Pinned straw:

Raelene Murphy will join the Board of $WTC from beginning 2026.

A seasoned ASX Non-Exec, Ms Murphy has significant experience chairing Audit and Risk Committees.

My guess is that she will likely succeed Andrew Harrison as Lead Independent Director, when the governance rebuild is complete. Andrew indicated at the AGM that he does not intend to serve his 3-year term, and will stand down once the goverance rebuild is done. The announcement says they have one more Independent Non-Exec left to appoint.

Ms Murphy adds experience and independence to the board, which is now starting to look like a more rounded and capable board (goverance, logistics industry experience, tech experience). From 2016-2022 she chaired the Audit & Risk Committee at Altium which, like $WTC, is a global enterprise SaaS player and leader in its industry.

From my perspective, this is a good appointment, and will hopefully sooth the nerves of some of the disgruntled insto. investors. I particularly like that, in addition to her Non-Exec experience, she has also had experience as a CEO / MD.

Interested if any other StrawPeople have views on Raelene from their exposure to her at other companies.

My BA has compiled the following resume for her. (Please note, I have not personally fact-checked it in detail, and so there may be some factual errors). From a quick look, it seems to align with her LinkedIn Profile.

Ms Raelene Murphy FCA GAICD

Independent Non-Executive Director

Incoming Director, WiseTech Global (effective 1 January 2026)

Profile

Highly experienced Australian public company director with more than 35 years’ leadership across governance, financial oversight, corporate restructuring, strategic transformation and complex transactions. Recognised specialist in audit and risk governance, frequently appointed as Chair of Audit & Risk Committees across ASX-listed companies. Brings deep expertise in turnaround situations, balance sheet discipline, enterprise risk management and board effectiveness across industrial, healthcare, FMCG, technology and regulated sectors.

Current Board Appointments

WiseTech Global Limited (ASX:WTC)

Independent Non-Executive Director (from 1 January 2026)

Tabcorp Holdings Limited (ASX:TAH)

Non-Executive Director

Chair, Audit Committee

Bega Cheese Limited (ASX:BGA)

Non-Executive Director

Chair, Audit & Risk Committee

Member, People & Capability Committee; Risk & Sustainability Committee

Integral Diagnostics Limited (ASX:IDX)

Non-Executive Director

Chair, Audit Committee

Amotiv Limited (ASX:AOV)

Independent Non-Executive Director

Chair, Audit Committee

Member, Nomination, Remuneration and Risk / Safety / Sustainability Committees

Former Board Appointments

Altium Limited (ASX:ALU)

Non-Executive Director; Chair, Audit & Risk Committee (2016 – 2022)

Elders Limited (ASX:ELD)

Non-Executive Director (2020 – 2024)

Service Stream (ASX:SSM)

Non-Executive Director (2015 – 2019)

Executive Career Highlights

Managing Director – 333 Group / KordaMentha

Senior restructuring and turnaround leader, specialising in complex corporate recovery, strategic reviews and performance transformation. Involved in major government and enterprise restructures, including advisory work on the National Broadband Network (NBN).

Chief Executive Officer – Delta Group

Led a diversified industrial services and construction group, overseeing operational restructuring, financial stabilisation and strategic repositioning.

Senior Executive – Mars Group

Held senior finance and operational roles within global FMCG operations, gaining deep exposure to multinational governance, supply chain operations and performance management.

Partner – Horwath (now BDO)

Led corporate turnaround and restructuring advisory practice.

Core Expertise

- Board governance & ASX-listed company oversight

- Audit & Risk Committee leadership

- Financial reporting & capital management

- Corporate restructuring & turnaround management

- Mergers, acquisitions & integration

- Enterprise risk frameworks

- Cyber and digital risk oversight

- Strategic transformation & cost optimisation

- Crisis management & business continuity

Qualifications & Professional Memberships

- Bachelor of Business

- Fellow, Chartered Accountants Australia & New Zealand (FCA)

- Graduate, Australian Institute of Company Directors (GAICD)

- Member, Chief Executive Women

- Member, Australian Institute of Company Directors

Governance Profile (Summary)

Ms Murphy is widely regarded for her disciplined approach to financial governance, pragmatic oversight of management, and ability to guide organisations through structural change while maintaining strong risk discipline and shareholder alignment. Her appointment to WiseTech strengthens the board’s depth in audit, risk and large-scale transformation oversight.

Disc: Held

Rick

@mikebrisy the only reason I hadn’t bought into Wisetech was the governance issue. I really like this business because it is global, profitable, has good ROE, excellent growth, low debt, sticky customers, and is at the start of a huge global runway. It may have been fortuitous, that I bought in over the week before this announcement with part of my losing Austin Engineering proceeds. I think this has been the first indication to the market that the board is now serious about governance. It seems to be on a roll since the announcement. I’m hoping this appointment gives the board some real teeth! This Aussy business is too good to let governance ruin it!

mikebrisy

@Rick welcome back on board. So I guess it is your buying back in that explains the recent SP movement!

But seriously, I agree. This is too good a business for the behaviour of one or a small number of individuals to destroy, even if it can do real short term SP harm.

I remain confident that in time these issues will long be in the rear view mirror, And I make this remark fully aware that there is still an open question about share trading.

$WTC is a firm I have owned for most of the last 9+ years, and one I hope to be saying the same in another 9.

While I know that smacks of endowment bias, it is driven more by my understanding of its position in its global market (market, strategy, product, value to customers, ability to extract value).

Rick

Actually, the penny dropped for me on Wisetech when I was sitting enjoying a coffee with my wife at Browns Bay on the northern beaches of Auckland recently. I happened to overhear a bloke at another table complaining to his mate over coffee about how Cargowise was costing him $30k per year but he can’t do without it now because of the time it saves him. I commented to my wife that maybe we should take a better look at this business. I said “I don’t like that founder, but I like the company he’s created!”

Solvetheriddle

@mikebrisy @Rick maybe I'm completely wrong, but im much more worried about the latest acquisition succeeding, especially with the debt load. any comments or concrete data about positive progress would be well received by me, anyway. i am slowly building here, but poor news on the acquisition would be a thesis breach.

if you want a bear case, listen to the latest Intelligent Investor podcast sums it up, but we all know this anyway. clearly shows the current sentiment.

Rick

Thanks @mikebrisy. Back for a bit at least. I’m always keeping an eye on you guys even though I’ve been a bit quiet lately. It’s just too hot to be outside painting anyway! In fact, I do better in the market when I don’t watch the market! In theory, If you buy the best businesses you shouldn’t have to come back for a long time because there’s nothing do! Well, that’s in theory! I’ve managed to pull a few of these great businesses together at opportune times in our IRL portfolio. I’m hoping Wisetech proves to be one of them.

Rick

@Solvetheriddle do you need to be a subscriber to Intelligent Investor to get the podcast? I have been, but currently not.

Solvetheriddle

@Rick , no its on Spotify etc

https://open.spotify.com/show/09xRsSKatXFFfEkfk699q7?si=dd2d2953dacb42bd

It's probably the best Ozzie podcast that i listen to, that's faint praise, since little to no competition, in my opinion. And I certainly disagree with many of their views.

mikebrisy

@Solvetheriddle I don’t think you are wrong at all. On the contrary there are two key issues to track:

-E2Open integration

-CTO rollout

My faith in $WTC is not blind faith. It must be earned continuously. And so I agree, progress on E2Open is critical and not a foregone conclusion.

The business was acquired relatively cheaply because it was no longer growing and had itself suffered the consequences of poorly executed M&A … based on what I have learned.

But I think it will be important to give $WTC 2-3 years to start delivering real value from it (beyond the “easy” cost out quick wins that will arise in the first 1-2 years.)

Also, as I think I have written before, E2Open plays in spaces where there is greater competitive intensity. (Think SAP and SAS is forecasting and supply chain planning. E.g. SAP are already implementing some pretty impressive AI-enabled enhancements. So competition is evolving rapidly.)

I’ll add “Winners and Warning Bells” to my weekend listening list. (@Rick available free wherever you get your podcasts.)

Rick

Thanks for the link @Solvetheriddle. The Intelligent Investor team came down hard on Wisetech. Apart from the E2Open acquisition risk, they also frowned on their accounting methods in regards to expensing R&D. While its legal and acceptable by accounting standards, Nick pointed out that 55% of R&D costs are treated as capital and expensed over 5 to 10 years, rather than included in the operating costs. Had R&D been treated differently, this would have eroded much of the margin improvement claimed in recent years. They also think the business was still expensive at $66. However, on the flip side, Nick thought Cargowise was one of the best software platforms that has been developed in Australia with only 1% churn. They would buy Wisetech at a price, even with all its warts, just for Cargowise! While they obviously didn’t disclose their buy price, it seemed to be well below $66. Any thoughts on accounting procedures @Solvetheriddle@mikebrisy?

tomsmithidg

@Solvetheriddle how can you say that when our illustrious leader is on The Pod Machine, aka "Motley Fool Money"...... ;D

PhilO

Intelligent Investor do a general podcast that anyone can listen to. They just started a stock specific deep dive as well that is only for members and can only be accessed via their member webpage. The first two companies were New Hope and CSL. I enjoy their collaborative discussions. There’s something richer when two or more smart analysts openly discuss something.

PhilO

Good point on the R&D. It’s certainly at upper end of what’s typical for tech companies at 50% plus of total spend. I wonder though in Wisetech’s case, if the capitalisation is appropriate, given a lot of Cargowise work including customs integrations tend to stay in use for many years. It’s in a pretty unique place here.

The price is pretty high at the moment when you adjust for this though. For instance, on a fully expensed basis the PE looks closer to 100× than the reported 70x.

mikebrisy

@Rick it is an old chestnut. I am indifferent because ultimately I am focused on FCF evolution.

While there is pleasing simplicity to seeing more or all development spend expensed, development of the platform is investing in an asset that continues to deliver value over time. Sure, it’s intangible and not bricks and mortar, but it is a revenue-generating asset that delivers far into the future, as their cohort revenue analysis included in the appendix of every annual results pack shows. So in my view it is entirely reasonable to capitalise that portion of the spend which underpins future revenue.

Their total cash development spend-to-revenue ratio (i.e., expense + capex) for the last 5 years has been 33%, 29%, 32%, 35%, 34%, so essentially broadly constant at one third of revenue. You have to recognise that in the last two years they’ve completed development and launch of ComplianceWise, and done their major buildout into Landside Logistics, including integrating Envase, Blume and Matchbox and developing CTO … probably the biggest expansion of capability in several years … which is why I am so focused on the CTO rollout progress.

This also explains why the cap:exp ratio has increased significantly. Landside logistics, CTO and ComplianceWise are new products, so proportionately less of the spend has been on sustaining acquired legacy platforms and maintaining Cargowise, which are heavier expense items. Of course, I want to monitor it over time, but I see nothing here of any concern. I’ll listen to the podcast, but to date I haven’t heard anyone explain WHY it is a problem.

For me the accounting issue is a lower level question. I’m more interested in whether they succeed in building out the operating system capability. It is what they have to do, because that has long been the vision and strategy.

The question I think everyone should be asking is: can they succeed as they build the platform out from their freight-forwarding heartland into other parts of the supply chain. It is an analogous question to 1) could Altium go from mid market to enterprise; 2) can Xero go from ANZ to UK and USA; 3) can $TNE go from ANZ to UK or from local government to unis; and 3) can $SDR go from channel management to revenue management?

It is a pattern all growth companies have to follow,…extending from their competitive heartland into more contested and unfamiliar territories. And, as outsiders, we can only poorly assess how well competitive advantages from one domain can be leveraged into the next (but that is exactly where I spend my time trying to understand.)

Sometimes the answer is "yes they can" but eventually history shows for (nearly) all growth companies the answer becomes "no they couldn’t".

So that is where I am spending my time worrying about the future of $WTC.

Remember, a few years ago, short sellers tried to make a meal about $WTC and revenues from acquisitions. There was even a short report that tanked the share price. (I rebutted that at the time in another forum.) All a distant dot in the rearview mirror.

To be 100% clear, I am not dismissing this as something to keep an eye on. What I am saying is that, as of today, I see nothing that gives me concern on accounting treatment.

Solvetheriddle

@tomsmithidg ok ill give it a go, if anyone can add value its SM :)

Solvetheriddle

@Rick as you may remember, TNE got a short seller report a few years back on a similar accusation. its hard to properly reconcile as it is a judgement on the usefulness of the s/w. WTC plans are very ambitious, so you could argue that a longer depreciation schedule is warranted. It's a trust me to some extent. What I do undertake is a cash rec each year to see how close reported profit and cash flow are. Of course, there are many issues that can impact this, such as any cash flow going into provisions for restructuring etc., but it is useful in any case. i have mentioned this process before.

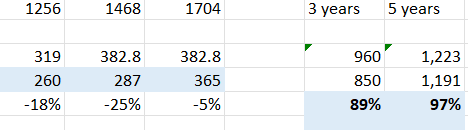

Below is WTC. we see a deterioration over the last few years. the columns on the left are 2023-2025. so, a better performance in 2025. Anything below 90% (-10%) starts to get my interest, so WTC has seen unreconciled cash outflows, but i don't think it is systemic, imo. we also have the acquisitions muddying the water, and we will have restructuring charges in E2O to come. so the WTC numbers are not as clean as I would like. Another reason for some caution, but not a deal breaker for me.

mikebrisy

@Solvetheriddle one explanation of that analysis is that the 5-yr horizon includes a relatively quiet couple of years (4&5) on M&A, while years 1-3 had the full impact of Blume, Envase, Matchbox and others.

You are right about another thing, … if those make the waters slightly murky, then E2Open will make them completely muddy for a couple of years. (Which is why I dislike M&A)

BTW Ive now listened to the podcast. And I consider it an unbalanced pile-on to support their overall storyline and low valuation ($40? $50$?)

For example FCF, properly measured (not the WTC measure) has grown from $79m in FY20 to $218m in FY25, a 22.5% CAGR. Whereas they make it sound like it’s all smoke and mirrors and accounting treatment.

There is some justification about the lightweight board, and I assume the podcast predates the appointment of Raelene Murphy.

My main objection to the podcast is the idea that $WTC can just be Cargowise. It can’t. The vision is and always has been to build the operating system for global logistics. Cargowise isn’t that. Blume, Envase, E2Open accelerate by many, many years putting in place the end to end building blocks. It is risky. But I think a pure organic build was going to take so long as to be irrelevant in a competitive context. Even with E2Open they might be too late given what incumbents are already doing.

I know I am sounding defensive which is not my intention. The podcast is valuable because it puts up in bright lights key risks investors should be thinking about. However it has too many internal inconsistencies to be taken too seriously by me.

Clio

@Rick - the II team have published a report to go along with the podcast. Their suggested buy price is below $35. Hold to $100, sell over that.

I'm not sure they'll ever get a chance at below $35, but who knows what may come re RW and the others involved in the recent ASIC investigation.

But if it does drop that low, or even into the low-40s, I'll likely be topping up - provided there's no more negative news, and at least a bit of the positive kind.

Solvetheriddle

@mikebrisy i agree but probably why WTC isn’t a large position at this stage for me, could go either way

Magneto

I’d love to see WiseTech get to $35. I’d definitely be keen to buy more at that level. Whether it actually gets there is another story.

The business isn’t perfect. On one hand, Richard White has built a genuinely great company. He’s clearly no fool. On the other hand, he’s made some questionable personal decisions over the years. But let’s be honest: you’re not getting rid of Richard anytime soon.

I first bought WTC days after the float, but sold when the short report came out years ago. A pretty stupid move in hindsight. I’ve recently bought back in on the latest pullback.

What I’ve never really loved is the sheer number of acquisitions. WiseTech has done a ton of them, and they can easily become a distraction.

It’s not a huge position for me at the moment, but I do see the product as mission-critical and sticky, once it’s implemented, it’s very hard for customers to rip out. That said, governance feels like a real risk here, which seems to be a theme across a lot of companies lately (MinRes, DroneShield, WiseTech, etc.). Ultimately, the next few reporting periods will tell us a lot.

Rick

@mikebrisy @Solvetheriddle @PhilO @Magneto @Clio Thank you for your well thought out replies. There is no doubt risk and uncertainty for Wisetech shareholders going forward, but show me a quality business that doesn’t have some risk and uncertainty! I think position size might be a reasonable way to manage this. Currently I hold 3% IRL and 4% SM.

If Wisetech can continue to integrate new acquisitions successfully, as they have in the past, and the new board manages to turn the governance issues around, I can’t see the share price going much lower.

If there is more bad news ahead, the share price could easily halve again. Will it be any easier to add shares at $35? I don’t think so. If the share price halves it will most likely be the result of additional issues emerging or the current risks playing out. At that point we probably won’t be interested in Wisetech, even at $35!

thunderhead

For mine, WiseTech is still in the "too hard" basket. There is no doubt the core CargoWise business is a gem, but it is heavily clouded by governance issues (founder/chairman shenanigans, largely inexperienced board for the kind of business it is, inexperienced CEO who has a close association with RW and could end up being a "yes" man), aggressive accounting with egregious R&D capitalisation flattering profitability metrics, and now a sizable acquisition funded with debt that can become a millstone around their necks.

I don't think the current valuation fully accounts for the mounting risks and challenges, but I am watching to see if the market strongly indicates that I am wrong.

thunderhead

A couple of months after expressing this view, the market is still a firm thumbs down on the company. The price is coming around to accounting for more of the risks though.

edgescape

Nearly all companies in the software saas sector are down. There are stories about Claude AI disrupting the Saas business models by giving application development away from coders and to the general mainstream that need applications without the exorbitant price tag.

At some point the selloff will be overshoot and value will appear but I think the claude narrative still remains.

Incidentally all my non software saas "boring" stocks like DVP, XRF and VYS are still doing the heavy lifting otherwise I would be even more worse off without them. Even IPG which some here highlighted governance concerns is still holding well! (See the posts by mikebrisy and karmast on that one)