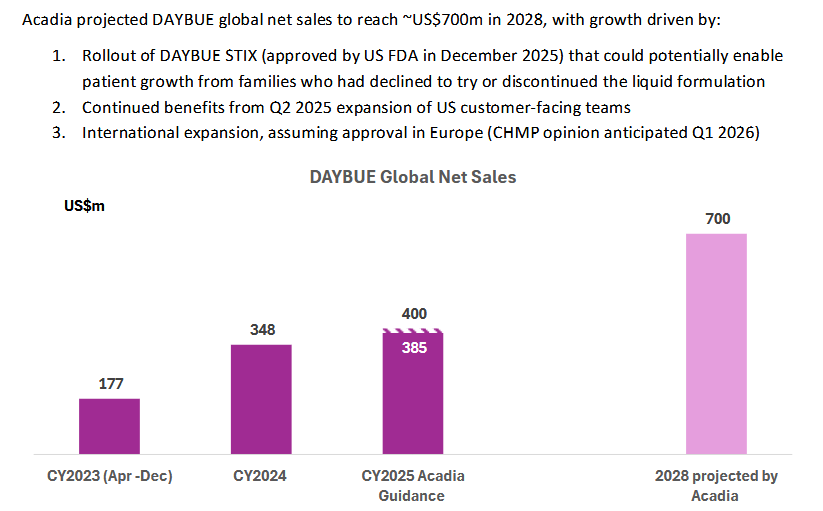

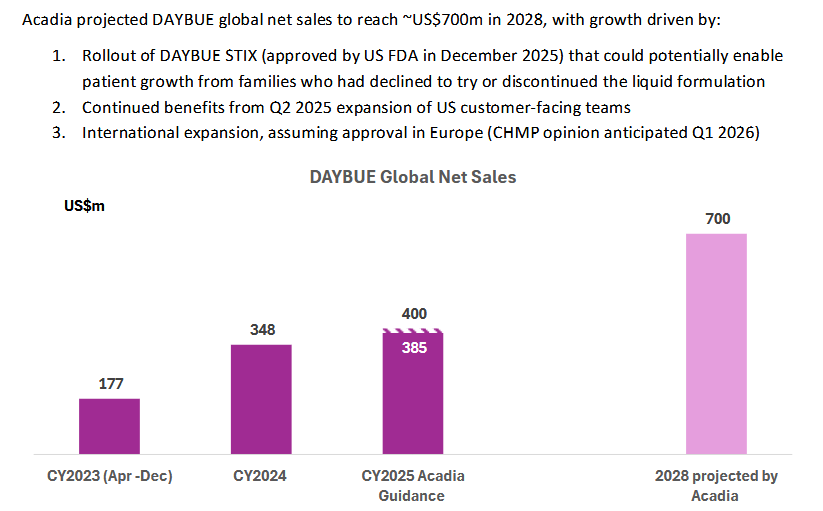

I just listened to the JP Morgan healthcare conference that Acadia presented at and it is pretty positive for Neuren. The surprise was a longer dated sales target of $700m by 2028 for Daybue. This has some pretty significant flow on effects for NEU if it is achieved in terms of milestone payments.

Three scenarios -

1) sales increase in the US and they manage to exceed the $500m threshold for the next $50m payment. I think this is likely as the 2000 patients that have tried Daybue of a total US population estimate of 6000 potentials (up 10% from previous estimate). So probably somewhere around 3-4000 actual patient pool. No mention of Canada approval solutions, so probably not likely to contribute anything by 2028. They mentioned the investment in sales people was having a positive effect. But to me it seems unlikely that they will get to $>750m milestone ($100m payment) from the US alone so I think this will be the final milestone payment from the US for a while and maybe forever. So then they would transition to a steady $60m or so per year of sale royalties

2) A big chunk of these sales come from outside the US, as they expect Europe approval Q1 2026 and an extra phase 3 trial for Japan will be completed in 2026. They were fairly positive on both of these. They will get $35 and $15m milestone payment for first commercial sale, which looks very likely. Then the sales milestone targets are not defined for the ROW, but are up to $170m for Europe and $110m for Japan. I am thinking the initial trigger levels of these payments will be higher than in the USA as they are getting a higher sales royalty - high teens to low twenties vs low teens in US. So I am expecting them to hit some milestone payments but what they are is largely unknown beyond its moving in the right direction.Another unkown is the actual pricing for these jurisdictions haven't been determined as far as I can tell, and this could impacted the sales quantum.

3) Have overpromised, and the new STIX formulation doesn't address the problems that some patients have with the oral liquid, so potential patient pool is still limited to those who tolerate it or perceive it to work. I can't assess this but from what they say about STIX it sounds like a good option, it can be mixed with any liquid (apple juice to gatorade) so should be more palatable, I still shudder at the thought of the unpleasant cherry flavored medicine from when i was a kid. STIX is lower in carbohydrates, which is impoartant as many of the patients follow a KETO diet and limit sugar intake. STIX is also more convenient- doesn't need to be refrigerated, much easier to travel with etc. Overall it does sound like it could be an accelerator but will watch and see. So from what I have seen it looks like a product improvement, they will start selling in Q1 but wont ramp up to full availability til Q2, they also said they will sell each version, but its hard to see why anyone would want the oral solution given the benefits of the STIX formulation.

Its likely to be some combination of these scenarios but I still like NEU, the ability to get a steady income while your developing a pretty exciting drug in NNZ2591. Happy to keep holding this one.