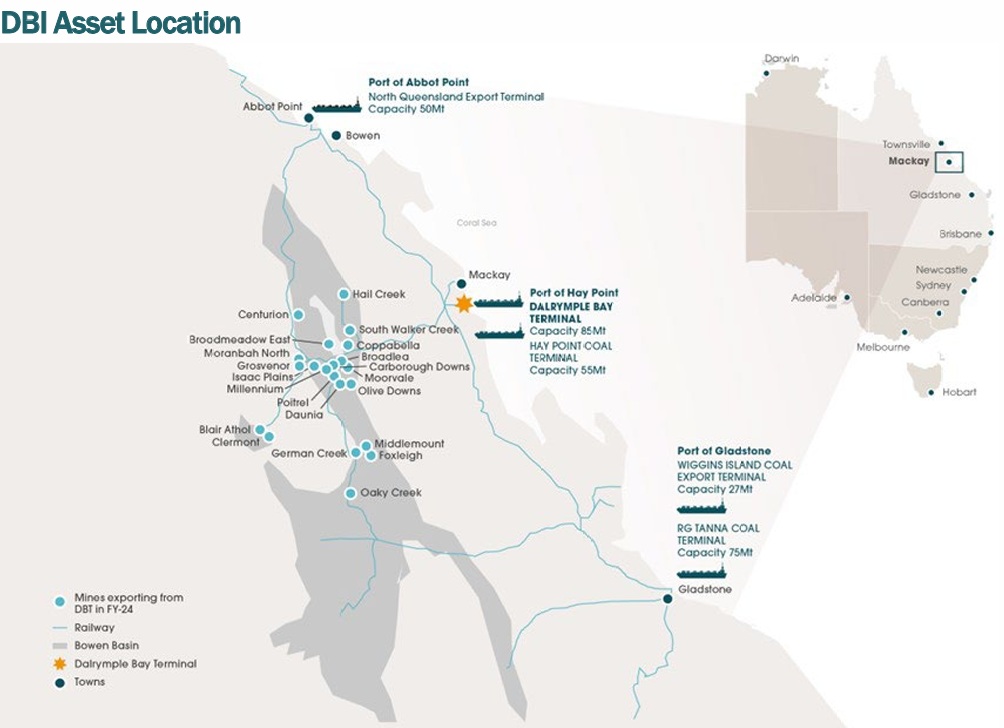

- Long tail to coal reserves in the Bowen Basin ...

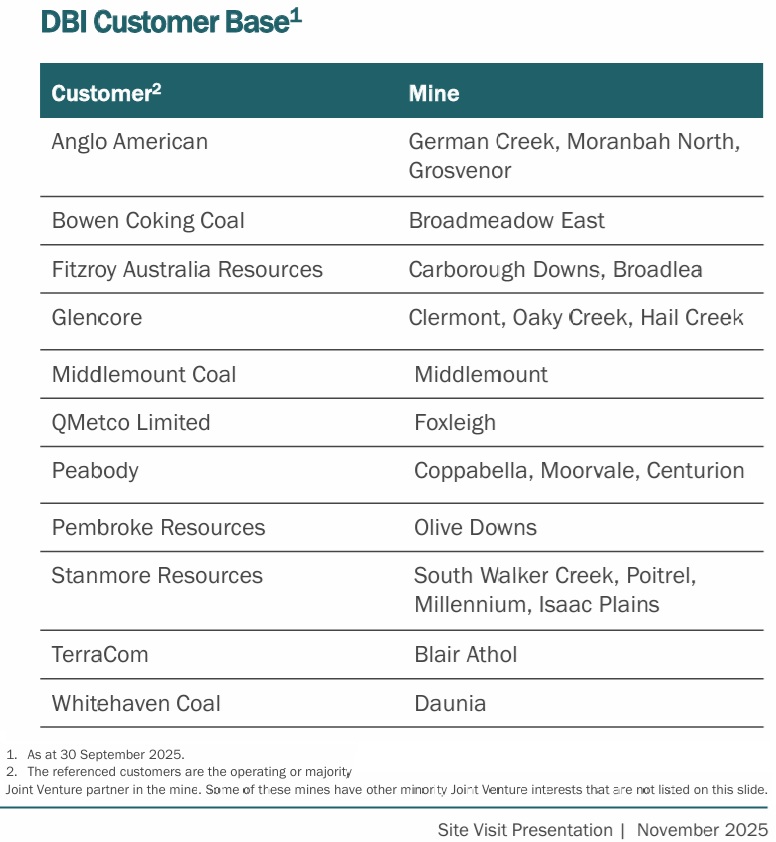

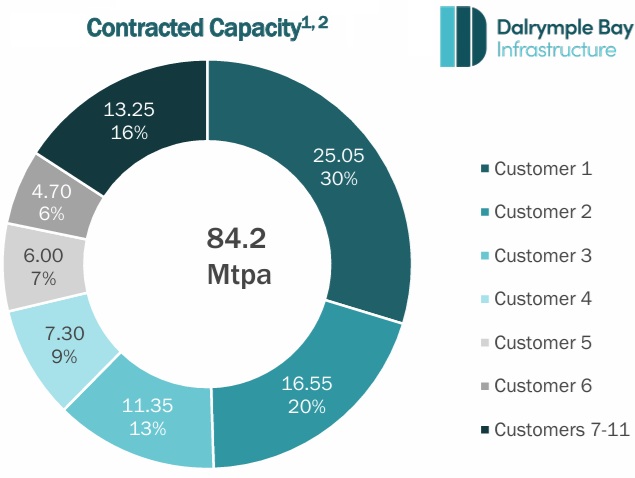

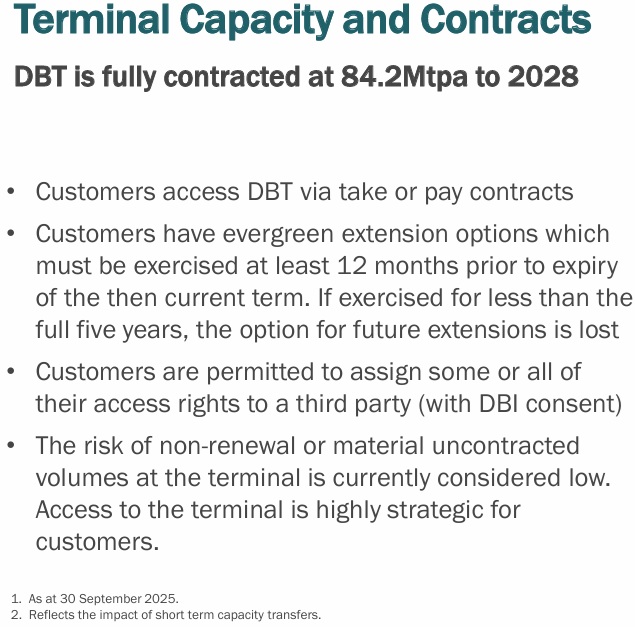

- The Take-or-Pay is a very unique arrangement, more so against the backdrop of its location, proximity to major mines vs other port options, available capacity and coal production requirements/commitments

- Alternative ports are either (1) too far (2) closed access for cost effective exporting - this is a huge moat for DBI

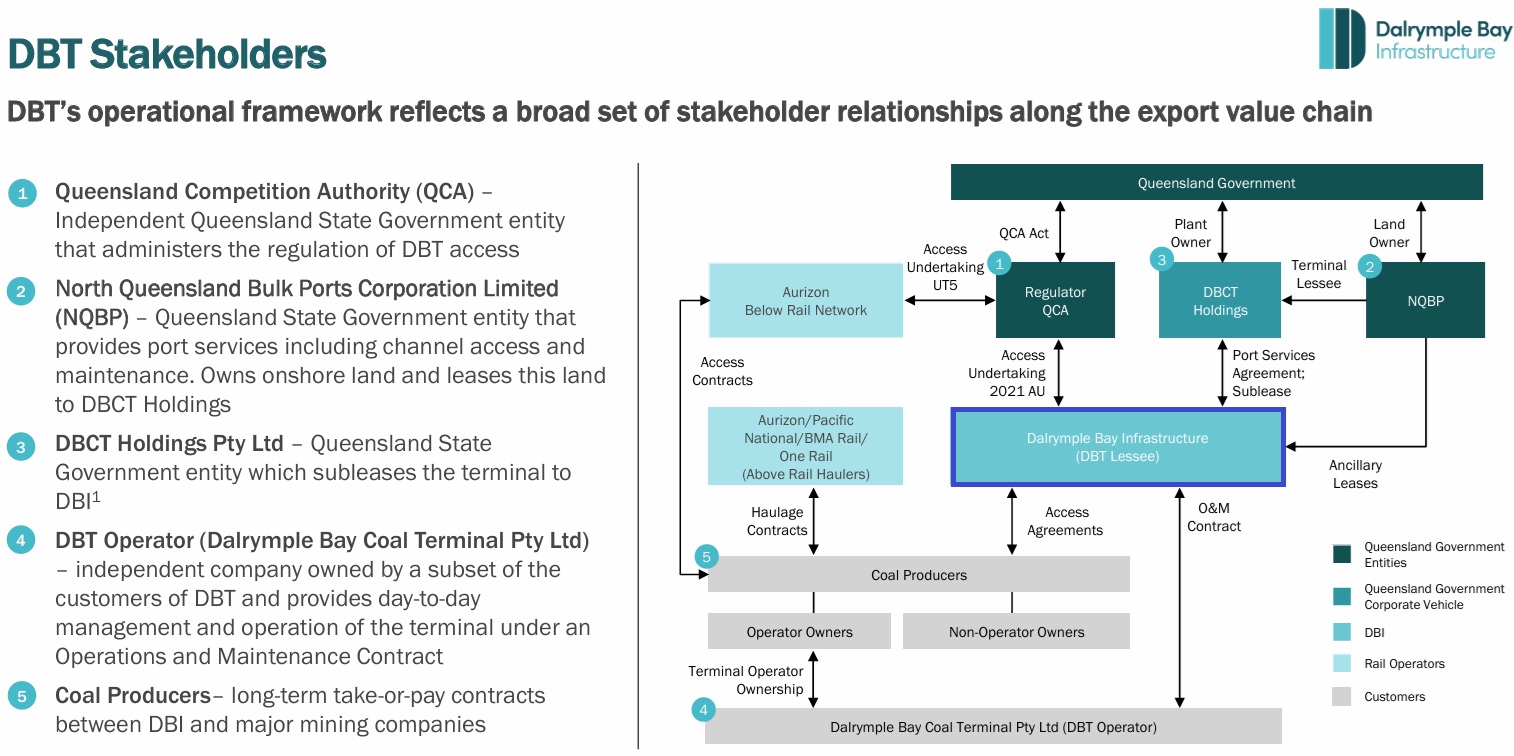

This was a really good slide:

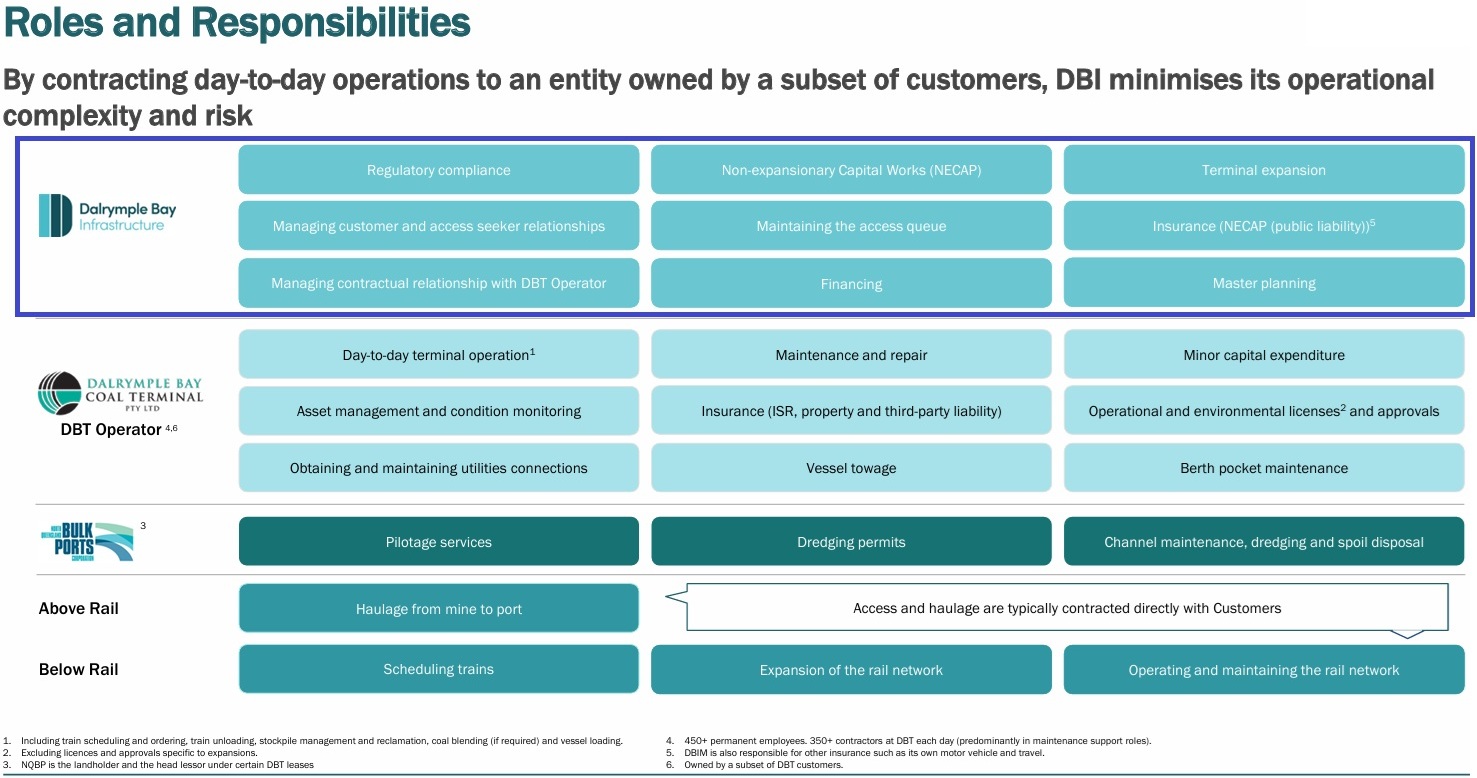

Makes clear that DBI only (1) leases the port and the land around the port (2) owns access to the port

DBI:

- Does not regulate the access of the Port - QCA

- Does not own the Land on which the port sits - NQBP

- Does not manage the channel, dredging - NQBP

- Does not own the Port - DBCT Holdings

- Does not manage the operations of the Port - DBCT P/L

I actually don't think of DBI as a "defensive" holding, but I consider it as "playing offense-with-a-defensive" holding.

As you say, the growth and capital gains will not be tech-growth like, but I really like the slower-but-steadier growth trajectory, backed by high-quality dividends, with a lot of unique downside safety nets and as tight a moat as I've seen. Hell, this is no Woolies ...!

Have slowly built my position, nibbling when it goes below 4.30 - was hoping to nibble some more today if the market correction continued, but that didn't quite play out.