12-April-2023: @Scott posted a Bull Case Straw about Lycopodium's latest Operational--Guidance-Update-Q4-FY2023.PDF (upgrade) on Tuesday - and raised his valuation/price target for LYL to $10 (from $9). I raised my own price target for LYL back on 23rd Feb from $7.40 up to $9.70. Well, today LYL rose +8.24% (or +75 cents) to close at $9.85/share, exactly half way between my current $9.70 PT and Scott's $10 target for LYL.

I'm tempted to raise mine again, but I know $10 is a nice big round number, and I also know that LYL can move quite a bit on small volume as it's a very illiquid stock most of the time. However, I'm comfortable to call $12 as a medium-term - say, a 3-year price target - so $12 by mid-April 2026. They're one of the best run companies on the ASX that most people have not heard of.

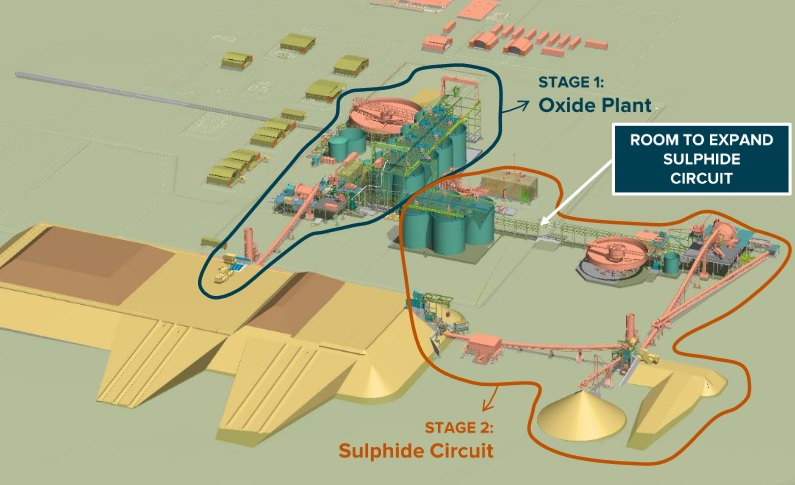

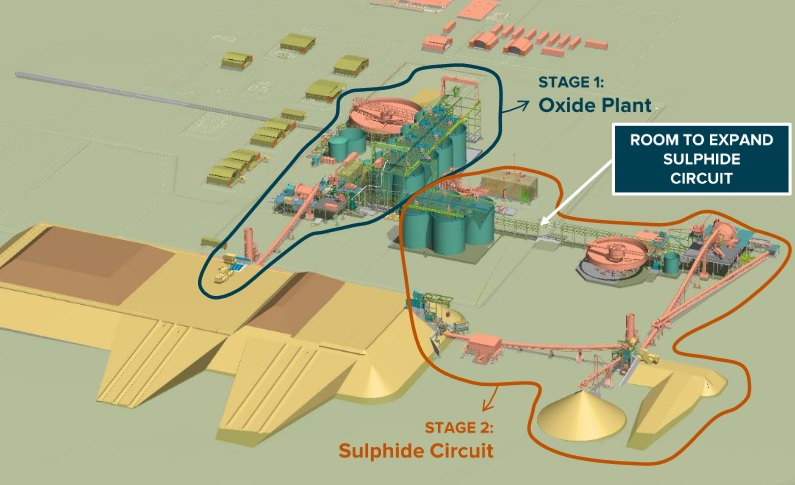

The rising gold price and sentiment around gold isn't going to do Lycopodium any harm, as designing, building and optimising gold processing plants is their bread-and-butter work. They do a lot of other stuff, but that has always been what they specialise in, and they are very good at working in some of the riskiest places around the globe without losing money. Risk management is definitely one of their biggest strengths and it enables them to correctly price and win work in areas where many others either fear to tread or just haven't got the requisite experience to enable them to operate there profitably. Lycopodium do NOT blow their own trumpet. They have a great track record of underpromising and overdelivering, so when they are as bullish as they are in this latest update, it's exciting stuff for their shareholders. And I'm definitely one of them.

In one of my portfolios which is an "income" generating portfolio where fully franked dividends are highly regarded (although not essential), LYL is currently my second largest position. GNG, a very similar company (they also design and construct gold plants) who mostly work here in Australia, are my 3rd largest position. I have a LIC, Sandon Capital (SNC) as my largest position in that portfolio currently, as they are trading at a good discount to their NTA, and they are going to continue to pay 5.5 cents per year in fully franked dividends for years to come, regardless of their own performance, because they have the profit reserve and the franking credits to do so. Their current profit reserve is 27 cents per share (cps) and they have 8.5 cps in franking credits available. They provide forward dividend guidance with every monthly update, and it always says that they intend to pay 2.75 cps for their next dividend, whether that be an interim or final dividend, and that's what they keep paying, 2.75 cps every 6 months, or 5.5 cps per year (p.a.), and they're trading at 64 cps with a before-tax NTA of circa 76 cps and an after-tax NTA of around 77.5 cps - see here: Net-Tangible-Assets-as-at-31-March-2023.PDF

The risk with SNC is that they're an activist fund, so they often buy into companies that I personally wouldn't go anywhere near, like Nuix (NXL), and SNC do have hits and misses, but overall they have a good longer-term track record of positive total shareholder returns (TSRs). Not for everybody, but I like them. SNC does the job it should in that particular portfolio. But they're not in my Strawman.com portfolio, whereas GNG and LYL both are, because with those two I expect both income from dividends AND from capital growth. It would make sense for GNG and LYL to merge actually, although it's possible that will never happen because each company has so much insider ownership and those insiders who own such large chunks of the company would probably prefer things to continue just as they are, rather than concede control to someone else.

Anyway, they often move at different speeds, and GNG is currently not doing anything while LYL is flying, and not so long ago those roles were reversed. I like it. Adds some excitement, in a good way, to what can sometimes be a reasonably boring portfolio.