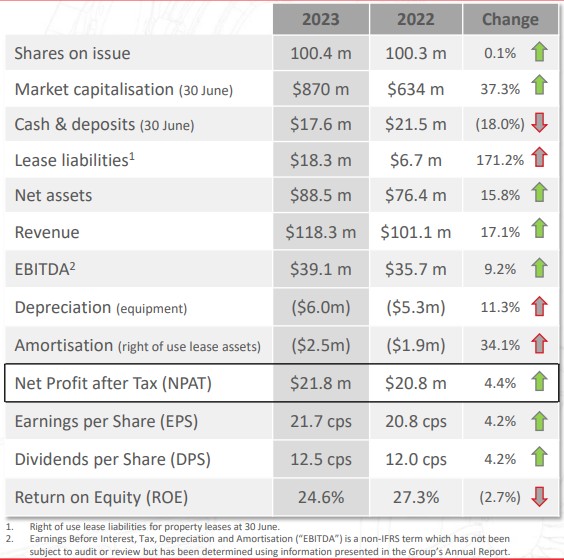

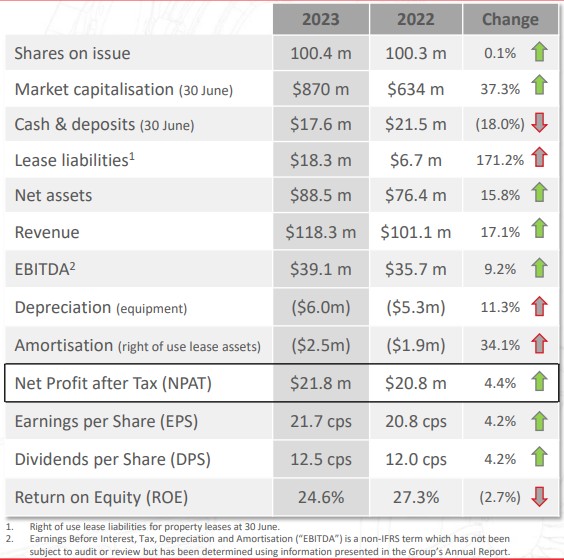

PWH released their FY23 results a few days ago, from their presentation:

I thought the result was pretty solid after a fairly disappointing 1H FY23. This year has been a year of investment in the business with the acquisition of several businesses to increase their footprint into Europe. The increase in net assets and lease liabilities reflects this.

Whilst 1H FY23 saw net margins fall below 15% as a result of this increase in spending and also the increased cost of raw materials. 2H FY23 saw a return to increased profitability with net margins improving to back above 20% again.

Management themselves have mentioned that with the increased investment, they will be able to support further growth with current capacity at their new site in Rugby (UK) only being 50% utilised at present.

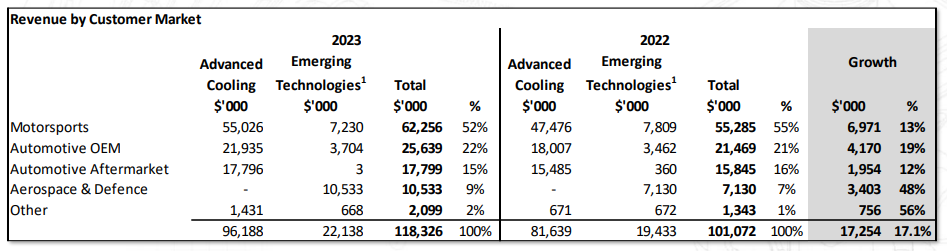

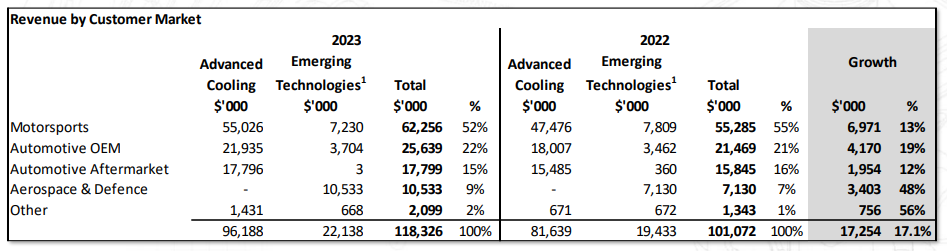

Once again there was strong growth in emerging technologies with Aerospace and Defence now making up 9% of total revenue. This table below shows their Revenue by Customer Market.

Still lots of projects in the pipeline and interestingly as an F1 fan, I saw that they had secured the contracts for multiple teams for FY26. This is interesting as this is around the time that several major teams will be entering/re-entering the F1 scene. I believe given the growth of F1 in North America, there will likely be more than 10 teams on the grid, thus providing more teams for PWH to work with.

Will update my valuation shortly. Whilst the business seems to be back on track, shares are still quite expensive, and growth would need to continue into the future to support the current price.

Disc: Held IRL and on Strawman.