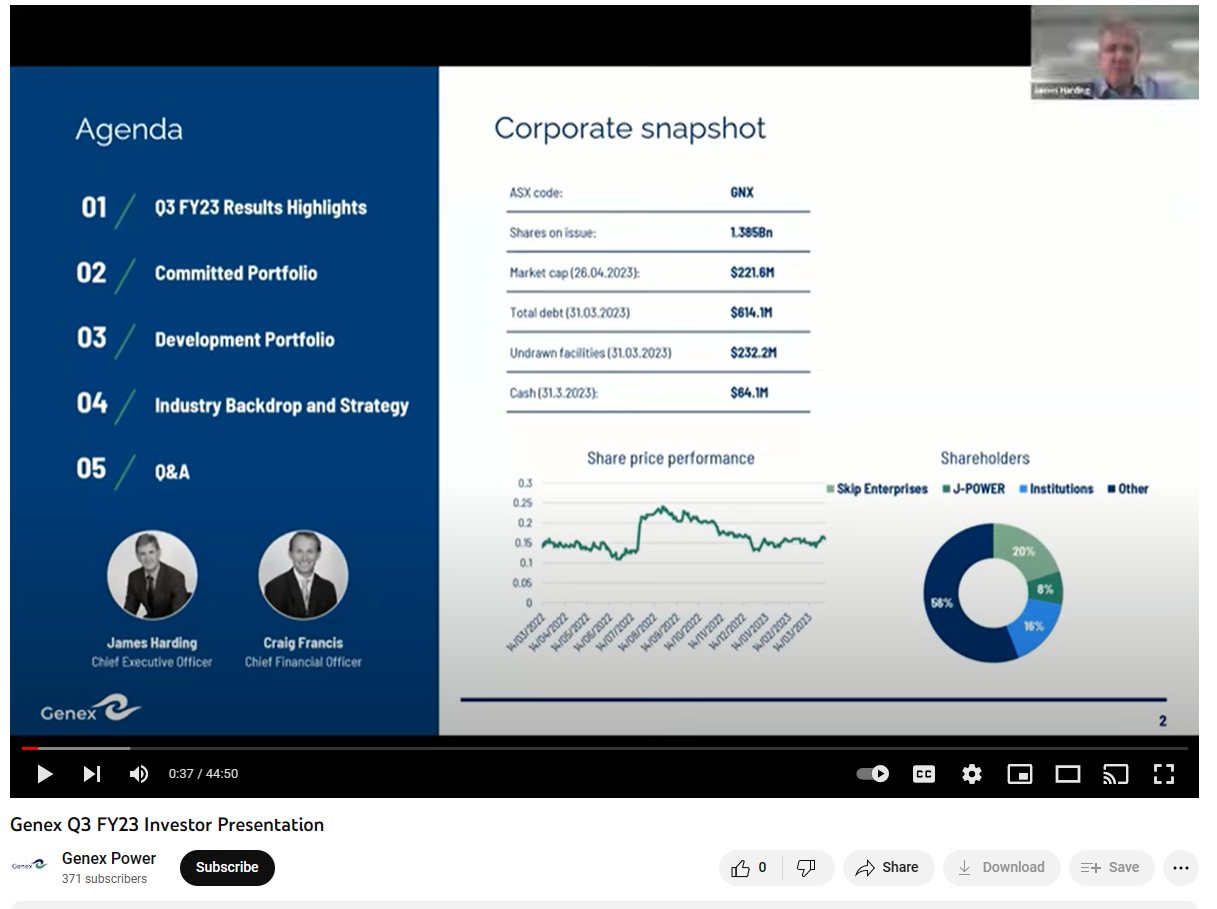

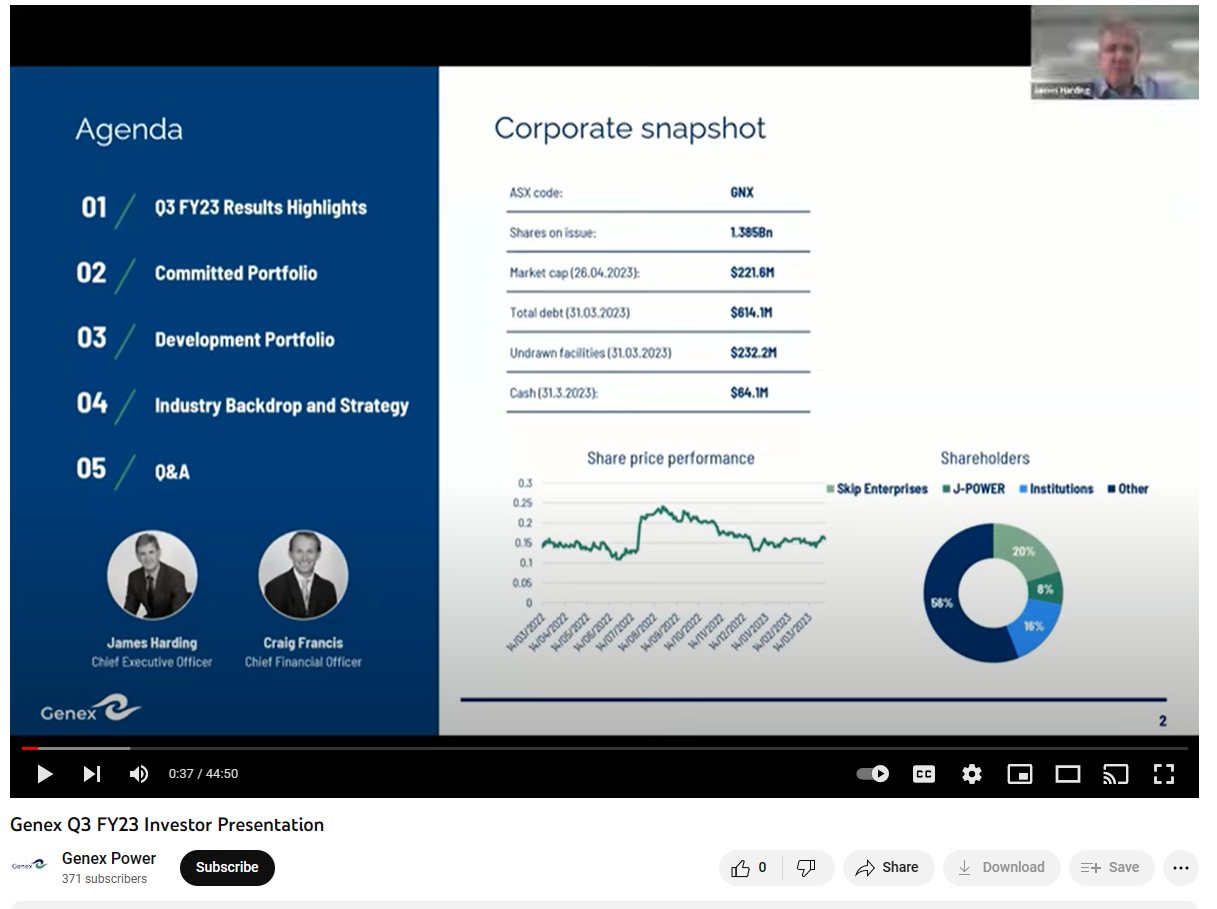

01-May-2023: As I explained in my recent #March '23 Qtr Results/Progress Straw for Genex (GNX) (that link takes you to my report on Genex, not that Straw, even though it should take you to the straw, but scroll down for a while and you'll find the straw eventually), there seemed to be a discrepancy between slide 2 of Genex's recent March 2023 Quarter Presentation (which was also used in their webinar last week) which stated that Skip Enterprises still holds 19.99% (circa 20%) of Genex...

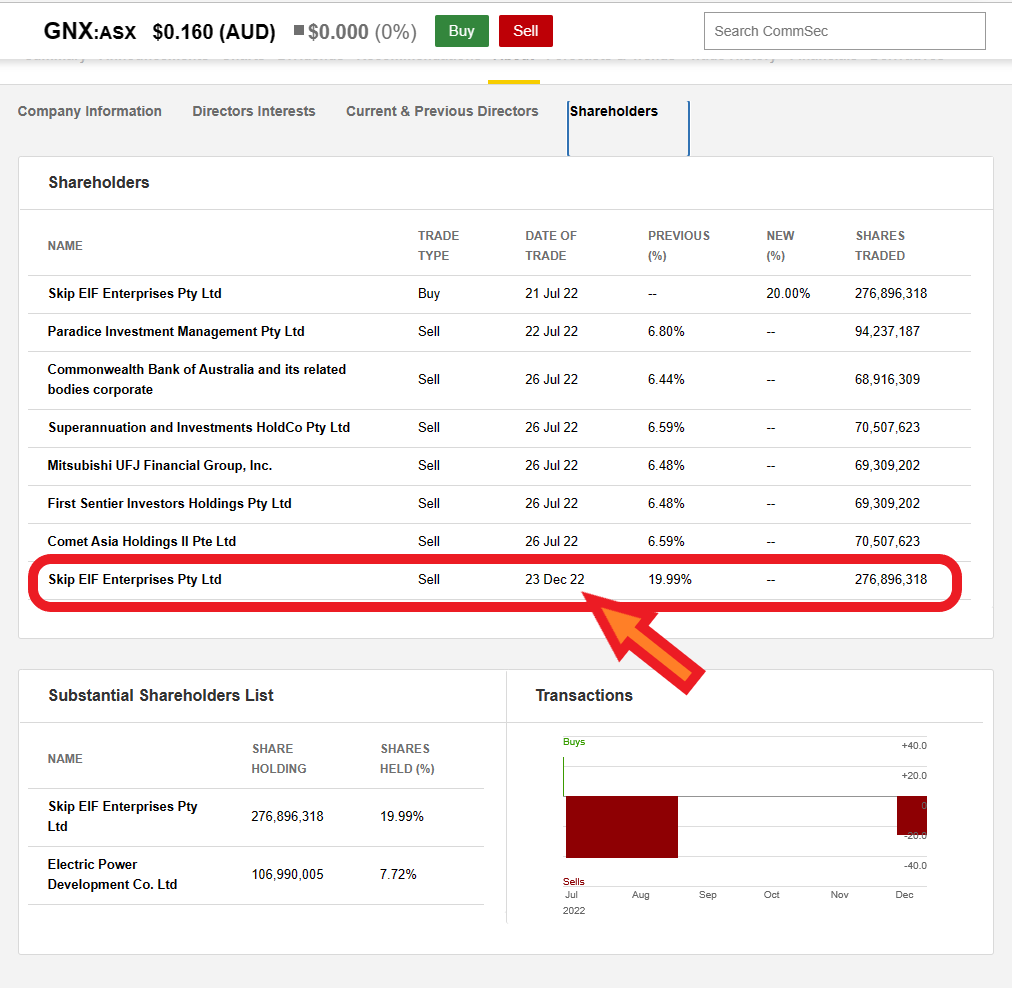

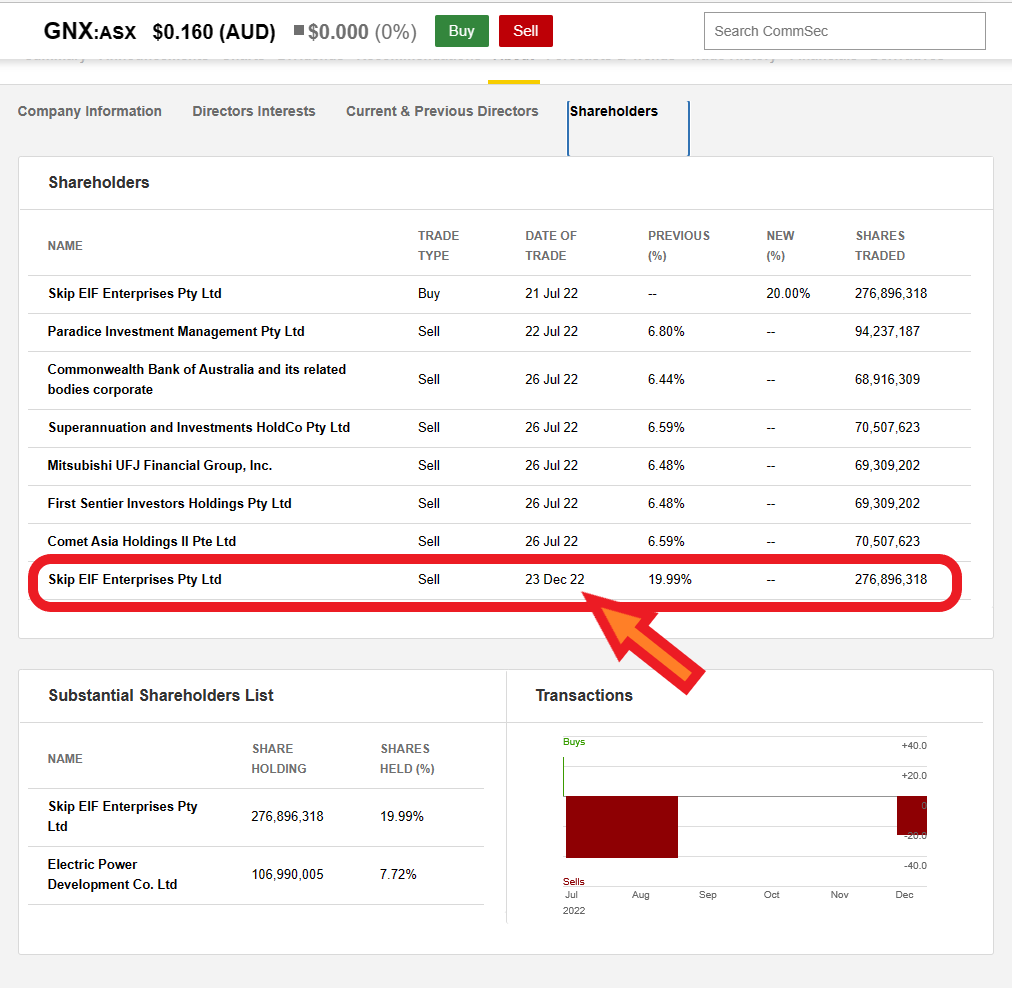

...and the list of substantial holder movements on Commsec which says the Skip ceased to be a "Sub" of Genex on 23-Dec-2022:

I emailed Genex on Sunday to query that, and I received a reply back this afternoon (Monday arvo) from Craig Francis, Genex's CFO (Chief Financial Officer), who explained that Skip do indeed still own 19.99% of Genex Power.

This is the timeline:

28-Feb-2022: Skip Enterprises lodged a "Notice of initial substantial holder" (Form 603) to say that they now owned 11.22% of Genex - see here: Becoming-a-substantial-holder-Skip-28Feb2022.PDF

25-July-2022: Skip Enterprises and Stonepeak Partners, as a consortium, lodged a "Notice of initial substantial holder" (Form 603) that said that Skip had increased their stake to 19.99% and that Stonepeak had an agreement with Skip (which was to takeover Genex at 23c/share, an offer they had just put to Genex - which Genex sunsequently refused to put to their shareholders due to the Genex Board considering the offer was too low and did not adequately value the company and its assets) and the Form 603 was in this case lodged by "The Consortium" (comprising Skip and Stonepeak). See here: Becoming-a-substantial-holder.PDF

23-December-2022: After withdrawing their offer, which they had by then raised to 25c/share, "The Consortium" lodged a Ceasing-to-be-a-substantial-holder---Stonepeak.PDF (Form 605) which stated that, "pursuant to the termination of the Co-operation and Process Agreement dated 21 July 2022", Stonepeak were no longer substantial shareholders of Genex.

Commsec mistakenly listed this as "Skip" instead of Stonepeak because Skip were mentioned in there, however Craig Francis (Genex's CFO) explained in his email to me today that Stonepeak had lodged the "Becoming..." notice (Form 603) on the 25th July because they had signed an agreement with Skip which effectively tied them to Skip's 19.99%, but that when that agreement was terminated in late December, Stonepeak were no longer tied to Skip's 19.99% so they lodged a "Ceasing..." notice (Form 605).

At no point did Skip sell down any of their 19.99%, it's just that Stonepeak no longer had an interest in that 19.99% so they lodged the Form 605 and Commsec mistakenly attributed that notice to Skip.

I've written here at length about Skip Infrastructure (a.k.a. Skip Enterprises), which was founded by and is owned and run by Atlassian co-founder and tech billionaire Scott Farquhar and his wife Kim Jackson (but mostly run by Kim Jackson it seems), and it's pleasing that while they walked away from that 25c/share takeover offer (that the Genex Board didn't seem too keen on anyway), they have maintained their stake in Genex, i.e. Skip still own a bee's whisker less than 20% of Genex (19.99%) and slide 2 of Genex's recent presentation was 100% correct on the day it was presented (and likely still is).

Note: if you click that "here" link to go to the Genex forum where I've talked about Skip, you'll need to scroll down a bit, until you see a photo of Kim Jackson sitting sideways on an uncomfortable looking high-back lounge in an underlit room with a gold coloured wall to her right (well to the right on the photo, which would be to her left), but anyway you'll know it when you see it - that's the start of one of my longer posts about Skip Capital (a.k.a. Skip Infrastructure or Skip Enterprises or Skip IEF Enterprises Pty Ltd) - it's all the same fund, run by the same two people.

Anyway, just thought I better set the record straight, as I'm sure I've mentioned somewhere that Skip dumped their Genex shares when they withdrew their 25c/share offer, and it turns out I was wrong about that; they didn't sell any of them.

I do not think this means that another offer (from Skip) is necessarily forthcoming, although one might be, but it does mean that Skip weren't scared enough by anything they uncovered during their DD (due diligence as part of the takeover offer process last year) to prompt them to sell out or even reduce their exposure to Genex. They still hold the same stake that they held then. A twist on that is that it's also a "blocking stake" in that nobody ELSE can takeover Genex unless Skip agrees to sell their Genex shares. But on balance I think it's positive.

Further Reading:

'It's the silent minority': Australia's $135 billion female entrepreneur gap (theage.com.au)

Skip Capital