Yes @Valueinvestor0909 and @Hackofalltrades - the KME director buys would have been coordinated to help absorb the supply - being 2 million shares - all hitting the market at once. If you don't have an increase in buying on market when that many shares hit the boards for sale with a smaller cap (and low liquidity) stock like this, it can really spook the market and cause a selling frenzy, which could drive the share price down a lot. Having had prior warning of this 2m share sale, the KME Board would likely have acted in this way to avoid that market panic, and they seem to have done a reasonable job too considering the shares rose +14.3% on the day instead of falling. Their positive Trading-Update.PDF released pre-open on the day (Wednesday 28th June) would certainly have set a good platform for that rise, even with that extra volume traded. I wonder if the timing of the Trading Update could also have been in response to knowing that those 2m shares were hitting the market on that day.

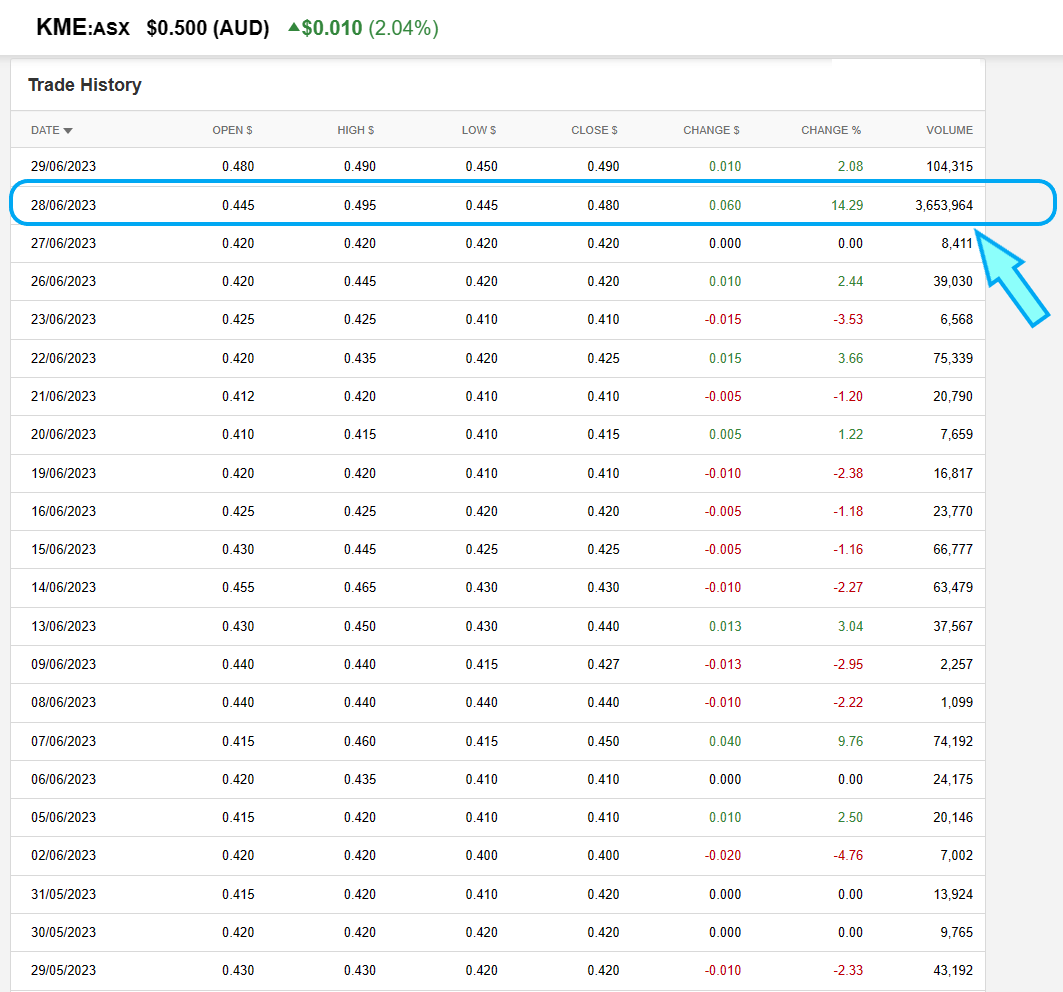

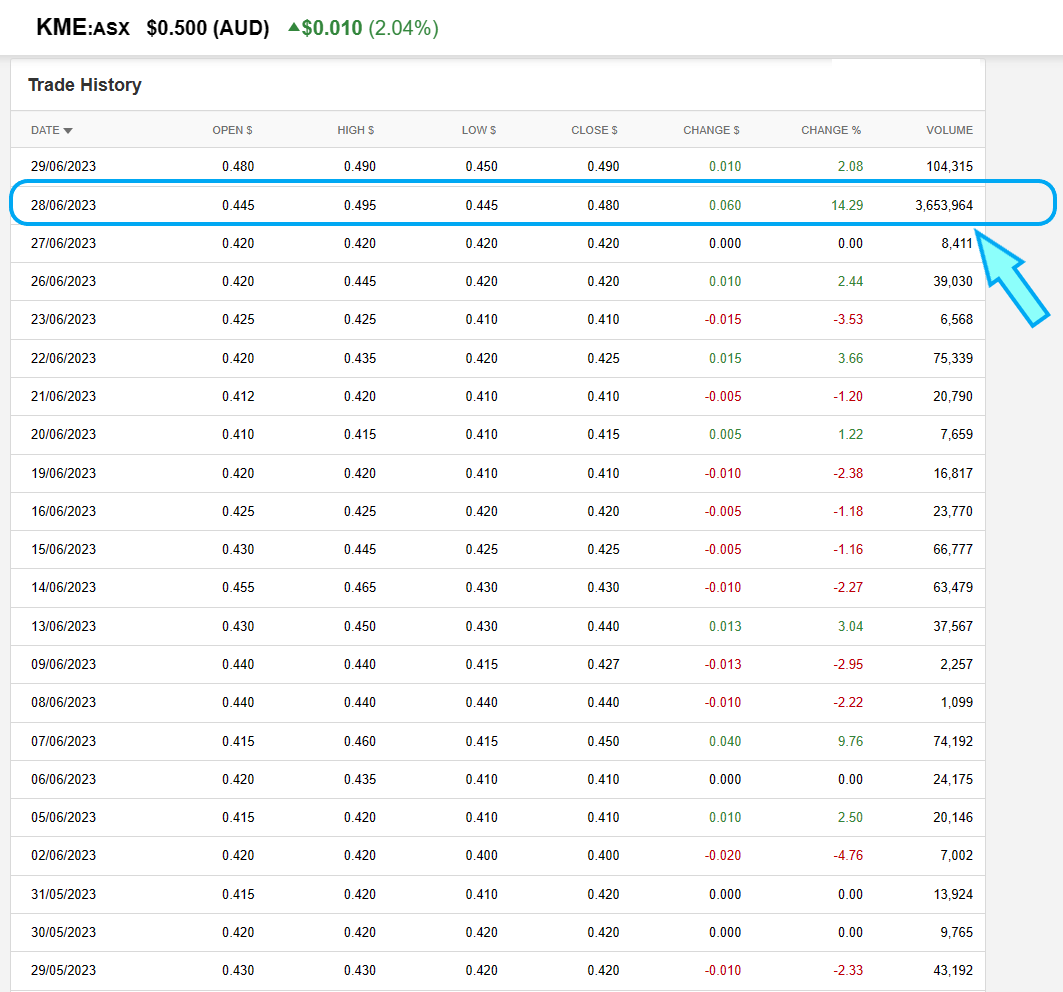

Check out the volume on Wednesday (28th) - which is when the 2 million KME shares were sold by "GoSchoolBox" on-market, and the KME directors bought 350,000 of those shares, clearly to show the market that there were buyers willing to absorb at least some of those 2m shares.

So, all-up, on the 28th, over 3.65m shares were traded, when the average daily volume is more like 1,000 to 75,000 shares.

If there were not decent buyers stepping in, as the KME Directors were, the market could have easily been spooked by a sale that large.

It is also worth noting that sometimes a company will facilitate such director or KMP (key management personnel) buying of their own shares (in a situation such as this in particular) via a loan or by bringing forward payments to those guys that would help cover the share purchase costs. Not saying that has happened here, coz I do not know, just saying it can happen sometimes. Not that I reckon Storm McGrath would need a loan, but the others might have been helped along to present a united front so to speak.

Anyway, between the positive Trading Update and the director buying, the market didn't fret at all about those extra 2m shares being sold on the day, so all in all, I reckon the board did a decent job there.

Final thought is that every company should have a director and KMP/company-employee share trading policy, which usually prohibits shares being bought or sold during any period in which those individuals have access to information that is relevant but not yet released to the market, and many such trading policies actually prohibit all share trading except during specific periods - often referred to as windows. Those windows are usually directly after results have been announced, or after the company has otherwise updated the market on how the business is travelling.

I haven't dug into KME's share trading policy myself, but in simple terms, if the directors had wanted to buy shares because they thought they were undervalued, yet they also knew they were about to release a Trading Update, they should wait until after the release of the Trading Update before buying or selling shares. Which is what happened here. As it should have.

If they had bought shares and then released a Trading Update which resulted in a decent (like, +14.29%) share price rise, then they could have been accused of insider trading, and of breaching the company's trading policy.

So the timing makes sense on a number of levels really.

Disclosure: I do not hold KME shares.