20-Nov-2025: https://investors.dbinfrastructure.com.au/DownloadFile.axd?file=/Report/ComNews/20251120/03025613.pdf

That link above may download a .PDF file to your device rather than open the file in your browser, but if you have any issues with that link, you can use the one below and click on "ASX Announcements" and then "Investor Presentation - Dalrymple Bay Terminal Site Visit"

Source: https://investors.dbinfrastructure.com.au/investor-centre/

Nine Sample Slides:

Source: https://investors.dbinfrastructure.com.au/DownloadFile.axd?file=/Report/ComNews/20251120/03025613.pdf

I hold DBI in my SMSF and I topped up the position today. I originally added DBI to my Super after watching the second (and most recent) meeting here between Andrew and DBI's CEO Michael Riches.

On September 30th DBI announced that their Board had appointed Michael Riches as DBI's MD, in addition to his role as CEO, so his title is now ‘Managing Director and Chief Executive Officer’.

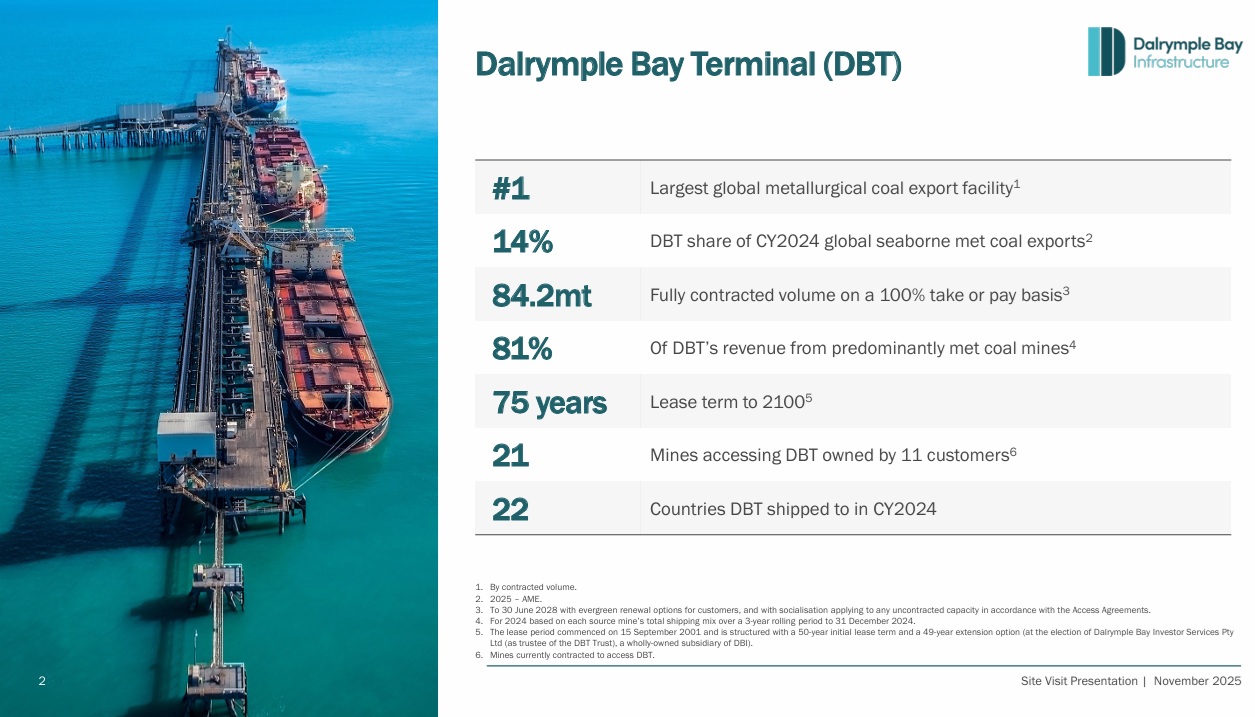

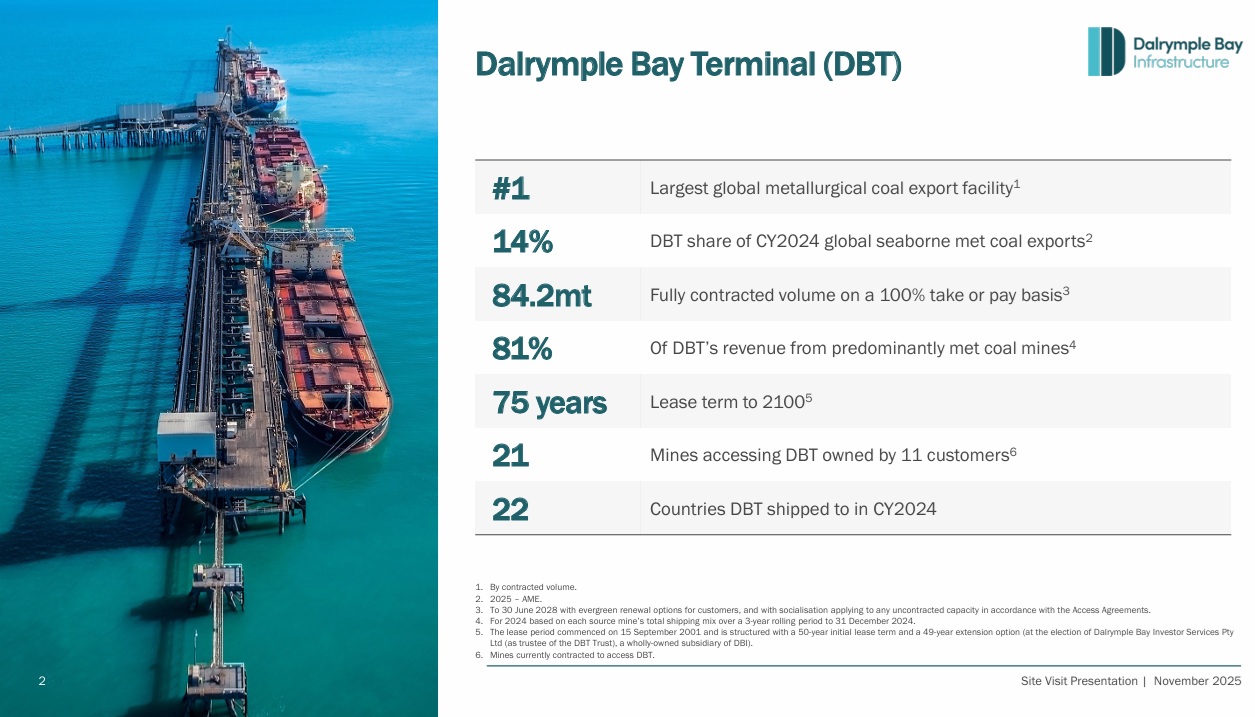

DBI has a compelling business case, even though they are not a growth story that is going to shoot the lights out. With their quarterly partially franked dividends DBI is a dependable income provider with some growth as well, that is a solid inclusion for an income portfolio or just as a place to park cash while waiting for better opportunity to deploy that cash, IMO.

I have trimmed some of my gold producer positions today (NST, CMM, EVN) and fully exited CSC (Capstone Copper) and have re-initiated positions in ARB and TNE - both of whom have fallen enough recently to provide some double digit percentage gains if they trade back up to where they were trading just 5 to 6 weeks ago. I don't believe they are worth less today than they were 5 to 6 weeks ago, and while I do understand that they both had quality / management premiums in their share prices then, so would have looked expensive to many, I believe those premiums were well-deserved.

I view TNE and ARB as two of the highest quality companies on the ASX, and ARB in particular as having one of the best management teams, and I'm always happy to add them back into my SMSF when they have share price falls like they have had in recent weeks. Both are up today, so I'm hoping the selling is over with both of them, but even if it's not, happy with these prices I paid today. I looked at MAQ as well, but the near-to-mid-term upside looks greater with ARB and TNE.

DBI is not in the same league as ARB and TNE (or MAQ), not by a long shot, but DBI do provide me with some diversification which I reckon I need when my SMSF is so heavily weighted to gold companies.

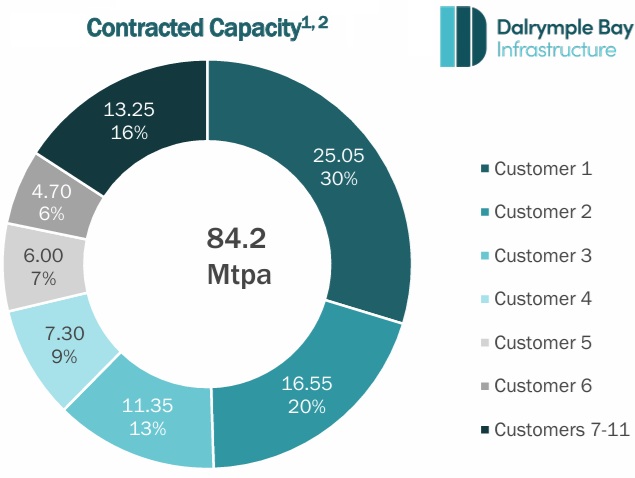

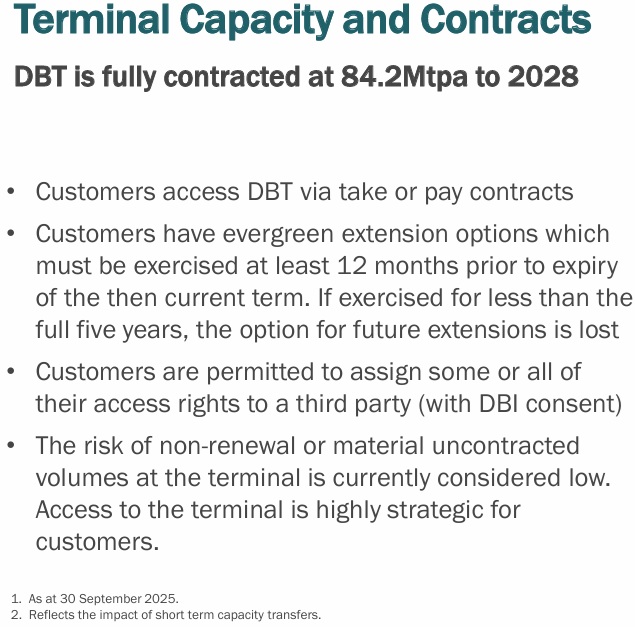

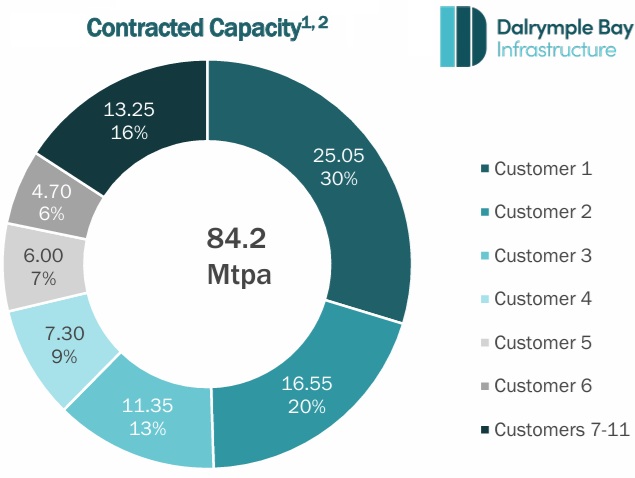

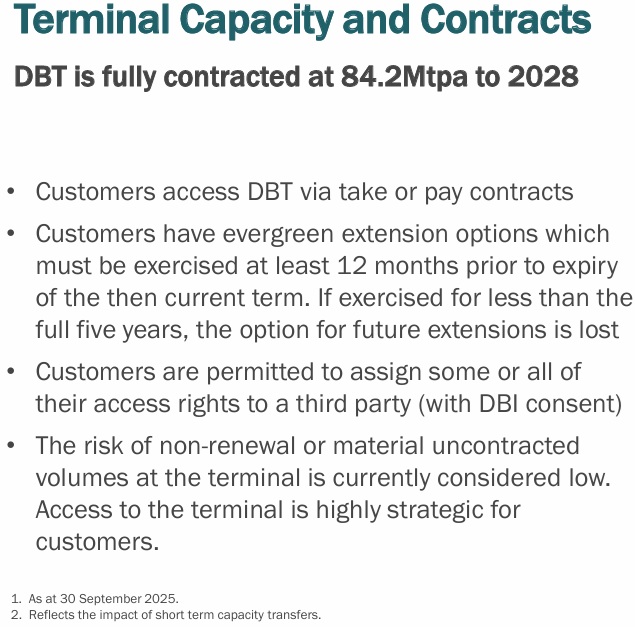

DBI is a solid defensive position in my view, as evidenced by the fact that their SP either didn't drop at all, or dropped less when it did drop, during the market's recent "down" days. DBI is actually a very well structured infrastructure play with very little downside over the next few years because of their structure and the fact that they are fully contracted via take or pay contracts and they have a waiting list for any spare capacity they may have in the future, so I rate them as a great place to park cash.