Financials

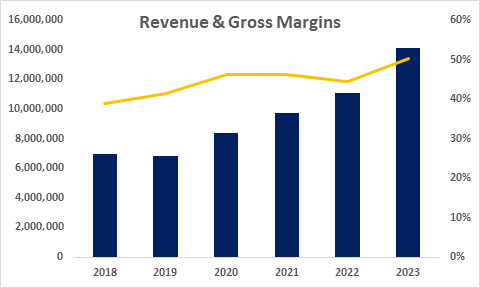

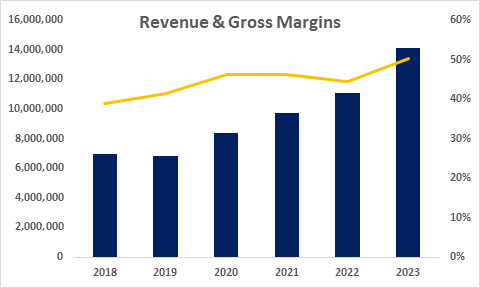

ABVs margins have grown from 45 to 50% over the past year, while revenues have grow 16, 14 and 28% over the past 3 years.

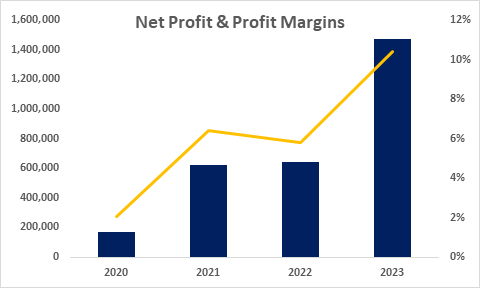

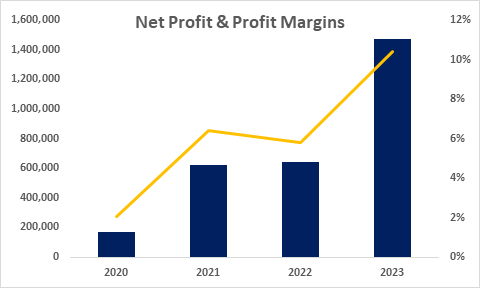

The company has been profitable and cash flow positive the past 4 years with profit growing from $644,000 to $1.474M and achieving a net profit margin of 10.4%.

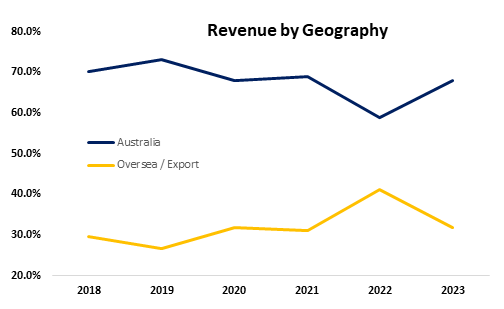

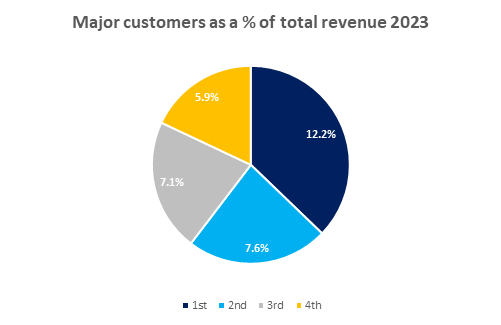

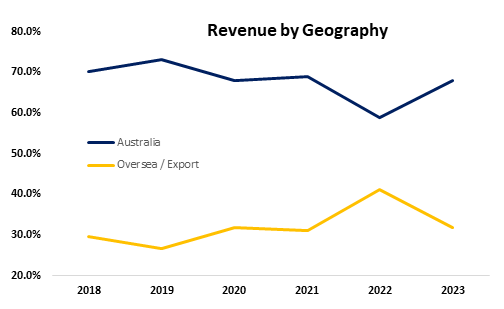

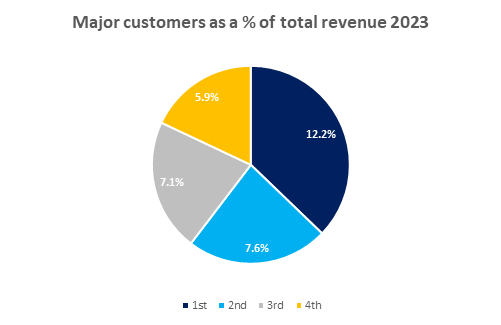

Segment revenue isn’t provided by ABV but they do brakedown (pun intended) revenue by geographical region as well as major customers. With 2023 revenues of $14.15M and profits of $1.474M, should ABV lose their largest customer they would, just barely, remain profitable.

The company has a strong balance sheet with $2M in cash, net assets of $6.9M and debt (interest bearing liabilities) of just $223,000.

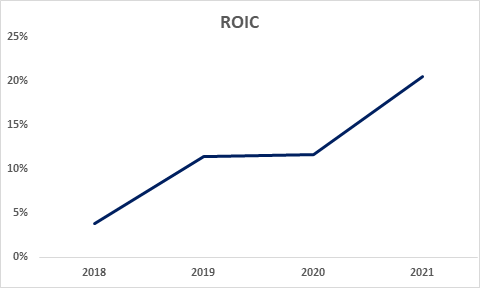

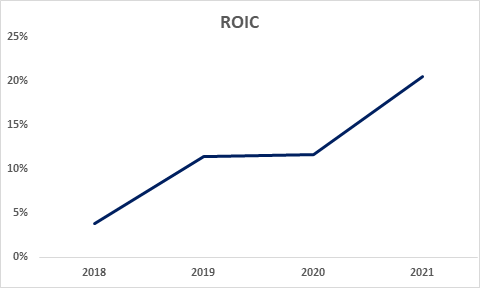

Lastly, ROIC has been steadily improving over the past 4 years which could indicate ABVs moat is widening.