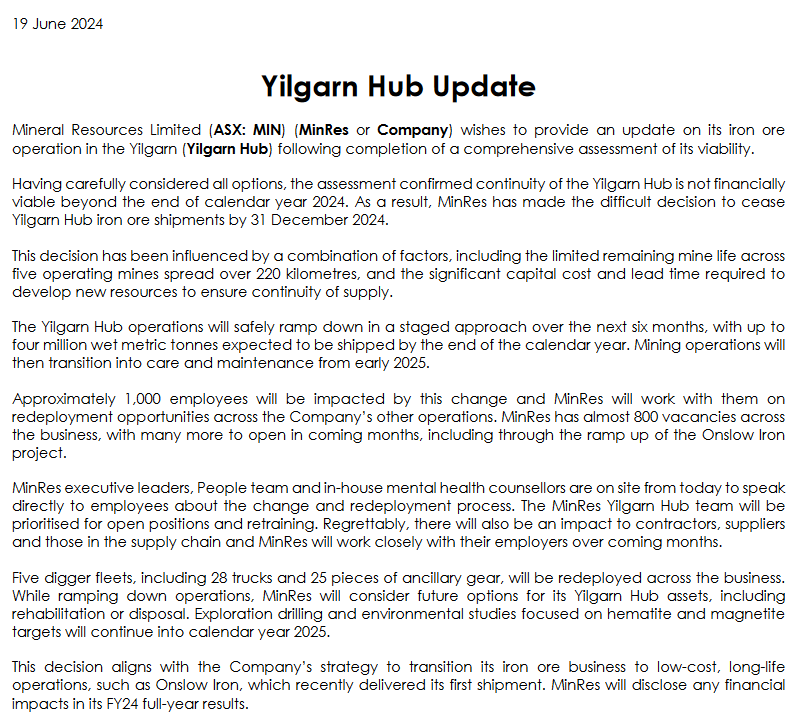

Massive pullback of the share price this week from the unfortunate news of the Yilgarn Hub closure

I know a month ago I mentioned about hoping for a pullback, but not in this sort of situation. Hopefully those workers get redeployed on other work.

Tempted to dip my toe in here but instead I will do some research...

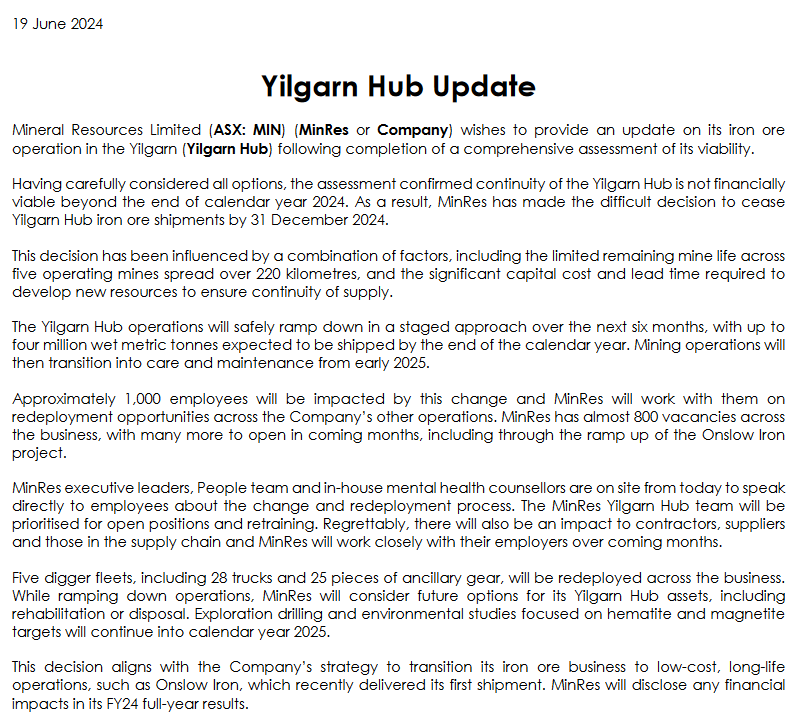

In the last JPM report (June 24), I found a few extracts about Yilgarn that looked interesting

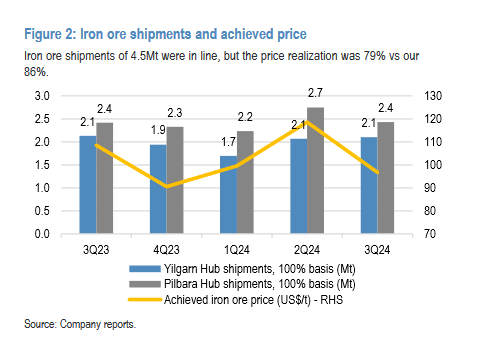

Yilgarn last quarter produced 2.1mt.

I guess Onslow will produce 10mt in next quarter so that makes up for the shortfall.

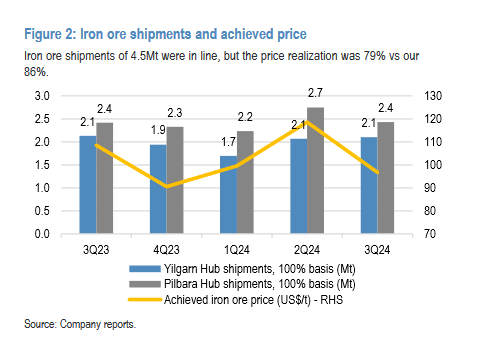

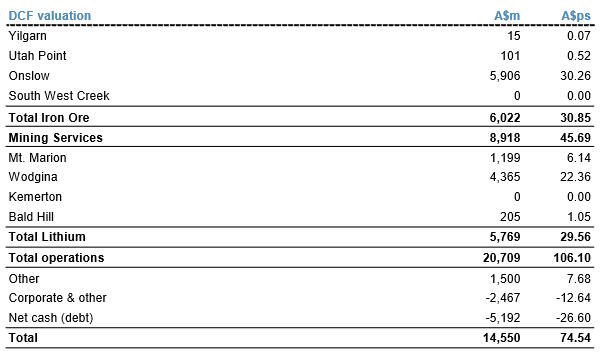

And below is the JPM valuation of Yilgarn which is only a few cents compared to Onslow.

So the share price fall of (7%) appears to be a big overreaction. However the market is probably factoring in all the costs associated with site decommissioning and rehab at Yilgarn.

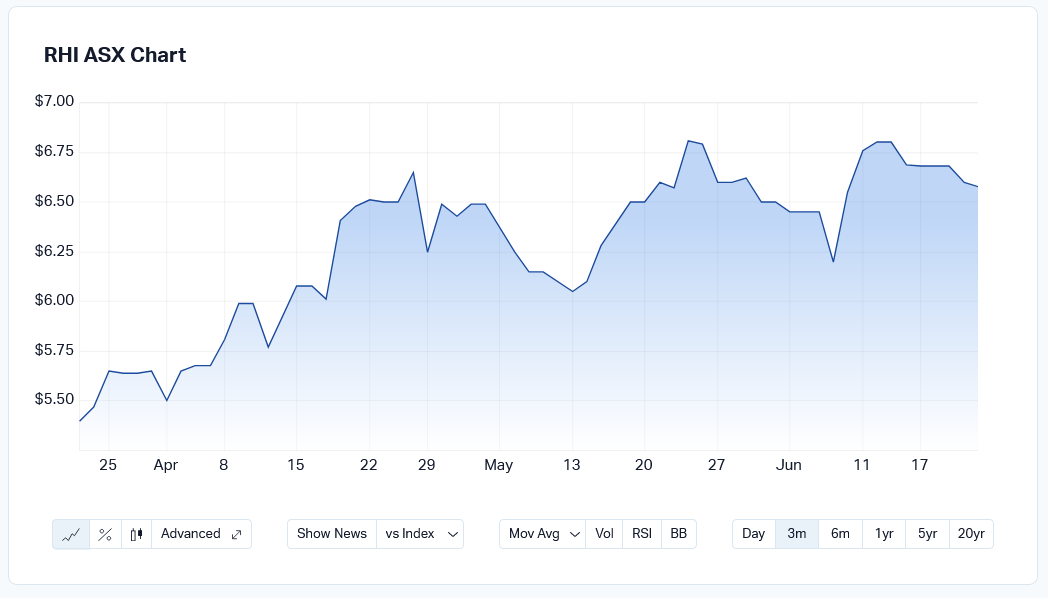

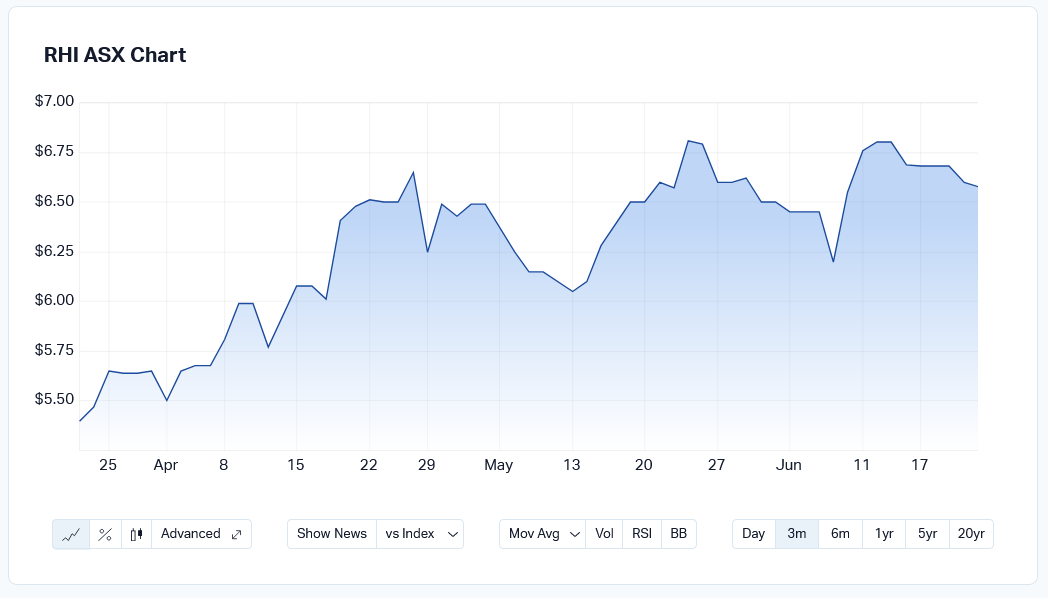

Of course former dog and possibly the Neuren equivalent of Iron Ore RHI has hardly reacted with the 200m milestone payment now a certainty

[holding RHI, thinking about MIN]