Pinned straw:

@BoredSaint Thanks for the analysis! Great insight into the Motorsports segment of the business.

In the earnings call on 18-Aug, Kees mentioned that there is quite a bit of growth for Motorsports with emerging tech and advanced cooling parts increasing, especially micro matrix. I don't know much about F1 so if you could shine some light on the application of "micro matrix" to Motorsports, that would be great!

Also, if I may, I find the central themes in the earnings call are around the a) the push on automation (which helps increase the efficiency and revenue per headcount) and b) the potential of Aerospace and Defense (A&D) becoming the main driver for the growth in both top and bottom line.

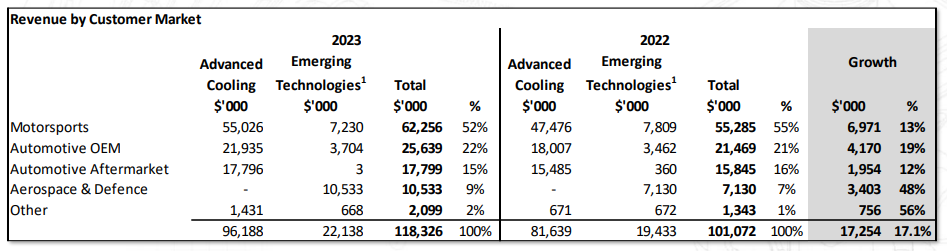

A&D: very healthy segment. We witnessed a strong growth 48% in 2023 but Kees said that we are just "scratching the surface".

the majority of the pipeline is in the U.S hence they've been spending a reasonably substantial capex over there with new furnaces, with short-term pipeline increase has been the cold plates for radar system. Another interesting market is electric lift vehicles (eVTOL) with, according to Kees, a bit of money being spent on building eVTOL and PWR is dealing with 4 of the leading companies in the space.

Some of the programs are entering pre-production and at least four programs will turn into production in FY24-25

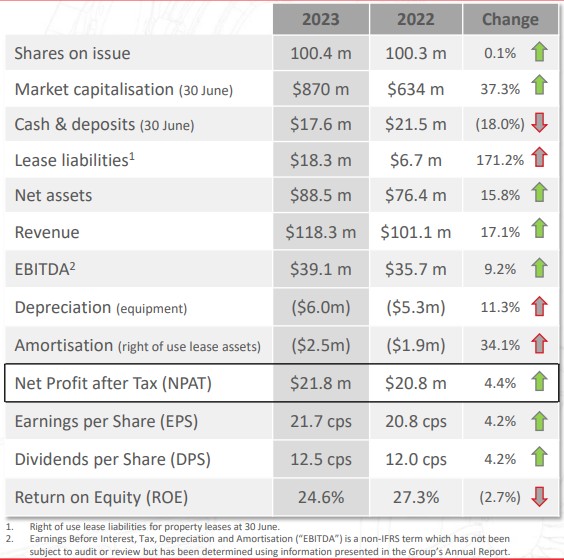

And of course, they are aiming for 20% NPAT margin (small R&D needed but margins per part are very high)

Look forward to your response.