C79

C79

Q4FY23 Results

Pinned straw:

Also looking at today's just released annual report. Key things that I'll be keeping an eye on moving fowards as this thesis plays out are:

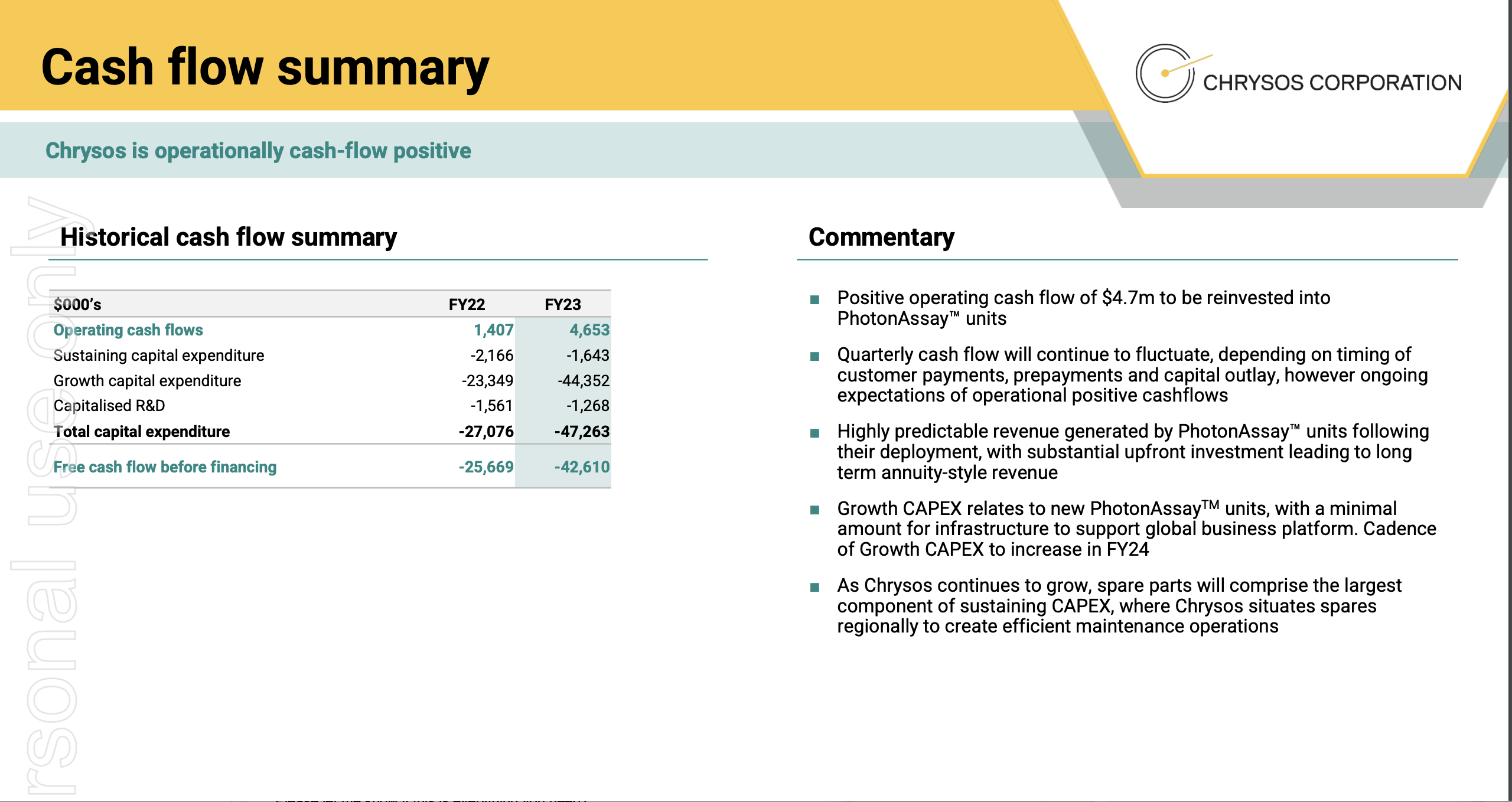

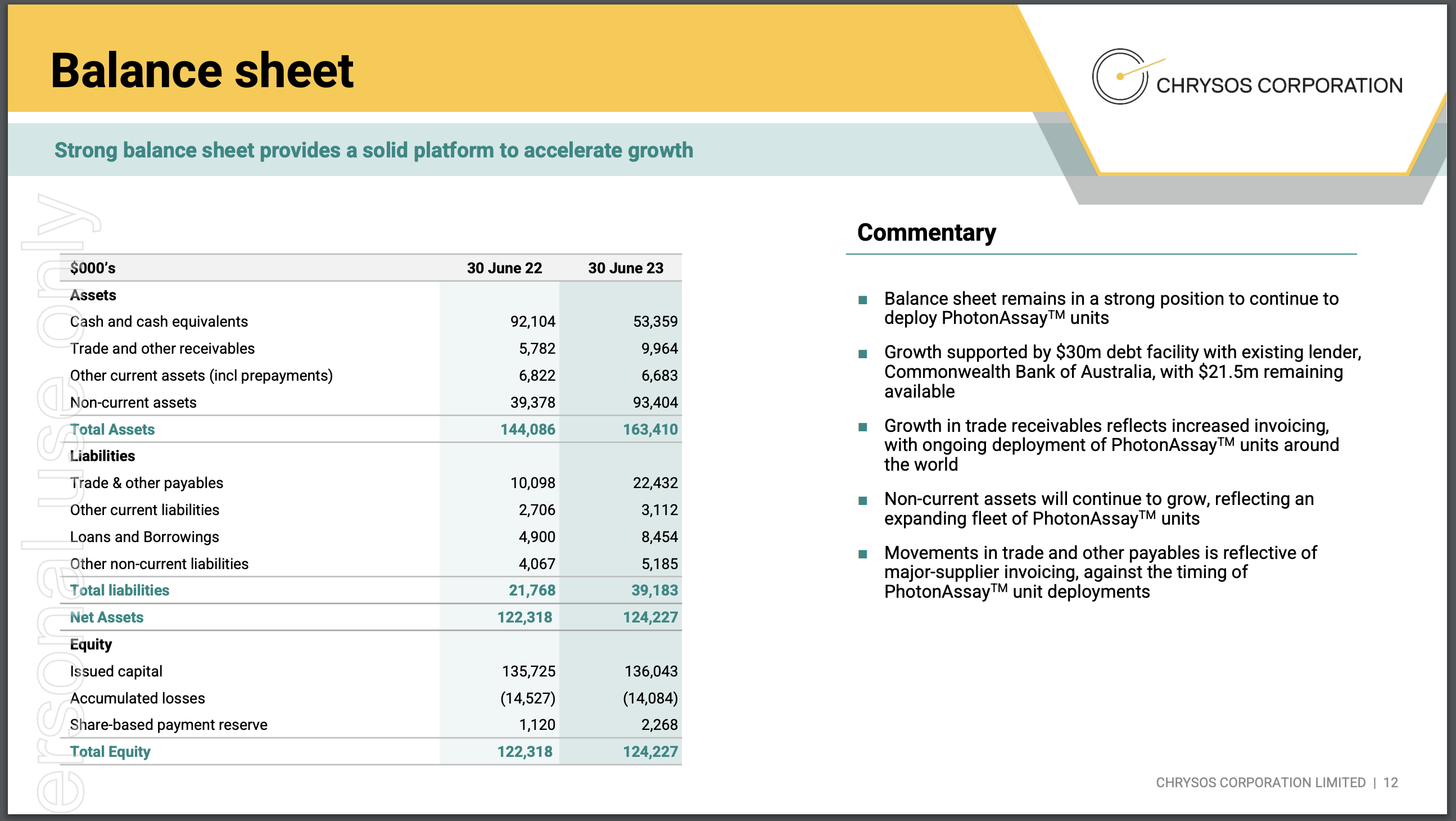

- How much of the CBA facility they choose to draw down (looks like BBSW + 4.4% so probably in the vicinity of 9% per annum). This could introduce up to 2.7m of interest payments that could hit the EBITDA range pretty hard

- Utilisation rate (which while they say is in line with the prospectus seems to be declining as they roll out more machines). This obviously has the key impact on the AAC (additional assay charges) which contributed 16% of revenue in FY23. Hoping that the reallocation of machines might help increase this utilisation rate.

- An ability to keep a lid on operating expenses (especially Employees, Travel and Admin) which all doubled in FY23. Hopefully they have now ramped up the organisation to a scale which can sustain equipment.

- Sales backlog (they say they have already got backlog to cover their FY24 deployment) that they begin to project into FY25. 49 contracted units less 21 already deployed less 18 to be deployed in FY24 = 10 units for FY25 deployment already contracted?

- Sustaining capital ... given their balance sheet shows 93m for 20 or 21 machines thats $4.65m per machine. With plans to deploy 18 machines this year they need $84m capital. It looks like it will be close given 54m cash + 21m undrawn loan plus 7-17m EBITDA forecast. I'm hoping these guys can manage their cash flow so they don't have to shake the tin again with investors to be able to meet FY25 plans ... 10 more machines so another 45m capital required from somewhere before they even grow their backlog further. The prospect of further dilution is my biggest fear with this company as they support "Cadence of Growth CAPEX to increase in FY24"

DISC: Held IRL and Strawman

8