Pinned valuation:

Latest updates are at the bottom.

This starts in early 2022:

Also please note that from 2024 I do NOT hold MinRes shares and I am actively avoiding the company.

16-Jan-2022: (yes, 2022) MinRes (Mineral Resources, ASX:MIN) are a very good company. They regard themselves as a mining services company however the majority of their revenue is now derived from iron ore mining - from their own mines, so they are really now a miner with a mining services division who provide digging, loading, hauling and crushing services for iron ore miners large and small.

I'll go into some more depth on their business and their high ROE and profitability in a minute but first, why $77, apart from it being one of my favourite numbers? Looking at their share price chart, I don't think they should have too much trouble punching through $70/share, however I think $80 may be a bridge too far in the shorter to mid-term. I'm sure that they will eventually punch through $80/share as well, but I wouldn't be surprised to seem them trading in that $70 to $80 range for a little while first. That said, they are not usually a range-trading or sidewise-moving stock. They tend to trend very well both up and down, as their chart clearly shows. Since early November (10-Nov-2021) the trend has been very definitely UP.

OK, MinRes' main exposure currently is undoubtedly to iron ore, both through their own iron ore mines, their vast iron ore infrastructure, and the amount of mining services they do from clients like BHP and RIO right down to some of the smaller players in the industry.

However they also have a significant presence in Lithium, despite most of their lithium assets currently being either on C&M (care and maintenance, i.e. temporally mothballed) or still under construction. They regard their Wodgina lithium mine as the world's largest hard rock lithium deposit, and they've been busy partnering with battery metals company Albemarle to create a vertically integrated lithium business from the lithium-rich spodumene concentrate that Wodgina produces to the lithium hydroxide that Kemerton will produce.

It's important to understand that MinRes is run by its founder Chris Ellison, and he tends to polarise views towards him; people tend to either love him or hate him. He can be a fairly ruthless businessman when it comes to takeovers and acquisitions and most of his detractors tend to have come from the other side of many of the deals that he has made over the years, which have tended to benefit MinRes a lot more than they benefitted other parties. I'll copy in a little history below from an investment thesis I prepared for MIN a couple of years ago. I refer to MRL which is often how MinRes refer to themselves, it's short for Mineral Resources Limited.

Chris Ellison, pictured above, has HEAPS of skin in the game - some 22,261,431 MIN shares worth $1.46 Billion at Friday's $65.62/share closing price, so Chris owns close to 12% of the company.

He was the MD of MND (Monadelphous Group Ltd) back in 1988 after they went into receivership, and he got them back to where they were able to re-list in late 1989. He was the founding shareholder of all three of the private companies (PIHA, CSI & PMI) which were merged to form MRL originally, and he has been in charge of them and then MRL (Mineral Resources Ltd) since inception.

At their November 2019 AGM, MinRes (MIN) avoided a fourth consecutive strike on their remuneration report with a vote of 84 per cent in favour. The breakthrough came after changes to the remuneration policy and talks with proxy advisers blamed for the report being voted down for the past three years. Some of those changes included Mr Ellison having his base annual salary as managing director cut from $1.5 million to $1.2 million and his capacity to earn bonuses increased from 50 per cent of base salary to 100 per cent.

While Ellison and his associates can sometimes be viewed as somewhat ruthless and uncaring when it comes to corporate maneuvering (acquisitions, takeovers, etc.), he has always been opportunistic and has built the company up partly via a series of opportunistic takeovers and the purchase of distressed assets at fire sale prices. When it comes to his own employees however, he is apparently a great boss, very loyal, looks after his own, and the word is that MinRes as a company have a very strong emphasis on positive company culture within the business.

It is this "MRL first, MRL’s clients second, everyone else third” approach that does rile some of his business rivals, particularly the little guys with the assets he often ends up acquiring at less than what the previous owners may have thought was a “fair” price. In one respect, that is one of MRL’s “edges” or competitive advantages – that they have the balance sheet and experience to identify opportunities in distressed assets and forced sellers and take advantage of those situations.

Another side of that is their ability and track record of selling assets at or near the top of the market, as they did with the 60% sale of Wodgina to the global battery metals giant Albemarle during the lithium bubble. By the time that deal was settled, the bubble had burst, but the contracts had been signed and were enforceable, and MRL got their money, as agreed. As they have done historically, when they sell a mine, or part of a mine, they always retain a life-of-mine or multi-decade mining agreement with the new owners, so MRL always continue to provide the mining services for that mine. In the case of Wodgina, that agreement is for at least the next 30 years. While Wodgina is currently on “care and maintenance” due to a current low lithium price, it is arguably the largest hard rock lithium deposit on the planet and one of the top 5 lithium mines (from an infrastructure point of view) globally, so when the lithium price rises again, Wodgina will absolutely be fired up again, and it will be MRL doing the work there – and being paid by the tonne, regardless of the prevailing price of lithium. Also, in the case of Wodgina, they (MRL) have retained a 40% stake, so they also will receive 40% of all sales receipts in addition to the mining services income (as long as they pay 40% of the costs).

That is the sort of dealing that Ellison’s enviable reputation is based on. Because Albemarle is a massive corporation, nobody is crying poor about this particular deal, even though MRL clearly got the better of it. When the counterparty is a small struggling miner with cashflow issues and lenders breathing down their necks, the reporting tends to paint MRL – and Chris Ellison – in a much less favourable light. We always like to feel sorry for the little guys – the underdogs. I have come to the view that Ellison is primarily a very astute businessman.

Here are some of the Pros (positives) of MIN (MRL/MinRes) as an investment that I jotted down in early December (last month):

- Exposure to iron ore.

- Exposure to lithium.

- They own some serious infrastructure, including rail wagons, port assets, hundreds of trucks, and a huge amount of mining equipment (both fixed and mobile plant).

- Consistently profitable, with very healthy ROE.

- Diversification of revenue via multiple commodities and various mining services divisions.

- Opportunity to trade in and out due to very volatile share price, with an underlying business that is very solid with no net debt and over $200m of net cash.

- Good, innovative management who have a focus on positive company culture.

- Balance sheet strength: MRL have no net debt, a rock-solid balance sheet, a large cash buffer (currently over $200m), and an excellent dividend payment and total shareholder return history.

- Good potential upside from exploration and development, as well as from multiple diversified business units, including new divisions that are yet to make a positive financial impact.

- Innovation focus; meaning they don’t stand still; they are always working on something new while leveraging their strengths within their existing business units.

- While MIN failed to acquire AWE a couple of years ago, they have assembled a collection of energy assets anyway and are actively drilling for gas on their own tenements with a view to hopefully becoming energy-self-sufficient at a number of their own mine-sites and reducing their annual diesel bill – which is currently in the hundreds of millions of dollars in total – across their entire operations. The market may be forgetting that the first 10 years of Chris Ellison’s (MRL’s founding shareholder and managing director’s) career in the mining and resources industry was spent on constructing, developing and operating in the gas industry. For more on their Energy division – see here: https://www.mineralresources.com.au/our-business/energy/

- MRL has the proven ability to safely deliver high quality production facilities in the mining and resources industry on time and on budget. The Company has a stellar reputation as the industry leader for delivering and operating world class projects at a low cost. They tend to be faster and cheaper than their competitors.

- MRL have a large collection of used crushing, screening and other mine-site-related equipment which are “off-balance-sheet” assets. They either buy the equipment at “fire sale” prices when companies fold, or else they get the stuff for free by agreeing to rehabilitate or clean-up old/disused mine-sites in exchange for salvage rights. Sometimes they get paid to clean up other people’s sites, AND they also get the salvage rights. The equipment often has little value (other than as scrap metal), but some of it is refurbished and/or re-purposed and used in/at either MRL’s own mine-sites or their clients’ mine-sites. The large bank of used equipment that MRL own gives them a cost advantage over their competition - who generally have to source everything from scratch when taking on additional contracting work.

- Recurring revenue from multi-year crushing contracts (CSI division) and other multi-year contracts for provision of services by MRL’s other mining services divisions. MRL’s CSI division have multi-year iron ore crushing contracts for Australia’s two largest iron ore producers, Rio Tinto (RIO) and BHP Billiton (BHP), as well as for a number of smaller companies.

- The recent pullback from over $60 to below $40 presented a good opportunity to get back into a company that looks even better now than when I last invested in them. They have begun rising again, however, they are still below $50 with plenty more room to run in my opinion based on their fundamentals as well as current investor sentiment having turned positive on them once more. They tend to trend well.

And that's where I bought back in, at $47.10 on 10-Dec-2021. They are now $65.62/share, so there's less upside from current levels than there was 5 weeks ago, but I think there's still upside. I haven't yet added them back in to my SM portfolio, but I do hold them in real life. As I have said, I need to sell stuff to buy stuff here, as I don't have any cash left here.

OK, here are the Cons (negatives) of investing in MIN (MRL/MinRes):

- Commodity price/outlook risk – mostly Iron ore & Lithium.

- Mine life risk - Mines have finite lives and more ore will need to be discovered or acquired at some point in the future.

- Grade/Costs risk – If MRL’s costs blow out, and/or grades fall, profitability may fall.

- Exploration downside risks – Amounts spent on exploration may not yield positive results. (i.e. bang for bucks might not be as positive)

- Key man risk – Chris Ellison might leave or retire. However, as Chris has the vast majority of his personal wealth tied up in the company (his MIN shares are currently worth over $1.5 billion dollars), it is unlikely he would do anything that was not in the best interests of MRL and its share price.

- Acquisition risk –future M&A activity may not result in the expected synergies and other benefits that are expected by the company’s management, or the benefits may not turn out to be a great as expected, resulting in possible goodwill write-downs, or unexpected costs (which may impact on profitability). This risk also extends to JVs, which might not all provide the expected benefits and returns on invested capital as previous ones have.

- Execution risk – MRL’s management need to execute well on their plans and be reasonably accurate in their forecasts. Chris Ellison tends to be fairly optimistic and bullish with his forecasts and while he does meet them, he doesn’t always hit them within the original timeframes that he first sets for them. It sometimes takes longer. It might be helpful if he tried to underpromise more, so that he can consistently overdeliver. Managing market expectations is another way of framing this particular risk.

- Client/contract risk – MRL have a number of mining services businesses and each carries risk associated with clients and contracts. For instance, in MRL’s crushing business (CSI, Crushing Services International, MRL’s largest mining services division), Fortescue Metals Group (ASX: FMG) decided to take their iron ore crushing & screening back in-house back in 2013, after an electrician died while working at one of the crushing plants being run by MRL at an FMG site. There was a large one-off payment made by FMG to MRL as part of the contract termination (break fee, transfer of equipment, etc), but MRL lost the annual recurring revenue that the FMG crushing contract had previously provided to them. These sorts of events can occur within these mining services divisions and are something to be mindful of. Losing contracts to competitors also falls into this category, although – to their credit – MRL have never lost a client to a competitor in their history so far. [that statement was true in 2019 – I have not verified it since then, so not sure if it still stands in 2022.]

- Director Selling - The Chairman (Wade) and MD (Ellison) were both selling shares on the 28th to 30th November 2017, when MIN were trading at between $19.33 and $20.01. In Chris Ellison's case, it was ~$37m worth, around 8% of his shares. The fact that Peter Wade sold 39% of his shares for $4m at exactly the same time, as well as their preference for using shares to pay for as much of AWE as possible (rather than cash) – as part of their bid for AWE that was ultimately unsuccessful – does seem to suggest that they believed that the MIN share price had got ahead of itself at that point in time. In hindsight, they were correct. After peaking at just over $22 on 1-Jan-2018, the MIN SP retraced over the next 11 months right back to $13.39 on 12-Nov-2018, then traded broadly sideways before bottoming at $12.70 on 14-Nov-19, being a 42.3% drop from top to bottom. The SP then went into a very strong uptrend from 14-Nov-19. I bought back into MIN at $14.94 on 25-Nov-19 and they were trading at over $17 within 3 weeks. There has been little evidence of this director selling since 2017, however it is certainly something to monitor – if they start selling shares in significant quantities once again.

- Village accommodation risk – the experience with both Fleetwood (FWD) and Decmil (DCG) suggest that there is a reasonable amount of risk in owning remote manufactured accommodation villages, particularly asset write-down risk when the mining and energy sectors experience a downturn. MIN’s exposure to this sector is a reasonably small part of their overall business mix, with the main village accommodation asset being their Poondano Village in Port Hedland, but they also build and operate accommodation and provide site services for their own mining operations, as well as for a number of their clients (on a smaller scale than Poondano), including the Onslow Highway Camp as well as a number of remote site services operations and exploration camps. December 2021 Update: According to their website – see here: https://www.mineralresources.com.au/about-us/our-companies/ And here: https://www.mineralresources.com.au/our-business/ ...MRL (MIN) have streamlined their business units now, and they do not appear to still be involved in Accommodation Villages, on-site catering, and those types of ancillary services. At least, if they are still doing that, it’s such a small part of their total business as to not even rate a mention on their website now, or in their annual reports and company presentations, so if there is any risk remaining there – it is negligible.

- Wide range of estimates amongst brokers and analysts. There is a risk in relying on other people’s forecasts, however I'm not relying on them and I'm largely ignoring them.

- There have been various allegations made occasionally over the years of unfair and/or unethical behaviour by Chris Ellison and his previous CFO, Bruce Goulds (now retired). This is not uncommon in business and is quite similar to allegations that have been made against Kerry Stokes, such as during the Nexus Energy takeover, when Stokes began building SGH Energy (part of SGH, ASX code: SVW). These rumours and unsubstantiated allegations are something to be aware of, as we want to be confident that management can be trusted to act in the best interests of ordinary shareholders, as well as to act well within the law, and in an ethically sound way as well. What I have found is that these matters get reported completely differently depending on whether MRL is considered to be the David or the Goliath in the story. As the David, the “brilliant” deal MRL managed to pull off with Albemarle buying 60% of Wodgina which settled on the day they shut down production and placed the mine on “care and maintenance” was hailed as a triumph for Chris Ellison. However, if they had enforced that same deal (which was inked back when we were in the middle of a lithium bubble with massively higher lithium prices) on a small junior miner who was struggling financially, MRL would have been painted as the uncaring, insensitive and ruthless Goliath prepared to crush the little guys underfoot to get the very best deal for themselves. All allegations need to be considered seriously, and management behaviour also watched closely, however, we also need to understand the inherent bias in the reporting of much of this stuff, and to clearly separate the legal/illegal from the fair/unfair-to-all-parties. Being able to quickly capitalise on opportunities, including in distressed assets and with forced sellers, is one of MRL’s “edges” or competitive advantages. It’s what has got them to where they are today. Previous owners of assets that eventually become part of MRL are often unhappy with the outcome that they received, but MRL didn’t put them in that position, they found themselves in it through bad luck, bad management, or bad timing, and MRL just seized on the opportunity, as they do. That’s business. Clearly not everybody is unhappy with their own outcome, but it’s the minority who are unhappy that get the most press coverage. Again – we have to be fairly astute in trying to ascertain what is unethical or illegal versus what is simply opportunistic behaviour.

- Shorting risk – The long lists of risks above may attract short sellers, and if MRL come under a sustained short-selling attack (for weeks or months), that will likely negatively affect the SP of MIN for the duration of the attack, and possibly well beyond it.

OK, so hopefully that's a reasonably balanced view on MIN. I wouldn't say they are a definite "BUY" up here, but they looked like a great opportunity 5 weeks ago, one which I pounced on in RL (real life). Because they tend to trend so well, I would always consider MIN as an investment opportunity when they have recently been in a downtrend and they break that downtrend and start to trend up once more. That was the situation I discovered in early December, and that's why I bought back in. Could be a good one for the watchlist for those who are interested in this area (mining and mining services, specifically iron ore and lithium).

Further Reading:

MinRes going Silicon Valley-style for new HQ - MiningNews.net

Mineral Resources founder Chris Ellison is Australia's newest billionaire (afr.com)

Wodgina Lithium - Mineral Resources (carbonart.com.au)

Mineral Resources’ Wodgina mine brought back to life by lithium rally (afr.com)

An Insider’s View: The Kemerton Lithium Hydroxide Processing Plant | Albemarle

MinRes' debut debt deal boosts sagging lithium sector (afr.com) [Apr 2019]

Chris Ellison's House in Perth, Australia - Virtual Globetrotting

It's a decent view...

Related News:

Liontown CEO Tony Ottaviano weighs in on lithium supply outlook (afr.com)

Iron ore prices defy expectations (afr.com)

20-Feb-2022: Update: I have sold my MIN shares IRL (on 10-Feb-22 on the morning after they reported) and have a sell in for MIN here on SM - but clearly should have sold them a couple of weeks ago here as well when I was still in the green on them, as I was IRL when I sold. I have mentioned before how they tend to trend really well. They do, and they're back in a strong DOWNtrend again, which was sparked by their recent half year report, which was a shocker - based on the big decline in the iron ore price in the half year ended 31-Dec-2021, higher discounting due to MinRes's (MRL's/MIN's) lower grades of iron ore compared to the larger producers (BHP, RIO, FMG), and the fact that they have announced that they are not paying any interim dividend this year (and they WERE a reliable dividend payer).

The prevailing spot iron ore price was actually around 50% higher on the day they reported than it was on December 31st, the last day of the period they reported on, and they gave reasonably positive guidance, and their mining services division had a great year, but that didn't stop their share price from being smashed.

They closed at $57.88/share on the 8th Feb, the day before they reported, and dropped -8.91% on the 9th, on the back of that H1 FY22 report and their accompanying presentation. They closed on Friday (18th Feb 2022, two days ago) at $47.76, having now dropped -17.48% in 10 days from that $57.88 level on the 8th (the day before they reported, and they've turned strongly down, as shown below:

Normally, with a company of this quality or of higher quality, I would be happy to hold through the cycle, but not when they've just refused to pay a dividend AND they've clearly entered a strong downtrend due to a poor result AND the cancellation (or suspension) of the dividend, AND they trend so well for months at a time. There's not much to be gained by holding MIN right now IMHO, when I can simply buy back in when the re-enter a clear uptrend again, and they DO trend particularly well, as that graph shows.

FMG, a larger iron ore miner who I also held (and still hold) shares in have also reported, but their report wasn't nearly so bad, and while they've REDUCED their interim dividend based on the lower realised iron ore price during that 6 month period, they are still on a massive dividend yield so the income they are paying their shareholders via dividends compensates them (i.e. me) for the share price volatility.

FMG's interim dividend (ex-div 28-Feb, pay-date 30-Mar-22) is 86 cps FF, and their final dividend paid back in September was $2.11/share. The iron ore price is now a lot higher than it was at the end of that H1 FY22 reporting period (i.e. on 31-Dec-2021), so their current half (H2 of FY22) is likely to be a lot better than H1, but even if they more than halve their final dividend this year and only pay $1/share in September 2022 (compared to the $2.11/share they paid last September), that would still put them on a dividend yield of 9.37% PLUS franking, so that 9.37% does NOT include the franking credits, and the dividends are fully franked at the 30% corporate tax rate. That's plenty of compensation for a volatile SP IMHO. And FMG also have their FFI division with their development of electric trains, green hydrogen, and the rest of it. Fortescue Future Industries (FFI) is what has really attracted me back to FMG actually. It's a decent kicker.

However, MIN doesn't have that. They have a brilliantly performing mining services division, but with them refusing to pay any interim dividend, that mining services division is not enough for me to hold them through the cycle. Not when they trend both up and down as well as they do, and they are clearly back in a strong downtrend.

05-June-2022: Update: OK, I bought back into MIN at $48.65 on March 22nd after selling out at $54.50 on 10th Feb. So I did save a few dollars and it worked out OK, however I may not bother doing that again, as the downtrend turned around quite quickly, quicker than I had expected and I reckon in future I probably WILL just hold them through the cycle.

Chart Source: Commsec (edited by me).

I bought back in when it became clear to me that they were back in an uptrend and that the market had forgiven them for their 1st half report AND for not paying an interim dividend. Of course those trades were in real life, and I did NOT buy MIN back here on Strawman.com - unfortunately, because they have done really well, even better than FMG have lately, because MIN were bouncing back from that sell-down (downtrend) that stopped just below $45/share. They're now back up over $60/share, so have put on over 30% in 11 weeks (2.5 months). My closed MIN position is showing here as a -9.15% loss because I sold out here at $47.36 and never bought back in here. Just another example of where I can't mirror my real life trades here because I can only use end-of-day prices here, and I don't always bother because the buys and sells often take too long to go through. And I need to sell something to buy something (coz I don't have any cash available here) and I never know whether the sells or buys have gone through because I'm usually at my real world job every weekday afternoon and evening so I'm not monitoring price movements and making adjustments to my limit prices. My real life trading is generally done in the mornings before I go to work (at around mid-day).

Anyway, I did understand why MIN went into that strong downtrend, and I wanted to avoid the downside if it went on for longer, which I did, but they turned around pretty quickly and here on SM I would have clearly been much better off just holding them through. Trying to be too cute, and it backfired.

In real life the strategy actually worked, but only because I was able to buy them back at a lower price than where I sold them before they had risen too much, which was as a result of knowing in advance that they are a quality company that I'm happy to hold and therefore being willing to pull the trigger as soon as they had clearly re-established another uptrend.

So the work I had previously done understanding MinRes stood me in good stead there. Obviously the Iron Ore price has stayed a lot higher than where it ended up on December 31, 2021 (which was the end of MIN's 1st half reporting period) so their 2nd half result is going to be a lot better than their first half result.

Source: Iron Ore | Today's Spot Price & Charts - Market Index

(https://www.marketindex.com.au/iron-ore) Click here for those Iron Ore FAQs that they mention there.

Those prices are in US$/tonne and as previously mentioned, MIN's grades aren't as good as the larger players (BHP, RIO, FMG, Vale) so they receive less per tonne as a result, however the trend is clearly up in the second half and was clearly down in the first.

While MIN (a.k.a. MinRes) get lumped in with lithium plays now, because they have substantial lithium interests, they are currently an iron ore producer and a mining services company. That mining services division is substantial and is mostly involved in drill & blast, loading, crushing and hauling for BHP, RIO and some other smaller iron ore miners; previously also FMG but not any more coz that was one of the very few contracts that MinRes has ever lost, when FMG decided to pay MIN out and do that work themselves a couple of years ago after a fatality at an FMG site where MIN was operating the crushing plant.

They also do work outside of iron ore - their mining services division, CSI (Crushing Services International) recently won a lithium crushing contract as well - see here: https://www.mineralresources.com.au/news-media/csi-mining-services-wins-new-lithium-crushing-contract/

So lithium will be a factor in the future, and it's something to keep in mind for future exposure, however it's still all about iron ore at this point for MinRes. And Iron Ore is going OK. And when they release their full year report in August I think we'll find that MIN is doing OK too.

Best to keep in mind that MinRes own a LOT of transport and logistics assets - both mobile and fixed plant and infrastructure (including trains, trucks and port assets), plus a substantial graveyard of disused and surplus plant and equipment that they can use to quickly assemble crushing plants for new clients as and when needed - or sell off as parts for others in the industry - see here: Aftermarket Crusher Parts Specialists - Mining Wear Parts [Mining Wear Parts is a new division of MinRes]

They have always been an agile company that has been able to take advantage of opportunities as they have identified them, and Chris Ellison always has his fingers in a few different pies, so there's always something cooking in the background that may not have necessarily become material yet, but well might in the future.

Never underestimate the man or his company to find new ways to make money, including in new commodities that they may not previously have been involved in. Or in a revolutionary new iron ore transport system, the BOTS (Bulk Ore Transport System) idea, which has been in development for almost a decade now, and could still happen. Or their Energy division.

So, yeah, I'm back onboard as a MIN shareholder IRL - since March (just not here on SM unfortunately).

11-Jan-2023: Update: The MIN SP has well and truly overtaken my previous $70 price target. I'm now raising it to $95. They'll be over $100 at some point but $100 is one of those big round numbers that might take a few attempts to break through, so $95 for the next year will do.

I've unfortunately sold out of MIN, and in my usual fashion, I managed to do that at a profit but just before the share price surged. This time it surged because of rumours that Chris was contemplating spinning out MIN's lithium assets into a separate company which would result in all MIN shareholders then owning shares in both companies, i.e. Mineral Resources, now the world's largest (or biggest) mining services company and an iron ore producer with a considerable collection of iron ore infrastructure assets (trains, trucks, port assets, etc.) as well as interests in other minerals and in energy (oil and gas, but mostly Perth Basin onshore gas) PLUS the NewLithiumCo. MinRes (MIN) said this back in September: Response-to-media-speculation.PDF

So, nothing to see here. Move on. However the share price was trading at around $60 prior to that announcement, and was trading at around $70/share immediately after it, and is now trading at almost $90/share.

Meanwhile, Chris has had MIN build a 10.10% stake in Global Lithium Resources (GL1), which, incidentally, is a blocking stake, meaning no other company can takeover GL1 now without MIN agreeing to it, because you need 90% or more to move to (apply for) compulsory acquisition of the remainder of the company that you do not already own. Someone else could gain control of GL1, but they could not force MIN to sell their stake as long as they retain that 10.1%. Any less than 10% and a forced sale is a possibility. Chris Ellison is a lot of things, but stupid is not one of them. He's a crafty bugger, and a bloody good manager. Very strategic and very forward thinking.

MIN also made a bid for Norwest Energy (NWE) which is still playing out. The NWE Board has rejected the offer and recommended that their shareholders do nothing (i.e. do not accept the offer), however, once again, Chris has ensured that MIN are in the box seat here as well, as MIN already own just under 20% (19.9%) of NWE so they will have a say in whoever ends up controlling or acquiring the company. Sure, the bid was opportunistic and well timed, as suggested by the NWE Board, and will be a bargain if NWE's Lockyer discovery is as good as they think it might be, but that's what Chris Ellison does. He buys assets cheaply and sells them at the top of the market, or at the very least at a very good premium to what he paid to acquire them. In this case however, I think Chris is damn serious about developing a strong energy (gas) arm within Mineral Resources (MIN) and NWE would fit into that quite nicely. Chris sees a future in which MIN not only provides the gas to run their own mines and processing plants, but sells a good portion to other miners and indeed anyone else who wants to buy it.

As I have said previously, it pays to remember that Chris started out (many, many moons ago) in the energy industry before moving into mining and mining services. So he knows what he's doing, as is usually the case.

Meanwhile, he keeps MIN in the news, or in prospective investors' field of view, with the odd announcement like this one in October - Response-to-media-speculation-October-2022.PDF

That sort of thing keeps fuelling speculation and reminding people of the strong position within the Australian lithium industry that MIN has, however they do not need to build a lithium hydroxide facility at Wodgina. They've built a world-class lithium hydroxide plant at Kemerton (just north of Bunbury, and a couple of hours South of Perth, in WA) and that has been designed and built by global battery metals player Albemarle, who are MIN's Lithium partners, and Albermarle and MIN jointly own both the Kemerton Lithium Hydroxide Plant AND the Wodgina Lithium mine.

I am not as bullish on Lithium as many here on SM, but if I was, I would play lithium via MIN and IGO, because of their respective positions within the industry now, with upstream processing already in place in both cases, and both aligned with global experts in the field who own multiple lithium processing facilities across the globe.

But MIN is SO much more than just Lithium. I'll be back in (like Flynn) if their SP has a decent pullback, but in the meantime, a further rise to around $95/share wouldn't surprise me at all.

Image Source: Thursday 17th November: The West Australian Newspaper: https://thewest.com.au/business/lithium/mineral-resources-chief-chris-ellison-tempers-lithium-spin-off-speculation-c-8885861

19-July-2023: Update: MinRes hit my $95 price target two weeks after I raised it back in early January this year, but has fallen back down to just over $70 since then. I held MIN as a low-maintenance (almost set and forget, but not quite) position in my SMSF, and two days ago (on Monday 17th July 2023) I added MIN back into my main RL portfolio (the largest one). Chris Ellison is still doing deals and buying shares in other listed companies through MinRes, and MIN now owns 13.9% of Develop Global (DVP), making them the second largest substantial holder of DVP shares behind Bill Beament himself (who I believe now holds around 18.74%, down slightly from the 19.62% of DVP he held in May, because of extra shares that have been issued since; Bill owns 36,325,776 shares of the 193,806,896 DVP shares on issue according to the ASX).

DVP don't mind taking stakes in other companies either - they own 19.55% of Essential Metals (ESS) who own the Pioneer Dome Lithium Project in WA as well as a number of gold and nickel projects.

MinRes has also now acquired Norwest Energy.

There's always something happening with MIN. I only just realised a couple of hours ago that Justin Langer has joined their Board (in December), something I missed. I just posted a straw on that.

Anyway, that $95 price target is still good. They tagged it in January, and they'll be back up there again soon enough, and they'll be above $100/share in time. Good company to hold this one. I've just got to stop selling out all the time because I think I can buy back in cheaper later. That often works, but so does "buy and hold" with these guys. And Buy-and-Hold is a lot less work, and stress.

I have to remember that some of my best profits have been made when I've been on holidays and have NOT been following the market. I've got to stop trimming my winners so much and also selling out with a view to getting back in at lower levels. Too much trading. Not enough of doing nothing.

18-January-2024: Update: This one was marked as stale, so I've reviewed it. All good. Happy to maintain a $95/share PT (price target) at this point.

MinRes is the largest Mining Services company to the iron ore sector (crushing, screening and loading of iron ore, plus transport to port as well if required) in the world, with billions worth of ships, trains, trucks, earthmoving equipment, crushing and screening plants, etc, and they're also one of the largest Mining Services companies in the world - across all sectors.

They are also a significant Iron Ore miner themselves - from their own mines, and they're currently building out a significant Lithium business.

Their 50%-owned Wodgina hard-rock lithium mine contains one of the largest lithium deposits globally, and they also own 50% of Mt Marion, and have recently also acquired 100% of Bald Hill.

Those projects are favourably positioned on the cost curve, although only Wodgina would be profitable on an All-In-Cost basis at the current low spod price (below US$1,000/tonne). Even the low cost Greenbushes lithium mine owned by Albemarle, IGO and Tianqi have announced late last year that they are intending to stockpile a fair bit of their lithium ore until prices rise significantly.

Wodgina was put into care and maintenance a couple of years ago due to lower lithium prices, and was brought back into production late last year.

Mt Marion and Bald Hill are not currently in production.

Chris Ellison, the founder of MinRes (MIN), has been buying into other lithium companies using his own money (through private investment companies) as well as using MinRes to take significant stakes in a range of other ASX-listed lithium companies.

One example of that was the recent IPO of the ASX's newest lithium company, Kali Metals (KM1), in early January (a couple of weeks ago) where they had prevented large corporate bodies (companies) such as MinRes from participation in the IPO, so Chris Ellison participated in it personally through his company Wabelo, which emerged with 4.86% of KM1. Chris, along with friends and acquaintances, had piled into KM1 back in November, when the extraordinary IPO opened and closed in less than 20 minutes. When it hit the ASX boards on Monday 8th January, it shot up from the 25 cps IPO price to as high as 47.5 cps as MinRes snapped up a heap of shares on-market. By Wednesday (10th Jan), after KM1 had released some positive rock chip assay results (Spodumene-identified-at-Higginsville-Lithium-District.PDF), KM1 had hit 89 cps, and ended up with a "Please Explain" (or "speeding ticket") from the ASX. 89c was 256% above that 25c IPO price. In two days!

KM1 provided their response to that "Please Explain" on Monday of this week (15th Jan): Response-to-ASX-Aware-Query (KM1).PDF

Long story short, MinRes (MIN) now hold 9.97% of KM1 (14,366,786 KM1 shares) all bought after the IPO either on-market or through cross-trades done by Bell Potter (7.5m of those 14.37m shares were bought through two Bell Potter cross-trades - meaning where the broker is both the buyer and the seller on behalf of two different clients, and one if not both of those sellers are likely/probably associated with Chris Ellison). Chris Ellison and MinRes usually use Bell Potter for most of their trading.

See here: KM1 ASX: MinRes grabs big stake in lithium play Kali Metals just days after IPO (afr.com)

And here: https://www.youtube.com/watch?v=xhlHaBF9NhA&t=300s [Money of Mine Podcast on Jan 16th discussing those KM1 cross trades]

MinRes told the AFR: “The MinRes investment in Kali Metals, which has assets in proximity to our Mt Marion and Bald Hill operations, is consistent with previous strategic acquisitions in numerous junior lithium companies with assets in the Goldfields and Pilbara regions. MinRes is confident these investments will deliver shareholder value over time.”

Apart from their 9.97% stake in Kali Metals (KM1), MinRes are also substantial shareholders of the following companies: They own...

- 23.1% of Delta Lithium (DL1) - held by MinRes subsidiary Lithium Resources Operations Pty Ltd;

- 19.9% of Wildcat Resources (WC8);

- 10.1% of Global Lithium Resources (GL1);

- 13.6% of Azure Minerals (AZS); and

- 14% of Bill Beament's Develop Global (DVP) who are a mini-me (much smaller) version of MinRes, meaning a mining services company that also owns mines and has stakes in other companies.

DVP acquired Essential Metals last year whose flagship project is their 100%-owned Pioneer Dome Lithium project covering 450 square kilometers in Western Australia, where most of this lithium is. DVP also have the A$46 million underground development contract to establish and develop an exploration decline at the Mt Marion lithium mine that is operated by and 50%-owned by MinRes. DVP also have a number of JVs including one with Anax Metals Limited (ASX: ANX) who are developing the Whim Creek Copper-Zinc Project, located 115 km south west of Port Hedland (WA), where they are also finding Lithium and Gold - see here: ANX-Whim-Creek-Lithium-and-Gold.PDF. DVP's main interests appear to be battery metals and precious metals, so lithium, base metals (copper, nickel, zinc, lead, etc) and gold. Their mining services expertise lies in underground mining, whereas MinRes are surface miners that specialise in iron ore, so there are synergies between the two companies - they don't compete with each other for work.

Another mining services company that MinRes owns a good chunk of is Resource Development Group (RDG) where Chris' brother Andrew Ellison is the MD and executive Chairman. MinRes own 64.3% of RDG and have given them some work, all arms-length transactions of course...

See here: Chris Ellison’s Mineral Resources awards $140 million to Andrew Ellison’s Resource Development Group | The West Australian [12-Oct-2023]

And here: Rich lister's company in manganese deal with his brother (afr.com) [19-Mar-2020]

I have posted here about that connection (between MIN & RDG) a few months ago.

MinRes have also partnered with Lithium Australia (LIT) including loaning them up to A$4.5m via a convertible note - see here: Second-drawdown-from-MinRes-and-appointment-of-lead-engineer.PDF [15-Jan-2024] and here: MinRes invests in game-changing lithium extraction technology - Mineral Resources [07-Aug-2023]

LIT is a tiny company, at their current 2.9 cps SP, their entire market cap is only around $35 million.

Andrew Ellison's RDG (mentioned above) is another small one, currently trading at around 4.1 cps, so m/cap of around $121 million, and MinRes own around $77 million of that (64.3%).

MinRes has a market cap of around $11.6 Billion. Usually higher, but their share price has come down recently.

MinRes also have other interests - either through JVs or direct investments - in other companies, but those ones listed above are most of their main interests in other companies.

MinRes also previously held shares in another one of Australia's largest lithium producers, Pilbara Minerals (PLS), but MinRes sold out of PLS in 2021; that was a $50m investment that netted around $330m in profit (see here).

That's what I mean about Chris Ellison creating value for MinRes shareholders.

There has been a LOT of activity in WA lithium in the past year, and if the Kali Metals IPO earlier this month is anything to go by, it's not over yet.

Not everybody is bullish, but there are enough billionaires like Gina Rinehart and Chris Ellison to keep the M&A ticking along.

Further Reading: Arcadium Lithium willing to wait on WA assets - Australian Mining

Australia is a big player in lithium mining - currently the largest - and likely to remain the largest supplier of lithium for the foreseeable future:

Source: The Top Lithium Producing Countries | BatteryJuniors.com

China processes more lithium than Australia, but most spodumene is mined here in Australia, and the vast majority of that in WA. In Chinese lithium refineries, the spodumene ore undergoes intensive processing to produce lithium sulfate, which must then be further refined into battery-grade lithium carbonate (Li2CO3) or lithium hydroxide (LiOH). There are lithium hydroxide refineries being built or expanded here in Australia (including one at Kemerton and one at Kwinana, both south of Perth in WA), but there have been some issues reported with the ramp-up of those - up to full capacity.

At this point Chris Ellison appears to be focused more on spodumene ore production from his various hard-rock lithium deposits (Wodgina, Mt Marion, Bald Hill, etc) and locking in future supply via M&A and strategic stakes in other lithium companies that own other lithium deposits in WA. And that strategy will play out over the next few years.

At this point, the income that MinRes generates is from iron ore and mining services. Lithium is a future revenue stream that they will have, so I personally don't mind lithium prices being down this low at this point in time, as it assists Chris with his M&A (land grab).

Chris thinks and acts like a company owner, rather than just a company manager, and he owns 11.5% of MinRes himself (22,471,416, or 22.47 million MIN shares) worth over $1.3 billion at today's closing share price of $58.50/share.

He can be quite prickly and he is usually quite impatient, but he is a very astute businessman and he knows how to make money.

Further Reading: https://www.mineralresources.com.au/about-us/our-board/chris-ellison/

So, in summary, I'm still happy with $95/share as a PT but I won't give a strict timeframe this time. That said, I'd be surprised if they were trading below $95/share this time in 2027 (in three years' time).

I hold Mineral Resources (MIN) in my two largest real money portfolios (including my SMSF) as well as here in my Strawman.com virtual portfolio.

28-Aug-2024: Update: Not currently in this one.

I'm avoiding iron ore and lithium exposure at this point - uncertain outlook near-term for both metals. Still a fan of what Chris Ellison has achieved at MinRes and what Twiggy Forrest has achieved at FMG - both building those companies up from nothing to be the large multi-billion-dollar companies that they are today, however also happy to stand on the sidelines with both MIN and FMG at this point.

I sold out of the last of my FMG in June and the last of my MIN in July 2024. I'll update this if I buy back in. I've made money on both companies in prior years, in fact plenty of money on both, but they're not among my very best ideas right now.

I think they go lower from here - perhaps to $40/$41, or even lower, but they'll be back up at some point. I don't know when. It could take some time if iron ore prices go lower and lithium prices stay low.

13-Nov-2024: Update: MinRes now on my "Avoid list"

As I have mentioned elsewhere, MinRes is now on my "Avoid" list because of (a) Chris Ellison's pattern of poor behaviour in relation to using MinRes funds and people for his own personal use, as well as a series of previously undisclosed related-party dealings in which he and/or his family members and friends benefitted at the expense of MinRes shareholders, and (b) the MinRes Board's failure to provide adequate Governance (the "G" of ESG) with respect to their founder and MD and his pattern of poor behaviour despite more than one official complaint being made about it, with at least one of those complaints being made to the Board over two years ago. Apparently they've been investigating that for two years.

The only reason why the MinRes Board are acting now is because of a series of AFR articles that have sparked "Please Explain" letters from the ASX and an ASIC investigation into Chris Ellison's tax avoidance scheme that also resulted in MinRes claiming excess depreciation expenses on overpriced plant and equipment bought from a company that Chris Ellison was the controlling shareholder of.

And when I say the MinRes Board are "acting" now, they are taking some action, but most people who aren't invested in the company believe that it's far too little and a lot too late.

I'm raising my price target / valuation back up to $58 because I think that they'll pull through their "highly leveraged" period, including the capex they've got to spend this financial year to continue to ramp up Phase 1 of Onslow Iron to capacity, and they'll do it despite lower iron ore and lithium prices for longer than they had expected, but they'll pull through because they've structured their repayments in such a way that they don't have any repayments due for a couple of years, which has been explained well here by a few different people.

So I don't think their debt will kill them, or cause them to sell assets that they really don't want to sell, or that shareholders care most about anyway, such as their mining services business, however there's a bit going on:

Fitch (Fitch Ratings) revised their Outlook on MinRes Issuer Default Rating (IDR) to Negative, from Stable, back in September.

Last week, Australian superannuation fund HESTA said it has placed MinRes on its watchlist, citing disappointment with the company's inadequate response to governance issues involving its billionaire founder.

Also last week, the deputy chair of Australia's Securities and Investment Commission (ASIC), Sarah Court, told pollies in Canberra that ASIC and the ATO had begun an investigation into Min Res' affairs, but that it was too early to talk about consequences, if any.

At the same time, Moody's Ratings followed Fitch's lead and revised MinRes' outlook to "negative" from "stable" to reflect the potential implications of the company's corporate governance issues. The global ratings agency affirmed the "Ba3" corporate and senior unsecured bond ratings for MinRes.

So there are headwinds, but assuming that MinRes have already lined up all the debt they're going to need to get them through the next couple of years, and that they do get through, they're worth at least $58/share, even with the headwinds of lower iron ore and lithium prices.

It's a positive that they're offloading their Energy division to Gina, and that they've completed the haul road to Onslow now, and they still have a thriving mining services (crushing, loading & hauling) business.

But I won't be buying back in, even if Chris Ellison leaves. They're rotten with him there, and they're arguably worth less with him gone, even more so if there's a clean sweep of the Board and anybody else who has been in a position of influence during the entire period that MinRes has been ASX-listed - because the tax rorts and other related-party stuff has been going on since before they IPO'd.

So, yeah... Nah, not for me any more.

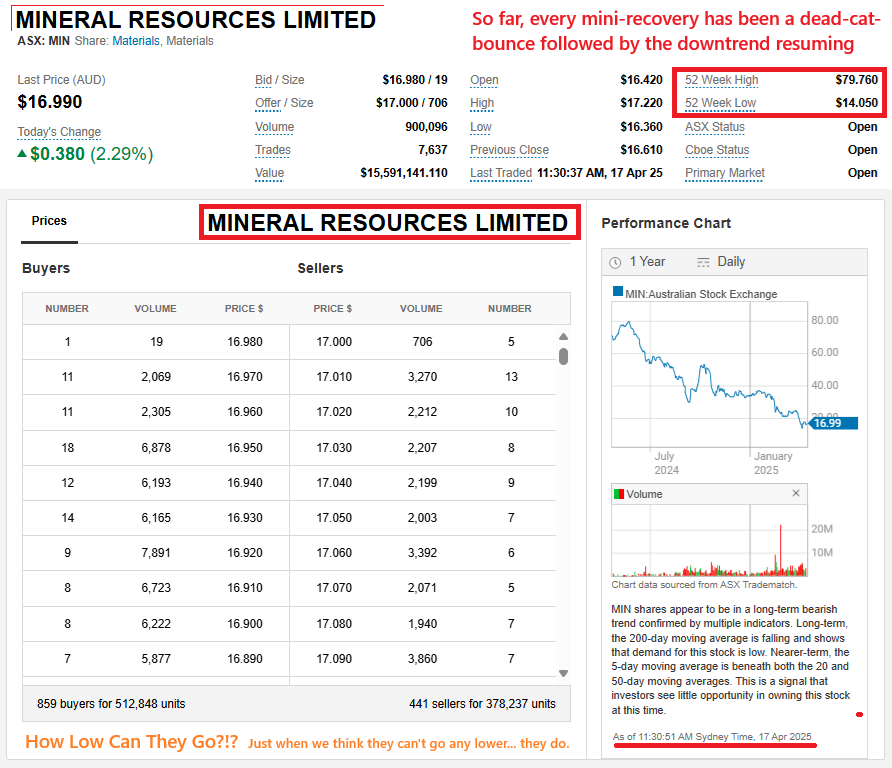

17th April 2025: Lowering my price target to $15.

They're worth more than that as a sum-of-the-parts valuation, however I think they can go as low as $15 if the remaining super funds that are still holding MinRes dump the stock on continuing unresolved governance issues.

Two thirds of MinRes' independent ethics and governance committee quitting the company with immediate effect yesterday (see here: Director-Resignations.PDF) is not going to help. That committee was formed to oversee the company’s compliance and to ensure it met legal and ethical standards, and that committee is now left with just a single member. Understandably these super funds want answers, and I posted a straw about that a few minutes ago here.

The read-through of yesterday's resignations is likely to be that those two directors felt that they were unable to do their job due to interference / push-back from Chris Ellison, who obviously wants to continue to maintain as much control as he can and stifle attempts to rein him in.

While the Board resignations at Wisetech (WTC) appears to have worked in Richard White's favour, Chris Ellison owns a hell of a lot less of MinRes (11.5% of a $3 Billion company) than RW owns of WTC (36.6% of a $28 Billion company), so RW was always going to determine his own fate at WTC IMO, even if that meant taking the company private (a move he hasn't needed to try to make yet, although he has mentioned it as a possibility), whereas CE doesn't have that sort of reach and control at MinRes.

There are 7 other "Subs" at MinRes currently and if 2 or 3 of those voted their shares together they would outnumber Chris Ellison's voting power. Obviously Chris would have others willing to back him so it wouldn't be that simple, but the numbers suggest that Chris' hold on power at MinRes, while still strong, pales in comparison to Richard's hold on power (and his control of) Wisetech.

Richard's not going anywhere, but it's not as clear cut with Chris Ellison at MinRes. He's still there, and still in control for now, but he's got a lot of stuff moving against him, from disgruntled major shareholders to not being able to hold his own Board together to not being able to ramp his Onslow Haul Road up to the required run-rate due to major design and construction flaws. And that's not even mentioning lithium and iron ore prices which both remain lower than where MinRes need/want them to be.

Think about this - what sort of calibre Board members are MinRes going to attract to replace those who are quitting without notice - when proxy advisers are not only calling for MinRes shareholders to vote against them, but to also vote against their re-election to the Boards of all other ASX companies (such as at Iluka) where they also serve as Directors??

These directors are realising that you can't be on the Board of MinRes without getting that stench of corruption and poor governance all over you, and that is now going to affect your standing in other roles outside of MinRes. So staying on the MinRes Board is increasingly going to be seen as a major personal liability in terms of your own reputation and standing.

It might have been tenable if you were on a committe tasked with cleaning up the poor governance and culture AND that committee was able to do it's job properly and be effective, but these directors who quit yesterday clearly don't think that's the case. One of them detailed a range of issues that had prompted her to quit in a letter to the MinRes Chairman, however other than via leaks to newspapers/news outlets, we aren't going to get to read that letter.

It's a mess. And it looks to me like the downward pressure on the share price certainly isn't over yet, particularly if these super funds follow through on their threats to sell out of MinRes entirely if their concerns are not adequately addressed.

I also think there's a very real prospect of a large capital raising to strengthen their very stretched balance sheet, and short of tipping a lot more money in, most investors in MinRes will get diluted by such a CR.

MinRes are getting a new Chairman shortly, and will need to replace the directors who quit yesterday, so while Chris keeps saying they're not going to raise fresh capital via the issue of more shares, they can't take on more debt, so their options are really limited to just asset sales and issuing more shares to raise money, if they need to raise money.

MinRes' lenders (both secured and unsecured lenders) are also going to be a lot more concerned with MinRes trading at sub-$20 levels than they were a year ago when MinRes were trading at between $70 and $80/share.

So, $15 is my new price target, and obviously I don't hold MinRes shares.

29th July 2025: Update:

"It is better to keep your mouth shut and be thought a fool than to open it and remove all doubt" is a well-known aphorism, often attributed to Mark Twain, though its origin is more complex. This proverb suggests that sometimes, remaining silent can preserve an impression of wisdom or competence, whereas speaking might reveal one's lack of knowledge or understanding and dispel that impression entirely.

Yeah. Nah. Still don't rate MinRes. Still think they're more likely to go to $15 than they are to go back above $60, despite the company putting on +77% since I set that $15 PT when they were trading at $17. They closed today at $30.10.

I remain bearish. There's value there in MIN if a number of things go right, including:

- The road (Onslow Haul Road) holds up, including through the hot northern WA summer at the end of this year, and through the wet season;

- Iron ore prices stay at current levels or above. If we see a significant decline in iron ore prices, that's not good for MinRes;

- They don't have any more truck (road train) accidents that might shut down the road during a subsequent investigation;

- MinRes' lithium partners at Wodgina and Mt Marion don't put sufficient pressure on MinRes to put one or both of those operations on C&M and slash MinRes' CSI (mining services) revenue;

- MinRes' CSI division don't lose a major crushing and hauling contract with RIO or BHP as they did some years ago with FMG after a fatality (one of their electricians was killed at one of their crushing plants);

- The bottleneck at Ashburton port doesn't cause delays with MinRes' transhippers due to Chevron Australia having priority with their LNG export vessels where MinRes are not allowed to move their transhippers when Chevron are using the channel between the port and open water, something that buying additional transhippers does not fix; and

- MinRes achieve and maintain their 35 million tonnes per annum Onslow Haul Road nameplate capacity target soon, without relying on third party trucks, i.e. only using their own road trains (to get their costs back under control).

But my issue is that the odds of all 7 or those things happening are slim to none, in my humble opinion, so... not touching this one with a barge pole at this point. Even if I was bullish on iron ore. And I'm not. So, yeah, $15/share seems about right to me.

And, I might point out, none of those 7 things involved the name of their MD and founder.

There are easier ways to make money in this game than with MinRes. Play when the odds are in your favour. The odds don't look real good with this company at this point in time.

21-Nov-2025: Update, post AGM (on 20th Nov):

So, Chris Ellison has certainly done a LOT better with the haul road and with selling down MIN's lihtium assets at a decent price (to reduce debt) than I had expected.

Credit where credit is due. It's been perfect execution from him over recent months, and as expected at their AGM yesterday they scrapped their previously announced succession plan for Chris Ellison, replacing it with a process that has no formal handover date.

I say "as expected" because he did (earlier this year) manage to get rid of any Board members who would stand up to him and he has a fully compliant Board now, so he isn't going anywhere, any time soon.

Not great for corporate governance and the lack of strong corporate governance at MinRes is one of two reasons that I won't be investing in the company again - my lack of trust in Chris is the other one. I think he's sorry that he got caught, but not sorry for his actions. But that does not change the fact that for those who stuck with the company (held their shares) and especially for those who topped up near their sub-$14/share lows in April this year, those people have to be happy with their decision.

So, because their debt no longer seems to be an issue and also because the haul road is performing very well now, my previous $15 price target for MIN is no longer sensible - so I'm raising it to $40, and while I do know that their SP is already above that $40 level now, I think there are some iron ore headwinds coming next year with Simandou producing and BHP and China expected to sort out their differences.

Well done to those who held from lower levels.

Discl: Not held.

All up, this has been a mighty impressive turnaround, both operationally and in the share price, so you have to doff your cap to the management.

Gaurav Sodhi from II reckons the market still doesn't fully appreciate the improvements.