Price History

Premium Content

Premium Content

Premium Content

Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

28th May 2025: MinRes (MIN) released the following two announcements at 6:15pm and 6:27pm last night, so the market got to react to the production downgrade today. MIN closed down -5.47% at $22.45 today.

Onslow-Iron-Update.PDF

Onslow Iron site visit presentation.PDF

Excerpt from the update:

I'm not surprised that they have reduced guidance, the only surprise was that it took them so long to do it.

The following are from the presentation about the site visit today. It's 52 pages long, so I'll include just 8 slides that I personally found most interesting and/or informative - please click on the link to read the rest of it if interested - there's plenty more, including truck clearance distances vs a typical public highway, truck frequency vs public roads, etc. There is plenty of disclosure in this presso.

--- end of excerpts ---

Source: Onslow Iron site visit presentation.PDF

Disc: Not holding. Avoiding.

19th May 2025: Appointment-of-Malcolm-Bundey-as-Director-and-Chair-elect.PDF [8:25am]

Excerpts from that announcement plus some images and a chart from me:

Malcolm Bundey will immediately join the lithium and iron ore miner as a non-executive director and will succeed outgoing chair James McClements on July 1. Credit: Andrew Ritchie/The West Australian (source).

James McClements above, Zimi Meka below.

[Zimi Meka, above, and James McClements above Zimi, pics sourced from MinRes website]

Outgoing MinRes Chairman James McClements continued...

Media Reaction:

West Australian:

Mineral Resources appoints Brickworks deputy Malcolm Bundey as new chair to start rebuild

by Daniel Newell and Adrian Rauso, The West Australian. Mon, 19 May 2025 8:37AM [clearly added to later today as they do mention MinRes' -8.8% share price decline today at the end of the article]

Mineral Resources has tapped the deputy chair of Brickworks to lead the rebuild of the depleted board and regain the trust of shareholders left burnt by a series of scandals.

Malcolm Bundey, who has never held a role with a mining-related business, will immediately join the lithium and iron ore miner and mining services provider as a non-executive director and then is set to succeed outgoing chair James McClements on July 1.

Mr McClements announced his exit shortly after revelations in October that founder and chief executive Chris Ellison was involved in historic tax evasion on co-owned offshore companies and used MinRes for personal benefit via a series of related-party transactions.

A subsequent review unveiled a catalogue of governance failures that continue to plague the miner, including the looming exit of Mr Ellison, who is due to depart before the middle of next year.

MinRes has previously said the new chair will have a major role in picking Mr Ellison’s successor.

Last month, MinRes was rocked again when Denise McComish, Jacqueline McGill and Susie Corlett — who together formed a new ethics and governance committee — all left within the space of a week with no explanation.

MinRes said Mr Bundey’s appointment followed an extensive international search and he was unanimously endorsed as its preferred candidate on April 10 — just days before Ms McGill’s and Susie Corlett’s exit.

“Mr Bundey is a highly experienced board director and executive who has led multinational and multibillion-dollar private and ASX-listed organisations through significant change, performance improvement, acquisitions and sustainable growth,” MinRes said.

“As a leader of diversified global businesses based out of Australia and the United States, he brings expertise in managing complex global heavy industry operations and deep experience across professional services, manufacturing and primary industries and private equity.”

Mr Bundey joined Brickworks in 2019 and has also served as an executive and adviser to portfolio companies for a major international private equity firm — a role MinRes said he currently holds and will continue following his appointment.

Prior to that, he was managing director of packaging business Pact Group between 2015 and 2019.

Mr Bundey’s resignation from Pact came abruptly in the wake of a poor full-year financial result.

He has also served as chief financial officer of food manufacturer Goodman Fielder, which owns brands like Helga’s and La Famiglia, and started his career at big four firm Deloitte — climbing the ranks to partnership.

Mr Bundey — who has already visited MinRes’ new Onslow Iron operations in the Pilbara — said he was committed to “putting in the hours and working as hard as it requires to restore shareholder confidence and value”.

“MinRes was built on the entrepreneurial and proactive culture that has attracted me to every senior role I’ve occupied in my career,” he said.

“I look forward to addressing the challenges before us, which we’ll approach head-on. I’m confident the new board will lead the company through the next chapter, continuing to strengthen the company’s corporate governance while focusing on a collegiate and success-driven culture in the boardroom.

“I look forward to engaging with all of our stakeholders as we navigate this path.”

Mr Bundey will pick up $750,000 a year, with half as cash and the rest, minus superannuation, to be paid in shares.

Shares in MinRes finished down 8.8 per cent during a horror day on the market for iron ore and lithium miners.

--- ends ---

Source: https://thewest.com.au/business/mining/mineral-resources-appoints-brickworks-deputy-malcolm-bundey-as-new-chair-to-start-rebuild--c-18739454

AFR:

MinRes’ new chair to pocket $8.34m if he turns miner around

by Mark Wembridge and Mark Di Stefano, Updated May 19, 2025 at 10.23am, first published at 9.58am.

Incoming Mineral Resources chairman Malcolm Bundey could pocket a windfall of $8.3 million over the next three years if he turns around the scandal-ridden miner, as he vowed to improve culture and governance at the company.

Bundey, whose resume includes working at Pact and Rank group, but who has no mining experience, will start as MinRes’ non-executive chairman in July. He will be paid an annual salary of $750,000 in cash and shares, and issued 780,000 options, which vest between $30 and $40 a share. The options’ exercise price is $25.40 a share.

His potential pay packet has raised the ire of corporate governance groups.

Malcolm Bundey will become the new chair of Mineral Resources on July 1.

Jeffrey Jackson, corporate governance partner at shareholder advisory group Open Engagement, said stock-based remuneration was typically reserved for executives, not directors. Investor groups prefer non-executive directors to be paid in cash rather than stock to remove the temptation to focus on short-term share price gains rather than long-term company performance.

“ASX corporate governance principles and recommendations do not support granting performance-based remuneration,” Jackson said. “If you provide incentive-based remuneration, it may lead to riskier thinking and decision-making. That’s something that Mineral Resources will need to engage with shareholders about.”

Jackson said the issuance of options to Bundey raised questions about his appointment as an “independent” chairman.

Bundey replaces United Kingdom-based James McClements, and faces a formidable task to repair the lithium and iron ore miner’s reputation. The Australian Securities and Investments Commission is probing the miner and the behaviour of its founder Chris Ellison, who has apologised for his involvement in an offshore tax rort and related-party transactions.

Shares in MinRes fell 9 per cent on Monday to $24.08 against the broader S&P/ASX 200, which was down 0.6 per cent.

The company’s stock last traded at $40 in October, and was as high as almost $80 in the past year.

A series of scandals has weighed on its shares and forced billionaire Ellison to pledge that he would quit the company by mid-2026. Ellison remains the company’s biggest shareholder, with an 11.5 per cent stake.

The miner said Bundey’s package of options was “heavily weighted toward an increase in shareholder value and aligned with shareholders’ interest … which is also reflective of the time commitment required”.

Paying non-executive directors with share price-focused awards also clashed with the guidelines of The Australian Council of Superannuation Investors, a key industry advisory body.

“Remuneration in shares is acceptable, but we do not support the payment of share options and other incentives which introduce leverage into non-executive remuneration,” the ACSI guidelines state.

‘Restoring trust’

Bundey is well aware of the size of the job he faces, as he acknowledged in a leaked memo to staff on Monday.

“There’s no doubt the past seven months have impacted value and trust in our company. My focus will be on creating shareholder value and restoring trust through board renewal, strong governance and a great company culture,” he said.

Investors have queried whether the miner’s efforts to improve its culture were superficial after all three members of its ethics and governance committee – a body established to oversee Ellison’s behaviour – quit last month.

Bundey is a private equity executive and deputy chair of Sydney-based building materials company Brickworks. He previously served as managing director and chief executive of the Pratt family’s packing group Pact for three-and-a-half years, but left after poor financial results triggered a share price collapse.

Rafael Lamm, chief investment officer at L1 Capital, which owns MinRes shares, said Bundey’s appointment was “an important step forward for the company and sets the pathway for a full reset to best practice corporate governance being implemented”.

“Mal has had an impressive career, both as a senior executive and director for high-quality organisations such as Rank Group and Brickworks. We believe that Mal’s skills, diverse experience and temperament position him well to successfully reset MinRes’ corporate governance.”

Bundey has been visiting the miner’s operations, including its $3 billion flagship Onslow Iron project in West Australia’s Pilbara region, to familiarise himself with the company.

“Mal was the standout candidate and unanimous choice of the board through our extensive international search,” said Zimi Meka, chair of the board nominations committee. “He’s a measured leader who strikes the right balance between strong corporate governance and savvy commercial outcomes.”

Bundey has extensive experience in the packing sector, including long stints at companies in the United States. He began his career in 1987 as a graduate at big four accounting firm Deloitte and left as a partner 16 years later.

Board replacements

The appointment of a new chair comes after last month’s abrupt exit of three non-executive directors – Denise McComish, Jacqueline McGill and Susan Corlett.

They comprised MinRes’ ethics and governance committee that was established to oversee Ellison’s conduct, and were privately the most critical of the blunt-speaking New Zealander.

In his memo to staff, Bundey said the company would “appoint new directors who bring the skills, diversity and fresh perspectives MinRes needs for our next phase of growth”.

“MinRes has made significant progress on governance. Our ethics and governance committee, which I will now lead, remains central to this work, and will continue with refreshed membership,” he said.

MinRes said Bundey’s appointment was agreed by the board on April 10 – shortly before the directors’ exodus. The miner has stonewalled investors’ questions about whether efforts to improve its culture have been superficial, and has never confirmed why the three directors quit.

The miner has lurched from one crisis to the next over the past seven months after The Australian Financial Review published a series of revelations about Ellison’s conduct and the board’s failure to curb its founder’s behaviour.

The board last November released a withering report into Ellison’s misdeeds, noting that the managing director’s conduct had stained the company’s reputation, and he had been less than honest with the board.

Skyrocketing debt

MinRes’ debt skyrocketed after it built its $3 billion Onslow Iron project. Repair costs ballooned on its iron ore haul road network after half a dozen jumbo road trains toppled over on its crumbling surface.

The miner ruled out a highly dilutive equity raise to shore up its wobbling balance sheet, which the market took positively. Still, the company’s $4.7 billion market capitalisation remains below its $5.8 billion in gross debt.

“We’ve got the assets plans and many quality options in place to grow our strong financial position,” Bundey said in his memo. “We can all be proud of our company’s proven track record for delivering value.”

Meanwhile, the lithium price has cratered from its 2023 peak, forcing MinRes to close some of its operations. There has been speculation by analysts that the group may look to raise cash by selling lithium assets.

More from the MinRes investigation

- Chris Ellison’s offshore secret An investigation has uncovered how Mineral Resources chief executive Chris Ellison, one of Australia’s richest men, allegedly evaded tax for years.

- MinRes scheme enriched execs, allegedly at investors’ expense Peter Wade failed to disclose his interest in Chris Ellison’s tax evasion scheme, which cost shareholders more than $7 million.

- Chanticleer | ASIC eyes Mineral Resources as Ellison circles the wagons The regulator is now taking an interest in the crisis, even as investors have been reassured by the company’s explanations.

- Rear Window | Chris Ellison, hubris? That’s for someone else If the Dark Lord of Dunedin is a rotten Scrabble player, well, his chairman is all word salad.

- MinRes sold Chris Ellison farm equipment at steep discount The company’s managing director and another director bought the machinery for their New Zealand property at a bargain price.

- Chanticleer | ‘Inconsistencies’ in Ellison investigation will haunt MinRes board A week after declaring their confidence in their founder, directors are suddenly singing a very different tune.

- MinRes paid a 70pc mark up to rent Chris Ellison-owned properties Valuations the owners of the industrial facilities commissioned indicated that the leases were well in excess of market rates.

--- ends ---

Source: https://www.afr.com/companies/mining/mineral-resources-new-chair-to-pocket-8-34m-if-he-turns-miner-around-20250506-p5lwwb

Also, from one week ago:

HESTA sells remaining stake in Mineral Resources due to ‘serious’ governance issues following board departures

by Adrian Rauso, The West Australian, Mon, 12 May 2025 12:15PM.

Mineral Resources managing director Chris Ellison pictured at their offices in Osborne Park. Credit: Ian Munro/The West Australian

Superannuation fund HESTA has bailed out of Mineral Resources over persistent “serious governance concerns”, but shares in the embattled miner have risen.

HESTA said its decision followed the “sudden resignations” of three MinRes directors in April, who together formed the ethics and governance committee that was established in November 2024.

The trio — Denise McComish, Jacqueline McGill and Susie Corlett — all left the committee and MinRes altogether within the space of a week with no explanation.

The committee was established after revelations in October that founder and chief Chris Ellison was involved in historic tax evasion on co-owned offshore companies and used MinRes for personal benefit via a series of related-party transactions.

Mr Ellison agreed to step down by the middle of next year and chairman James McClements is also supposed to be out the door by the end of this year.

But the desertion of the ethics and governance committee raised questions about the progress of MinRes’ promise to address major shortcomings in its governance and the timelines for the agreed exits of Mr Ellison and Mr McClements.

“Last year we outlined our concerns that the managing director’s succession timeframe did not reflect the seriousness of the issues, and the issues indicated a systemic failure of governance,” HESTA chief executive Debby Blakey said on Monday.

“We have since regularly engaged with senior leaders and directors at the business to encourage action we believe necessary to restore investor confidence.

“The departures of the directors on the ethics and governance committee last month in our view represented a significant step backwards in seeking to address the serious governance concerns. Given these departures and the forthcoming succession of the chair, we don’t currently see a path to our concerns being addressed.”

A MinRes spokesman said the company “remains committed” to “strengthening corporate governance and creating value for all shareholders”.

“The appointment of the new board chair is well advanced, and they will be involved in any recruitment process for new directors,” the company spokesman said.

“As previously stated, the ethics and governance committee will be maintained going forward.”

HESTA placed MinRes on its “watchlist” in October based on the view “appropriate action was not being taken” to address governance issues.

At the time of the watchlist addition, HESTA held 0.9 per cent of the company — equating to about 1.8 million shares — and by the end of last year had reduced that stake to 0.4 per cent.

Those 1.8m shares would have been worth about $83m prior to the October revelations. That has been whittled down to $40.3m at the current share price.

But MinRes’ broader shareholder base did not appear too concerned with HESTA wiping its hands clean of the company.

Shares in the lithium and iron ore miner finished up 8.3 per cent to $22.81.

--- ends ---

Source: https://thewest.com.au/business/mining/hesta-sells-remaining-stake-in-mineral-resources-due-to-serious-governance-issues-following-board-departures-c-18663293

MIN may have closed up +8.3% last Monday (12th May) but they closed down -8.8% today @ $24.08, although that is still higher than their $22.81 close a week ago, and in fairness not all of the share price decline today was down to the new Chair announcement discussed in this post, because commodity prices fell over the weekend and all major miners were down today: Iron Ore miners were down (BHP off -2.4%, RIO down -1.3% and FMG crunched -4.9%) but Lithium miners got smashed as shorters got stuck in again, with PLS off -10.0% and LTR down a whopping -16.6%. In that light, MIN falling -8.8% wasn't a bad effort given the carnage across the lithium sector. Could have been worse.

We'll see if Mal Bundey as new Chair of MinRes from 1st July makes any difference. I would imagine he's used to working with stubborn, head-strong people who like to get their own way, seeing as he's deputy Chair at BKW (since Oct 2019) with Rob Millner as Chair and the Millner family running both BKW and SOL. That could have possibly contributed to Chris Ellison being OK with Mal's nomination to be the incoming Chair at MinRes.

Disclosure: Not holding. Avoiding.

17th April 2025: https://www.theaustralian.com.au/business%2Fmining-energy%2Fmineral-resources-directors-jacqueline-mcgill-and-susie-corlett-quit-as-proxy-advisers-turn-up-the-heat%2Fnews-story%2F564e330078dfd4d9e3e296ffb56d1f3a

Mineral Resources board member Jacqui McGill has quit, alongside Susie Corlett. Picture: Tricia Watkinson

Mineral Resources directors Jacqueline McGill and Susie Corlett quit as proxy advisers turn up the heat

Published in The Australian, Wednesday evening, 16-Apr-2025

Efforts by Mineral Resources to clean up its act after a series of scandals involving managing director Chris Ellison are in disarray after the resignation of two independent board members.

Jacqueline McGill and Susie Corlett have resigned effective immediately, just five months after they were named as key members of the independent ethics and governance committee to oversee the company’s compliance and to ensure it met legal and ethical standards.

The resignations come as proxy advisers turn up the heat on MinRes directors who sit on other boards, given the extent of the governance issues at the Perth-based mining services provider and iron ore and lithium producer.

The resignations point to tensions within the board over efforts by Ms McGill and Ms Corlett to get the MinRes house in order. The company share price fell 9 per cent to $16.61 in trading on Wednesday.

Proxy adviser Ownership Matters recommended against Ms Corlett’s re-election to the board of mineral sands miner and taxpayer-backed rare earths player Iluka Resources based on her link to MinRes.

Mineral Resources founder Chris Ellison. Picture: Supplied

Iluka defended Ms Corlett, saying she should be judged on her performance at Iluka and that had been exemplary.

It is understood any MinRes directors who sit on other boards will face similar proxy recommendations against their re-election.

Ownership Matters said that during Ms Corlett’s time on the MinRes board, there had been “material corporate governance shortcomings”, particularly regarding related party transactions and board oversight.

In response, the Iluka board said Ms Corlett was a highly experienced and effective director of their company.

“Her contribution to the board has been invaluable in driving Iluka’s objective, which is to deliver sustainable value. The board has the fullest confidence in Ms Corlett.”

The MinRes ethics and governance committee, which also included independent non-executive directors Denise McComish, was set up after revelations about Mr Ellison’s involvement in a tax evasion scheme, misuse of company funds and third-party transaction involving members of his family.

The future of the committee and its work remains unclear now that Ms McGill and Ms Corlett have quit.

The committee was tasked with reviewing related party transactions involving Mr Ellison and overseeing internal and external investigations, including whistleblower reports and ethical breaches.

MinRes said last November that the committee could reopen previously closed investigations if further information came to light.

Ms McGill only joined the MinRes board in January last year. She serves as a non-executive director at Goldfields Limited, New Hope Group and 29 Metals Ltd as well as the Royal Automobile Association of South Australia.

Ms Corlett joined the MinRes board in January 2021. She serves as a non-executive director at Iluka Resources, Aurelia Metals and Silex Systems.

Their resignations come hot on the heels of The Australian revealing that MinRes is at war with Chevron and the WA government over shipping levies on every tonne of iron ore it exports from the Port of Ashburton in WA.

MinRes said at the weekend that it opted not to disclose the levies or a legal dispute over payment to the market because it considered the charges invalid.

The levies are the latest blow to the embattled company’s Onslow Iron project. The success of Onslow Iron — already facing cost blowouts and production downgrades amid big question marks over a 150 kilometre-long haul road connecting mining operations to the port facilities — is crucial to MinRes’ survival and thousands of jobs as it teeters under a $5.8bn debt pile.

Oil and gas giant Chevron stands to pocket more than $1bn from over the life of the Onslow Iron project under the terms of a secret port agreement with the WA government.

MinRes has launched legal action after being ordered to pay the levies by the Pilbara Port Authority that will be passed on to Chevron, which built the Port of Ashburton before handing it over to the WA government as public state-owned infrastructure.

The WA government has in turn taken action against MinRes in an attempt to recover what it alleges are already more than $5m in unpaid and overdue charges.

The Australian revealed the dispute over the previously undisclosed levies a day after Mr Ellison sent a message to the company’s 6000-strong workforce vowing to “once again prove the naysayers wrong”.

“Our financial position is strong – solid earnings continue to underpin a strong liquidity position. Our debt is unsecured, long-tenor and covenant-light bonds that were designed to ensure we had the flexibility to invest in the next stage of our business growth,” Mr Ellison said in the message to staff obtained by The Australian.

MinRes chairman James McClements, who is on his way out the door in the wake of the scandals now under investigation by the Australian Investment & Securities Commission, said: “Both Susie and Jacqui have dedicated substantial time and effort over recent months in our efforts to improve governance and procedures across the business, while navigating their significant other professional commitments.”

Mr Ellison has agreed to exit as managing director by April next year.

--- ends ---

Source: https://www.theaustralian.com.au/business%2Fmining-energy%2Fmineral-resources-directors-jacqueline-mcgill-and-susie-corlett-quit-as-proxy-advisers-turn-up-the-heat%2Fnews-story%2F564e330078dfd4d9e3e296ffb56d1f3a

MinRes announcement to the ASX yesterday: Director-Resignations.PDF

Also:

Updated

Super funds demand answers after MinRes board exodus

Mark Wembridge and Mark Di Stefano - AFR - Updated Apr 16, 2025 – 5.03pm, first published at 10.02am

Major superannuation investors are demanding Mineral Resources explain the sudden exit of two key board directors who were privately the most critical of the conduct of embattled founder Chris Ellison.

The iron ore and lithium miner said on Wednesday that Susie Corlett and Jacqueline McGill would leave the board. They were two of the three-member ethics and governance committee established after a board review found Ellison had “failed to be as forthcoming” with the company about his personal transactions, creating a “significant reputational impact”.

Susie Corlett (left) and Jacqueline McGill, who were both critical of founder Chris Ellison, have left the MinRes board

AFR Weekend has confirmed that two senior in-house lawyers tasked with assisting the same committee have also departed. The directors did not outline their reasons for leaving – McGill has only been on the board for 16 months – but Corlett raised a litany of issues in a letter to MinRes chairman James McClements as she quit.

Two people familiar with that letter, who requested anonymity because they were not authorised to speak publicly, described its contents as scathing about efforts to overhaul the company’s culture.

Ellison, a blunt-speaking New Zealander who is now MinRes’ managing director, has vowed to quit the company by next year after acknowledging his participation in an offshore tax scheme that enriched him and others at the expense of the iron ore and lithium producer he founded in 1992.

McClements has also committed to standing down as MinRes’ chairman, and his replacement is due to be announced within weeks.

Ed John, the executive general manager of the Australian Council of Superannuation Investors, which advises big retirement funds on how to vote on governance matters at shareholder meetings, said the resignation of the two directors raised a “major question”.

“The company needs to explain to its shareholders what has happened to prompt the departure of the directors and what this means for plans to improve independence and transition the roles of board chair and managing director,” he said.

Mineral Resources’ headquarters in Perth. The company has been in a corporate governance crisis for months. Bloomberg

HESTA, which invests on behalf of health workers, has requested a meeting with MinRes to “understand more about the future of the committee, whose work we see as critical in driving action to address … governance failures”.

“Having viewed the formation of the ethics and governance committee as a positive development, we believe today’s news delivers a significant hit to investor confidence,” said Debby Blakey, HESTA chief executive.

The company remains on the fund’s watch list, which means its stake could be sold if HESTA remains concerned about its governance issues.

Those issues, and broader questions about the business, are piling up.

The Australian Securities and Investments Commission is investigating MinRes and Ellison over alleged failings including interparty transactions, and forcing company employees to work on his $30 million private yacht.

MinRes has been bleeding cash from its lithium division after low prices forced the loss-making miner to mothball operations at Bald Hill, a project close to Kalgoorlie in the Goldfields region. Over six months, MinRes has also cut iron ore production, axed dividends, and flagged it will have to spend significantly more money than expected repairing a new haul road.

Board within a board

The company put its ethics and governance committee in place in November, in the hope of reassuring shareholders after The Australian Financial Review revealed Ellison’s British Virgin Islands tax scheme, and that he had reached an agreement with the Australian Taxation Office.

Corlett, McGill and another director, Denise McComish, were selected to sit on the committee. People with detailed knowledge of the board’s deliberations said they were the three directors who were the most critical of Ellison as the company’s governance problems spiralled.

The committee is chaired by McComish and its scope includes “reviewing related party transactions involving Ellison; enhancing internal controls regarding related party transactions; overseeing internal and external investigations, including whistleblower reports and ethical breaches”.

It could reopen “previously concluded investigations if further information comes to light and strengthening conflicts of interest procedures”.

Two weeks later, MinRes’ in-house counsel Jenna Mazza quit as company secretary, joining the board’s committee as specialist legal counsel. Soon after MinRes’ general manager of commercial and legal, Nick Rohr, did the same, becoming counsel-assisting to the governance committee.

Both have now left MinRes, serving out their notice periods.

McGill joined the MinRes board in January last year. She is also a director on several other resource company boards, including coal miner New Hope and copper and precious metals developer 29 Metals. Corlett joined MinRes in 2021 also serves on the boards of Iluka Resources, Aurelia Metals and Silex.

Ownership Matters, which advises institutional investors on how to vote at shareholder meetings, has recommended Iluka shareholders vote against Corlett’s re-election to the critical minerals producer’s board.

It advised that there were “material corporate governance shortcomings at MinRes, particularly regarding related party transactions and board oversight”. It recommended that Corlett not be re-elected to Iluka “in the interests of seeking non-executive director accountability”.

MinRes shares ended the day $1.64 lower at $16.61. They have slumped more than 70 per cent over the past 12 months.

--- ends ---

Source: https://www.afr.com/companies/mining/minres-board-in-turmoil-as-governance-committee-directors-quit-20250416-p5ls3x

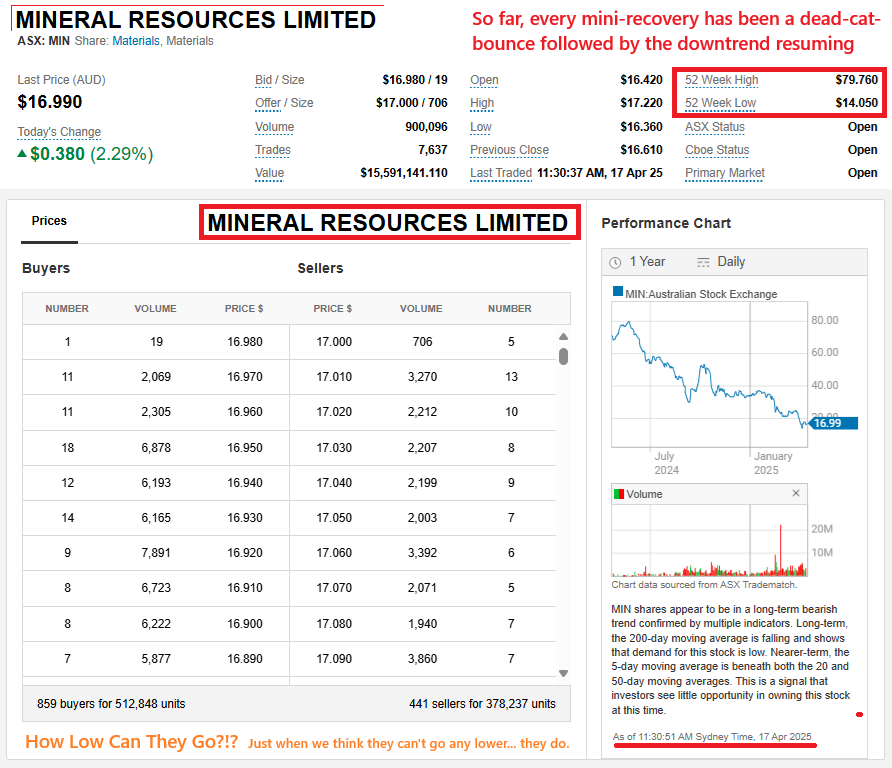

Despite MIN being up over +2% today, they're STILL in a horrible downtrend:

I'm actually not trying to troll MinRes, just pointing out that when there's more smoke than Woodstock in '69, it's likely going to be a higher risk "investment" and there's ALWAYS going to be further downside potential. So many better companies to invest in; We don't need to be invested in this one.

Source: MoM's daily newsletter, Friday's edition, "Director's Special" by Money of Mine

MinRes' AGM will be held on Thursday 21st November - this coming week - have the popcorn ready! It starts at 9:30am (AWST) and will be a HYBRID AGM. This one will be held at Mineral Resources Park - Function Room, 42 Bishopsgate St, Lathlain Western Australia - and online via their AGM portal (see below).

If you are attending the AGM in person, registration will commence at 9:00am (AWST). Please bring your Voting Form with you; using the barcode at the top of the Voting Form will help speed up the registration process.

Shareholders also have the option to attend the AGM virtually via the online portal.

To participate live online, please visit https://meetnow.global/M2WLDZQ on the day of the meeting.

Further details on attending the AGM virtually – including how to vote, comment and ask questions – are set out in the Notice of Meeting available at mineralresources.com.au/agm.

Any shareholder wishing to lodge a proxy vote or lodge questions ahead of the meeting can do so by visiting investorvote.com.au and entering the Control Number and Holder Number (SRN/HIN), as sent to shareholders with their notice of AGM.

Disclosure: Not holding, but would still like to be a fly on the wall.

Additional: That website address to "Investorvote" - powered by Computershare - is wrong, despite that web address being included in the MinRes notice of meeting. There is no ".au" in it, so that one doesn't work - the correct one is: https://investorvote.com/Login

Also, since that notice of meeting they've released the following announcements:

Pre-AGM Chair Presentation – October 2024 [29-Oct-2024]

Annual General Meeting - withdrawal of Resolution 4 [04-Nov-2024; Resolution 4 was for: Approval for Grant of Securities to Managing Director. Wouldn't have gotten up, one would have thought.]

13-Nov-2024: Bald-Hill-Operations-and-Mineral-Resources-Update.PDF

MinRes have put Bald Hill on C&M (care and maintenance) due to sustained low spod prices.

Also, yesterday, MinRes released their response to the ASX's latest "Please Explain" letter: Response to ASX Query Letter.PDF [12-Nov-2024]

I note that in this response the MinRes Board say in the "Background" section on page 1: "In answering ASX’s questions set out in the ASX Compliance Letter, given the subject matter of the questions, MIN considers it is most appropriate to answer ASX’s questions without reference to Mr Ellison’s knowledge or participation in the below matters."

So they are responding as a Board less the Managing Director of the company, which seems odd since he's still part of the Board.

They then use the words: "Excluding the knowledge of Mr Ellison, the present Board would be speculating in expressing a view as to..." in questions 6, 7 and 8. These questions relate to the lack of disclosures in the MIN IPO Prospectus and also the lack of related party disclosures in the 2006, 2007 and 2008 MinRes Annual Reports.

I'm not sure if the ASX will be satisfied with these responses considering Mr Ellison remains on the Board and remains able to provide the Board with details of his knowledge of these matters.

The entire letter in response to the ASX's questions has been written as though Chris Ellison is on leave - which I believe he is - and can not be contacted by the remainder of the MinRes Board so they have gone ahead and drafted a response without him that basically relies on the premise that none of them were on the Board back then so they don't know.

26-Aug-2024: MinRes' corporate governance has always been a little questionable, as it often is when it's one guy runnning the company as he sees fit - similar to Andrew ("Twiggy") Forrest at FMG, which is why the senior management at Fortescue don't seem to last long. Chis Ellison's MinRes (MIN) does not have those same issues with heaps of senior turnover, but this AFR article this morning is worth noting:

Chris Ellison’s daughter earns millions for MinRes shipping work

by Neil Chenoweth, Senior writer (AFR), Aug 26, 2024 – 5.00am

The daughter of Mineral Resources chief executive Chris Ellison has earned millions of dollars in undisclosed fees after her company was given preferential treatment to help ship the group’s iron ore exports, according to governance advisory group Ownership Matters.

An analysis of port records shows that Ship Agency Services, founded by Kristy-Lee Craker in 2011, has made as much as $10 million through hundreds of ships that have loaded Mineral Resources iron ore since SAS was set up in 2011.

Ship owners have been required since at least 2016 to use Ms Craker’s company when carrying the group’s iron ore exports.

Kristy-Lee Craker, managing director at Ship Agency Services.

Ownership Matters said port records showed that Ship Agency Services “is listed as shipping agent for hundreds of ships loaded with MinRes product that have sailed from the ports of Esperance, Dampier and Port Hedland over multiple financial years as far back as 2016”.

A review of hundreds of cargoes showed that all but a dozen shipments or fewer were handled by Ms Craker’s company.

Shipping agents provide myriad services, from organising documentation to port authorities and shippers to monitoring vessel operations, transport and crew arrangements.

The Ownership Matters report says her firm has chartered more than 1000 ships since it was set up. Industry standard rates for bulk carriers in Australian ports range between $5500 and $10,000 per engagement. Estimates of the fees paid to Ship Agency Services run as high as $10 million.

MinRes confirmed to Ownership Matters that Ship Agency Services was the group’s preferred shipping agent. However, it said payments to the firm did not have to be disclosed as related party transactions, because Ship Agency Services is engaged under contract with, and is paid by, the ship owner.

Mineral Resources said it was common within the industry to nominate a shipping agent. Ownership Matters is not suggesting the arrangements are improper.

Mineral Resources CEO Chris Ellison.

MinRes also uses a marine surveyor company, Propel Marine, set up by Ms Craker in 2018, to perform vessel draft surveys, inspections and marine warranty surveys on ships carrying the group’s iron ore. This leads to the unusual position where safety checks on MinRes ships are the responsibility of the daughter of the CEO.

“These services were performed at arm’s length rates,” a spokesman told Ownership Matters.

“It is common in the commodity industry for industry participants to recommend the use of a preferred ship agency. This enhances efficiency, safety and productivity in the loading or cargoes.

“MinRes has a process in place to ensure its shipping arrangements are in line with the market, and at commercial rates.”

Ownership Matters noted that “unlike BHP, Rio and Fortescue, ship agency at MIN has never been subject to a competitive open tender process.”

SAS also acts as shipping agent for ships owned and operated by Mineral Resources. These direct payments to SAS from MinRes as the shipowner are caught by the related party rules and should be disclosed. A Mineral Resources spokesman said that “direct transactions” between MinRes and SAS over almost 10 years were only “approximately $0.5 million in aggregate”.

In 2023, MinRes reported $428,000 in related party transactions involving SAS for “import/export services”, following $247,000 paid in 2022, but said the figures would be higher in 2024.

“This is due to the critical role played by SAS in facilitating the importation of key items for the Onslow Iron Project,” a spokesman said, an apparent reference to the acquisition of trans-shippers.

Until last year both Propel Marine and Ship Agency Services operated out of offices leased by Mineral Resources from a trust in which Mr Ellison has a 51 per cent interest. A MinRes spokesman told Ownership Matters that SAS paid rent for the offices.

An earlier Ownership Matters report in June raised questions over related party issues when MinRes invested in Wildcat Resources and Kali Metals.

--- ends ---

Source: https://www.afr.com/companies/mining/chris-ellison-s-daughter-earns-millions-for-minres-shipping-work-20240824-p5k51h [Today, 26-Aug-2024]

Disclosure: I am not directly exposed to MIN, FMG, BHP, RIO or any other iron ore companies at this point. I have also stepped aside from direct investing in any lithium companies for the time being. I admire and appreciate what Chris has achieved with MinRes and what Twiggy has achieved with FMG, and I have certainly made money from both companies, however I don't want exposure to either of them at this point in time for a variety of reasons, but underlying commodity exposure is the main one.

05-June-2024: 7:22pm: MinRes-sells-minority-stake-in-Onslow-Iron-Haul-Road.PDF

0:00:00 Introduction

0:01:36 MINs bring the cash

0:04:51 The Onslow iron ore hopefuls

0:17:48 What's going on in uranium

0:31:59 Sheffield start stumbling

0:39:39 Novelis ditch IPO plans

0:44:04 Leaky deals on the ASX

Disclosure: I hold MinRes (MIN) shares.

21-May-2024: Onslow-Iron-delivers-first-ore-on-ship-ahead-of-schedule.PDF

This is an important milestone for MIN. The whole sector (iron ore) is down today, so they're not getting the love they deserve for this achievement today, but it will come. I think this is another "up yours!" moment for Chris Ellison - because people definitely had their doubts especially a number of analysts who love to hate on Chris and MinRes. He was too bullish. His timeline wasn't achievable. He was too abrasive and abusive during analyst briefings and investor calls. Well, Chris isn't trying to win any popularity contests. He's running a business. And as businesses go, it's one of the better ones for sure.

MIN closed at $79.49 yesterday. MIN and RIO are both down by around -1% today. FMG -0.5%. BHP slightly up, but essentially flat, however BHP is trying to takeover Anglo American, so there's that - BHP would become a copper play if that goes through, which it probably won't - see here: BHP debates improved Anglo bid as time runs out in takeover saga - MINING.COM

I hold MIN.

0:24:50 MinRes - Katana Asset Management's biggest holding - Romano Sala Tenna tells us why [19-Feb-2024]

Disc: I hold MIN (MinRes) both here and in my larger real money portfolios.

23-November-2023: OK, MinRes (MIN) is certainly one of Australia's best mining services companies, and Gaurav Sodhi went as far as to call them "the best mining business on the ASX" in his 14-Dec-2022 article titled "Lithium: The mania and the cure - part 2" for the Intelligent Investor paysite where Gaurav has been their resources analyst since 2009. As well as resources, Gaurav covers telecommunications and power infrastructure. As Gaurav points out, MinRes' unique business model, far-sighted management and exceptional growth prospects have resulted in fantastic long-term returns.

They are also either the largest or one of the largest mining services businesses in the world, specialising in moving and crushing iron ore, they have billions of dollars worth of earthmoving equipment, fixed plant, trains, trucks and port assets, mostly in Western Australia - where most of the iron ore is.

They are also mine owners and operators, with a number of producing iron ore mines and other mining assets that includes two of the best lithium deposits on the planet - Wodgina and Mt Marion - neither currently in production but they will be soon enough. MIN is a company where a PE ratio is a flawed metric because the Earnings do not include the value of assets that haven't produced any revenue and earnings at all in the past year or two - or during whatever historical period you are looking at. These assets, while not currently producing any earnings, have substantial value and should not be overlooked.

On top of that we have MIN buying into various other Australian lithium companies while the lithium price is down and that's obviously for strategic reasons but part of it seems to be to stop Chinese and other overseas companies getting control of too much Australian lithium and other "critical minerals".

On 22-May-2023 the AFR published an interesting article titled, "What are Australia’s ‘critical minerals’ (and why are they critical)?": https://www.afr.com/companies/mining/the-critical-minerals-boom-is-about-geopolitics-not-geology-20230519-p5d9t7

Excerpt:

The wave of new lithium hydroxide processing plants built in WA is slowly reducing China’s dominance of battery grade lithium, but will amount to only 10 per cent of world lithium hydroxide supply by the end of 2024.

It’s a similar story in cobalt; 63 per cent of world supply is mined in the Democratic Republic of Congo, but it needs to be processed before it is turned into something useful, and China is responsible for 60 per cent of global cobalt refining.

To exacerbate the situation, China also makes about 75 per cent of all lithium-ion batteries and produces about 76 per cent of the world’s silicon metal, a crucial ingredient in solar panels.

As things stand, the world can decarbonise only if China permits it to do so.

--- end of excerpt ---

I'm not sure how Australia have 53% of global lithium production while China have 56%, but I'm guessing it's to do with the Chinese investments into Australian lithium mines, but in any case I believe Chris Ellison at MinRes and Gina Rinehart (Australia's richest woman, on the back of iron ore mining mostly, plus some other investments) both would like to (a) keep control of the best of our remaining Australian lithium assets right here in Australia, and (b) make some money for themselves in the process.

In Chris's case, he'd be making money for himself and other MinRes shareholders. Gina Rinehart's companies are not listed, they're all private family controlled companies, but we CAN invest in MinRes (MIN) and have exposure to Chris Ellison's vision and shareholder value creation.

In the past year or so, there's been a flurry of buying by MIN of blocking stakes in lithium companies like Wildcat Resources (WC8: 19.9% of WC8 is owned by MIN), 13.56% of Azure Minerals (AZS) where Gina Rinehart also owns 18.3%, and 17.4% of Delta Lithium (DLI) where Gina owns another 7%. It is not clear if there are any plans for Chris and Gina to work together with respect to any of these companies towards a mutually beneficial outcome, but it's interesting to view those companies in the context of what Chris and Gina control together between them.

Additionally, Gina and daughter Bianca Rinehart own 19.99% of Liontown Resources (LTR), another lithium company, and MIN have issued Lithium Australia (LIT) a $4.5m convertible note which LTR have begun drawing down recently. According to LIT's 30-Oct-2023 First-drawdown-from-Mineral-Resource's-convertible-note.PDF announcement, "On successful completion of the pilot plant operations and engineering study, MinRes’ convertible note will convert into equity in a new 50:50 joint venture (“JV”) between MinRes and Lithium Australia, which will wholly own the LieNA® technology going forward. The JV plans to license the LieNA® technology to third-parties at a target headline gross product royalty rate of 8%"

Fingers in many pies, but many of them are clearly lithium-related.

This is all while there have been overseas takeover attempts of some of these companies (LTR, AZS) and the lithium price has fallen quite a bit, AND lithium companies represent 5 of the 20 most shorted stocks on the ASX, including the number one most shorted stock, Pilbara Minerals (PLS), currently 18.5% sold short and rising.

Source: https://www.shortman.com.au/ [with some colourful highlighting on the left side added by me.]

MinRes also own 12.87% of Develop Global (DVP), the new miner/mining services hybrid company (just like MIN only a lot smaller) that is being built up currently by Bill Beament, the former driving force behind Northern Star Resources (NST) for all of those years. There are some analysts who believe that Bill B is the natural successor to Chris Ellison at MIN once Chris decides to step back or retire - both Chris and Bill admire each other's accomplishments with what they have done in business and their entrepreneurial mindsets. For that change at the top of MIN to occur however, it is likely that MIN would have to acquire the rest of DVP with Bill's blessing and for Bill to stay on to run the combined company. No guarantees but that's one possible future outcome, and makes sense in the context of MIN owning 12.87% of DVP, being a blocking stake that stops all other suitors from fully acquiring DVP, unless MIN agrees to sell. That blocking stake may hold DVP's SP back a little but doesn't do MIN's any harm. For clarity, Chris Ellison owns around 4.25% of MinRes shares on issue and Bill Beaument owns 18.5% of DVP shares on issue.

In 2006, Ellison and others established Mineral Resources as a merger of three mining services firms – pipeline contractor PIHA, ore-crushing firm Crushing Services International (CSI), and Process Minerals International (PMI). Ellison was a major shareholder in each of the three. Mineral Resources was floated on the Australian Stock Exchange (ASX) in 2006 at 90 cents per share. By 2022 the company's share price had risen to $71 per share, with Ellison holding around 12 percent of the company. He has since sold down that stake, but still holds 22,471,416 MIN shares, a stake with a current market value (based on MIN's closing SP of $64.72 yesterday) of $1.454 billion. He also owns one of Australia's most expensive homes and has other assets.

The Mosman Park mansion bought for $57.5 million in December 2009, setting an Australian record at the time.

The following is a small excerpt from: https://www.intelligentinvestor.com.au/recommendations/mineral-resources-takes-a-dive/152981 [Gaurav Sodhi, 10-Oct-2023]

The story of Mineral Resources is now legend. After leaving school at the age of 15, Chris Ellison made a fortune as he founded, then sold, a mining services business to Monadelphous in the 1980’s.

Then a troubled firm, Monadelphous went to the wall and Ellison lost everything. The firm was later revived under new management and is now a blue chip stalwart of WA, but Ellison missed all of that. He used his credit card, reportedly maxed to $10,000, to tie up three small services firms to create Mineral Resources.

The firm listed on the ASX in 2006 at 90c per share. It is now a $12bn colossus, the largest third-party crushing business in the world and, until recently, a stock market darling.

Source: Pilbara Minerals

Lithium meets the cycle

Lithium is a notoriously difficult commodity to analyse. There is no spot market. Sales are made by opaque contracts and prices only disclosed after a lag.

Carbonate and hydroxide prices, which are processed lithium products used to make cathode materials for lithium batteries, require specific offtakes and prices are usually contracted and secretive.

Most miners, however, sell a spodumene concentrate, and prices for the concentrate have diverged from processed carbonate and hydroxide. While carbonate prices have fallen by 80% over the past 12 months, spodumene prices have merely halved.

These intricacies are lost when prices are driven by euphoria and fear.

We have been cautious about lithium. Markets tend to accommodate new demand with new supply in unexpected ways. When the world expected peak oil, shale extraction technologies upended the narrative. When cobalt became hard to access outside Congo, car makers learned how to build without it. Indonesian nickel producers have disrupted nickel supply by learning to process complex laterite ores. We’ve always been skeptical of the higher for longer camp in any commodity because that hasn’t been the path of history.

Lithium, however, is in a unique spot.

Niche gets big

As we have noted in Lithium: the mania and the cure, lithium is moving from a niche commodity to a bulk commodity, a transition that will take time and require oodles of capital. To attract that capital, prices will need to stay above marginal costs for an extended time.

Lithium is out of favour now. Prices rose too far; subsidies in China have played havoc with inventories and new supply is coming. Yet we think there is a good chance that prices remain higher for a while. Only higher prices can incentivise new supply.

Albermarle, one of the world’s largest lithium producers, is valuing spodumene from Liontown, a takeover target, at US$1,600 a tonne. Industry insiders don’t always get it right, but their actions shouldn’t be ignored. Albermarle’s actions suggest new supply, especially low-cost supply, is hard to introduce.

MinRes is currently expanding output from its two hard rock mines (each 50% owned) and should produce about 900,000 tonnes of spodumene concentrate within 3 or 4 years, up from about 300,000 tonnes last year.

Costs are expected to fall to between $500-600 a tonne, which leaves plenty of margin even if prices decline further.

Services and iron ore

MinRes is, of course, more than just lithium. The mining services business at the heart of MinRes has raised volumes by 20% a year for the past decade. We’ve explained why our valuation of the services business, at about $30 a share, sits higher than most in previous reviews.

The iron ore business is undergoing a step-change in quality that will see output double and costs crumble from about $100 a tonne to $40 a tonne. That is being done by building an integrated logistics line to take ore from pit to port.

All the infrastructure to move ore will be owned by MinRes and it could be opened for third party access, or even partial sale, at some point. We don’t think improvement in the iron ore business, or the attached infrastructure, is being counted by the market. Iron ore adds another $10-15 per share to our valuation.

Following its expansion, the lithium business could be worth the entire market capitalisation of the business today. On a sum of parts basis, we think MinRes is worth over $90 a share.

Slow down

The balance sheet remains a risk. Over the next three years, MinRes will spend about $4bn in capital expenditure to grow lithium and iron ore volumes. Net debt has grown to $3.6bn and could climb further.

Yet the founder owns 12% of the business and management have built a track record of conservatism and success. We note that MinRes retains plenty of options of lowering risk such as selling project equity or infrastructure. The balance sheet is a risk, but not an insurmountable one.

Lithium prices also present a risk. Prices could remain weak. We also need to be aware that, like oil, cobalt or nickel, new technologies could change everything. Low costs, however, should protect margins as volume growth adds to cash flow.

It’s uncomfortable to buy when commodity prices are falling but these are the opportunities we must seize. We recommend starting slowly, but it’s time to BUY.

Disclosure: The author owns shares in Mineral Resources, as does the Intelligent Investor Equity Income Fund, Equity Growth Fund, and Ethical Shares Fund.

IMPORTANT: Intelligent Investor is published by InvestSMART Financial Services Pty Limited AFSL 226435 (Licensee). Information is general financial product advice. You should consider your own personal objectives, financial situation and needs before making any investment decision and review the Product Disclosure Statement. InvestSMART Funds Management Limited (RE) is the responsible entity of various managed investment schemes and is a related party of the Licensee. The RE may own, buy or sell the shares suggested in this article simultaneous with, or following the release of this article. Any such transaction could affect the price of the share. All indications of performance returns are historical and cannot be relied upon as an indicator for future performance.

--- ends ---

Note: As I explained earlier, Chris Ellison no longer owns 12% of the business as Gaurav suggests there, but he does still own around $1.5 billion worth (4.25% of MIN).

And Gaurav hasn't mentioned the various stakes that MIN is buying in other lithium miners (that I discussed above) which I think points to a longer term plan to control or at least provide the mining services for a larger group of lithium mines than what MIN currently owns.

MIN are market leaders in Mining Services but not yet in lithium and they are still a higher cost iron ore producer from their own iron ore mines. However, they do have a number of competitive advantages, not least of which is Chris Ellison, and his very entrepreneurial management, but also their off-balance-sheet assets like their P&E (plant and Equipment) graveyards - they will happily clean up old mining and crushing/ore-processing sites from miners who have gone broke, where MIN remove all of the old mining, crushing and loading equipment and plant - and also often do some site rehab - sometimes they are paid to do this and other times they will do it for free for the salvage rights because they store all of the old conveyors and ore crushing hardware etc. and use it to build new crushing plants at either their own mine sites or their clients' mine sites. And all of that used plant and equipment has a book value of $Nil. It probably has little to no value until they use it again, and then it does.

MIN can be sold down on poor iron ore sentiment or on poor lithium sentiment - and also when people are concerned by Chris's M&A moves, but having watched Chris Ellison operate for a number of years, it's an easy decision for me to buy MinRes shares at below $60 or up to $65/share, particularly with that very significant future lithium upside.

As usual, Chris has a longer term view and he's not content to JUST be a large player in spodumene - he wants that vertical integration and to refine the spodumene to produce battery-grade lithium hydroxide - and so far he's mostly used Albemarle for that, and he's outplayed them at every turn so far, but he's fairly agnostic about where his partners come from as long as he gets a good deal from them. And when he can't get a good deal, he just ploughs on and does it himself.

Here's a quick case study - just of Wodgina: when Chris Ellison was first developing Wodgina he said he was getting into lithium for a good time, not a long time, and he would likely sell out at a good profit before the peak, and then he sold half of it to Albemarle in late 2018 pretty much at the previous lithium peak, with an agreement that gave MIN half of the Albemarle Lithium Hydroxide (LH) plant that was being constructed at Kemerton (near Bunbury in south west WA) as well, and when that sale (for half of Wodgina) settled - at $US1.15 billion (A$1.58 billion), it looked like Albemarle had overpaid by quite some margin because the lithium price had declined sharply - and then Chris recut that deal a few more times over the next few years (always in MIN's favour), which saw Albemarle further increase their stake in Wodgina - which remained on "care and maintenance" (i.e. not producing anything) since shortly after the first sale announcement at the lithium peak.

This year Chris announced that MinRes had "simplified" their JV arrangements with Albemarle and that Albemarle would now control all of the Kemerton LH refinery but that MinRes would increase their own stake in Wodgina back up to 50% and would remain the mine operators. This came with a further payment to MinRes by Albemarle of US$380-400 million, including the net consideration for MinRes’ share of Kemerton and completion adjustments at Wodgina and Kemerton. See here: https://www.mineralresources.com.au/news-media/simplified-marbl-jv-agreement-reached/ [20 July 2023]

And here: https://www.afr.com/companies/mining/ellison-eyes-new-lithium-prize-near-albemarle-joint-venture-20231018-p5ed9f [22-Oct-2023]

He's not silly, that one! Smart cookie, and great to have in your corner. Not so good when you're on the other side of a deal with him or his company, but apparently he's loyal to his friends, employees, clients and partners, and so far longer-term MinRes shareholders have done very well out of investing in his company as well.

https://www.mineralresources.com.au/investor-centre/annual-reporting-suite/

Disclosure: I hold MinRes (MIN) shares in my major real life portfolios (including my SMSF) and have recently added them back into my virtual SM portfolio as well, taking advantage of the lower share price.

07-Aug-2023: LIT-Landmark-joint-development-agreement-with-Mineral-Res.PDF

It's interesting. I hold MIN, but I do not hold LIT shares. Back on the 20th July, MinRes (MIN) announced that they'd made some big changes to their arrangements (via the MARBL JV) with Albemarle - Simplified-MARBL-JV-Agreement-Reached.PDF - and the market initially sent their share price up +5.16% (or +$3.72 to $75.78) before selling them down over the next fwo days by -9.86% to $68.31. Then, on July 26th, MinRes released their FY23-Q4-Quarterly-Activities-Report.PDF and their share price rose +4% (to close the day at $73.82).

Monday's announcement (reproduced above, with a link at the top of this straw) didn't result in much movement; just -0.77% or 54 cents down to $69.42, on a day when the overall market was slightly down anyway.

By contrast, on the same day - Monday 7th August 2023, the LIT share price finished the day up +66.67%. They'd been trading at 3.3 cents ($0.033) for a week, and they finished Monday at 5.5 cents ($0.055), which is also where they finished Tueday (yesterday evening) after trading as low as 4.9 cps and as high as 6.6 cps during the day (Tuesday).

While this is Big News for a $67 million microcap like LIT (possibly a nanocap coz they had a market capitalisation of only $40 million last Friday), it's not such big news for MinRes (MIN), whose market cap is now $13.5 Billion. MinRes are no longer small - they're an ASX50 company now.

There's always plenty going on at MinRes, but I reckon the market often struggles to know how to interpret it. Certainly, if the recent Money-of-Mine Podcast coverage of Chris Ellison on the latest quarterly earnings call is anything to go by, the analysts at Australia's major broking houses don't have much of a clue!

Here's what happened to the LIT share price on Monday:

lit

Good if you're a holder (I'm not), but the context is that they were trading at higher levels a year ago and people were just giving up on them and selling out for the past 11 months. That is a massive lift in volume for LIT though, ain't it?!

Those sort of movements no longer happen with companies as big as MinRes is these days, but they can and do still grind higher, and MinRes (MIN) do tend to trend well both up and down for weeks and months at a time, so you can also trade them if you've got the time. I've done that in the past, but I'm just planning to hold them now.

19-July-2023: I hold MIN shares in my SMSF, however I haven't been following them very closely for the past 18 months or so, and I recently (on Monday) added MIN shares back into my largest RL portfolio as well, which is more actively managed than my SMSF is - meaning I often leave my SMSF alone for months, and that happens less with my other larger portfolio. Anyway, I was going through their announcement list this evening and I came across this: Change-of-Director's-Interest-Notice---Justin-Langer.PDF [13-April-2023]

Not THE Justin Langer, surely?! Not J.L. ?! But, a quick google search revealed that yes, Justin Langer AM, former Australian Mens Cricket Team Coach, and legendary Test Match opening Batsman for Australia for many years - alongside Matthew Hayden AM - was indeed now on the MinRes Board - see here: https://www.mineralresources.com.au/news-media/justin-langer-joins-minres-board-as-non-executive-director/ [15-December-2022]

MinRes’ Chairman James McClements said Justin’s appointment demonstrated the high premium the Board places on diversity of experience.

“As MinRes continues to grow, we believe bringing in a breadth of expertise and knowledge is key to our success,” McClements said.

“Justin’s outstanding leadership experience will further enhance our focus on people and culture, which is critical as we continue to expand our workforce to execute on our significant growth strategy.

Together with the recent announcement of Colleen Hayward as Non-Executive Director, the Board is now well-equipped to address the opportunities that lay ahead for our business.”

Justin said he was inspired by Chris Ellison and the Board’s vision for the future of MinRes and their commitment to the people who have helped make the business the success it is today.

“As a proud Western Australian, I understand the vital contribution of the resources industry and I’m excited to join such an outstanding WA success story.

“I look forward to making a meaningful contribution and bringing my leadership and people and culture experience to the Board from the new year.”

[mid-December-2022]

I remember when Australian wicket-keeper/batsman Adam Gilchrist (who is also from WA) was a director of TFS, a Perth-based sandalwood supplier. That story didn't end well. See here: Adam Gilchrist scores post as TFS director (smh.com.au)

and here: TFS Corp: the big short you can't short (afr.com)

TFS became Quintis and then collapsed: Quintis collapse: investors left with thousands of worthless shares after company calls in administrators | The West Australian

I don't think that's going to happen to MinRes however. MinRes is in an entirely different league than TFS was.

I don't know how I missed this bit of news over the past 7 months, but I did. Not bothered by it either way. Just thought it was interesting is all.

28-July-2022: MinRes-FY22-Q4-Quarterly-Activities-Report.PDF

MIN is up by almost 5% so far today on the back of this report. They are a significant iron ore player and by this time next year will also be a significant lithium player here in Australia. They have two of the world's largest known hard rock lithium mines (Wodgina and Mt Marion), and they have partnered with Albemarle whose Lithium Hydroxide refinery at Kemerton (200km south of WA's capital, Perth) is ramping up now after years of construction and they're already talking about a major expansion.

Albemarle lithium processing plant just weeks from first production already looking to expand - ABC News [16-May-2022]

Albemarle Bunbury lithium facility facing workplace safety investigation after complaints - ABC News [24-May-2022]

Image: One of MinRes' iron ore mines.

Disc: I hold MIN shares.

28-Jan-2022: I just read this article - Kemerton Omicron outbreak rapidly grows - which details an outbreak of the Omicron variant of the Covid-19 virus at the construction site of the Lithium Hydroxide plant being built by Albemarle and Mineral Resources (ASX: MIN) at Kemerton in WA, just north of Bunbury (south of Perth). Wouldn't be a major issue almost anywhere else in Australia, certainly not in the eastern states or SA, but it is in WA, which has a lot less active infections than those other states and they would like it to stay that way.

Some interesting bits from the article:

The first case of COVID-19 related to the plant was detected on Monday.

Of the 24 total new cases of COVID-19 detected in WA yesterday, nine were related to Kemerton.

It took the total Kemerton cluster to 16.

"They are all related to Kemerton and Albemarle in one way or another," WA premier Mark McGowan said yesterday.

"[The plant] has been under construction now for a few years and is an important investment for the state in terms of downstream processing of lithium."

. . . . .

"There are 30 contractors on site but one contractor and one work area in particular have been affected."

The work area has been temporarily suspended, with all close contacts in isolation, some at a beachside resort north of Bunbury.

[could be worse...]

. . . . .

The Kemerton development, a 60:40 joint venture between Albemarle and MinRes, comprises two 25,000 tonne per annum lithium hydroxide modules.

The US$1 billion project has already been plagued by delays due to WA's tight labour market.

Kemerton I was due for construction completion by the end of 2021, but Kemerton II was twice-delayed last year until the June quarter.

First lithium hydroxide is expected by mid-year.

. . . . .

Remember that MIN (who I own shares in) are currently an iron ore play and a mining services play, but they have these lithium assets that they are developing in readiness for higher lithium prices, including the Kermerton lithium hydroxide plant and the Wodgina mine which they believe is the largest known hard rock lithium deposit in the world. That mine is on C&M (mothballed) ready to be fired back up when prices are more supportive.

I don't see this latest issue at Kermerton as a thesis breaker. These sort of delays are going to happen during a global pandemic. Still, I wouldn't mind being a close contact and having to "isolate" at a beachside resort - perhaps here.

The following images are of the Kemerton Lithium Hydroxide plant over the past couple of years.

16-Jan-2022: While MinRes (ASX:MIN, Mineral Resources Ltd, a.k.a. MRL) is a mining and a mining services company, they are highly profitable. This straw is just about that and their key metrics, which are good and getting better. With the exception of net profit margin (NPM), which dipped in FY21, their growth has been impressive and is all heading in the right direction:

Source: FNArena.com

The main thing to note here is the quantum of growth in EPS and book value over the past two FYs and also the Divs, Revenue, and net operating Cashflow in FY21. Their growth has not only continued, it has markedly accelerated.

While it’s very hard to value their mining businesses because the value of the commodities (like iron ore and lithium) change daily, it’s relatively easy to value their mining services businesses – which mostly have recurring revenue at set rates. TDM Growth Partners described MIN, on November 19th, 2019, like this:

“One of the most unknown, underappreciated, Australian innovation and commercial success stories, that since IPO in 2006 has achieved (and get ready to wipe your eyes in disbelief…);

- EPS growth of 15%

- Total shareholder return including dividends of 20x (26% per annum)

- Return on funds employed (pre-tax) averaging approx. 30%

- EBITDA to cash flow conversion of approx. 100%

Currently, this business has:

- A bulletproof balance sheet with $200m+ of net cash

- Inside ownership of over 15%

DO YOU WANT MORE?

What if we said it has the potential for EBITDA to grow over 20% p.a over the next 5 years

STILL WANT MORE?

And the kicker…. This business is trading on FY20 PE (ex-cash) of 7x!!!”

On that day (19-Nov-19) MIN was trading at $14.67. They were $14.65 the day before and got down to $13.92 two days later. They are now over $65/share.

TDM finish their Nov 19 piece with this:

“And so, why such a mismatch between the market’s view and how we (and other long-term shareholders like Emma @ Airlie) view the business? Rather than thinking (and valuing) MRL like you would a typical mining services business, with earnings heavily dependent on the mining cycle, why would you not start to think of it like a Macquarie Group – yes there are market-facing businesses whose earnings will rise and fall with commodity prices, but underpinning this, after 13 years of track record, are very strong annuity earnings streams. To back this up, in the last 5 years, MRL have retained 96% of all of its mining services contracts (and the other 4% is accounted for through a mine closure that had run its expected life span), and 76% of these contracts are for longer than 5 years (and a third is longer than 10 years!). Just to spell this out more clearly – MRL’s mining infrastructure earnings (crushing/processing/contract mining/accommodation) are high-quality annuity-style earnings with a high return on funds employed and the commodities (market facing) business can then be viewed as cream on the cake. Tasty cream. Very tasty cream.

We didn’t have the opportunity at SOHN (but loved Emma’s pitch!) to give the insight into our own thinking and appreciation of both MIN’s track record and unique business model. After all, at the moment, the mining infrastructure business and cash/investments alone are worth more than the share price. We can only hope over time more people feel the same way as we do but don’t expect this to happen overnight. Thankfully we are very patient investors. If it takes another 13 years and 20x bags later, then so be it. Sometimes it is best just to let these compounding machines speak for themselves.”

Source/Further Reading:

https://www.tdmgrowthpartners.com/insight/sohn-bonus/

https://www.tdmgrowthpartners.com/insight/when-charlie-munger-meets-mineral-resources/

https://www.tdmgrowthpartners.com/insight/mineral-resources/

Remember - that was back in 2019, and MinRes has really accelerated their EPS (earnings), sales (revenue), cashflow, dividends, book value and net profit margin since then. All are significantly higher than when TDM wrote that piece.

This business has been a wealth-winner for their investors:

Dividends:

All divs are 100% (fully) franked, and they've been growing strongly since 2019.

For more, see my Valuation for MIN.

Disclosure: I hold MIN shares in RL, and plan to add them back in to my SM portfolio once I sell something to free up some cash.

02-Mar-2021 (6:18pm): MIN Presentation at JP Morgan Global High Yield Conference

Mineral Resources (MIN) is a company I have held at various times and done very well out of. They look expensive to me currently, but many, including Guarav Sodhi from Intelligent Investor and Mark Moreland from TeamInvest believe MIN are the best run and highest quality mining services contractor listed on the ASX, and own them - even ast current prices. I wish I did, but I can't bring myself to pay these prices.

19-Nov-2020: 2020 AGM - Managing Director Presentation

Today, Friday 20-Nov-2020, Marcus Padley in his morning newsletter said:

- Mineral Resources (MIN) - CEO says MIN is set to double in size within three years. At the company’s AGM, CEO Chris Ellison noted plans to achieve iron ore export capacity of 92m tonnes a year, saying: "We believe without any doubt that over the next 2½ to three years we are going to double the entire Mineral Resources business," "That is doubling in revenue, probably in the number of people we employ, the tonnes we shift and, more importantly, doubling the bottom line."

22-Sep-2020: Presentation to Bond Investors

[I do NOT currently hold MIN shares, but I wish I did. They're too hot for me at these levels, so I would NOT be buying up here. However, they are one of Australia's best listed mining services companies, and I've certainly held them at various times, and probably will do again. They have a lot of exposure to iron ore via BHP and RIO - they do a lot of crushing and screening - and ore transportation - for them, plus they also own their own iron ore mines.]

24-7-2020: MinRes (MIN) Quarterly Activities Report

This is a mining services company that also own a few iron ore mines themselves and have other mining interests, and I made some money on them this year, and sold out WAY too early!! I took profits (sold out) at $16.29 in mid-April, thinking that the iron ore price was being artificially propped up by Vale's issues in Brazil, and that I could swap that money into something with better upside. MIN just kept on rising from there, and are now over $24. Should have trimmed some and kept the rest!

18-June-2020: Bull Case from Anthony KAVANAGH from Chester Asset Management: https://www.livewiremarkets.com/wires/can-mineral-resources-be-a-40-stock

Can Mineral Resources be a $40 stock?

No, we aren’t projecting a USD150/t iron ore price. Last year we wrote, A Different Kind of Portfolio Manager, wherein we argued Mineral Resources (MIN) was heavily discounted, trading at ~AUD15/share vs our AUD26/share valuation. Given the wide discount there wasn’t much need for over-enthusiasm on the upside but this note serves as an update and provides us the opportunity to revise one of the issues we had with our first note, the Mining Services' valuation. Yes, we’re allowed to have issue with our own work. Rarely is the sequel better than the original but just as Adam Sandler made Grownups 2 sometimes the original was that bad/no-one saw it that it doesn’t hurt to have another go. For time poor readers we have worked backwards from our original note, providing an update on our valuation, followed by the detail on Lithium, Iron Ore and Mining Services, before rounding out with earnings implications.

Valuation Update

Combining our work below into a valuation is easy enough but within our analysis we are left with some key questions which materially influences the fair value outcome, hence the multiple valuation scenarios below. These include:

a) Whether to accept the iron price implied by Fortescue Metals (FMG)?;

b) What is a reasonable multiple and hence valuation of MIN’s Mining Services segment as more contracts become sticky Life of Mine (LOM) type infrastructure deals?; and

c) How much of the theoretical value of future projects: Marillana, West Pilbara and lithium downstream, including the associated Mining Services upside is reasonable?

--- click on link above (top of this straw) for the rest of this article, published on Livewire on June 18, 2020 ---