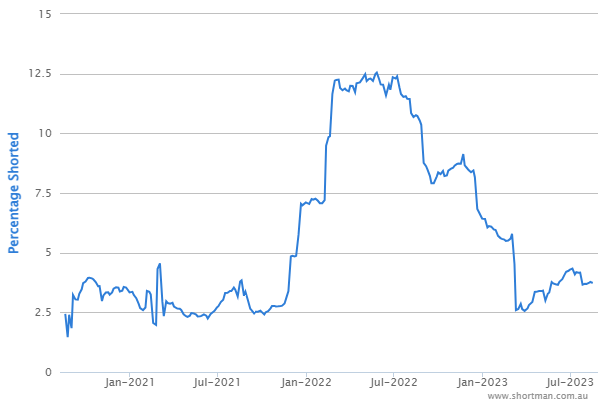

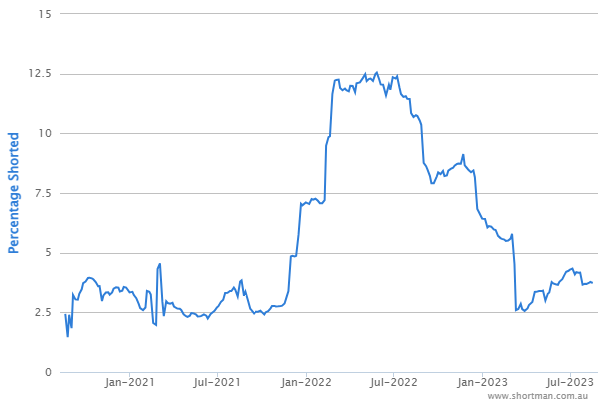

I remember when Nanosonics was one of the most heavily shorted stocks on the ASX:

Between March and September last year, over 10% of shares outstanding were shorted (average price over that period was about $4, and for 90% of the time it was below the current price).

My best guess was that these were valuation based short positions -- after all, the business had more cash than a small nation, no debt and surging revenue. It was a dumb bet that this thing was every likely to be insolvent anytime soon!

And, sure, 10x sales (or thereabouts) wasn't exactly cheap. But here we are a year later and we've got another strong uplift in sales (38% higher) and record pre-tax and free cash flow. I'm not sure shares are exactly cheap, but it was a real head scratch to see it so heavily shorted.

My only point, i guess, is that Shorters seem to get far more credibility than they deserve. And if you're going to do it, at least bet on business failures and not on valuation grounds -- remember, the market can remain irrational longer than you can stay solvent!