C79

C79

Capital Raise Needed ???

Pinned straw:

@jcmleng Thanks for your detailed view.

I think where our models are differing is the Capex per unit ...

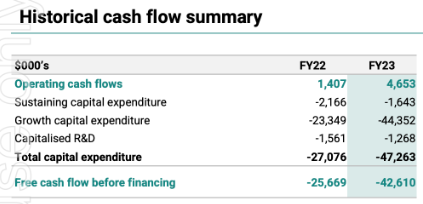

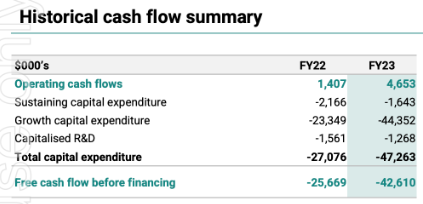

- You have used the Growth Capex for FY23 (from the Cash Flow) and divided by the total number of deployed units of (all time) 20.

- However, I've assumed that Growth Capex for FY23 was for just the 10 units deployed in FY23 as that number was cashflow not Balance Sheet.

- Hence, I get to 4.5m per unit using your method of last year's deployed capital

- And the 4.65m per unit using my original method of 93m on the balance sheet divided by 20 machines totally deployed.

- The Capex for each unit was derived from the 12M Capex in the Appendix 4C - for 18 units, the calculated Capex is about $39.2m, which sort of lines up with the FY23 Growth Capital Expenditure below which was for 20 units, so I think this $2.17m capex per unit feels "about right"

I'm pretty comfortable with your in-flow assumptions. The Additional Assay Charges were 16% of revenue last year so that's the other way you could do it to account for that incremental revenue.

However, in my previous post I noted that the AAC per machine is probably coming down as the Utilisation rate is also coming down.

- This makes sense to me as the new machines are probably under-utilised until the Labs/Sites get used to using them and then their utilisation grows over time (hopefully).

- Also, I think the historically higher utilisation in the early days could be as a result of C79 utilising a smaller number of machines for demo/future sales purposes.

- In my modelling, I've been very conservative and just assumed the Minimum Monthly Charge.

- To me the AAC is additional icing on the cake and is something C79 can increase if they are smart about the locations to which they deploy their machines (eg. Lab vs Mine Site) and the success of their "Lab Partners".

- I assumed how many units will be deployed by month to make up the 18 planned units in FY24. The deployment is back-ended to make it more cashflow conservative, capex is spent in the month of deployment, and MMAP flows the month after @ $130k per deployed unit - the cash inflow increases each month depending on the number of new units deployed

- Cash Inflow from Ops - I took 3QFY23's Net cash inflow of ~$1m per Q - this is a proxy for cash flow in from the already-deployed 20 units less operating expenses - noting 4QFY23 was net outflow of ($0.6m), but allows for increases in Additional Assay Charges etc.

6