Straws are discrete research notes that relate to a particular aspect of the company. Grouped under #hashtags, they are ranked by votes.

A good Straw offers a clear and concise perspective on the company and its prospects.

Please visit the forums tab for general discussion.

- Recent

- Votes

Genex Power (GNX) will to be removed from the ASX tonight after the recent shareholder meeting voted UP the scheme of acquisition whereby J-Power will acquire all of Genex Power (GNX) @ 27.5 cps.

16-July-2024: Proposed-Acquisition-by-J-Power---Results-of-Scheme-Meeting-16July-2024.PDF

19-July-2024: Acquisition-of-Genex-by-J-POWER---Court-approves-Scheme-19July2024.PDF

Today: 22-July-2024: Notice-of-withdrawal-of-takeover-offer.PDF

Today: 22-July-2024: Acquisition-of-Genex-by-J-POWER---Scheme-is-Effective.PDF

For clarity, there were two offers, both from Japanese renewable energy company J-Power:

- An off-market offer in the form of a scheme of arrangement (scheme) that was voted on at the meeting on the 16th that would pay 27.5 cps for every GNX share, but was subject to the scheme being voted UP at the meeting - which it was, and;

- A second on-market offer at the slightly lower price of 27 cps that was subject to the scheme being voted DOWN at the meeting, which it wasn't, so the second offer (at the lower price) is the offer that has been withdrawn. It never kicked in - it was just their back-up plan if the scheme was voted down.

Therefore, all GNX shareholders (other than J-Power) will receive the higher price of 27.5 cents per share from J-Power for their GNX shares, and GNX will be removed from the ASX tonight.

Genex's largest shareholders (prior to this acquisition) were Skip Capital (founded and owned by billionaire Atlassian co-founder Scott Farquhar and his wife Kim Jackson, but run by Kim, not Scott), which I have talked about here previously, and Skip were clearly happy enough to take the 27.5 cps.

So @Strawman - if there are any GNX holders here, you can close those positions out at $0.275 per share today.

I sold mine in June, both here and in my real money portfolio. Good profit in the end - worth the wait.

06-June-2024: Update-on-proposed-acquisition-of-Genex-by-J-POWER.PDF

Plus: Genex releases Transaction Booklet.PDF

I've cobbled together the following indicative timetable from that last announcement - which is 373 pages long by the way...

As with the Renesas takeover of Altium, this J-Power takeover of Genex is going to go through. The Japanese don't like to play games, like some people do (won't mention any countries in particular). Japanese firms tend to have longer term investment horizons that allow them to pay more upfront and avoid any bidding wars because nobody else is prepared to pay any more. In other words, bid high up front and get the thing done ASAP, and be happy that you've made a good purchase, even if the returns are going to take a little longer to flow through.

Although with FIRB and the shareholder meetings to vote on the scheme and everything, it still tends to take months to actually settle. As with the Altium acquisition by Renesas, this one will also settle in August, or if the scheme is voted up, possibly on the last day of July. If the scheme is voted down, J-Power will have that on-market T/O offer open at 27 cps (half a cent less than the 27.5 cps off-market offer being voted on at the scheme meeting on the 16th July) and the on-market offer would stay open until 14th August, unless extended.

Still no word on Skip Capital's intentions - they hold 19.99% of Genex and are the largest "Subs", with J-Power being the second largest (with 7.72%).

I hold both Genex and Altium, and both were purchased at significantly lower prices than where they're being acquired now, so happy enough with these outcomes. I hear people saying they wanted to hold some of these companies forever, but realistically we rarely get the chance to hold a company for decades - there is just too much M&A that goes on. It's part of the game and in this case, both companies are being taken out at a fair price, so I'm not unhappy.

04-March-2024: Genex-receives-NBIO-from-J-POWER.PDF

GNX is up +32.4% (to 24.5 cps) at this point today, however they've been as high as 25.5 cps this morning, which was +37.8% above their 18.5 cps close yesterday. This non-binding, indicative and conditional proposal from Electric Power Development Co., Ltd. of Japan (J-POWER) to acquire all of the ordinary shares on issue in Genex that J-POWER and its associates do not already own (by way of a members’ scheme of arrangement) is priced at A$0.275 in cash per Genex Share, and also contains an alternative structure, under which J-POWER will potentially also, concurrently with the Potential Scheme, make an off-market takeover bid for all of the Genex Shares for A$0.270 in cash per Genex Share.

The Scheme Consideration of 27.5 cps cash per Genex Share represents a:

- 49% premium to the last closing price of Genex Shares on the ASX of $0.185 (as at 1 March 2024, being the last trading day on the ASX before the date of this announcement);

- 56% premium to the 1-month (to and including) 1 March 2024 volume weighted average price (VWAP) of Genex Shares of $0.176;

- 58% premium to the 3-month VWAP of Genex Shares of $0.174; and

- 65% premium to the 6-month VWAP of Genex Shares of $0.166.

The first 4 pages of today's announcement are reproduced below. For the full announcement, click on the link at the top of this straw.

The remainder of the announcement can be viewed here: Genex-receives-NBIO-from-J-POWER.PDF

Genex has rejected takeover proposals in prior years, from Skip Capital and also from a consortium that included Skip Capital and others, and Skip Capital still owns 19.99% of Genex today. Japanese company J-Power has plans to get around that supposed blocking stake by Skip (explained below).

Skip Capital was founded by and is run by Atlassian co-founder Scott Farquhar and his wife Kim Jackson (pictured below), and they recently teamed up with private equity giant KKR to acquire Queensland Airports - see here: KKR teams up with Skip Capital for Queensland Airports; vets EastLink (afr.com)

The IBC (independent Board committee, so the Genex Board minus J-POWER’s representative and nominee to the Genex Board, Kenichi Seshimo) intends to recommend the transaction to Genex Power (GNX) shareholders - see pages 3 and 4 of today's announcement - reproduced above.

In this AFR article published today: J-Power taps MacCap, Minters to Skip-proof Genex Power bid (afr.com), they say this:

Genex Power’s 7.72% shareholder J-Power and its bankers at Macquarie Capital have baked in two safeguards in their Monday morning bid to combat Skip Capital’s 19.99% stake.

While J-Power stopped short of naming Scott Farquhar’s Skip Capital as the reason, it’s clear that’s what its advisers were thinking of when they rebooted the dual-track bid structure seen at Azure Minerals late last year.

Skip EIF Enterprises Pty Ltd owns 19.99% of Genex and in 2022, lobbed a bid to buy it for 25¢ a share with Stonepeak Partners before walking away. Of note, it hasn’t yet committed its stake to supporting J-Power’s bid.

The second set of safeguards – no talk, no shop, no DD – is much more customary. But Genex’s ASX announcement called out Skip and related entities as parties with whom interaction is prohibited during the four-week exclusive due diligence.

To be clear, there’s no suggestion Skip or another interloper is about to hit back with a competing proposal, but J-Power is watching its back. It’s already a 50% partner in Genex’s Kidston Stage 3 Wind and Bulli Creek projects and provided it with a $35 million loan facility last year.

As for Skip, it would be interesting to see what it does with its 19.99% stake. Selling into J-Power’s bid should get some tongues wagging on the Atlassian co-founder’s ambitions to support energy transition.

“We have been a supportive shareholder of Genex, and we believe that long-term, private capital can help the company reach its full potential,” Kim Jackson said at the time.

Goldman Sachs is advising Genex.

-- ends ---

Source: https://www.afr.com/street-talk/j-power-taps-maccap-minters-to-skip-proof-genex-power-bid-20240304-p5f9jg

[by Sarah Thompson, Kanika Sood and Emma Rapaport, Mar 4, 2024 – 12.12pm]

Genex is building the Kidston Clean Energy Hub on the site of the old Kidston gold mine.

---

Further Reading: Why Scott Farquhar, Kim Jackson want to take Genex Power private (afr.com) [25-July-2022]

This is an interesting development today, and it's looking like a change of control transaction IS going to occur this time. I had expected Genex to get taken out at some point by a larger player, so this does not come as a surprise to me. I would have liked a higher price however, but a profit is still a profit.

30-Jan-2024: GNX-Quarterly-ActivitiesAppendix-4C-Cash-Flow-Report.PDF

Plus GNX-Appointment-of-PCL-as-Preferred-EPC-Contractor-for-BCS.PDF

Genex Power are the quiet achievers, steadily building out a decent portfolio of renewable energy generation and storage assets across the eastern states of Australia. I hold GNX shares and while their share price trajectory has not been stellar lately, the company itself is still doing its thing, which takes time, but it's happening, and the M&A interest will come again, sooner or later.

Disclosure: I hold GNX shares.

12-Dec-2023: Comprehensive construction update on Genex's Kidston Pumped Storage Hydro (K2H) Project – K2H---Construction-Update.PDF - with photos - for those who are insterested. On track for energisation in 2H CY2024. [I hold GNX]

08-Dec-2023: Genex-secures-long-term-offtake-with-Stanwell-for-258MW-K3W.PDF

Genex Power (which I hold) has announced today that they've signed a 15-year power purchase agreement with Stanwell Corporation for the 258MW Kidston Stage 3 Wind Project (K3W) to be built at Kidston alongside the Kidston Stage 2 pumped-Hydro project currently under construction (K2H). Stage 1, the Kidston Solar Project (K1S) was the first phase in the development of the Kidston Renewable Energy Hub, providing approximately 145,000 megawatt hours of renewable electricity each year to the nine million Australian residents connected to the National Electricity Market (NEM). See image below.

The offtake agreement announced today for K3W covers 50% of the project generation capacity at a fixed price over the 15-year term and underpins the K3W project financing structure and confirms K3W as the next stage of the Kidston Clean Energy Hub.

K1S

The K2H upper and lower reservoirs in the foreground (at Kidston) with K1S (solar farm) behind it.

See also: Genex lands 10-year supply contract for huge Kidston wind project | RenewEconomy [20-Oct-2023]

Excerpt from that October announcement:

Listed renewable and storage developer Genex Power has landed a 10-year power purchase deal with utility giant EnergyAustralia for its proposed 258MW wind project in a major boost for its Kidston green energy hub in Queensland.

The deal means that the Kidston project will combine an existing solar farm (50MW), the 250 MW, eight hour pumped hydro storage now being built at Kidston’s disused open pit coal mine, and a new wind project. An expanded solar facility may still follow.

The deal between Genex and EnergyAustralia will account for around 30 per cent of the proposed output from Kidston Wind, which is jointly owned by Genex and its Japanese partner J-Power.

It continues a successful string of deals for Genex, which recently signed up aspiring green hydrogen producer Fortescue as the foundation customer for the first 450 MW solar stage of the huge 2GW Bulli Creek project in southern Queensland.

EnergyAustralia also has the operating rights for the Kidston pumped hydro project and will pay a fixed price for the output of the Kidston wind component, which will form part of its “firmed” renewables supply for customers.

EnergyAustralia CEO Mark Collette says the deal will bring the company closer to its goal of having up to 3GW of renewable energy capacity in operation by 2030. It is due to close its Yallourn brown coal power generator in Victoria in 2027.

"Both Kidston Wind and the Kidston Pumped Storage Hydro Project are important steps in delivering EnergyAustralia’s purpose to lead and accelerate the clean energy transformation for all,” Collette said in a statement.

Genex, meanwhile, is looking for more customers for the Kidston wind project and hopes to reach financial close in late 2024, with generation to begin in 2026. [Bear77 note: Today's announcement - see above - secures an additional 50% offtake, so they now have offtake agreements for 80% of K3W.]

CEO Craig Francis said the deal with EnergyAustralia is a significant milestone for the clean energy hub at Kidston, and a “material step” in mitigating project risk.

Francis told RenewEconomy that the wind project, to be located on pastoral leases less than 20kms from the Kidston mine, would help fill in new capacity from the new transmission link being built at the site.

He said the report into the recent fire in a Tesla Megapack module at the new Bouldercombe battery near Rockhampton is still being finalised, but the company is still hopeful to complete commissioning by the end of the month.

Giles Parkinson is founder and editor of Renew Economy, and is also the founder of One Step Off The Grid and founder/editor of the EV-focused The Driven. Giles has been a journalist for 40 years and is a former business and deputy editor of the Australian Financial Review.

---

Disc: I hold GNX shares both here and in my largest real money portfolio.

30-June-2023: Funding-Package-and-JDA-Agreed-with-J-POWER.PDF

Positive. It is a good move to replenish the contingency for the 250MW/2,000MWh Kidston Pumped Storage Hydro Project (K2-Hydro), which was depleted after the tunnel flooding ("water ingress event") that Genex reported back in November. These funds will also be used to progress the development of the multi-stage up-to-2GW Bulli Creek Solar and Battery Project (BCP) and for general working capital.

The source of this latest funding package, J-Power, a leading Japanese renewable energy infrastructure development company, already own 7.72% of Genex (GNX), making them Genex's second largest shareholder, after Skip EIF Enterprises Pty Ltd, which is part of Skip Capital, the private investment fund (that specialises in technology and infrastructure) that was founded by (and is run by) Kim Jackson and her husband Scott Farquhar, the co-founder and co-CEO of Atlassian (NASDAQ-listed Australian success story). They are billionaires (see here: Scott Farquhar (forbes.com)) and are both passionate about clean energy generation, having already tried to buy all of Genex at 23 cps (cents per share) in July last year (2022) before upping their offer to 25 cps in August, and then walking away without a deal. The Genex SP (share price) has since been down to 11 cps intra-day (on Dec. 28th) and closed as low as 13 cps. However Skip still retain their 19.99% position in Genex, and are still Genex's largest shareholders.

The market seemed unconcerned and unimpressed by today's funding and JDA agreement announcement from Genex, as their SP closed flat, at 15 cps, same as yesterday and Wednesday.

See the full announcement (link at the top of this straw) for full details of the new funding from, and the JDA (Joint Development Agreement) with, J-Power.

While they certainly have a number of other renewable energy generation and storage assets/projects in various stages of development - as well as two operating solar farms that are generating income already - a great deal of Genex's future succcess depends on the timely completion and energisation of K2-Hydro on schedule next year (CY 2024). Replenishing the depleted contingency funds for K2-Hydro is a smart move.

Genex CEO James Harding said in today's announcement:

“Today’s structured funding package totalling $44.5 million demonstrates the deepening of an already strong relationship between Genex and J-POWER.

“While the costs of the water ingress event at the Kidston Pumped Storage Hydro Project last year have been fully funded, we consider it prudent that additional funding is secured against any further unforeseen events during the balance of the construction program. The Loan Facility with J-POWER gives us significant buffer to complete the construction of the project and provides a non-dilutionary, cost-efficient means of securing this funding.

“In addition to the Loan Facility, the Joint Development Agreement for the Bulli Creek Project will allow us to fast-track development activities at this exciting project, which represents the next phase in the Company’s growth. Given the scale at Bulli Creek, we are pleased to welcome J-POWER as our co-development partner which will not only provide important development funding, but also de-risk the equity financing of each stage of the project through bringing significant power sector capability and balance sheet strength to the partnership.

“This funding will be instrumental in fuelling the growth of our renewable energy portfolio in Australia. On behalf of Genex, I would like to thank J-POWER for their continued support of the Company and its strategy. This collaboration reaffirms our commitment to expanding the reach of sustainable energy generation and storage assets, and together we will continue to focus on leading Australia’s transition to a clean energy future.”

Disclosure: I hold Genex (GNX) shares both here and IRL. I'm happy with this announcement.

Further Reading/Viewing:

[Click on images below to read more]

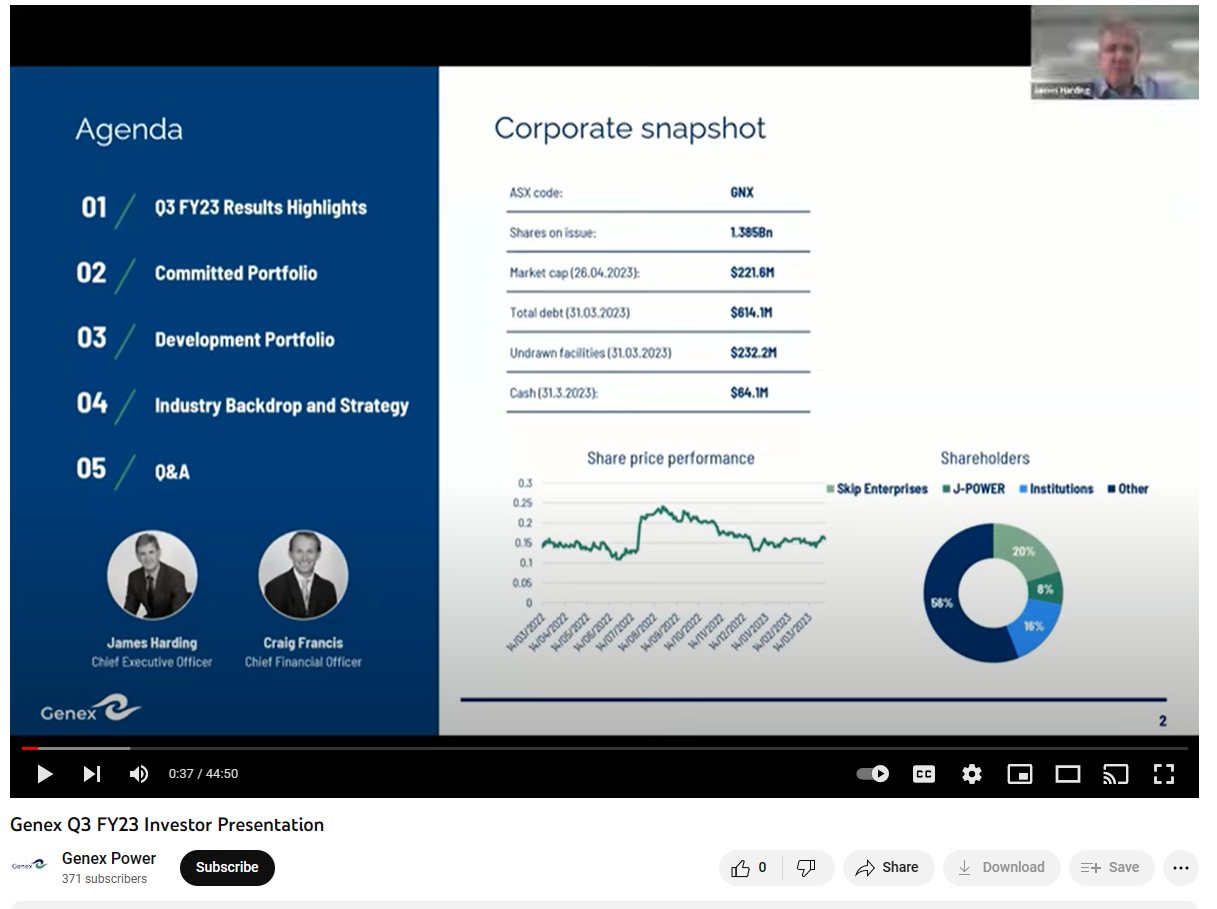

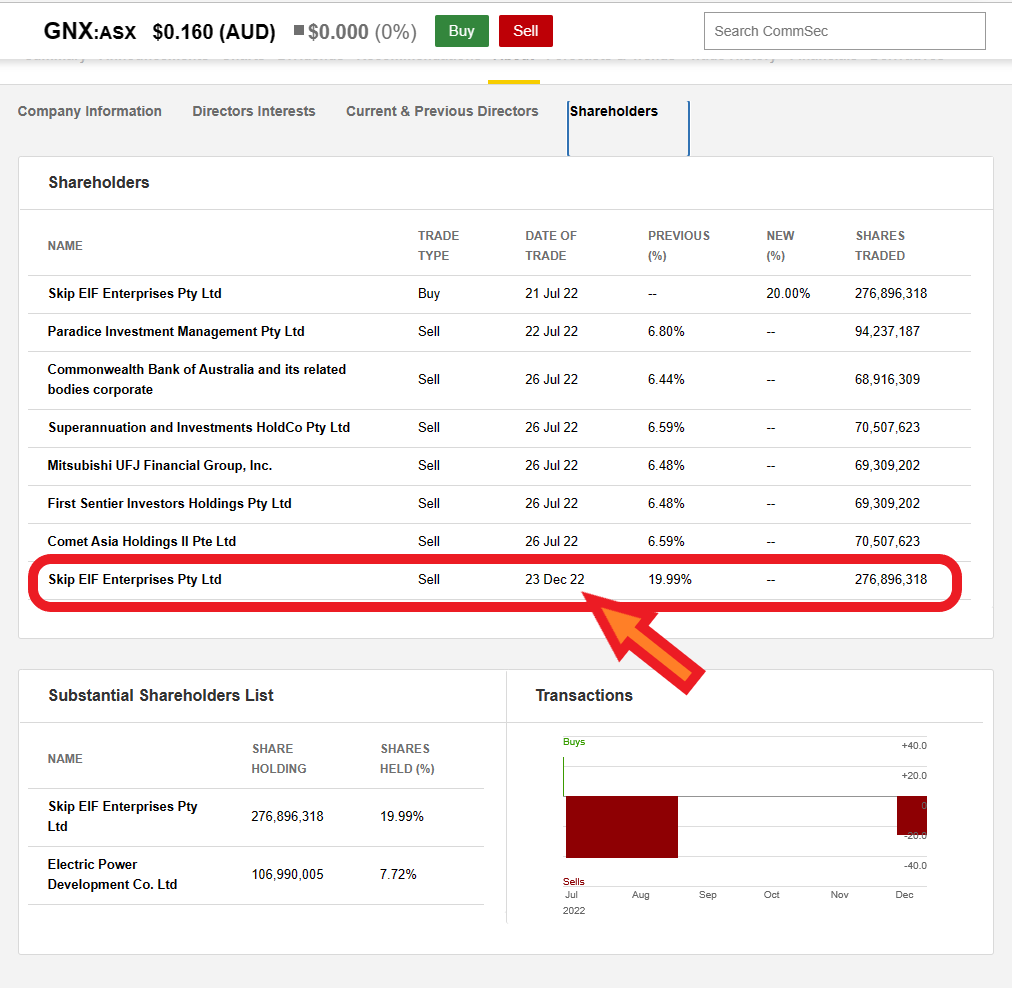

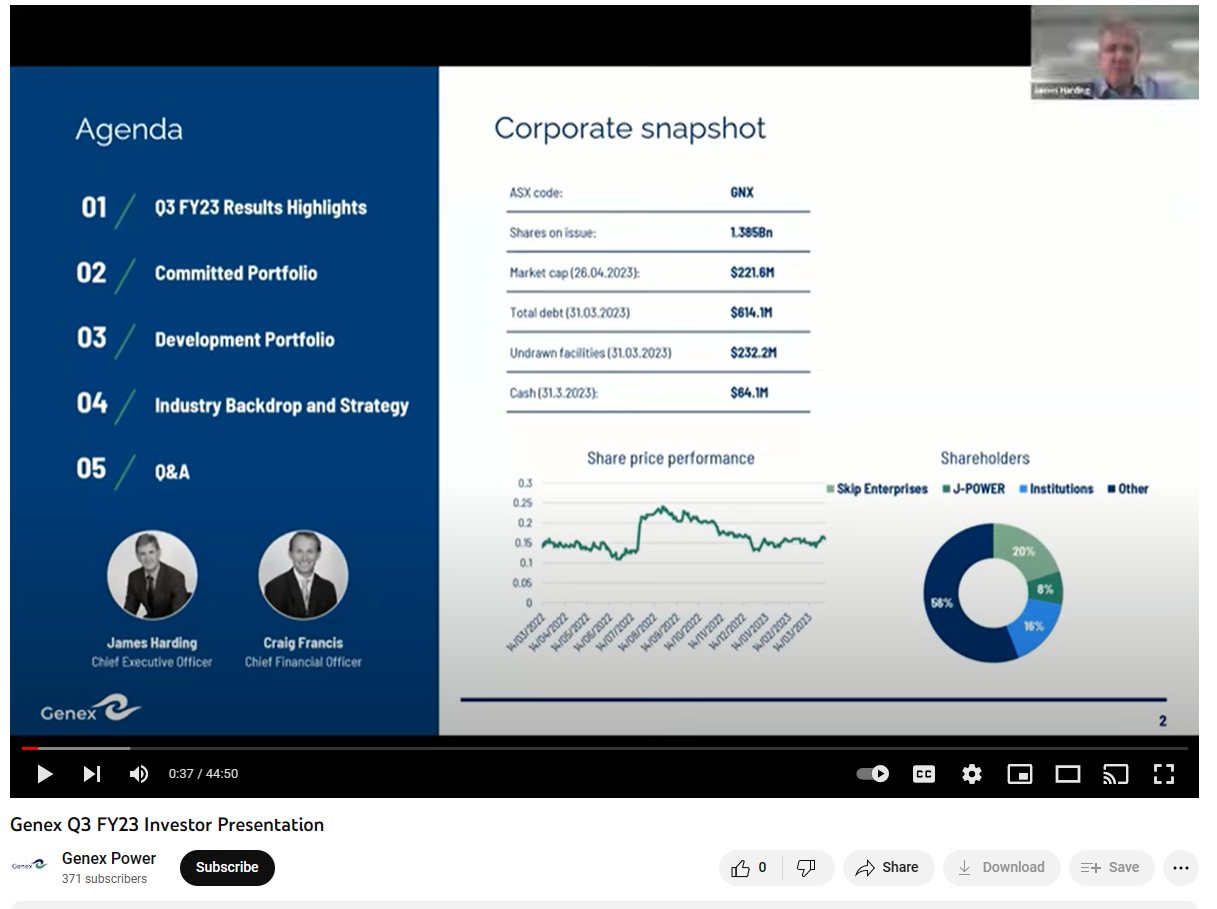

01-May-2023: As I explained in my recent #March '23 Qtr Results/Progress Straw for Genex (GNX) (that link takes you to my report on Genex, not that Straw, even though it should take you to the straw, but scroll down for a while and you'll find the straw eventually), there seemed to be a discrepancy between slide 2 of Genex's recent March 2023 Quarter Presentation (which was also used in their webinar last week) which stated that Skip Enterprises still holds 19.99% (circa 20%) of Genex...

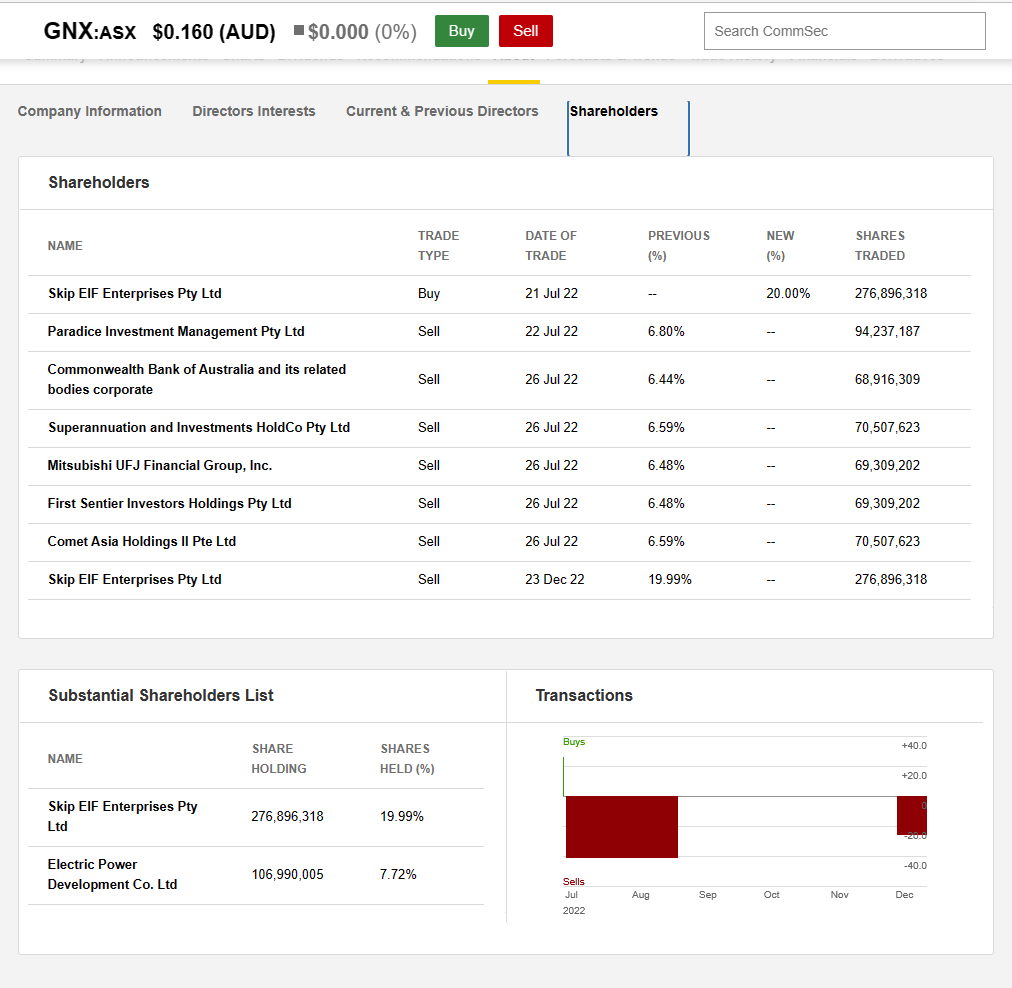

...and the list of substantial holder movements on Commsec which says the Skip ceased to be a "Sub" of Genex on 23-Dec-2022:

I emailed Genex on Sunday to query that, and I received a reply back this afternoon (Monday arvo) from Craig Francis, Genex's CFO (Chief Financial Officer), who explained that Skip do indeed still own 19.99% of Genex Power.

This is the timeline:

28-Feb-2022: Skip Enterprises lodged a "Notice of initial substantial holder" (Form 603) to say that they now owned 11.22% of Genex - see here: Becoming-a-substantial-holder-Skip-28Feb2022.PDF

25-July-2022: Skip Enterprises and Stonepeak Partners, as a consortium, lodged a "Notice of initial substantial holder" (Form 603) that said that Skip had increased their stake to 19.99% and that Stonepeak had an agreement with Skip (which was to takeover Genex at 23c/share, an offer they had just put to Genex - which Genex sunsequently refused to put to their shareholders due to the Genex Board considering the offer was too low and did not adequately value the company and its assets) and the Form 603 was in this case lodged by "The Consortium" (comprising Skip and Stonepeak). See here: Becoming-a-substantial-holder.PDF

23-December-2022: After withdrawing their offer, which they had by then raised to 25c/share, "The Consortium" lodged a Ceasing-to-be-a-substantial-holder---Stonepeak.PDF (Form 605) which stated that, "pursuant to the termination of the Co-operation and Process Agreement dated 21 July 2022", Stonepeak were no longer substantial shareholders of Genex.

Commsec mistakenly listed this as "Skip" instead of Stonepeak because Skip were mentioned in there, however Craig Francis (Genex's CFO) explained in his email to me today that Stonepeak had lodged the "Becoming..." notice (Form 603) on the 25th July because they had signed an agreement with Skip which effectively tied them to Skip's 19.99%, but that when that agreement was terminated in late December, Stonepeak were no longer tied to Skip's 19.99% so they lodged a "Ceasing..." notice (Form 605).

At no point did Skip sell down any of their 19.99%, it's just that Stonepeak no longer had an interest in that 19.99% so they lodged the Form 605 and Commsec mistakenly attributed that notice to Skip.

I've written here at length about Skip Infrastructure (a.k.a. Skip Enterprises), which was founded by and is owned and run by Atlassian co-founder and tech billionaire Scott Farquhar and his wife Kim Jackson (but mostly run by Kim Jackson it seems), and it's pleasing that while they walked away from that 25c/share takeover offer (that the Genex Board didn't seem too keen on anyway), they have maintained their stake in Genex, i.e. Skip still own a bee's whisker less than 20% of Genex (19.99%) and slide 2 of Genex's recent presentation was 100% correct on the day it was presented (and likely still is).

Note: if you click that "here" link to go to the Genex forum where I've talked about Skip, you'll need to scroll down a bit, until you see a photo of Kim Jackson sitting sideways on an uncomfortable looking high-back lounge in an underlit room with a gold coloured wall to her right (well to the right on the photo, which would be to her left), but anyway you'll know it when you see it - that's the start of one of my longer posts about Skip Capital (a.k.a. Skip Infrastructure or Skip Enterprises or Skip IEF Enterprises Pty Ltd) - it's all the same fund, run by the same two people.

Anyway, just thought I better set the record straight, as I'm sure I've mentioned somewhere that Skip dumped their Genex shares when they withdrew their 25c/share offer, and it turns out I was wrong about that; they didn't sell any of them.

I do not think this means that another offer (from Skip) is necessarily forthcoming, although one might be, but it does mean that Skip weren't scared enough by anything they uncovered during their DD (due diligence as part of the takeover offer process last year) to prompt them to sell out or even reduce their exposure to Genex. They still hold the same stake that they held then. A twist on that is that it's also a "blocking stake" in that nobody ELSE can takeover Genex unless Skip agrees to sell their Genex shares. But on balance I think it's positive.

Further Reading:

'It's the silent minority': Australia's $135 billion female entrepreneur gap (theage.com.au)

30-April-2023: Catching up on a few quarterly reports and other announcements during the past two weeks, and the report from Genex is a good one I reckon.

GNX-Quarterly-ActivitiesAppendix-4C-Cash-Flow-Report.PDF

They released that back on the 20th April, and on the 27th (Thursday), they released this:

GNX-Q3-FY23-Investor-Presentation.PDF

And here's the video of the Results Webinar:

Genex Q3 FY23 Investor Presentation - YouTube

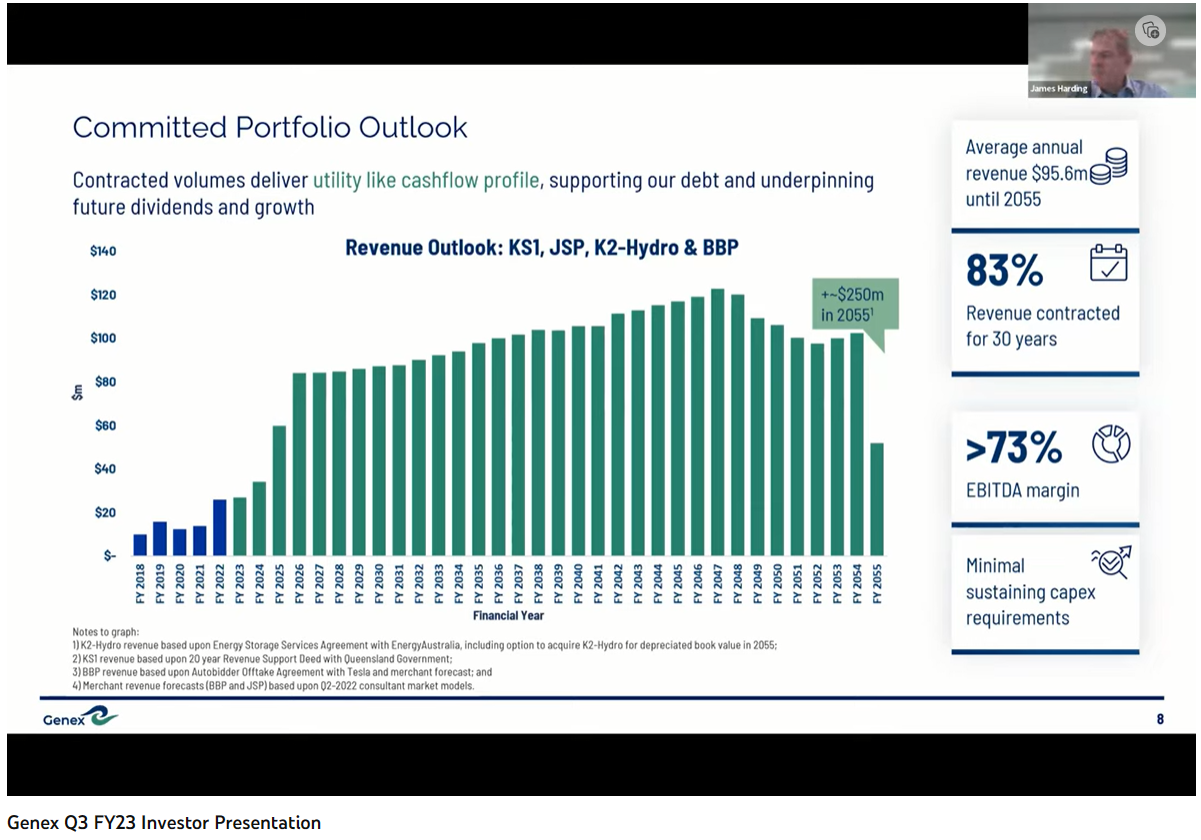

Slide 8 was the most interesting from my point of view, as they are giving details of expected cashflows over the next 32 years (through to 2055) based on their current portfolio of assets:

That's an average annual revenue of $95.6m, 83% of which is already contracted for the next 30 years, and an EBITDA margin of over 73%.

And it's all green/renewable energy production and storage assets that are producing this revenue.

There is plenty more in there, including the Q&A at the end, but this slide is a stand-out for me, in terms of quantifying the future value of the company vs. the current low share price.

Another thing that did peak my interest me was slide 1 which lists Skip Enterprises (which I assume is part of Skip Capital) as owning 20% of the company.

You might remember that Skip Capital (owned by Atlassian co-founder and tech billionaire Scott Farquhar and his wife Kim Jackson, and run by Kim Jackson) partnered with Stonepeak to bid 23c/share for Genex last year, a bid they then raised to 25c before walking away, and Commsec listed Skip as ceasing to be substantial holders of Genex on December 23rd, as shown below.

The "Substantial Shareholders List" in the bottom left corner there is taken from their FY22 Annual Report, however the subsequent trades are listed above that, and the last of those shows Skip selling 276,896,318 Genex shares and going from 19.99% to "--" and "--" can mean anything from 0% to 4.99%. 5% is the minimum threshold for substantial shareholders and anything below 5% is not required to be reported, unless you're a company director of that company (on their Board).

I'll flick them an email tomorrow and ask for some clarification on that.

Anyway, other than the shareholders piechart on slide 1, which may or may not be out-of-date, it's a good presentation I reckon.

They have just strung 4 quarters together of being cashflow positive too, so they're certainly moving in the right direction now that the tunnel boring issues at K2H (Kidston Pumped Hydro) have been fully resolved and the construction is fully back on track and the minor issues at their two operating solar farms have also been fully resolved.

Disclosure: I hold Genex shares both here and IRL.

01-Aug-2022: As I hoped and expected, the Genex Board has considered the proposal and has "unanimously concluded that the Indicative Proposal undervalues Genex and, therefore, is not in the best interests of the holders of Genex Shares (Genex Shareholders) as a whole. Accordingly, the Board is not prepared to grant the access to due diligence requested by the Consortium on the basis of the Indicative Proposal.

However, the Board is willing to engage constructively with the Consortium to explore whether the Consortium can submit a revised proposal that is capable of being recommended to Genex Shareholders by the Board. The Board has advised the Consortium that it is prepared to provide the Consortium with certain limited due diligence information (on a non-exclusive basis and subject to the Consortium entering into a confidentiality agreement containing suitable protections for Genex) to assist the Consortium to develop such a revised proposal.

Genex notes that there is no certainty that the provision of this limited due diligence information to the Consortium (if it occurs) will result in the Consortium providing a revised proposal to the Board that is capable of being recommended to Genex Shareholders or that the Potential Transaction (or any other transaction in relation to Genex and the Consortium) will proceed.

Irrespective of whether the Consortium provides a revised proposal, the Board believes Genex has a highly attractive future as a dedicated renewable energy and storage company having regard to the following:

- Genex’s diverse portfolio of more than $1bn of renewable energy generation and storage assets across Australia, including the first pumped storage hydro project to be developed in Australia in over 40 years;

- Genex is unique as the only pure play renewable energy and storage company listed on the ASX;

- Genex’s 100MW of existing operating solar projects which are benefiting from current elevated pricing in the National Electricity Market;

- Genex’s 300MW of fully funded storage projects currently under construction which are poised to benefit from the accelerating energy transition; and

- Genex’s significant pipeline of renewable energy and storage growth opportunities and proven track record of execution and delivery.

Genex Shareholders do not need to take any action in relation to the Indicative Proposal or the Potential Transaction. Genex will continue to keep Genex Shareholders informed about the Potential Transaction in accordance with its continuous disclosure obligations.

Genex is being advised by Goldman Sachs and Gilbert + Tobin in relation to the Potential Transaction."

As a Genex shareholder, I agree they're worth more than 23c/share.

You can read today's entire announcement here: Response-to-Non-Binding-Indicative-Proposal.PDF

27-July-2022. OK, firstly a shout-out to @TEPCapital for his straw on this takeover offer for Genex Power (GNX) at 23cps (cents per share). You can read that straw here.

I returned from our road trip last night, so have been mostly "offline" for the past 5 days. I hold GNX shares, and I believe the Genex Board will announce shortly that they believe this offer significantly undervalues the company and it's future prospects and they will recommend shareholders take no action in relation to the offer.

I'm in the green at 23cps, and could simply take that money and rotate it into another investment, but I do think they're worth more than that. I note that Genex informed the market of this offer on Monday morning, then released this Q4 FY 22 Investor Presentation Update on Tuesday which clearly highlights their potential. I think that helps explain why they're about to say the offer is too low, despite being a good deal higher than where Genex have been trading lately.

As @TEPCapital said in his straw, "Over the past decade, the 10+ listed ASX renewables plays have gradually been de-listed over time due to takeover offers and M&A, so this has been an ongoing theme. Today, there are really only 2 pure-play ASX renewables companies left and Genex is the absolute standout."

Agree 100%.

In Monday's Receipt of Non-Binding Indicative Proposal announcement, Genex said about the members of the bidding consortium, "SEIF, part of Skip Capital, is a long-term, Australian investor in future-aware infrastructure and now holds 19.99% of the Genex Shares. Stonepeak is a global alternative investment firm specialising in infrastructure and real assets with an extensive portfolio of energy and renewables assets and a dedicated renewables investment fund."

It's worth noting that SEIF owned virtually 20% of GNX before the offer, and can go over 20% now that they've launched their offer. That could certainly frustrate any other potential bidder, so might reduce the chance of someone else coming over the top with a higher bid, although based on the M&A history in the sector (both on the ASX and the NSX), I think there could easily still be a bidding war now that Genex is "in play".

"The Indicative Proposal is expressed to be subject to a number of conditions, including, but not limited to the satisfactory completion of the Consortium’s due diligence, the receipt of all necessary internal approvals, the unanimous recommendation of the Genex Board, and the execution of binding transaction documents to give effect to the Potential Transaction. The Indicative Proposal also states that implementation of the Potential Transaction will be subject to the approval of the Foreign Investment Review Board (FIRB)."

So this is far from a done deal and could easily fall over, particularly if the Genex Board do what I expect them to do and recommend that shareholders ignore this offer.

I am not selling. IMHO, 23cps for Genex is too low.

On the other hand, MACA (MLD), another company I hold received a takeover offer priced at $1.025/share (announced yesterday) from Thiess, who have already done their DD, and the offer is fully supported by the MACA board who are unanimously recommending that MACA shareholders accept the offer. MACA is trading at between 99cps and $1/share today, which is probably too low when this deal has very little chance of falling over. There are very few conditions that need to be satisfied and all the hard work (including getting the MACA Board onside) is already done.

However, like with the Genex takeover offer, any dividend declared by the company will reduce the amount of the takeover offer by the same amount. Genex won't be declaring any dividends, but I think MACA (MLD) will, and I think it's likely to be at least 2.5c once again, as they have been paying every 6 months for a few years now. If MACA declare a 2.5cps FF (fully franked) div in August, Thiess will reduce their offer price from $1.025 to $1.00, however the dividend would come with around 1c worth of franking credits, so that would mean that for those people who can make full use of those franking credits (and not everyone can I know) the amount received would be in the order of $1.035. I'm happy to sell my MACA shares at pretty much any price over $1/share, particularly when their latest MD and CEO (Mike Sutton, who was ex-Downer Mining) finished up 5 days ago (on 22nd July) and a new guy (an internal appointment) has just taken over. MACA's metrics have mostly gone backwards over recent years, so they are certainly not one of the best mining services companies out there at this point. And I'm happy to let them go at $1.01 to $1.035, but I'll likely wait for their results and their dividend to be declared before making a decision because I think the chance of that particular takeover deal falling over is pretty slim. There is also far less of a chance of a higher offer coming through than there is with Genex. There is a chance, but I wouldn't rate it as a big chance by any means.

Genex on the other hand has assets that PE (Private Equity), super funds, and other funds would like to get their hands on, and the options in the stock-exchange-listed renewable energy generation and storage space (in the Australian region) are reducing, so there will likely be further interest IMO.

No need to take any action at this point I reckon.

I need to go on holidays more often!

16-July-2021: Noosa Mining Conference Presentation

plus: Links to Reports on GNX by Intelligent Investor, Euroz, Canaccord Genuity, Ord Minnett and Morgans

Disclosure: I hold Genex Power (GNX) shares.

Edit: Link to broker reports fixed.

22-Dec-2020: Kidston Hydro Project - Genex Final Investment Decision (FID)

23-Dec-2020: Commencement of Early Works Program at Kidston Hydro Project

No movement yesterday (22-Dec), but GNX rose +12.82% today (23-Dec) on the back of this (from 19.5cps to 22cps, i.e. +2.5 cents). They briefly traded as high as 28cps in early August before raising capital at 22cps. I am not a GNX shareholder, but they're on my watchlist. I currently have similar exposure (to renewable/sustainable energy production such as hydro and wind power) through IFT - Infratil.

29-Oct-2021: Update: I bought a GNX position in April (2021) - in two tranches - @ 20.25 cps and 21 cps. They've traded above that level ever since then, up until today when they dropped -6.82% (or -1.5 cps) to close at 20.5 cps ($0.205). I don't have a problem with that. I view Genex as a long term holding. They are only early stage now, just getting started really, and as long as they execute well, as they have done so far, they should be worth multiples of their current SP in the years to come. It will take some time however.

I still hold IFT (as mentioned above), and they're doing OK also. Making all the right moves. IFT are a lot bigger and have been going a lot longer too, so they have an enviable track record. GNX are well under the radar, and busy establishing their own track record, from scratch. Very different companies at very different stages but both have plenty of upside IMHO.

Image: Kidston Pumped Storage Hydro Project site, with the Kidston Stage 1 Solar Farm in the background, also owned by Genex.

[I hold GNX shares. I am excited about Pumped Hydro - or Pumped-storage hydroelectricity (PSH) - which is not a new technology but is underutilised in my opinion as an energy storage solution, especially in Australia. It is perfect for storing wind and solar energy to enable that energy to be released when there is no wind or sun - in times of peak demand. The main downside is that you need the right location or else it becomes very costly to construct. Genex have the perfect location, being old gold mining pits in FNQ (far-north-Queensland) that have filled up with water and are on two different levels, which is a requirement for pumped hydro, as it relies on gravity when water is flowing from the upper reservoir to the lower reservoir via a turbine that generates electricity. And they now have everything in place, including the financing, and have commenced construction of K2-Hydro which they own 100%. Further Reading: (from mid-March, 2017, about Pumped Hydro, not about Genex): https://www.climatecouncil.org.au/turnbull-s-pumped-but-should-we-be-what-s-the-deal-with-pumped-hydro-energy-storage]

20-May-2021: Broker Briefing Webinar & Updated Corporate Presentation

Also: [this morning] GNX Achieves Financial Close for Kidston Hydro

[I hold GNX shares.]

Post a valuation or endorse another member's valuation.