Alcidion announced today that it had signed two Silverlink PCS contract renewals.

Along with this signing, these two contracts also trigger the earnout payment of A$2.8m agreed upon during the acquisition.

An interesting new update is that their current cash on hand is $15.6m Which is $4.5m more than the last disclosed figure as of 31 March 2023 in their 3Q 4C.

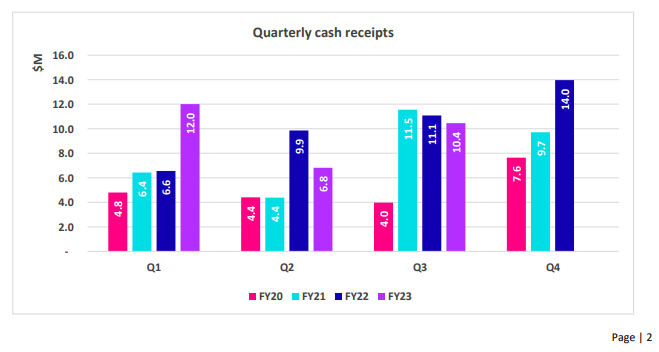

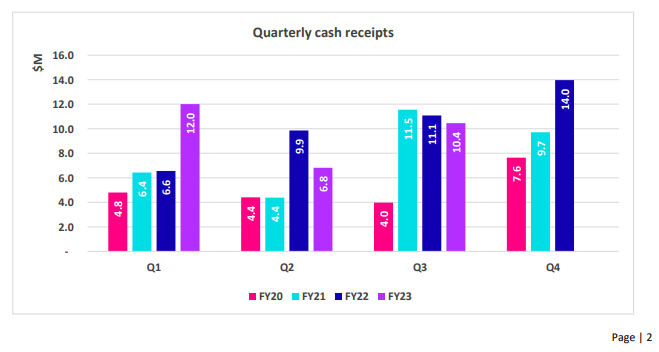

So two months of 4th Q have passed and their general expense of Q is ~11.5m so I think it indicates to me that 4th Q receipt will be in the vicinity of ~$15m.

So if we exclude this $2.8m payout, their FY23 operating cash outflow will be roughly 2m or thereabout.

Essentially, if it manages to sign a few big NHS contracts by the end of FY24, the Probability of them being cash flow positive in FY24 is very high.

sentiment currently for this business is very low.

Seems like the perfect setup for better performance compared to the index in my opinion for the next 2 years.