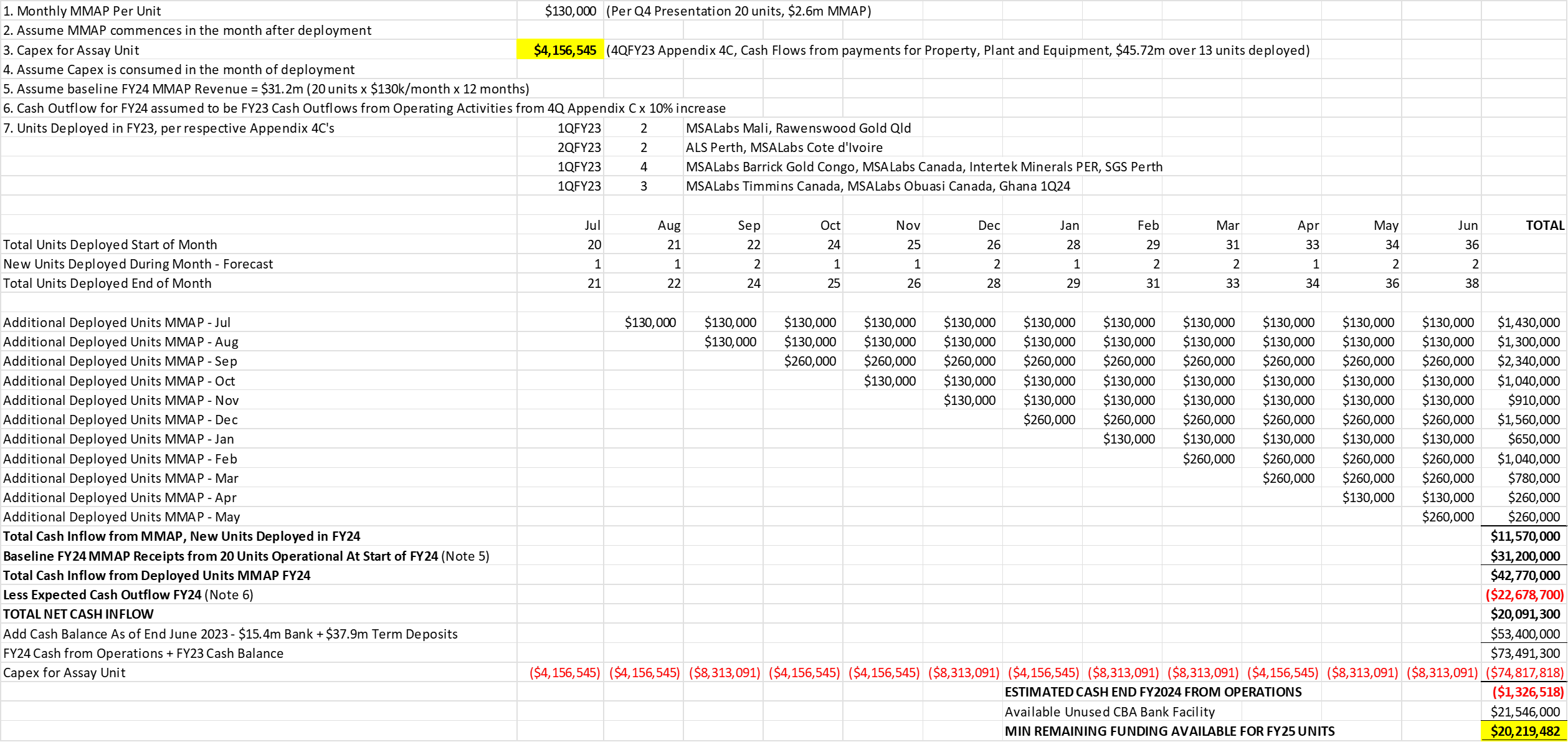

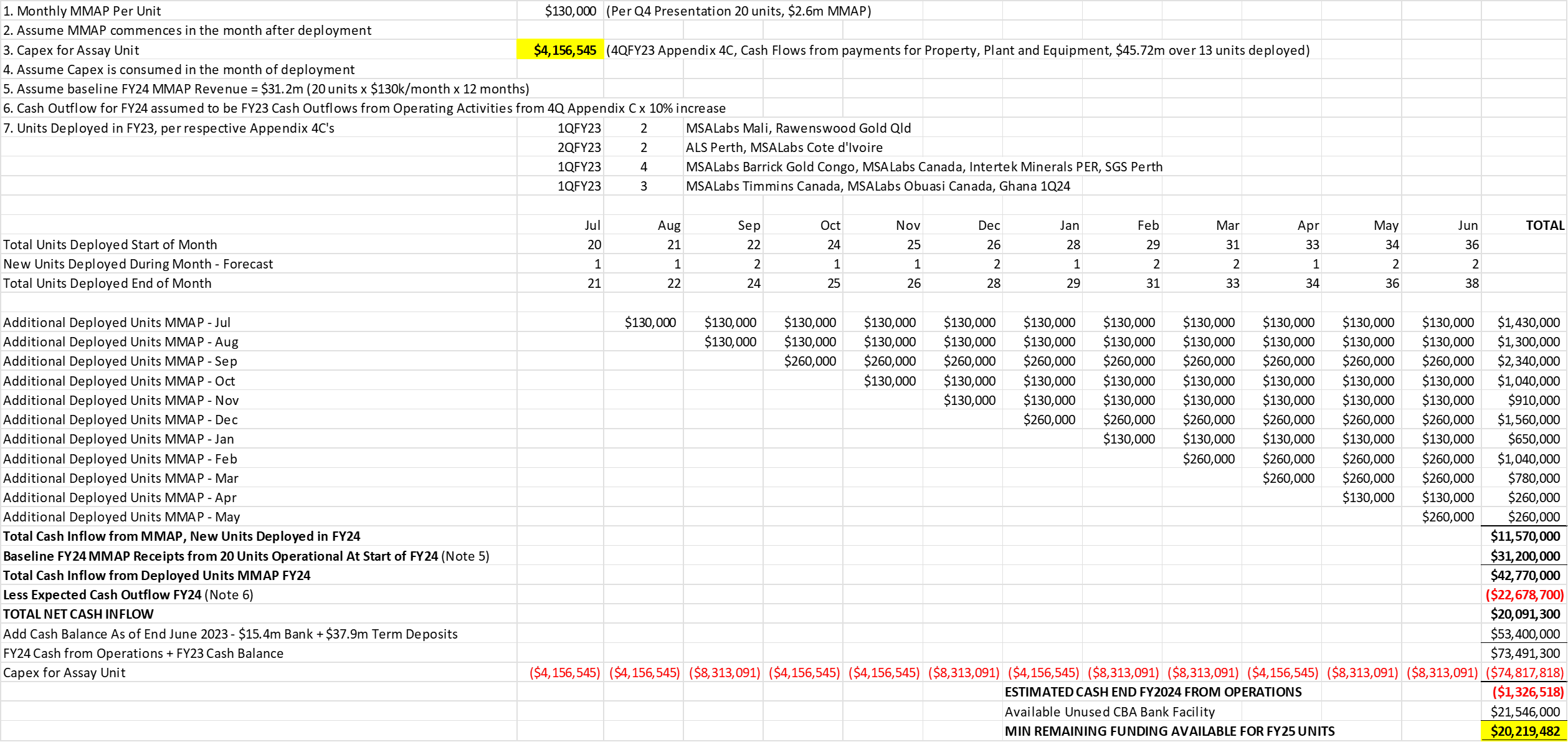

Did a bit more work this evening and updated the C79 cashflow outlook for FY24

Made the following changes to the cash flow xls of 3 weeks ago:

- @RhinoInvestor is correct around the capex per unit. It is looking to be ~$4.16m. Used the Appendix 4C full year capex for PPE, divided by the 11 units deployed during FY23.

- Went through each of the 4 Appendix 4Cs to work out how many units were deployed in FY23 - 10 units in FY23 itself, 1 was due in 1QFY24, have simplistically assumed that they will have spent capex on 11 units, not just the 10, in FY23.

- Added a line for the baseline MMAP cash inflow for the 20 units deployed in FY23 - this is $31.2m

- For FY24 cash outflows, took the full year FY23 Cash Outflow from Operating Activities in the Appendix 4C, bumped up by 10% - C79 expects operational leverage as more units are deployed, not sure how good this estimate is

- Took the exact Cash Balances from the 4C - Bank Balance + Term Deposits

- C79 has available unused CBA Bank Facility of $21.5m as at end FY23.

The cash position at end-FY24 is now looking to be a SHORTFALL of ($1.3m) vs the earlier calculated cash surplus of $29.8m.

There will be ~$20.2m of debt still available at the end of FY24. This can fund ~4.9 FY25 deployment units, which given the FY24 plan, is ~1 Quarter's worth of FY25 deployment.

Funding is thus in place for ~42.9 (20 FY23 + 18 FY24 + 4.9 FY25) of the 49 contracted units.

The CBA facility size thus seems to make good sense, noting that it is contracted when the interest rate cycle has been on the up. A new loan facility sometime mid-FY24 is probably on the cards when the interest rate cycle should hopefully be on its way down. This should cover FY25 + new contracts beyond the current 49.

I do not see any capital raise occurring due purely to operational funding gaps. Indeed, given the high visibility of revenue, costs and funding needs, it will probably be a huge management red flag if they do not get the funding right ...

An opportunistic capital raise, similar to AD8, could be something to look out for in 3Q/4Q FY24, if the share price spikes to say $10-12 from the current ~$6 as a cheaper/more effective way of raising capital vs debt. This could be based on a better-than-expected revenue trajectory and/or a surge in newly contracted sales or expanded breadth of use of the Assay units.

Am happy that I now have a simplistic cash flow model against which to track the cash position during FY24!

Hope this makes sense.

Remaining very bullish on C79 and looking for the opportunity to top up.